Company Summary

| LMAX Group Review Summary in 10 Points | |

| Founded | 2010 |

| Headquarters | London, UK |

| Regulation | FCA, CYSEC |

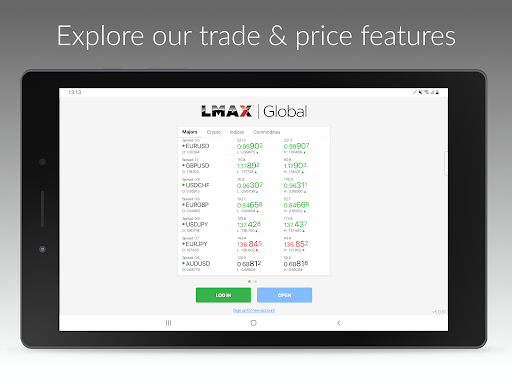

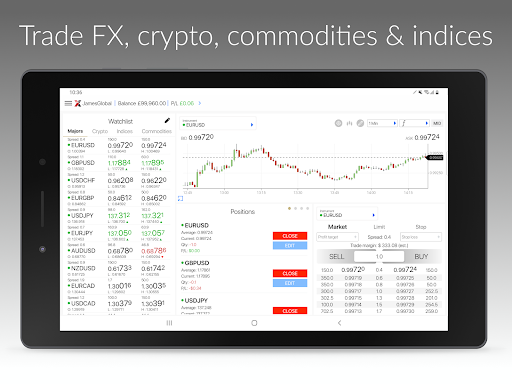

| Market Instruments | Forex, precious metals, stock indices, commodities, cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:100 (forex), 1:50 (metals and commodities) |

| EUR/USD Spread | 0.2 pips |

| Trading Platforms | LMAX Global, MetaTrader4 |

| Minimum deposit | $1,000 |

| Customer Support | 24/7 phone, email, and live chat |

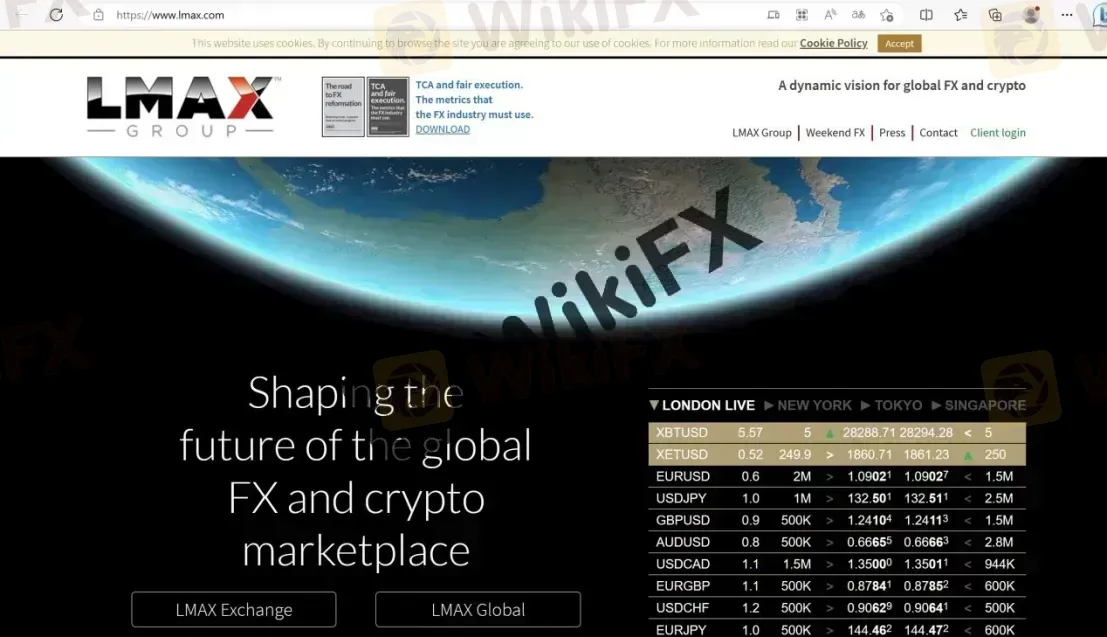

What is LMAX Group?

LMAX Group is a UK-based multilateral trading facility (MTF) that offers forex and cryptocurrency trading to retail and institutional clients. It was founded in 2010 and is regulated by the Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CYSEC). LMAX is known for its transparent and fair execution model, as well as its low latency and high-speed trading technology. The company's headquarters are located in London, and it has additional offices in New York, Tokyo, and Hong Kong.

What Type of Broker is LMAX Group?

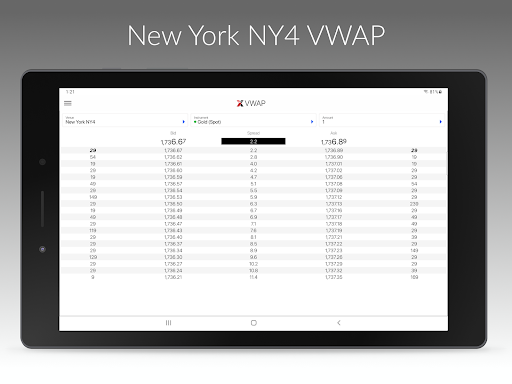

LMAX is an electronic communication network (ECN) broker that operates a multilateral trading facility (MTF) for forex and cryptocurrency trading. It is a pure agency broker, which means it does not take positions against its clients and earns revenue solely from commissions and fees. LMAX provides institutional and retail traders with deep liquidity, fast execution, and transparent pricing through its proprietary trading platform, LMAX Global.

Pros & Cons

LMAX has several advantages, such as being a regulated broker, offering transparent and direct market access, providing a range of trading instruments, and offering a professional trading platform.

On the other hand, LMAX has some drawbacks, including limited account types and high minimum deposit requirements.

| Pros | Cons |

| • Regulated by FCA and CySEC | • High minimum deposit requirement |

| • Offers DMA (Direct Market Access) | •High commission fees |

| • Low latency and fast trade execution | • No social trading or copy trading features |

| • Transparent pricing and deep liquidity | |

| • Advanced trading technology and tools | |

| • Professional and institutional grade services | |

| • Segregated client funds and investor protection |

Is LMAX Group Safe or Scam?

As a regulated broker by reputable financial authorities such as FCA and CySEC, LMAX is considered a reliable broker. The company also prioritizes the security of its clients' funds by keeping them in segregated accounts and offering negative balance protection.

| Protection Measures | Detail |

| Regulation | FCA, CySEC |

| Segregated client funds | To protect them in case of any financial difficulties or insolvency |

| Financial Services Compensation Scheme (FSCS) | A member of the FSCS, which provides eligible clients with protection up to £85,000 per person in the event of the broker's insolvency |

| Negative balance protection | Ensures that clients can never lose more than their account balance |

| Two-factor authentication | Adds an extra layer of security to clients' accounts |

| SSL encryption | To protect clients' personal and financial information from unauthorized access |

LMAX is a highly regulated and reputable broker that takes the security of its clients' funds seriously. It is regulated by the FCA and CYSEC, and it implements various measures to ensure the safety of its clients' funds, such as holding them in segregated accounts and offering negative balance protection. Overall, LMAX appears to be a reliable and trustworthy broker.

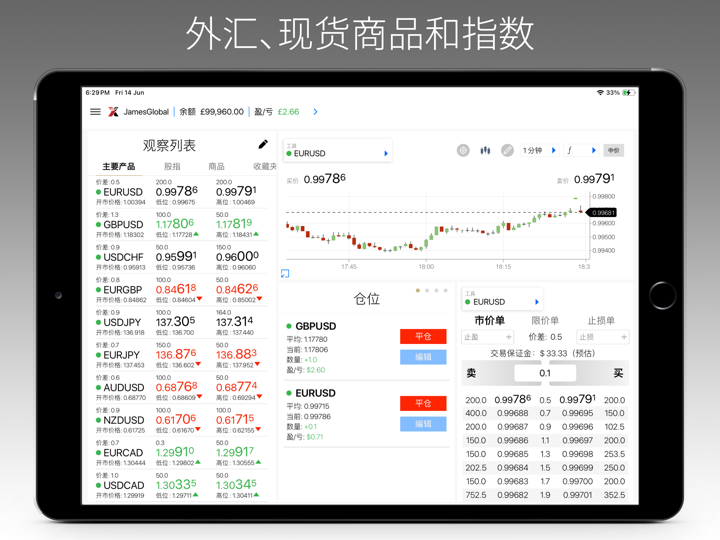

Market Instruments

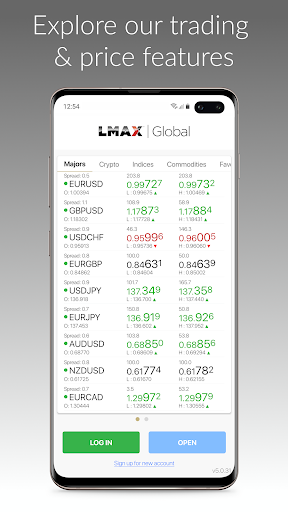

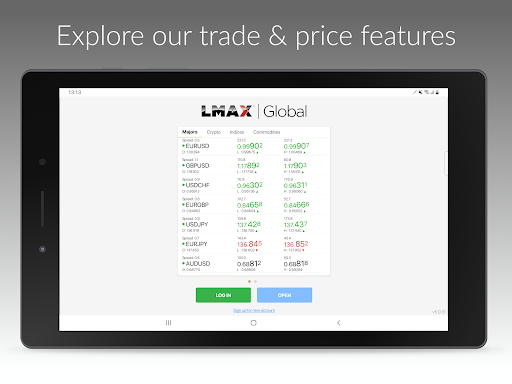

LMAX provides access to a range of financial instruments across various asset classes, including:

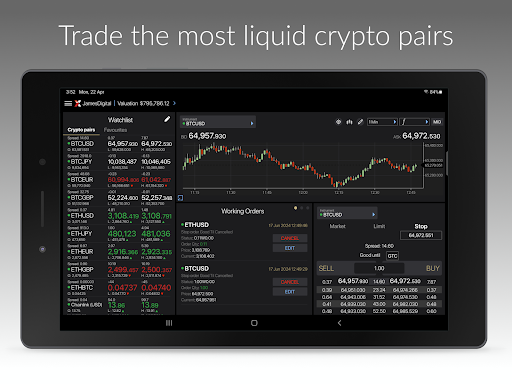

- Forex: Major, minor, and exotic currency pairs

- Indices: CFDs on major global indices, including UK100, GER30, US30, and more

- Commodities: Precious metals such as gold and silver, as well as energy products like crude oil and natural gas

