公司简介

| 亚达盟 评论摘要 | |

| 成立时间 | 2010 |

| 注册国家/地区 | 香港 |

| 监管 | SFC |

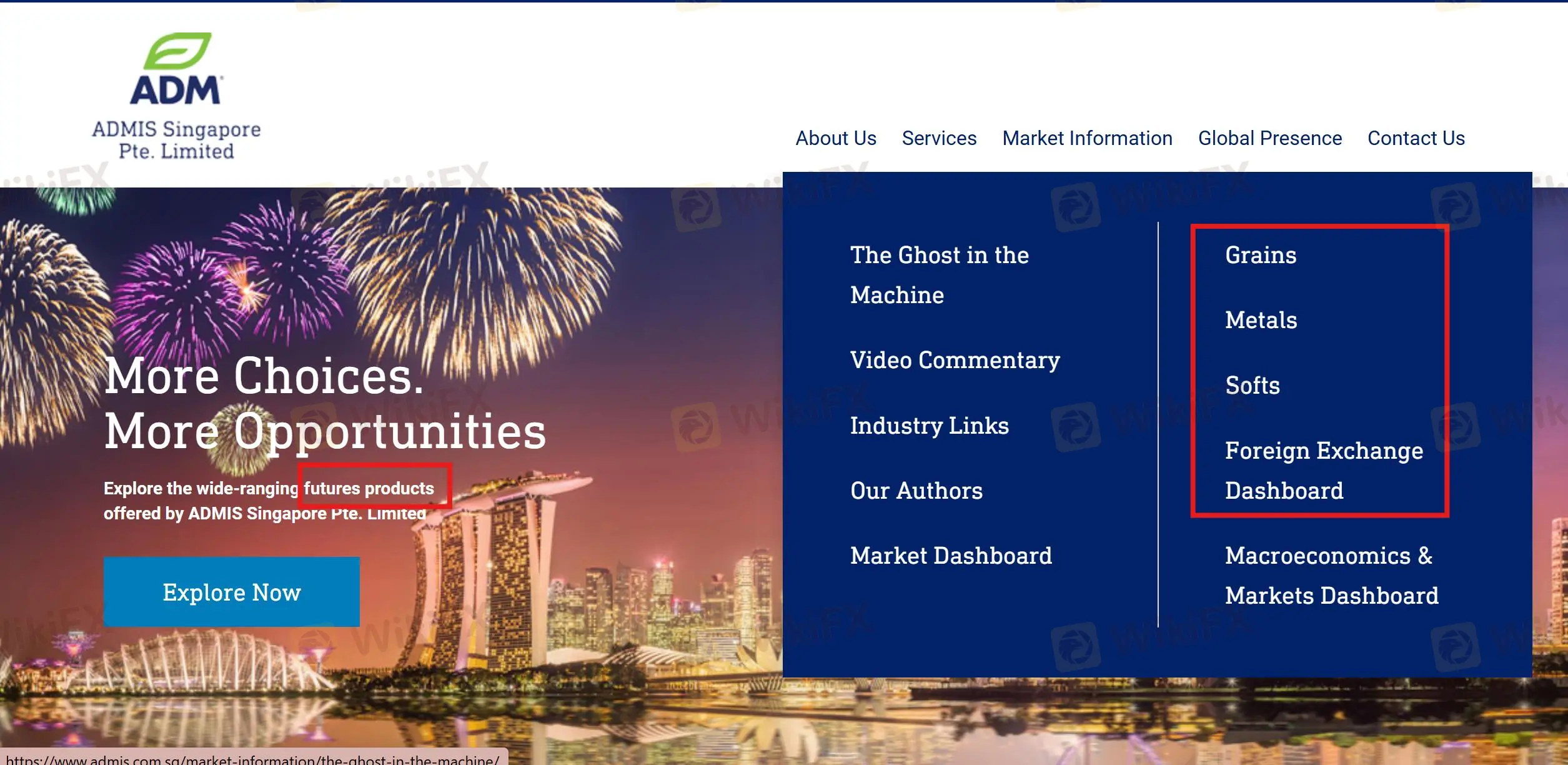

| 市场工具 | 谷物、金属、软商品和外汇期货 |

| 模拟账户 | / |

| 杠杆 | / |

| 交易平台 | CQG、TT |

| 最低存款 | / |

| 客户支持 | 电话:+65-6632-3000 |

| 电子邮件:sales@admis.com.sg | |

| 地址:新加坡188024维多利亚街武吉士大厦#11-06 | |

亚达盟于2010年在香港注册,是一家专门从事期货交易的经纪商。它使用CQG和TT作为其交易平台,并受SFC监管。然而,它并未透露关于账户和交易细节的太多信息。

优点和缺点

| 优点 | 缺点 |

| 操作时间长 | 没有实体办公室 |

| 费用结构不清晰 | |

| 没有MT4或MT5 | |

| 支付方式未知 |

亚达盟是否合法?

