基礎資訊

印尼

印尼天眼評分

印尼

|

2-5年

|

印尼

|

2-5年

| https://straitsfutures.id/

官方網址

評分指數

MT4/5鑒定

主標

StraitsFutures-Live

影響力

D

影響力指數 NO.1

印尼 2.46

印尼 2.46

MT4/5鑒定

主標

新加坡

新加坡影響力

D

影響力指數 NO.1

印尼 2.46

印尼 2.46單核

1G

40G

1M*ADSL

印尼

印尼

正規的主標MT4/5交易商會有健全的系統服務與後續技術支持,一般情況下業務和技術都較為成熟、風險控制能力較強

straitsfutures.id

straitsfutures.id 印尼

印尼

| Straits Futures Indonesia Review Summary | |

| Founded | 未提及 |

| Registered Country/Region | 印度尼西亞 |

| Regulation | 由BAPPEBTI許可 |

| Market Instruments | 商品、期貨、期權、外匯 |

| Demo Account | ✅ |

| Trading Platform | Straits Direct、CQG Desktop、Straits Quick Trade |

| Customer Support | 實體地址:金邊市Boeung Keng Kang區63街176號Amass Central Tower大樓 |

Straits Futures Indonesia(SFI)是一家印度尼西亞的商品和期貨交易平台。它受BAPPEBTI監管。除了為商品生產商和高資產客戶提供風險管理選擇外,該組織還提供適合自主交易和經紀人協助交易的工具和平台。

