Note

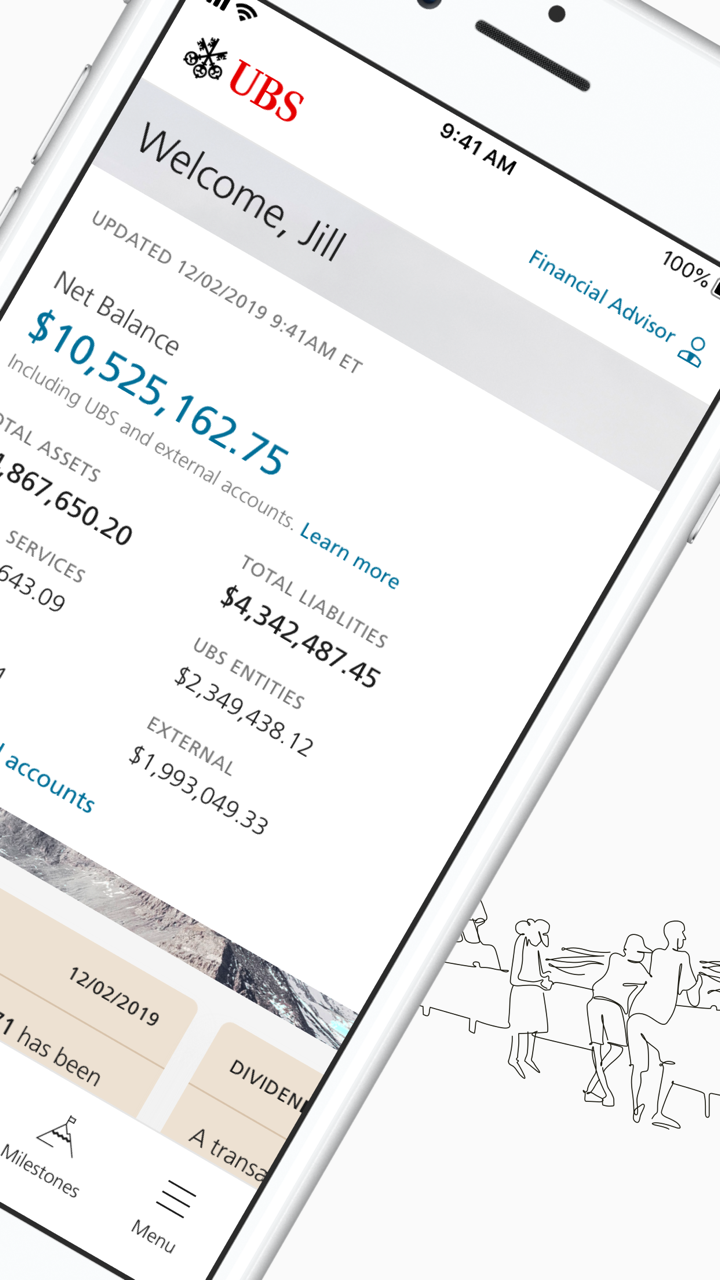

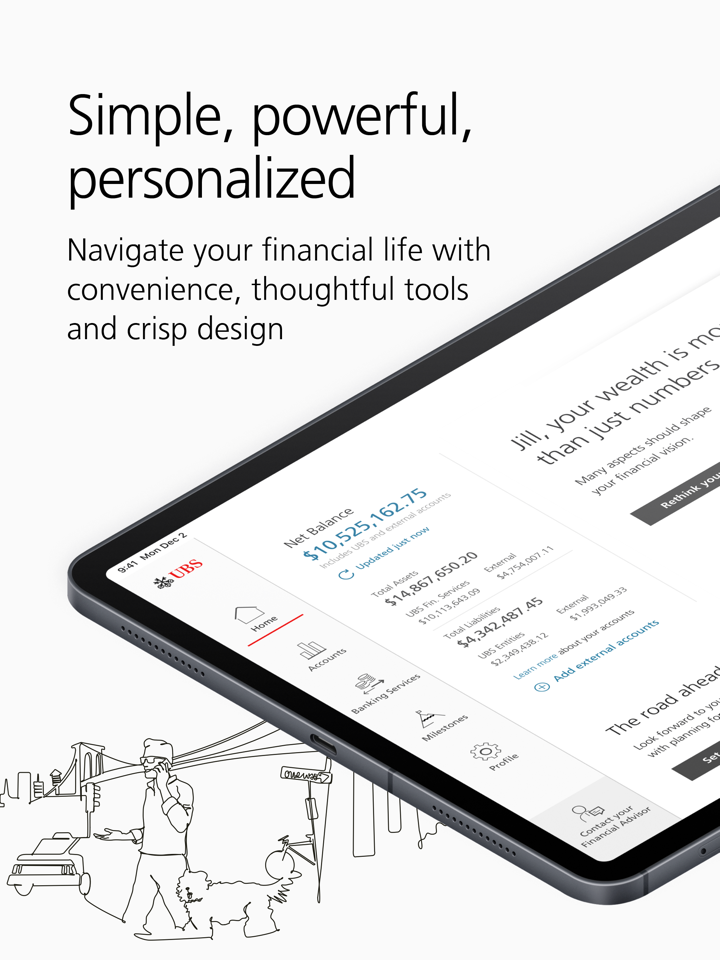

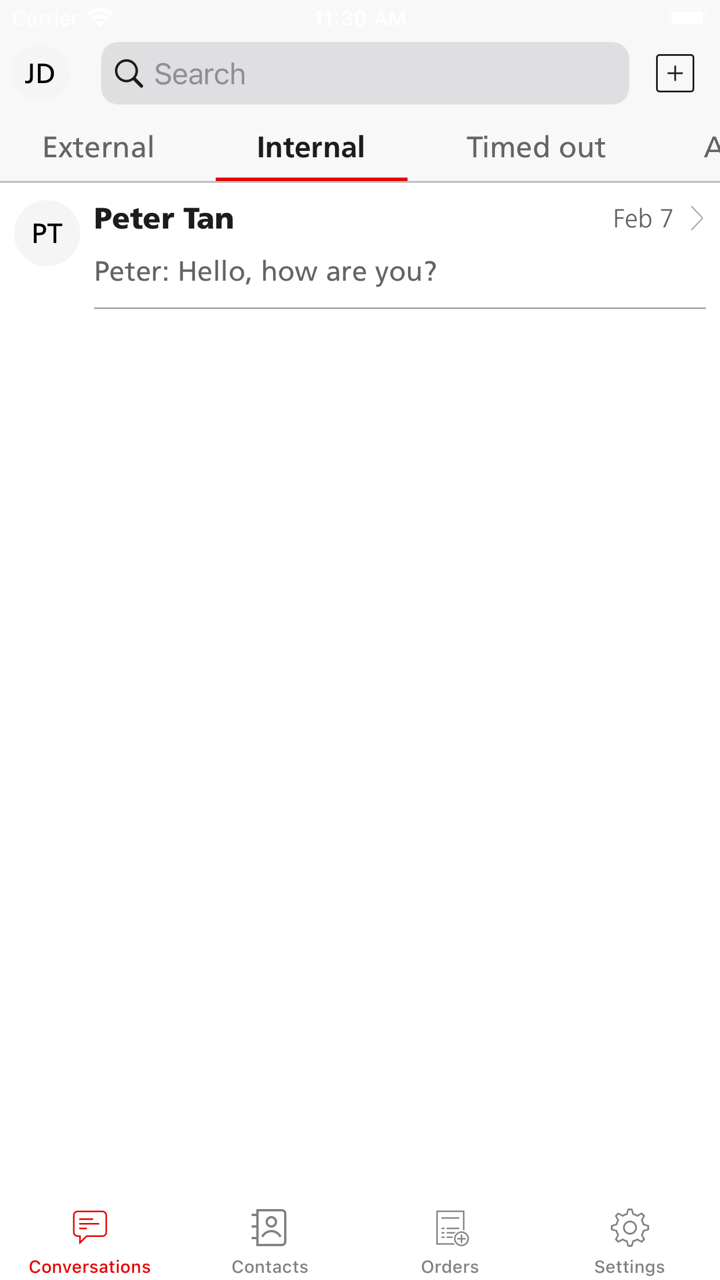

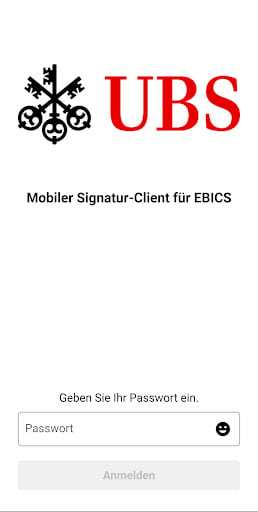

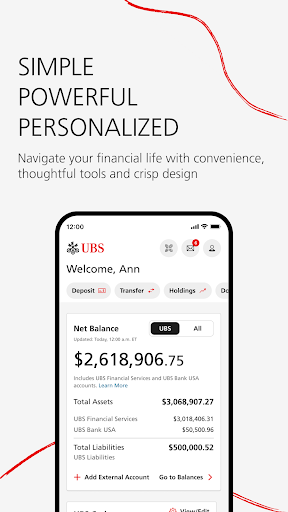

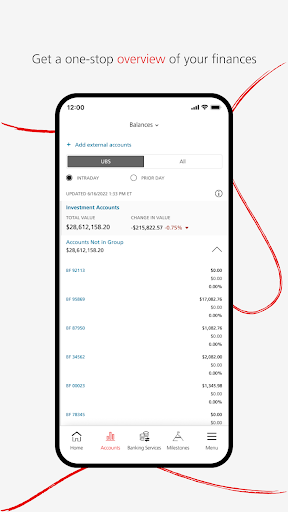

UBS

Suisse | Plus de 20 ans |

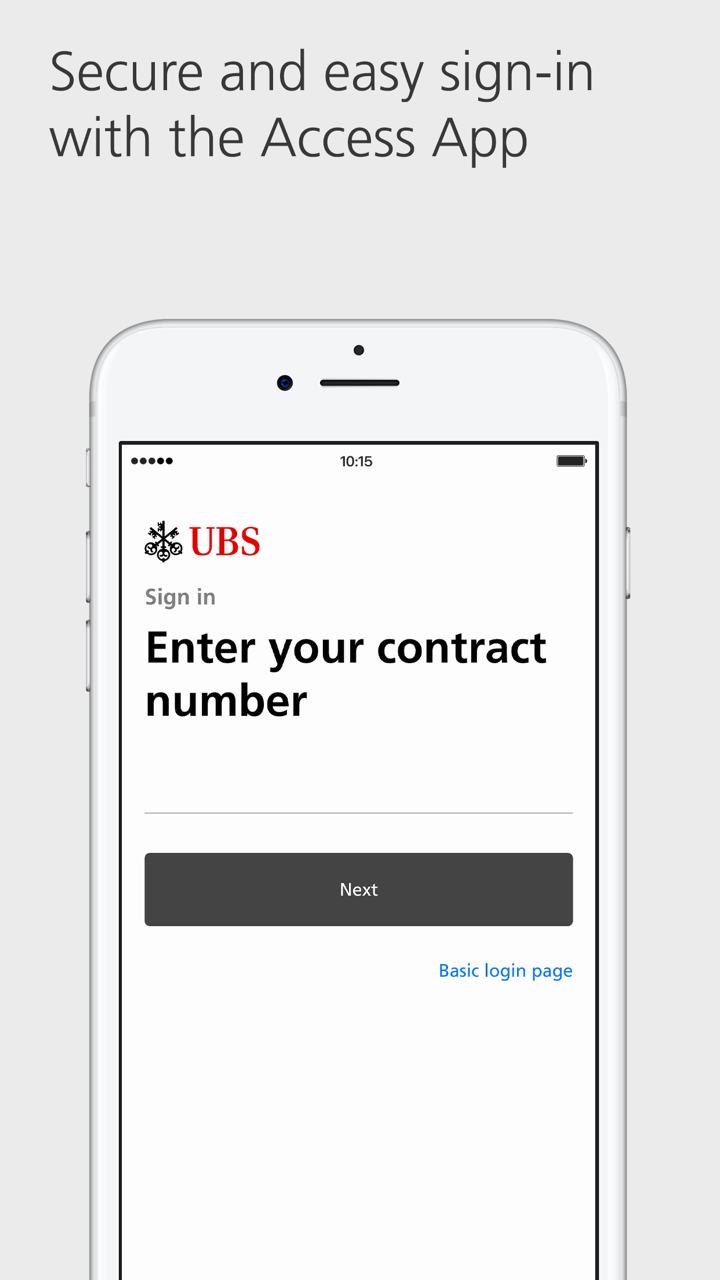

Suisse | Plus de 20 ans |https://www.ubs.com

Site officiel

Indice de notation

Influence

Influence

AAA

Indice d'influence NO.1

Suisse 9.38

Suisse 9.38 Contact

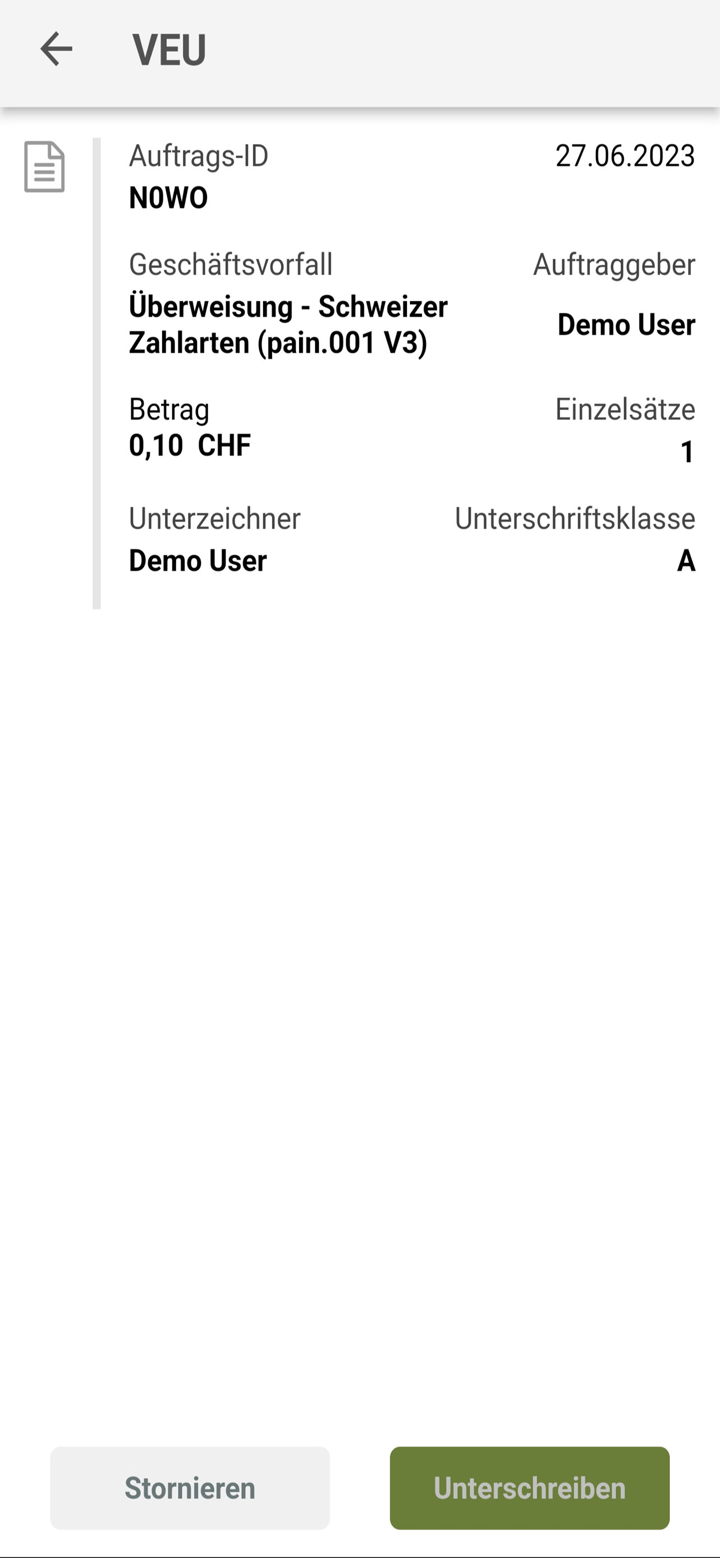

Licence de change 3

Licence de change 3

Mono-cœur

1G

40G

1M*ADSL

- WikiFX a reçu un total de 14 plaintes d'utilisateurs contre ce courtier, soyez conscient des risques et ne vous laissez pas arnaquer !