是的,亚达盟受到香港证券及期货事务监察委员会(SFC)的监管。

| 监管国家 | 监管机构 | 当前状态 | 受监管实体 | 许可证类型 | 许可证号码 |

| 香港证券及期货事务监察委员会(SFC) | 受监管 | 亚达盟香港有限公司 | 从事期货合约交易 | ACP509 |

WikiFX实地调查

WikiFX实地调查团队访问了亚达盟在香港的监管地址,但我们没有找到其实体办公室。

我可以在亚达盟上交易什么?

亚达盟 提供了广泛的期货产品。此外,它还提供与谷物、金属、软商品和外汇相关的市场信息。

交易平台

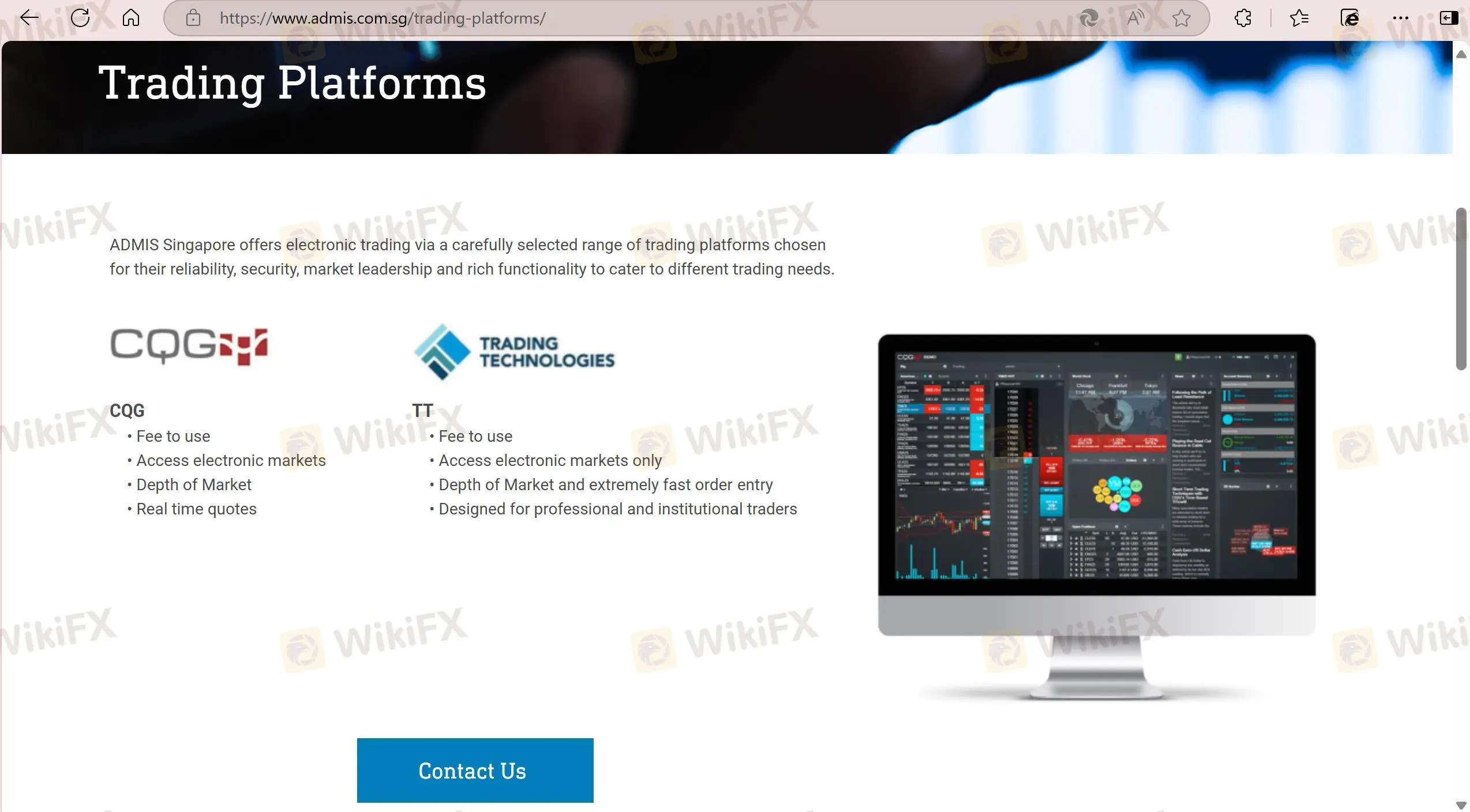

亚达盟 使用CQG和Trading Technologies (TT)作为其交易平台,不支持MT4或MT5。

| 交易平台 | 支持 | 可用设备 | 适用于 |

| CQG | ✔ | PC,Web | / |

| Trading Technologies | ✔ | PC,Web | / |

| MT4 | ❌ | / | 初学者 |

| MT5 | ❌ | / | 有经验的交易者 |

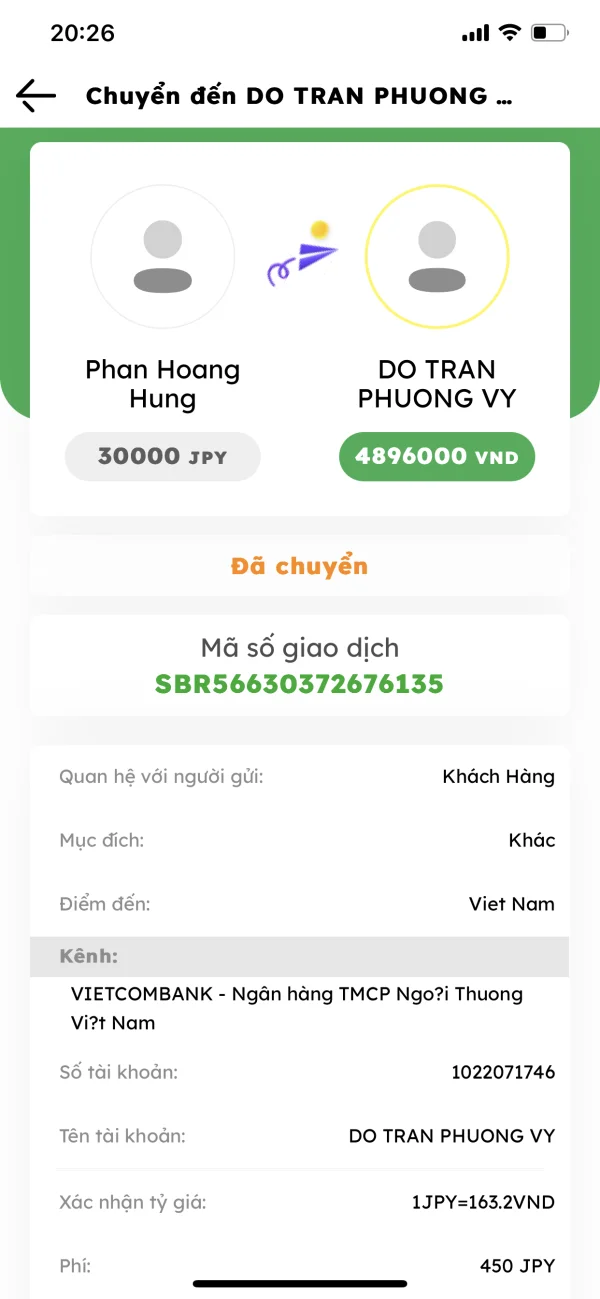

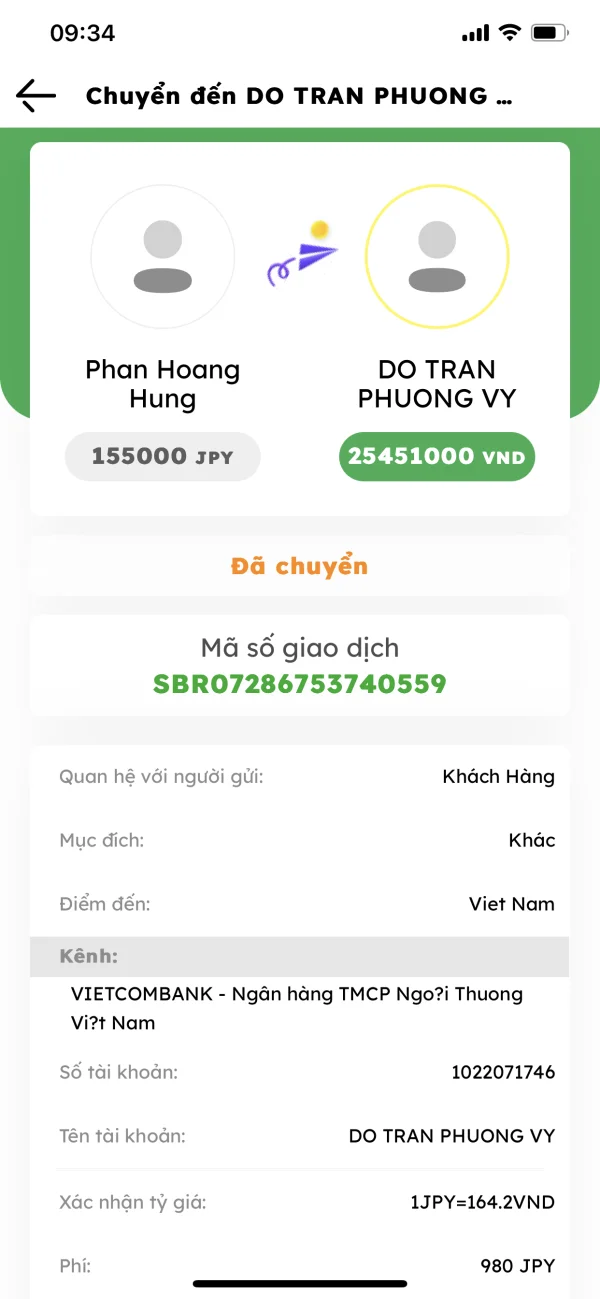

hung816

日本