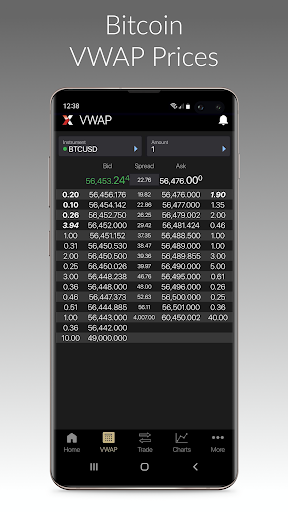

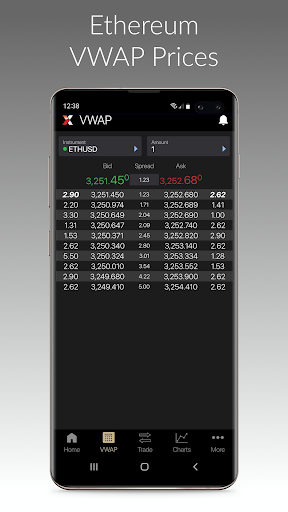

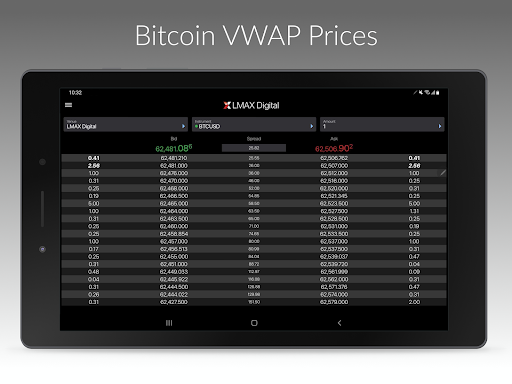

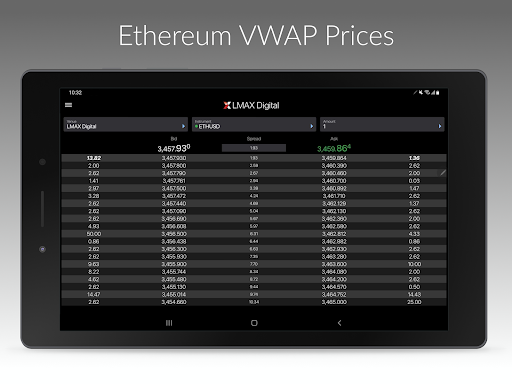

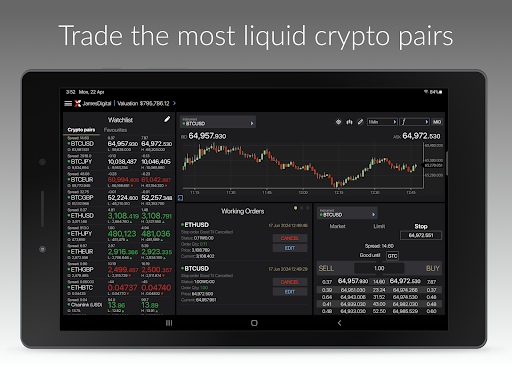

- Cryptocurrencies: CFDs on Bitcoin, Ethereum, Litecoin, and Ripple

- It is important to note that the range of trading instruments may vary depending on the specific entity of LMAX and the jurisdiction in which it operates.

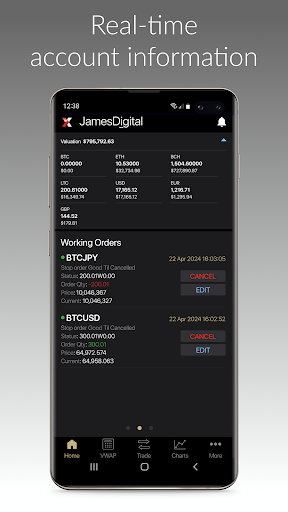

Accounts

LMAX offers different account types, each with different features and benefits:

- LMAX Global Account: This account is designed for institutions, hedge funds, asset managers, and professional traders. It offers access to the LMAX Global trading platform, deep liquidity, and low latency execution.

- LMAX Professional Account: This account is designed for experienced traders and offers access to the LMAX Exchange central limit order book, low latency execution, and competitive pricing.

- LMAX Prime Account: This account is designed for brokers, banks, and other financial institutions that want to access LMAX Exchange liquidity and offer it to their clients. It offers deep liquidity, low latency execution, and access to a range of trading tools and services.

- LMAX Interbank Account: This account is designed for banks and other financial institutions that want to access LMAX Exchange liquidity and offer it to their clients. It offers deep liquidity, low latency execution, and access to a range of trading tools and services.

All of these accounts have different minimum deposit requirements and fee structures.

Leverage

The maximum leverage offered by LMAX varies based on the account type and the asset being traded. For example, the maximum leverage for forex trading is up to 1:100, while for metals and commodities, it is up to 1:50.

It's important to note that leverage can increase both potential profits and losses, so it should be used with caution.

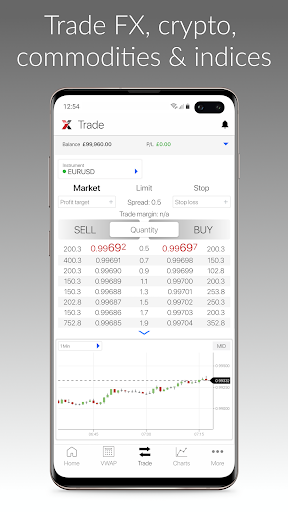

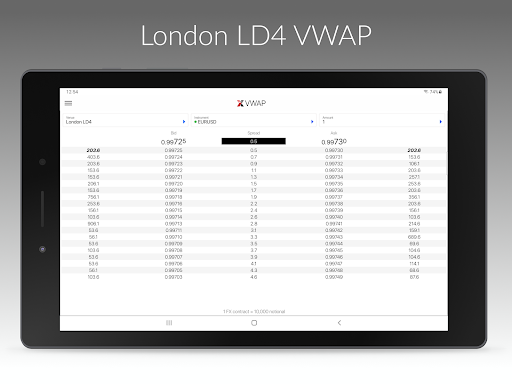

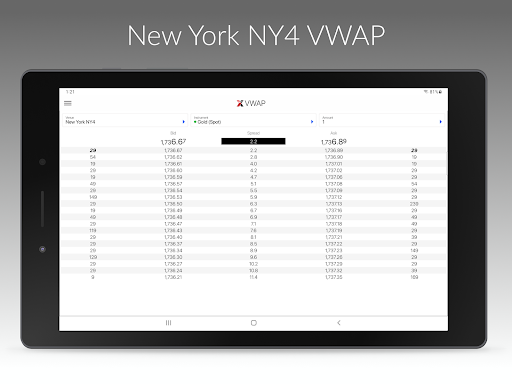

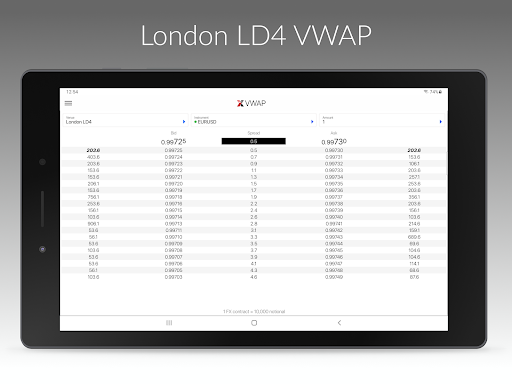

Spreads & Commissions

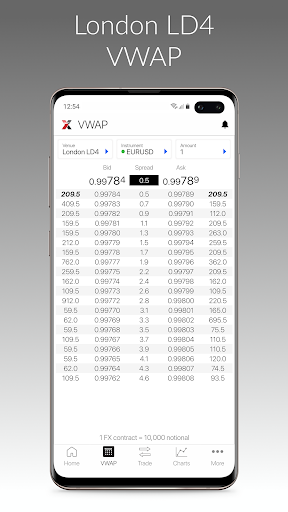

LMAX offers a variable spread on EUR/USD, which can start from as low as 0.2 pips during peak trading hours. However, the average spread is usually around 0.5-1 pip. It's worth noting that the spread can widen during periods of low liquidity or high market volatility.

The commission fee varies depending on the account type and the trading volume of the client. Here is a breakdown of the commission fees for LMAX:

LMAX Global: The commission for forex pairs ranges from $2.5 to $4.5 per $100,000 traded, depending on the trading volume. For indices, the commission ranges from $1.25 to $5 per lot traded, depending on the instrument and the trading volume.

LMAX Professional: The commission for forex pairs ranges from $2 to $3 per $100,000 traded, depending on the trading volume. For indices, the commission ranges from $1 to $3 per lot traded, depending on the instrument and the trading volume.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| LMAX | 0.2 pips | $2-$4.5 per lot/trade |

| IG | 0.6 pips | None |

| Saxo Bank | 0.9 pips | None |

| CMC Markets | 0.7 pips | None |

| Admiral Markets | 0.5 pips | $6 per lot/trade |

| Pepperstone | 0.16 pips | $3.76 per lot/trade |

Note that the above information may vary depending on the account type, trading platform, and other factors. It's always a good idea to check with the broker directly for the most up-to-date and accurate information.

