Profil perusahaan

| OTKRITIE Ringkasan Ulasan | |

| Dibentuk | 2015 |

| Negara/Daerah Terdaftar | Siprus |

| Regulasi | CySEC |

| Layanan | Penasihat Investasi, Layanan Broker, Manajemen Aset |

| Platform | Platform Kunci Terbuka, Platform QUIK |

| Dukungan Pelanggan | Tel: +357 25023870 |

| Email: infocyprus@otkritie-broker.com | |

Informasi OTKRITIE

Otkritie, terdaftar di Siprus, adalah platform perdagangan online yang diatur oleh CySEC. Ini menawarkan Layanan Penasihat Investasi, Brokerage, dan Manajemen Aset melalui platform Kunci Terbuka dan QUIK-nya.

Pro dan Kontra

| Pro | Kontra |

| Layanan komprehensif | Tidak ada dukungan obrolan langsung |

| Diatur oleh CySEC |

Apakah OTKRITIE Legal?

OTKRITIE memiliki lisensi Market Maker (MM), diatur oleh Cyprus Securities and Exchange Commission (CySEC) di Siprus, dengan nomor lisensi 294/16.

| Otoritas yang Diatur | Status Saat Ini | Negara yang Diatur | Entitas Berlisensi | Jenis Lisensi | No. Lisensi |

| Cyprus Securities and Exchange Commission (CySEC) | Diatur | Siprus | Otkritie Broker LTD | Market Maker (MM) | 294/16 |

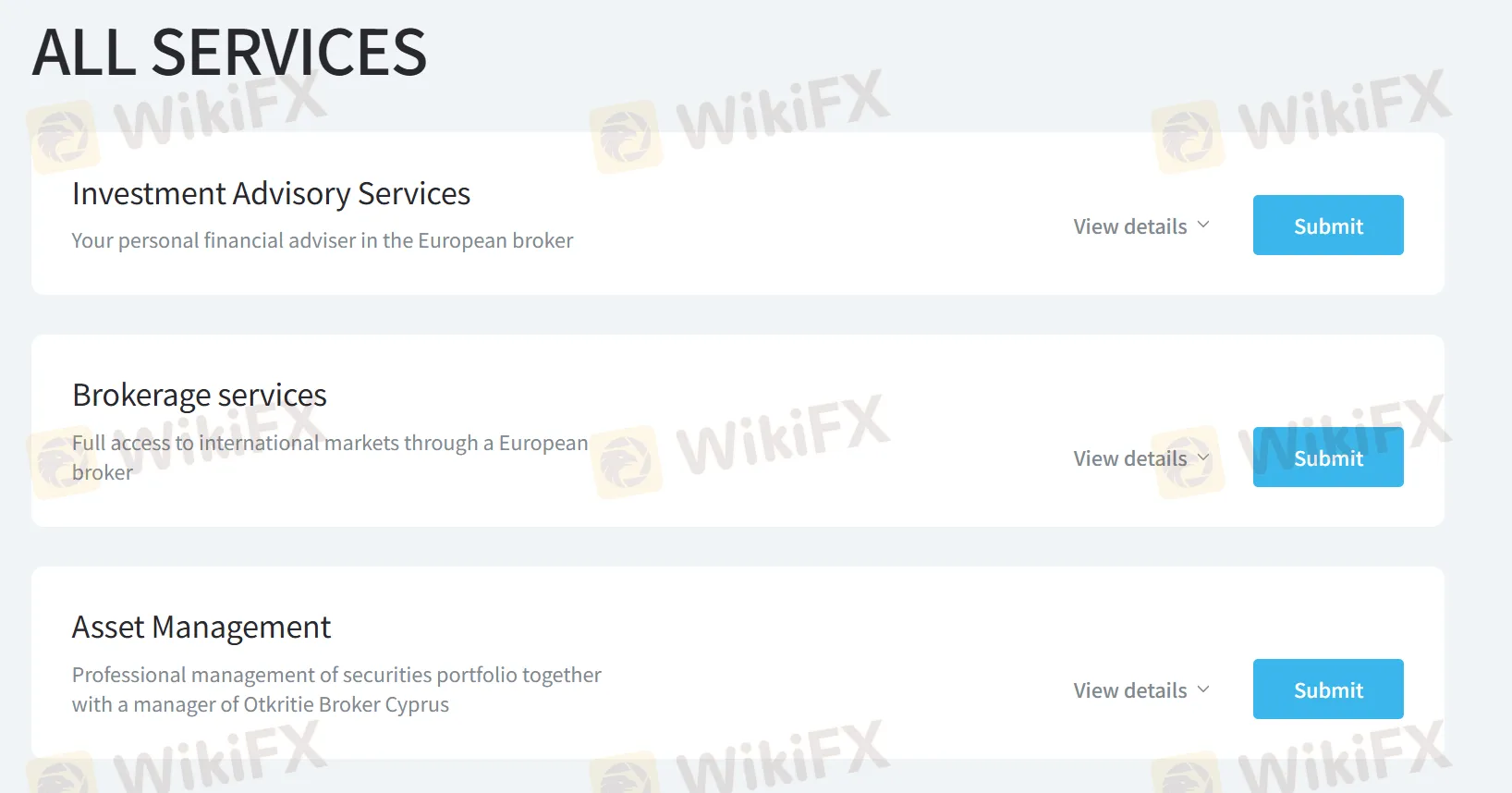

Layanan

OTKRITIE menawarkan layanan keuangan komprehensif, termasuk Penasihat Investasi untuk panduan keuangan yang dipersonalisasi, Layanan Broker untuk akses pasar global, dan Manajemen Aset untuk pengawasan portofolio profesional—semuanya melalui platform pialang Eropa-nya.

