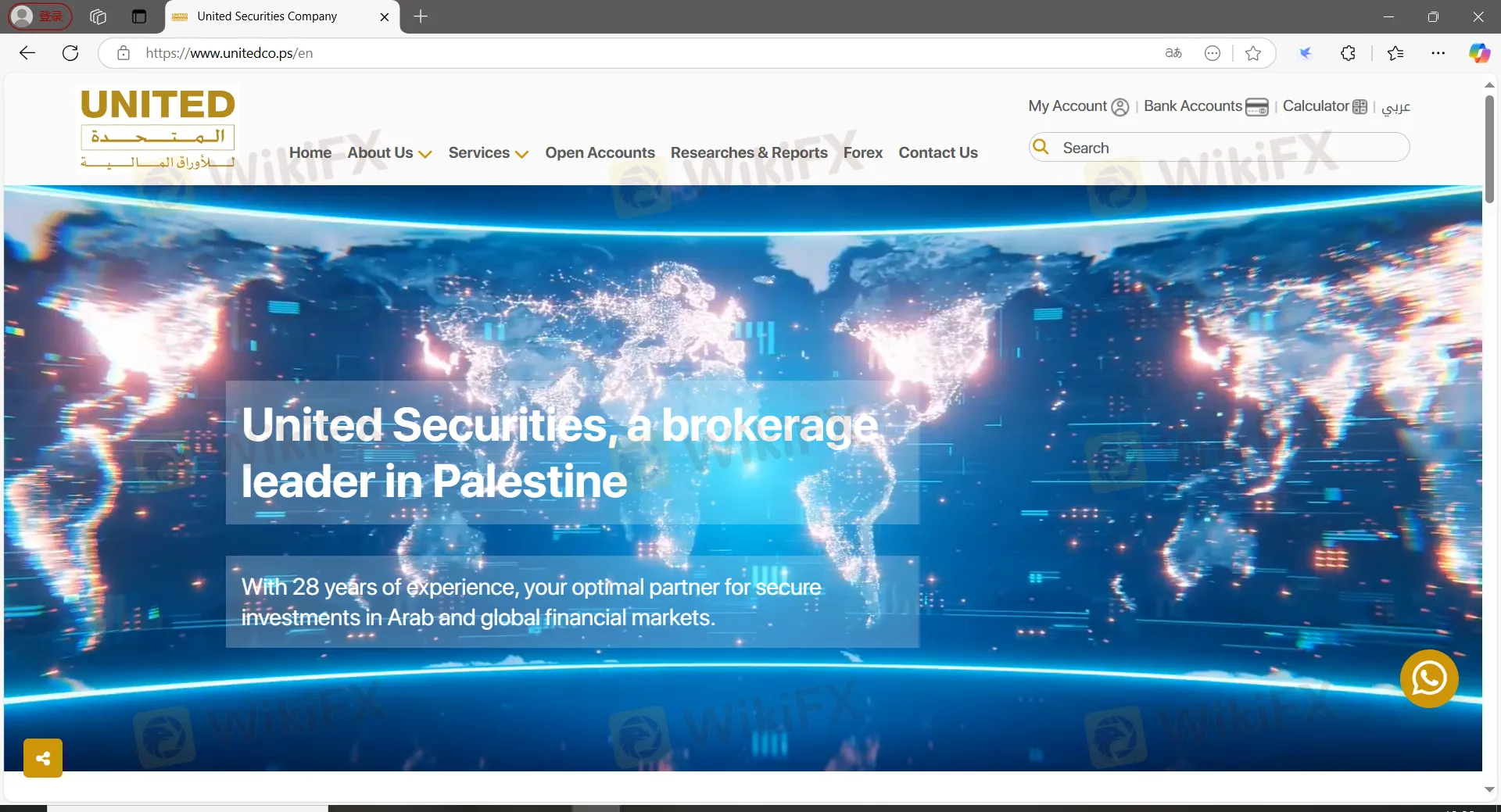

Company Summary

| United Securities Co. Review Summary | |

| Founded | 1996 |

| Registered Country/Region | Palestine |

| Regulation | No regulation |

| Services | Proprietary trading, Trading on behalf of others, Issuance management, Portfolio management, Custodian services, Trading in foreign markets, Trading Applications, E-Trade |

| Demo Account | ❌ |

| Leverage | Up to 1:300 |

| Spread | From 0 pips |

| Trading Platform | United Securities Co., MT5 |

| Minimum Deposit | $100 |

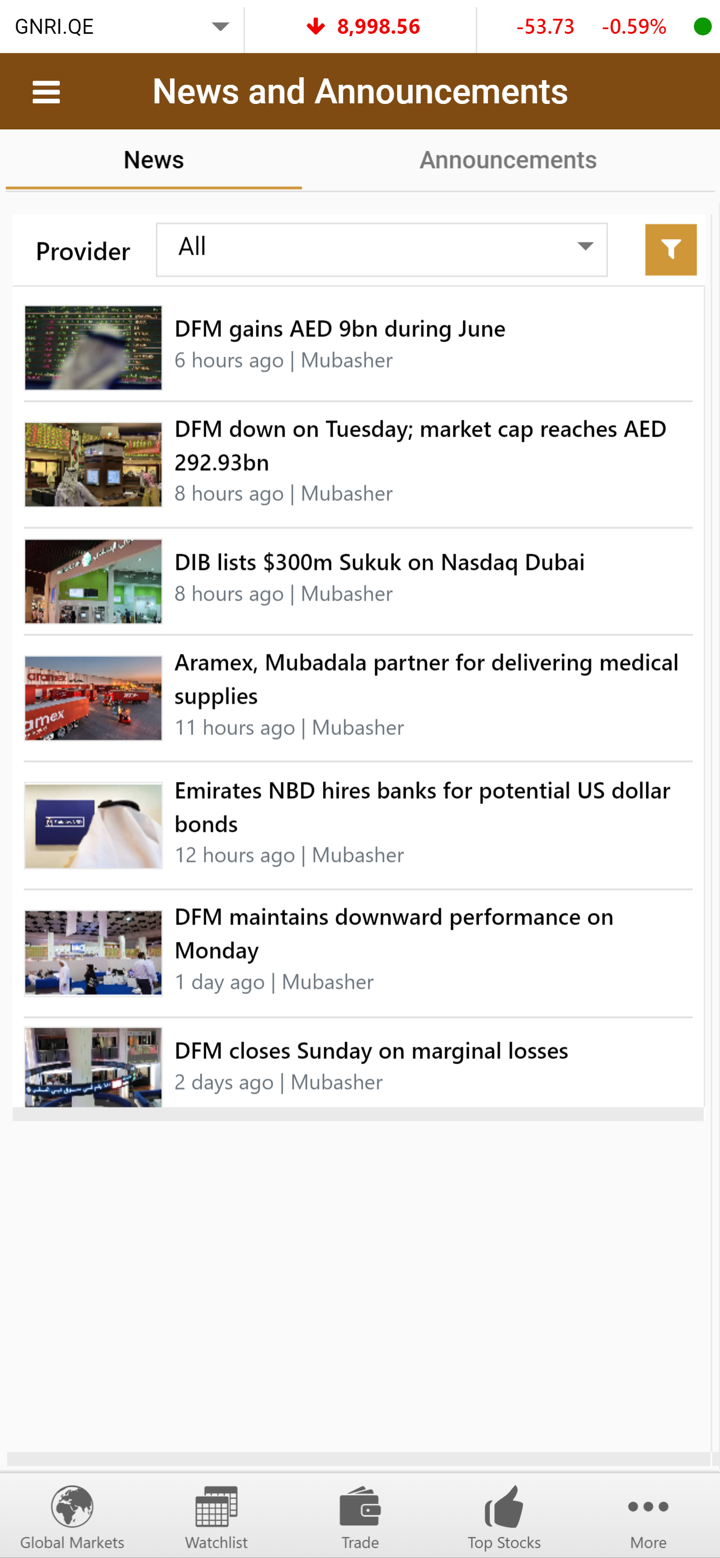

| Customer Support | Live chat, contact form |

| Tel: 02-2423090 | |

| Email: info@unitedco.ps | |

| Address: Rawabi City Q Center, Office Building, first floor | |

| Social media: Facebook, Whatsapp, Instagram, LinkedIn | |

United Securities Co. Information

United Securities Co. is an unregulated service provider of premier brokerage and financial services, which was founded in Palestine in 1996. It offers services in Proprietary trading, Trading on behalf of others, Issuance management, Portfolio management, Custodian services, Trading in foreign markets, Trading Applications and E-Trade.

Pros and Cons

| Pros | Cons |

| Long operation time | Lack of regulation |

| Various contact channels | No demo accounts |

| Various trading products | No MT4 platform |

| MT5 platform | Commission fees charged |

| Limited account choices |

Is United Securities Co. Legit?

No. United Securities Co. currently has no valid regulations. Please be aware of the risk!