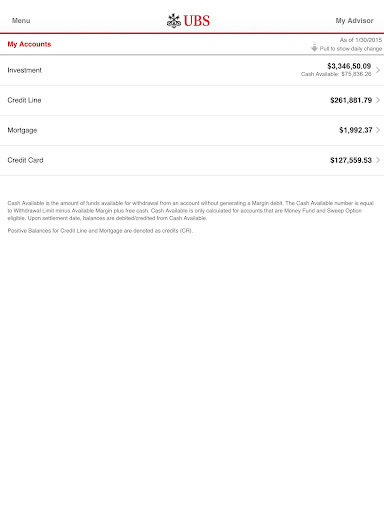

Informations de base

Suisse

Suisse

Les utilisateurs qui ont consulté UBS ont également consulté..

FXCM

XM

GO Markets

GTCFX

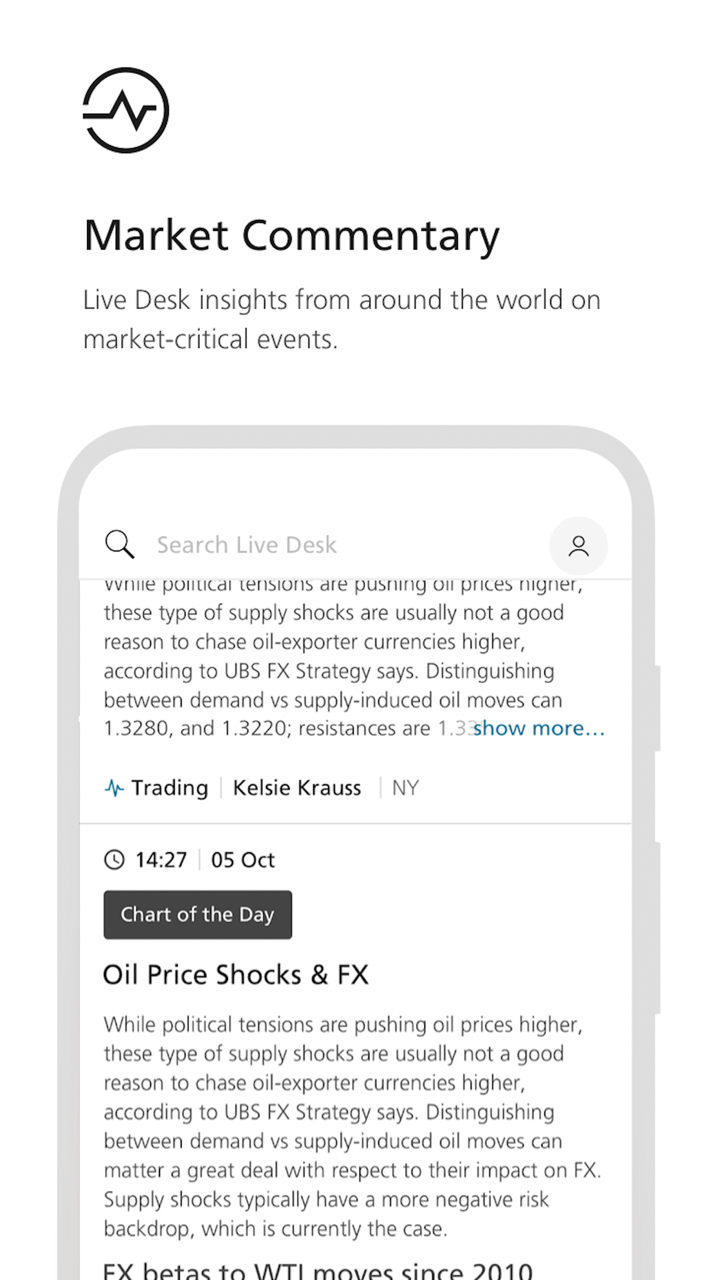

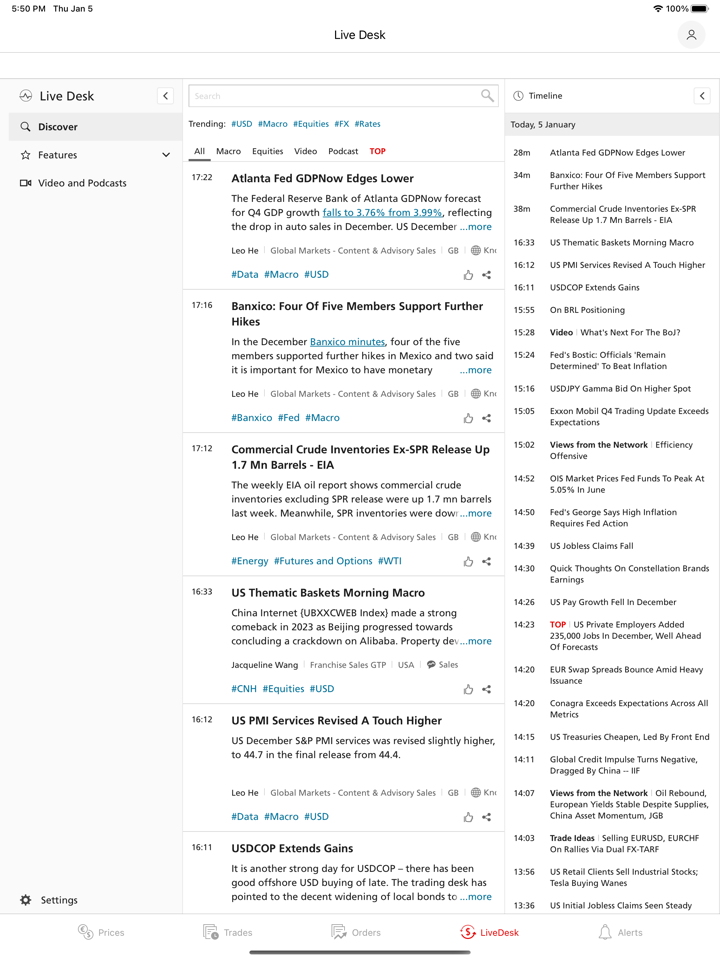

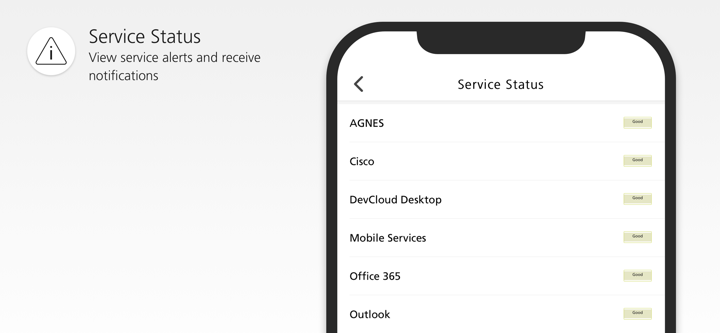

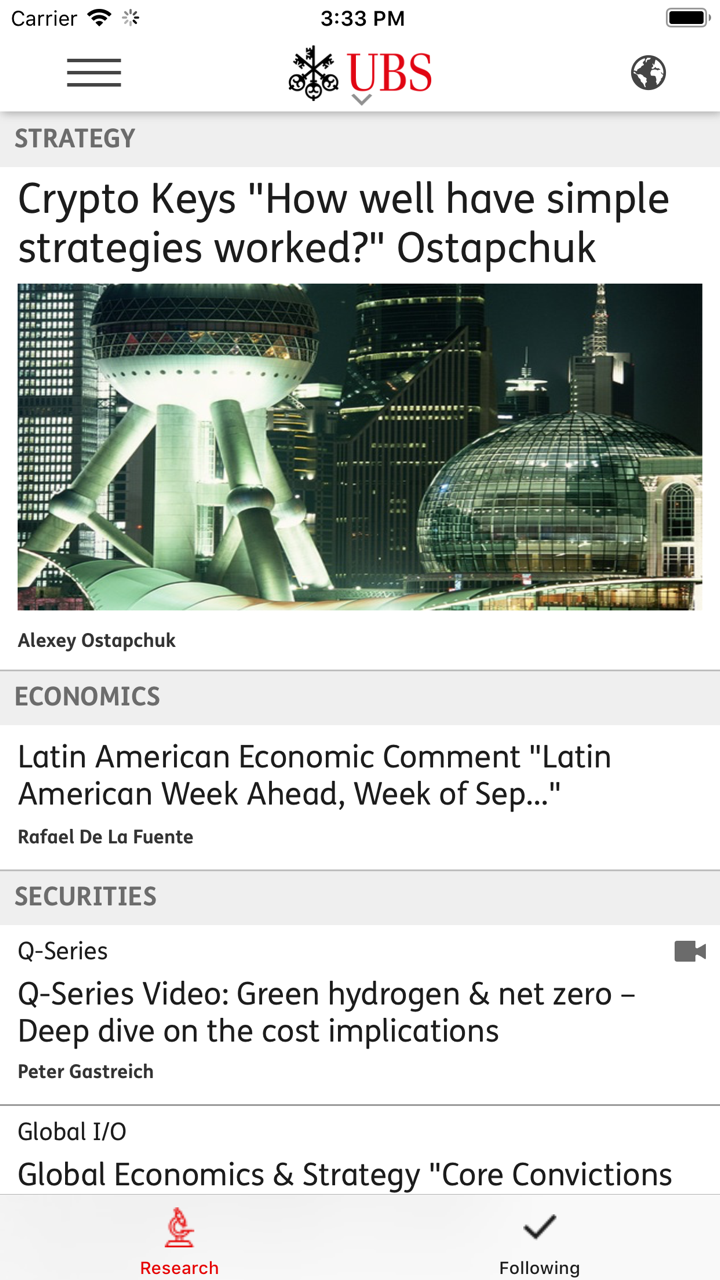

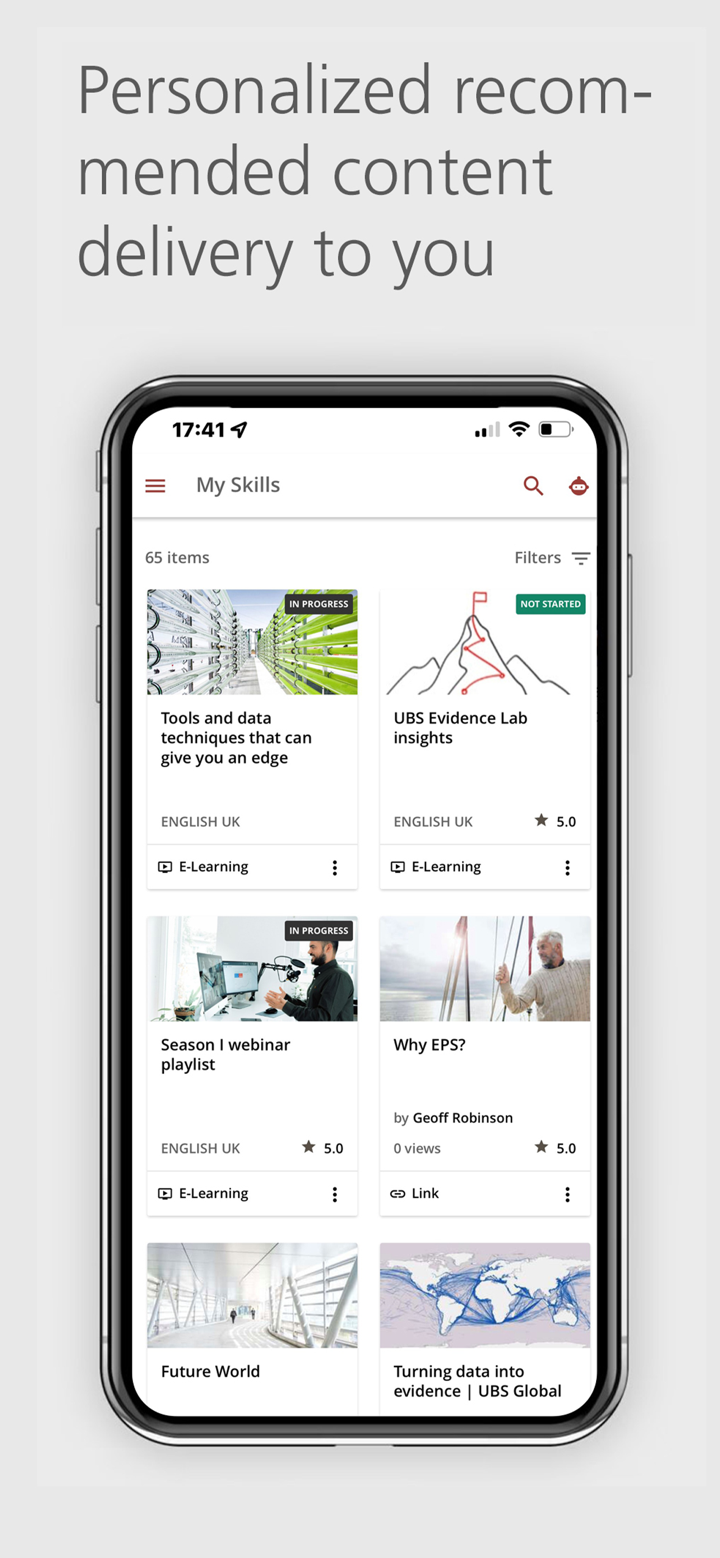

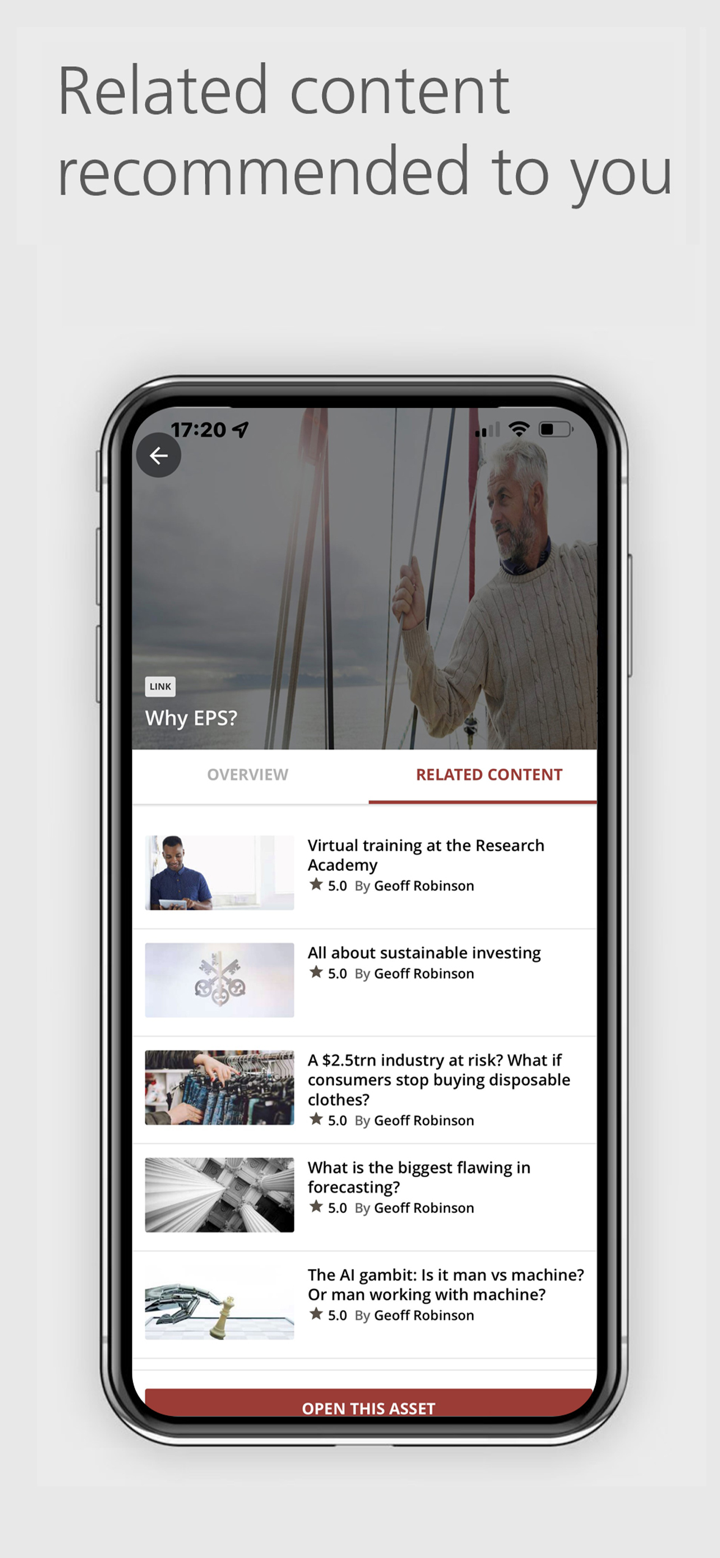

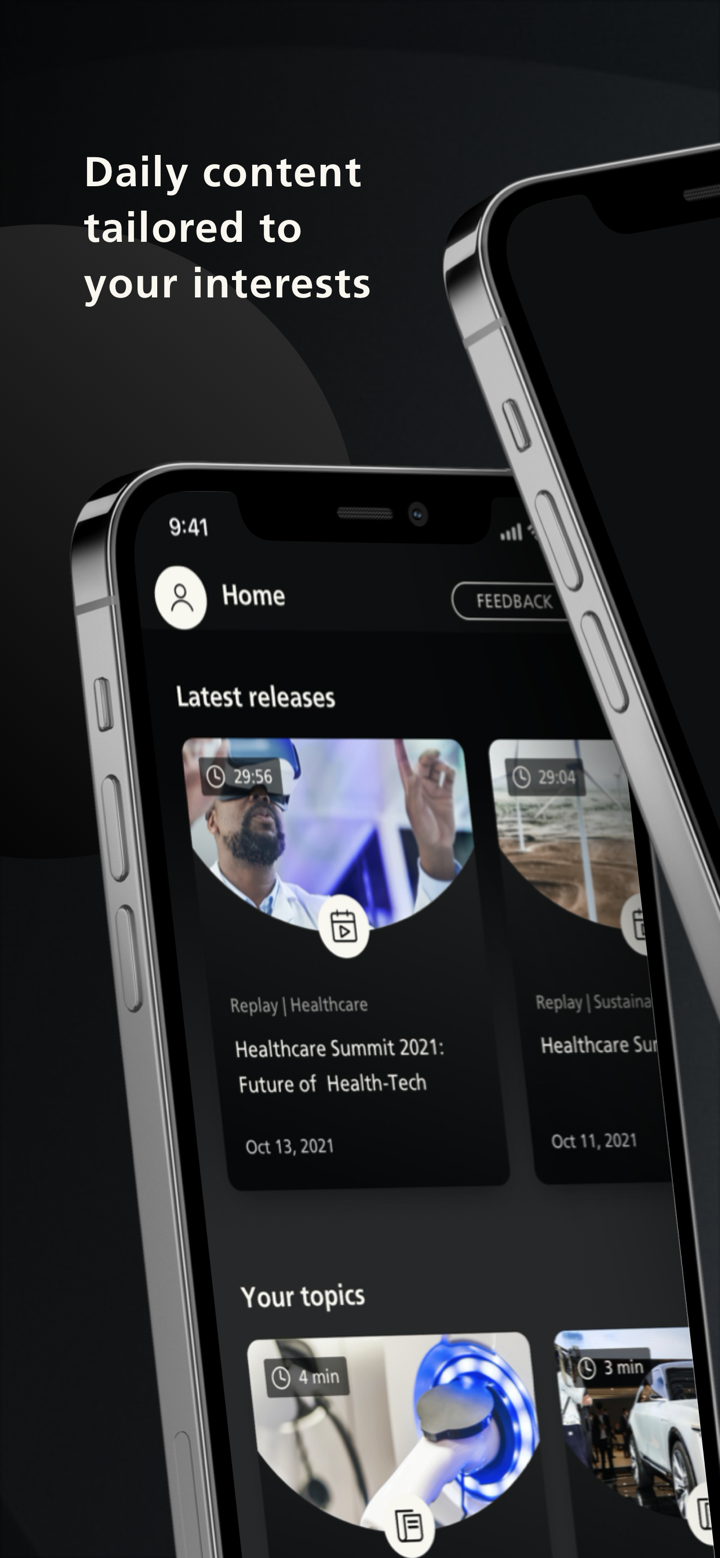

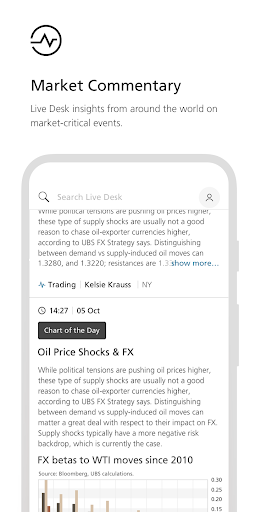

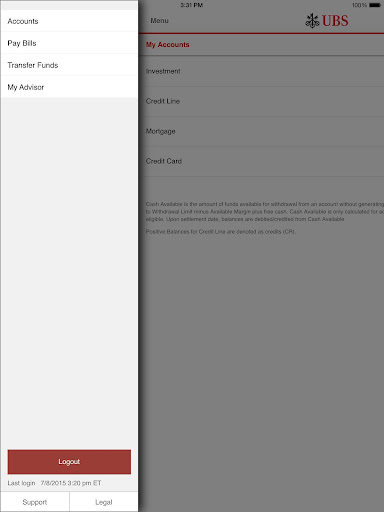

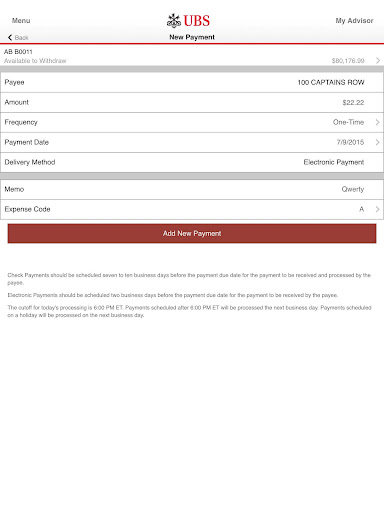

Source de recherches

Langue de diffusion

Analyse du marché

Diffusion de matériaux

Site web

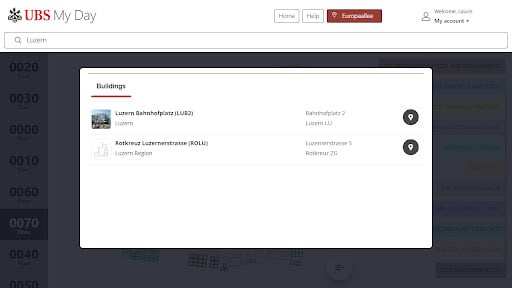

Suisse

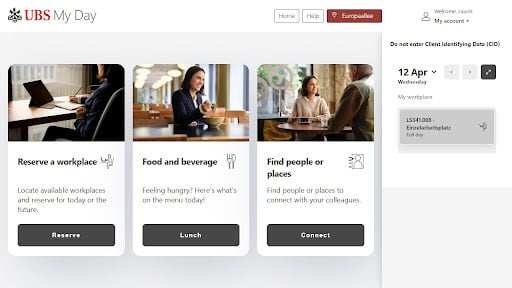

Suisseubs.com

193.5.110.18Localisation du serveurSuisse

