公司簡介

| ILimits Invest Review Summary | |

| 成立時間 | 12年 |

| 註冊國家/地區 | 塞浦路斯 |

| 監管 | 受監管 |

| 市場工具 | 貨幣、加密貨幣、股票、商品、指數、ETF和衍生品 |

| 模擬帳戶 | 無 |

| 槓桿 | 最高1:200 |

| 點差 | 無 |

| 交易平台 | XCITE App |

| 最低存款 | $200 |

| 客戶支援 | 電子郵件:customer.service@finansero.com電話:+447441938812地址:Athalassas 62, Mezzanine, Strovolos, 2012, Nicosia, Cyprus |

FINANSERO 資訊

FINANSERO成立於2012年,是一家在塞浦路斯註冊的受監管的經紀公司。該公司專注於多種工具(貨幣、加密貨幣、股票、商品、指數、ETF和衍生品)的差價合約交易,並提供專有的移動和桌面平台(XCITE App)。最低存款為$200,最高槓桿為1:200。

客戶可以通過多種方式與該公司聯繫,包括電話號碼(+447441938812),電子郵件(customer.service@finansero.com)以及Whatsapp和Facebook上的即時聊天。

優點和缺點

| 優點 | 缺點 |

| 專有平台(XCITE) | 低層級帳戶收取較高費用 |

| 多種帳戶類型 | 收取貨幣轉換費和不活躍帳戶費用 |

| 受監管狀態 | 較高的最低存款 |

| 官方網站提供相對完整的信息 |

FINANSERO 是否合法?

FINANSERO獲得塞浦路斯證券交易委員會(CYSEC)的授權和監管,註冊號碼為190/13。

| 受監管國家 | 監管機構 | 受監管實體 | 監管狀態 | 許可證類型 | 許可證號碼 |

| 塞浦路斯證券交易委員會 | Global Trade CIF Ltd | 受監管 | 直通處理(STP) | 190/13 |

我可以在FINANSERO上交易什麼?