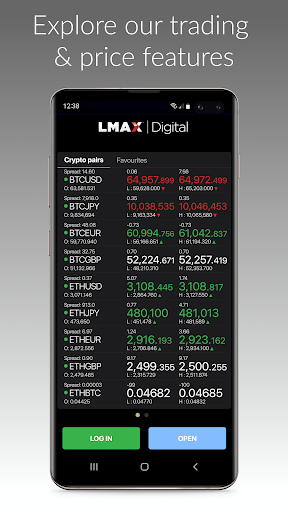

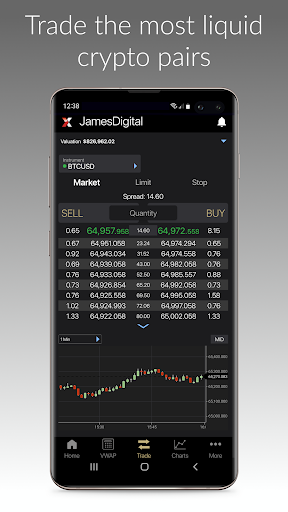

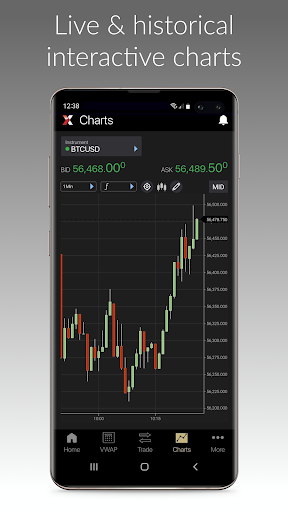

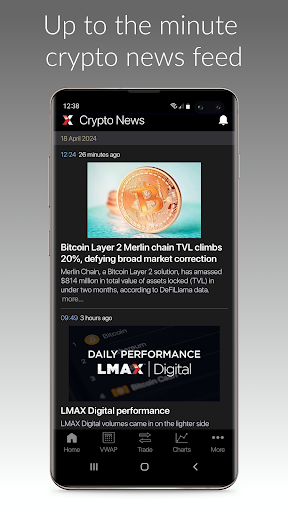

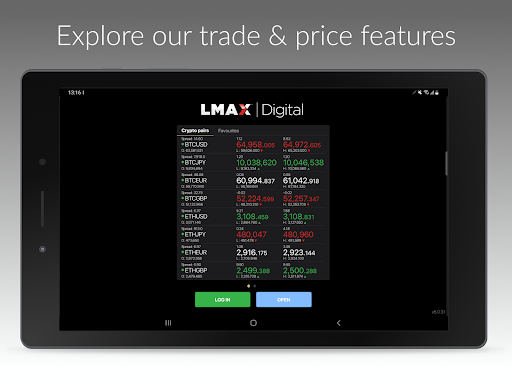

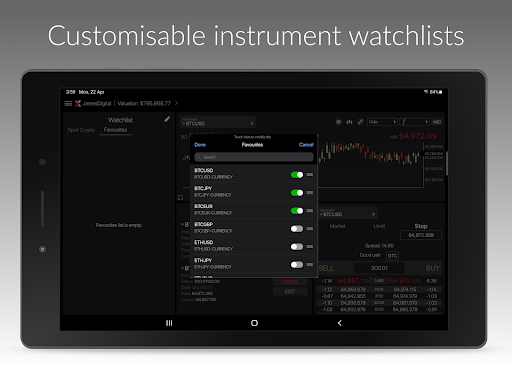

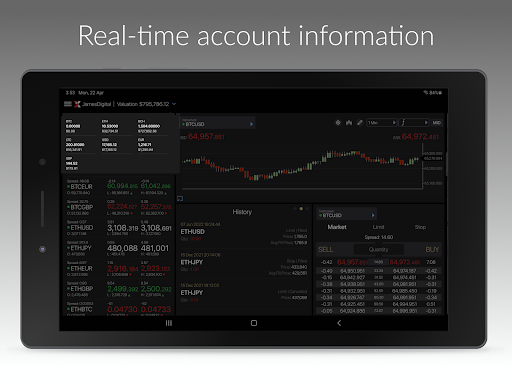

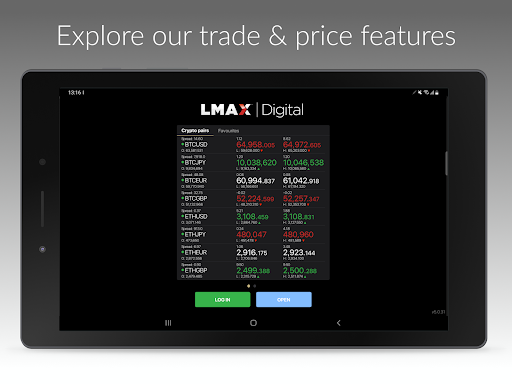

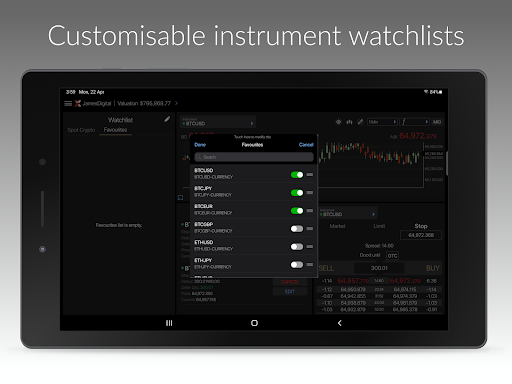

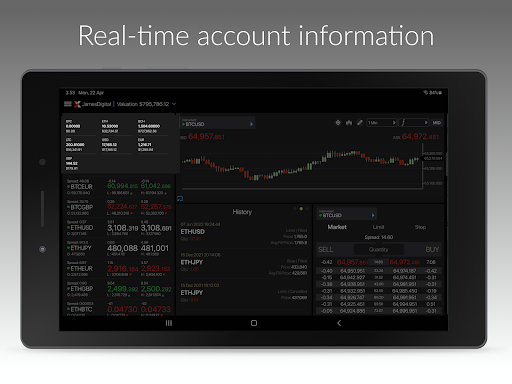

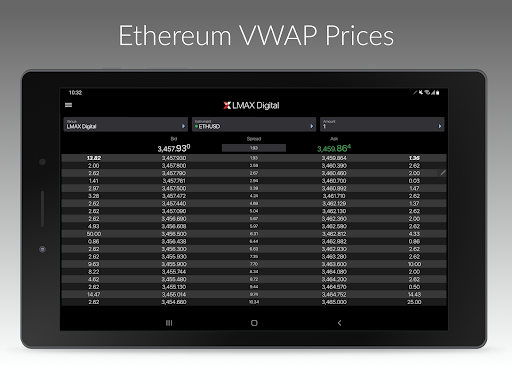

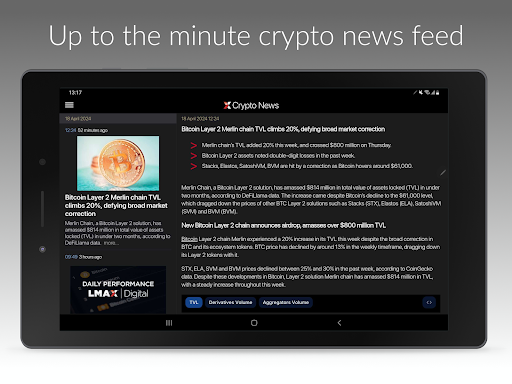

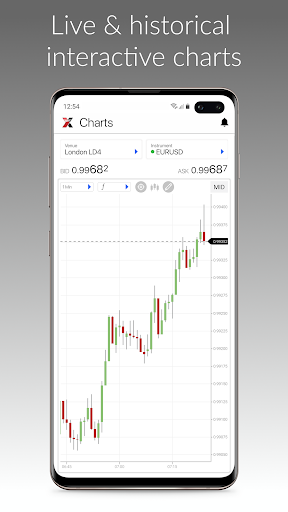

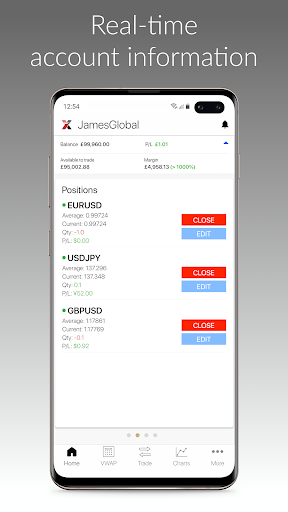

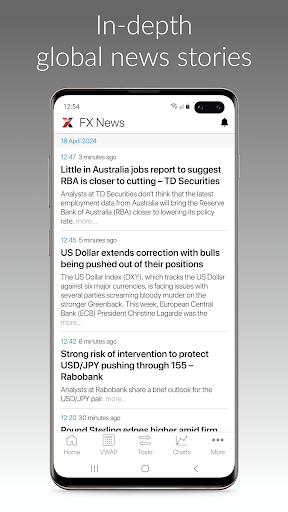

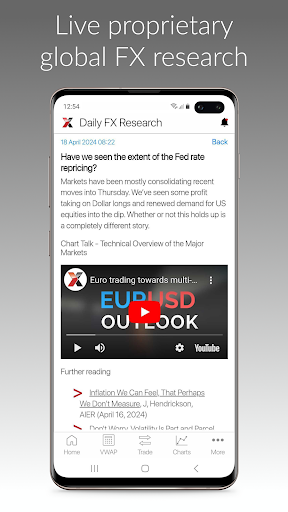

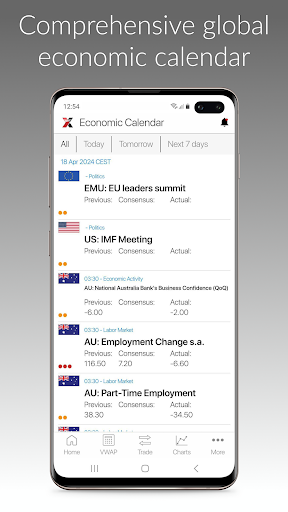

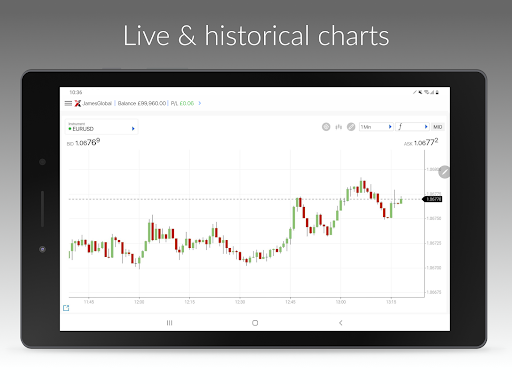

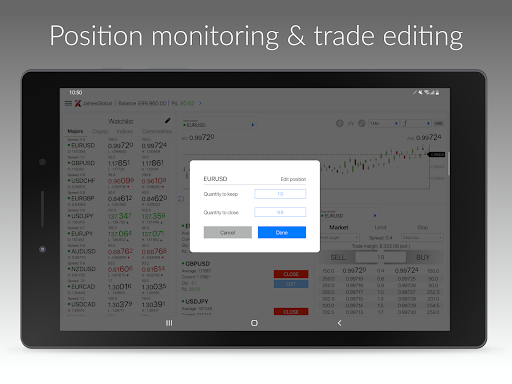

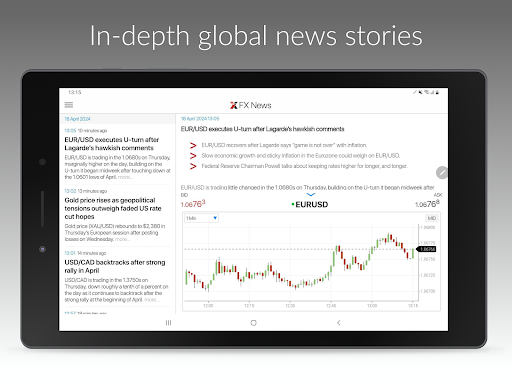