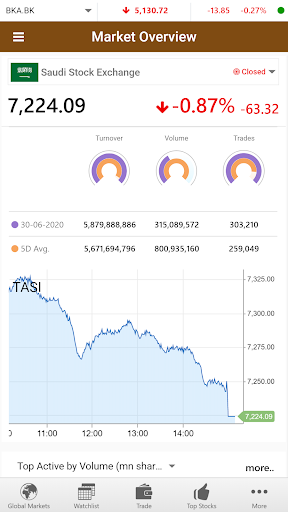

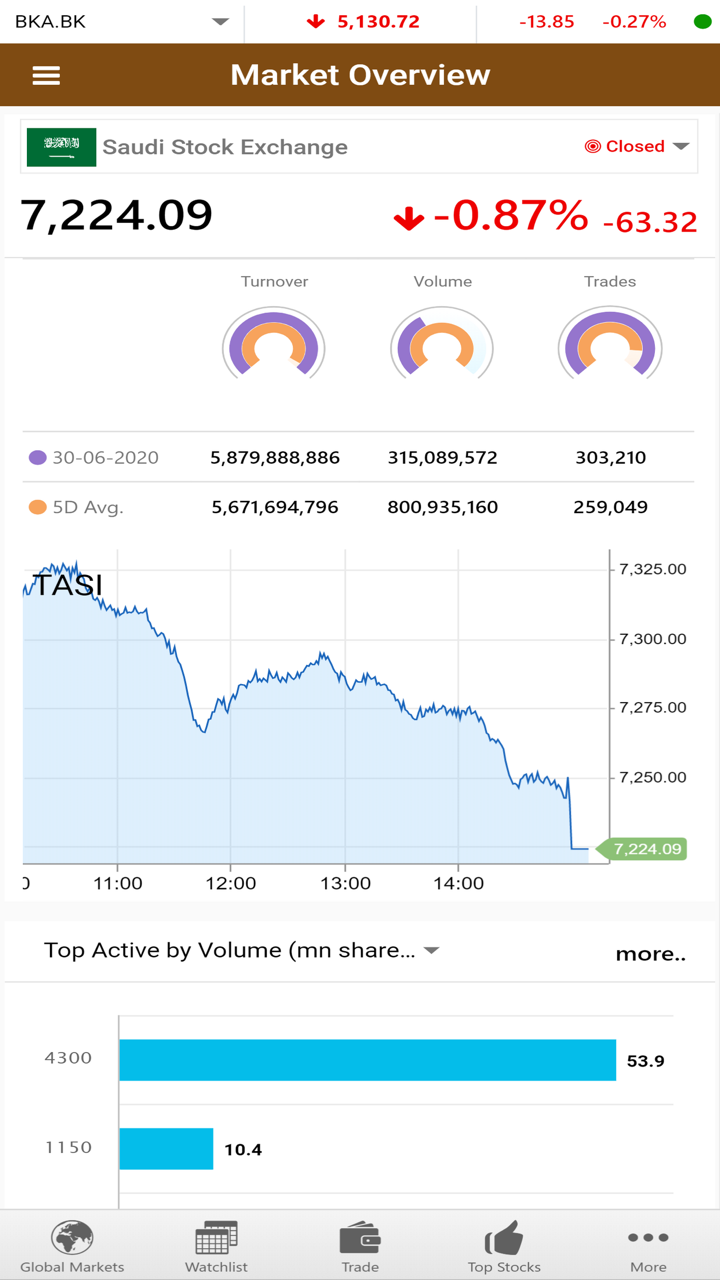

United Securities Co. Services

| Services | Supported |

| Proprietary trading | ✔ |

| Trading on behalf of others | ✔ |

| Issuance management | ✔ |

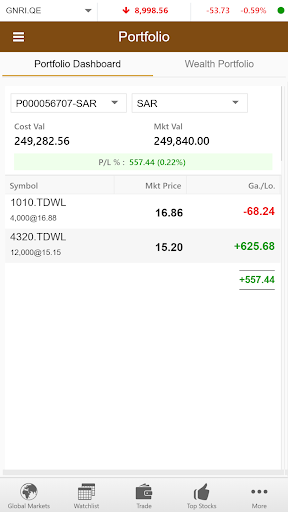

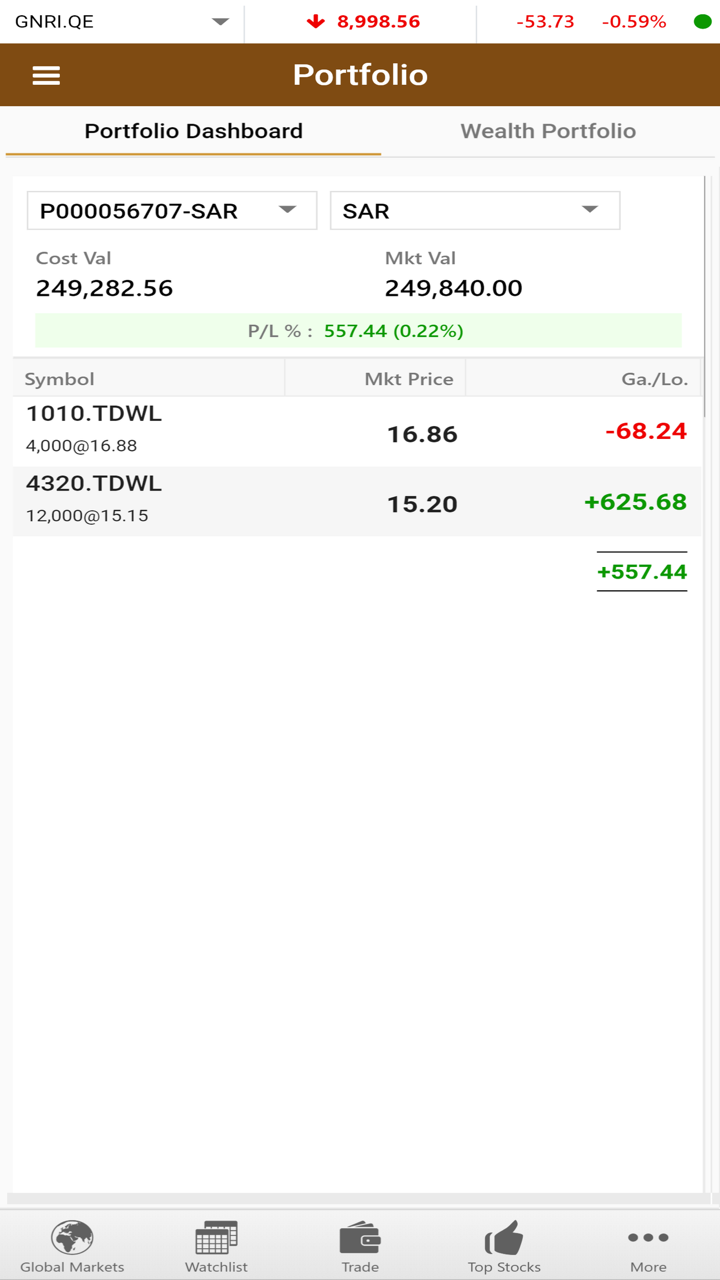