Numéro d'enregistrement PCI--Pays / Région les plus visitésSuisse

Date de création du domaine0001-01-01Nom du site webWHOIS.MARKMONITOR.COMSociété d'appartenanceMARKMONITOR, INC.

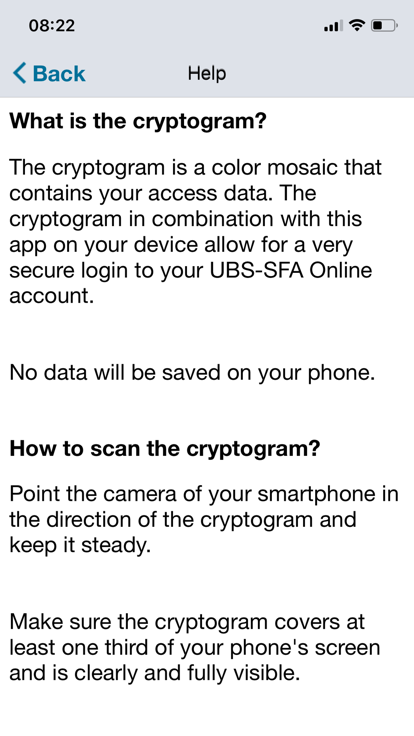

Diagramme de la généalogie

Entreprises apparentées

Divulgation réglementaire

Liste d'avertissement de la FCA concernant les sociétés non autorisées Credit Suisse Asset Management / Credit Suisse Group AG (Clone de sociétés autorisées par la FCA).

Pays / Région

UK FCA

Délai de divulgation

2020-06-17

Divulguer le courtier

Liste d'avertissement de la FCA concernant les sociétés non autorisées UBS Global Asset Management Funds Ltd (clone d'une société autorisée par la FCA).

Pays / Région

UK FCA

Délai de divulgation

2015-04-23

Divulguer le courtier

Actions administratives contre UBS Securities Co., Ltd. Tokyo Branch et UBS AG Japan Branch