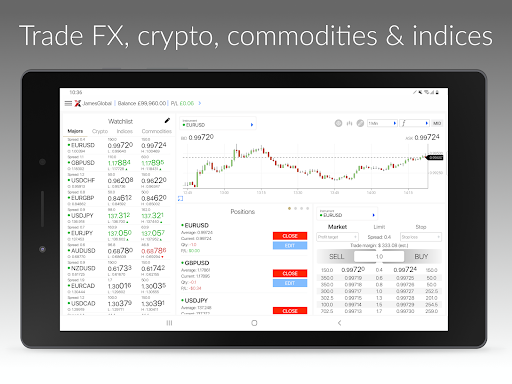

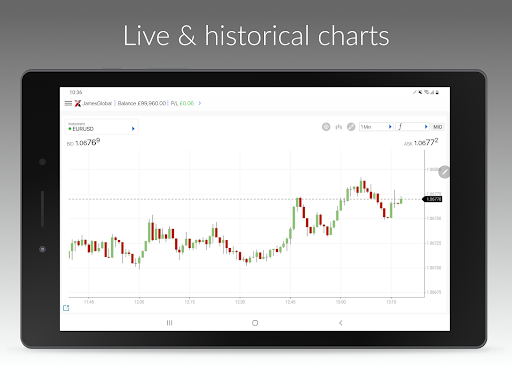

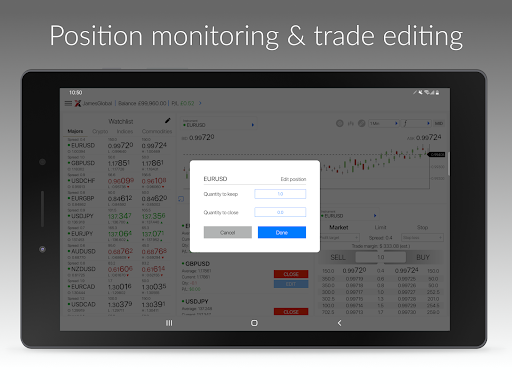

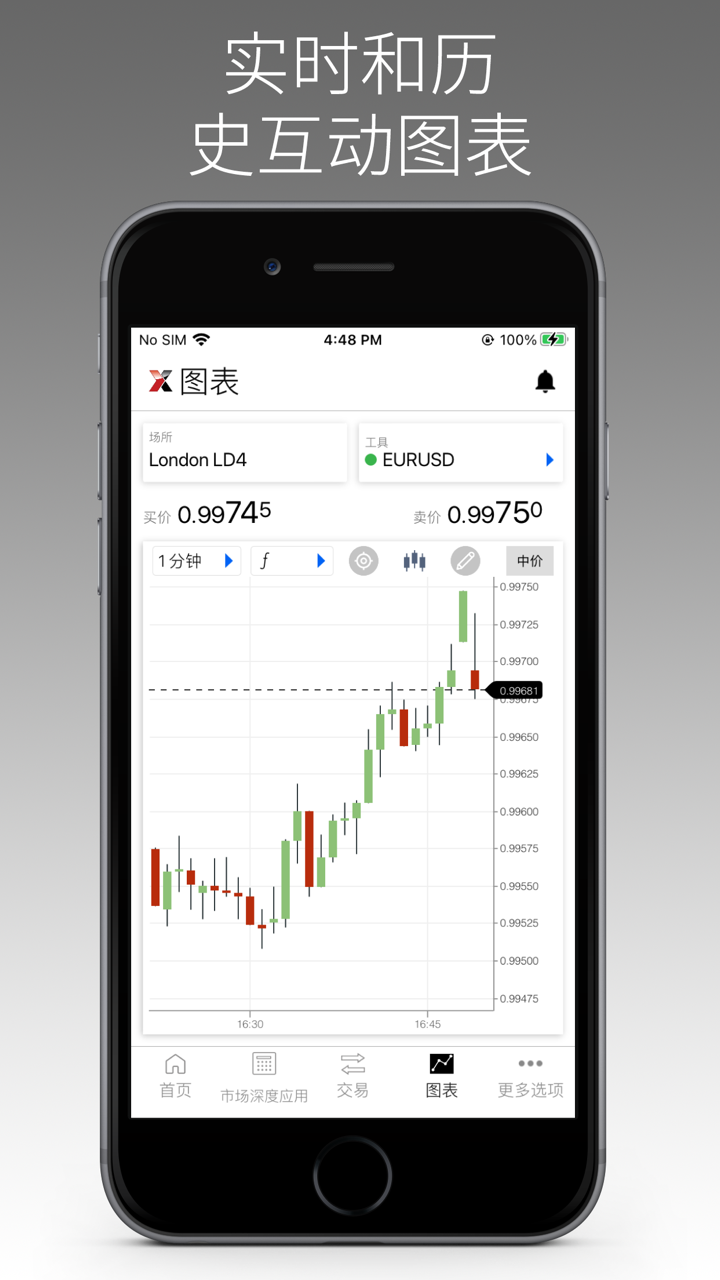

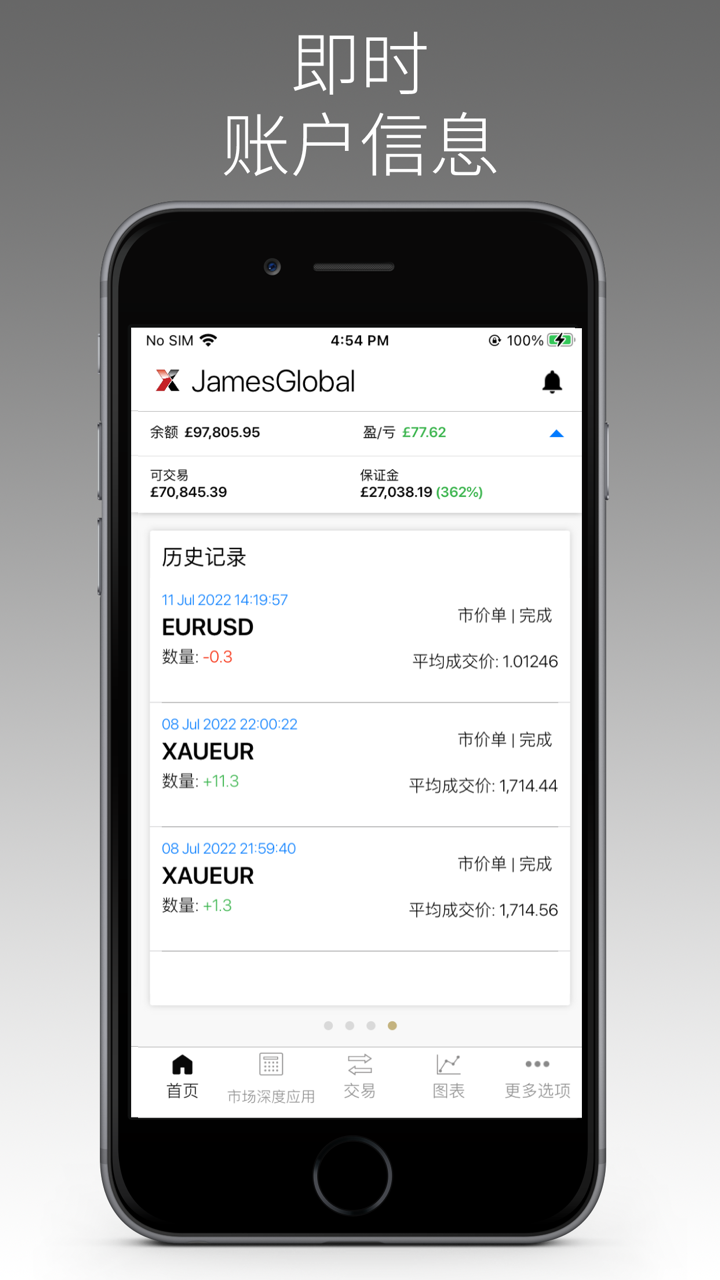

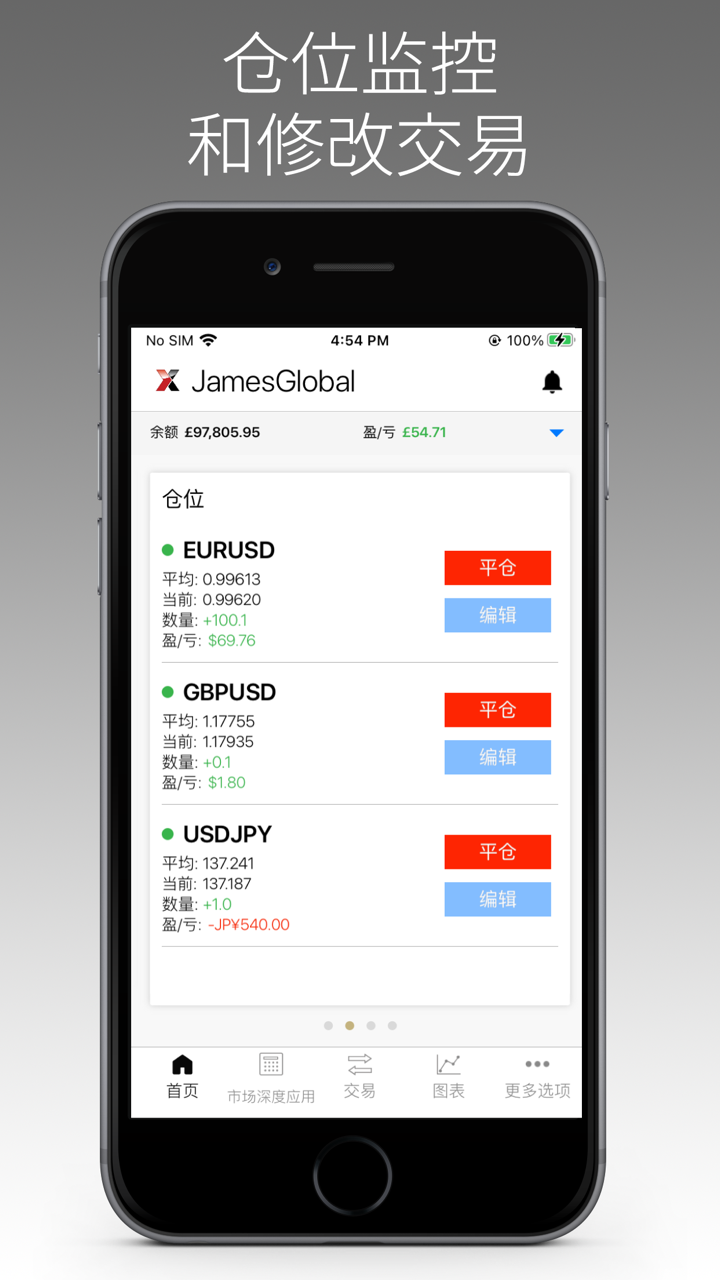

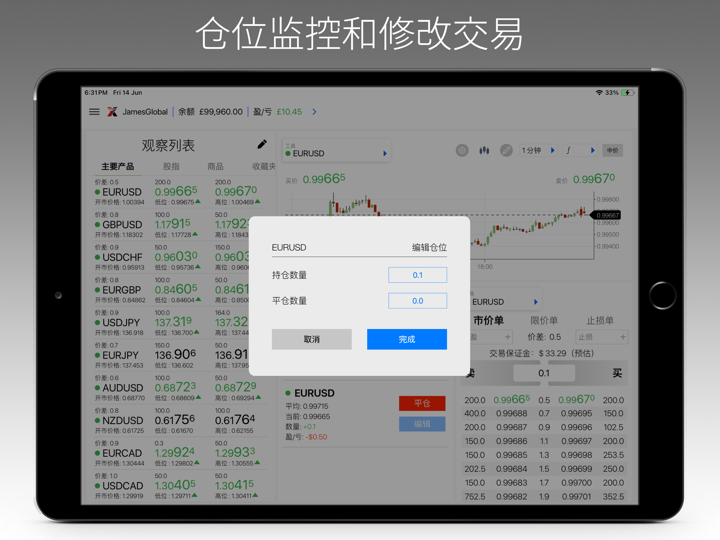

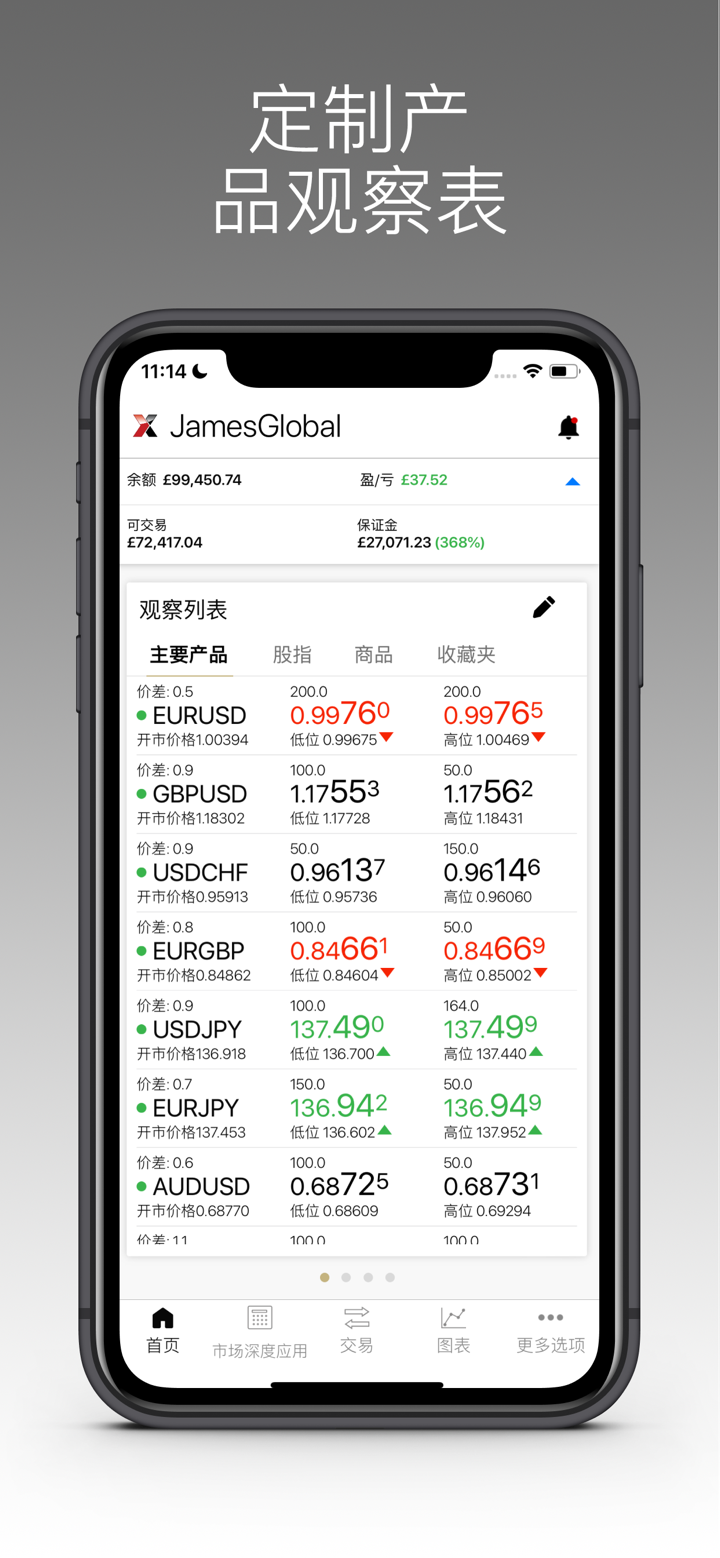

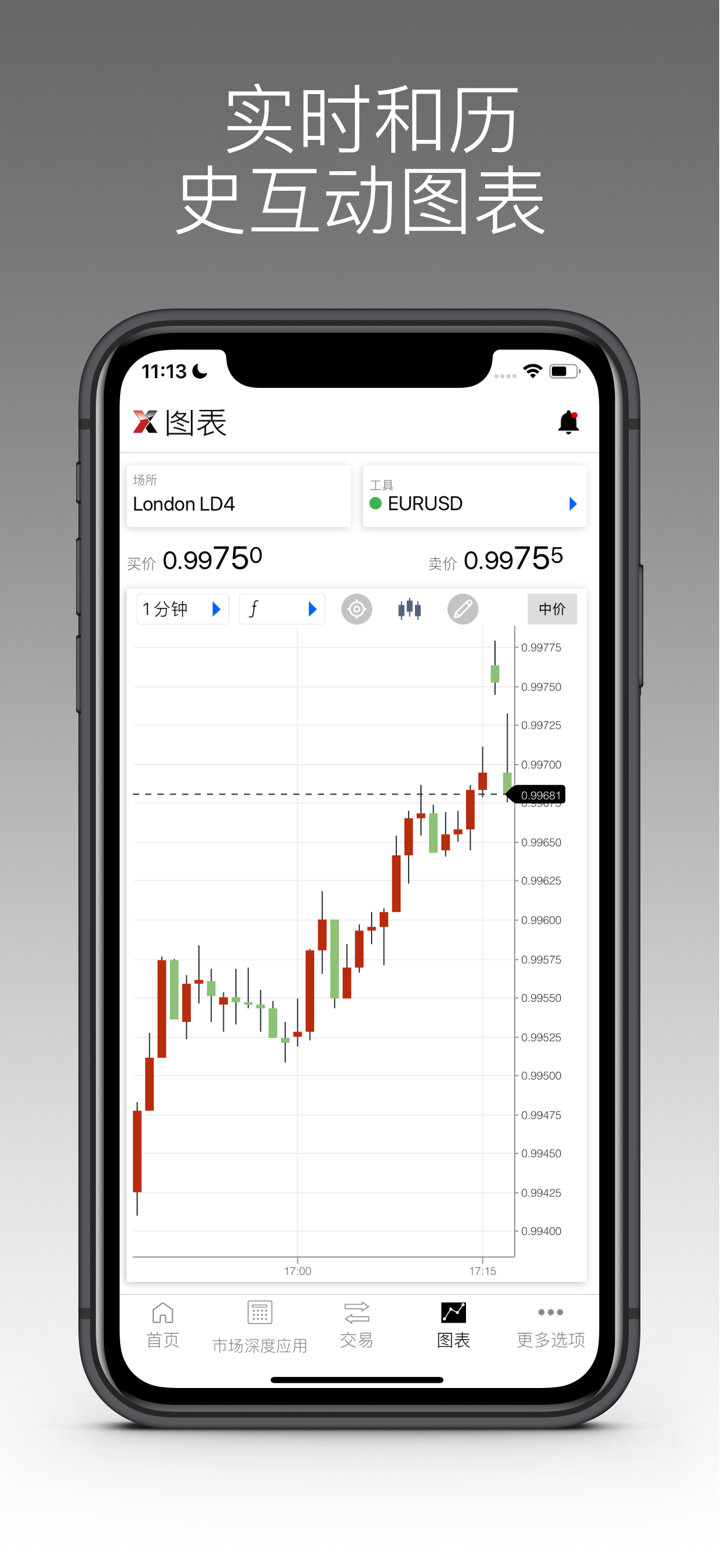

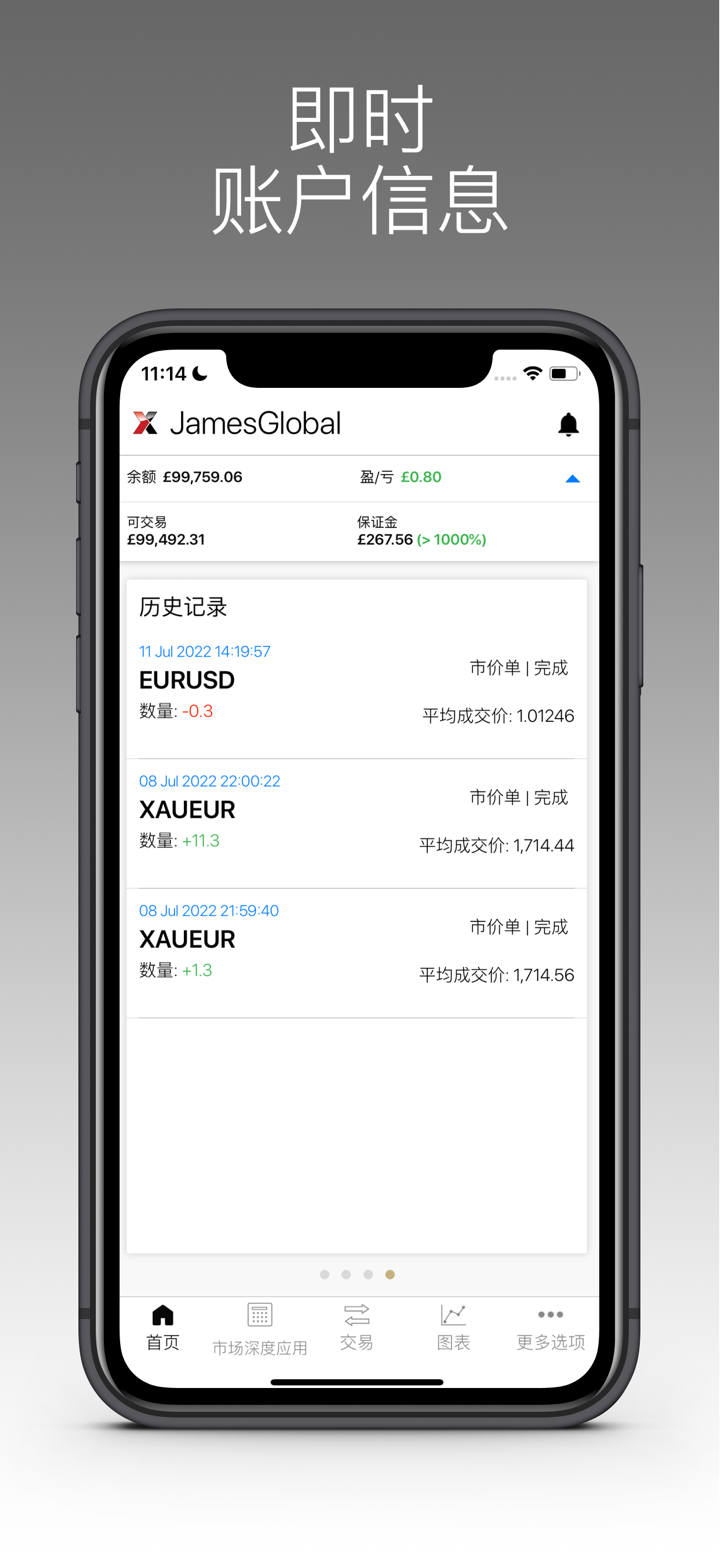

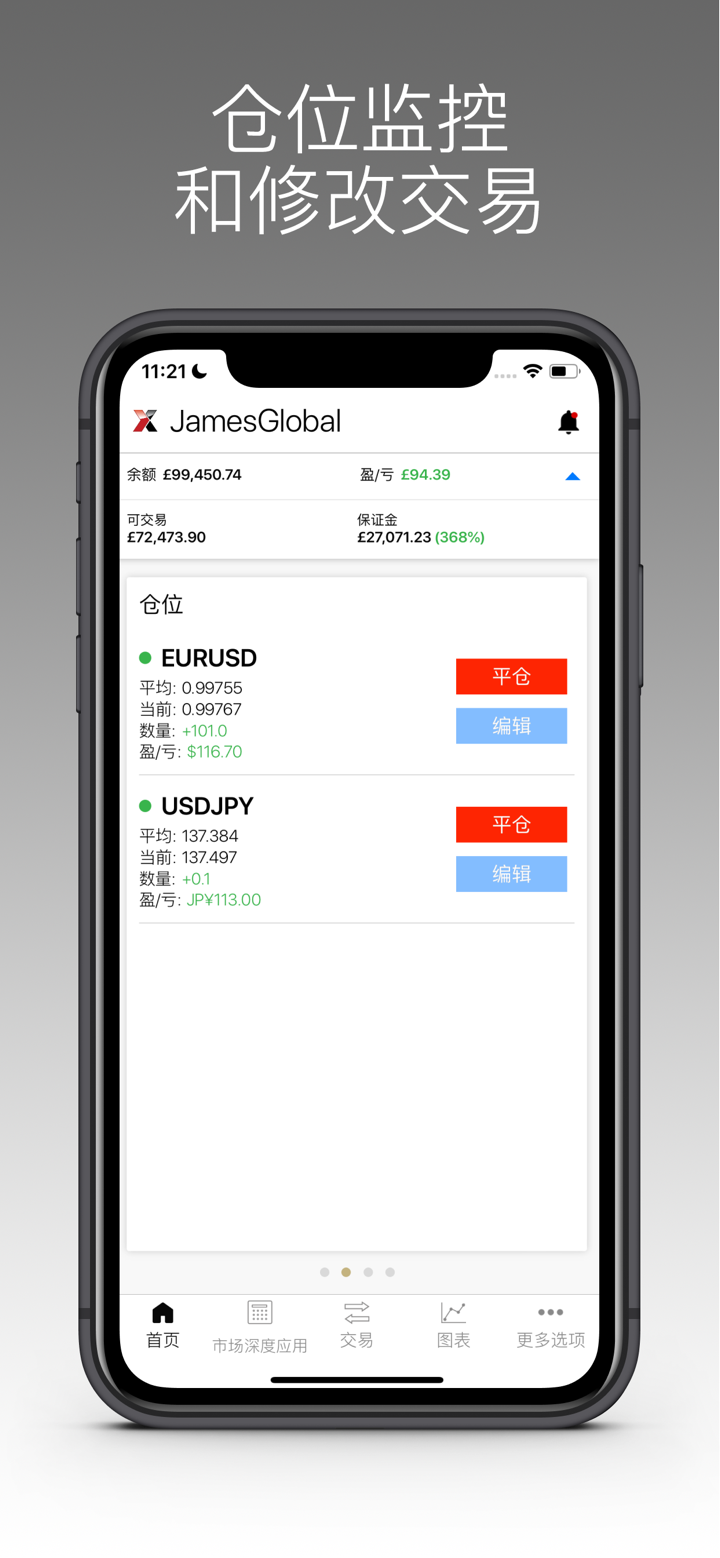

Trading Platforms

LMAX offers its proprietary trading platform called LMAX Global, which is a web-based platform accessible from any device with an internet connection. It also offers connectivity through industry-standard APIs, allowing clients to connect directly to LMAX Global's liquidity pool through third-party platforms.

