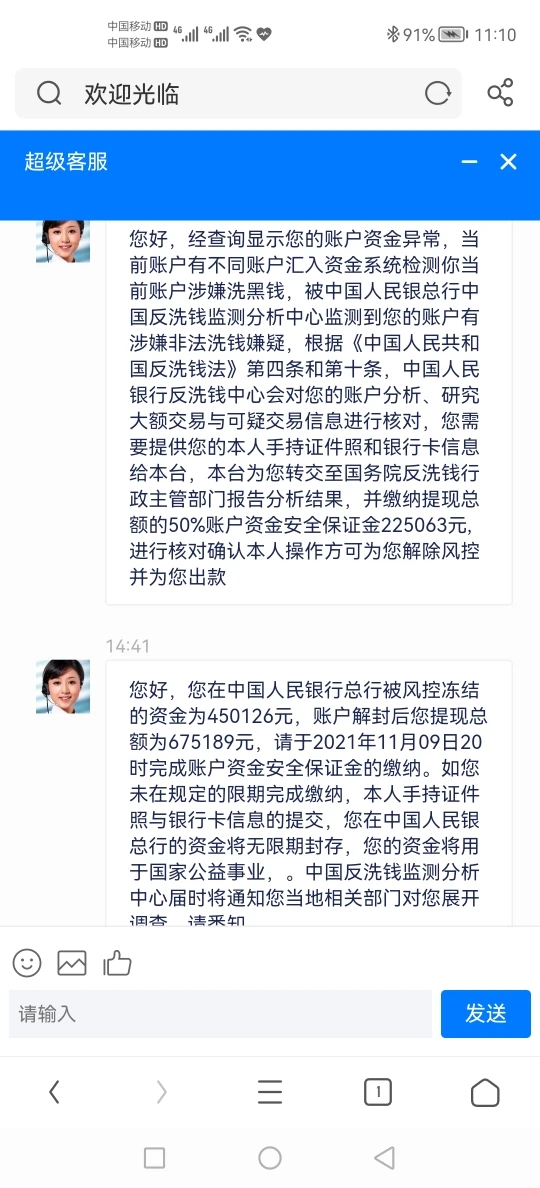

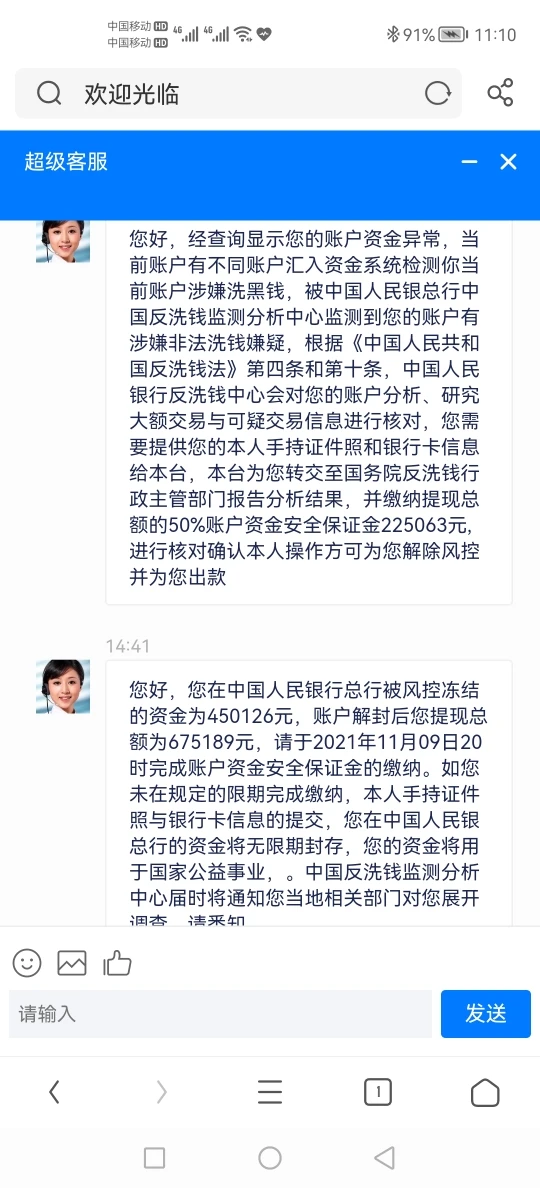

Resumo da empresa

| Morgan StanleyResumo da Revisão | |

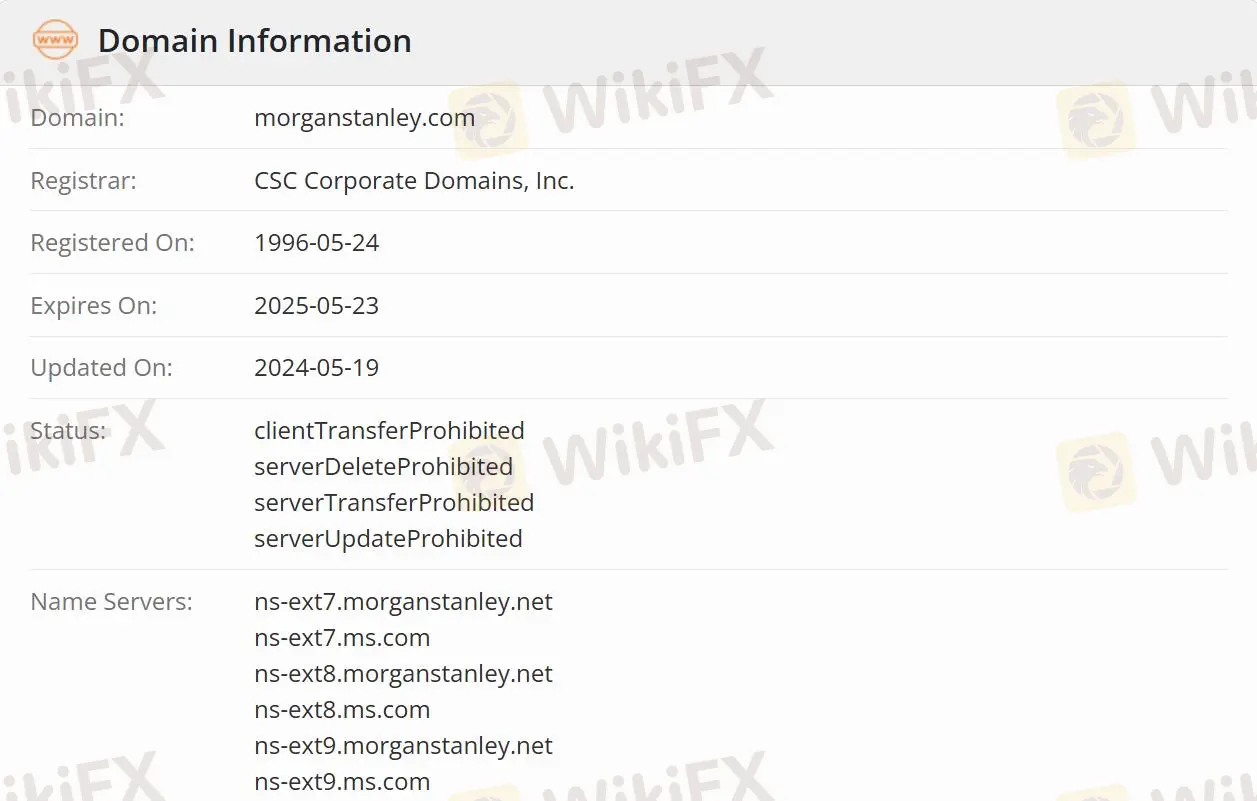

| Fundado | 1996-05-24 |

| País/Região Registrado | Estados Unidos |

| Regulação | Regulado |

| Serviços | Gestão de Patrimônio, Banco de Investimento e Mercados de Capitais, Vendas e Negociação, Pesquisa, Gestão de Investimentos, Morgan Stanley no Trabalho, Investimento Sustentável e Grupo de Empreendimentos Inclusivos |

| Suporte ao Cliente | Mídias Sociais: LinkedIn, Instagram, Twitter, Facebook, YouTube |

Informações sobre Morgan Stanley

Morgan Stanley é uma corretora que ajuda indivíduos, famílias, instituições e governos a captar, gerenciar e distribuir capital.