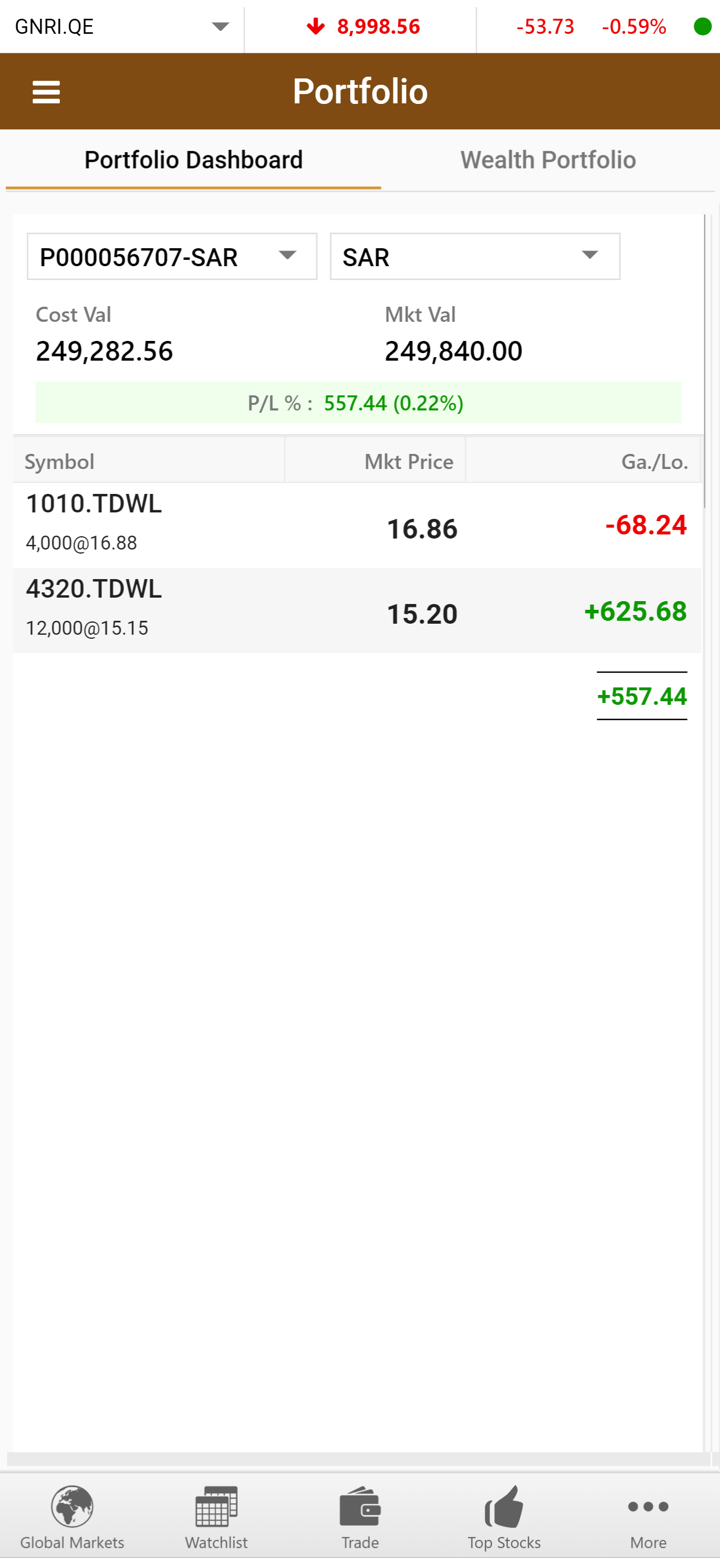

| Portfolio management | ✔ |

| Custodian services | ✔ |

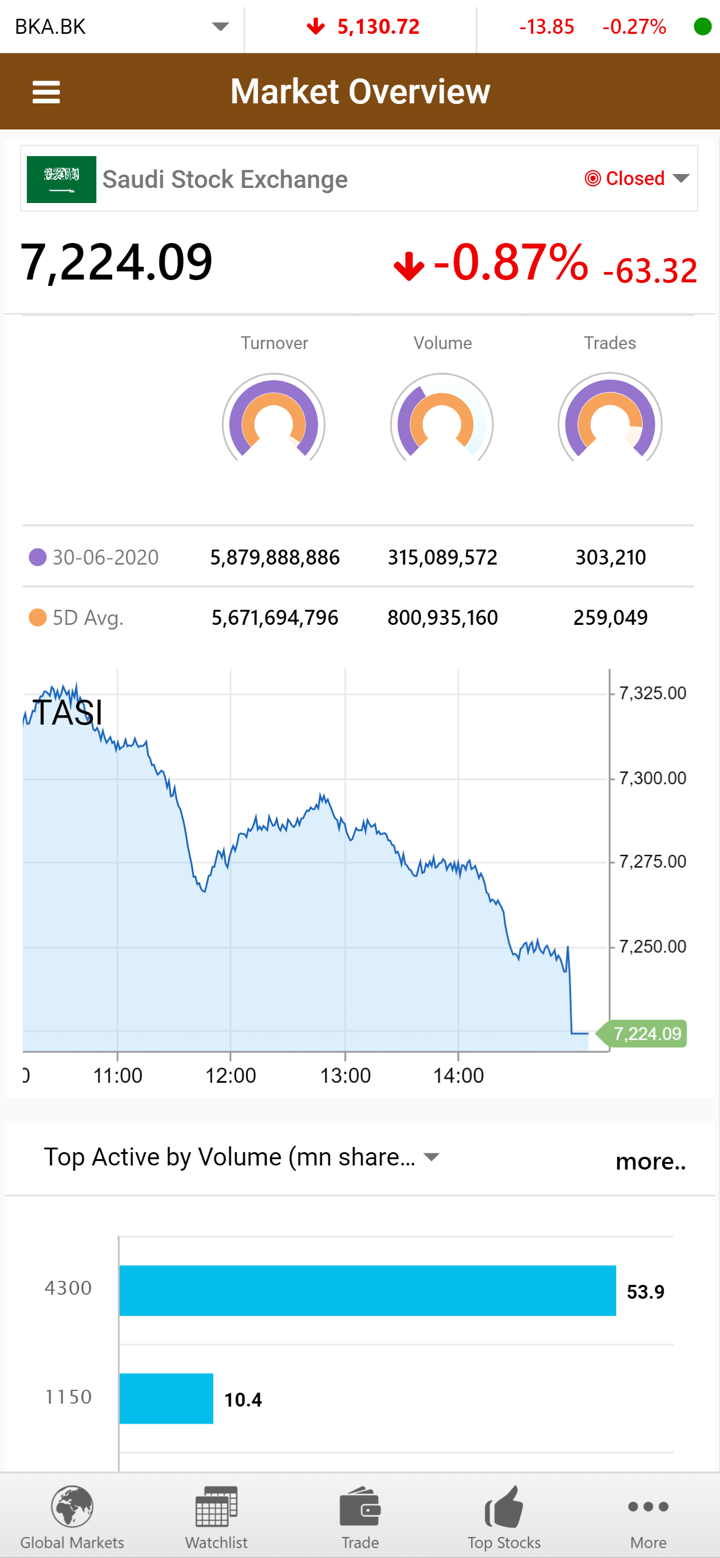

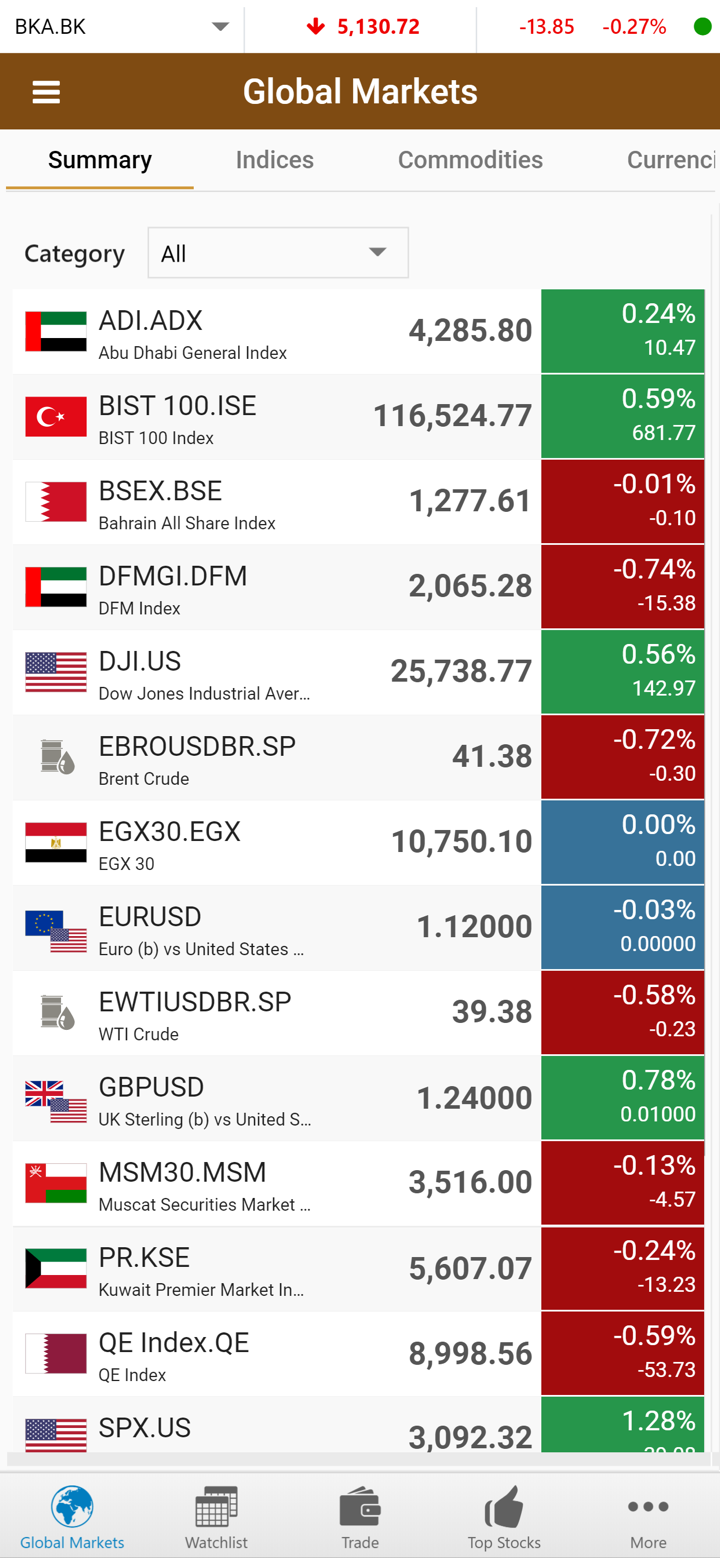

| Trading in foreign markets | ✔ |

| Trading Applications | ✔ |

| E-Trade | ✔ |

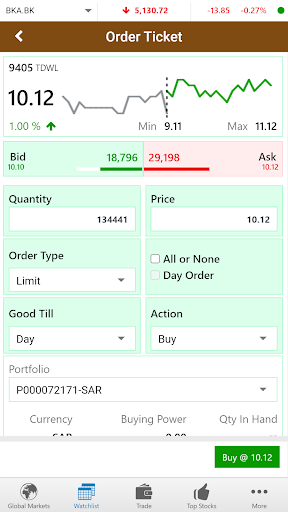

