Company Summary

| Finansia Review Summary | |

| Founded | 2002 |

| Registered Country/Region | Thailand |

| Regulation | No regulation |

| Trading Product | Securities |

| Demo Account | ❌ |

| Trading Platform | Finansia HERO (PC, iOS, Android) |

| Minimum Deposit | / |

| Customer Support | Tel: 02 782 2400 |

| Email: cxcenter@fnsyrus.com | |

Finansia Information

Established in 2002 and headquartered in Thailand, Finansia Syrus Securities is a brokerage company providing a broad spectrum of services including securities trading, IPO subscriptions, and educational seminars. Though it runs as Broker No. 24 on the Stock Exchange of Thailand, it is not controlled globally and has no demo or Islamic account choices.

Pros and Cons

| Pros | Cons |

| Free investment seminars | No regulation |

| Offers multiple account types | No demo account for practice |

| Powerful in-house trading platform (Finansia HERO) | Unclear minimum deposit |

| Long operational history |

Is Finansia Legit?

Finansia is not a licensed or regulated entity by any major financial regulatory body. Although it is registered in Thailand, the Thai Securities and Exchange Commission (SEC) does not control its international or currency brokerage services.

WHOIS records show the domain fnsyrus.com was registered on May 26, 2009 and last modified on May 16, 2025. It will run out on May 26, 2026. Its present state is “client transfer prohibited”, which suggests it is active and safeguarded from unauthorised modifications or transfers, suggesting it is a live and functional domain under standard protection policies.

Finansia Services

Focusing on securities brokerage for both retail and institutional customers in Thailand, Finansia Syrus Securities provides a thorough spectrum of investment services. With a significant presence on the Stock Exchange of Thailand (Broker No. 24), it offers digital trading tools, market research, and educational support.

Account Type

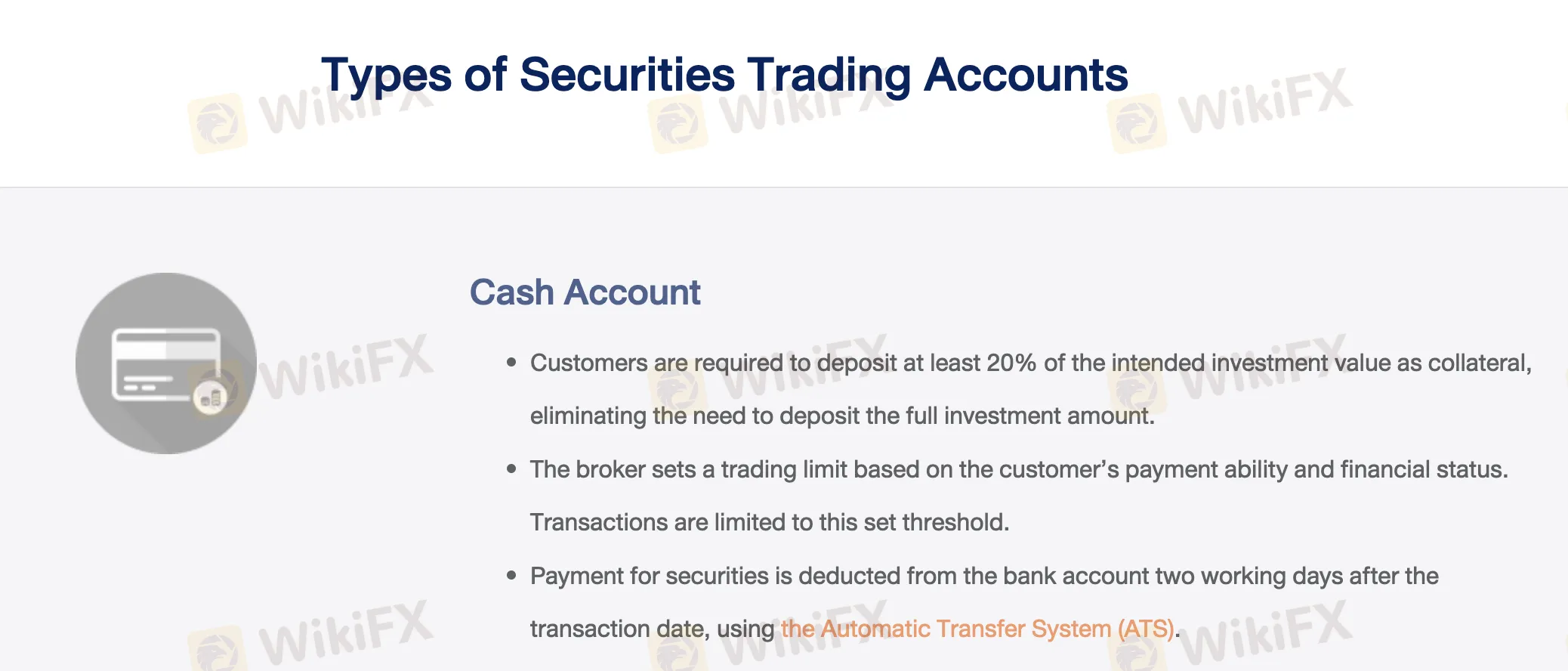

Finansia provides three kinds of actual trading accounts: Cash Account, Cash Balance Account, and Credit Balance Account. Each fits various trading requirements depending on financial flexibility and risk attitude. The official website has no sign of demo or Islamic (swap-free) accounts.

| Account Type | Key Feature | Suitable for |

| Cash | Deposit ≥20% of trade value as collateral; pay later via ATS | Traders with flexible capital |

| Cash Balance | Pre-fund 100% of trade amount; earns interest | Conservative investors, interest seekers |

| Credit Balance | Margin trading with collateral; automatic lending from broker | Experienced, high-risk tolerance traders |

