Profil perusahaan

| CloudfuturesRingkasan Ulasan | |

| Didirikan | 2019 |

| Negara/Daerah Terdaftar | China |

| Regulasi | CFFE |

| Instrumen Pasar | Futures |

| Akun Demo | ❌ |

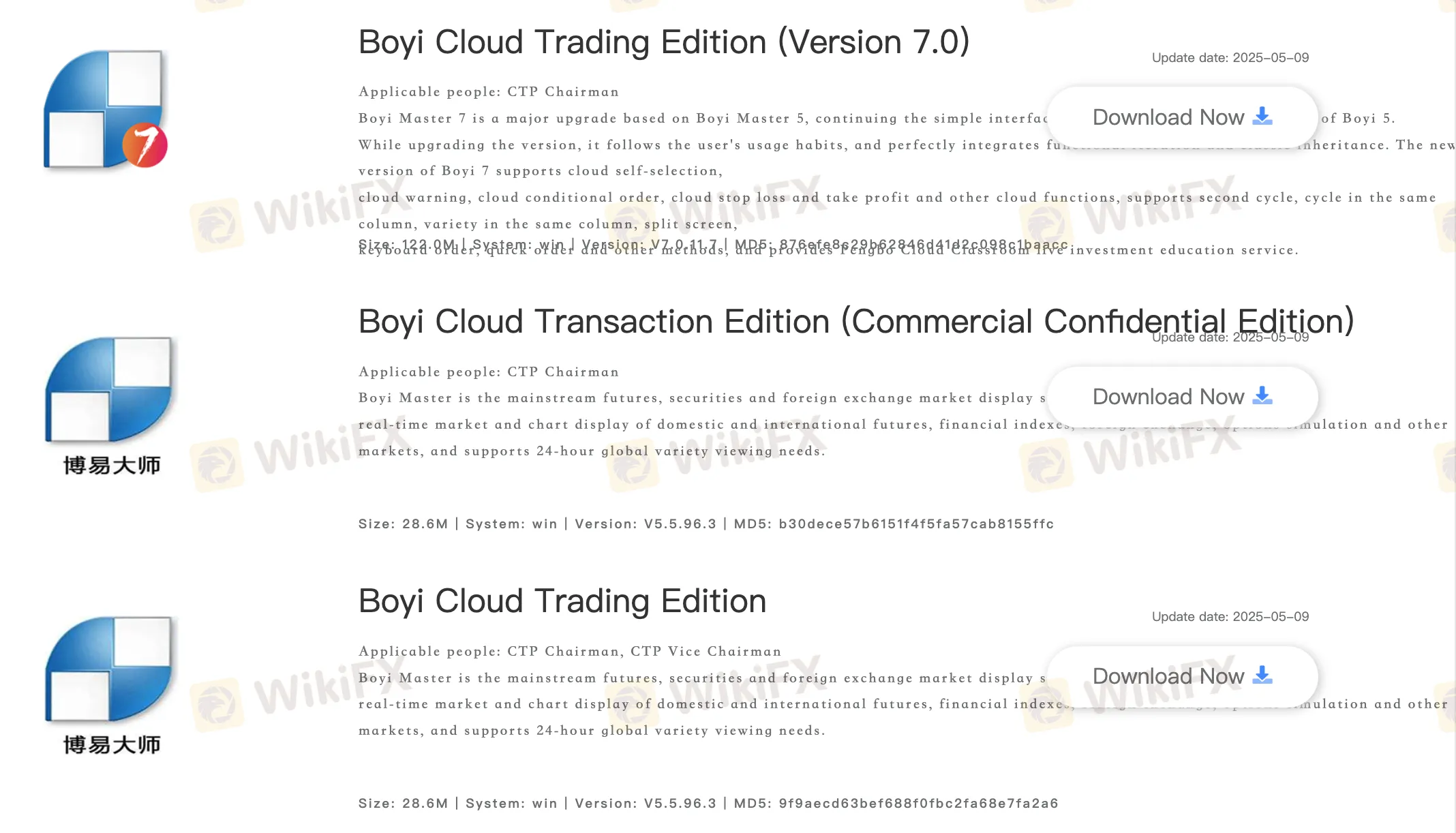

| Platform Perdagangan | Edisi Perdagangan Awan Boyi (Versi 7.0), Edisi Transaksi Awan Boyi (Edisi Rahasia Komersial), Edisi Perdagangan Awan Boyi, Edisi Khusus Kekayaan Awan Panlifang, Versi V2 Penerbitan Cepat (Versi Rahasia Komersial), Versi V3 Penerbitan Cepat (Versi Rahasia Komersial), Versi V2 Penerbitan Cepat, Versi V3 Penerbitan Cepat, dll. |

| Dukungan Pelanggan | Tel: 4001119992 |

| Email: YCFQH@cloudfutures.cn | |

Informasi Cloudfutures

Cloudfutures adalah broker yang diatur, menawarkan layanan perdagangan futures di berbagai platform perdagangan. Broker ini tidak menawarkan akun demo dan memberikan sedikit informasi tentang kondisi perdagangan. Karena sedikit informasi yang disediakan, terdapat kurangnya transparansi situs web.

