Profil perusahaan

| TF SECURITIES Ringkasan Ulasan | |

| Dibentuk | 2003-11-19 |

| Negara/Daerah Terdaftar | China |

| Regulasi | Tidak Diatur |

| Layanan dan Produk | Layanan Riset, Perbankan Investasi, Manajemen Kekayaan, Manajemen Aset, Bisnis Luar Negeri, Perdagangan Proprietary, Ekuitas Swasta dan Modal Ventura, Investasi Alternatif, dan Futures |

| Dukungan Pelanggan | 95391; 400-800-5000 |

| Obrolan Online | |

Informasi TF SECURITIES

TF SECURITIES didirikan pada tahun 2000, dengan kantor pusatnya berlokasi di Wuhan, Provinsi Hubei. Sebagai lembaga keuangan komprehensif, ia menawarkan sistem layanan yang kaya, beragam, dan khas.

Perusahaan ini menyediakan berbagai perusahaan dengan pembiayaan ekuitas, merger dan akuisisi, restrukturisasi, pembiayaan obligasi, dan layanan konsultasi keuangan yang beragam. Ruang lingkup bisnisnya tidak hanya mencakup proyek-proyek tradisional seperti penawaran umum perdana saham, penempatan swasta, obligasi perusahaan, obligasi perusahaan, dan akuisisi aset besar, tetapi juga melibatkan bisnis inovatif seperti obligasi swasta untuk usaha kecil dan menengah, sekuritisasi aset, dan saham preferen.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Ruang Lingkup Bisnis yang Beragam | Tidak Diatur |

| Latar Belakang Terkait Pemerintah | Persaingan Pasar yang Intens |

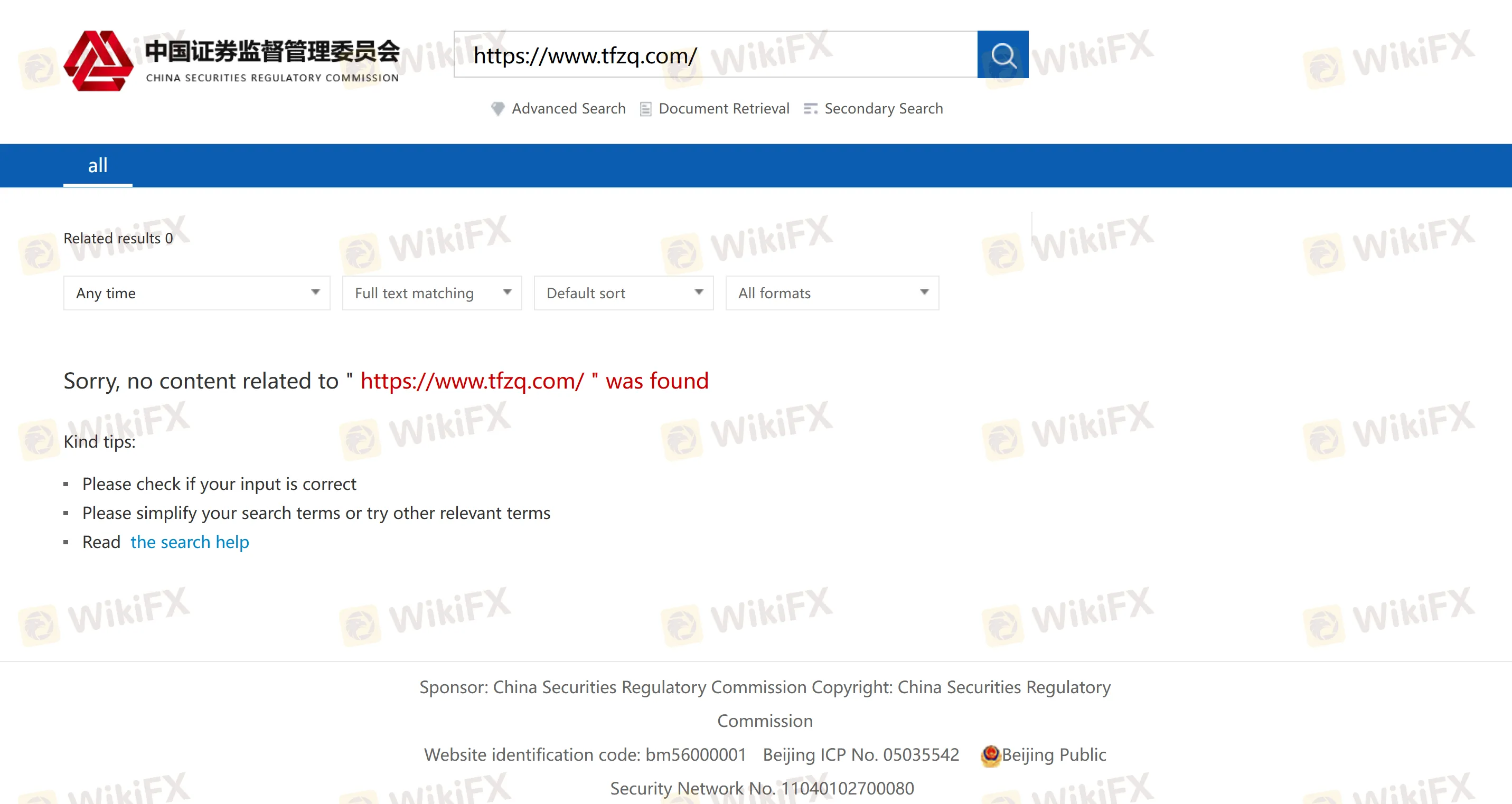

TF SECURITIES Legal?

Ada keraguan tentang keabsahan TF SECURITIES. Perusahaan ini terdaftar di Bursa Saham Shanghai. Meskipun perusahaan sekuritas ini mengklaim memenuhi persyaratan pencatatan yang ketat dan diawasi oleh Otoritas Regulasi Pasar Modal China (CSRC) dan otoritas pengawas lainnya, tidak ada informasi relevan yang dapat ditemukan di situs web resmi CSRC.

Layanan Apa yang Disediakan oleh TF SECURITIES?

TF SECURITIES menyediakan berbagai layanan, termasuk layanan riset, perbankan investasi, manajemen kekayaan, manajemen aset, bisnis luar negeri, perdagangan proprietary, ekuitas swasta dan modal ventura, investasi alternatif, dan bisnis futures.

Bagaimana Cara Membuka Akun?

TF SECURITIES memungkinkan pembukaan akun melalui ponsel. Anda dapat mengambil foto kartu identitas Anda dengan ponsel atau melalui verifikasi video. Foto kartu identitas akan dibaca secara otomatis, dan ini dapat dilakukan di bawah jaringan Wi-Fi atau 4G.