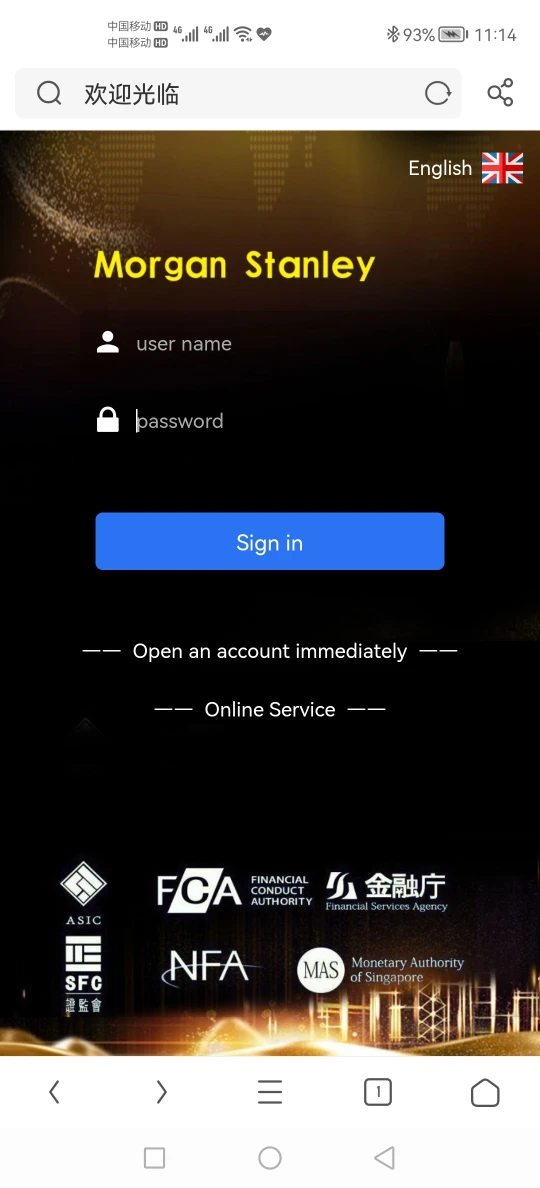

Morgan Stanley é Legítimo?

Morgan Stanley é autorizado e regulado pela Organização Reguladora de Investimentos do Canadá (CIRO), tornando-o mais seguro do que corretores regulados. Mas os riscos não podem ser completamente evitados.

O que Morgan Stanley faz?

O trabalho da empresa envolve 8 aspectos principais, incluindo gestão de patrimônio, banco de investimento e mercados de capitais, vendas e negociação, pesquisa, gestão de investimentos, Morgan Stanley no trabalho, investimento sustentável e grupo de empreendimentos inclusivos.

Gestão de Patrimônio: Ajuda pessoas, empresas e instituições a construir, preservar e gerenciar patrimônio.

Banco de Investimento e Mercados de Capitais: Expertise em análise de mercado e serviços de consultoria e captação de capital para corporações, instituições e governos.

Vendas e Negociação: Morgan Stanley para serviços de vendas, negociação e formação de mercado.

Pesquisa: Oferece análise de empresas, setores, mercados e economias, auxiliando os clientes em suas decisões.

Gestão de Investimentos: Fornece estratégias de investimento em várias classes de ativos, em mercados públicos e privados.

Morgan Stanley no Trabalho: Fornece soluções financeiras para o local de trabalho para organizações e seus funcionários, combinando conselhos.

Investimento Sustentável: Oferece produtos de investimento sustentável, promove soluções inovadoras e fornece insights acionáveis sobre questões de sustentabilidade.

Opções de Suporte ao Cliente

Os traders podem seguir Morgan Stanley em várias mídias sociais, incluindo LinkedIn, Instagram, Twitter, Facebook e YouTube.

| Opções de Contato | Detalhes |

| Mídias Sociais | LinkedIn, Instagram, Twitter, Facebook, YouTube |

| Idioma Suportado | Inglês |

| Idioma do Site | Inglês |

| Endereço Físico | Morgan Stanley 1585 Broadway New York, NY 10036 |