Pays / Région

JP FSA

Délai de divulgation

2011-12-16

Divulguer le courtier

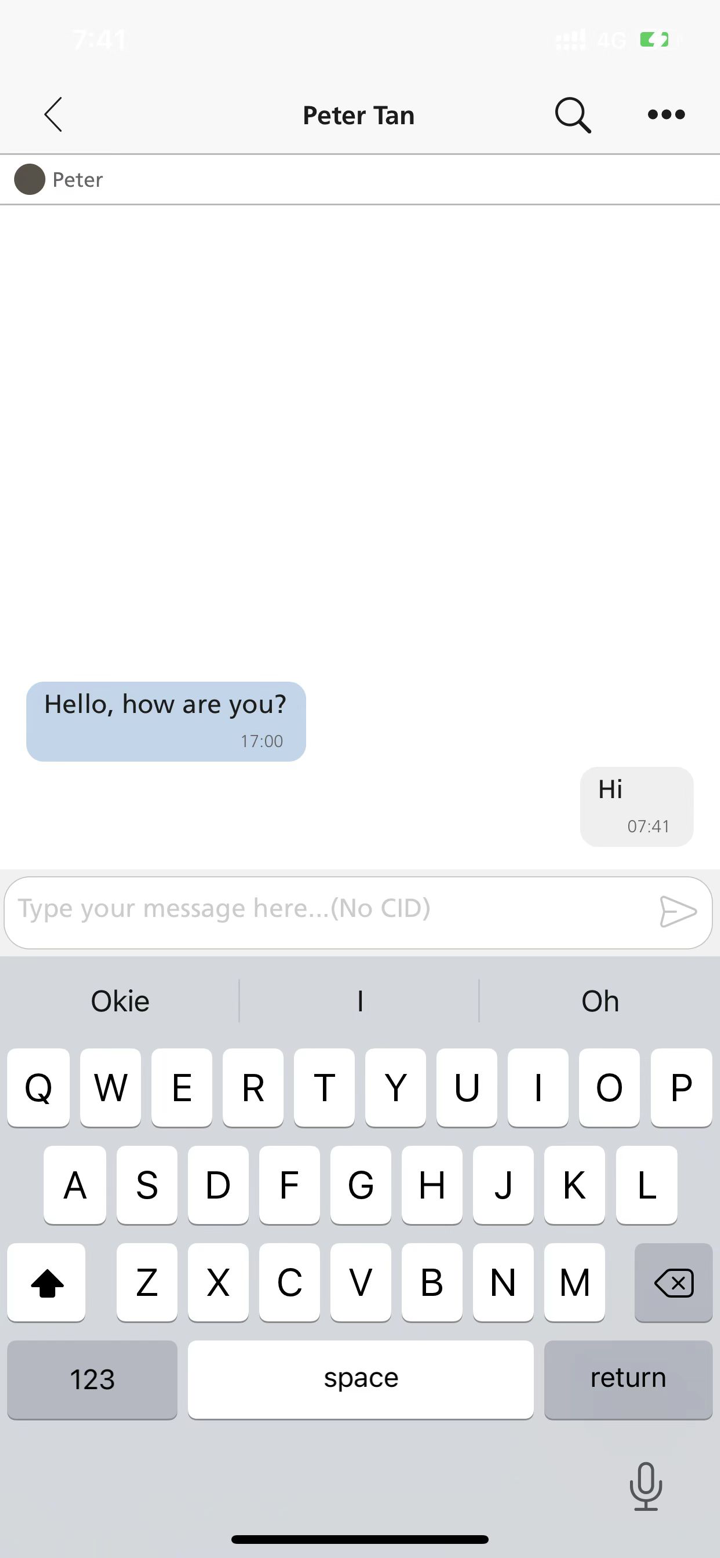

Questions et réponses sur le wiki

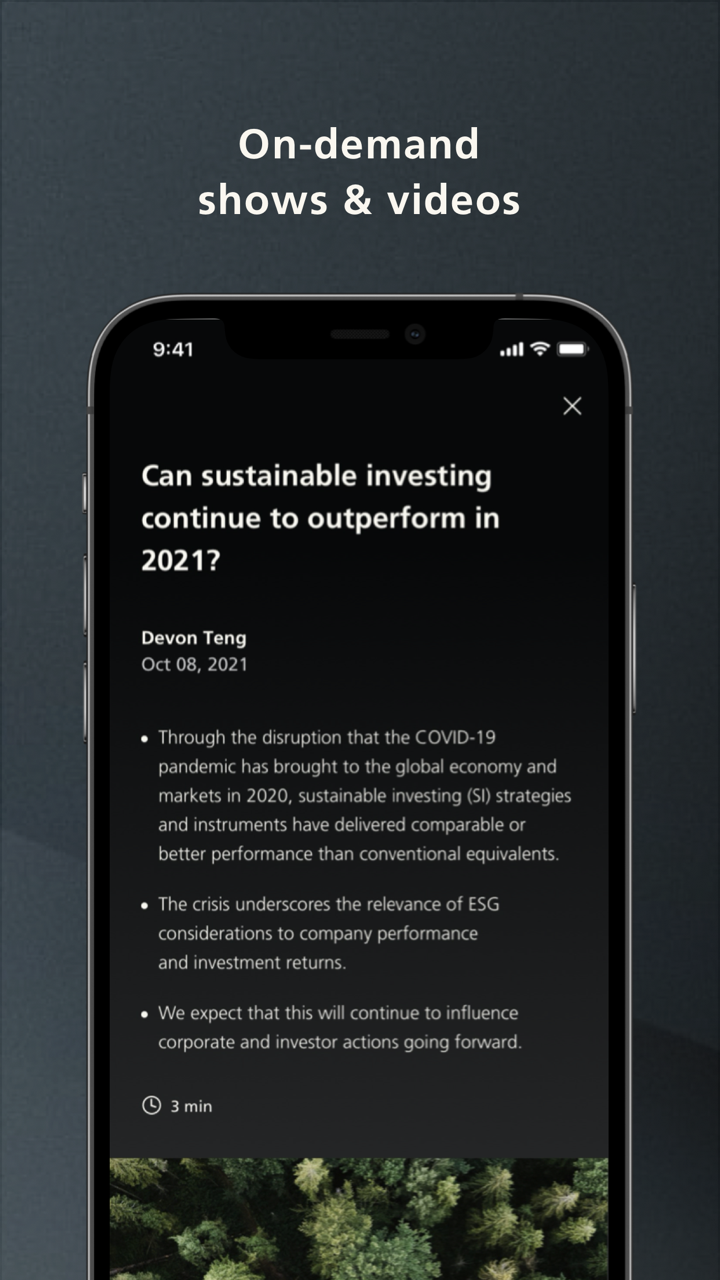

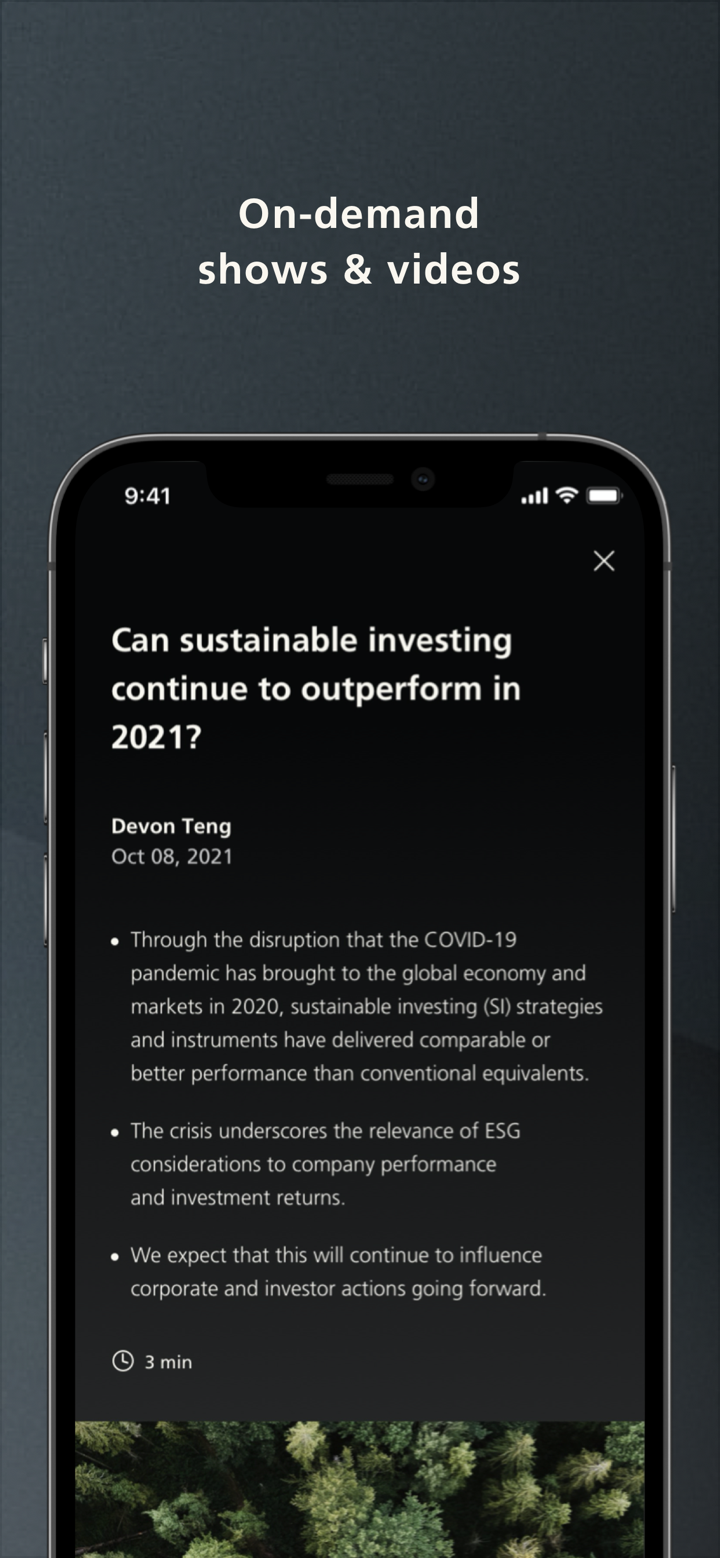

Is UBS overseen by any regulatory bodies, and if so, which financial authorities are responsible?

From my own research and experience as a trader, regulatory oversight is one of my top concerns when evaluating any broker or financial institution. In the case of UBS, I've found that it is indeed regulated by multiple well-established authorities, particularly for its operations in Asia. Specifically, UBS Securities Asia Limited and UBS Securities Hong Kong Limited are both licensed and supervised by the Securities and Futures Commission (SFC) of Hong Kong. These entities hold the necessary futures licenses, which require adherence to stringent standards set by the regulator. Understanding why this matters is straightforward—having recognized financial oversight helps ensure a certain level of operational integrity and client protection. Regulation by the SFC means regular audits, compliance requirements, and legal accountability in the services they offer, especially regarding futures contracts. However, it's crucial not to conflate the existence of regulation in certain regions with blanket security across all markets or divisions. While regulatory registration provides a baseline level of trust, it does not guarantee a trouble-free experience, as user complaints and risk alerts highlighted in public forums have shown. For me, this underlines the necessity of ongoing due diligence and a careful approach when choosing a financial partner, regardless of the brand’s global reputation.

Would it be safe and reliable to use UBS as my trading broker?