FINANSERO 提供超過300種貨幣、加密貨幣、股票、外匯、商品、指數、ETF和衍生品的差價合約給零售和專業客戶。

| 可交易工具 | 支援 |

| 商品 | ✔ |

| 貨幣 | ✔ |

| 股票 | ✔ |

| 指數 | ✔ |

| ETF | ✔ |

| 加密貨幣 | ✔ |

| 衍生品 | ✔ |

| 外匯 | ✔ |

| 共同基金 | ❌ |

| 期貨 | ❌ |

帳戶類型

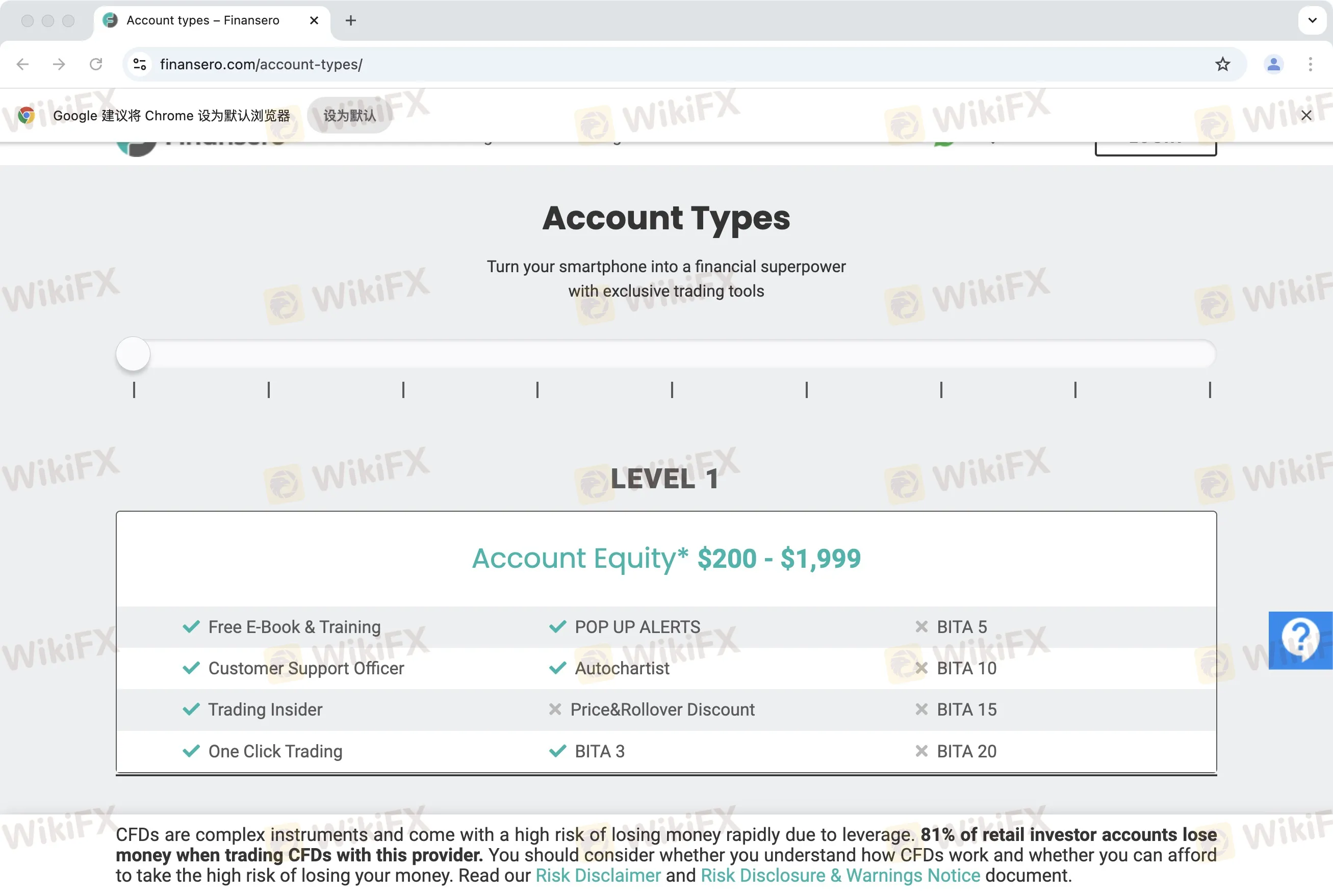

FINANSERO 將其帳戶分為九個等級。

所有等級都可以獲得免費電子書和培訓、客戶支援人員、交易內幕、一鍵交易、彈出警示和bita5。

除非帳戶資產超過$5,000,否則客戶將無法享受Autochartist的高級功能。

如果交易帳戶價值超過$100,000,客戶可以享受40%的價格和展期折扣。

| 福利 | 等級1 | 等級2 | 等級3 | 等級4 | 等級5 | 等級6 | 等級7 | 等級8 | 等級9 |

| 帳戶資產 | $200 - $1,999 | $2,000 - $4,999 | $5,000 - $9,999 | $10,000 - $14,999 | $15,000 - $29,999 | $30,000 - $49,999 | $50,000 - $74,999 | $75,000 - $99,999 | $100,000 - ∞ |

| 免費電子書和培訓 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| 客戶支援人員 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| 交易內幕 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| 一鍵交易 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| 彈出警示 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Autochartist | X | X | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| 價格和展期折扣 | X | 5% | 10% | 15% | 20% | 25% | 30% | 35% | 40% |

| BITA 5 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| BITA 10 | X | X | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| BITA 15 | X | X | X | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| BITA 20 | X | X | X | X | X | ✔ | ✔ | ✔ | ✔ |

