Company Summary

| CXMarkets Review Summary | |

| Founded | 1999 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Market Instruments | Weather-related financial protection products |

| Customer Support | Monday - Friday, 9:00 AM to 5:00 PM ET |

| Tel: +1 877-300-4555; +1 212-829-5455 | |

| Email: customerservice@cantorexchange.com | |

CXMarkets Information

CXMarket is an unregulated broker offering a specialized platform for trading weather-related financial products, including rain, snow, temperature, and landfall contracts. They provide various fee schedules, with no fees for application, deposit, or withdrawal.

Pros and Cons

| Pros | Cons |

| No application or deposit/withdrawal fees | Lack of regulation |

| Specific products for weather risk | |

| Long operation time | |

| Various channels for customer support |

Is CXMarkets Legit?

CXMarkets is an unregulated broker. The WHOIS search shows the domain cxmarkets.com was registered on August 02, 1999. Its present state is “client transfer prohibited,” which indicates the domain is locked and cannot be moved to another registrar. Therefore, please be aware of the risks!

CXMarkets Products and Markets

CXMarkets offers a trading platform and API access for weather-related financial protection products, providing market information, trade execution, and clearing/settlement services.

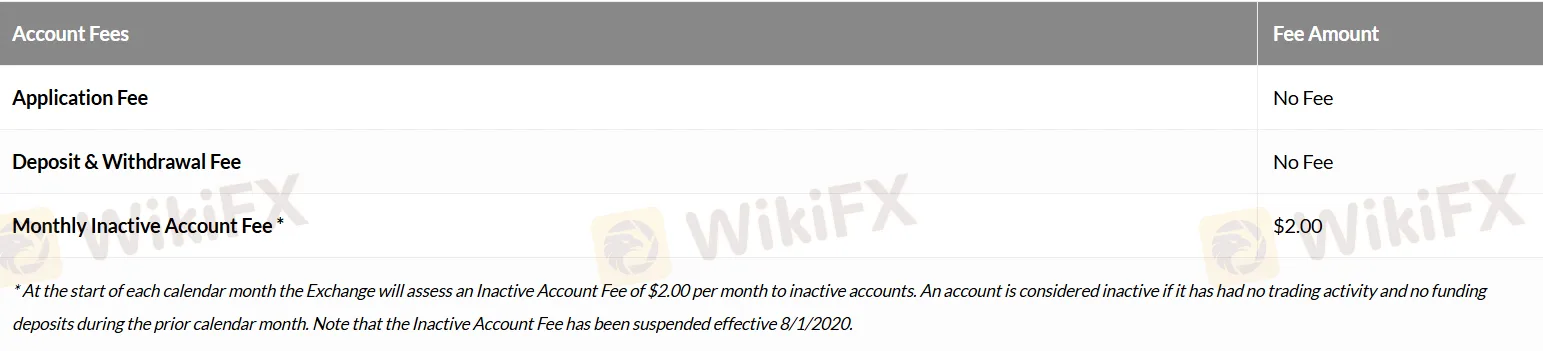

CXMarkets Fees

- General Fee Schedule

| Types of Fees | Fee Amount |

| Application Fee | ❌ |

| Deposit & Withdrawal Fee | ❌ |

| Monthly Inactive Account Fee | $2 (suspended after August 1, 2020) |

- Weekly Rain Markets Fee Schedule

| Trading Fees (on all completed trades) | Fee Amount (per contract) |

| Executed Buy Order | ❌ |

| Executed Sell Order | $0.02 |

| Settlement Fees (on all open positions at contract settlement) | Fee Amount (per contract) |

| All settlements | ❌ |

- Forex & Metals Markets and Monthly Rain Markets Fee Schedule

| Trading Fees (on all completed trades) | Fee Amount (per contract) |

| All Market Orders | ❌ |

| Limit Orders that execute at the market | ❌ |

| Other limit orders | $0.01 |

| Settlement Fees (on all open positions at contract expiration) | Fee Amount (per contract) |