尊敬的客户,我需要回复越南财政部担保的越南债务贸易有限公司(越南政府担保)业务订单的进度。 您的国库业务订单由于转账(金额过大,疑似洗钱)而处于异常状态。 越南财政部担保的越南债务贸易有限公司(越南政府担保)为了确保业务资金安全,避免出现安全隐患,目前已冻结此业务订单。 为了确保您的业务资金能够有效安全地转入您的银行账户,越南财政部担保的越南债务贸易有限公司(越南政府担保)请求您。 备注编号:20230825.6192061 PHAN HOANG HUNG 先生 1:电话号码:08075008346 2:Gmail 地址:hungphan3051999@gmail.com 3:电话号码提款金额:205.643$ = 4.935.432.000 越南盾 4:银行名称:西贡上信商业股份银行 (Sacombank) 5:银行账号:050111039736 6:账户持有人姓名:TRAN THI KIM NGOC 金额 205.643$ = 4.935.432.000 越南盾已盖章。您需要支付货币兑换费,然后由越南政府担保的越南财政部债务贸易有限公司将为您发出提款指令。- 货币兑换费按 2% 计算。兑换率 205.643$ = 4.935.432.000 越南盾 x 0.02 = 98.708.640 越南盾 请说明,付款完成后,该金额将自动转换为商业汇款订单,并转入越南国家银行。 - 2023年8月25日至2023年9月5日期间申请,您必须支付 98.708.640 越南盾 全额支付后 98.708.640 越南盾,由越南政府担保的越南财政部债务贸易有限公司将在您全额支付 98.708.640 越南盾之日起 30 天内退还 98.708.640 越南盾。 