Présentation de l'entreprise

| UTRADE Résumé de l'examen | |

| Fondé | 1996 |

| Pays/Région Enregistré | Hong Kong |

| Régulation | Réglementé par la SFC (Hong Kong) |

| Instruments de Marché | Actions, ETF, FPI, Options, Contrats à terme, CBBC, Obligations, Bons de souscription |

| Compte de Démo | ❌ |

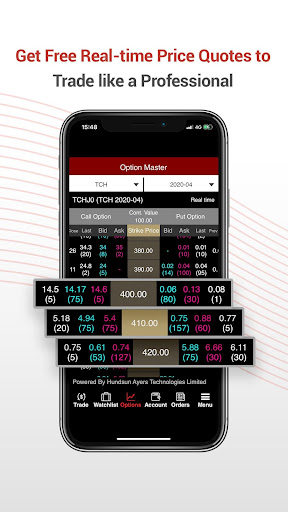

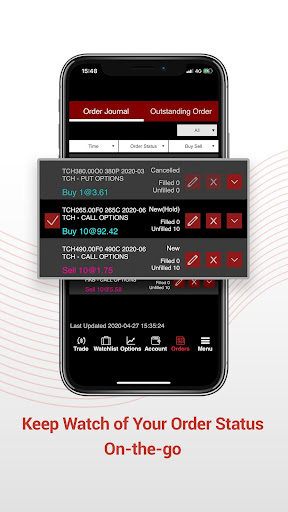

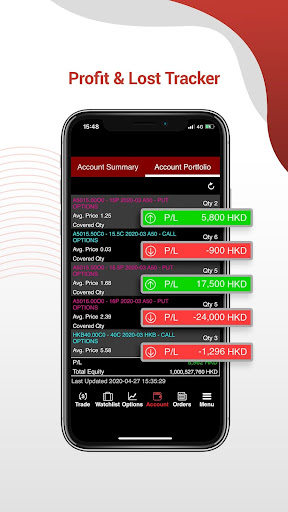

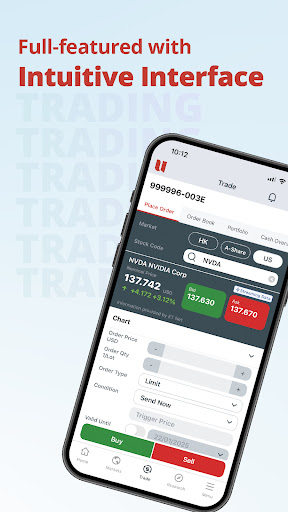

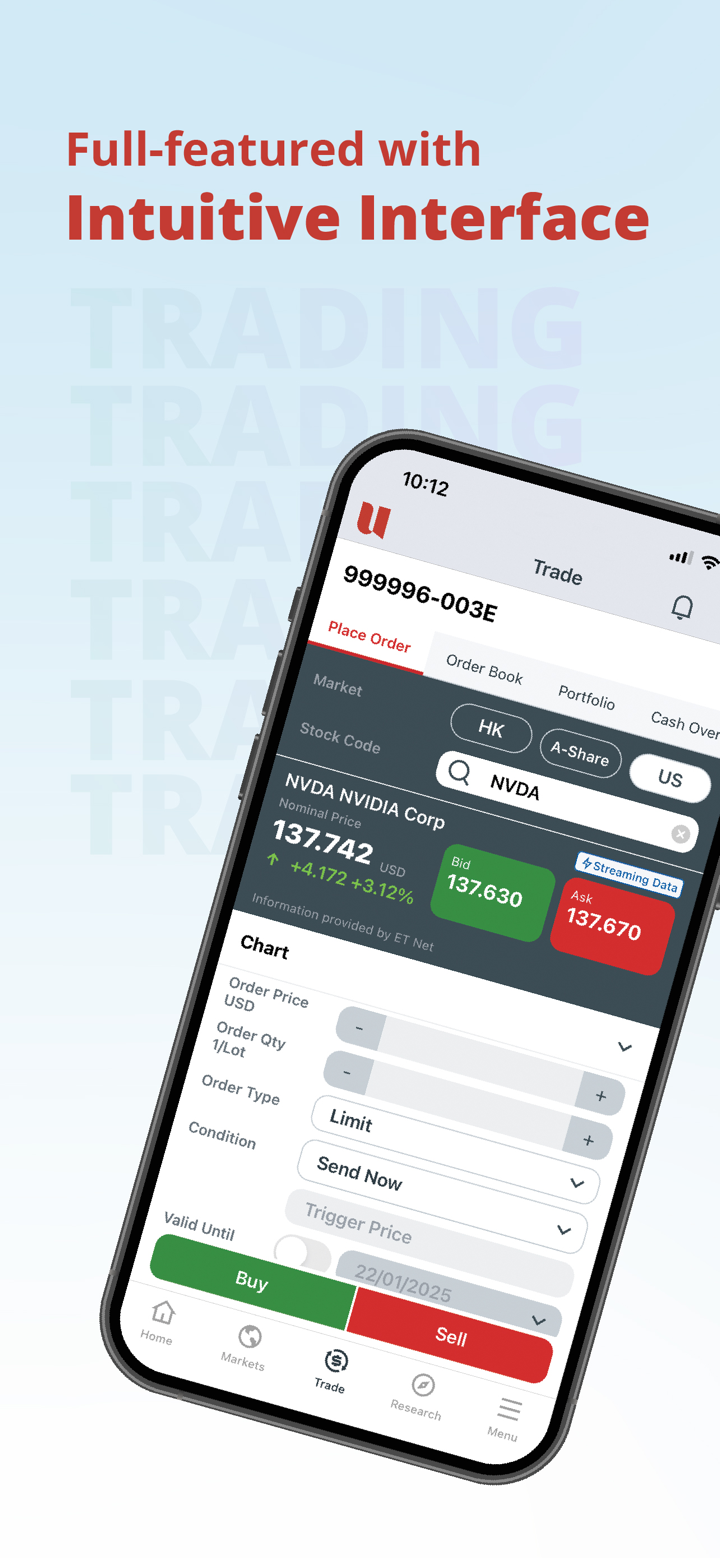

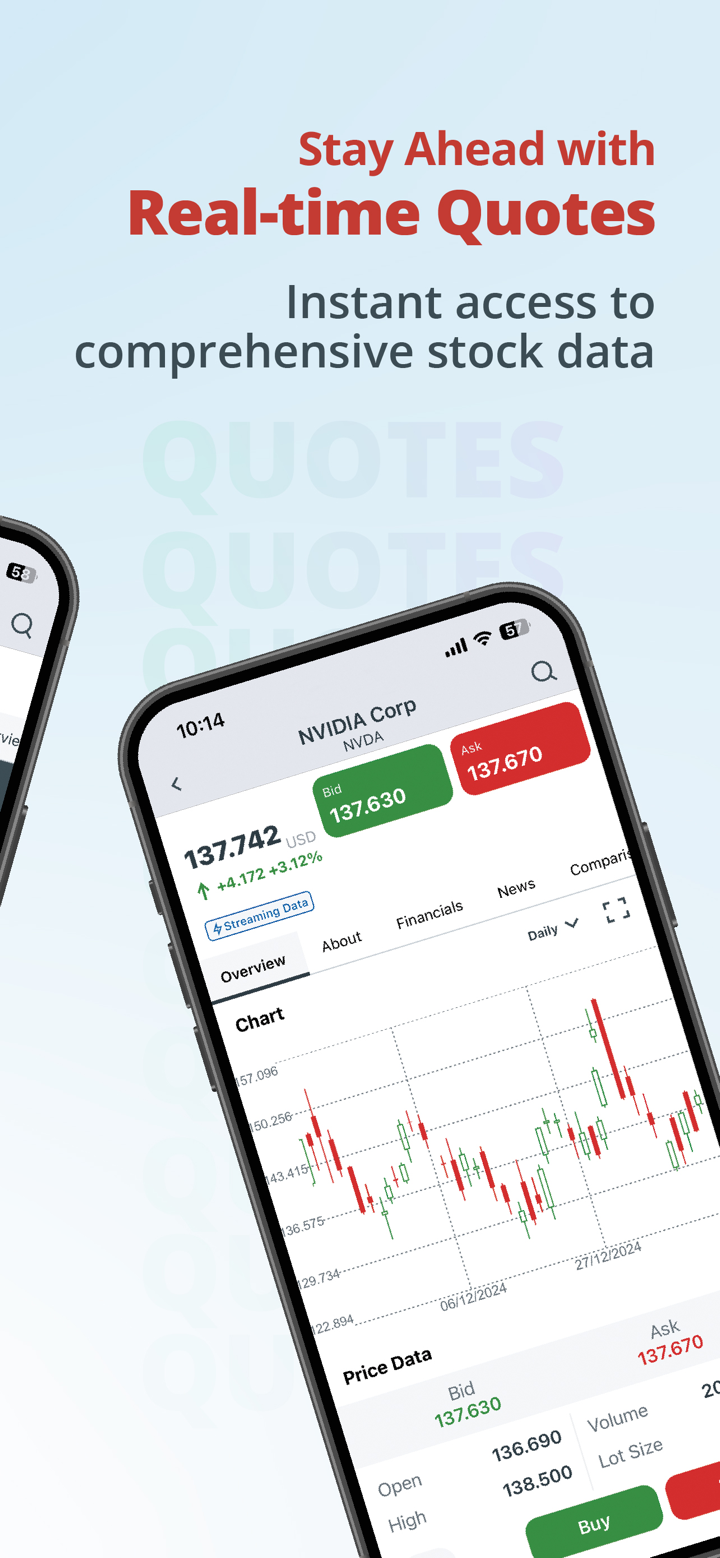

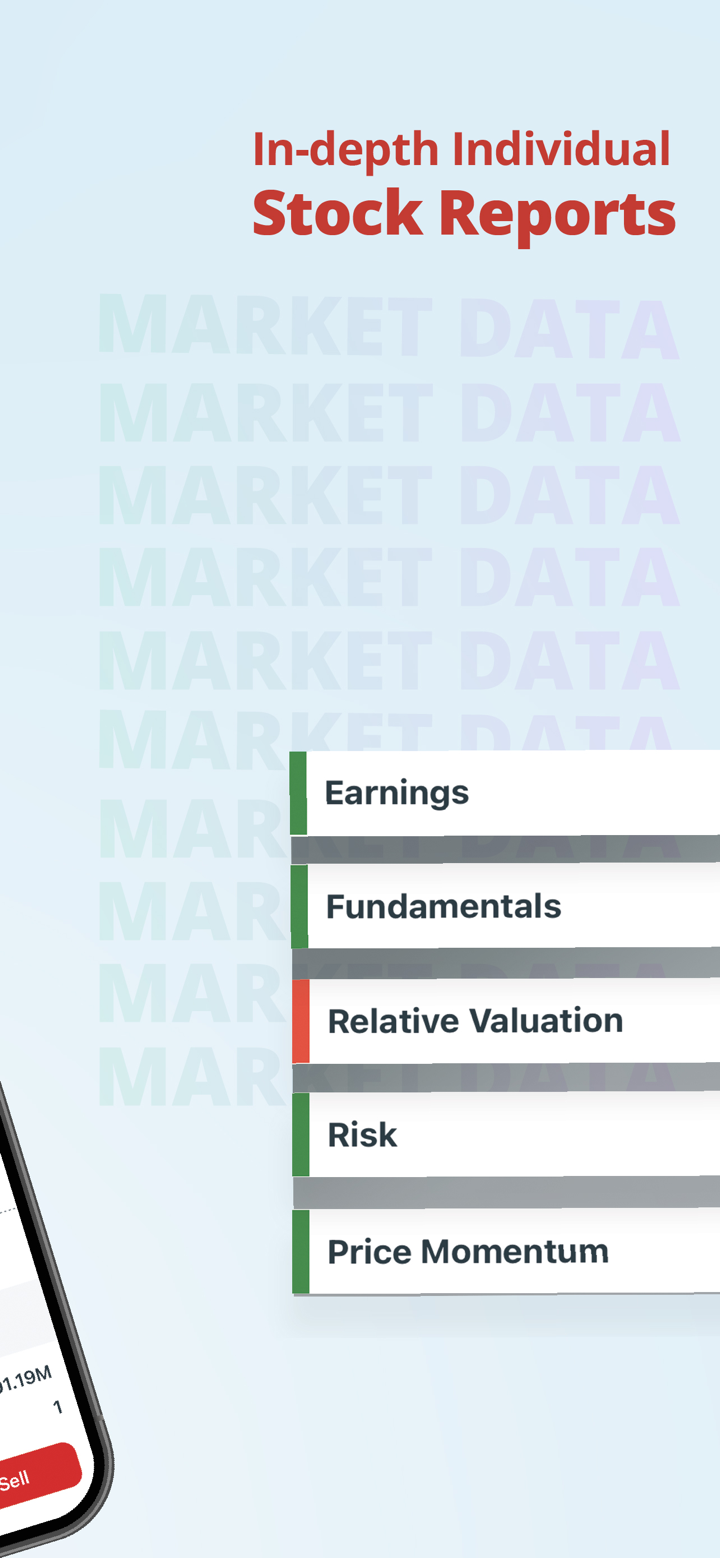

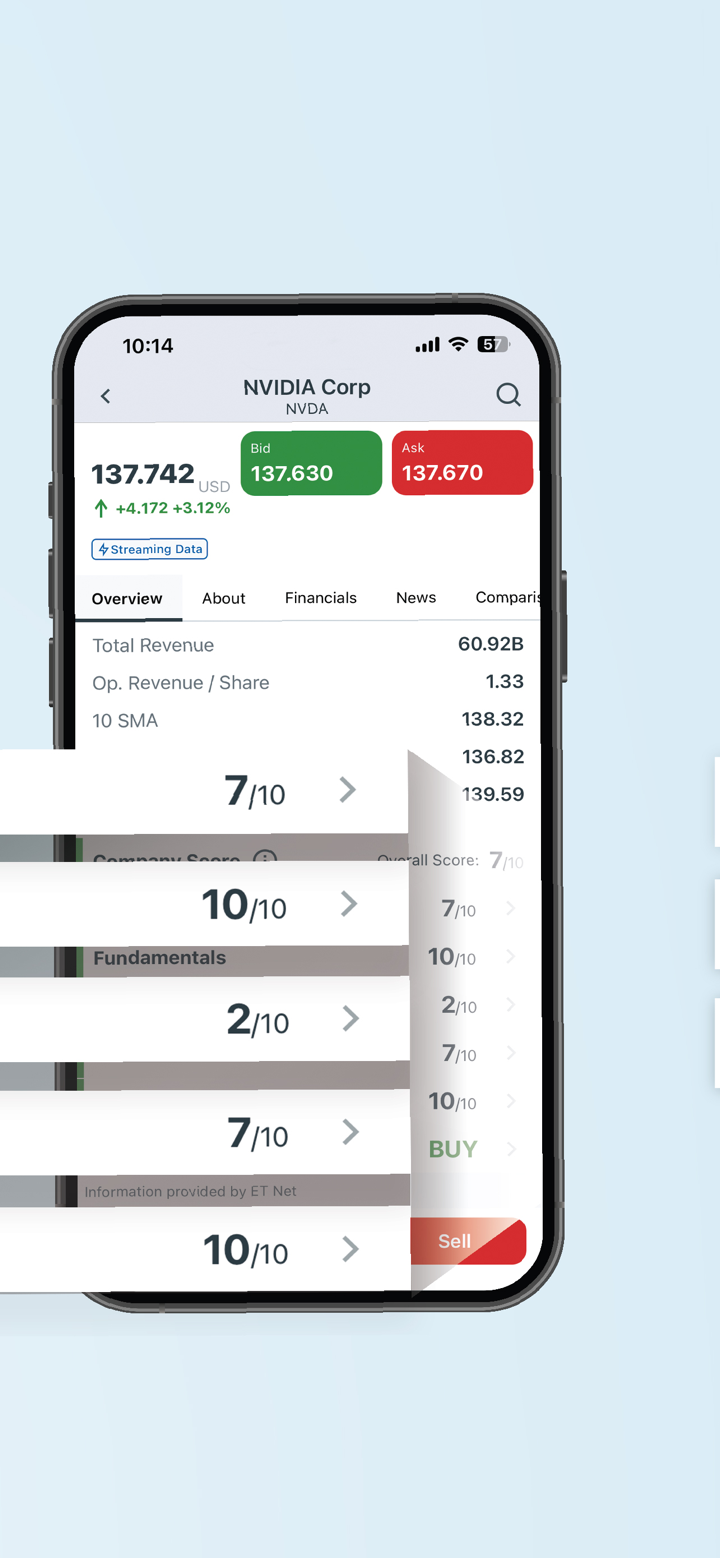

| Plateforme de Trading | WebTrader, Application Mobile UTRADE |

| Support Client | Chat en ligne, Formulaire de Contact |

| Email: clientservices@uobkayhian.com.hk | |

| Tél: +852 2136 1818 | |

| Adresse: 6/F Harcourt House, 39 Gloucester Road, Hong Kong | |

Informations sur UTRADE

UTRADE est un courtier basé à Hong Kong fondé en 2014, réglementé par la SFC. Il propose une gamme diversifiée d'instruments de marché, tels que : Actions, ETF, FPI, Options, Contrats à terme, CBBC, Obligations et Bons de souscription.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé par la SFC | Informations limitées sur les conditions de trading |

| Multiples canaux de contact | Pas de comptes de démonstration |

| Chat en direct pris en charge | |

| Divers instruments de trading | |

| Temps d'opération prolongé |

UTRADE Est-il Légitime ?

UTRADE est partiellement légitime. Il est réglementé par la SFC (Hong Kong) sous UOB Kay Hian Futures (Hong Kong) Limited, avec le numéro de licence AHY424.

| Statut Réglementaire | Réglementé Par | Institution Agréée | Type de Licence | Numéro de Licence |

| Réglementé | SFC (Hong Kong) | UOB Kay Hian Futures (Hong Kong) Limited | Opérations sur contrats à terme | AHY424 |

Enquête sur le Terrain WikiFX

L'équipe d'enquête sur le terrain de WikiFX a visité l'adresse de UTRADE à Hong Kong et nous avons trouvé son bureau sur place, ce qui signifie que la société opère avec un bureau physique.