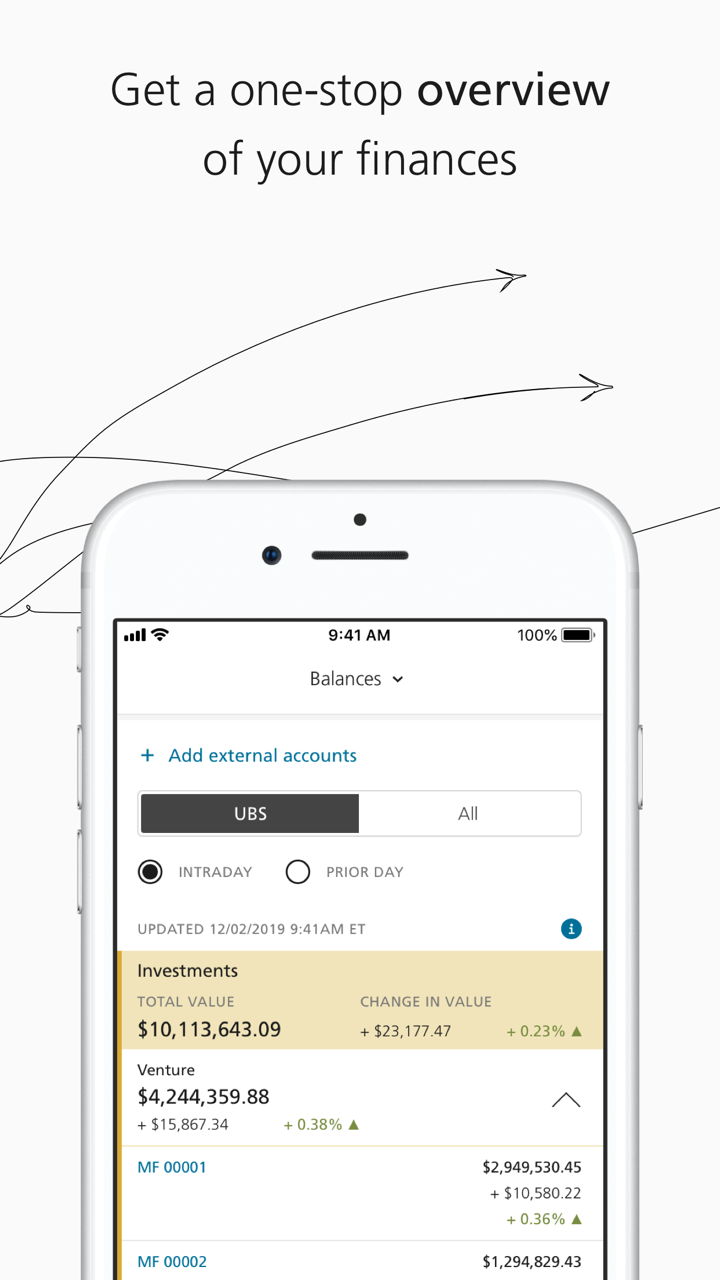

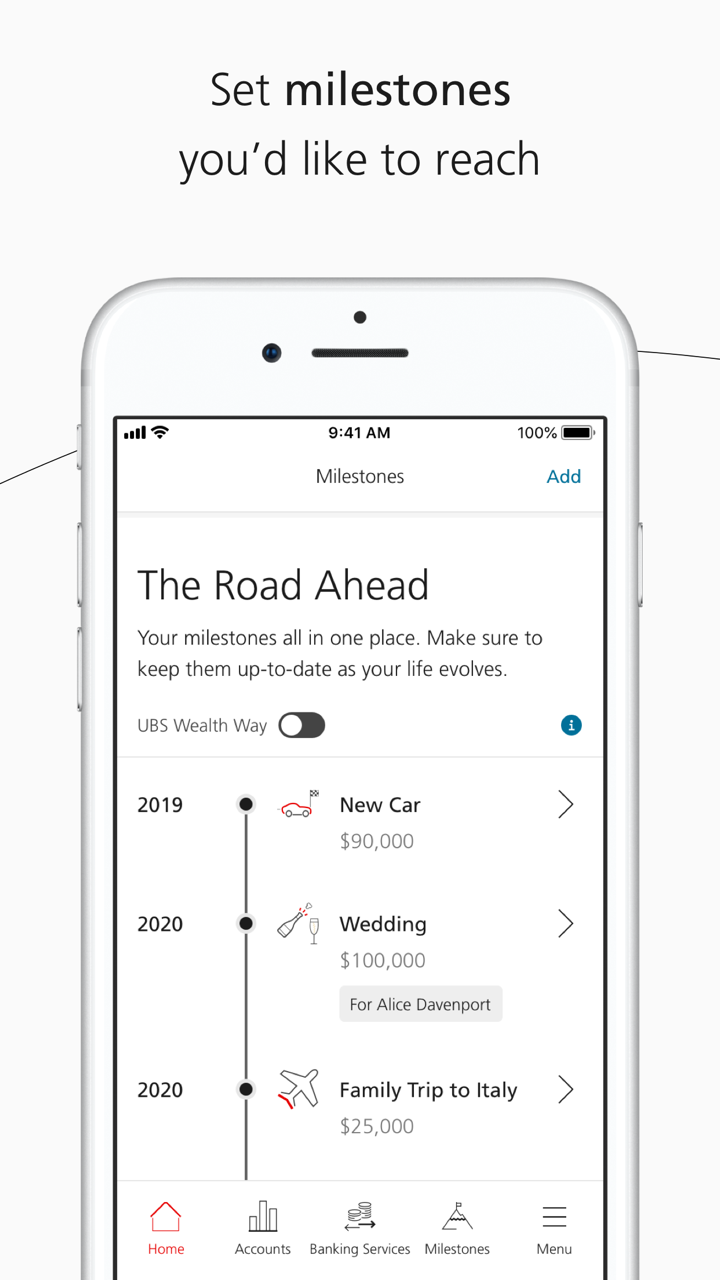

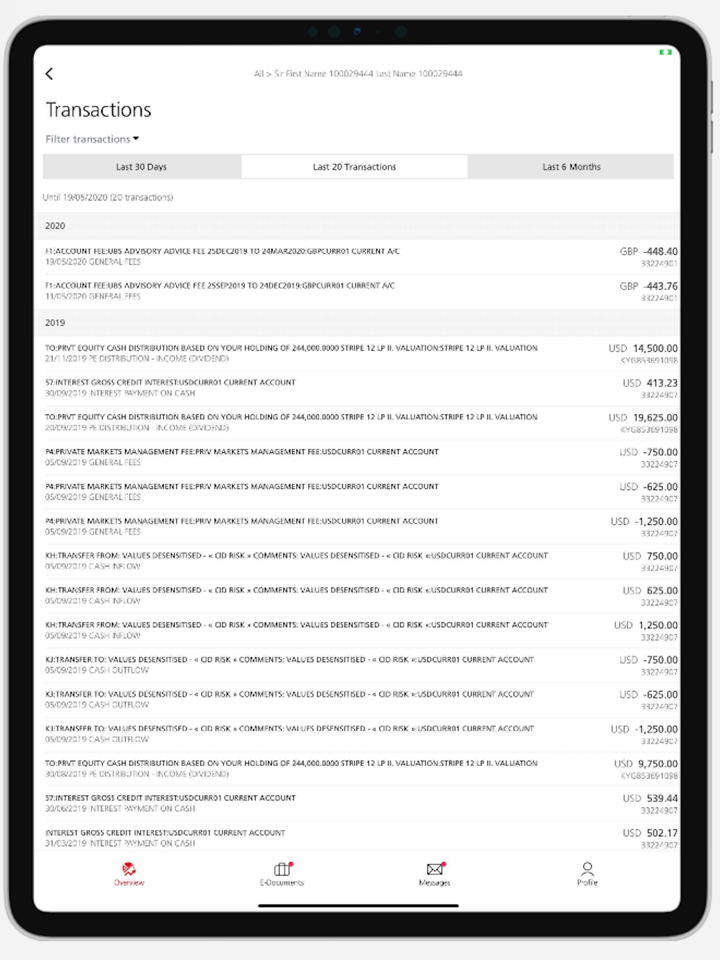

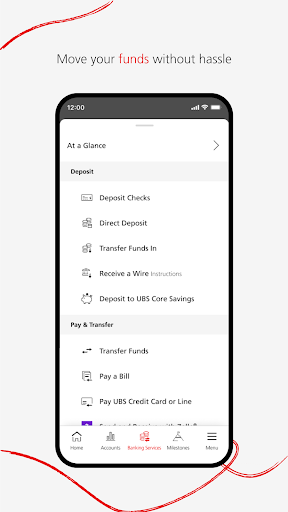

From my perspective as a seasoned forex trader, assessing whether UBS is safe and reliable as a trading broker requires a cautious and informed approach. UBS is a well-established financial institution with a strong global presence, multiple regulatory licenses, and a history exceeding two decades. Its breadth of regulated operations in regions like Switzerland, China, and Hong Kong is encouraging, as regulatory oversight typically provides an extra layer of security for client funds and operational standards. However, I cannot ignore the critical issues highlighted by numerous customer complaints. Many users have reported serious concerns such as difficulties withdrawing funds, unexpected fees or requirements for additional deposits, and, in some cases, allegations of account manipulation or customer service deficiencies. The broker's WikiFX score has been notably reduced specifically because of these complaints. For me, consistent reports of withdrawal problems are a significant red flag—reliable access to funds is paramount in choosing any broker. While UBS’s reputation, product diversity, and licensed status might appear reassuring, the pattern of unresolved disputes and negative feedback suggests a heightened level of risk that, in my experience, cannot be overlooked. As someone responsible for my own financial security, I would exercise caution, perform thorough due diligence, and consider alternative brokers with more transparent and consistently positive client histories before making any commitments. Ultimately, my trust as a trader is reserved for platforms where client protection and fund accessibility are clearly demonstrated.

How much do you need to deposit at a minimum to start a live trading account with UBS?

As someone who has explored multiple brokers, I always look for clear and accessible information about account opening requirements, especially when it comes to minimum deposit amounts. When I researched UBS as a potential trading partner, I found that while they present themselves as a long-established, globally regulated institution with many financial services, there’s a noticeable lack of transparency about the specific minimum deposit required to open a live trading account. This is not entirely unusual for large banks or institutions mainly focused on wealth management and high-net-worth clients; these types of firms often customize their requirements and conditions based on individual profiles and account types. However, as a trader, I see this absence of public detail on fundamental points like minimum deposits as an important consideration. It means that anyone interested in trading live with UBS should contact them directly for up-to-date and official requirements. In my experience, this often signals that their services may be tailored more towards larger investors rather than retail traders who prefer clearly defined barriers to entry. For me, clarity and predictable costs are essential—so I would approach UBS carefully, ensuring I receive written, transparent terms before proceeding, especially given their mixed customer feedback regarding account and fund accessibility.

Is it possible to deposit cryptocurrencies such as Bitcoin or USDT into my UBS account?

