Buod ng kumpanya

| Invesco Buod ng Pagsusuri | |

| Itinatag | 1995 |

| Rehistradong Bansa/Rehiyon | Estados Unidos |

| Regulasyon | FSA |

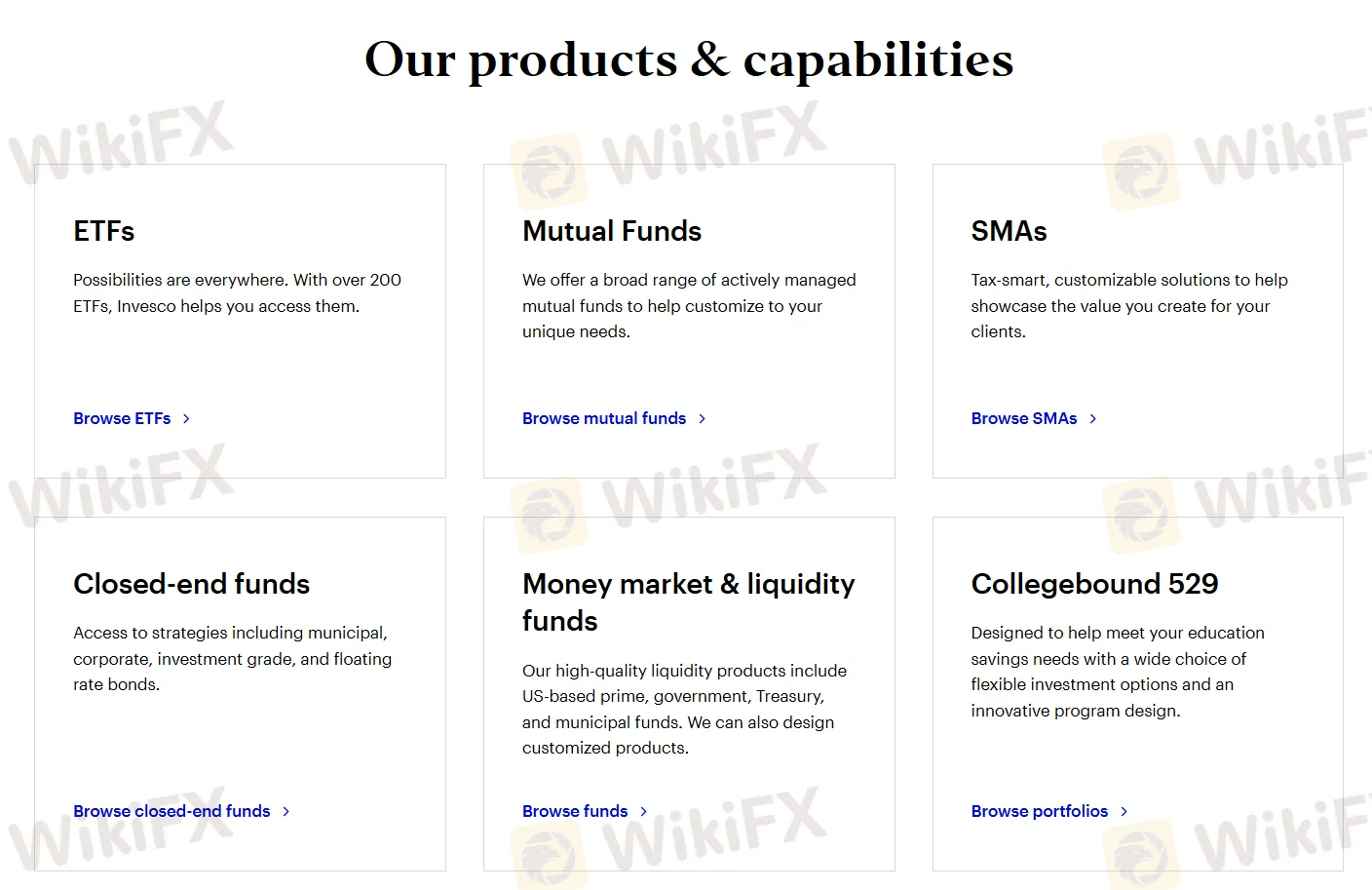

| Mga Produkto at Serbisyo | ETFs, aktibong pinamamahalaang mutual funds, SMAs, mga pondo ng saradong dulo, mga pondo sa pamilihan at liquidity, at mga plano ng Collegebound 529 |

| Suporta sa Customer | US (800) 959-4246Outside US (713) 626-1919Invesco linya ng mamumuhunan (800) 246-5463Mga pondo ng saradong dulo (800) 341-2929Lunes - Biyernes, 7:00 am-6:00 pm, CT |

Invesco Impormasyon

Ang Invesco ay isang kilalang global na kumpanya sa pamamahala ng pamumuhunan na regulado ng FSA. Nag-aalok ang kumpanya ng iba't ibang mga produkto at serbisyo sa pananalapi, kasama ang ETFs, mutual funds, SMAs, mga pondo ng saradong dulo, mga pondo sa pamilihan, at mga plano ng 529, na nagbibigay ng mga solusyon sa pamumuhunan na parehong standard at pasadyang may mga kagamitang pang-pangasiwaan ng account.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

|

|

|

|

Tunay ba ang Invesco?