槓桿

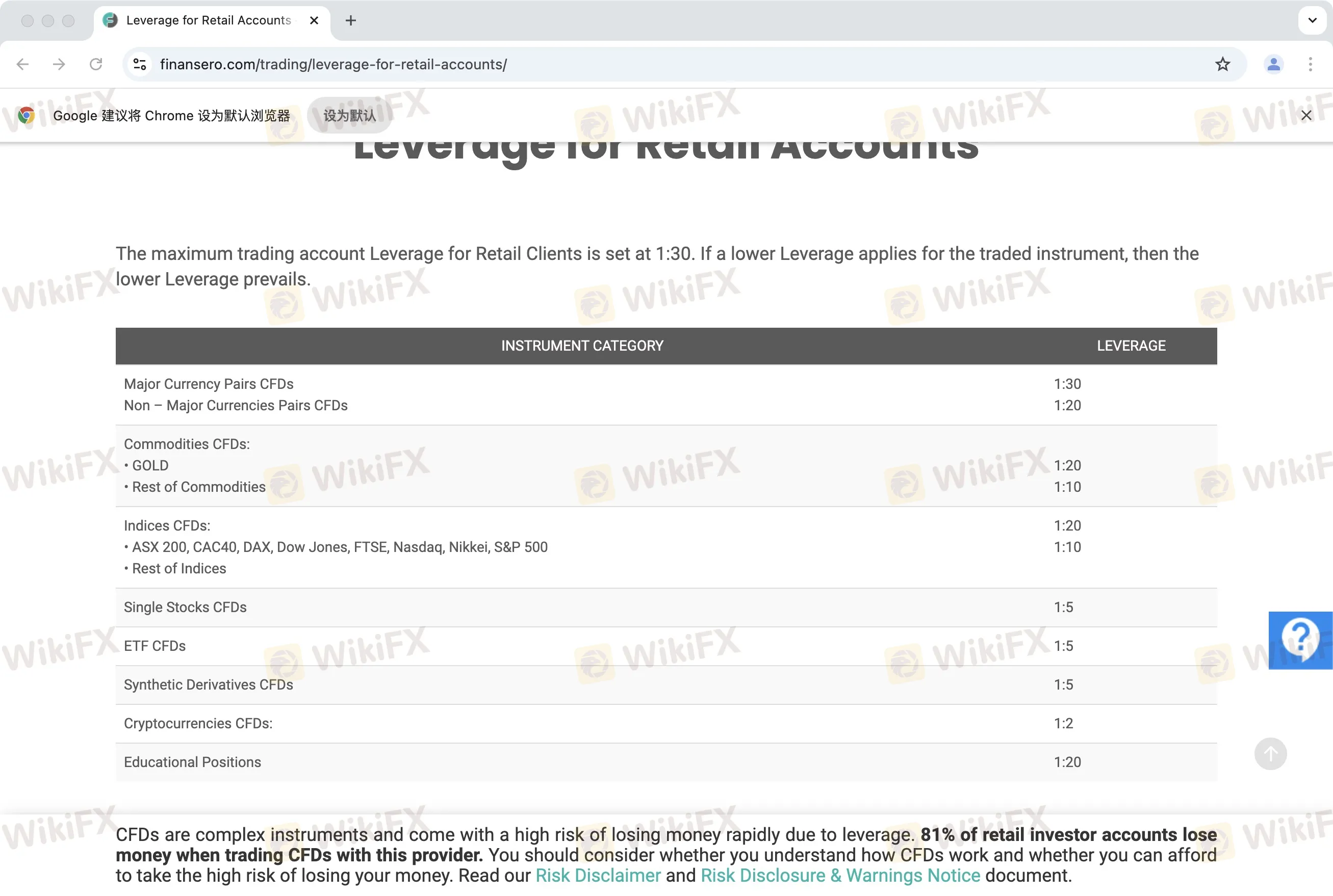

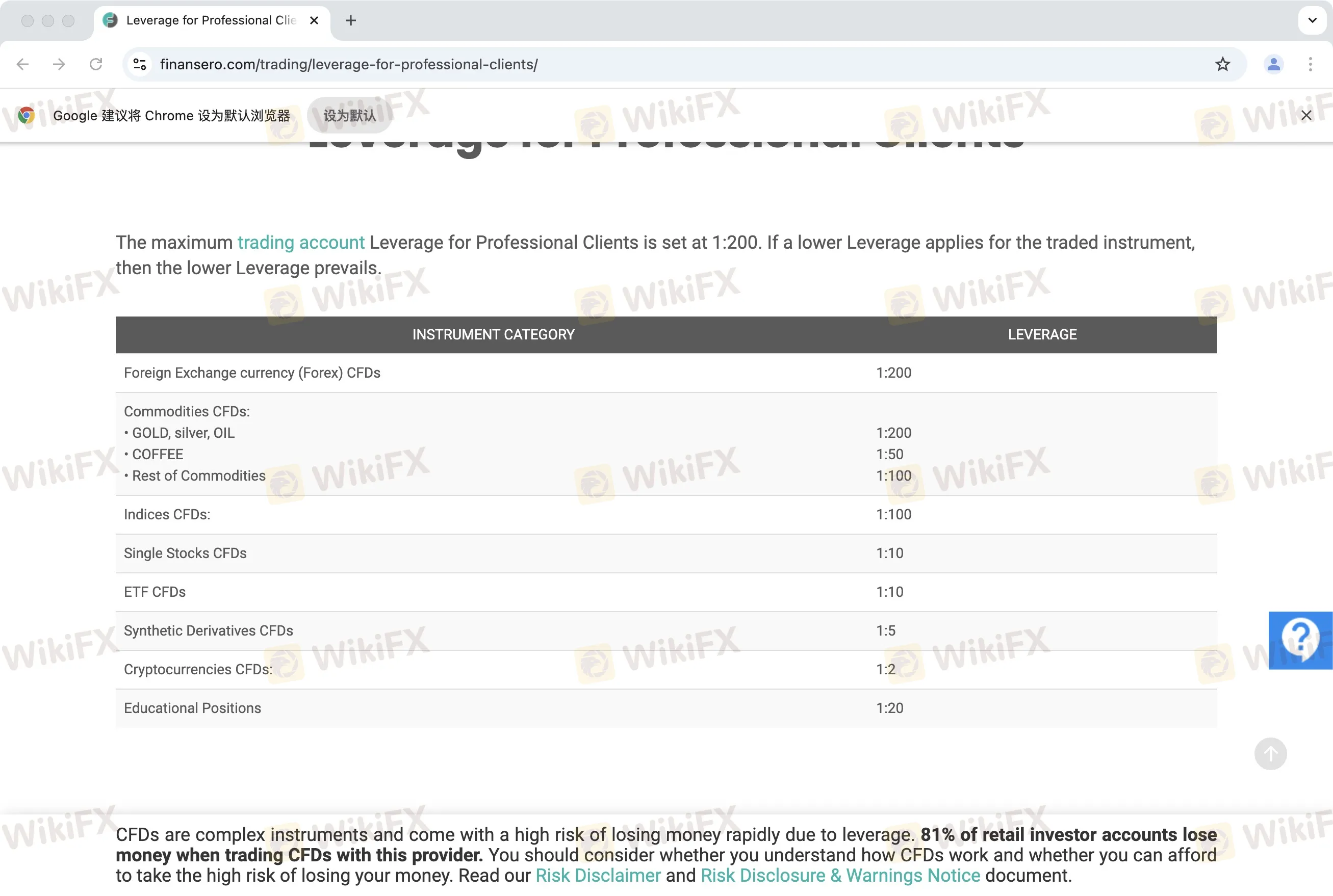

零售客戶和專業客戶的最大槓桿不同,設定分別為1:30和1:2000。

零售客戶交易帳戶槓桿:

| 儀器類別 | 槓桿 |

| 主要貨幣對CFDs非主要貨幣對CFDs | 1:301:20 |

| 商品CFDs:• 黃金• 其他商品 | 1:201:10 |

| 指數CFDs:• ASX 200, CAC40, DAX, Dow Jones, FTSE, Nasdaq, Nikkei, S&P 500• 其他指數 | 1:201:10 |

| 單一股票CFDs | 1:5 |

| ETF CFDs | 1:5 |

| 合成衍生品CFDs | 1:5 |

| 加密貨幣CFDs: | 1:2 |

| 教育職位 | 1:20 |

專業客戶交易帳戶槓桿:

| 儀器類別 | 槓桿 |

| 外匯貨幣(Forex)CFDs | 1:200 |

| 商品CFDs:• 黃金,白銀,原油• 咖啡• 其他商品 | 1:2001:501:100 |

| 指數CFDs: | 1:100 |

| 單一股票CFDs | 1:10 |

| ETF CFDs | 1:10 |

| 合成衍生品CFDs | 1:5 |

| 加密貨幣CFDs: | 1:2 |

| 教育職位 | 1:20 |

FINANSERO 費用

如果前5筆交易失敗,經紀人將退還您的款項。

至於費用,不同產品的倉位轉儲費用的詳細資料如下:

| CFD產品 | 倉位轉儲費用 |

| 貨幣 | 過夜敞口的0.015% |

| 商品 | 過夜敞口的0.022% |

| 指數 | 過夜敞口的0.0165% |

| 股票 | 過夜敞口的0.055% |