Finansia Fees

Especially for customers utilizing internet trading channels, where brokerage costs can be as low as 0.10% for high-volume traders, Finansia Syrus Securities' trading fees are fairly inexpensive in comparison to the Thai industry average. The charge system is tiered, so lower rates reward more trade activity.

| Daily Trading Volume (THB) | With Investment Advisor (Cash A/C) | Cash Balance / Credit Balance A/C | Online Channel |

| ≤ 5 million | 0.25% | 0.20% | 0.15% |

| 5M < value ≤ 10 million | 0.22% | 0.18% | 0.13% |

| 10M < value ≤ 20 million | 0.18% | 0.15% | 0.11% |

| > 20 million | 0.15% | 0.12% | 0.10% |

Trading Platform

Supported on PC, iOS, and Android, Finansia Syrus Securities provides the Finansia HERO trading system. Active and tech-savvy traders seeking real-time statistics, auto orders, backtesting, and configurable stock scans will find it perfect.

| Trading Platform | Supported | Available Devices | Suitable for |

| Finansia HERO | ✔ | PC, iOS, Android | Active traders seeking AI-driven tools, automation, and real-time picks |

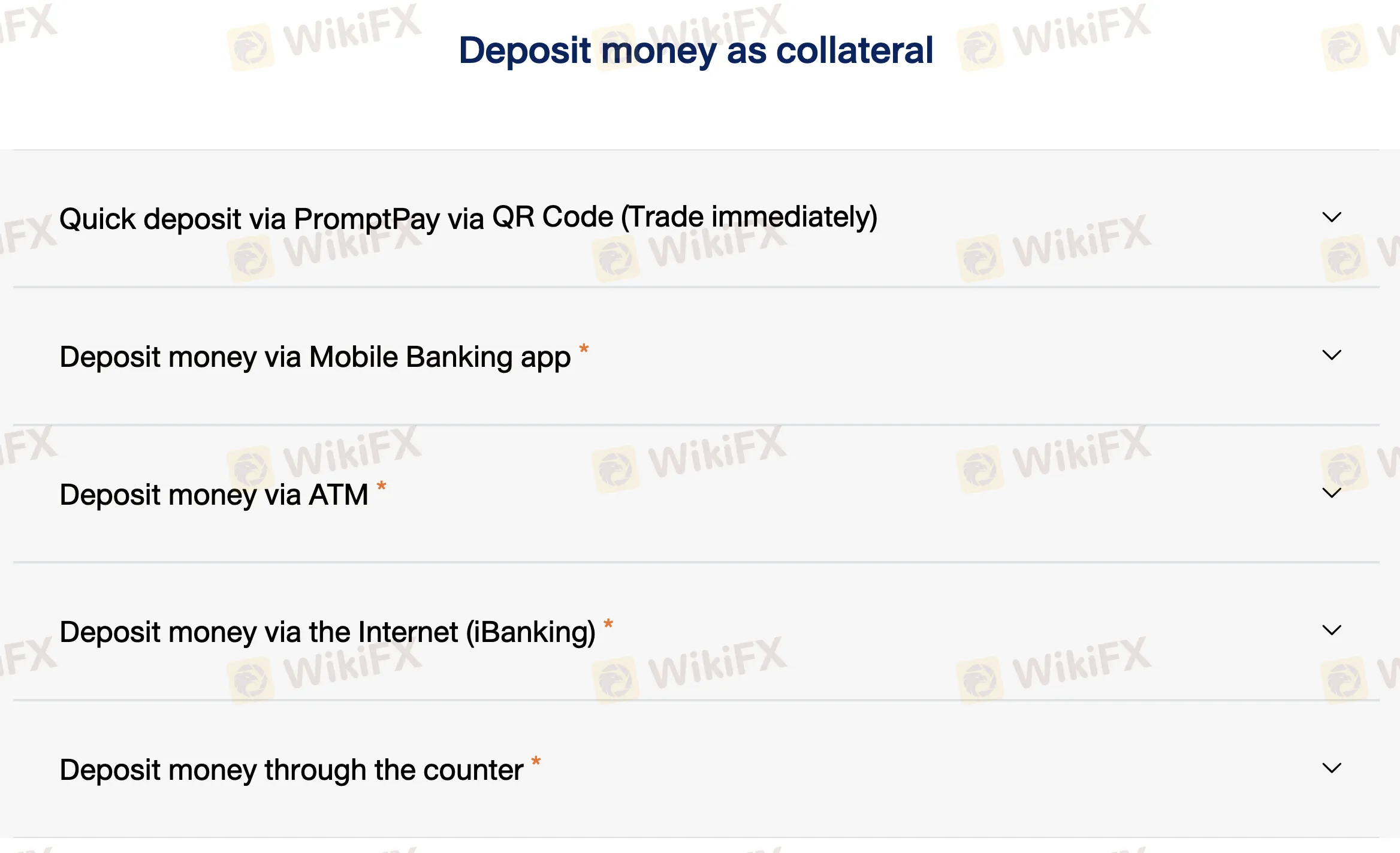

Deposit and Withdrawal

Though deposits up to 2,000,000 THB are supported via PromptPay QR, Finansia does not impose deposit fees and the minimum deposit requirement is not explicitly defined. Deposits have to come from an account under the same name as the owner of the securities trading account.

| Payment Method | Fees | Processing Time |

| PromptPay QR Code | Free | Immediate (8:00–18:00) |

| Mobile Banking App | Varies by bank | |

| ATM Transfer | ||

| Internet Banking (iBanking) | ||

| Bank Counter Deposit |