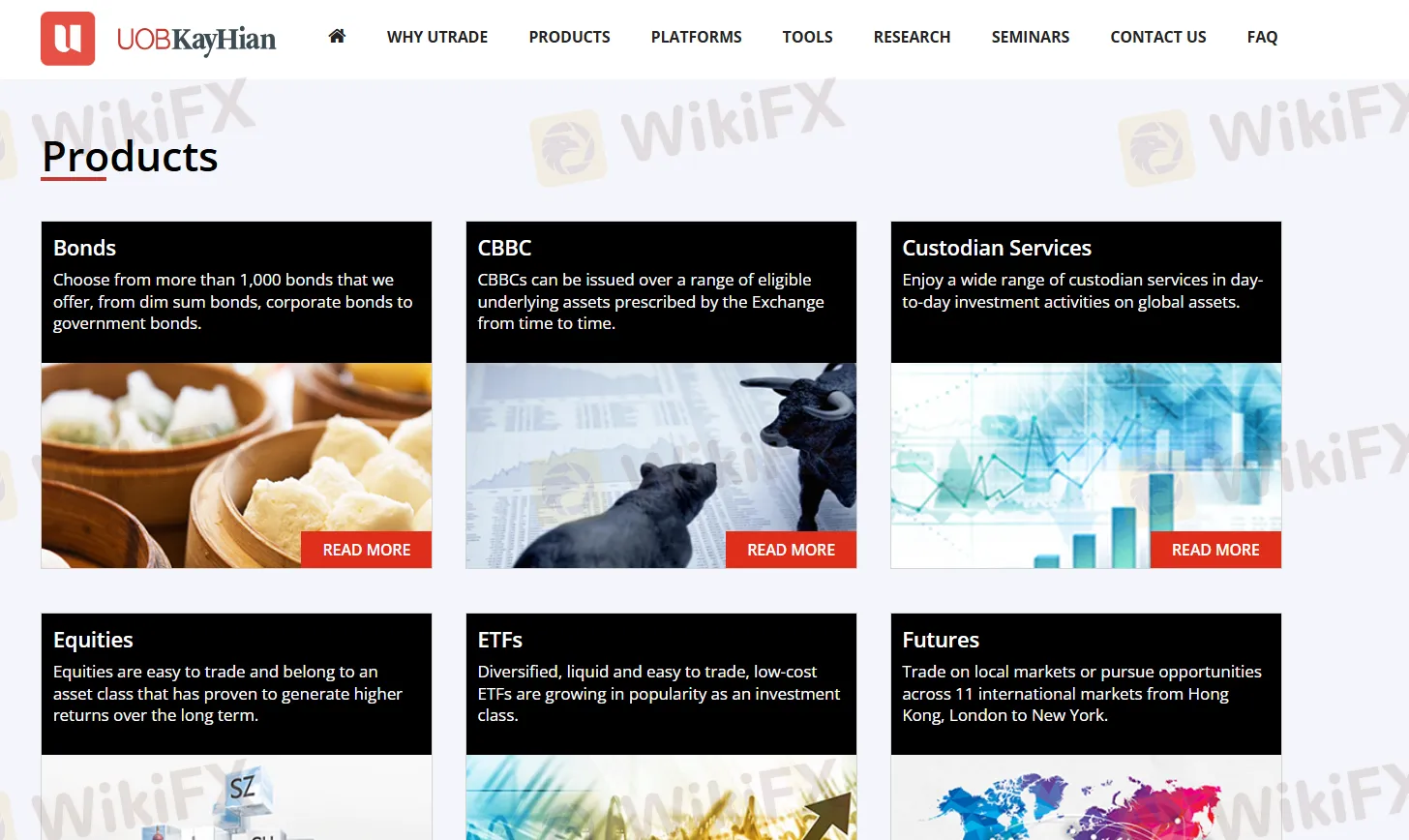

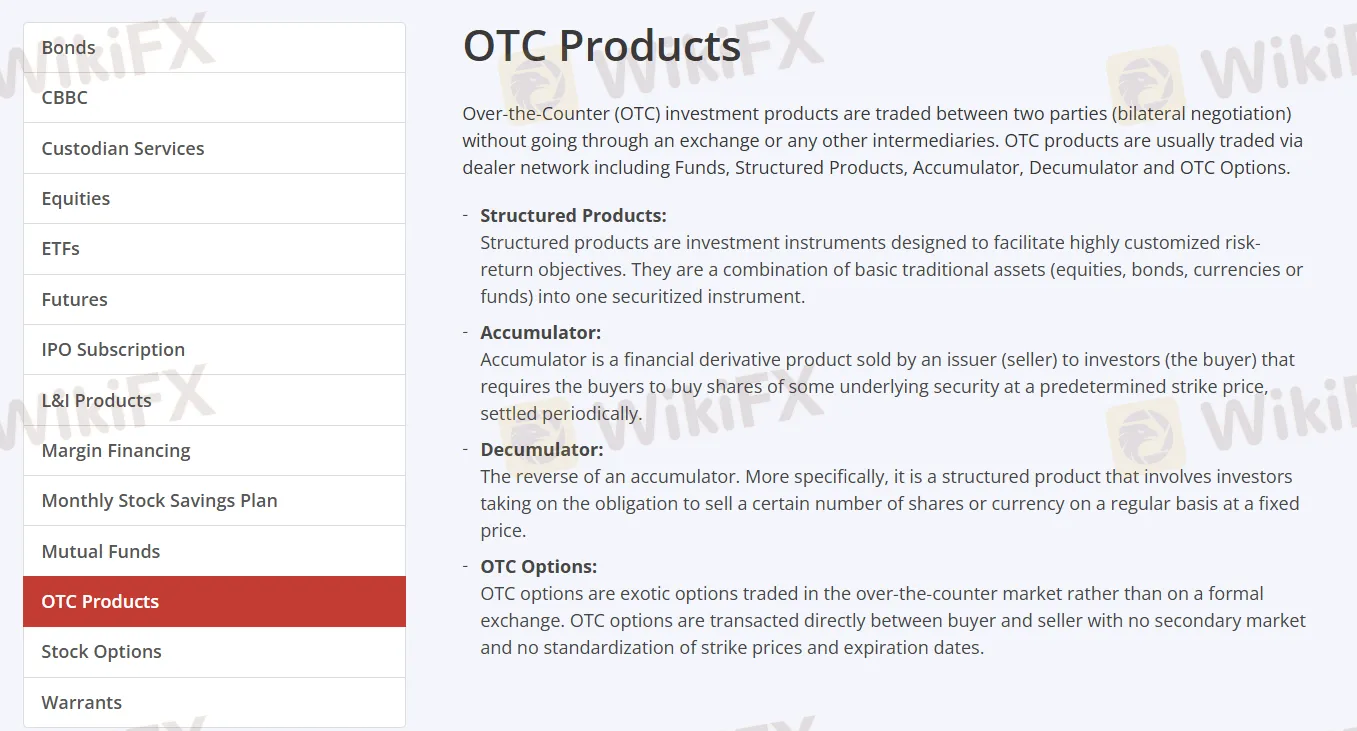

Que puis-je trader sur UTRADE ?

| Instruments de trading | Pris en charge |

| Actions | ✔ |

| ETFs | ✔ |

| REITs | ✔ |

| Options | ✔ |

| Futures | ✔ |

| CBBC | ✔ |

| Obligations | ✔ |

| Warrants | ✔ |

| Forex | ❌ |

| Matières premières | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptomonnaies | ❌ |