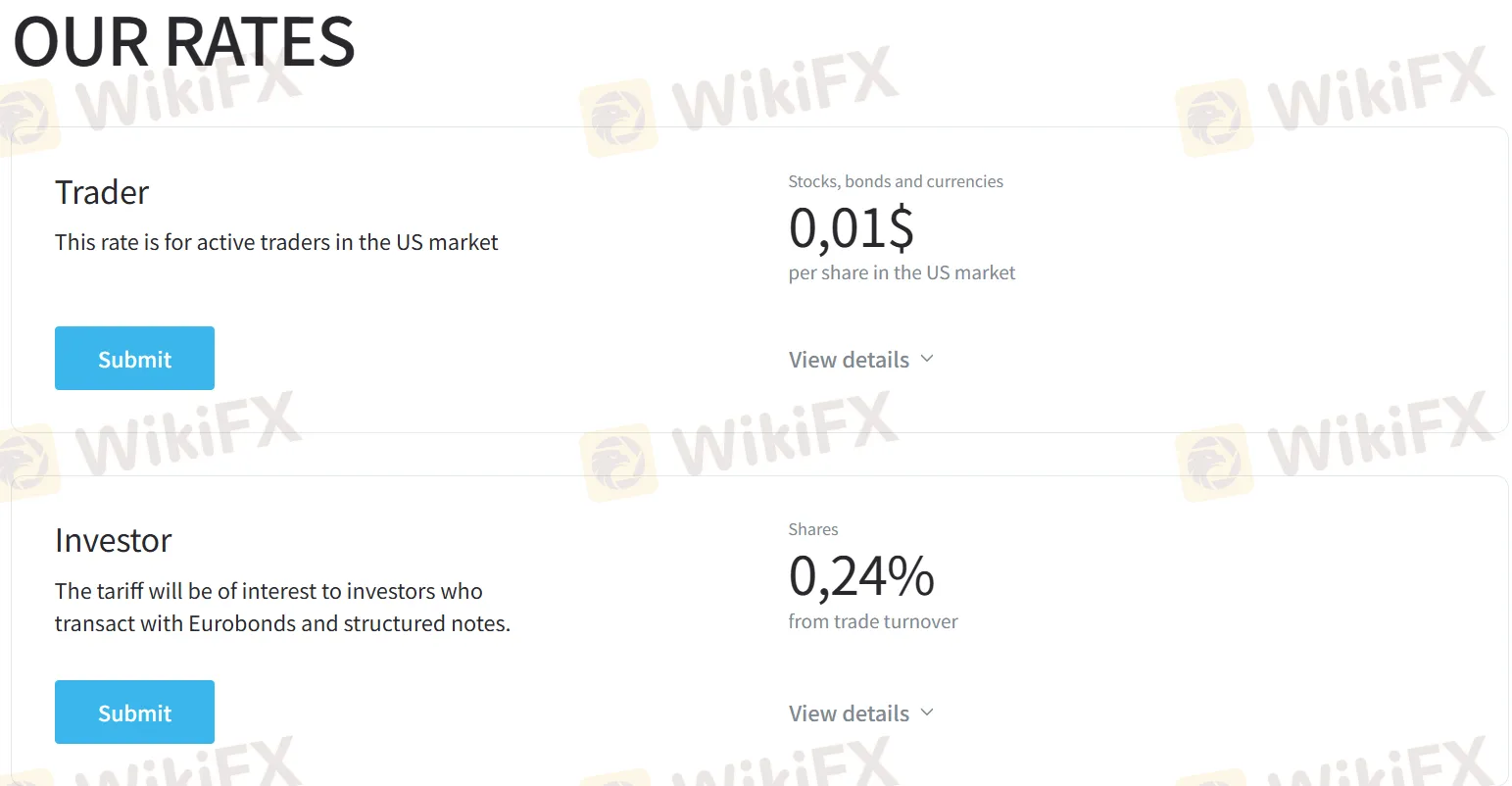

Tarif

OTKRITIE menawarkan dua rencana tarif kompetitif yang berbeda: Tarif Trader untuk peserta pasar AS (dikenakan biaya $0.01 per saham), dan Tarif Investor untuk transaksi Eurobond dan structured note (0.24% dari omset perdagangan).

Platform

| Platform | Didukung | Perangkat Tersedia |

| Open Key Platform | ✔ | Desktop workstations |

| QUIK Platform | ✔ | Desktop (QUIK ITS), Mobile (PocketQUIK) |