Additionally, LMAX offers the MetaTrader 4 platform for traders who prefer using a familiar interface.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| LMAX | LMAX Global, MT4 |

| IG | IG Trading, MT4 |

| Saxo Bank | SaxoTraderGO, SaxoTraderPRO, SaxoInvestor, MT4 |

| CMC Markets | MT4, proprietary mobile trading platform |

| Admiral Markets | MT4, MT5, proprietary Supreme platform |

| Pepperstone | MT4, MT5, cTrader |

Deposits & Withdrawals

LMAX offers a variety of deposit and withdrawal methods, including:

Payment Options:

- Bank Wire Transfer

- Debit/Credit Cards (Visa and Mastercard)

- Skrill

- Neteller

LMAX does not charge any deposit or withdrawal fees. However, fees may be charged by the payment provider or bank involved in the transaction.

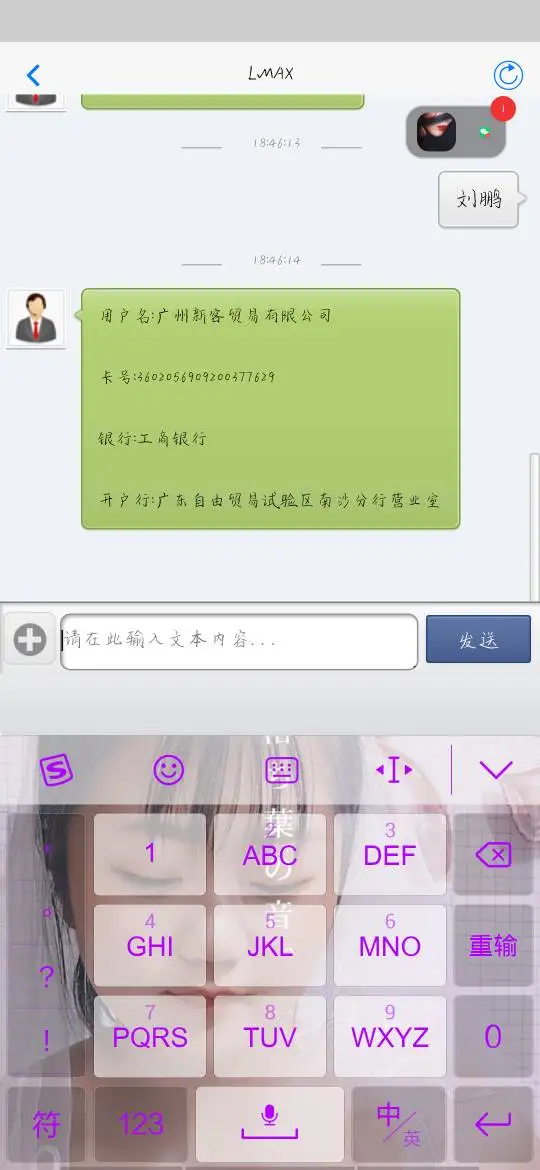

LMAX Group Money Withdrawal

To withdraw funds from LMAX, you need to follow these steps:

Step 1: Log in to your LMAX account and go to the “My Account” section.

Step 2: Click on the “Withdraw Funds” button.

Step 3: Select the account you want to withdraw from and enter the amount you wish to withdraw.

Step 4: Choose your preferred withdrawal method and fill out the necessary information.

Step 5: Submit your withdrawal request.

LMAX processes withdrawal requests within one business day, and the time it takes for the funds to reach your account will depend on the withdrawal method you choose.

Fees

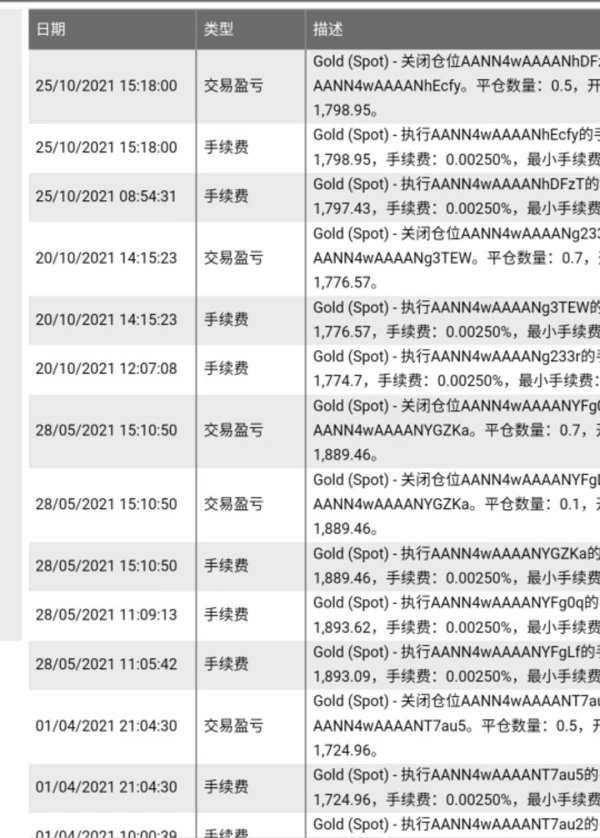

LMAX charges various fees for trading and account maintenance. Here is an overview of some of the fees charged by LMAX:

- Swap Fees: LMAX charges a swap fee for positions held overnight. The swap fee is based on the interest rate differential between the two currencies of the trading pair.