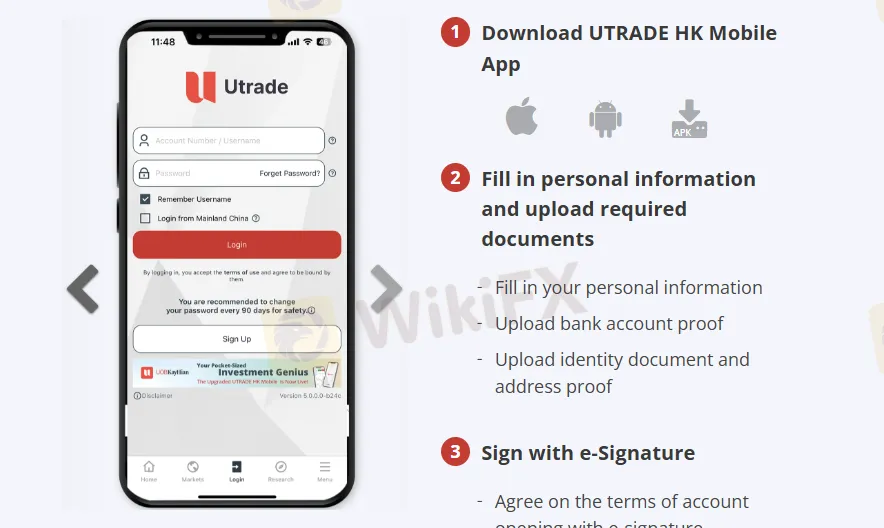

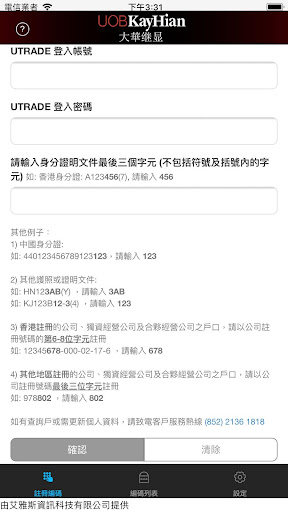

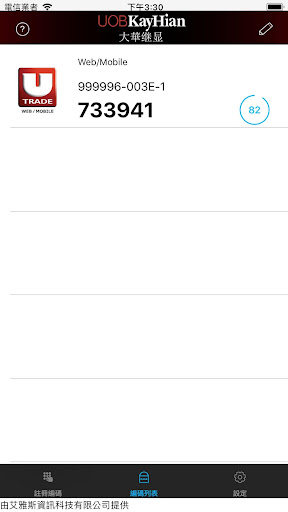

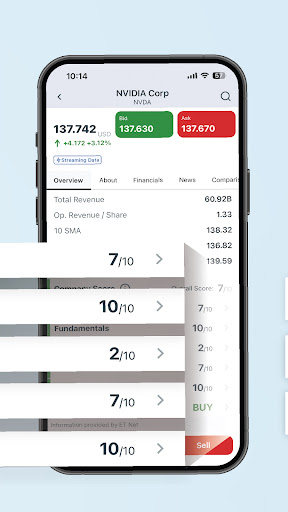

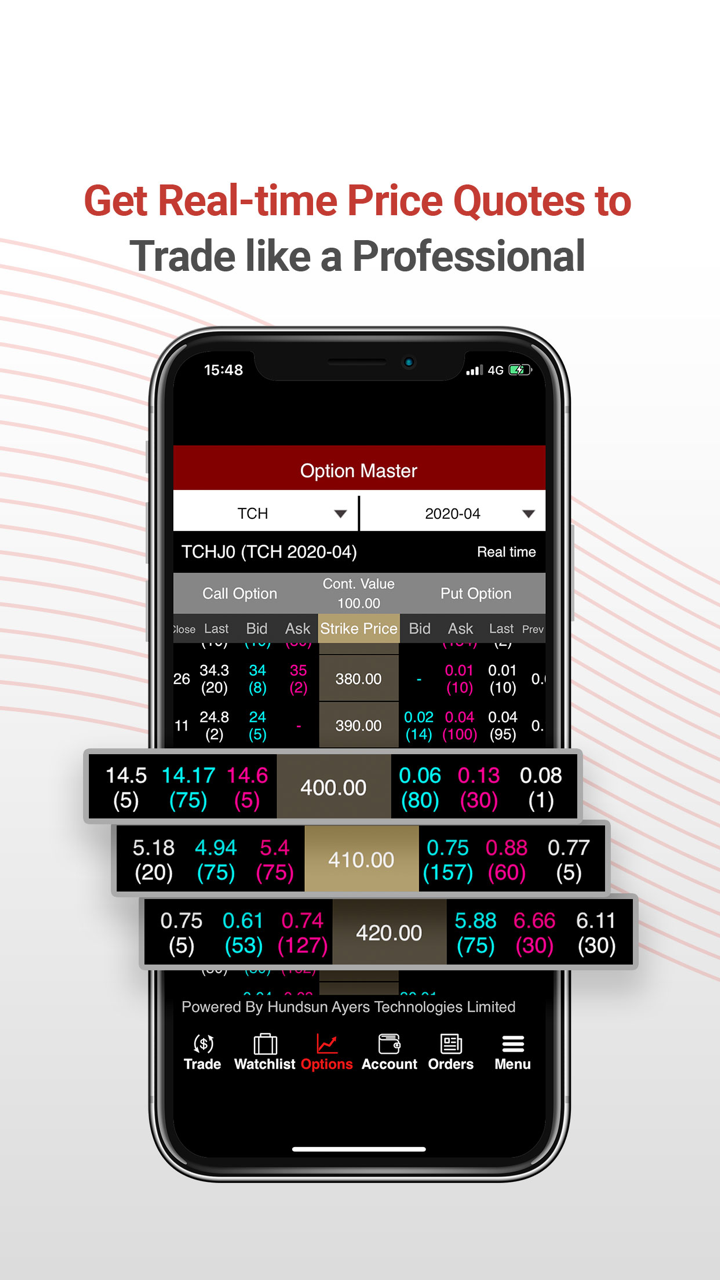