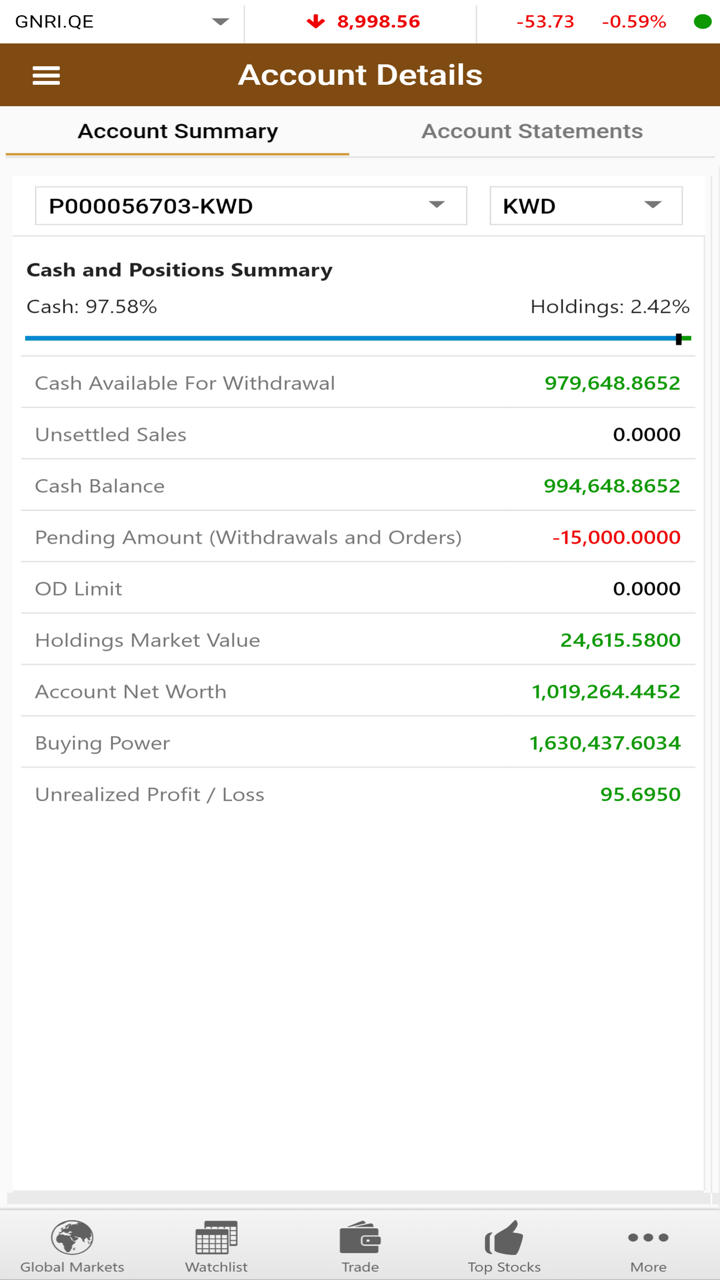

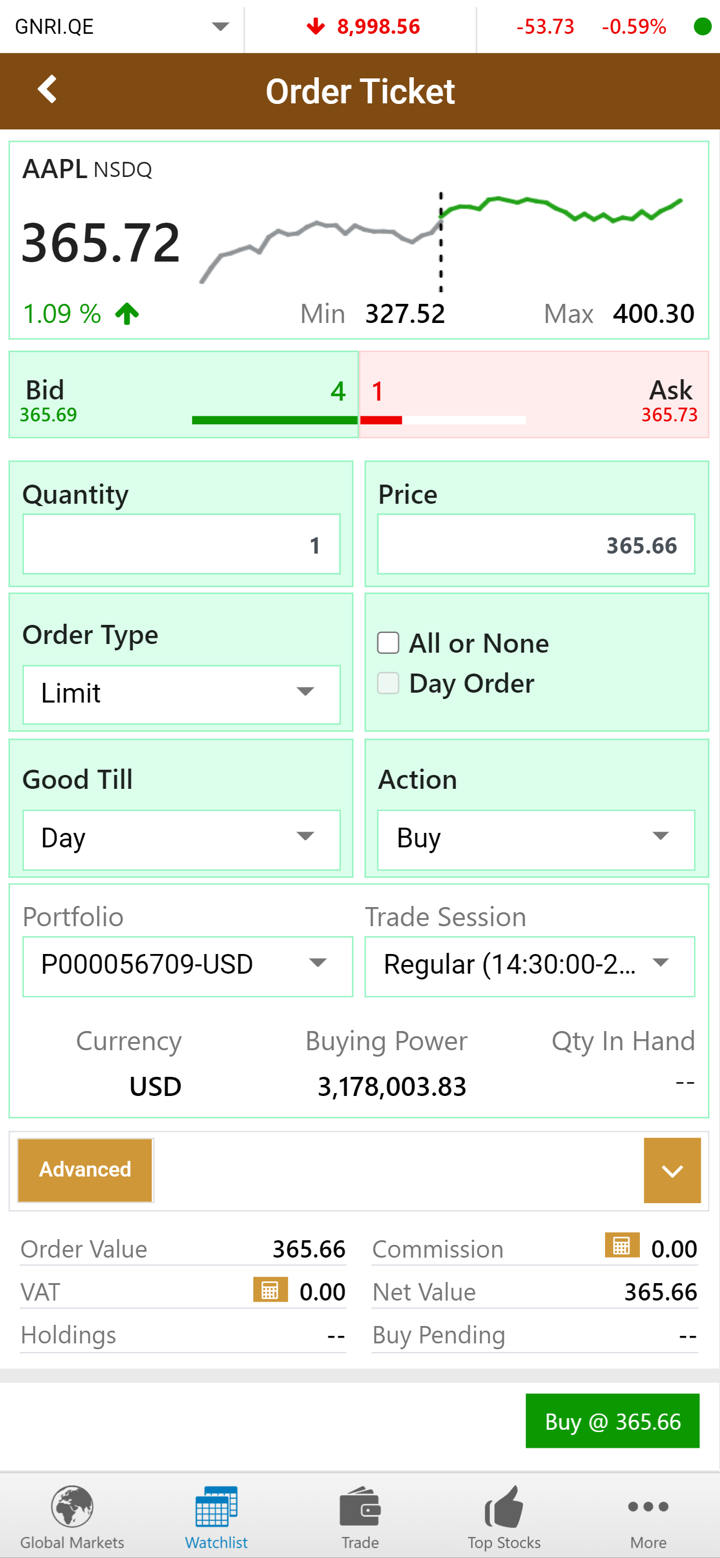

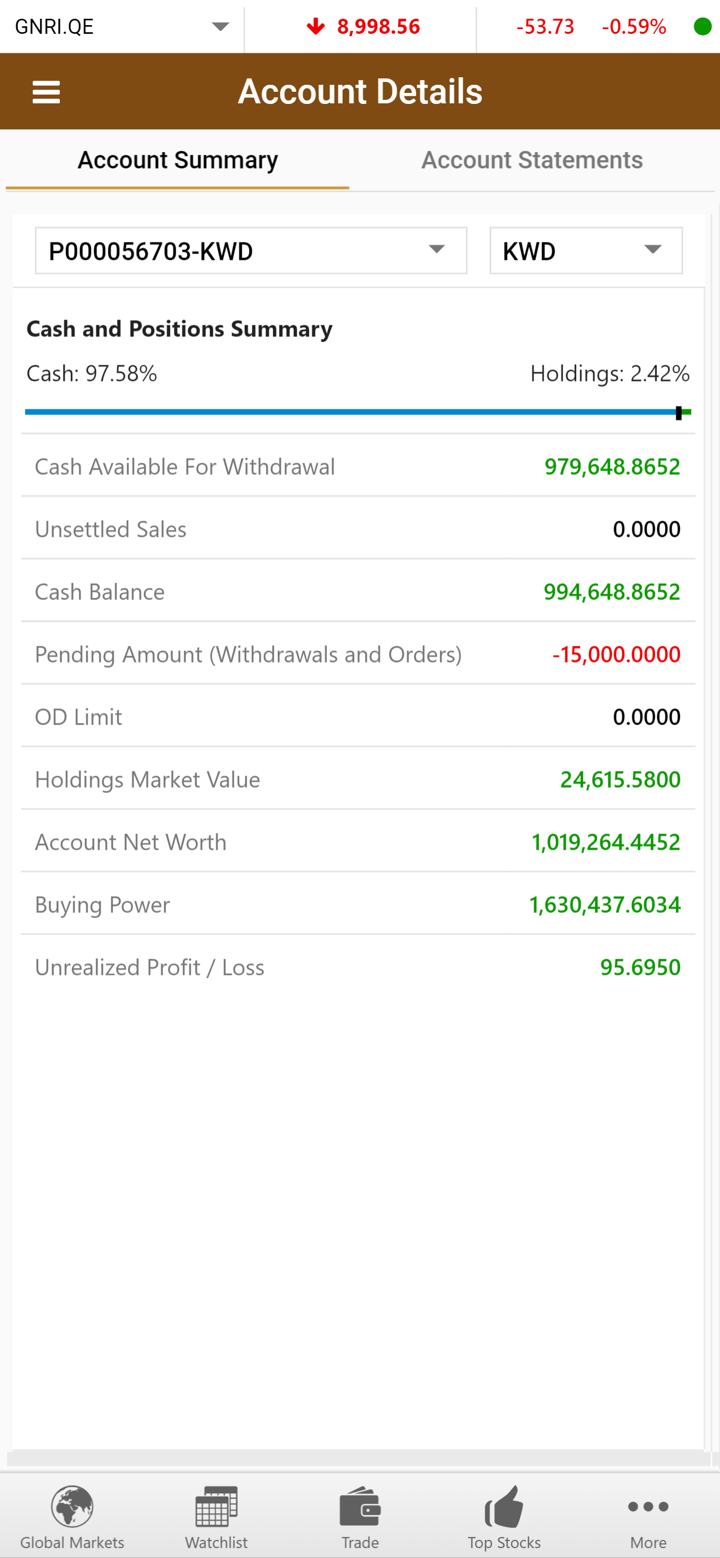

Account Type & Fees

| Account Type | Minimum Deposit | Maximum Leverage | Spread | Commission |

| Professional | $1,000 | 1:300 | 0 pips | $4/side |

