公司簡介

| First State Futures 評論摘要 | |

| 成立年份 | 2022 |

| 註冊國家/地區 | 印度尼西亞 |

| 監管機構 | ICDX 監管 |

| 市場工具 | 美國單一股票、貨幣、金屬和能源、股票指數、微型多邊、商品(CPO、Olein、可可、咖啡) |

| 模擬帳戶 | ✅ |

| 槓桿 | / |

| 點差 | / |

| 交易平台 | JAFeTS NOW 和 MT4 交易平台 |

| 最低存款 | / |

| 客戶支援 | 09:00 - 05:00 WIB |

| 電話:+6231-505-5599(分機:212) | |

| 傳真:+6231-503-8885 | |

| 電郵:info@firststate-futures.com | |

| Facebook、Twitter、Linkedin、Telegram | |

| 地址:印度尼西亞東爪哇省泗水市蘇拉威西街48號 PPFX+4F | |

| 區域限制 | 加拿大的不列顛哥倫比亞省、魁北克省和薩斯喀徹溫省,以及朝鮮民主主義人民共和國(北韓)、伊朗、美國和香港。 |

PT. First State Futures 在泗水設有多個分支機構,如巴厘島、詹伯和索羅等城市。作為期貨交易所的許可會員並獲得 BAPPEBTI 認可,該公司提供 JAFeTS NOW 和 MT4 等交易平台。

這是該經紀商官方網站的首頁:

優點和缺點

| 優點 | 缺點 |

| ICDX 監管 | 被撤銷的 BAPPEBTI 許可證 |

| 提供安全措施 | 可疑的 JFX 許可證副本 |

| 多樣化的市場工具 | 區域限制 |

| 模擬帳戶 | 有關交易條件的信息有限 |

| MT4 平台 | 收取閒置費用 |

| 存款和提款免費 | 付款選項有限 |

| 多種聯繫渠道 |

First State Futures 是否合法?

First State Futures受印尼商品和衍生品交易所(ICDX)监管。它持有零售外汇牌照,编号为037/SPKB/ICDX/Dir/VIII/2010。此外,它还提供包括隔离账户在内的安全措施。

| 印尼商品和衍生品交易所(ICDX) |

| 监管状态 | 受监管 |

| 监管机构 | 印尼 |

| 牌照机构 | First State Futures, PT |

| 牌照类型 | 零售外汇牌照 |

| 牌照编号 | 037/SPKB/ICDX/Dir/VIII/2010 |

然而,他们的Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan(BAPPEBTI)许可证被吊销,而雅加达期货交易所(JFX)则是可疑克隆。

| Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan(BAPPEBTI) |

| 监管状态 | 吊销 |

| 监管机构 | 印尼 |

| 牌照机构 | PT. First State Futures |

| 牌照类型 | 零售外汇牌照 |

| 牌照编号 | 18/BAPPEBTI/PN/3/2010 |

| 雅加达期货交易所(JFX) |

| 监管状态 | 可疑克隆 |

| 监管机构 | 印尼 |

| 牌照机构 | First State Futures |

| 牌照类型 | 零售外汇牌照 |

| 牌照编号 | SPAB-058/BBJ/01/04 |

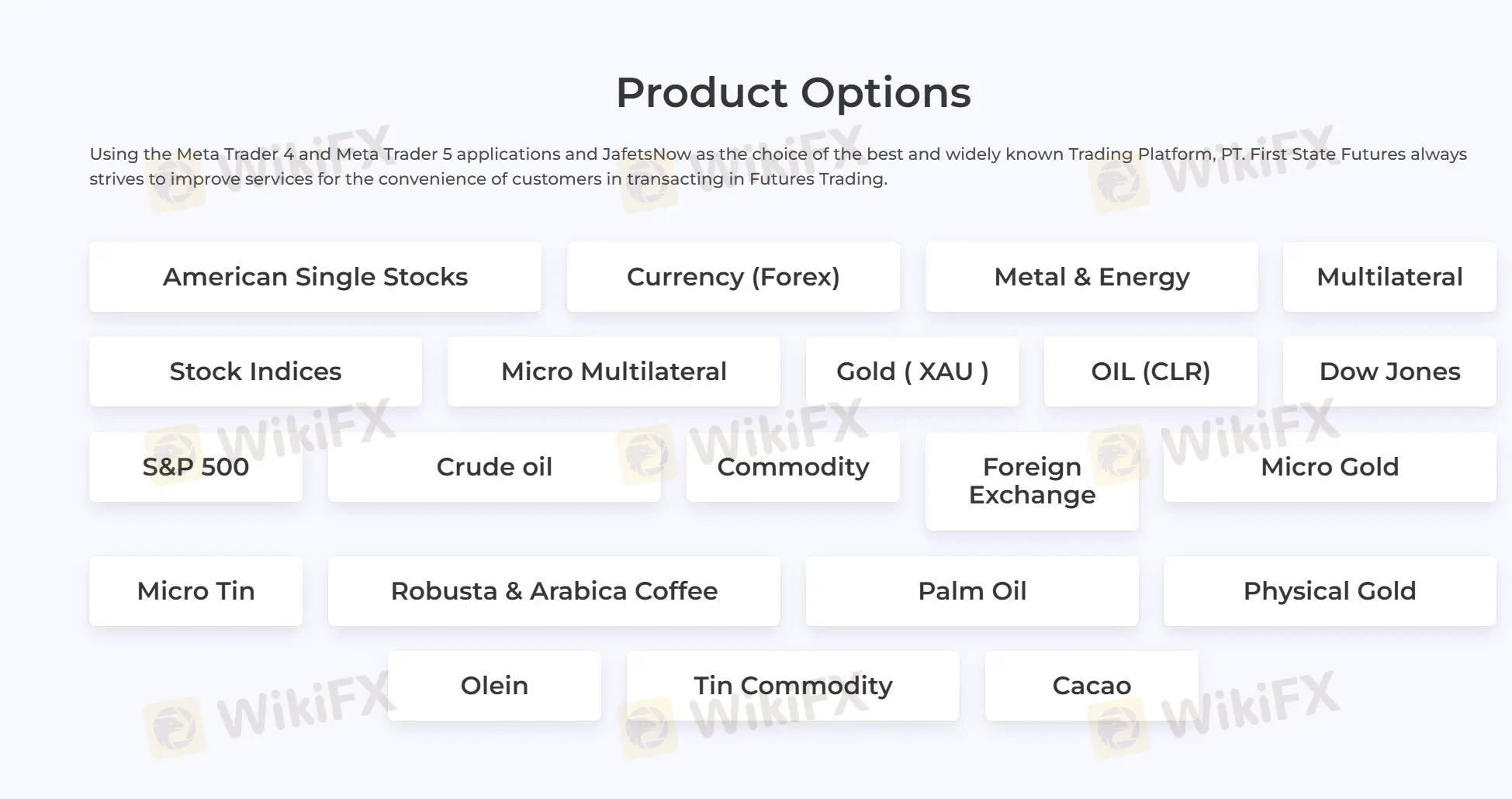

我可以在First State Futures上交易什麼?