如果您在 2023 年 9 月 5 日之后仍未全额支付 98.708.640 越南盾,则文件将被发送至公安部计划财政部进行处理和结算。谢谢

曝光

FX1519754694

香港

事实证明,ADMIS 的客户服务是一流的。它有一种你在任何地方都找不到的责任感。响应很快,提供的解决方案也足够。感觉就像在我的交易之旅中拥有了一个可靠的盟友。同样令我印象深刻的是他们的提款过程的速度。从 ADMIS 接收资金就像收到快递一样,快速且没有任何不必要的延误。

好评

FX7287257892

英国

太棒了,我赢了10万美元,交易所帮我顺利存取款。谢谢!

好评

FX1993775032

越南

我个人感受到客服热情周到,提供24/7的支持。存取款处理流程迅速。交易平台运行良好,交易时没有出现错误。

好评

时尚阳光

厄瓜多尔

我个人觉得这个ADMISI没什么问题,但我在wikifx网站上看到一些不好的信息,有点担心。实地考察发现他们在英国没有办公室。这是否意味着他们是骗子?我应该及时止损吗?

好评

FX1023300450

英国

这家经纪商的客户服务不够专业,而且不支持在线聊天。我记得曾向他们发送过咨询,却无人回应,这相当奇怪。我发现了一些问题:费用明细缺失,最低入金信息不明确……谁能告诉我这个平台表现如何?

中评