| Standard | $100 | 1:300 | 1 pip | ❌ |

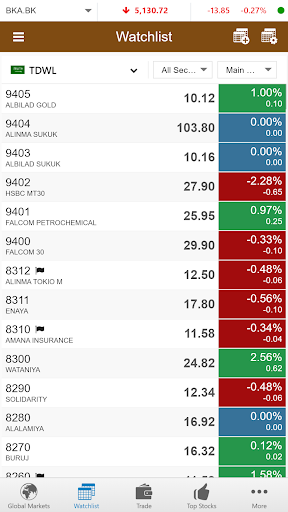

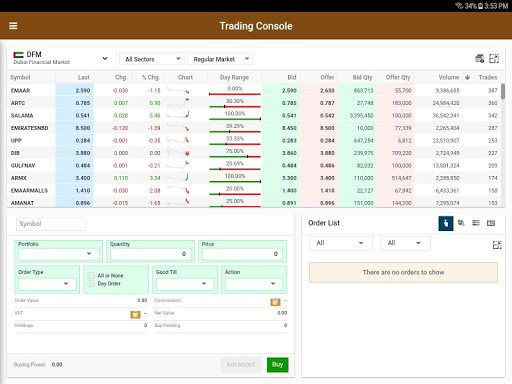

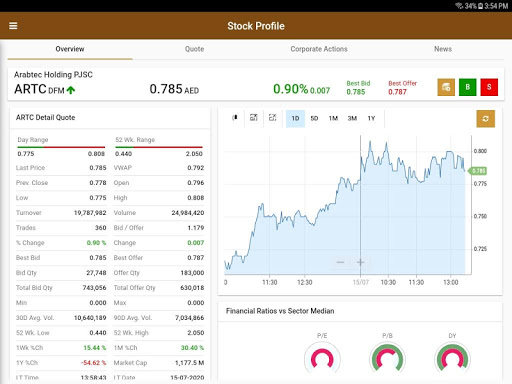

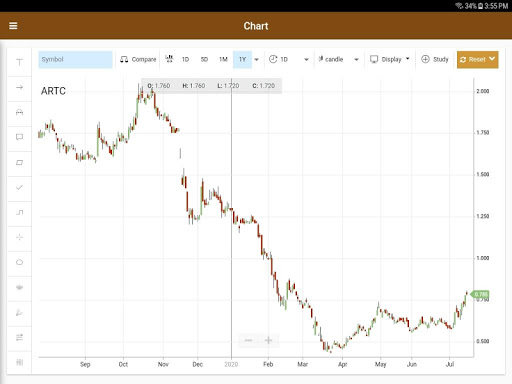

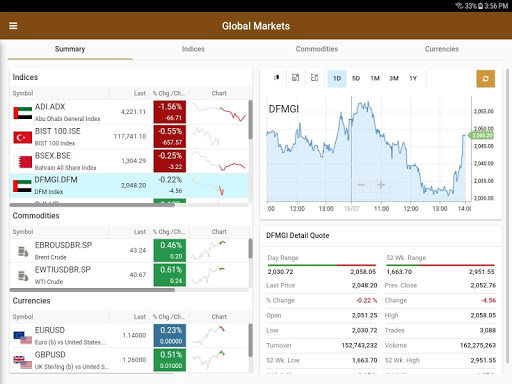

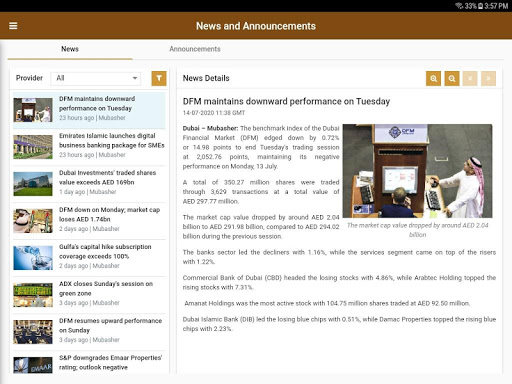

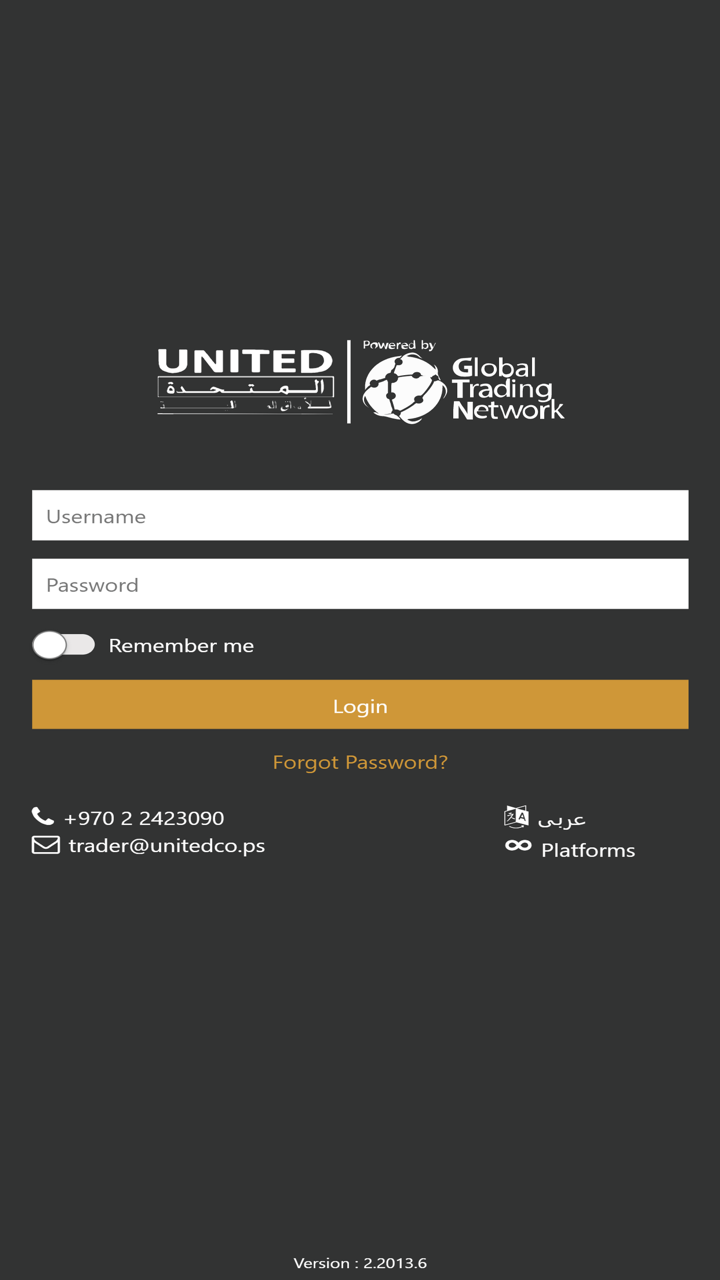