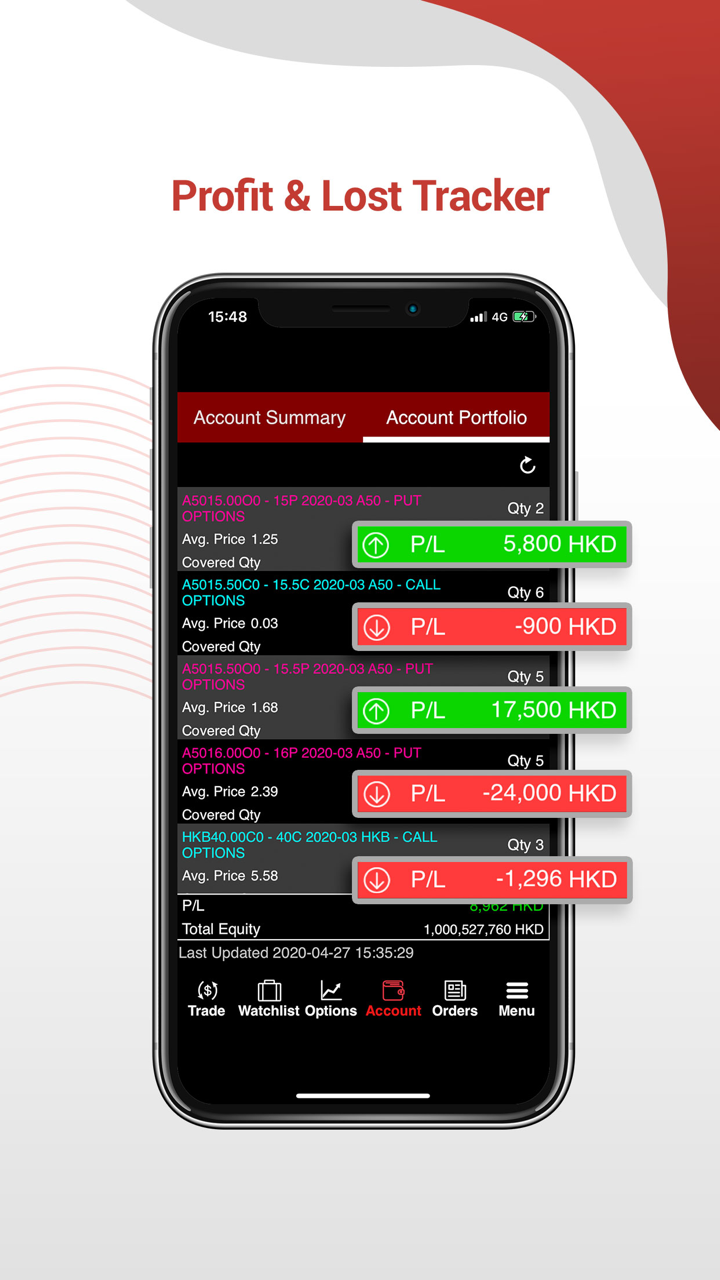

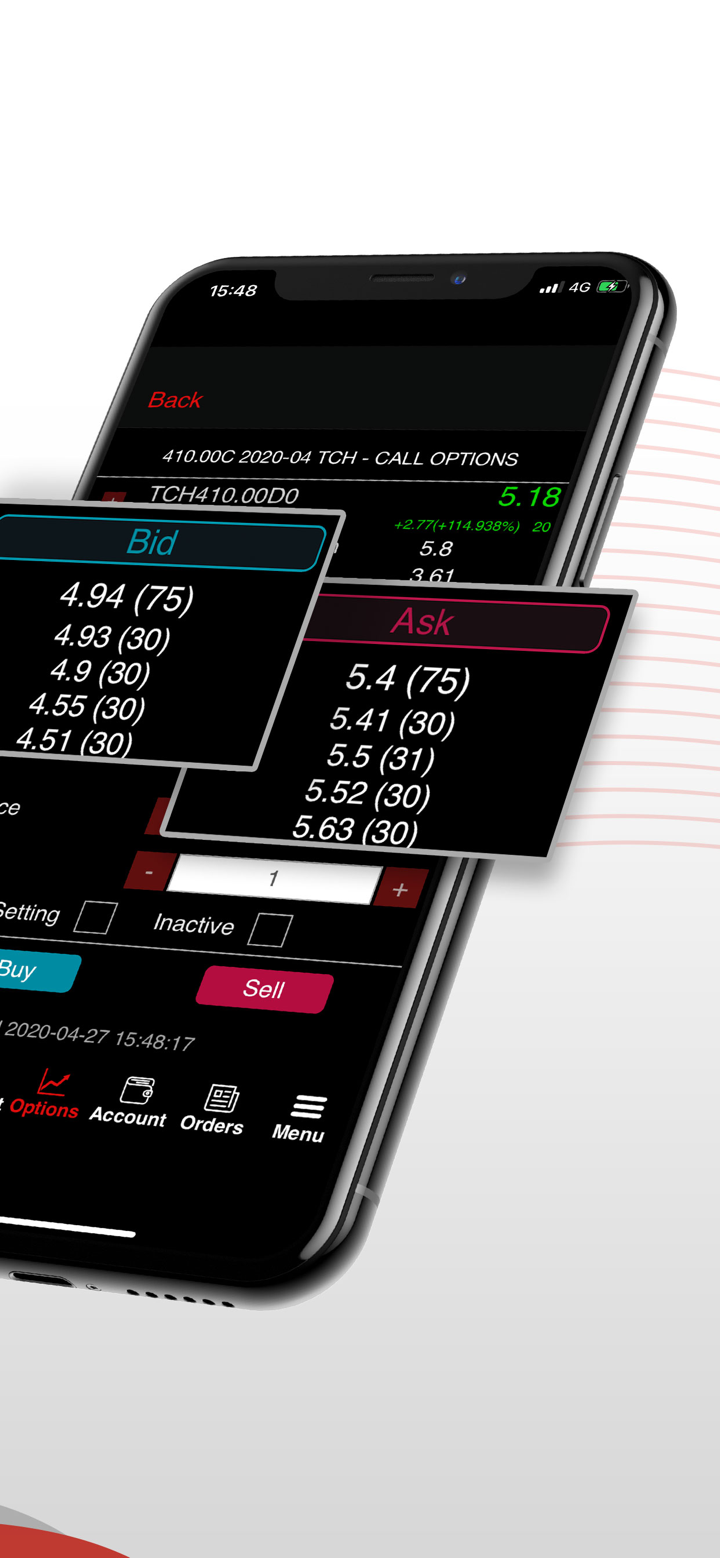

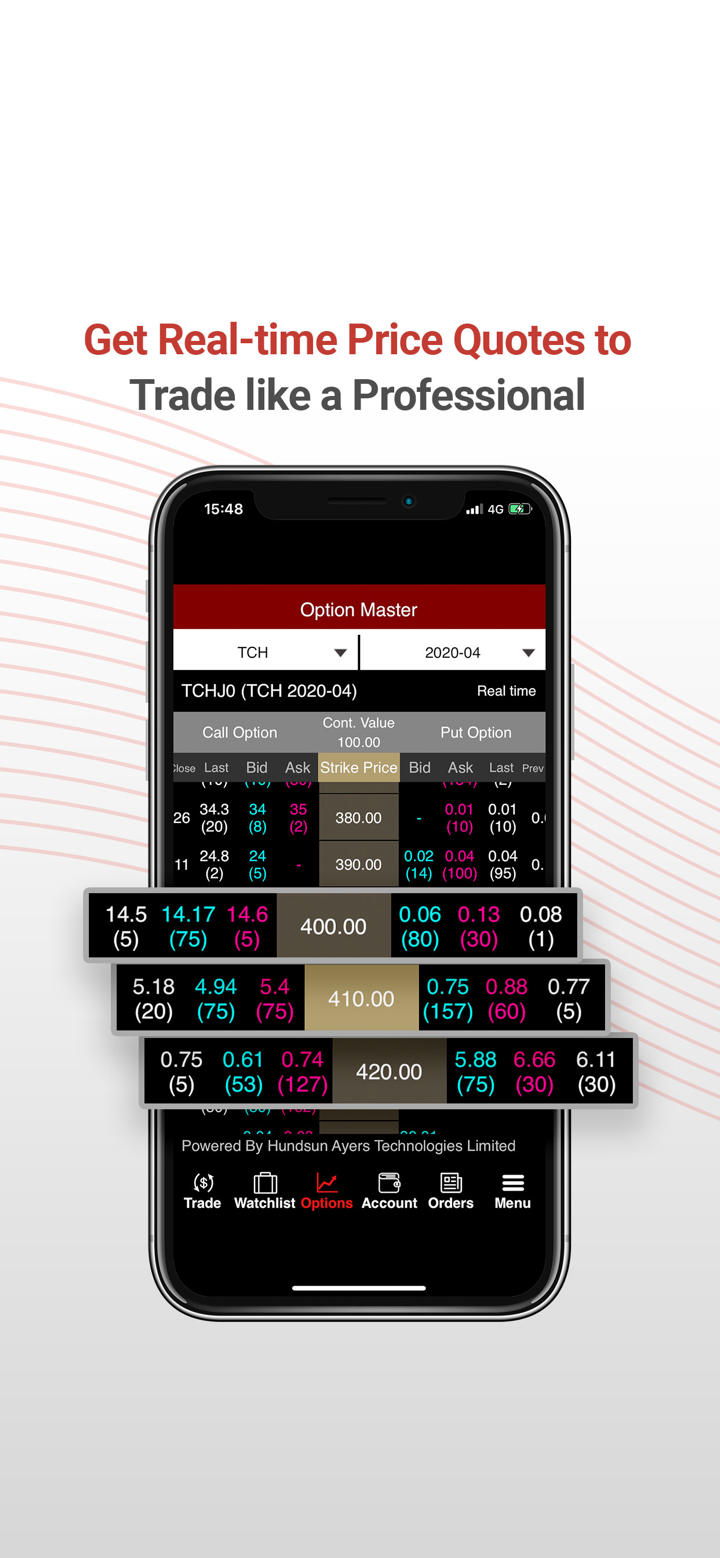

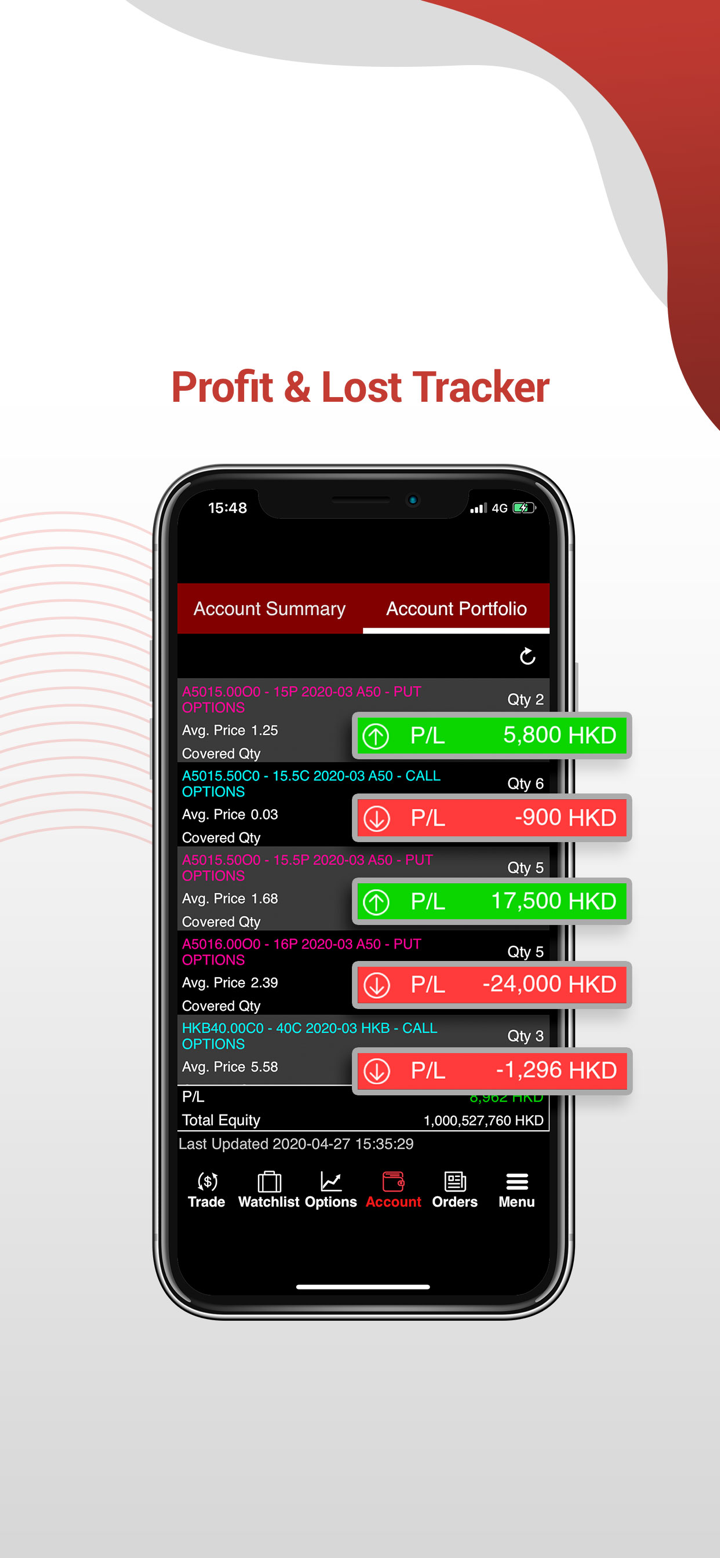

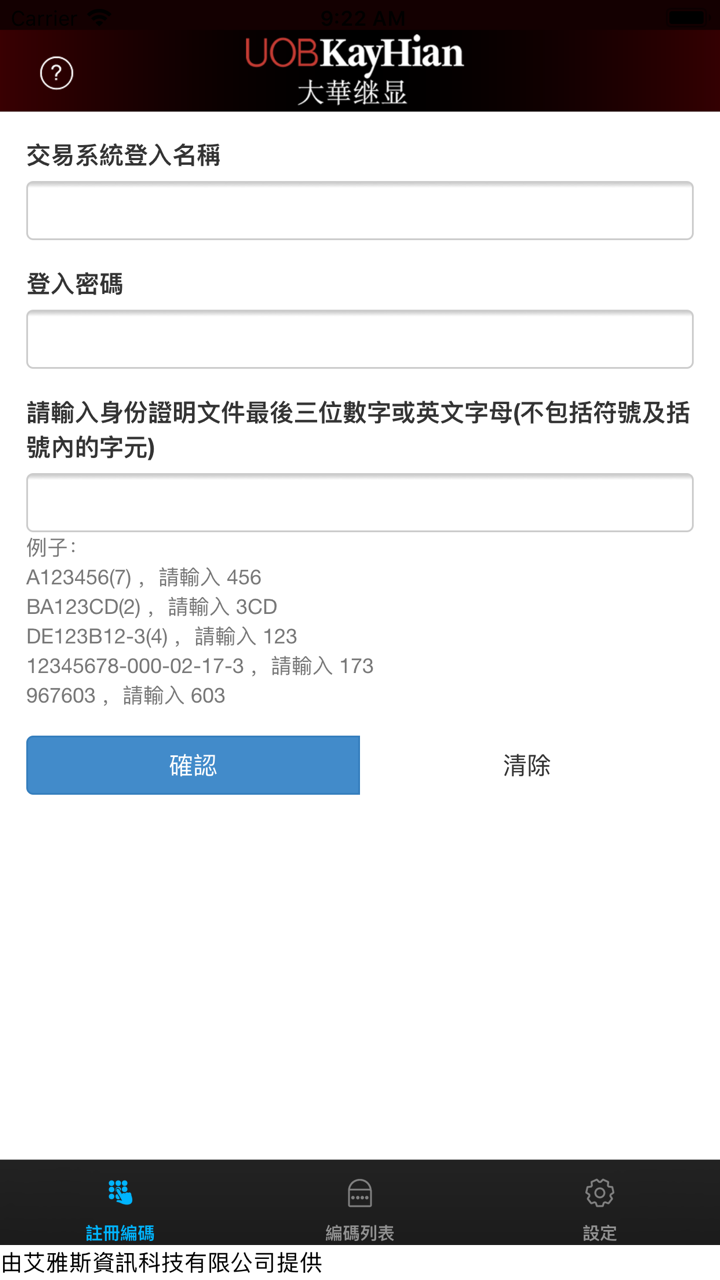