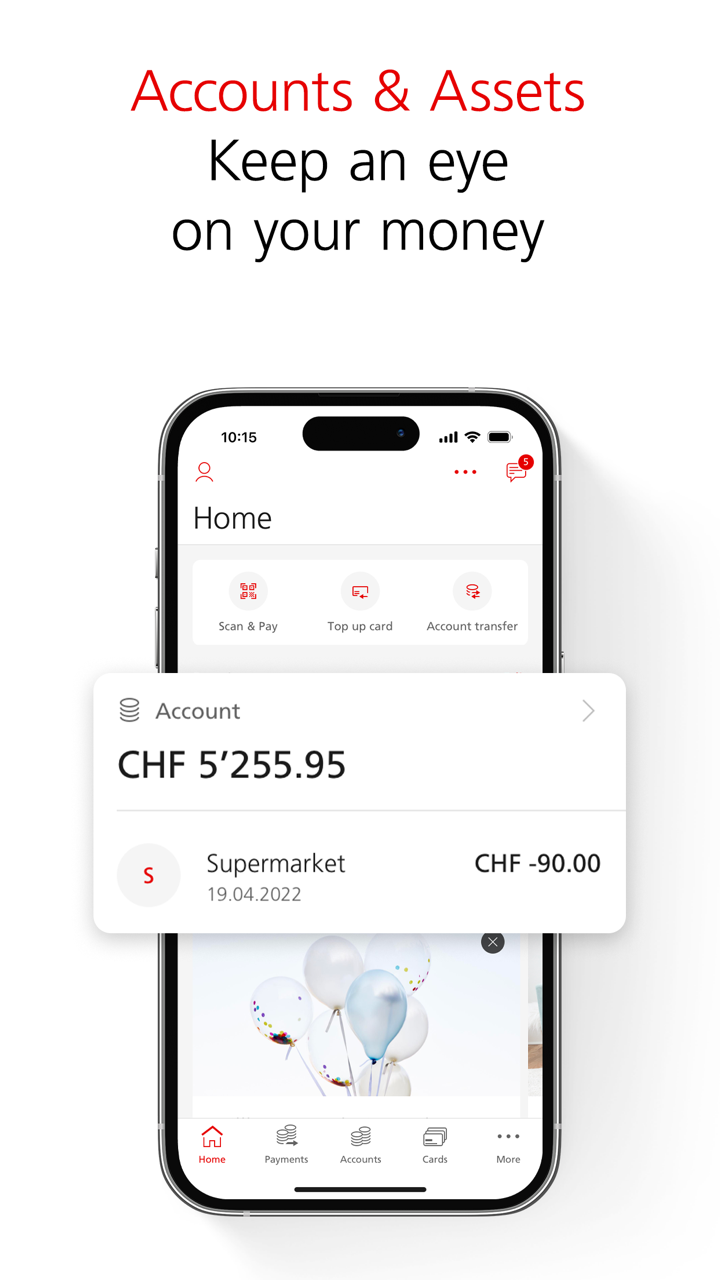

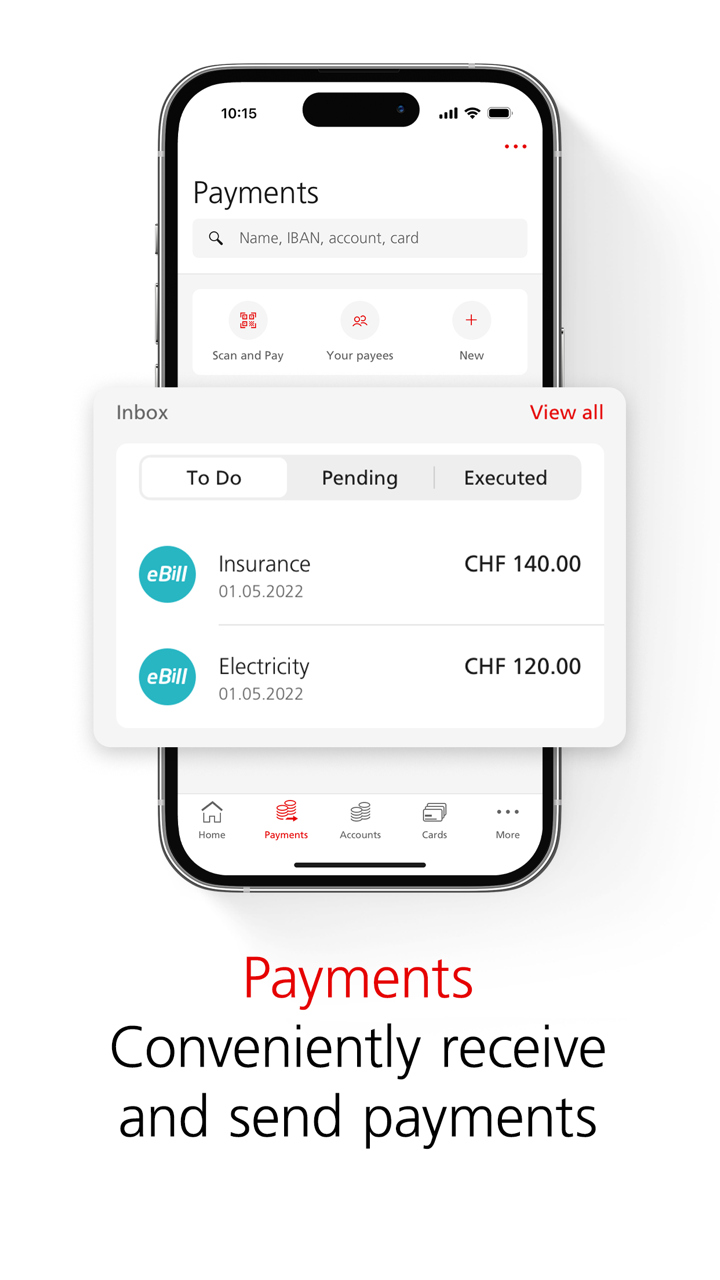

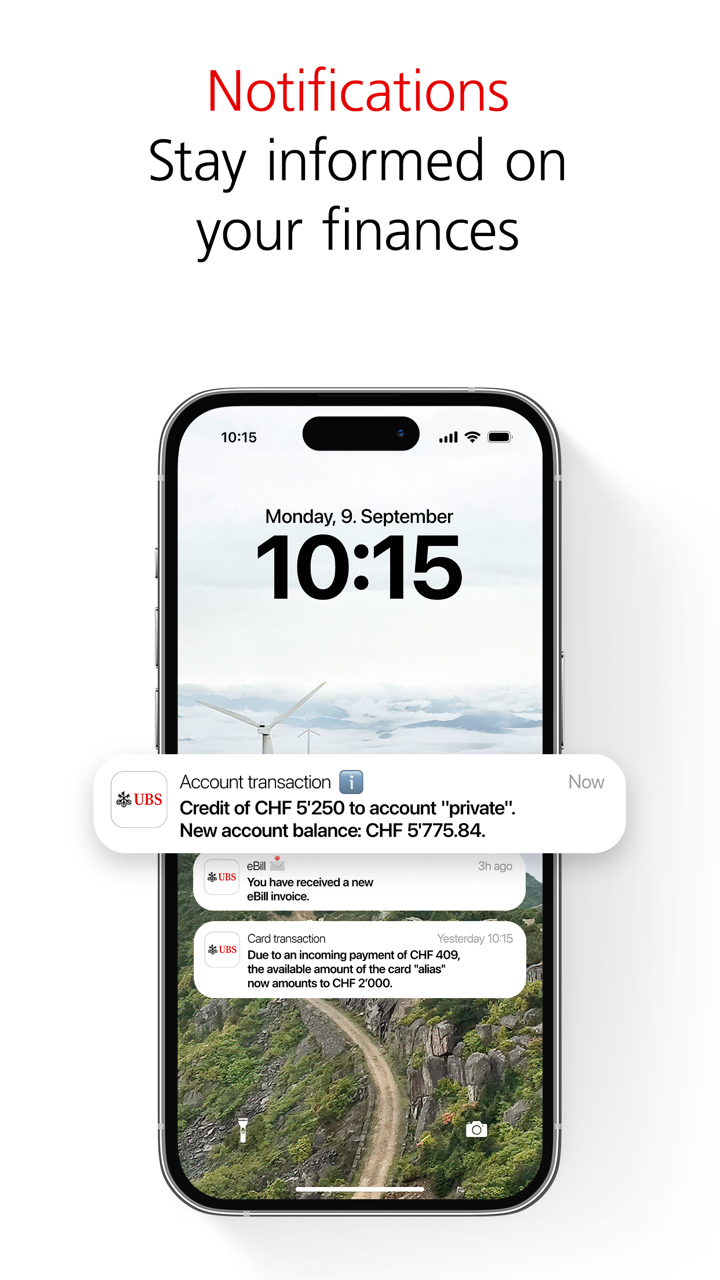

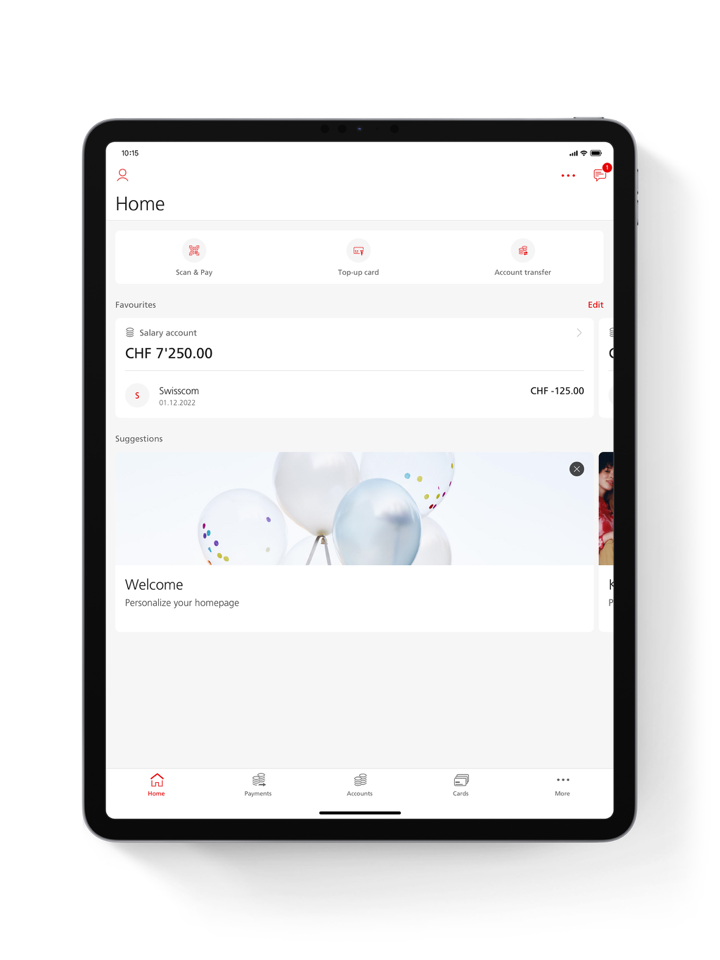

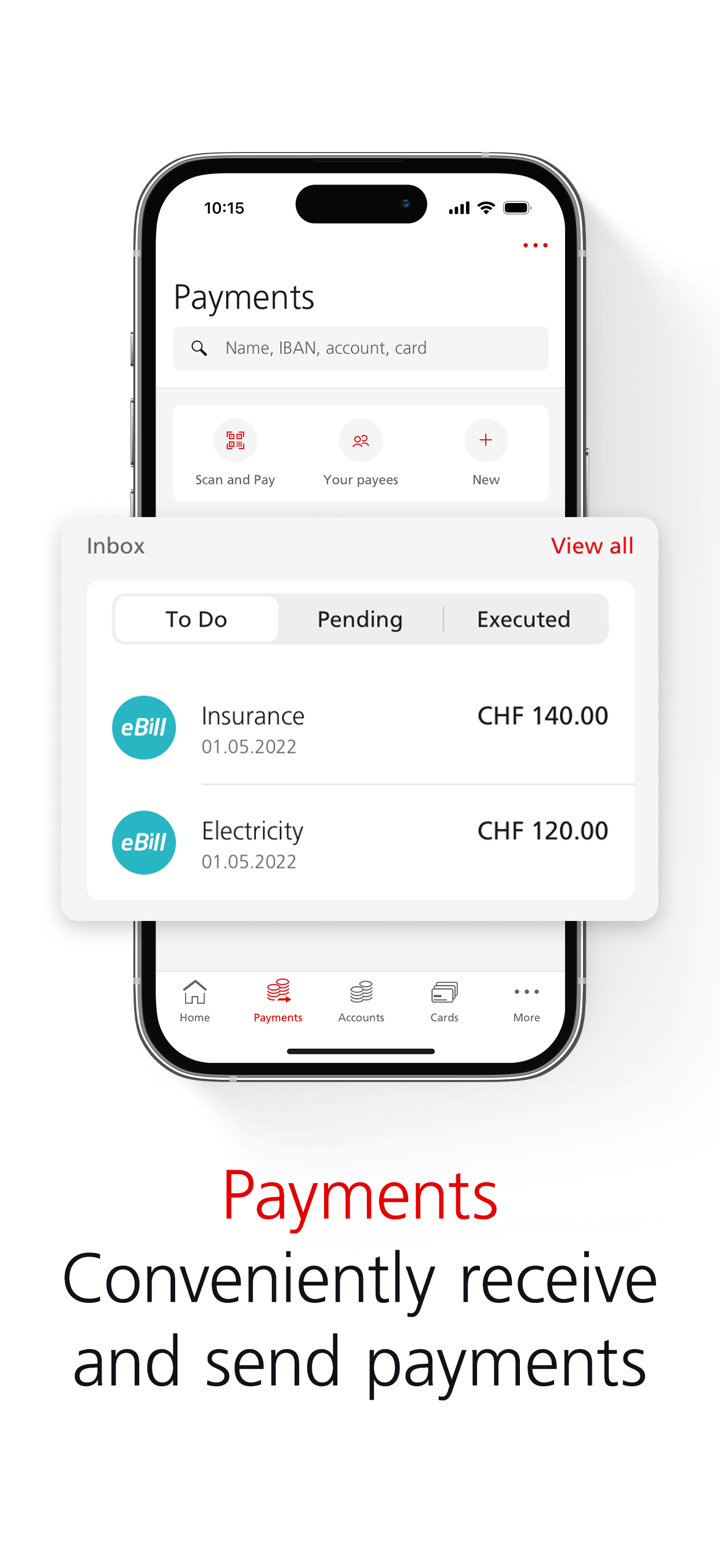

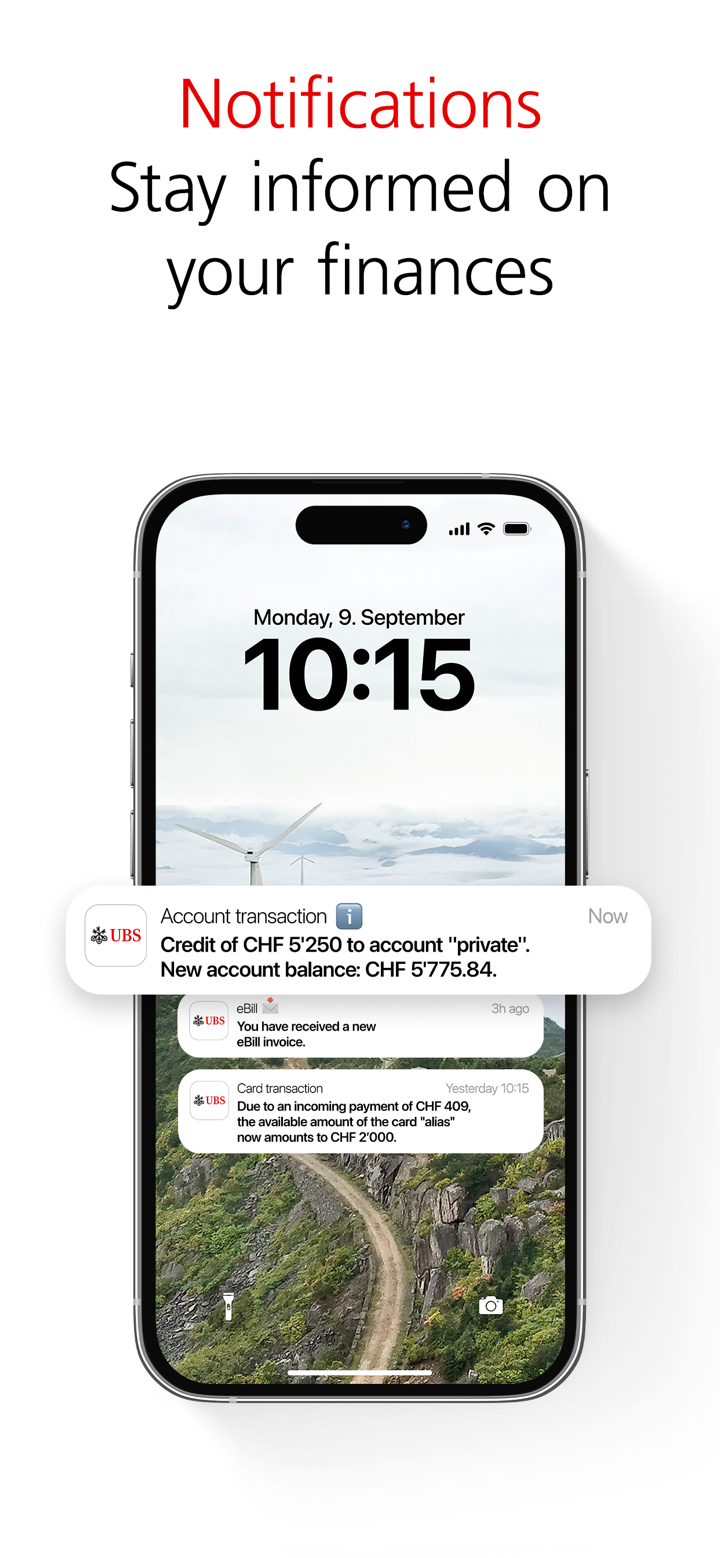

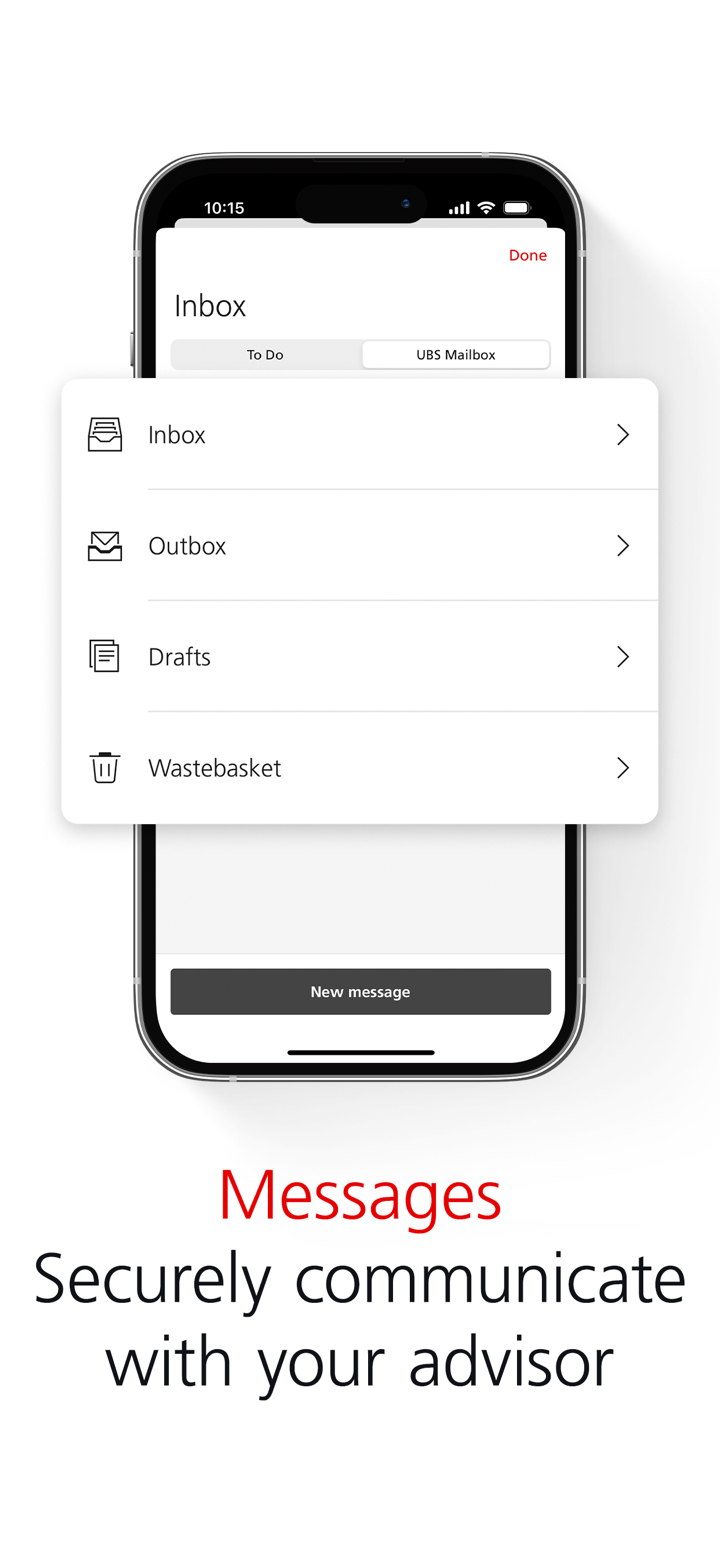

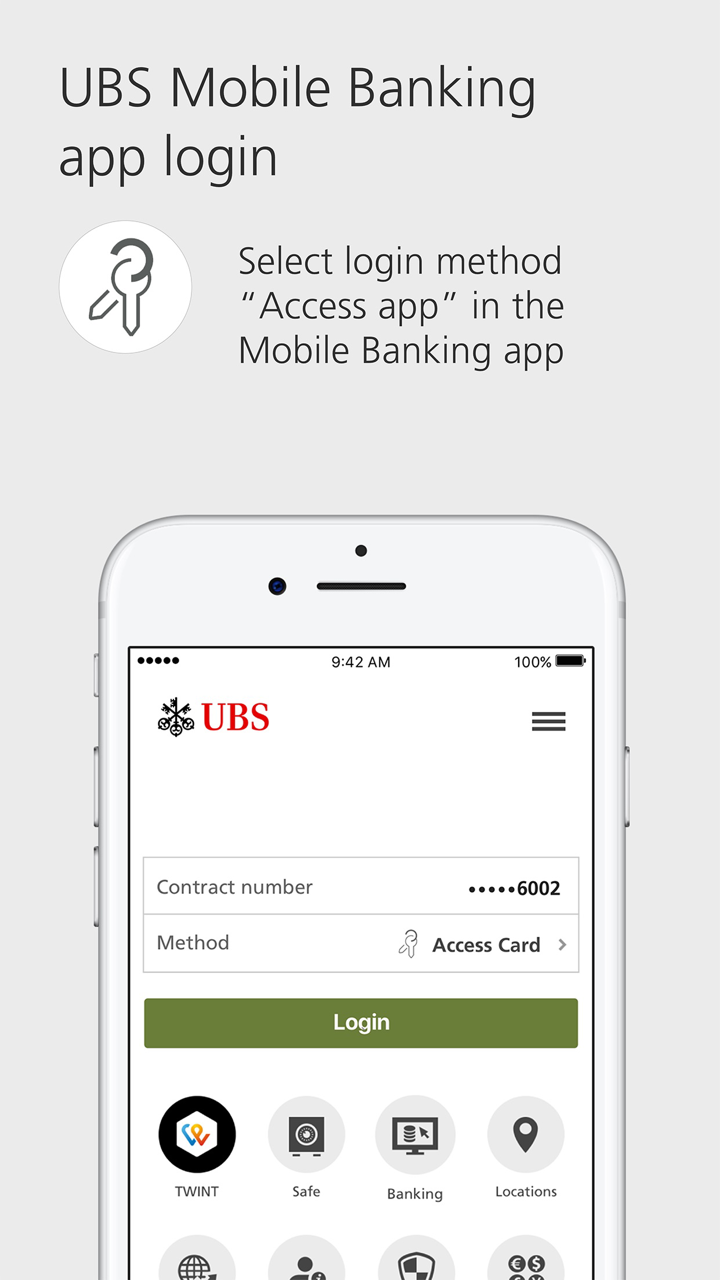

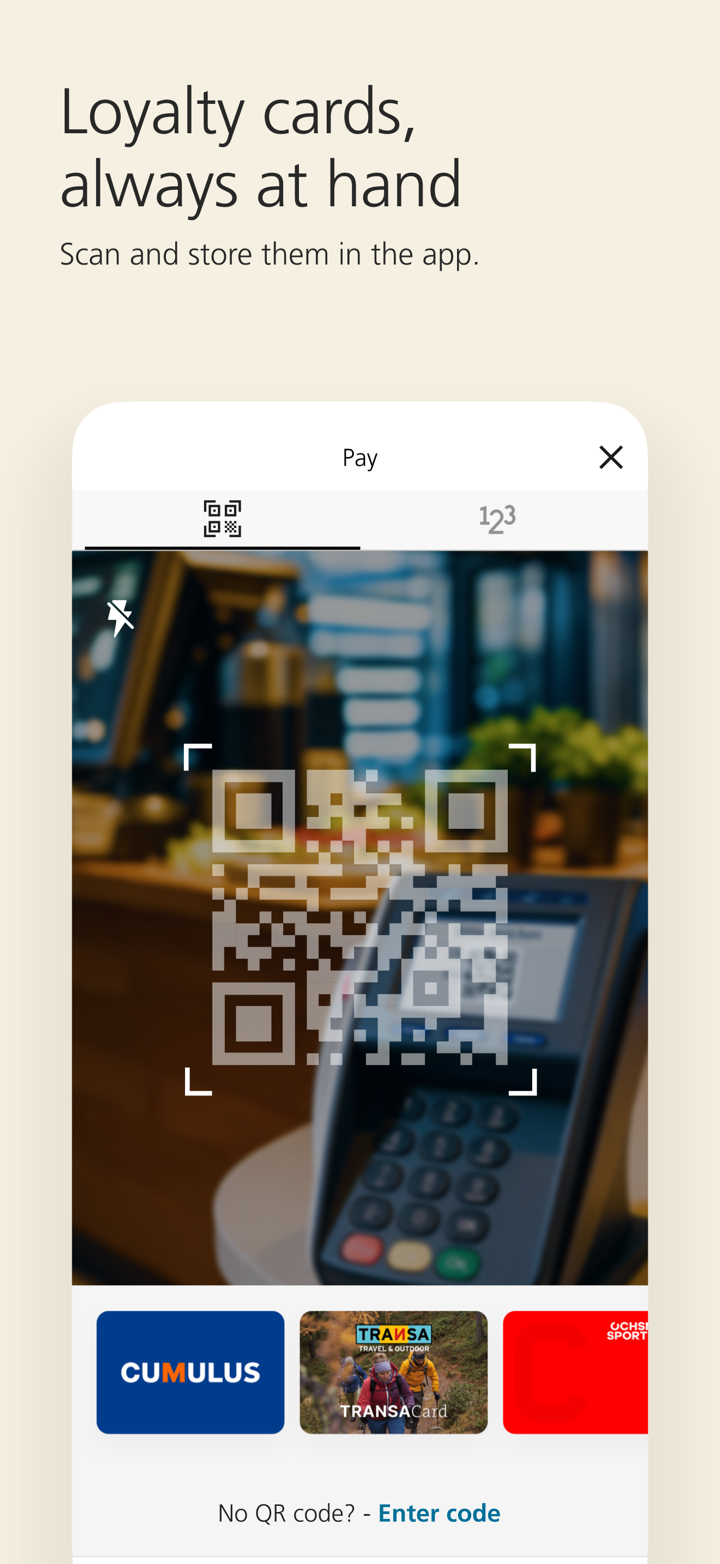

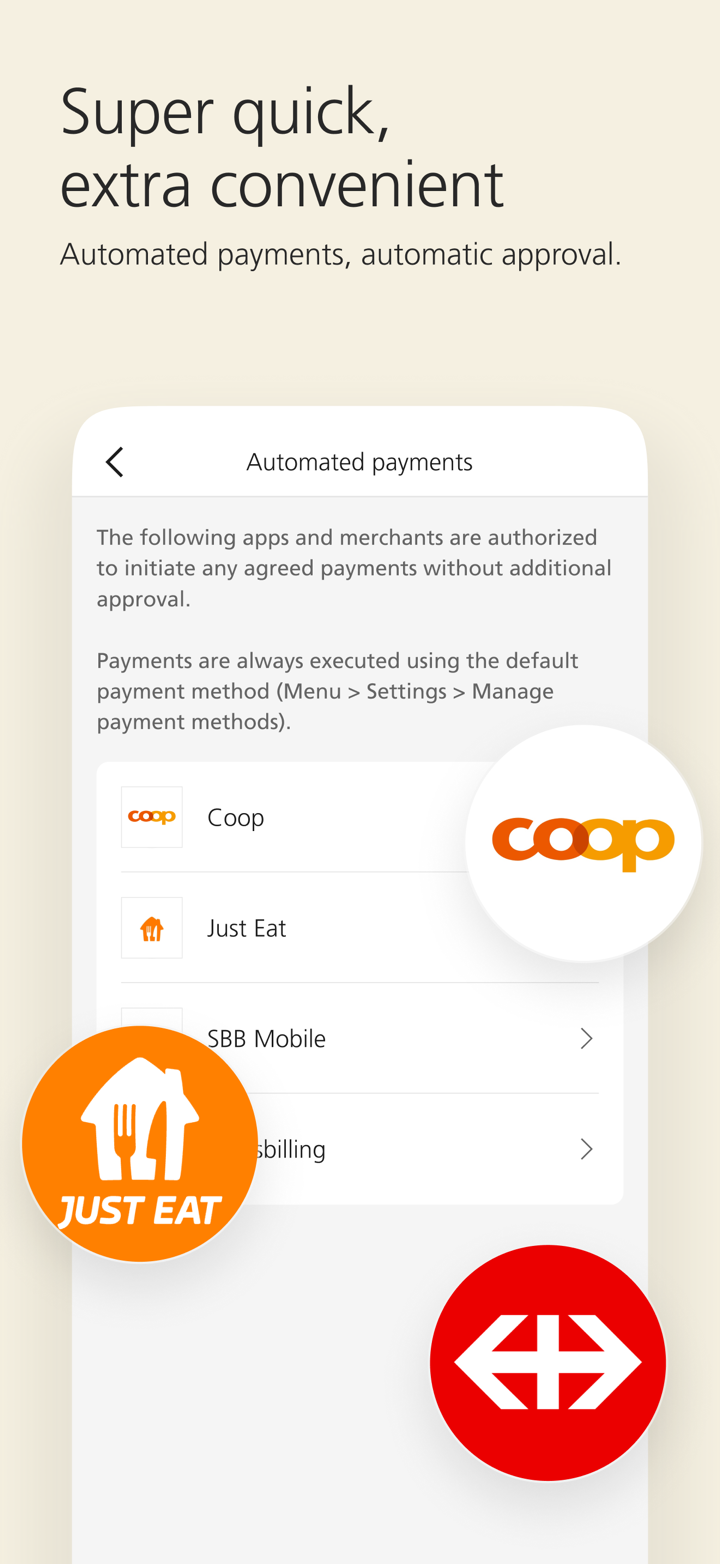

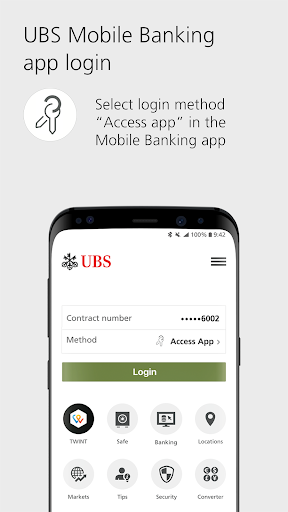

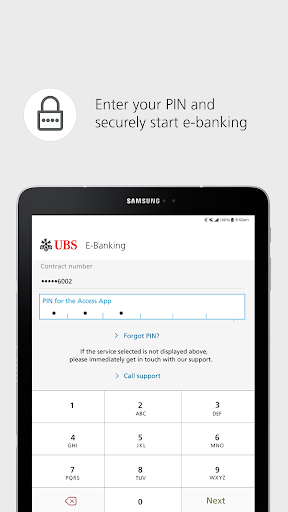

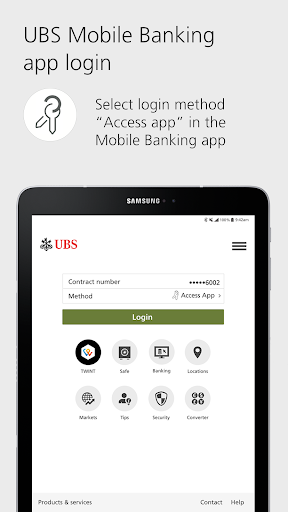

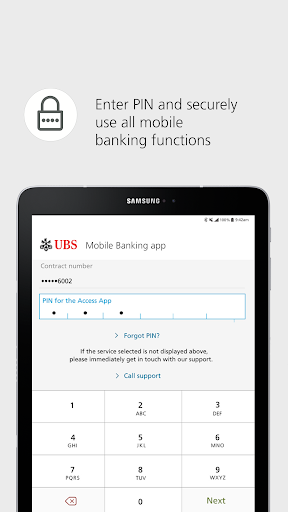

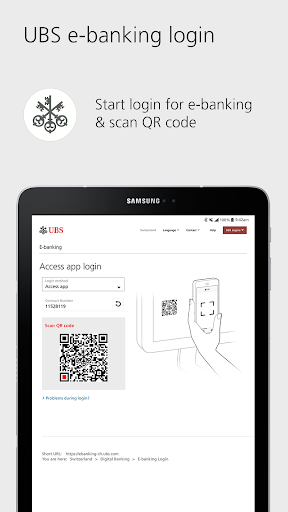

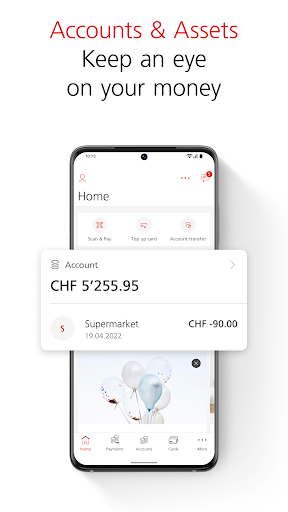

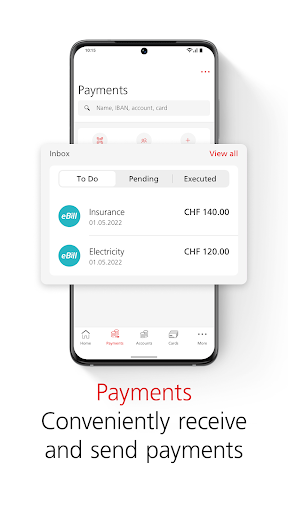

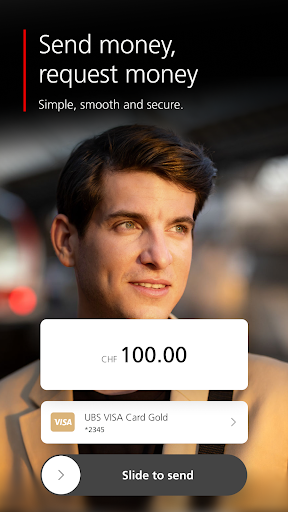

Based on my own experience as a forex trader and after carefully reviewing what is publicly known about UBS, I would approach the question of depositing cryptocurrencies like Bitcoin or USDT into a UBS account with considerable caution. UBS is a long-established, globally regulated banking institution with a broad focus on wealth and asset management, and while it offers a range of banking products and account types, its primary operations and supported payment methods are traditional fiat-based. According to their available services, UBS allows funding via methods such as QR-bill, eBill, TWINT, direct debit, and various mainstream payment platforms, but explicit support for direct deposits of cryptocurrencies into UBS accounts is not indicated. Why does this matter? Large and historically conservative banks