회사 소개

| Going Securities 리뷰 요약 | |

| 설립 연도 | 2021 |

| 등록 국가/지역 | 홍콩 |

| 규제 | SFC |

| 제품 & 서비스 | 선물, 증권, 자산 관리, 자산 운용, 투자 연구 |

| 거래 플랫폼 | Going Securities Pro |

| 고객 지원 | 전화: +852 2187 2100 |

| 이메일: cs@goingf.hk | |

| 주소: Suite 3102, 31/F, Tower 6, The Gateway, Harbour City, Tsim Sha Tsui, KLN, 홍콩 | |

Going Securities 정보

Going Securities은 토론토, 아부다비, 베이징, 상하이, 심천, 도쿄, 후주 및 싱가포르에 글로벌한 존재감을 확장한 홍콩 금융 서비스 제공업체입니다. 선물, 증권, 자산 관리, 자산 운용 및 투자 연구를 포함한 금융 서비스를 제공합니다.

회사는 현재 SFC에 의해 규제되고 있으며, 이는 일정 수준의 신뢰성과 고객 보호를 의미합니다.

장단점

| 장점 | 단점 |

| SFC 규제 | 수수료 구조 불명확 |

| 글로벌 존재감 |

Going Securities 합법성

Going Securities은 현재 SFC(홍콩 증권 선물 위원회)에 의해 라이선스 번호 BPS863으로 잘 규제되고 있습니다.

| 규제 국가 | 규제 기관 | 현재 상태 | 규제 업체 | 라이선스 유형 | 라이선스 번호 |

| SFC | 규제됨 | Going Securities Limited | 선물 계약 거래 | BPS863 |

제품 및 서비스

Going Securities은 선물 및 증권 거래, 자산 관리, 자산 운용, 그리고 투자 연구를 포함한 다양한 금융 서비스를 제공합니다.

이 회사는 개인 및 기관 고객을 위해 맞춤형 솔루션을 제공하며, 글로벌 시장 접근과 데이터 기반 전략을 결합합니다.

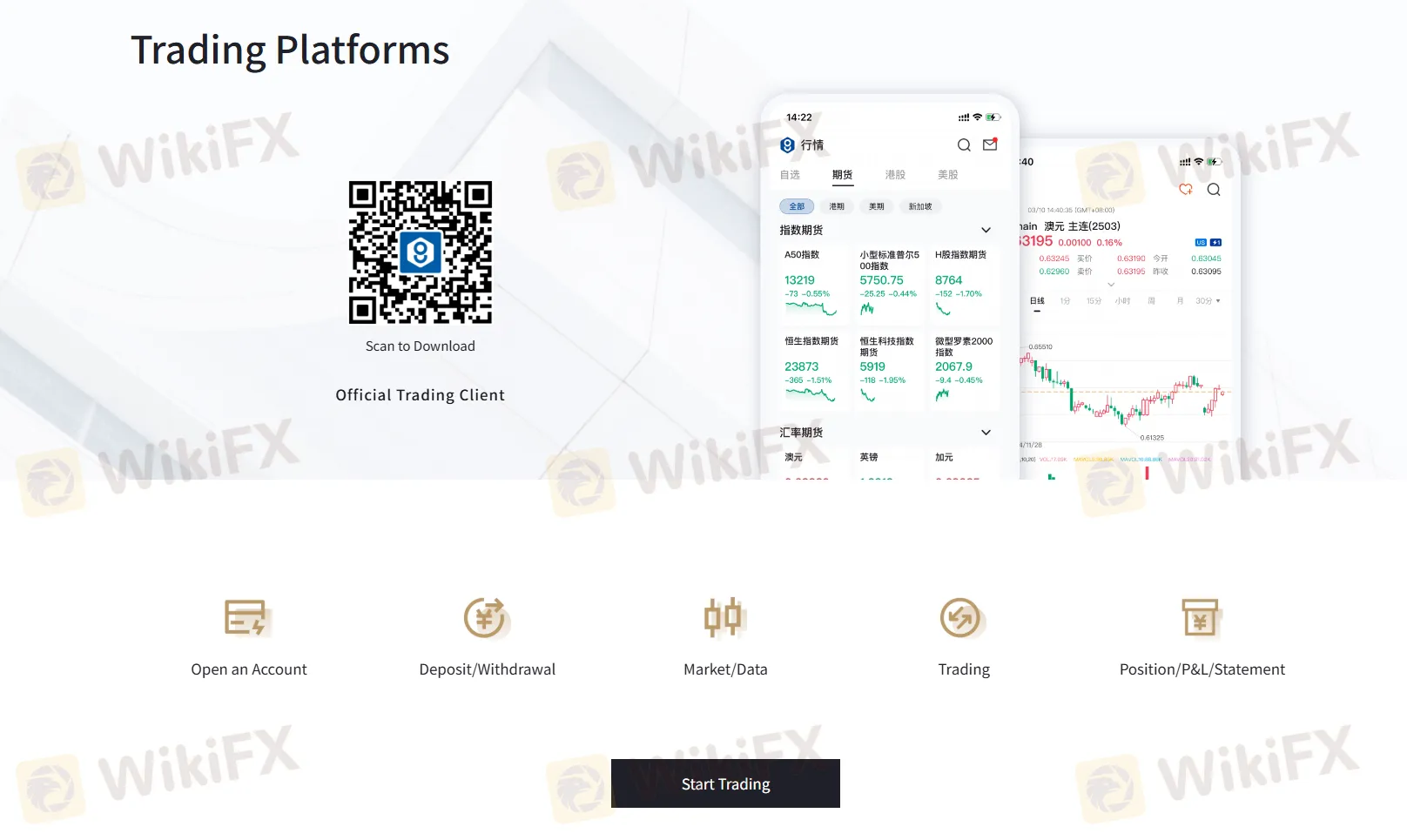

거래 플랫폼

Going Securities은 독점적인 거래 플랫폼을 제공합니다: Going Securities Pro.

트레이더들은 웹사이트의 QR 코드를 스캔하여 모바일폰에서 플랫폼을 다운로드하고 회사와 거래를 시작할 수 있습니다.