First State Futures 提供美國單一股票、貨幣、金屬和能源、股票指數、微型多邊、以及商品(CPO、Olein、可可、咖啡)。

| 可交易工具 | 支援 |

| 外匯 | ✔ |

| 商品 | ✔ |

| 金屬 | ✔ |

| 能源 | ✔ |

| 美國單一股票 | ✔ |

| 股票指數 | ✔ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| ETFs | ❌ |

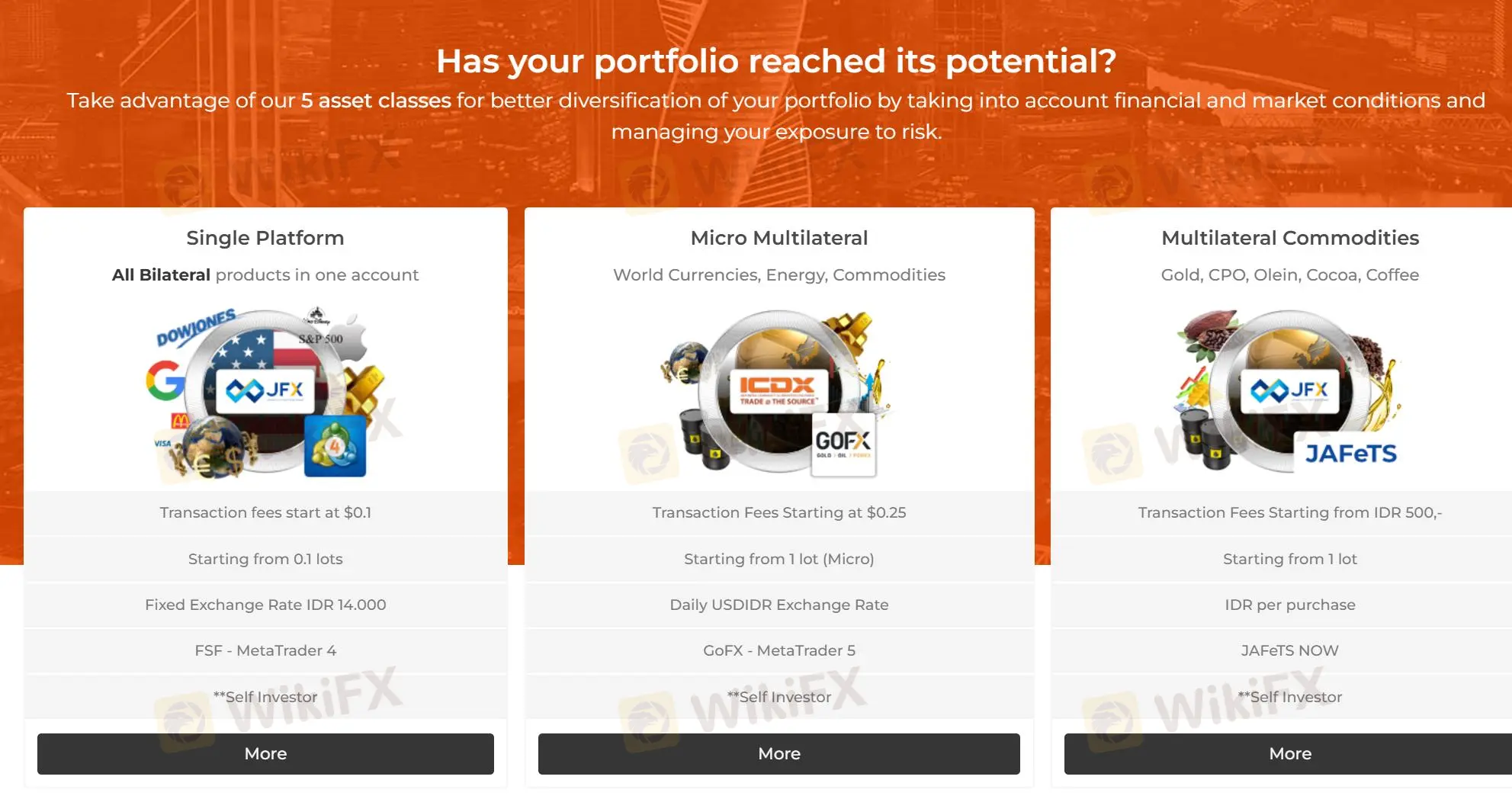

帳戶類型

First State Futures 提供三種帳戶類型:單一平台帳戶、微型多邊帳戶和多邊商品帳戶。此外,還提供模擬帳戶。

| 帳戶類型 | 涵蓋的產品 | 手數 | 匯率/貨幣 |

| 單一平台帳戶 | 所有雙邊產品 | 從0.1手 | 固定為IDR 14,000 |

| 自主投資者 - 微型多邊帳戶 | 世界貨幣、能源、商品 | 從1手(微型) | 每日USDIDR匯率 |

| 自主投資者 - 多邊商品帳戶 | 黃金、CPO、Olein、可可、咖啡 | 從1手 | 每筆購買的IDR |

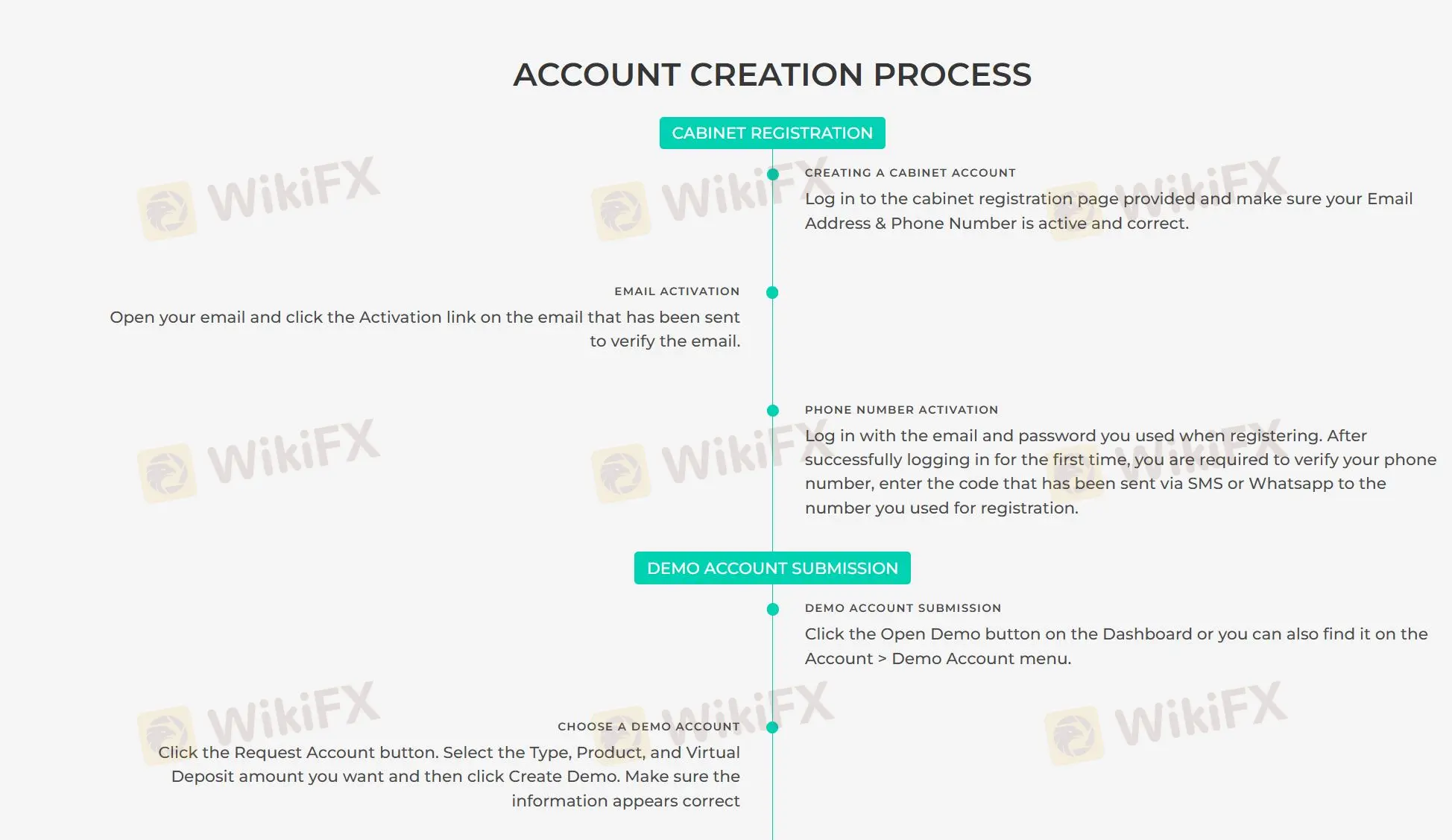

要開設First State Futures的帳戶,您需要先擁有模擬帳戶,然後再申請真實帳戶。此外,請登錄提供的櫃檯註冊頁面。打開您的電子郵件,點擊已發送的郵件上的激活鏈接以驗證郵件。

First State Futures 費用

| 帳戶類型 | 交易費用 |

| 單一平台帳戶 | 從$0.1起 |

| 自主投資者 - 微型多邊帳戶 | 從$0.25起 |

| 自主投資者 - 多邊商品帳戶 | 從IDR 500起 |

此外,當客戶的帳戶連續30(三十)天不活躍時,還會收取50美元的不活躍費用。

交易平台

First State Futures 提供JAFeTS NOW和MT4交易平台。

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| JAFeTS NOW | ✔ | 基於電子 | / |

| MT4 | ✔ | 網頁、桌面、手機 | 初學者 |

| MT5 | ❌ | / | 經驗豐富的交易者 |

JAFeTS NOW交易平台:

該平台基於最新技術構建,支持未來技術發展,並可根據市場需求進行進一步開發。它還支持多邊商品交易的模擬。

MetaTrader 4(MT4)交易平台:

基於Metaquotes Software Corp的軟件,MT4是一個多功能平台,支持所有類型的設備。該平台提供實時報價、圖表、市場新聞,並提供全面的即時交易執行。

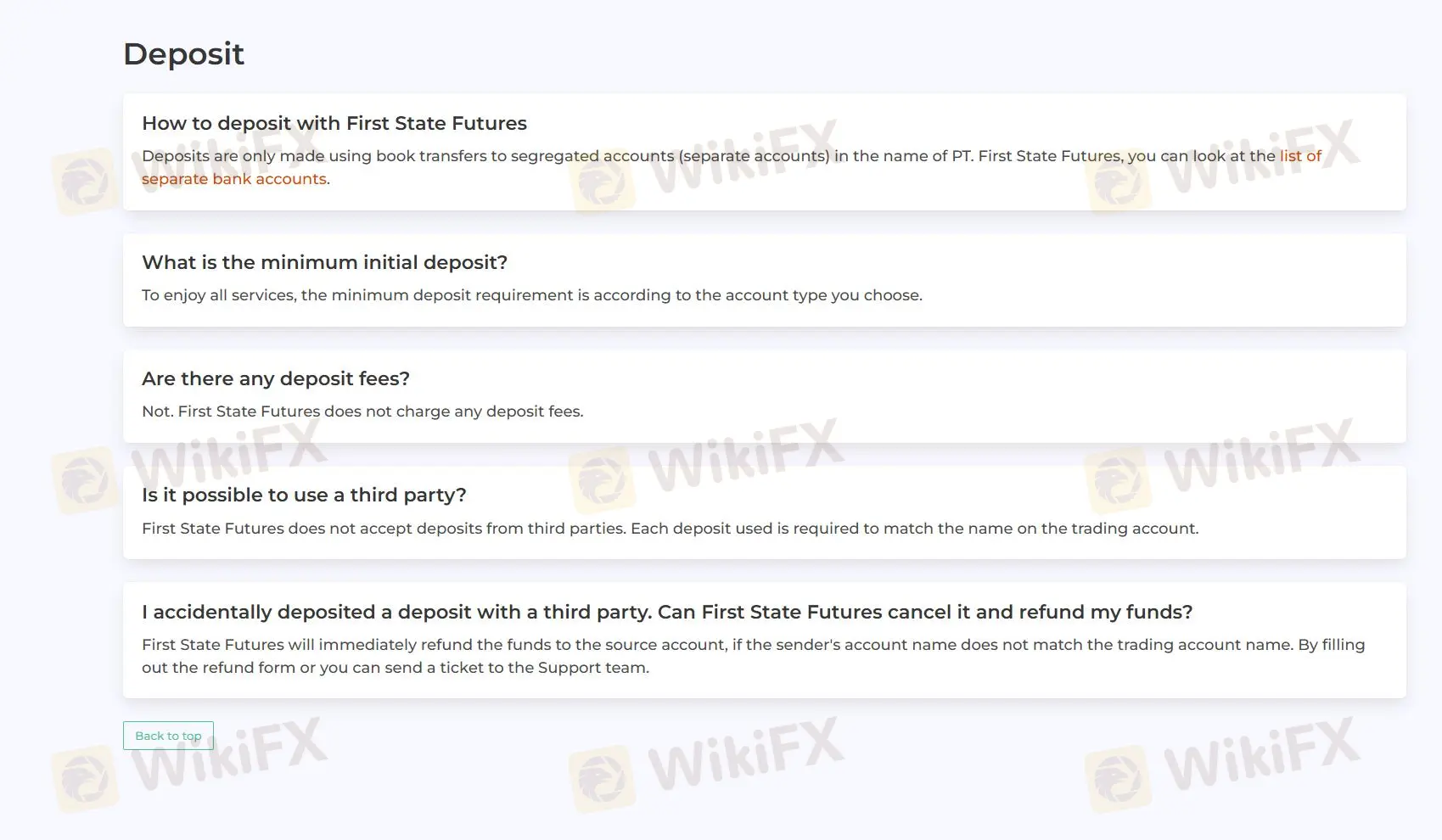

存款和提款

在First State Futures,存款只能通過將資金轉入以PT為名的分離帳戶(獨立帳戶)進行。它不收取存款或提款費用。

提款只能通過您用於存款的支付方式進行處理和轉帳。