회사 소개

| U.S. Bank리뷰 요약 | |

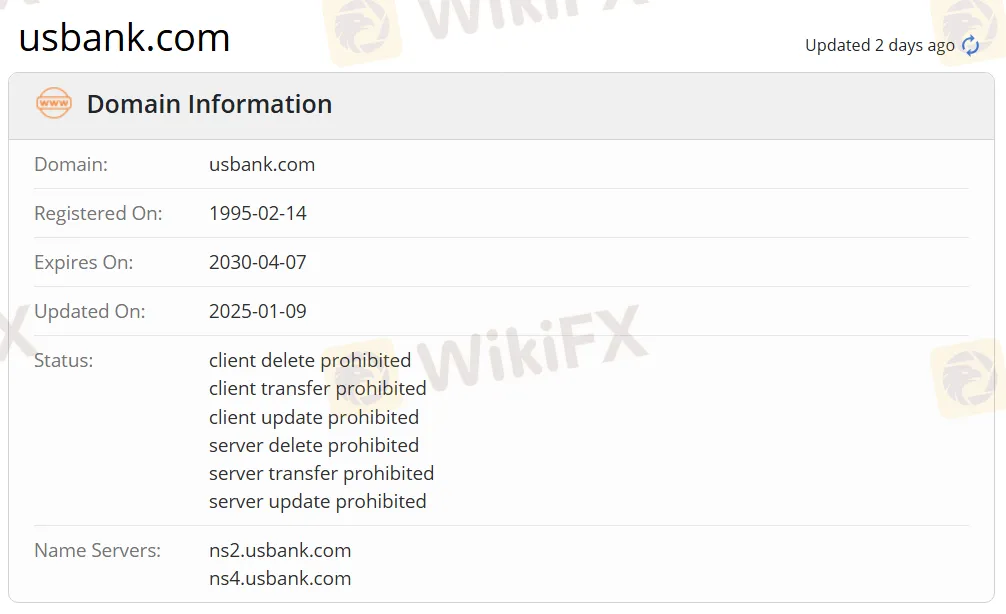

| 설립 연도 | 1995 |

| 등록 국가/지역 | 미국 |

| 규제 | 규제 없음 |

| 제품 및 서비스 | 은행 서비스, 자산 관리 |

| 데모 계정 | / |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | U.S. Bank 앱 |