Ang Invesco ay may Retail Forex License na regulado ng Financial Services Agency (FSA) sa Hapon na may numero ng lisensya na 関東財務局長(金商)第306号.

Mga Produkto at Serbisyo

Ang Invesco ay nag-aalok ng iba't ibang mga produkto at kakayahan sa pananalapi, kasama ang ETFs, aktibong pinamamahalaang mutual funds, SMAs, mga pondo ng saradong dulo, mga pondo sa pamilihan at liquidity, at mga plano ng Collegebound 529, na nagtatugon sa iba't ibang mga pangangailangan sa pamumuhunan at uri ng kliyente. Nagbibigay ang kumpanya ng mga solusyon na maaaring bilhin o pasadyang ayon sa kagustuhan.

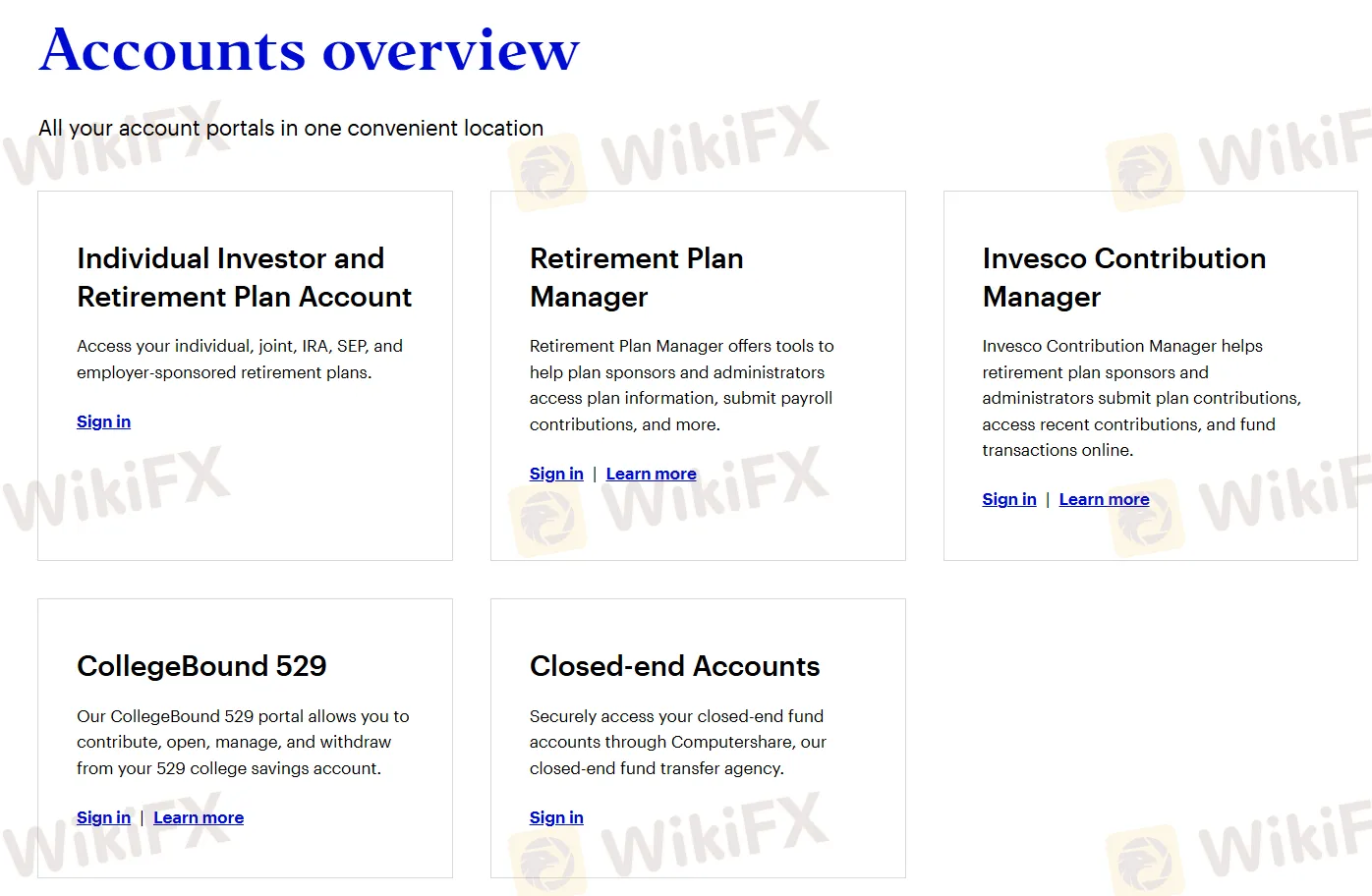

Pangkalahatang-ideya ng Mga Account

Nag-aalok ang Invesco ng access sa mga indibidwal na mamumuhunan at mga account ng retirement plan, mga tool para sa mga tagapagtaguyod at tagapamahala ng retirement plan, isang plataporma para sa pagpapamahala ng mga kontribusyon ng Invesco, access sa mga account ng CollegeBound 529, at ligtas na access sa mga account ng saradong dulo.