- Deposit/Withdrawal Fees: LMAX does not charge any deposit or withdrawal fees. However, fees may be charged by the payment provider or bank involved in the transaction.

- Inactivity Fee: LMAX does not charge any inactivity fee.

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| LMAX | Free | Free | Free |

| IG | Free | Free (over $100) | $18/month after 2 years |

| Saxo Bank | Free | Free | €100/year after 2 years |

| CMC Markets | Free | Free | £10/month after 12 months |

| Admiral Markets | Free (except bank transfer) | Free (over $150) | Free |

| Pepperstone | Free (except bank transfer) | Free (over $100) | Free |

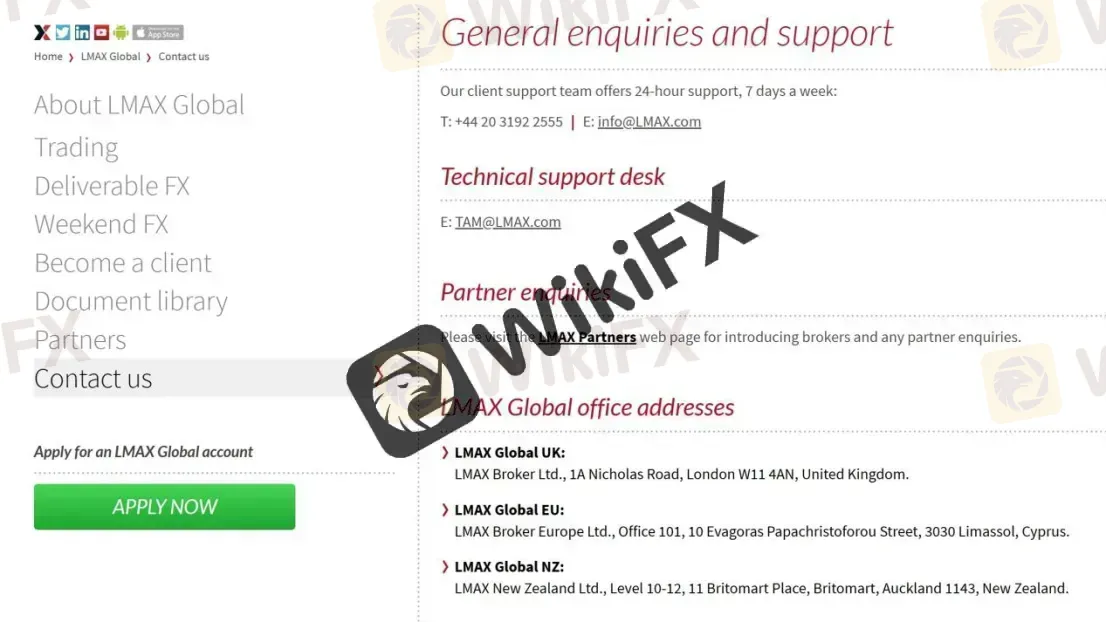

Customer Service

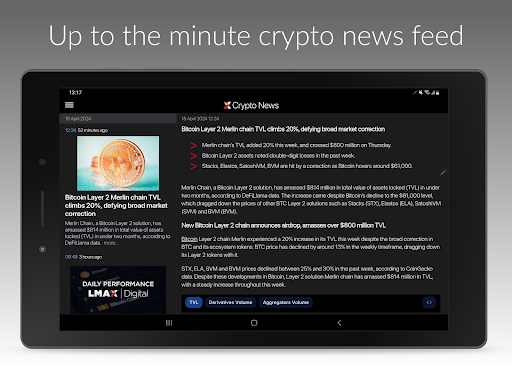

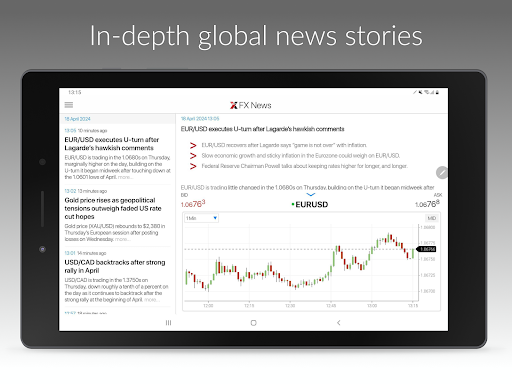

LMAX provides 24/7 customer service through phone, email, and live chat. You can also follow LMAX on some social networks such as LinkedIn, Facebook and YouTube.

Conclusion

In conclusion, LMAX is a highly-regulated broker that offers institutional-level trading services to retail clients. The broker offers a wide range of trading instruments and a powerful trading platform. LMAX's low-latency trading environment, deep liquidity pool, and transparent pricing model make it an ideal choice for traders who demand high-quality execution and a fair trading environment.

chogi

India

LMAX is a liquidity provider of a broker I was trading with. This particular broker accepts crypto, so I deposited crypto. The strategy didn't go well, so I asked my broker to withdraw. This broker requested the funds from LMAX, but now LMAX is questioning wether the funds belog to me or not. It is not the brokers fault, it is LMAX's fault. I have all the proof that the funds belong to me, and I have also approached LMAX directly. I never got a reply from them, they are just simply withelding my funds, and me or the broker cannot do anything about it. So if you are a broker, don't ever work with LMAX, otherwise, you and your customers will soon be in trouble.