| 최소 입금액 | $25 |

| 고객 지원 | 소셜 미디어: Facebook, Twitter, Instagram |

| 주소: U.S. Bank 800 Nicollet Mall Minneapolis, MN 55402 | |

U.S. Bank 정보

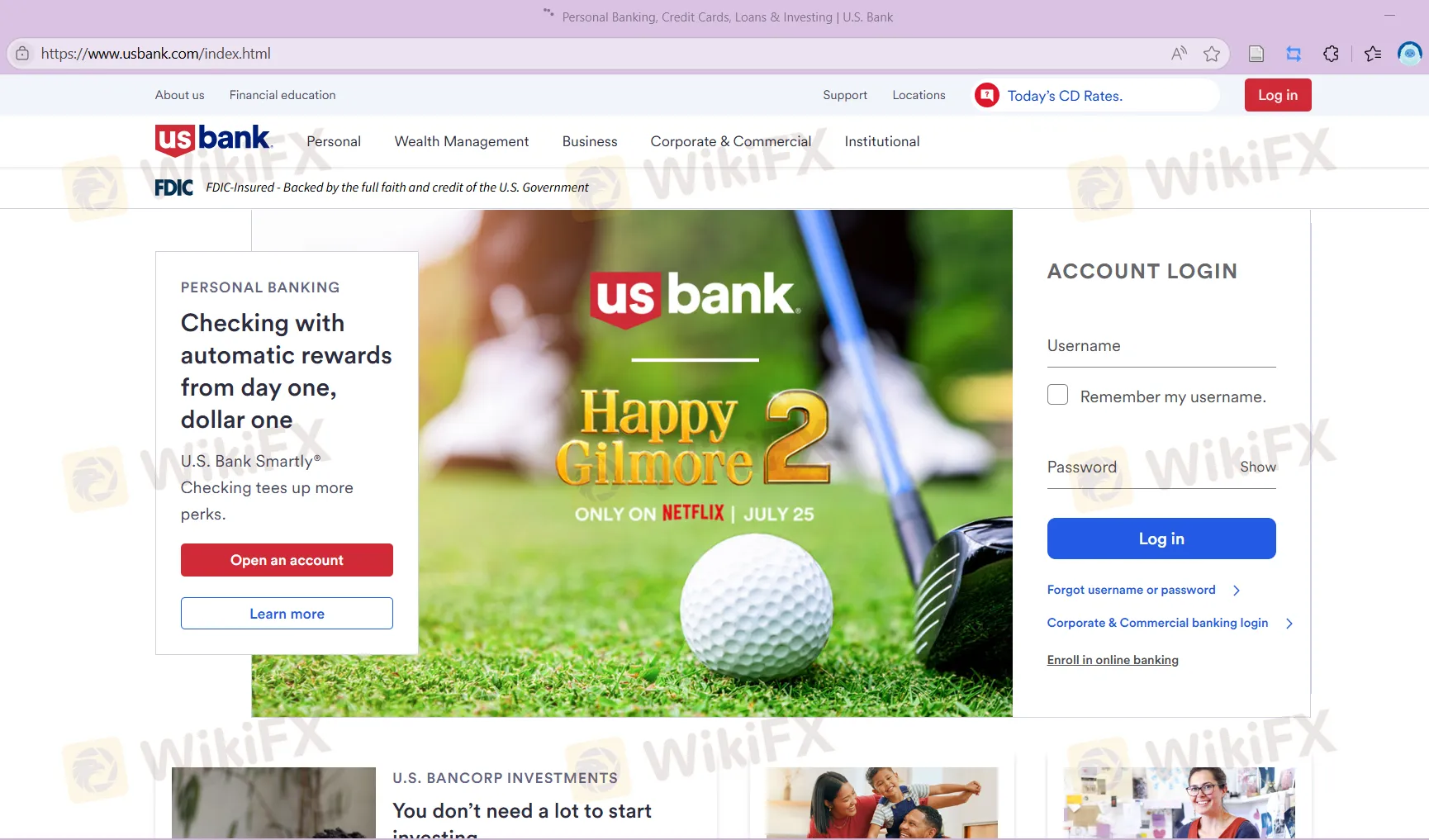

U.S. Bank은 1995년에 설립되었으며 미국에 등록되어 있습니다. 신용카드, 입출금 통장, 적금, 예금증서(CDs), 모기지 대출, 투자 관리 및 자산 계획을 포함한 다양한 은행 서비스를 개인, 기관 및 기업 고객에게 제공합니다. 최소 입금액이 $25로 편리한 거래 경험을 제공하지만 회사는 규제를 받지 않으므로 투자자는 그의 합법성과 투명성에 대해 주의해야 합니다. U.S. Bank은 상업용 입출금 통장, 상업용 적금 통장, 상업용 머니 마켓 계좌 및 상업용 예금증서(CDs)라는 네 가지 주요 계정 유형을 제공하여 다양한 비즈니스의 현금 관리 및 성장 요구를 충족시킵니다.

장단점

| 장점 | 단점 |

| 전문화된 은행 서비스 | 규제 없음 |

| 미국에서의 긴 운영 역사 |

U.S. Bank 합법성

U.S. Bank은 규제를 받지 않습니다. 거래 시 주의를 기울이고 자금을 신중하게 사용해야 합니다.