Pro dan Kontra

| Pro | Kontra |

| Berbagai platform perdagangan | Tidak ada akun demo |

| Diatur dengan baik | Beberapa saluran kontak |

| Kurangnya transparansi |

Apakah Cloudfutures Legal?

Ya. Cloudfutures memiliki lisensi dari CFFEX untuk menawarkan layanan.

| Negara yang Diatur | Regulator | Status Saat Ini | Entitas yang Diatur | Tipe Lisensi | No. Lisensi |

| Bursa Futures Keuangan China | Diatur | 云财富期货有限公司 | Lisensi Futures | 0240 |

Apa yang Bisa Saya Perdagangkan di Cloudfutures?

Cloudfutures menawarkan perdagangan futures.

| Instrumen yang Dapat Diperdagangkan | Didukung |

| Futures | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Saham | ❌ |

| Kripto | ❌ |

| Obligasi | ❌ |

| Opsi | ❌ |

| ETF | ❌ |

Platform Perdagangan

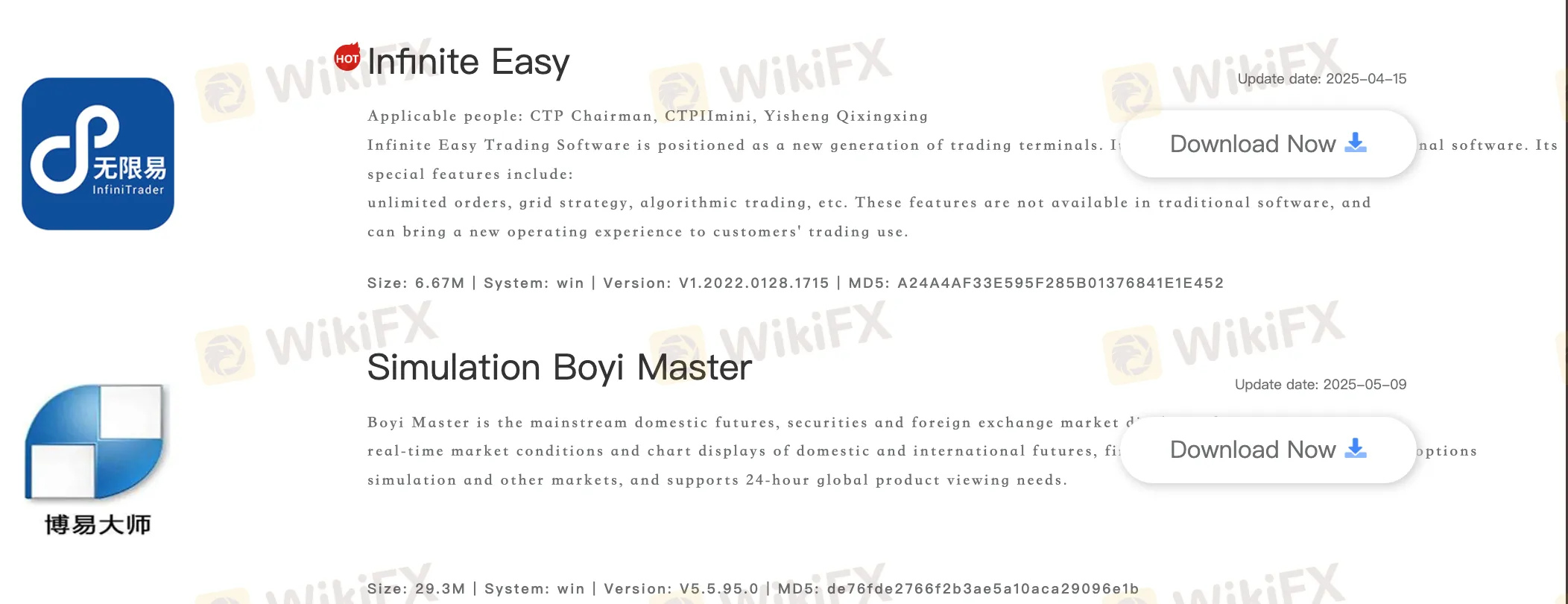

Broker ini menyediakan berbagai platform perdagangan, termasuk Boyi Cloud Trading Edition (Versi 7.0), Boyi Cloud Transaction Edition (Edisi Rahasia Komersial), Boyi Cloud Trading Edition, Edisi Khusus Kekayaan Cloud Panlifang, Quick Issue V2 (Versi Rahasia Komersial), Quick Issue V3 (Versi Rahasia Komersial), Fast Issue V2, Quick Issue V3, Fast Issue V2, Quick Issue V3, Perangkat Lunak Perdagangan Cloud Winshun (wh6), Cloud Wealth Futures, Travel, Disk Cube, Cloud Wealth Polestar 9.5, Cloud Wealth Polestar 9.5 MacOS, Cloud Wealth Polestar 8.5, Infinite Easy, dan Simulation Boyi Master.

Perangkat yang Tersedia: desktop dan mobile.