| 優點 | 缺點 |

| 由BAPPEBTI許可 | 沒有費用結構信息 |

| 專注於商品的服務 | 沒有帳戶類型信息 |

| 提供3個交易平台 |

| 類別 | 詳情 |

| 監管狀態 | 受監管 |

| 許可證類型 | 零售外匯許可證 |

| 監管機構 | 印度尼西亞-BAPPEBTI |

| 許可機構 | PT. Straits Futures Indonesia |

| 許可證號碼 | 43/BAPPEBTI/09/2015 |

Straits Futures Indonesia提供許多可交易的資產,主要集中在商品和期貨市場。

| 可交易工具 | 支援 |

| 商品 | ✔ |

| 期貨 | ✔ |

| 期權 | ✔ |

| 外匯 | ✔ |

| 股票 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

Straits Futures Indonesia並未提及帳戶類型和費用結構的具體信息。

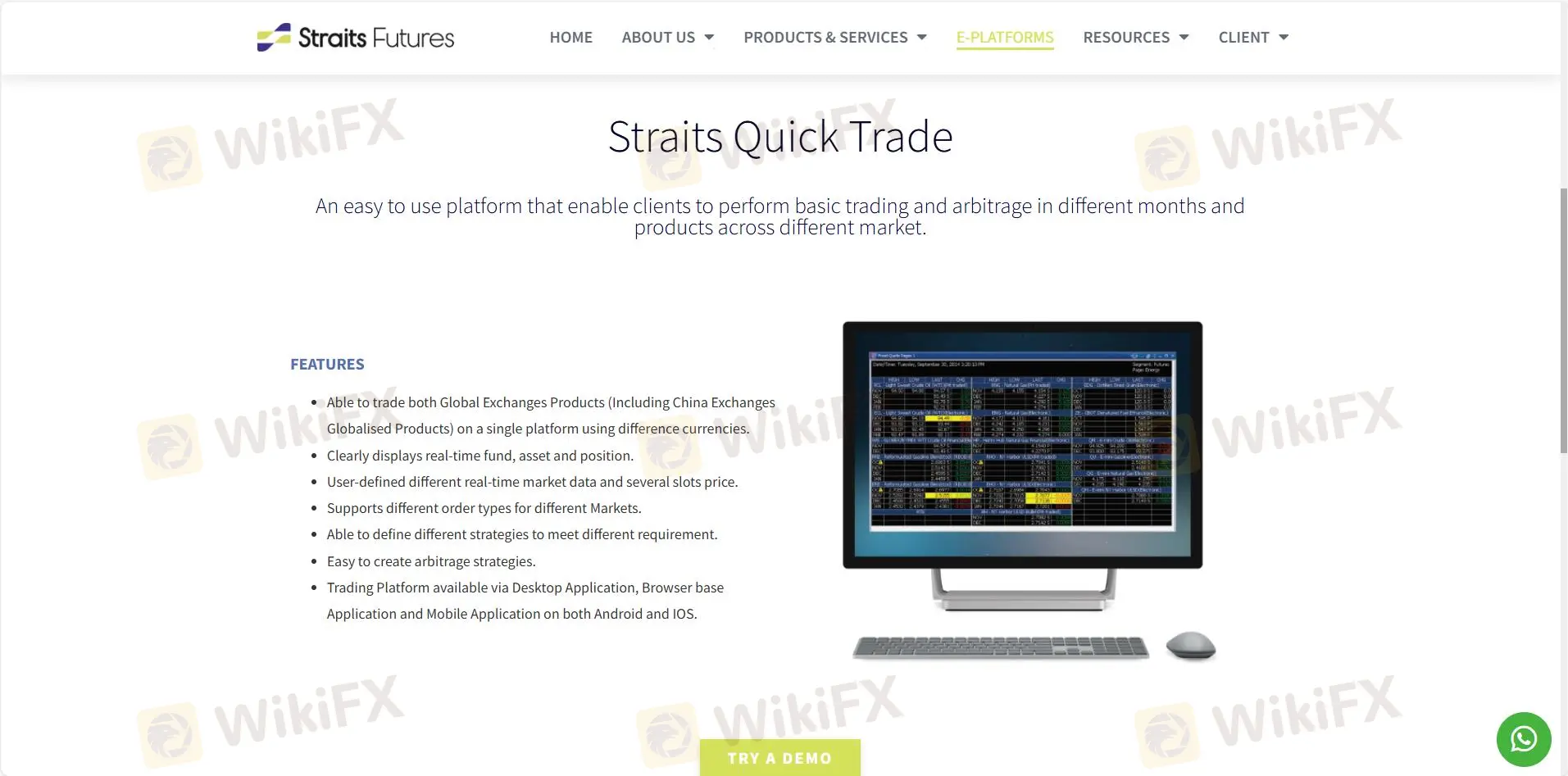

Straits Futures Indonesia為用戶提供了3個交易平台。

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| Straits Direct | ✔ | 桌面,移動設備 | 所有層次的交易者 |

| CQG Desktop | ✔ | 桌面 | 經驗豐富的交易者 |

| Straits Quick Trade | ✔ | 桌面,瀏覽器,移動設備 | 追求簡單的交易者 |

Straits Futures Indonesia並未提及存款和提款費用或最低存款要求。

Straits Futures Indonesia primarily focuses on commodities, futures, options, and forex trading. These are the main instruments available for trading on the platform. However, SFI does not offer stocks, indices, or cryptocurrencies, which could be a limitation for traders looking for a more diversified range of assets. If your interest lies specifically in trading commodities, futures, or forex, then SFI markets provide excellent opportunities. But for those interested in stocks or digital currencies, SFI may not meet all your investment needs.

Straits Futures Indonesia is licensed by BAPPEBTI, the regulatory body in Indonesia. While this license ensures compliance with Indonesian laws, it is important to note that BAPPEBTI's oversight is focused on local markets. For international traders, this means that SFI is legally operating within Indonesia, but their regulatory standing may not carry the same global recognition as brokers regulated in jurisdictions like the UK, the EU, or Australia. As an international trader, you should evaluate the adequacy of local regulation and ensure it meets your investment protection standards.

Yes, Straits Futures Indonesia (SFI) is regulated by BAPPEBTI, the Commodity Futures Trading Regulatory Agency in Indonesia. SFI operates under a Retail Forex License, with license number 43/BAPPEBTI/09/2015. This regulation ensures that the broker adheres to Indonesia's financial laws, protecting traders’ interests and promoting transparency. If you're considering trading with SFI, it's important to note that the firm’s regulatory oversight is focused within Indonesia, which provides a level of safety for local investors but may not offer the same level of international recognition as regulations from bodies like the FCA or CySEC. This is crucial to understand when assessing the legitimacy of SFI markets.

BAPPEBTI regulation provides several protections for traders, such as ensuring that Straits Futures Indonesia keeps client funds segregated from operational funds. This provides protection in the event of financial difficulties. Additionally, as part of its regulatory framework, SFI is required to adhere to high standards of financial reporting and audit practices. This increases transparency, reduces the risk of fraud, and enhances overall security for traders. While these protections are significant, it's essential to remember that no regulatory body can completely eliminate trading risks, particularly in volatile markets like futures and commodities.

請輸入...