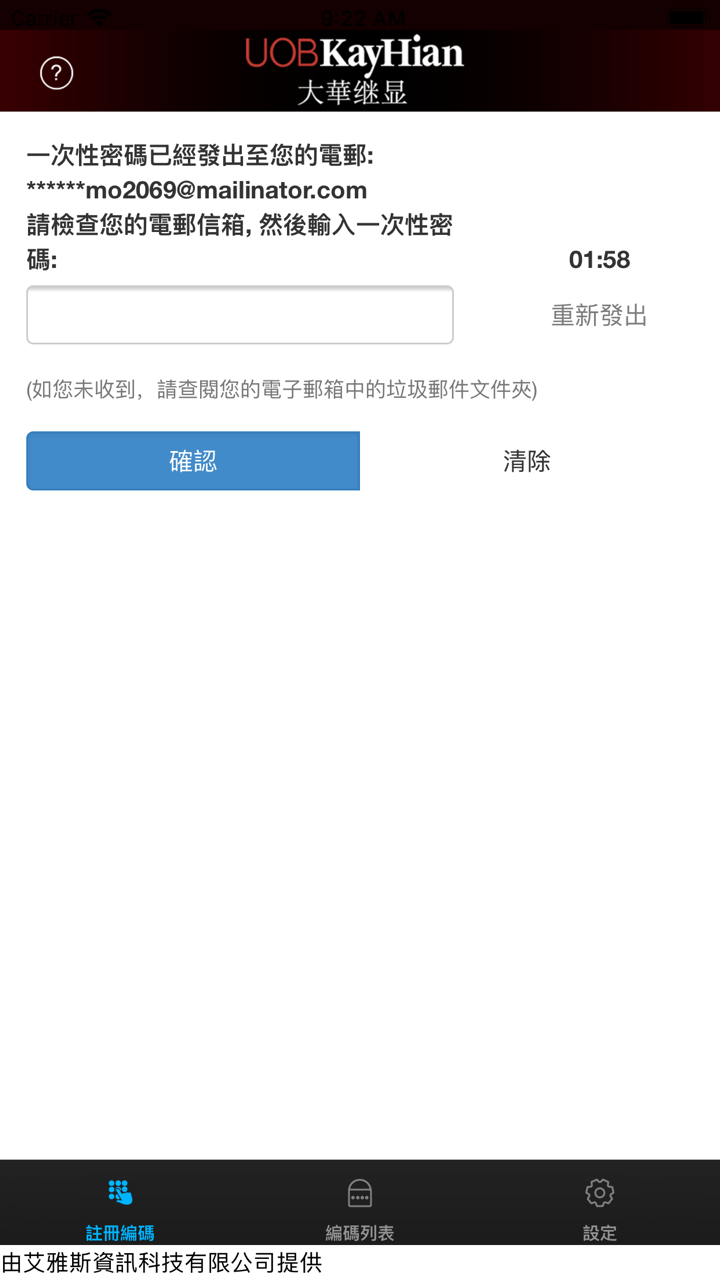

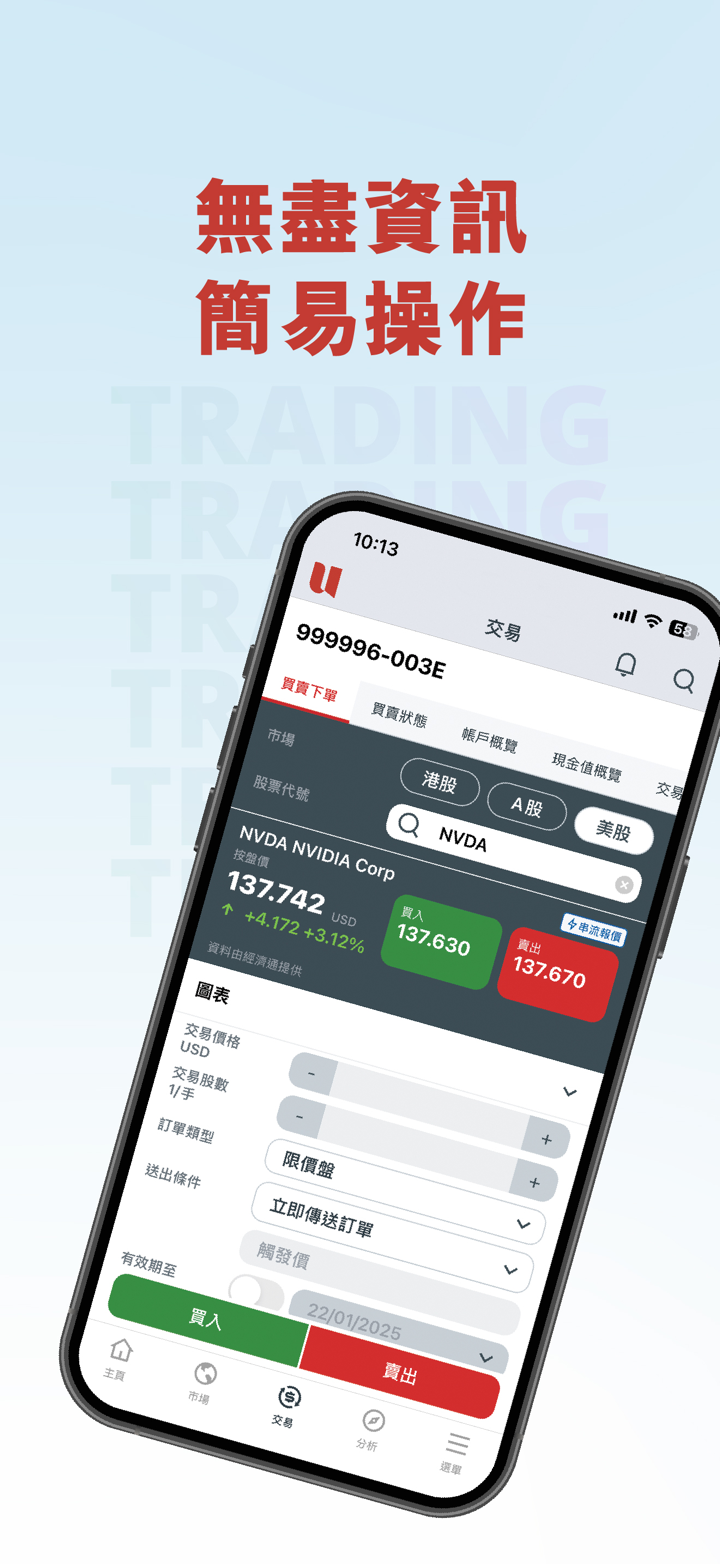

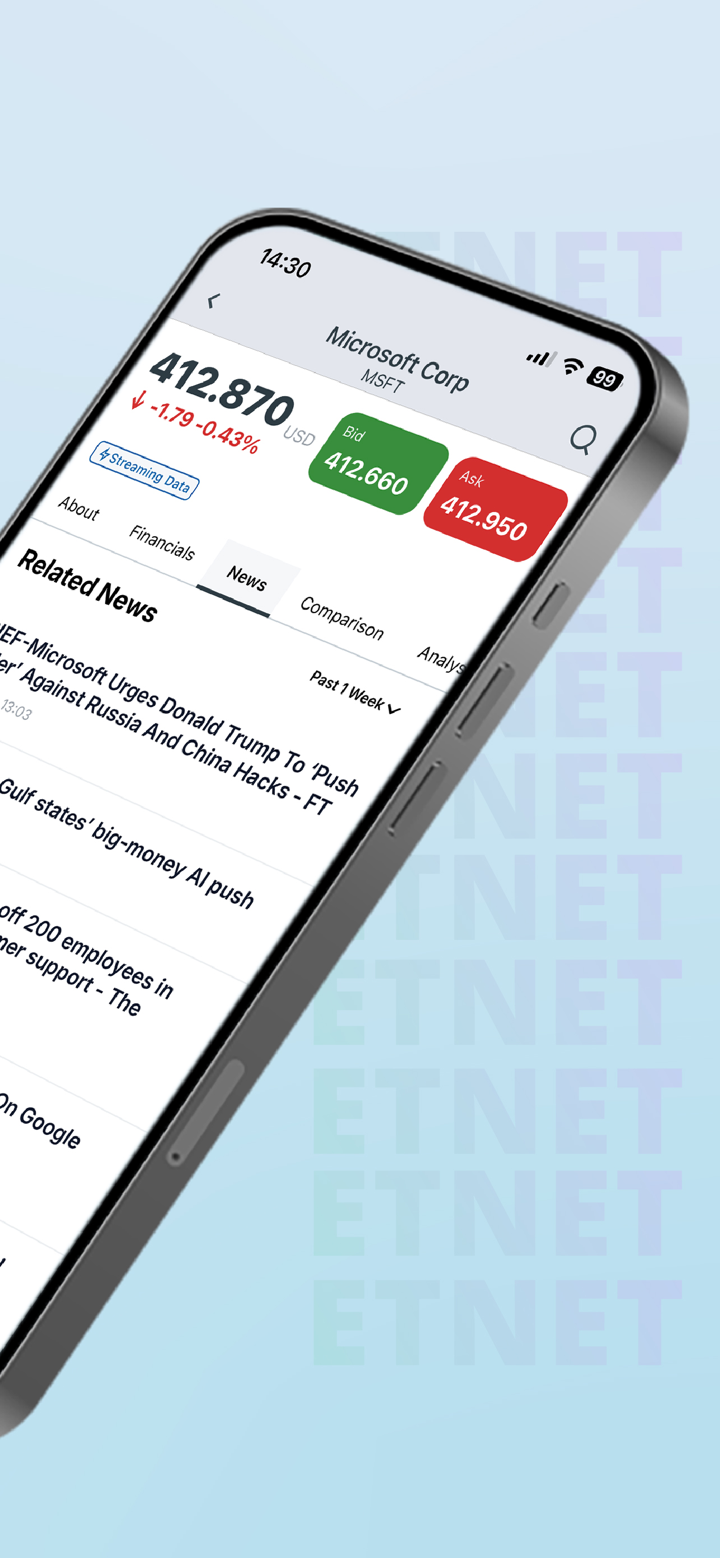

Plateforme de trading

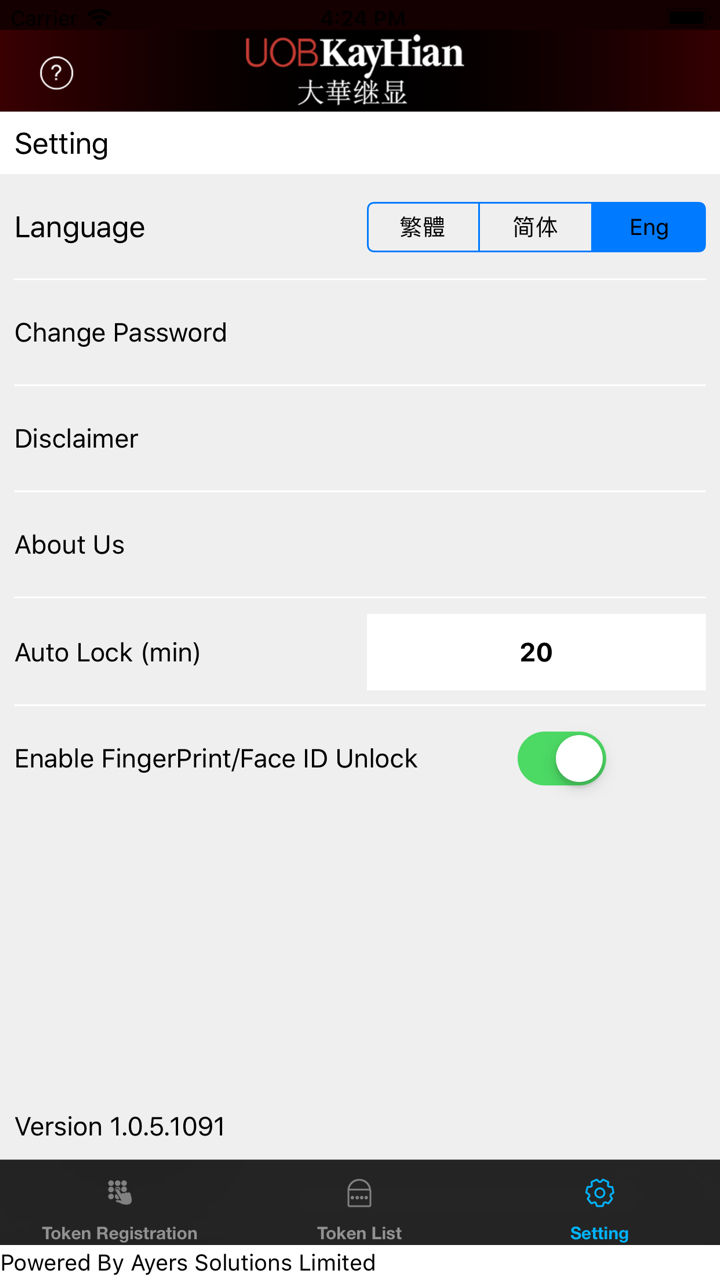