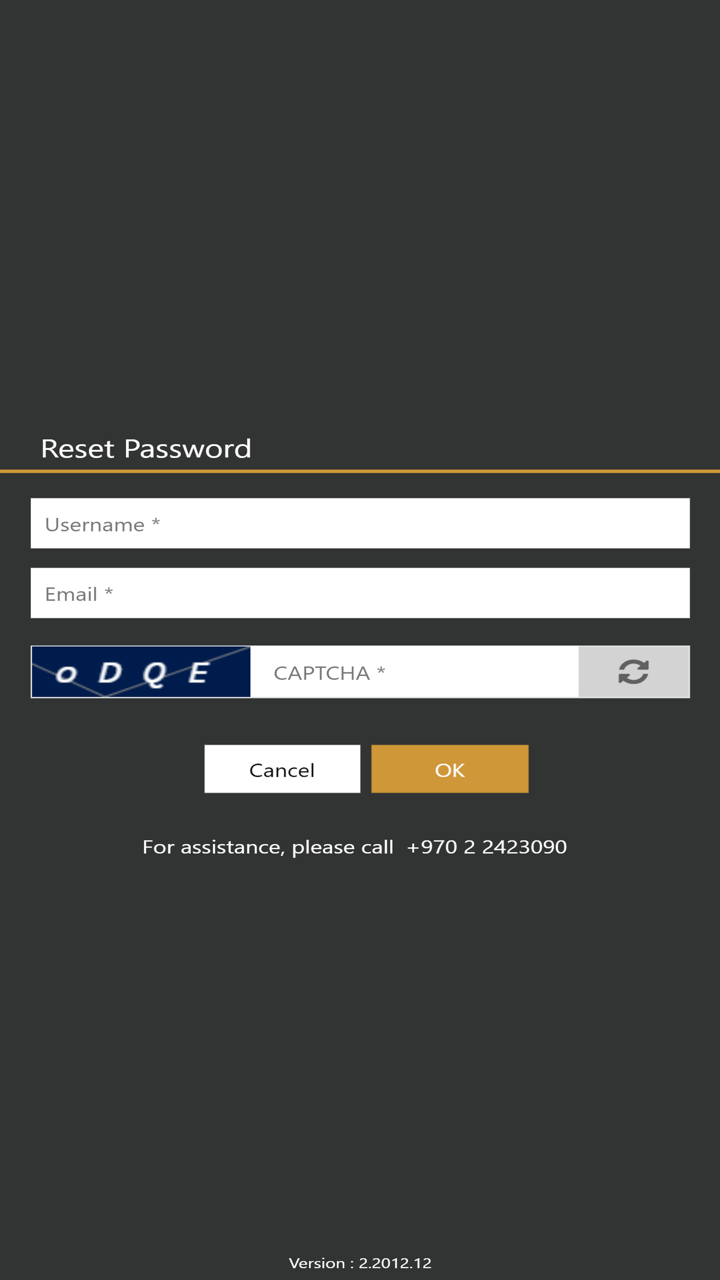

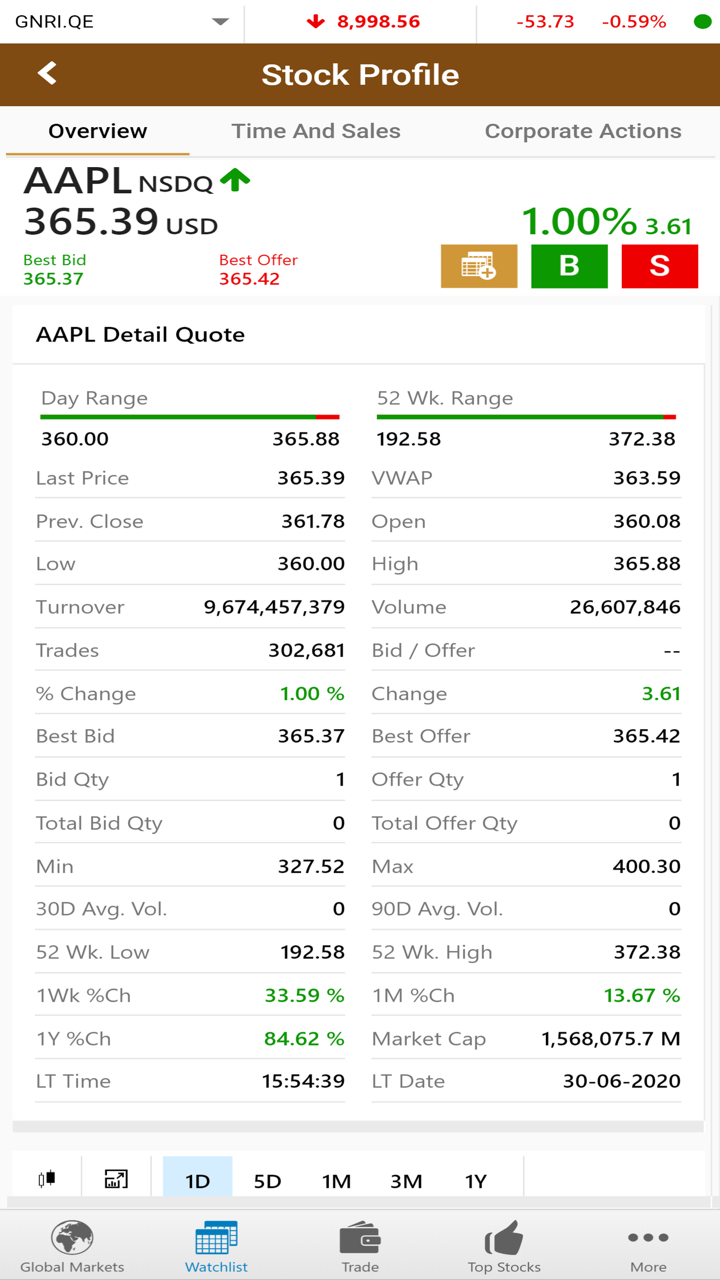

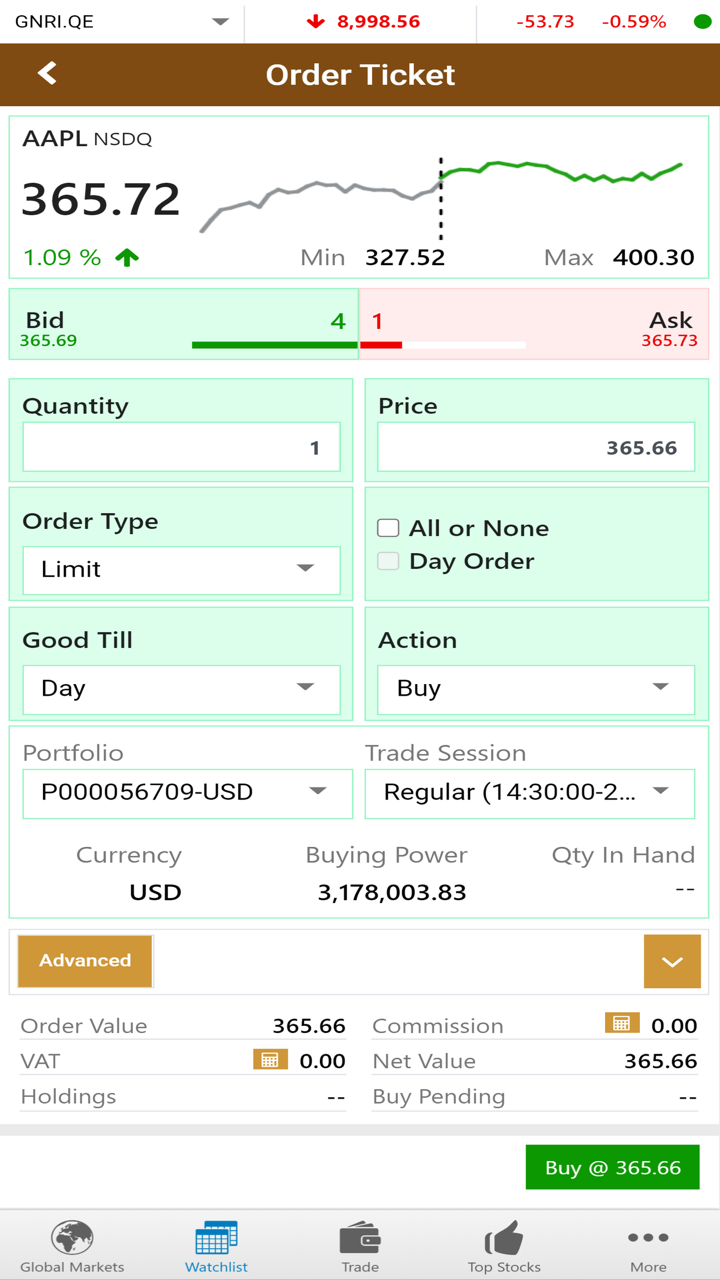

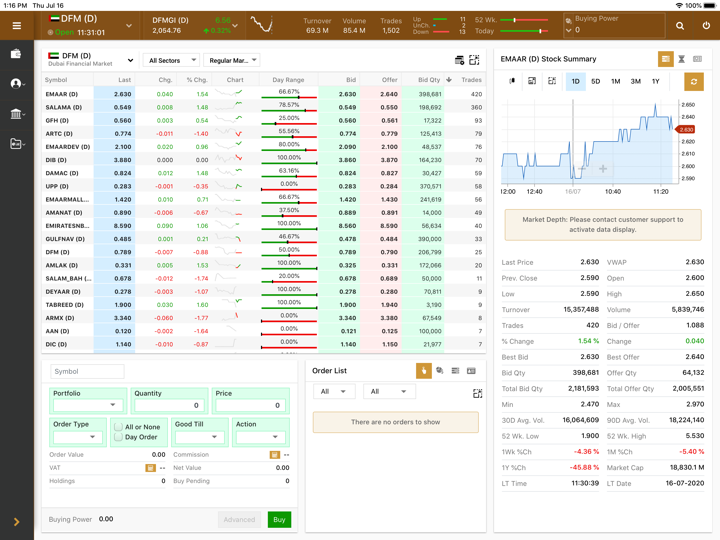

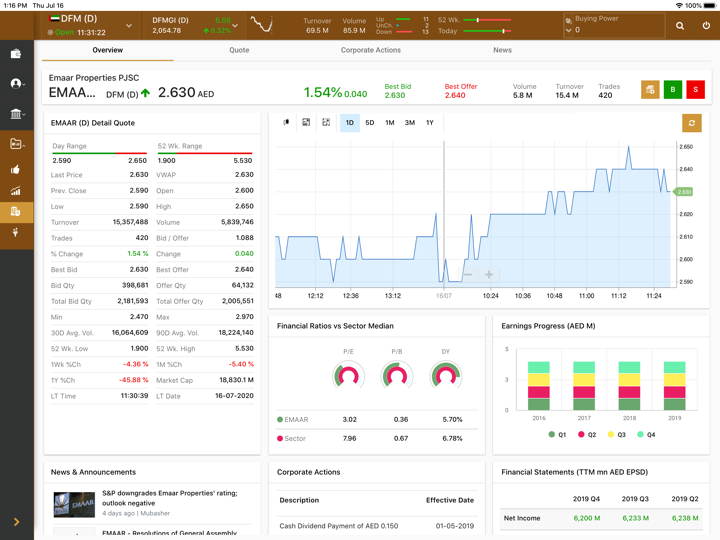

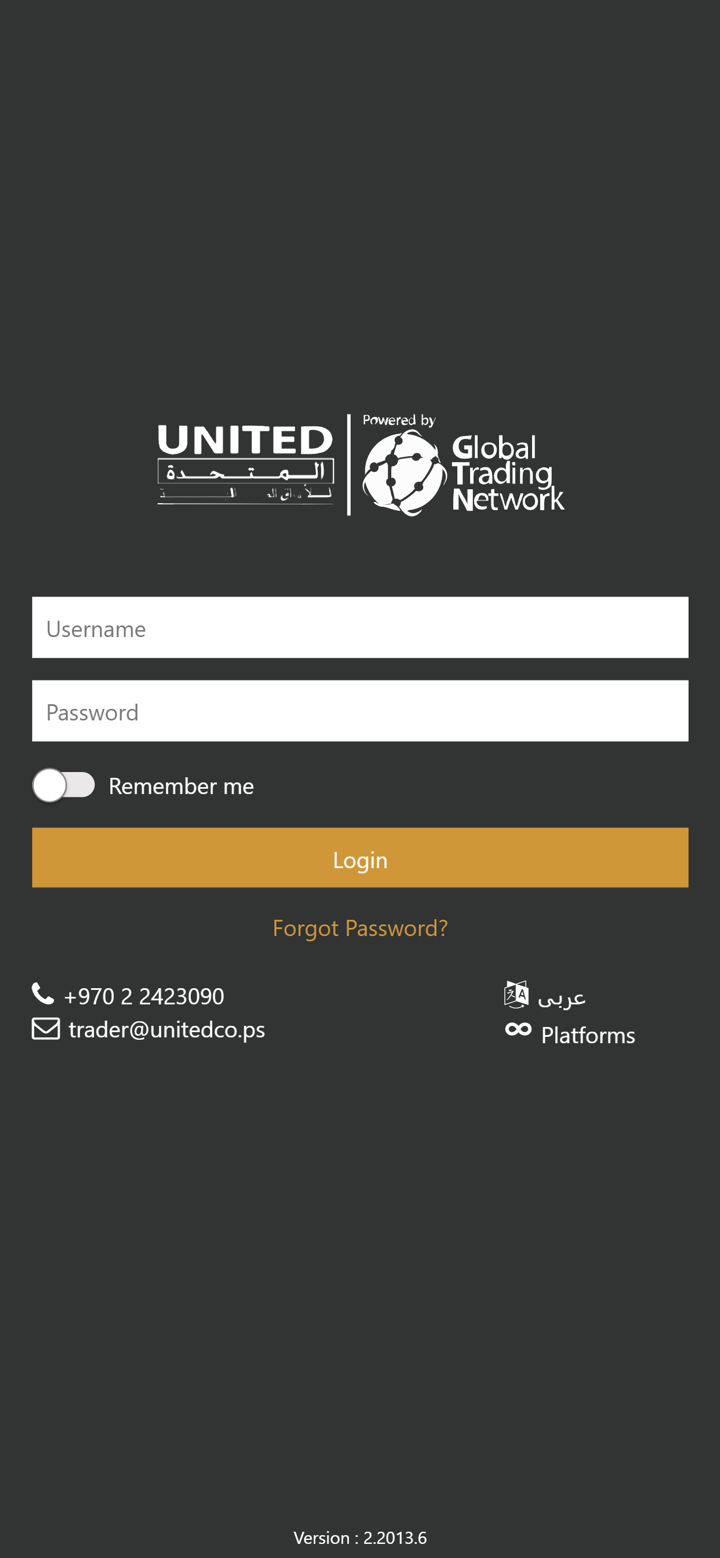

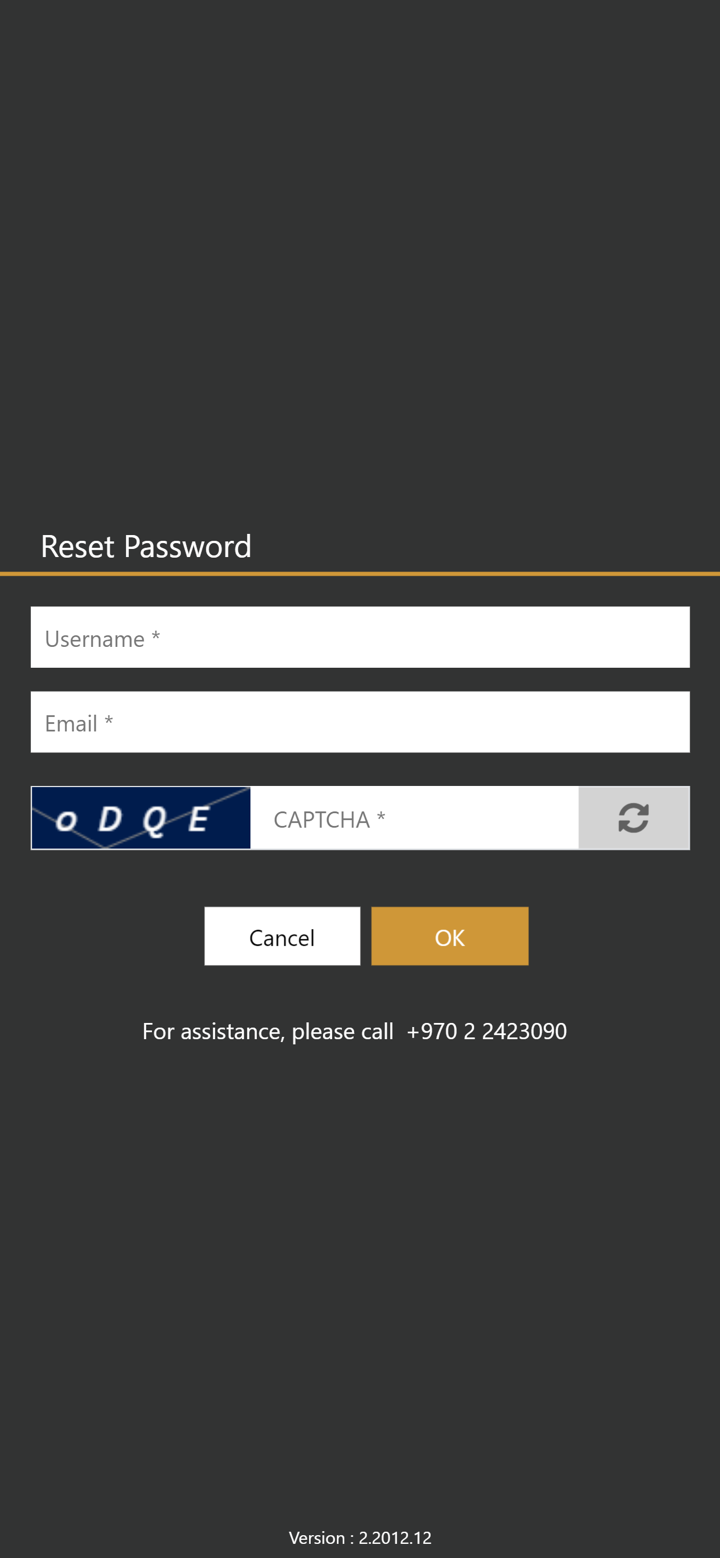