| Out-of-the-money settlements | ❌ |

| In-the-money settlements | $0.01 |

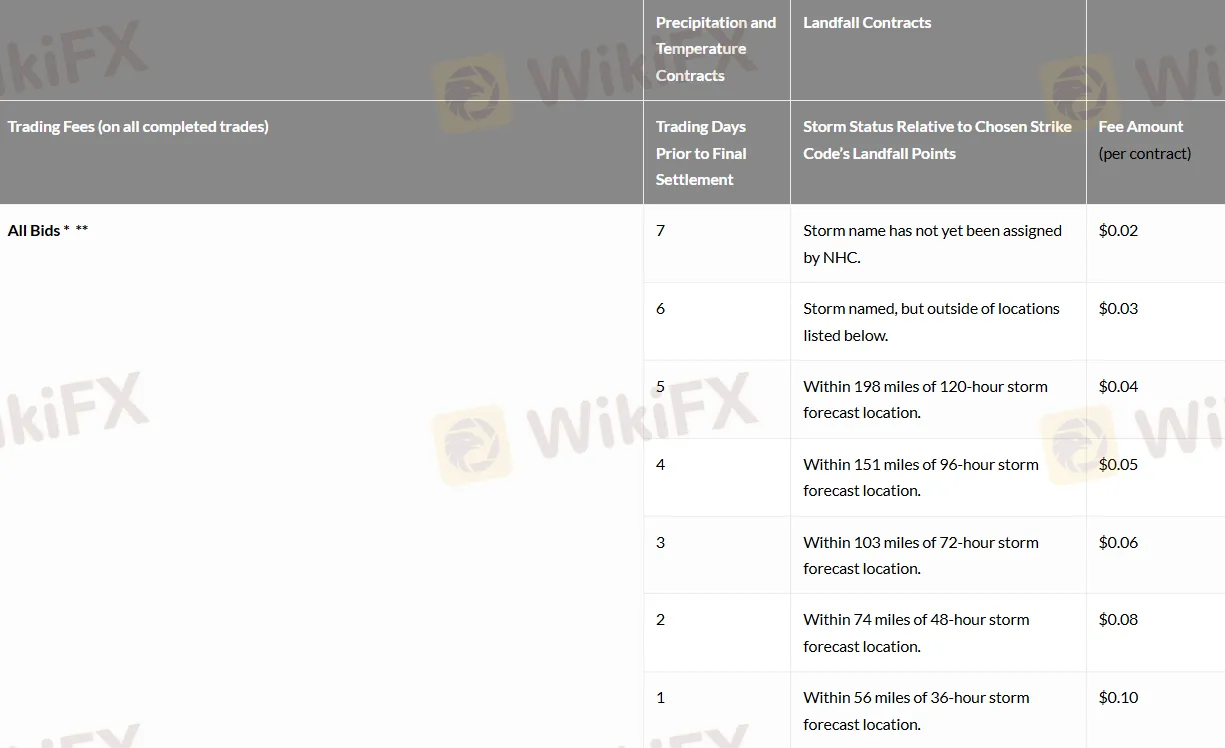

- Daily Rain, Snow, Temperature, and Landfall Markets Fee Schedule:

| Trading Fees (on all completed trades) | Precipitation and Temperature Contracts: Trading Days Prior to Final Settlement | Landfall Contracts: Storm Status Relative to Chosen Strike Code's Landfall Points | Fee Amount (per contract) |

| All Bids ** | 7 | Storm name has not yet been assigned by NHC | $0.02 |

| 6 | Storm named, but outside of locations listed below | $0.03 | |

| 5 | Within 198 miles of 120-hour storm forecast location | $0.04 | |

| 4 | Within 151 miles of 96-hour storm forecast location | $0.05 | |

| 3 | Within 103 miles of 72-hour storm forecast location | $0.06 | |

| 2 | Within 74 miles of 48-hour storm forecast location | $0.08 | |

| 1 | Within 56 miles of 36-hour storm forecast location | $0.10 |