like UBS face stringent regulations regarding digital assets, especially in jurisdictions like Switzerland and Hong Kong where they operate. While some major banks have begun to explore digital asset custody or are building frameworks for future crypto integration, UBS does not currently promote itself as a platform for direct cryptocurrency deposits into standard banking or trading accounts. This is further highlighted by several user complaints about issues with deposits and withdrawals, though these mostly involve fiat transactions rather than crypto. In summary, as of now, depositing cryptocurrencies such as Bitcoin or USDT directly into a personal or trading account at UBS does not appear to be supported. For traders considering integrating digital assets into their portfolio with UBS, I'd recommend verifying directly with the bank or looking for updates, as offerings and policies in this space can change rapidly. However, for now, I personally would not expect to be able to deposit crypto directly into a UBS account.

Avis des utilisateurs18

Ce que vous souhaitez évaluer

Veuillez saisir...

Commentaire 18

TOP

TOP

Chrome

Extension chromée

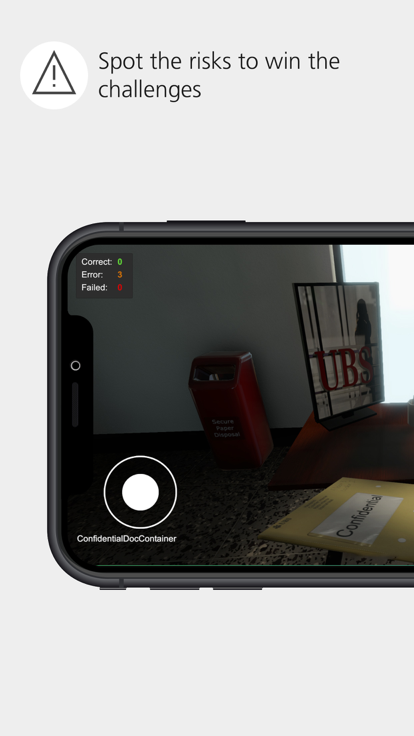

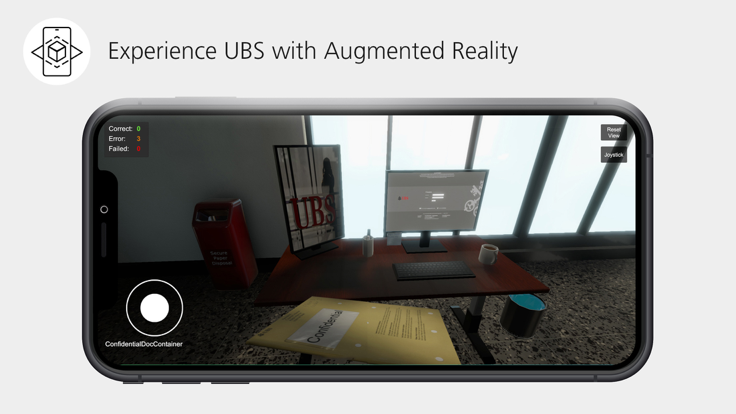

Enquête réglementaire sur les courtiers Forex du monde entier

Parcourez les sites Web des courtiers forex et identifiez avec précision les courtiers légitimes et frauduleux

Installer immédiatement

FX1739561792

L'Egypte

Fermez mon compte et le compte de toute la communauté S'il vous plaît Supprimez-les définitivement