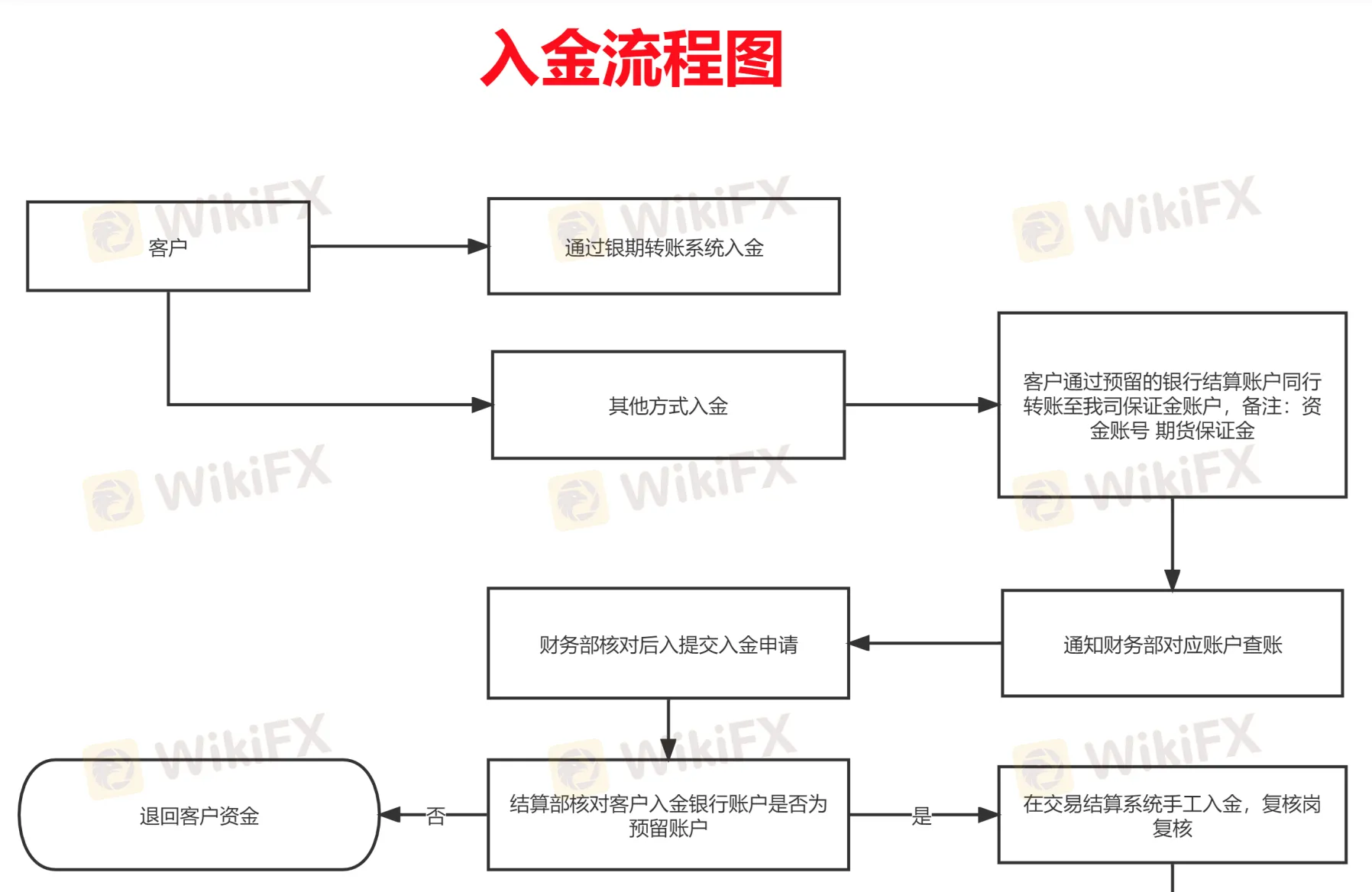

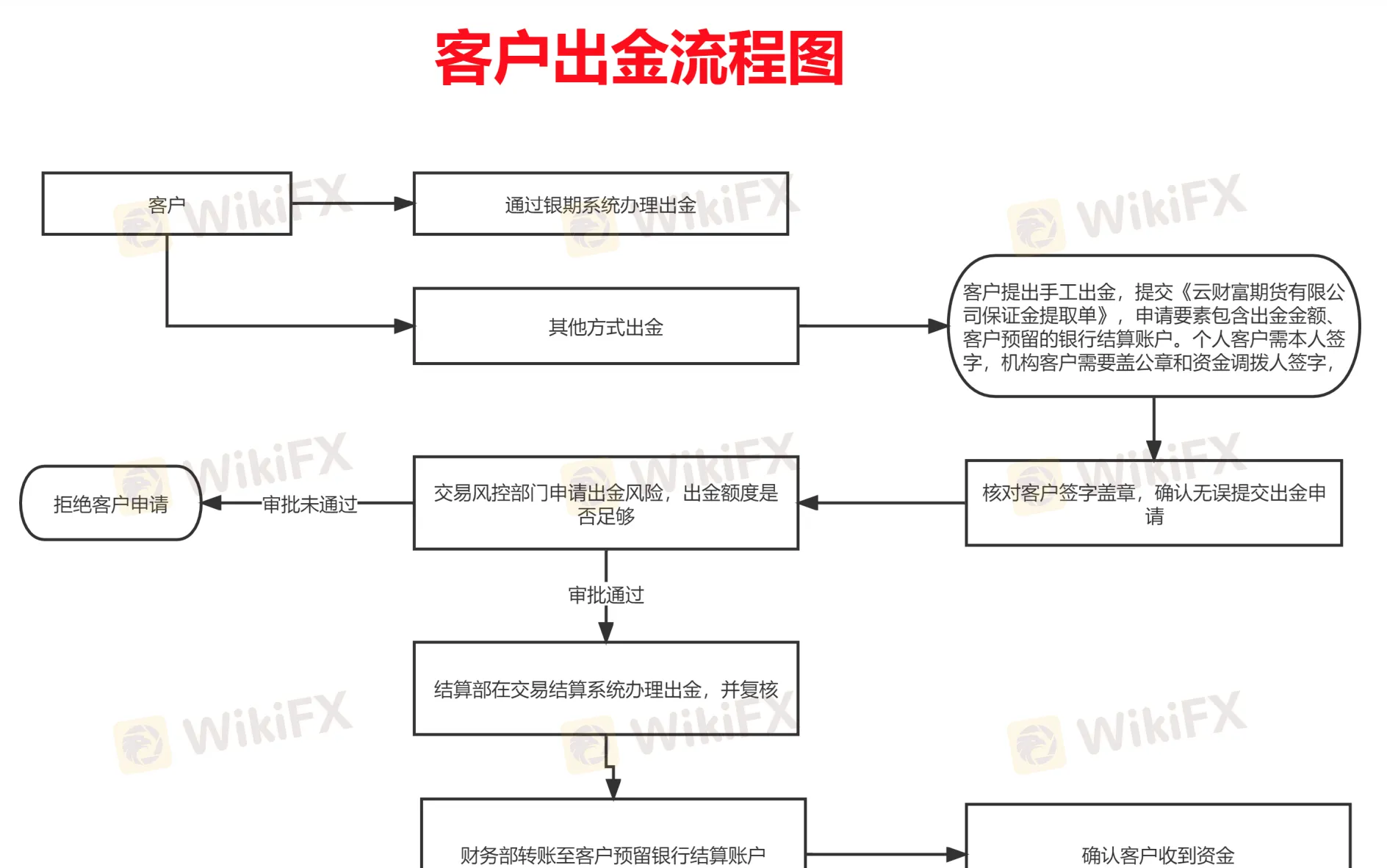

Deposit dan Penarikan

Tidak ada jumlah deposit atau penarikan minimum yang ditentukan dan tidak ada biaya atau biaya yang spesifik. Situs web hanya menampilkan proses deposit dan penarikan.