| ETF | 過夜敞口的0.0165% |

| 合成衍生品 | 取決於衍生品 |

| 加密貨幣 | 0.50%(零售客戶)0.50%(專業客戶) |

此外,至少三個月沒有交易活動的帳戶可能需要支付每季度€150的費用。貨幣轉換費用為交易的實現淨利損的0.7%,並即時反映在未實現淨利損的帳位上。

交易平台

FINANSERO 提供其專有的交易平台,名為XCITE。

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| XCITE | ✔ | Windows, MAC, IOS, Android | 各種經驗水平的投資者 |

存款和提款

付款方式包括Visa、Diner Club、Mustercard、銀行轉帳、Apple Pay、Skrill、Google Pay、OEAL和Open Banking。

最低存款額為€200。

提款將以與存款相同的方式退還。如果有任何剩餘資金,將存入指定的銀行帳戶。

存款和提款不收取任何佣金。

存款選項:

| 存款選項 | 最低存款金額 | 手續費 | 處理時間 |

| 國際信用卡/借記卡 | €200 | 無佣金 | 即時 |

| 多種電子錢包 | €200 | 無佣金 | 即時 |

| 銀行電匯 | €200 | 無佣金 | 可能需要最多5個工作日 |

提款選項:

| 提款選項 | 最低提款金額 | 手續費 | 處理時間 |

| 國際信用卡/借記卡 | 不適用 | 無佣金 | FINANSERO在24小時內處理。之後,取決於您的銀行或電子錢包。 |

| 多種電子錢包 | 不適用 | 無佣金 | FINANSERO在24小時內處理。之後,取決於您的銀行或電子錢包。 |

| 銀行電匯 | 不適用 | 無佣金 | FINANSERO在24小時內處理。之後,取決於您的銀行或電子錢包。 |