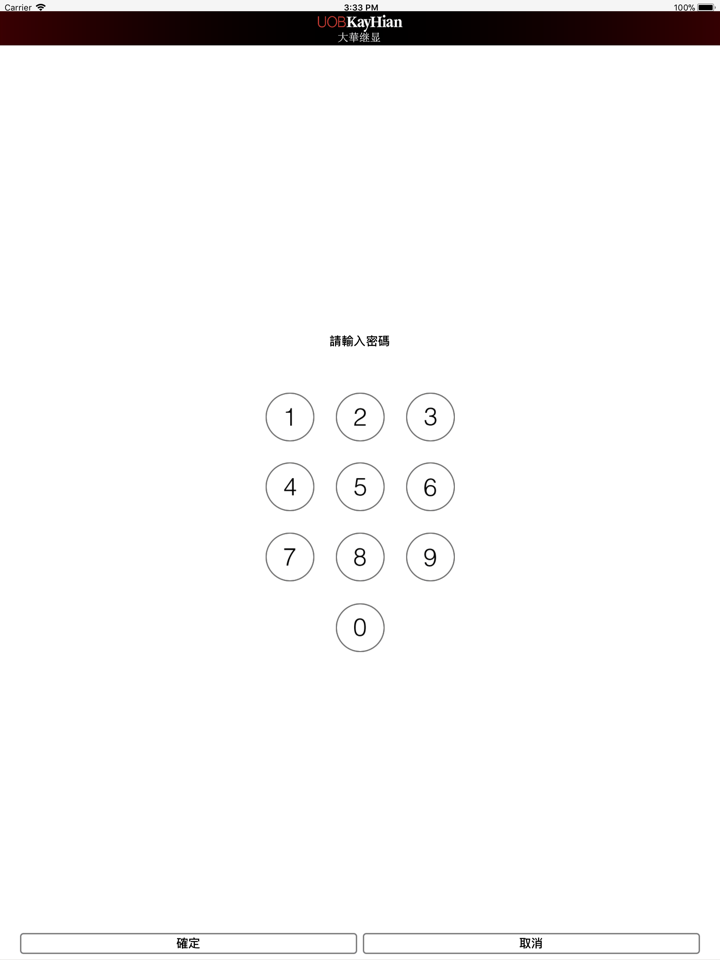

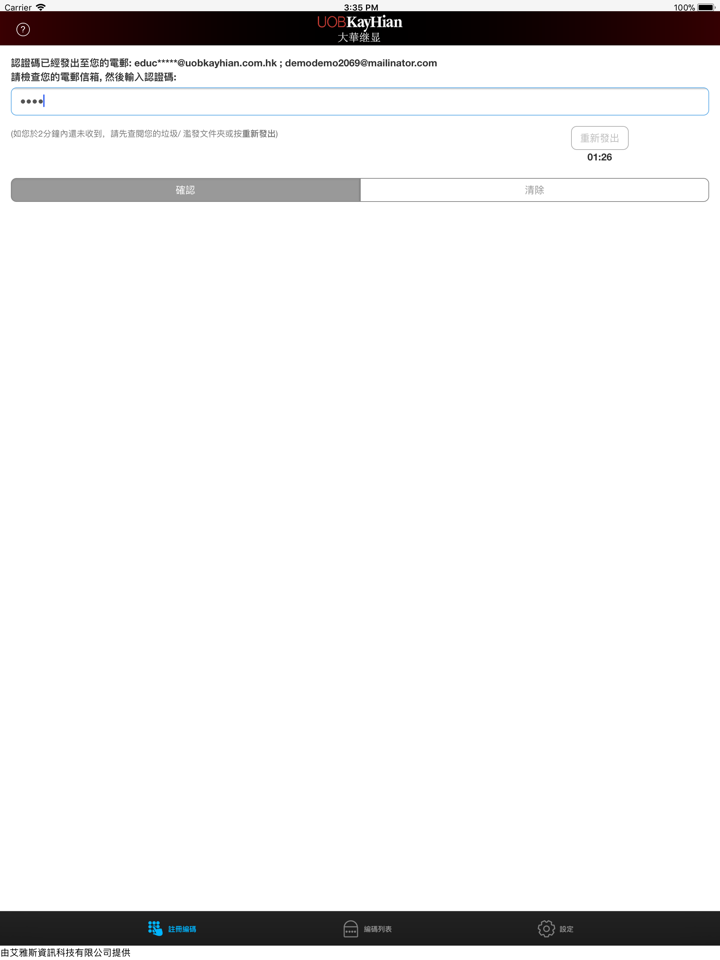

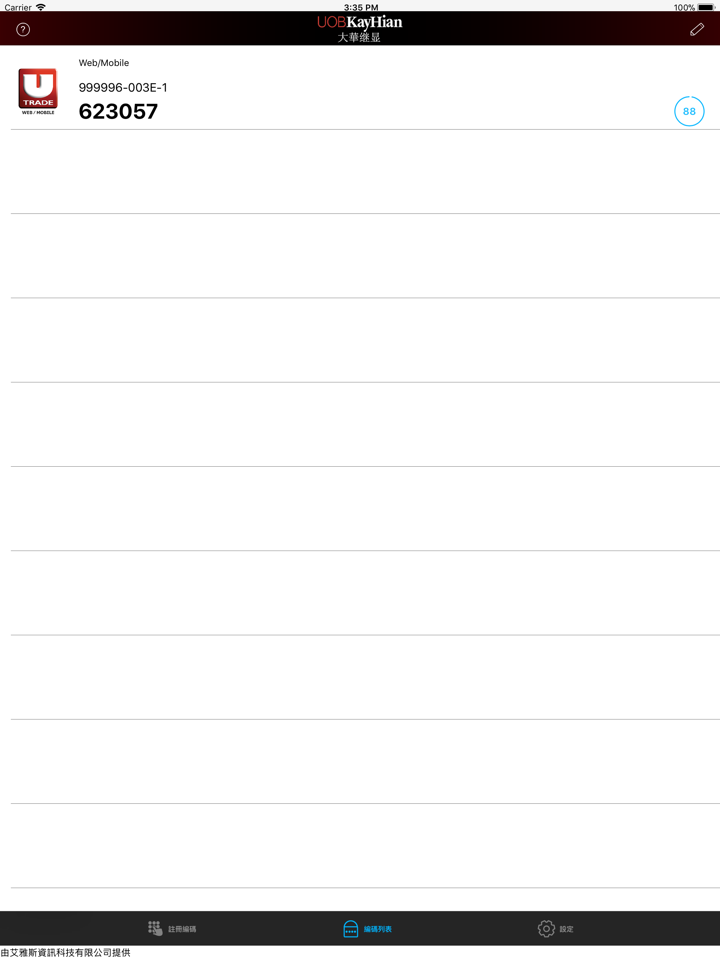

| Plateforme de trading | Pris en charge | Appareils disponibles |

