Buod ng kumpanya

| IndiaNivesh Buod ng Pagsusuri | |

| Itinatag | 2006 |

| Rehistradong Bansa/Rehiyon | India |

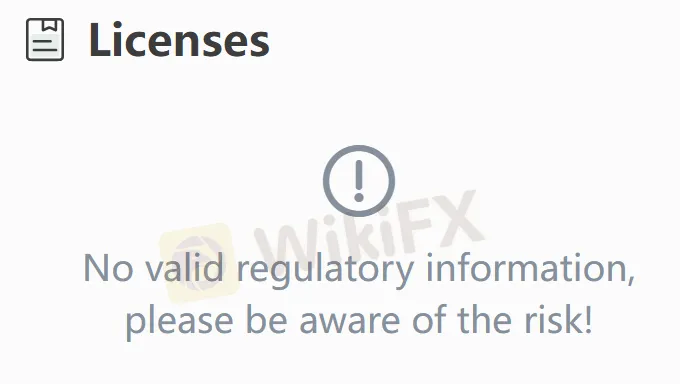

| Regulasyon | Walang regulasyon |

| Mga Instrumento sa Merkado | Mga Ekswelto, mutual funds, derivatives, IPO, currencies, insurance, commodities |

| Demo Account | ❌ |

| Platform ng Paggawa ng Kalakalan | IndiaNivesh APP |

| Suporta sa Customer | Tel: 022 – 62406240 |

| Social media: Facebook, X, Instagram, LinkedIn, YouTube | |

| Email: customersupport@indianivesh.in | |

Impormasyon Tungkol sa IndiaNivesh

Ang IndiaNivesh ay isang hindi naaayon na tagapagbigay ng pangunahing brokerage at mga serbisyong pinansyal sa India Stock Exchange. Nag-aalok ito ng mga produkto at serbisyo sa mga ekswelto, mutual funds, derivatives, IPO/OFS, currencies, insurance, commodities, LAS&MTF, mga solusyong pinersonalisa, serbisyong pangangasiwa ng portfolio, pribadong ekwiti, pangunahing mga pamumuhunan, pananaliksik, benta at kalakalan, pagtaas ng puhunan (ekwiti at utang), pagpasok sa India, globalisasyon ng mga kumpanyang Indian, mga pag-akma at pag-akwasyon.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Mahabang oras ng operasyon | Kawalan ng regulasyon |

| Iba't ibang mga paraan ng pakikipag-ugnayan | Walang demo accounts |

| Iba't ibang mga produkto at serbisyo |

Tunay ba ang IndiaNivesh?

Walang. Wala itong mga wastong regulasyon sa kasalukuyan. Mangyaring maging maingat sa panganib!

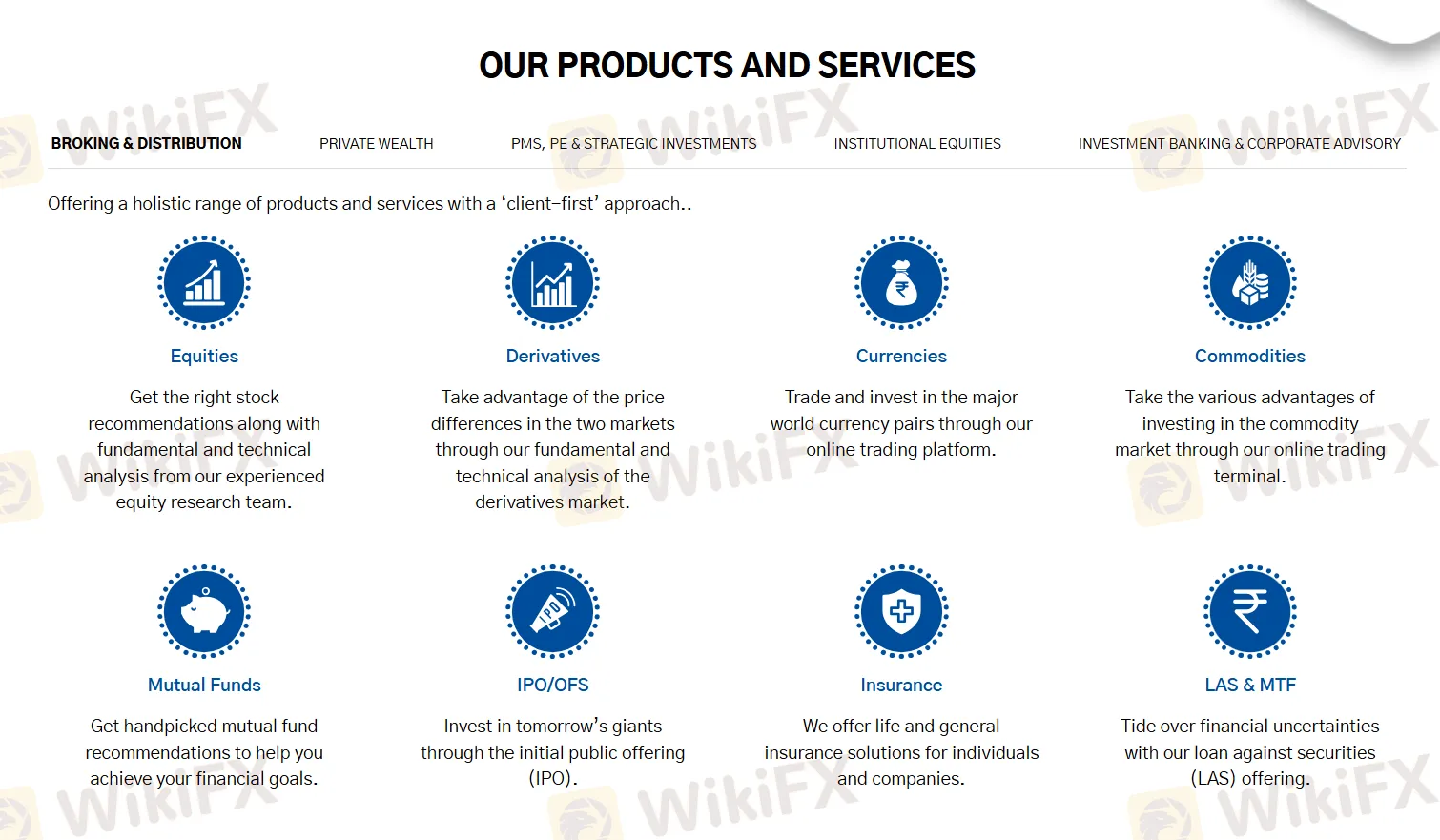

Ano ang Maaari Kong I-trade sa IndiaNivesh?

| Mga Asset sa Paghahalal | Supported |

| Mga Ekwiti | ✔ |

| Mutual funds | ✔ |

| Derivatives | ✔ |

| IPO | ✔ |

| Mga Pera | ✔ |

| Seguro | ✔ |

| Mga Kalakal | ✔ |

| Mga Indise | ❌ |

| Mga Cryptocurrency | ❌ |

| Mga Bond | ❌ |

| Mga Opsyon | ❌ |

| Mga ETF | ❌ |

Plataforma ng Paghahalal

| Plataforma ng Paghahalal | Supported | Available Devices | Suitable for |

| IndiaNivesh APP | ✔ | Mobile | / |