Profil perusahaan

| Ringkasan Ulasan HSBC | |

| Dibentuk | 1865 |

| Negara/Daerah Terdaftar | Hong Kong |

| Regulasi | SFC, LFSA, ASIC (Tidak Terverifikasi) |

| Produk | Saham, trust, obligasi/sertifikat deposito (CD), produk terstruktur, waran & CBBCs, IPO, emas, ESG dan investasi berkelanjutan, dll. |

| Layanan | Perbankan, investasi, pinjaman, kartu kredit, manajemen kekayaan, dan asuransi |

| Platform Perdagangan | Aplikasi HSBC HK, HSBC Reward+, HSBC HK Easy Invest, PayMe by HSBC, Aplikasi HSBC HK - Mode Lite |

| Dukungan Pelanggan | Dukungan 24/7, obrolan langsung |

| Tel: +85222333322 | |

| Alamat: Level 11(B1), Menara Utama, Kompleks Taman Keuangan, Jalan Merdeka, 87000 Labuan F.T. | |

Informasi HSBC

HSBC (HSBC) adalah lembaga keuangan terkemuka yang terdaftar di Hong Kong, diatur oleh Komisi Sekuritas dan Berjangka (SFC) Hong Kong dan Otoritas Layanan Keuangan Labuan (LFSA) Malaysia, antara lain. HSBC menawarkan berbagai layanan keuangan, termasuk perbankan, investasi, pinjaman, kartu kredit, manajemen kekayaan, dan asuransi. Selain itu, HSBC berkomitmen untuk mendukung investasi lingkungan, sosial, dan tata kelola (ESG) serta investasi berkelanjutan, menyediakan pelanggan dengan beragam pilihan investasi dan solusi mobilitas yang nyaman.

Pro dan Kontra

| Pro | Kontra |

| Sejarah panjang | Lisensi ASIC yang tidak terverifikasi |

| Diatur oleh SFC dan LFSA | Struktur biaya kompleks |

| Berbagai produk dan layanan | |

| Dukungan obrolan langsung |

Apakah HSBC Legal?

HSBC diatur di beberapa negara dan wilayah, termasuk Hong Kong, wilayah Labuan Malaysia, dan Australia.

Di Hong Kong, HSBC memegang lisensi AAA523 untuk perdagangan kontrak berjangka, yang diatur oleh Komisi Sekuritas dan Berjangka Hong Kong (SFC).

Di Labuan, HSBC diatur oleh Otoritas Layanan Keuangan Labuan (LFSA) sebagai Market Maker (MM), namun nomor lisensi tidak diungkapkan.

Namun, lisensi yang diatur oleh Australian Securities and Investments Commission (ASIC) belum terverifikasi.

| Negara yang Diatur | Otoritas yang Diatur | Status Regulasi | Entitas yang Diatur | Jenis Lisensi | Nomor Lisensi |

| Komisi Sekuritas dan Berjangka Hong Kong (SFC) | Diatur | Hongkong and Shanghai Banking Corporation Limited | Bertransaksi dalam kontrak berjangka | AAA523 |

| Otoritas Jasa Keuangan Labuan (LFSA) | Diatur | Hongkong and Shanghai Banking Corporation Limited | Pembuat Pasar (MM) | Belum Dirilis |

| Australia Securities & Investment Commission (ASIC) | Belum Diverifikasi | HSBC BANK AUSTRALIA LIMITED | Pembuat Pasar (MM) | 232595 |

Apa yang Dapat Diperdagangkan di HSBC?

HSBC menawarkan berbagai produk perdagangan, termasuk saham, trust, obligasi/sertifikat deposito (CD), produk struktural, waran & CBBC, IPO, emas, ESG dan investasi berkelanjutan, dll.

| Produk Perdagangan | Didukung |

| Saham | ✔ |

| Trust | ✔ |

| Obligasi/CD | ✔ |

| Produk struktural | ✔ |

| Waran & CBBC | ✔ |

| IPO | ✔ |

| Emas | ✔ |

| ESG | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Kripto | ❌ |

| Opsi | ❌ |

| ETF | ❌ |

Jenis Akun

HSBC menawarkan akun all-in-one. Akun bank terintegrasi all-in-one untuk deposito, kartu kredit, investasi, asuransi, dan lainnya.

Biaya HSBC

Komisi: Bebas Komisi, HSBC tidak akan membebankan komisi kepada klien.

HSBC menawarkan berbagai layanan keuangan di berbagai sektor, termasuk kartu kredit, pinjaman, overdraft berlebihan, investasi, dan asuransi jiwa.

Untuk informasi lebih lanjut, silakan klik: https://www.hsbc.com.hk/fees/

| Layanan | Biaya & Tarif | ||

| Kartu Kredit | Layanan Penambahan Nilai Otomatis Octopus (AAVS) | Gratis saat pertama kali mengajukan layanan ini. Biaya pengolahan sebesar HKD20 akan dikenakan untuk transfer atau reaktivasi layanan AAVS dari bank lain. | |

| Pinjaman | Biaya Keterlambatan | Pinjaman Angsuran Pribadi | 2,25% per bulan dihitung setiap hari untuk jumlah tunggakan, ditambah HKD400 pada setiap angsuran yang jatuh tempo karena dana tidak mencukupi |

| Pinjaman Pajak Pribadi | |||

| Fasilitas Kredit Revolving | 8% flat untuk pembayaran yang tertunggak (minimum HKD100, maksimum HKD200) ditambah Tingkat Berlaku | ||

| Overdraft | Biaya Layanan | Overdraft Pribadi | Biaya Tahunan: 1% dari batas overdraft per tahun (Minimum: HKD200, Maksimum: HKD700) |

| HSBC One dan Rekening Terpadu Personal - Kredit Bersih | Biaya Bulanan: Diproratakan pada HKD50 berdasarkan persentase pemanfaatan limit kredit bulan sebelumnya, maksimum HKD50 | ||

| HSBC Premier - Kredit Bersih | |||

| Asuransi | Jika pelanggan menyerahkan kebijakan sebelum akhir jangka waktu kebijakan, pelanggan mungkin mendapatkan kembali jumlah yang kurang dari yang dibayarkan. | ||

Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat Tersedia |

| Aplikasi HSBC HK | ✔ | Mobile |

| HSBC Reward+ | ✔ | Mobile |

| HSBC HK Easy Invest | ✔ | Mobile |

| PayMe by HSBC | ✔ | Mobile |

| Aplikasi HSBC HK - Mode Lite | ✔ | Mobile |

Deposit dan Penarikan

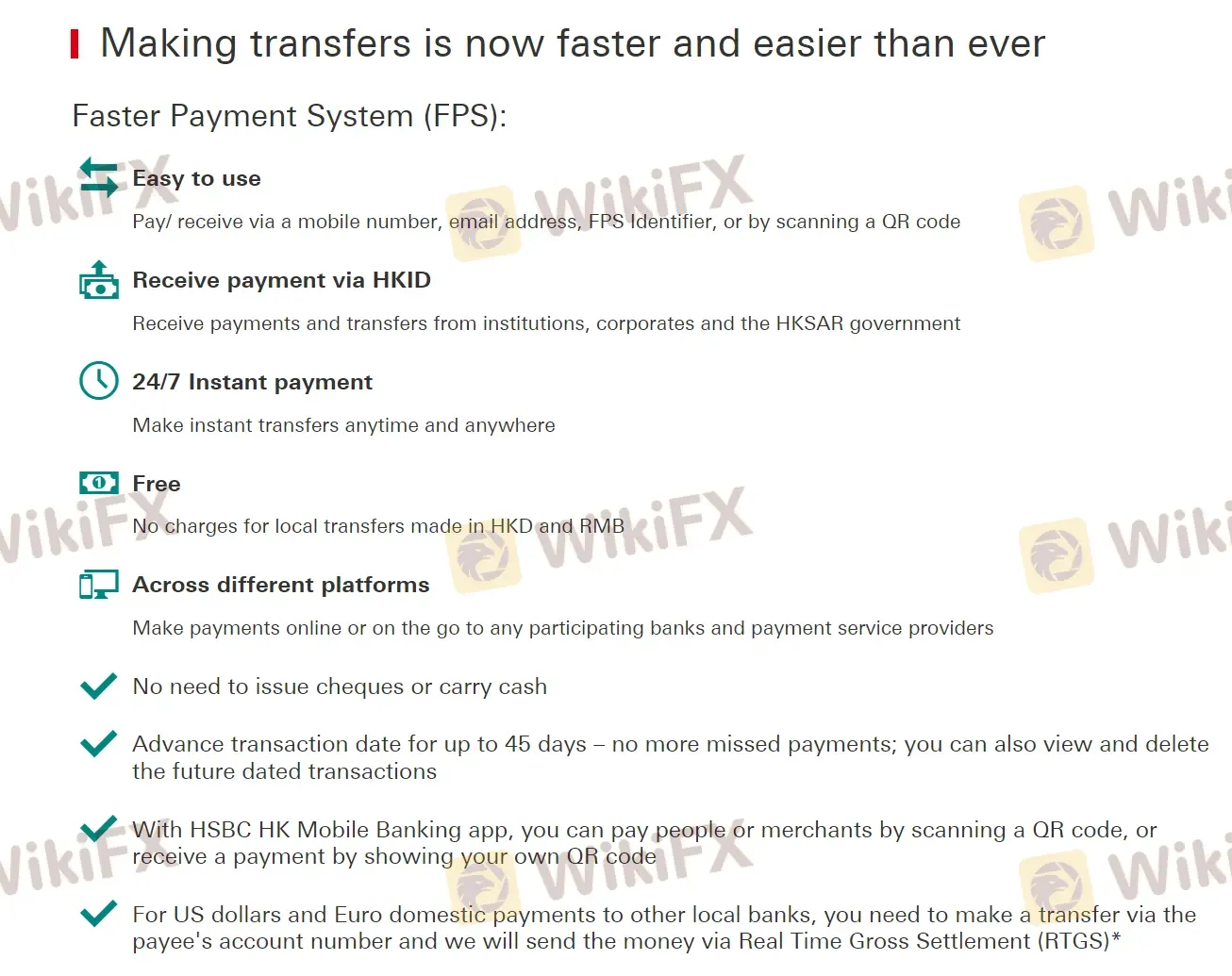

HSBC menawarkan transfer cepat melalui Sistem Pembayaran Lebih Cepat (FPS). Selain itu, pengguna dapat memindai kode QR untuk mengirim atau menerima uang melalui aplikasi Perbankan Mobile HSBC HK, atau untuk transfer lokal dalam USD dan EUR, penyelesaian penuh secara real-time (RTGS) melalui nomor rekening.