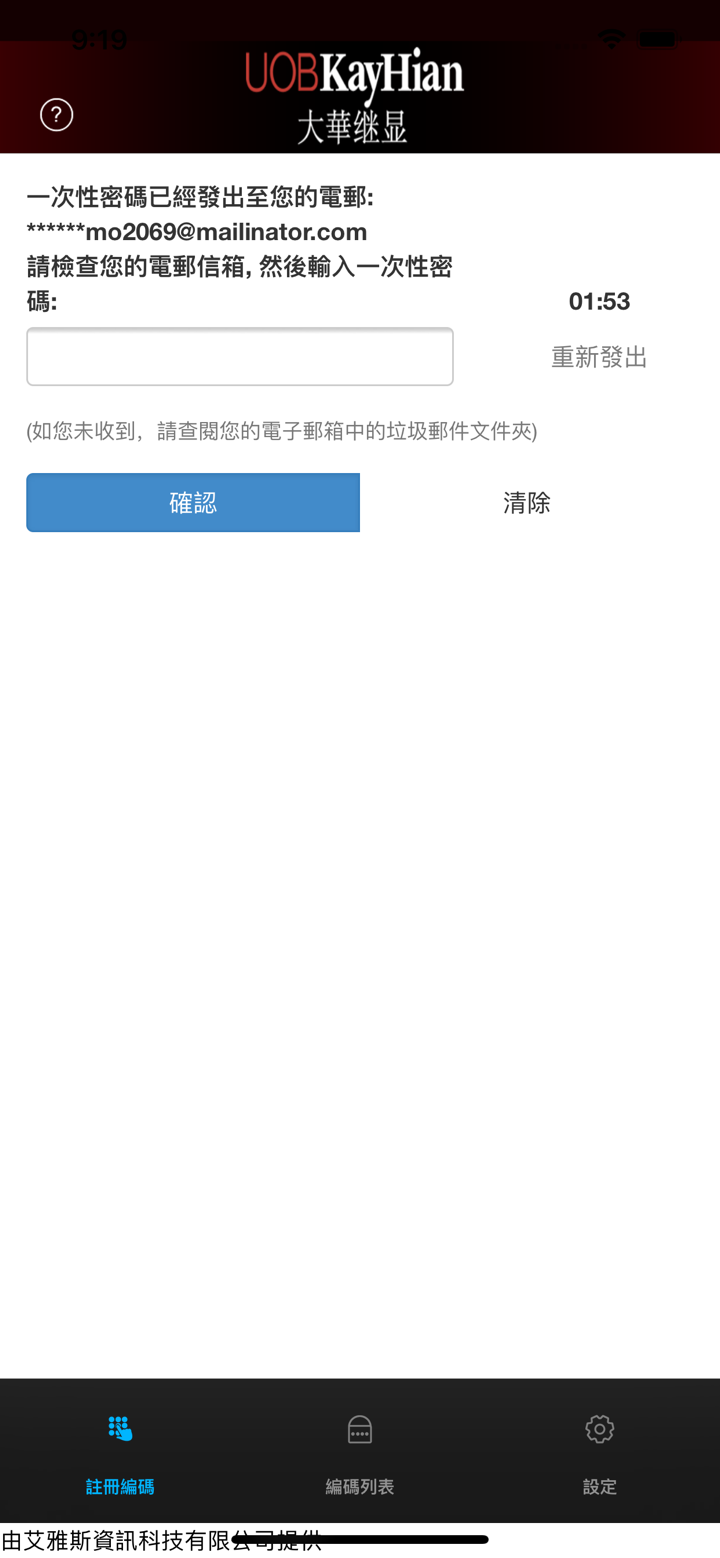

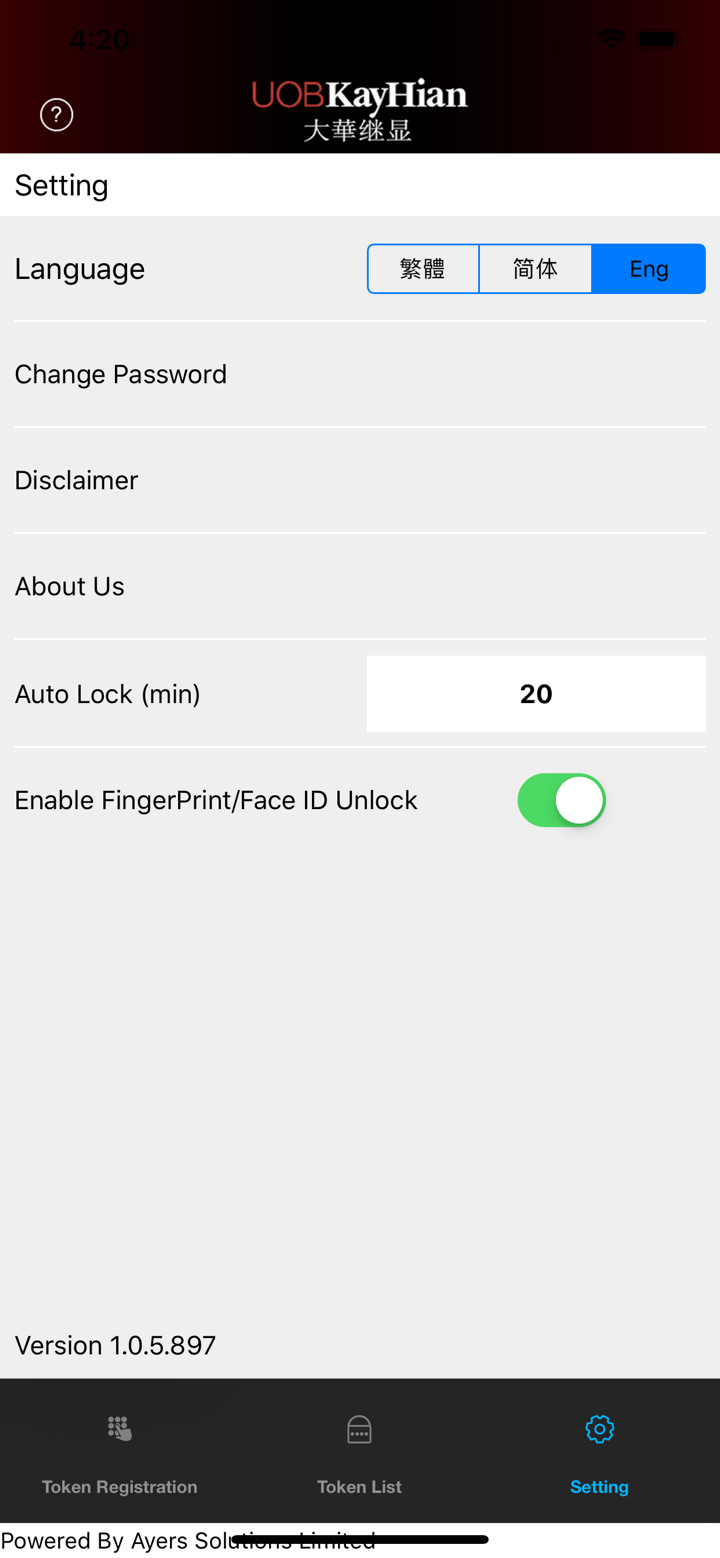

| WebTrader | ✔ | Web (basée sur le navigateur) |

| Application mobile UTRADE | ✔ | Windows, macOS, iOS, Android |