제품 및 서비스

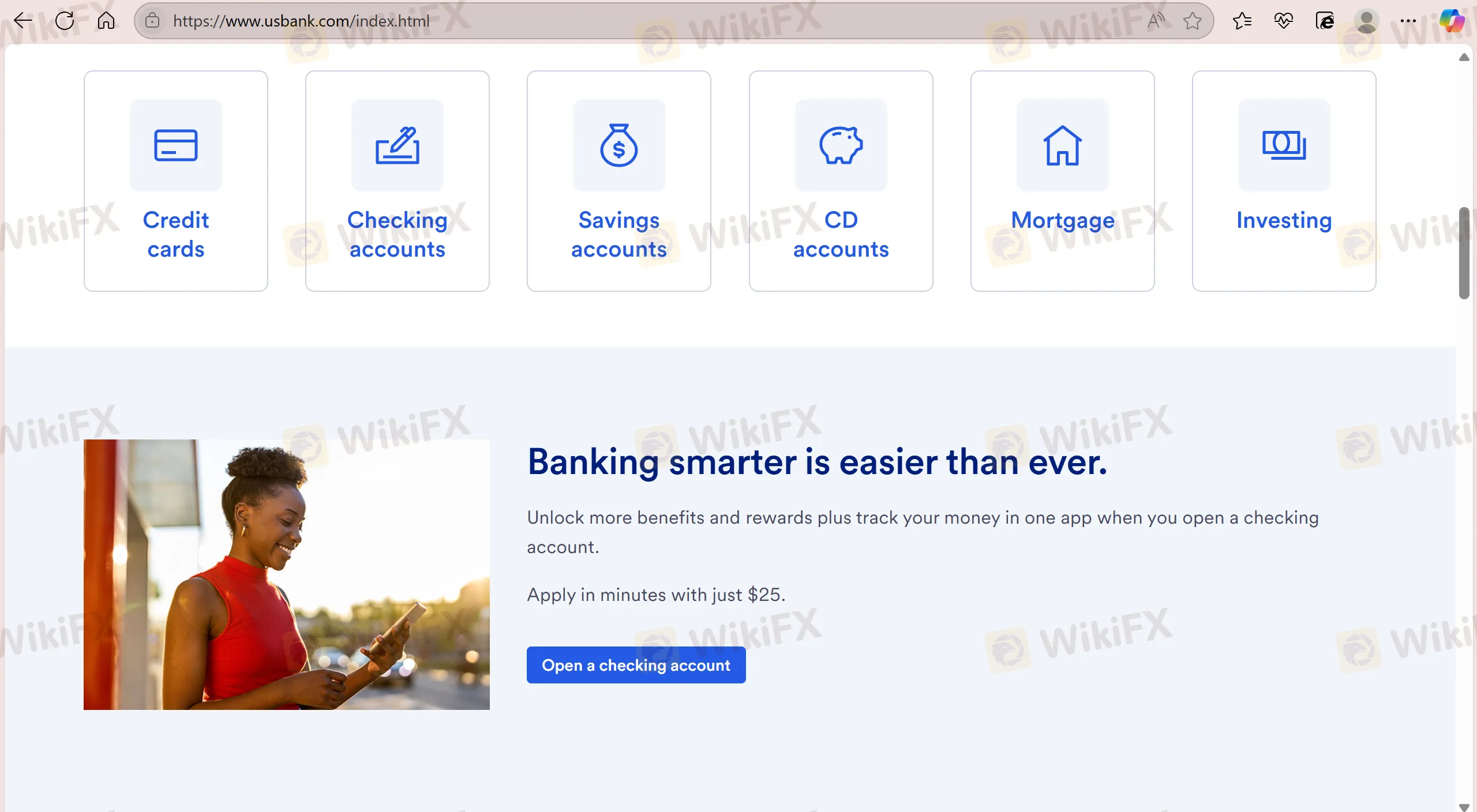

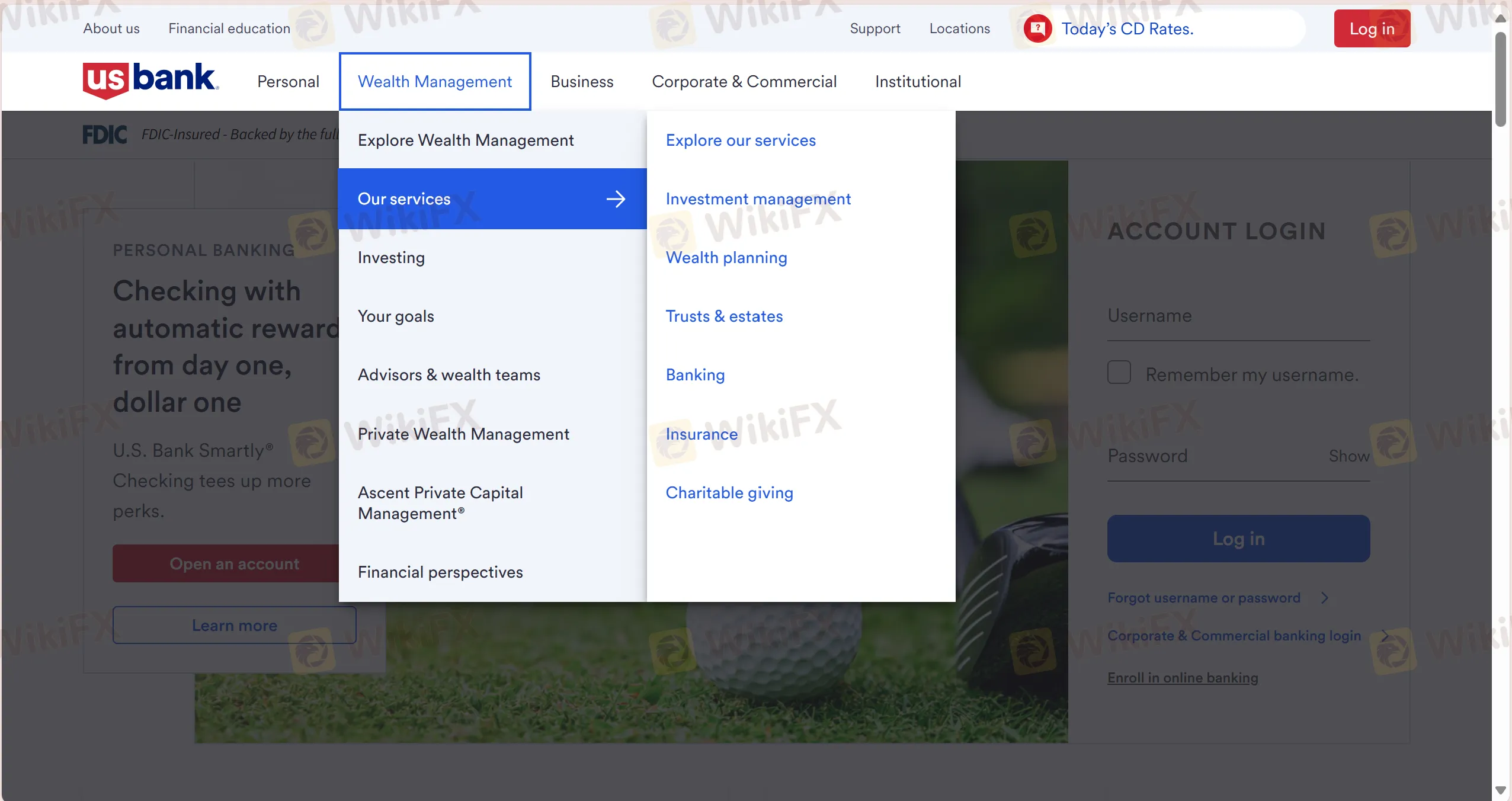

U.S. Bank은 신용카드, 입출금통장, 적금, CD 계좌, 모기지, 투자, 주택 모기지, 자동차 대출, 주택 자본 회선(HELOC), 투자 관리, 재무 계획, 신탁 및 재산, 은행, 보험, 자선 활동을 포함한 다양한 금융 상품 및 서비스를 제공합니다.