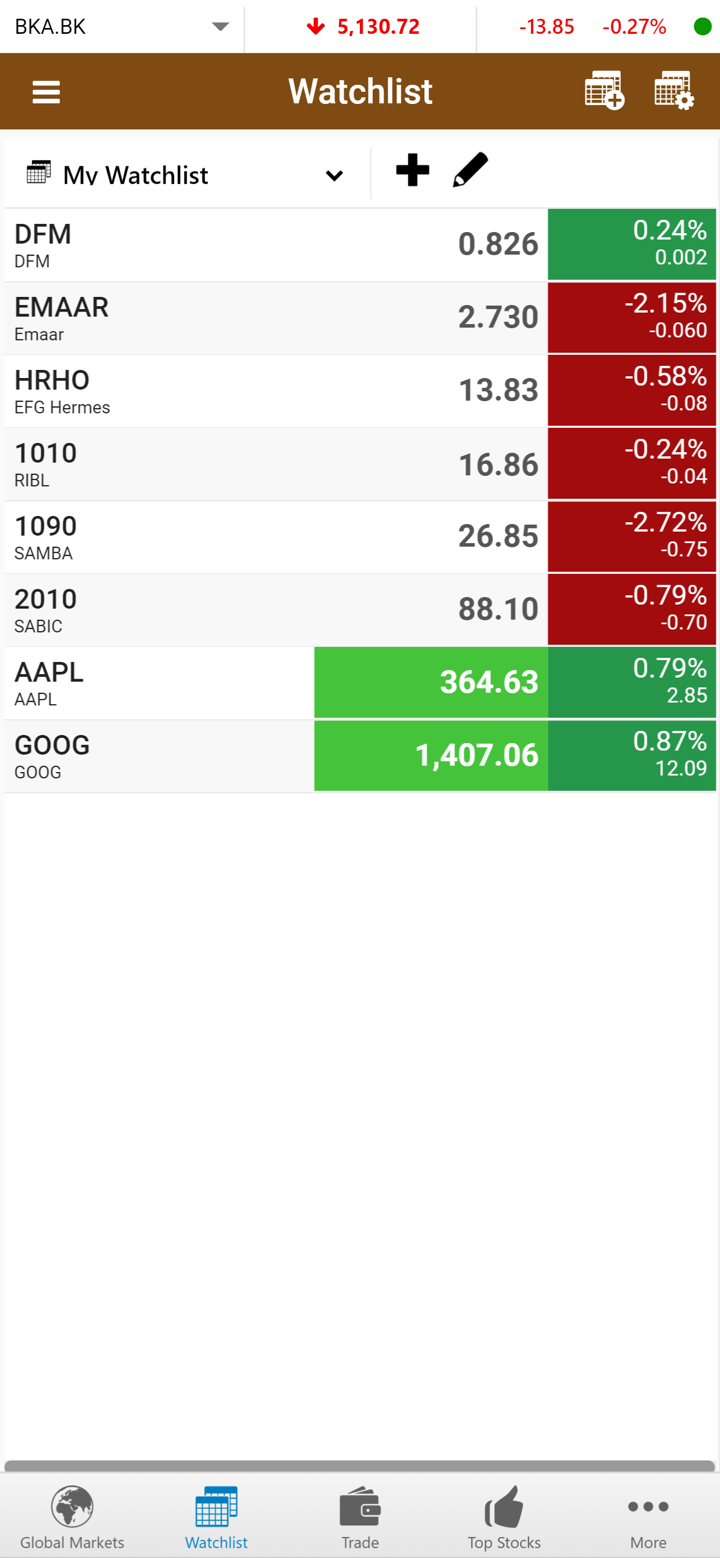

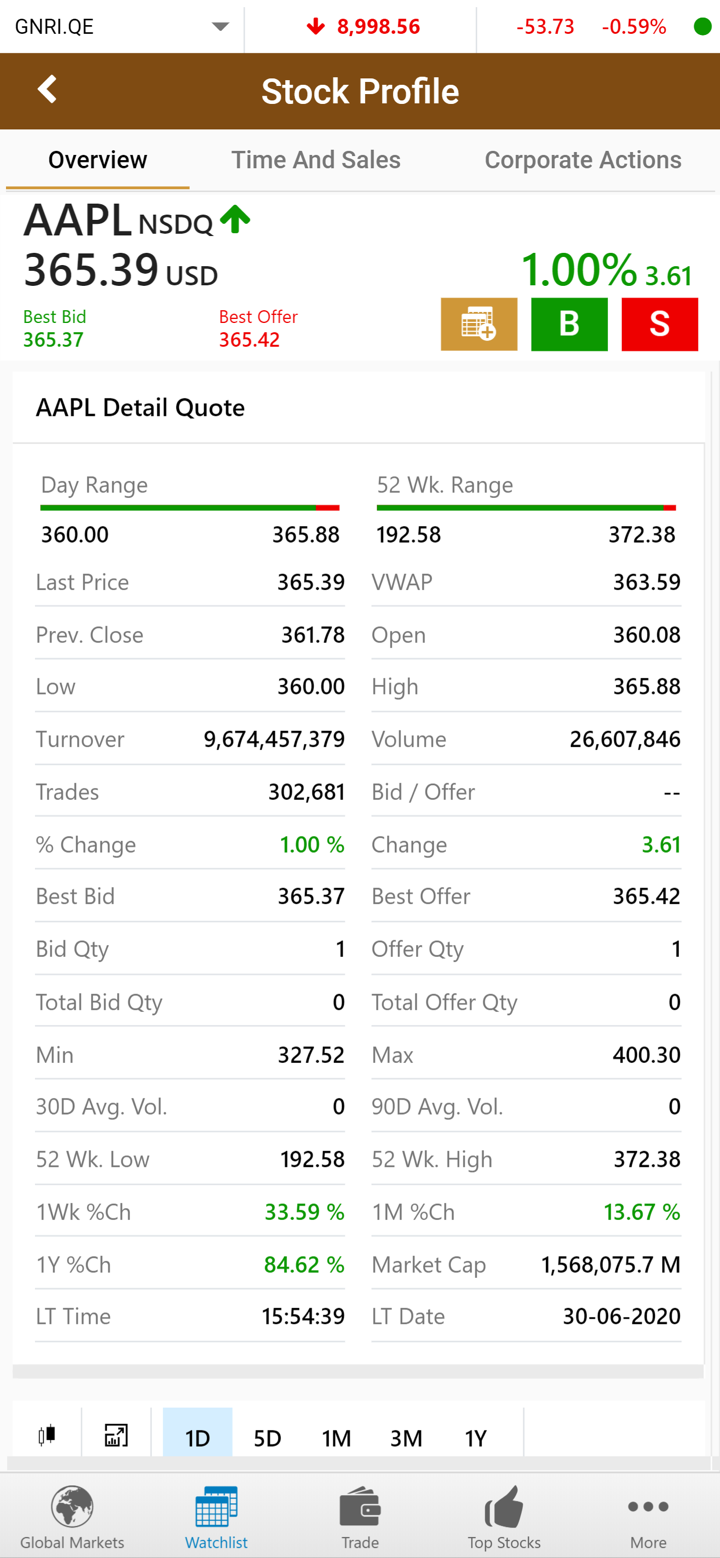

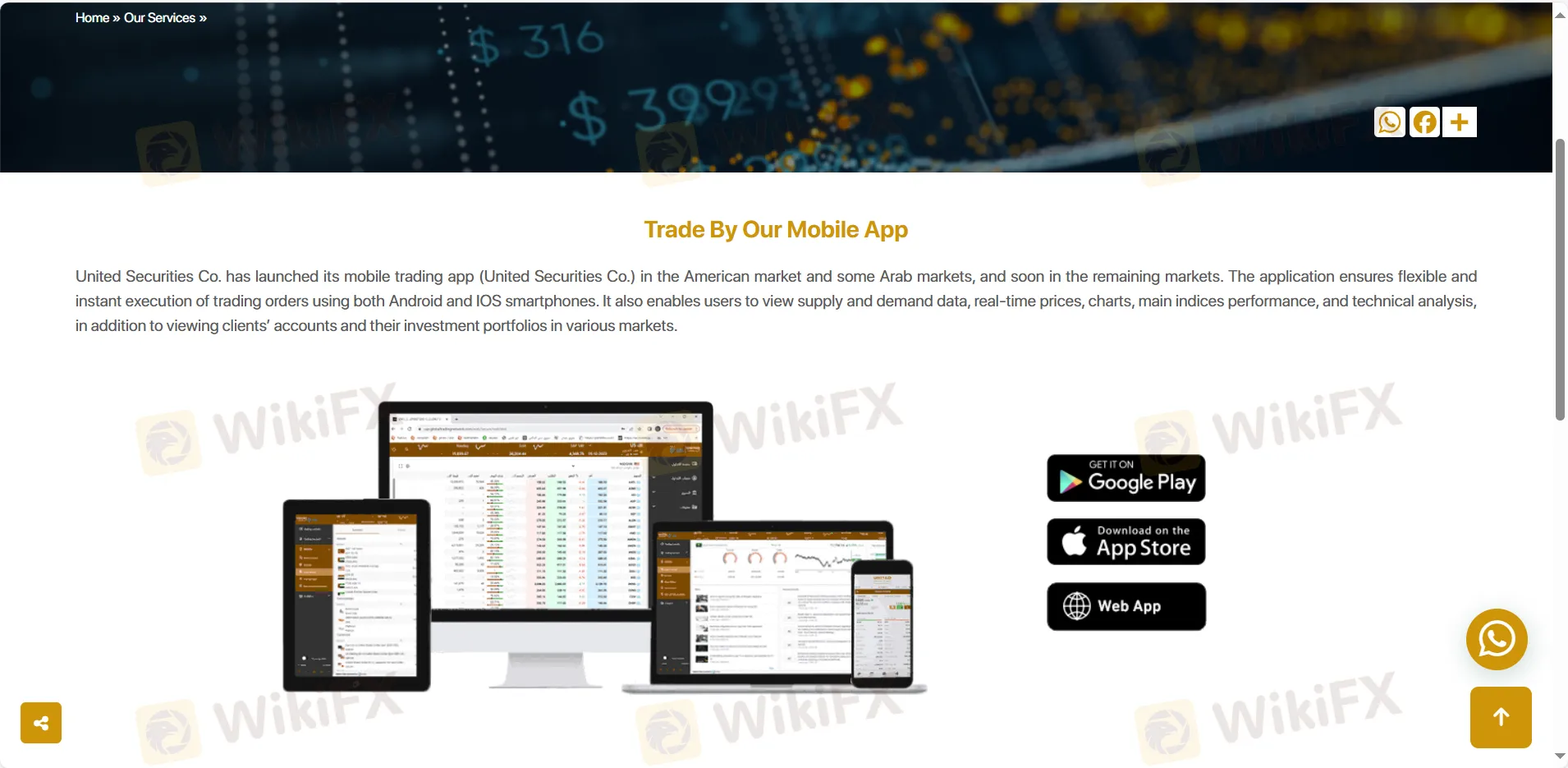

Trading Platform

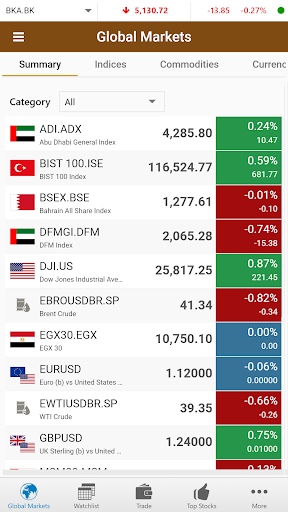

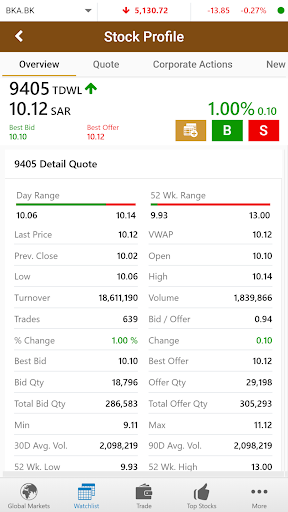

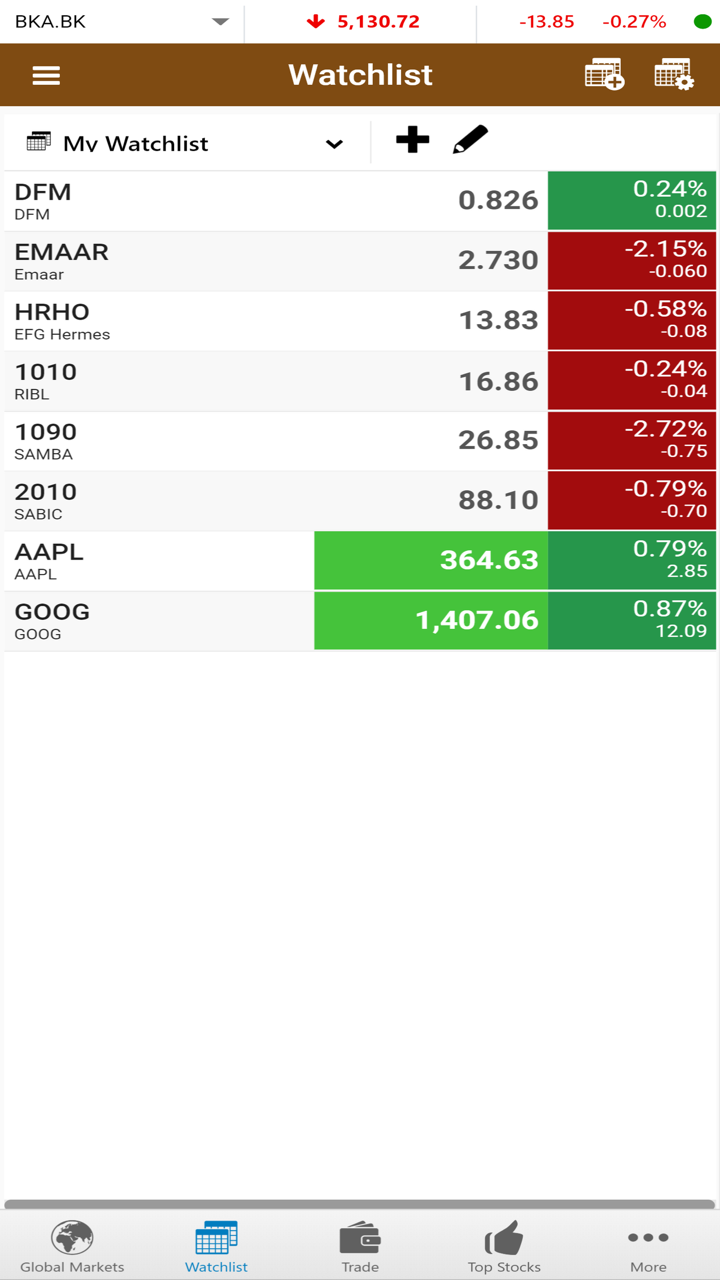

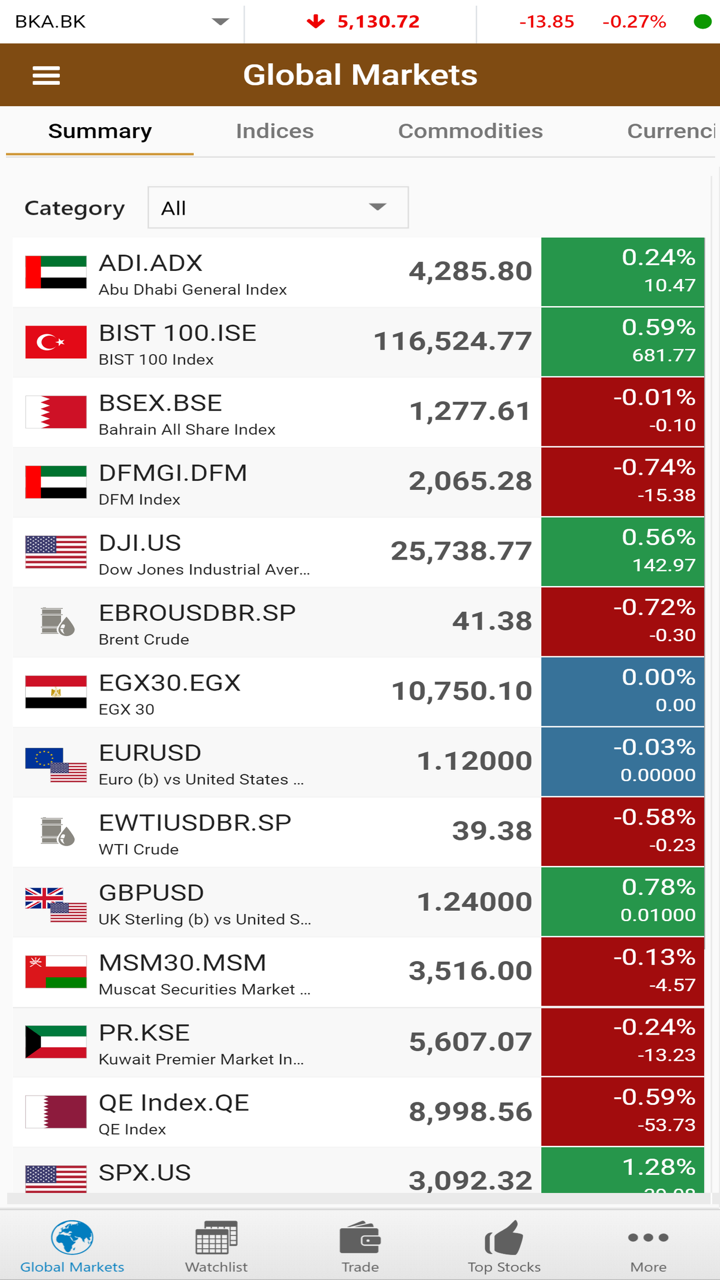

| Trading Platform | Supported | Available Devices | Suitable for |

| United Securities Co. app | ✔ | Mobile, desktop, laptop | / |

| MT5 | ✔ | Mobile, desktop, web | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

United Securities Co. accepts payments done via VISA, mastercard and banktransfer.