Divulgation

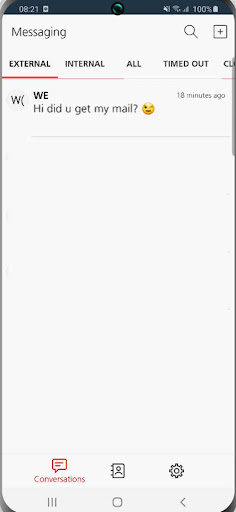

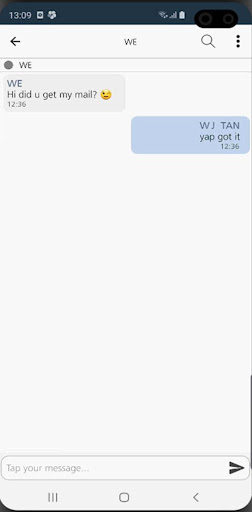

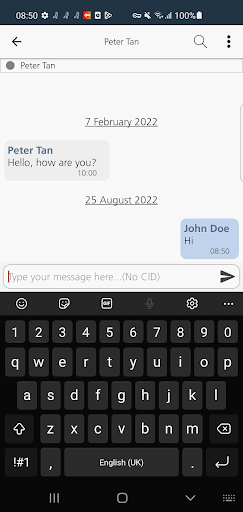

薇11六1四3零2七1

Hong Kong

Le 6 septembre, Baiyang, un enseignant, m'a amené dans un groupe d'assistant, dans lequel il analysait le marché boursier et recommandait certaines actions, ce qui me convenait le mieux. Et il me montra les captures d'écran des profits. Je ne savais pas grand-chose de ces manières auparavant, et je le croyais digne de confiance, car je lui faisais des profits avec son aide. En tant que vétéran du marché boursier, j'hésitais échanger avec eux. Mais le conseiller m'a suggéré de déposer 500 000 $ et d'essayer, et m'a encore réconforté par les profits élevés réalisés en une semaine. J’ai hésité mais il m’a demandé instamment d’ouvrir un compte en me disant qu’il pourrait m'aider à gagner des bénéfices l’après-midi et en partageant les coordonnées de UBS Le personnel du service clientèle de. Le 10 septembre, après avoir envisagé une nuit, j'ai déposé la majorité de mes économies, soit 600 000 RMB au total. Le 20 septembre, sur la recommandation de son ordre, j'ai fait d'énormes pertes, mon compte restant de 10000 RMB ou plus. expliquer quoi que ce soit, mais m'exhorter à ajouter des fonds pour récupérer les pertes. J'étais déprimé.Après l'avoir refusé, j'ai été retiré du groupe et supprimé par lui.

Divulgation

yukiiii

Hong Kong

Un droit de timbre de 5% est requis pour le retrait en UBS Est-ce légitime?

Divulgation

AlfredoRomero

L'Argentine

Je pense que c'est un bon courtier pour trader, il a donné de bons résultats pour moi en plus des nombreux avantages que j'ai sur mon compte. De plus, les niveaux de levier me semblent très attractifs. Ce sont des dépôts sécurisés.

Positifs

Scott Walker

La france

Il y a 8 ans, j'ai établi ma pension avec UBS, en choisissant d'investir dans l'un de leurs fonds de croissance à haut risque gérés en Suisse. J'avoue ne pas l'avoir examiné annuellement en raison de mes engagements dans la gestion d'une grande entreprise et d'avoir maximisé mes cotisations de retraite. Cependant, au cours de ces années, le fonds n'a augmenté que de 3,5% en moyenne, ce qui a entraîné une perte nette compte tenu de l'inflation. De plus, avec des frais de conseil de 5 000 £ par an et des frais de fonds d'environ 1%, j'ai finalement décidé de transférer tous mes investissements d'UBS vers un meilleur.

Neutre

Đặng Công Hà

Vietnam

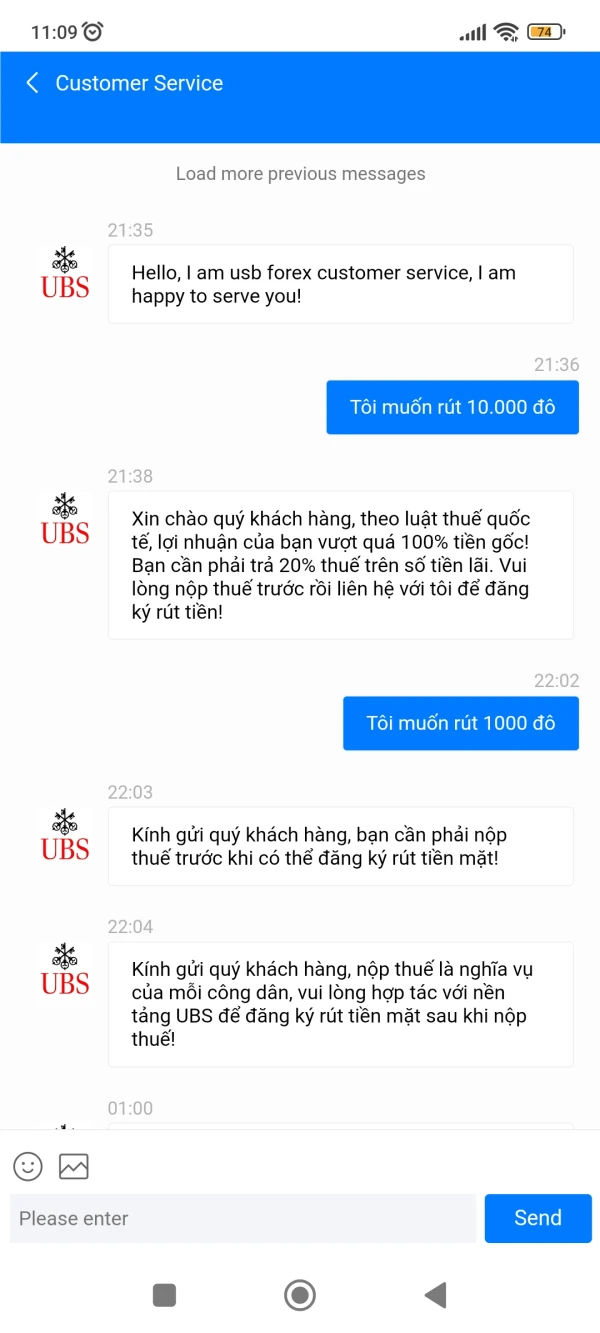

Ils vous obligent à payer des impôts parce que votre compte de profits dépasse 100%.

Divulgation

Ajs142

Le pakistan

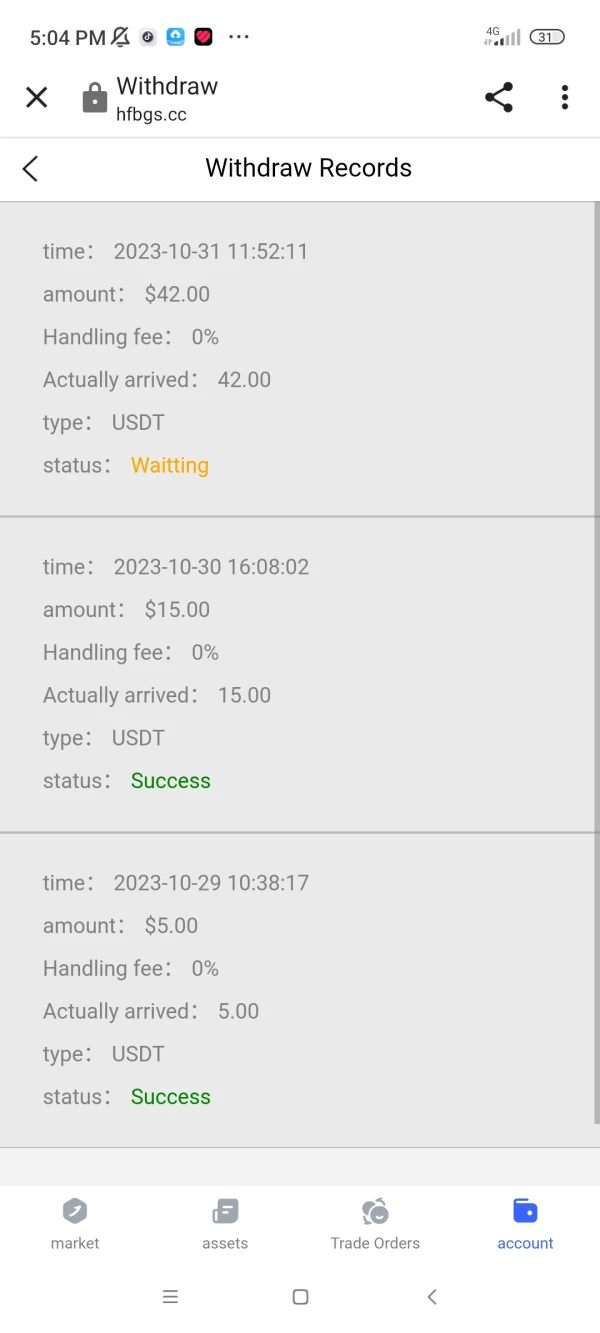

depuis UBS Binance

Divulgation

salman khan468

L'Inde

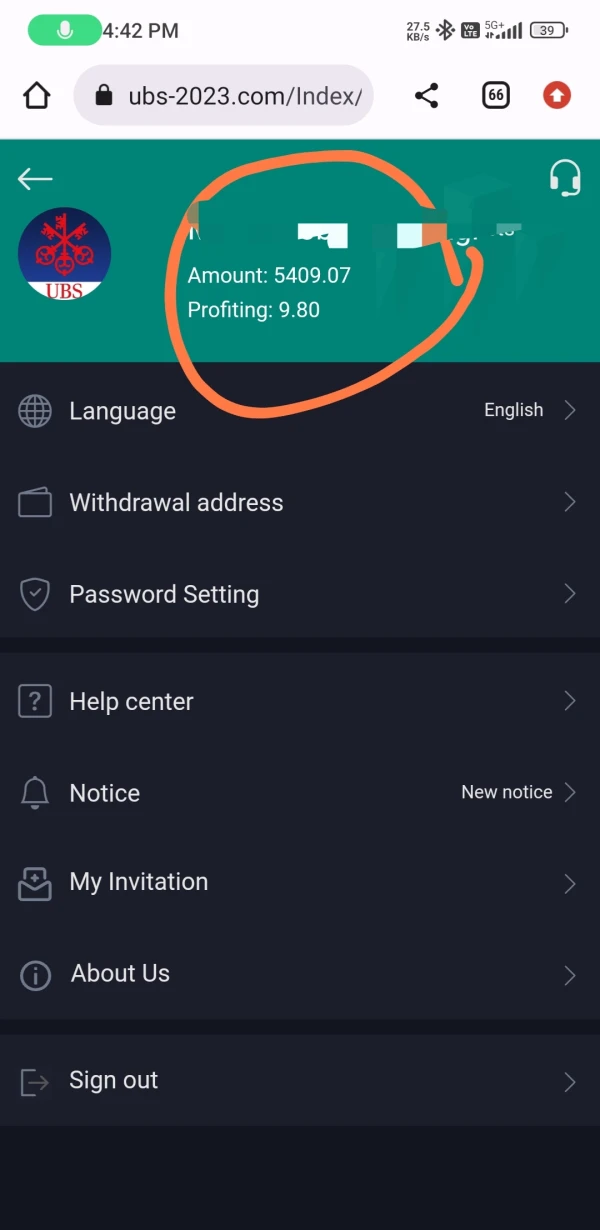

J'ai déposé 2 400 USD et gagné 3 000 USD. Maintenant, j'ai plus de 5 400 USD dans mon compte. UBS compte du marché, quand j'ai essayé de retirer, ils m'ont dit que vous deviez payer 20 % d'impôt, c'est une fraude totale, ils peuvent déduire mon compte

Divulgation

FX1352371297

L'Indonésie

Ils ont examiné l'un de mes métiers où je me suis plaint de la manipulation des graphiques et il s'est avéré qu'ils avaient manipulé le compte derrière. Ce que je veux vraiment me plaindre, c'est que leur personnel ne semble pas bien équipé, je veux dire, en matière de connaissances. Ils n'ont pas les compétences de base pour comprendre les besoins des clients, leur parler me torture vraiment…

Positifs

FX4198274585

Australie

après avoir échangé et perdu mon argent, ils ne m'ont pas permis de retirer une somme de 2138,73. J'ai envoyé un message au service client à plusieurs reprises, mais il n'y a pas de réponse. J'ai essayé de faire du trading et je n'ai pas été autorisé Je veux de l'aide pour retirer mon argent

Divulgation

筱飛【Graphic Design】

Hong Kong

J'ai déposé plus de 100 000 yuans mais ils ont rejeté mon retrait pour plusieurs raisons.

Divulgation

往后7407

Hong Kong

Ils ont toutes les raisons de rejeter mon retrait, et ont changé leurs excuses tous les jours, et ils ont continué à me demander de déposer afin de retirer?

Divulgation

D S Y

Hong Kong

UBStrompe les gens, c'est vraiment une série d'escroqueries, l'une après l'autre

Divulgation

D S Y

Hong Kong

Vous devez payer 68888 pour passer à l'adhésion avant de pouvoir retirer des fonds.

Divulgation

起风了69241

Hong Kong

Il n'y a aucun moyen de retirer des fonds. Le service client exige que vous deviez déposer jusqu'à 50000 pour devenir membre et vous retirer

Divulgation

FX3892210959

États-Unis

Je connaissais un gars qui m'a incité à investir dansUBS . Il s'agit d'une plateforme de monnaie numérique contre la fraude. J'ai profité après avoir échangé plusieurs fois. Mais je ne peux pas retirer de fonds. Le service client a dit que mon chiffre d'affaires n'avait pas atteint 20 000 (je n'en ai jamais entendu parler. Et mon chiffre d'affaires était supérieur à 1 000 à l'époque). Ensuite, j'ai laissé entendre que je continuerais à investir des dizaines de milliers. J'espère donc qu'ils pourront m'aider à retirer l'argent avec succès. Le service client a entendu cela et a dit que ma demande serait traitée automatiquement par le système (aucun principe du tout). J'ai demandé comment je pouvais récupérer mon argent au bout d'un jour. Et le service client a dit que je pouvais devenir VIP et qu'il en fallait 5000. J'ai demandé autre chose, à la fin, j'ai demandé quel était l'écart de mon chiffre d'affaires. Service client: 5000

Divulgation

Bottle

Hong Kong

Lorsque je me suis retiré après une opération avec leur technicien, on m'a dit que les informations de ma carte bancaire étaient fausses. Je dois payer une marge de 30% pour modifier les informations et retirer des fonds. Mais je ne peux pas après avoir offert ma carte d'identité et mes informations bancaires

Divulgation

FX3393443657

Hong Kong

Ma demande était toujours en cours de vérification, et on m'a même demandé une taxe avant de retirer mon fonds.

Divulgation