| 상품 및 서비스 | 지원 |

| 신용카드 | ✔ |

| 입출금통장 | ✔ |

| 적금 | ✔ |

| CD 계좌 | ✔ |

| 모기지 | ✔ |

| 투자 | ✔ |

| 자동차 대출 | ✔ |

| 주택 자본 회선(HELOC) | ✔ |

| 투자 관리 | ✔ |

| 재무 계획 | ✔ |

| 신뢰 및 재산 | ✔ |

| 은행 | ✔ |

| 보험 | ✔ |

| 자선 활동 | ✔ |

계정 유형

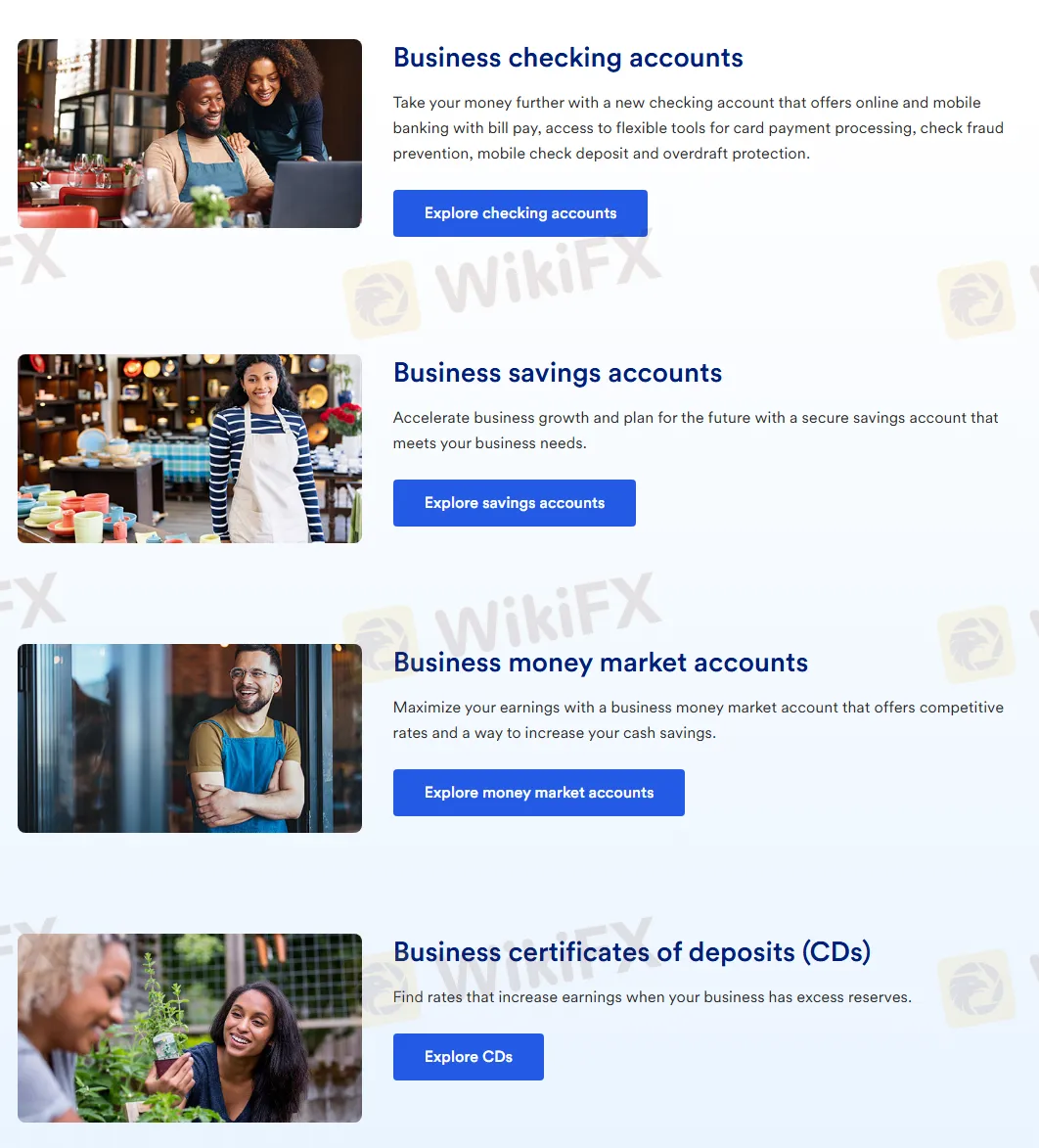

U.S. Bank은 비즈니스 입출금통장, 비즈니스 적금, 비즈니스 통장 시장 계좌 및 비즈니스 예금증서(CDs)를 포함한 네 가지 유형의 계정을 제공합니다.

다음은 그들의 주요 기능입니다:

| 계정 유형 | 설명 | 적합 대상 |

| 비즈니스 입출금통장 | 온라인 및 모바일 뱅킹 기능을 지원하여 청구서 지불, 카드 결제 처리 도구, 수표 사기 방지, 모바일 수표 입금 및 초과 인출 보호를 제공합니다. | 종합적인 뱅킹 솔루션이 필요한 기업을 위한 것입니다. |

| 비즈니스 적금 | 안전한 적금 계좌를 제공하여 기업이 성장을 가속화하고 자금 필요를 충족할 수 있도록 돕습니다. | 기업이 미래 성장을 위해 자금을 축적하려는 경우에 적합합니다. |

| 비즈니스 통장 시장 계좌 | 경쟁력 있는 이자율을 제공하여 기업이 수익을 극대화하고 현금 저축을 증가시킬 수 있도록 돕습니다. | 기업이 유동성을 유지하면서 높은 수익을 추구하는 경우에 적합합니다. |

| 비즈니스 예금증서(CDs) | 기업이 여분 자금을 보유할 때 수익을 향상시키기 위한 이자율 옵션을 제공합니다. | 기업이 특정 기간 동안 높은 수익을 확보하려는 경우에 적합합니다. |

수수료

최소 입금: U.S. Bank의 최소 입금액은 $25입니다.