Exposure

FX2324976274

Hong Kong

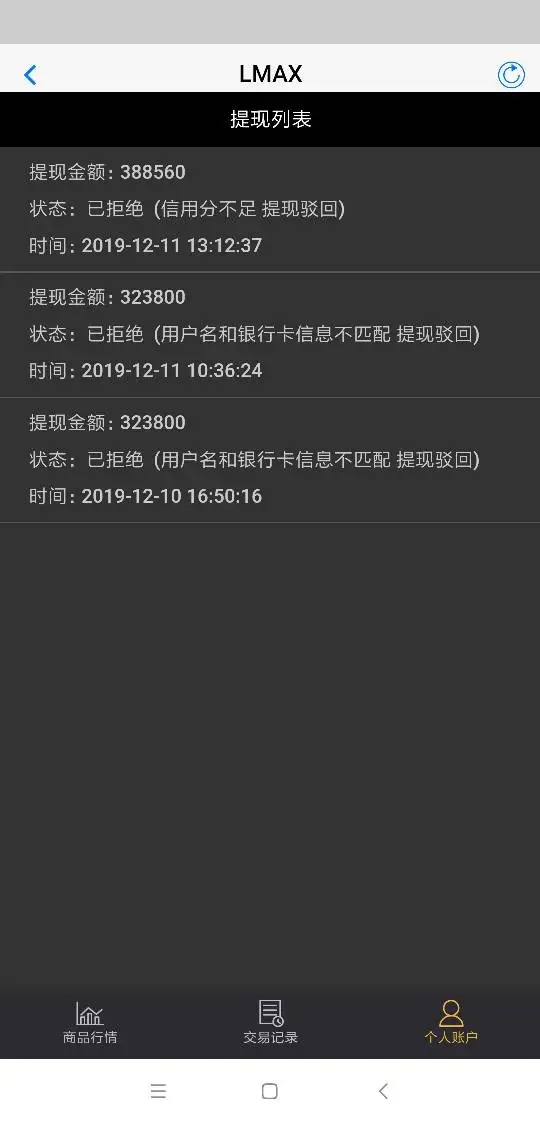

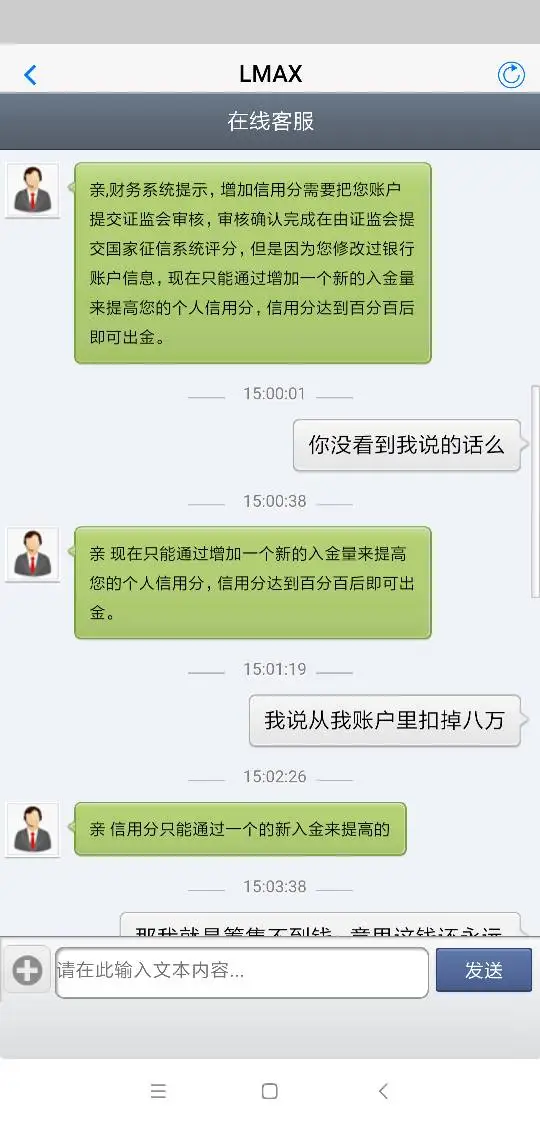

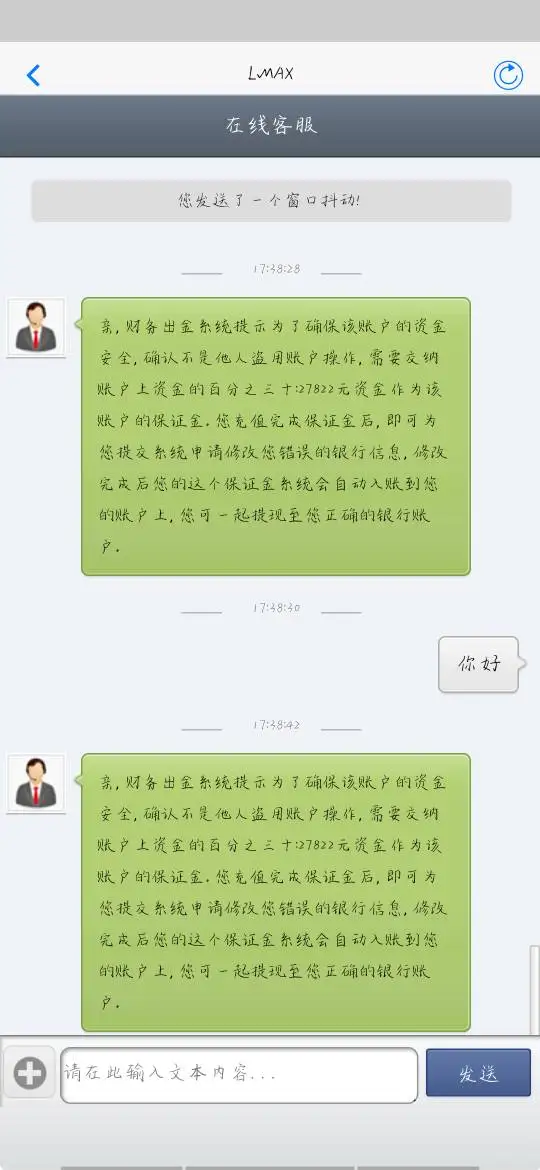

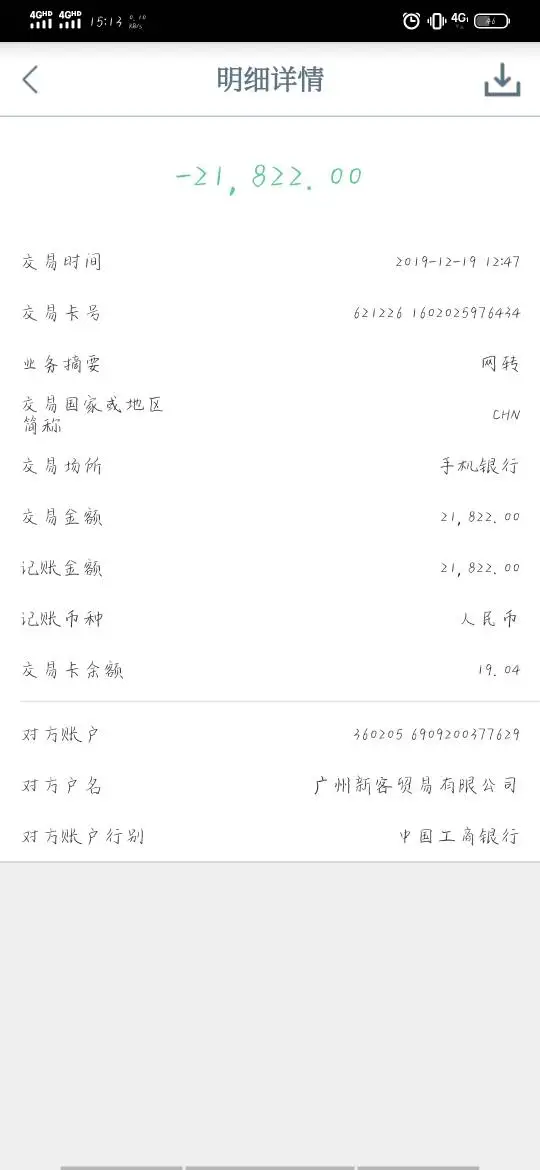

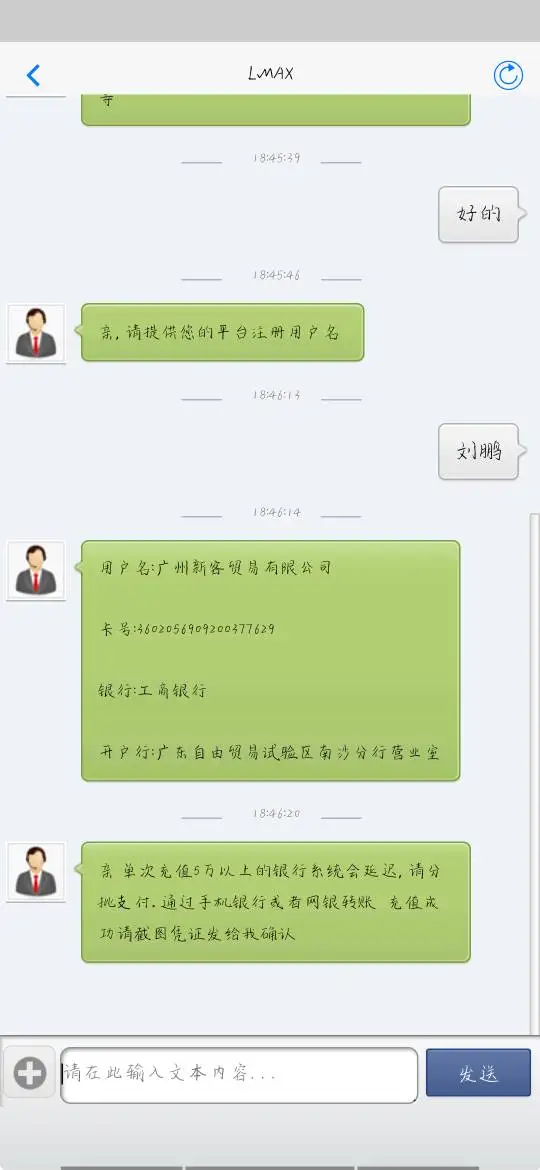

I applied for the withdrawal on December 10, 2019, but hadn’t received it yet until 11st. The customer service asked me to pay the margin since my bank information was wrong. After paying 60000 RMB, I still hadn’t seen the balance on the noon of 12nd. I noticed that my credit score was not sufficient and needed to raise it. The customer service claimed that a withdrawal needs a 100 score, asking me to pay 4000 RMB for per score. Thus, I need to pay 80000 RMB. But the previous fund was all paid by my credit card.

Exposure

满目柔光

Hong Kong

After modifing my bank information illegaly, the platform gave no access to withdrawal and asked for margin.

Exposure

Beluga

United Kingdom

easy to create new account and trading system is clear and stable

Positive

Fortenor

Australia

LMAX Group offers a positive experience with its diverse account types, including FCA-regulated options in the UK and New Zealand. The spreads are competitive, especially with the ECN+commission model, providing traders with cost-effective trading opportunities.

Positive

Afra

Kazakhstan

I signed up for LMAX Group and wasn't given the option to deposit and start trading immediately, at first I was disappointed, but John my account manager who is awesome, called and spoke to me about my account, apparently LMAX Group wanted to be sure if I had experience trading, unlike other services that want to take your deposit and see you trade and loose so they gain, I feel LMAX Group is taking the right steps.

Positive

FX1487258397

United Kingdom

Super honest, fast withdrawals, truly professional. But their support for API integration was a buzzkill. Also, they gotta rethink that 1:100 leverage, it's not cutting it. So great, yet kinda fell short.

Neutral

AAAA201253

Japan

For the time being, the transaction has not encountered any major problems. If it does, I will tell it for your reference. The commission has always been normal.

Positive

FX4166899258

Thailand

At first, do mission 120000 After completing the mission, it was announced that the profit received was higher than the profit that the company had set. and let the compensation mission increase to 500000 of the next round of missions When finished, there are still 550000 final missions. Another time, at that time, the funds were no longer available. and force him to complete the mission until he can withdraw The company has borrowed 550000 until the mission is completed. Is not willing to do the last round like being forced to do And what should people who do not have money to return? If I don't return the portion borrowed from the company, I can't withdraw it. What should I do?

Exposure

Michael Li

Japan

The comment area is all commented after being deceived by the fake LMAX, please look for the official website of LMAX.

Positive

LKmingye

Hong Kong

This woman is a liar, failed to seduce, and began to curse. Everyone wiped their eyes, this kind of platform can only enter and not come out, and the platform salesmen promise to protect their capital. After inferior, regular platform salesmen are not allowed to do transactions, and the platform promises to protect their capital? ? ?

Exposure

董98129

India

LMAX is just amazing when it comes to forex trading. It offers extremely narrow spreads, which I haven’t seen it anywhere else. hI suggest that you can apply for a demo account first if you want to trade with them.

Neutral

曾峥

Australia

I didn’t have a pleasant trading experience with this platform: excessively high entry barrier, trading fees, especially for cryptocurrency trading, platform fees, why don’t directly rob money? If you really want to trade forex, you can totally select some influential brokers under strict regulation, you can easily find them on internet…

Neutral

lucky73682

Hong Kong

I’m thinking about whether to continue to deposit. I feel that it is too difficult about endless traps. I feel that I can’t withdraw my hard earning money and it is impossible to get help from others. Should such platform be blocked?

Exposure

良人终不及菇凉

Hong Kong

The withdrawal was refused, indicating that the account was suspected of making illegal profits and has been frozen. If you need to withdraw, you need to deposit the same amount of balance to unfreeze. The user did not deposit and found that the account was emptied the next day, and the balance was reset to zero.

Exposure

十七33735

Hong Kong

There is an anniversary event today and offering gift money so I deposit ten thousands, but I cannot withdraw then. It requires me to deposit another ten thousands in order to wihtdraw. Why you do not state clearly when you have this event. I won't make appointment if you state it clearly.

Exposure

十七33735

Hong Kong

There is an anniversary event today and offering gift money so I deposit ten thousands, but I cannot withdraw then. It requires me to deposit another ten thousands in order to wihtdraw. Why you do not state clearly when you have this event.

Exposure

永不止步35221

Hong Kong

Money has been detained and unable to withdraw. Please deal it with fairness. I had no other choice.

Exposure

永不止步35221

Hong Kong

Unable to withdraw. All the money was locked. Money will be cleared to zero without withdrawal. How to resolve it.

Exposure

潭幽

Hong Kong

there is a little balance left which use for many years. I cannot withdraw them at first because the account has been freezed. It requires lots of documents. I unfreeze the account first and then it is able to withdraw. although it is complicated process but the fund withdraw successfully at the end. People may refer my case if you have similar situation.

Exposure

张子玉

Hong Kong

There was an anniversary celebration last night and I made an appointment for 100000 and deposited 50000. Then I could not withdraw. It asked me to deposit 50000 further. Is this a scam?

Exposure

FX2882573530

Hong Kong

When I first started trading on this platform, it was very successful. Later, I booked an event customer service, and he told me that I could withdraw money by charging 50,000. I charged it but the withdrawal was unsuccessful. The customer service said that I did not have a turnover account, so it was frozen. I can withdraw money only when I have an VIP account, and I need to charge more than 60,000. Then I tried a way to charge it, but I couldn't withdraw money. I asked the customer service again, and the customer service said that a dedicated channel was needed for payment, so I need to pay another 30,000 deposit to get money. Now I don't have the money to pay the security deposit, and money has been scammed by the platform.

Exposure

Boon65837

Malaysia

Unable to withdraw and the account funds will be frozen if personal tax is not paid. The deposit is not recorded. It is easy to withdraw money in the early period, but you cannot receive a response even waiting for three days.

Exposure