거래 플랫폼

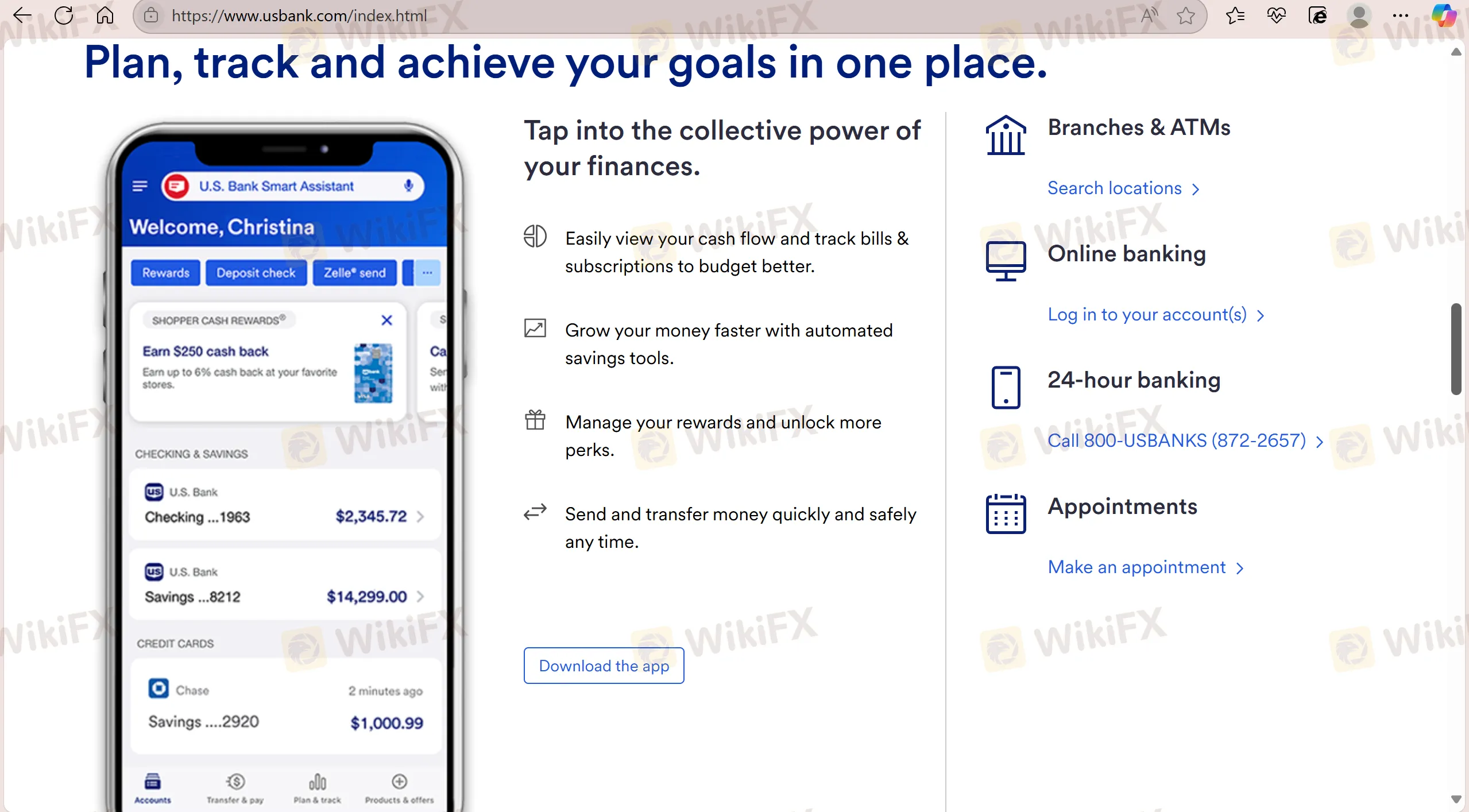

U.S. Bank는 독점적인 U.S. Bank 앱을 통해 거래를 지원합니다. 이 앱은 24시간 서비스를 제공합니다.

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합한 대상 |

| U.S. Bank 앱 | ✔ | 모바일 | / |