Perfil de la compañía

| Islamic Financial Securities Resumen de la reseña | |

| Establecido | 2003 |

| País/Región Registrada | Qatar |

| Regulación | Sin regulación |

| Instrumento de Mercado | Acciones |

| Cuenta Demo | ❌ |

| Plataforma de Trading | Aplicación |

| Depósito Mínimo | / |

| Soporte al Cliente | Formulario de contacto |

| Teléfono: +974 44498888 | |

| Fax: +974 44498802 | |

| Correo electrónico: info@wasata.qa | |

| Dirección: Edificio N.º 48, Edificio Q03, Al Kharaba Sur, Msheireb Downtown, Doha | |

| Facebook, Twitter, LinkedIn, Instagram | |

Islamic Financial Securities es una empresa financiera no regulada fundada en 2003 y con sede en Qatar. Solo ofrece trading de acciones a través de su propia aplicación. Además, hay información limitada disponible sobre detalles de cuentas y tarifas de trading.

Pros y Contras

| Pros | Contras |

| Múltiples canales de soporte al cliente | Sin regulación |

| Producto de trading único | |

| Información limitada sobre cuentas | |

| Información limitada sobre tarifas de trading | |

| Sin cuentas demo |

¿Es Islamic Financial Securities Legítimo?

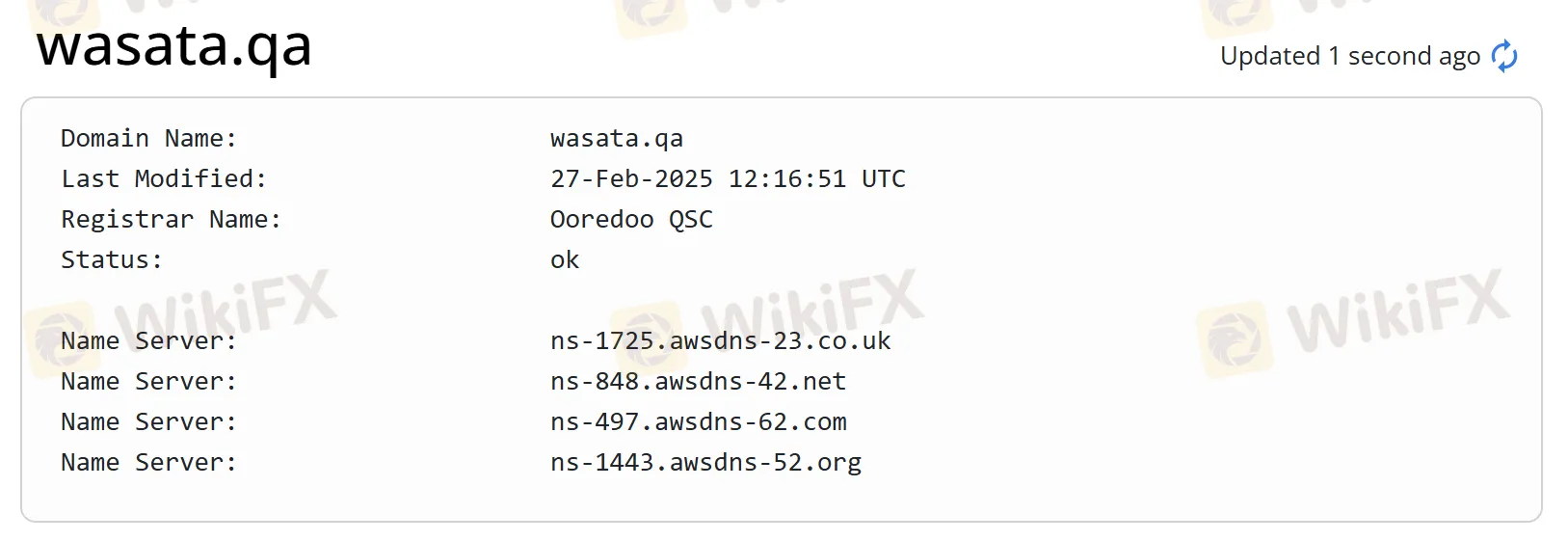

Actualmente, Islamic Financial Securities carece de regulación válida. Además, hay información limitada sobre su dominio. Le recomendamos buscar otras empresas reguladas.

¿Qué Puedo Operar en Islamic Financial Securities?

Parece que Islamic Financial Securities solo ofrece trading de acciones. Hay información limitada sobre los detalles.

| Instrumentos Negociables | Soportado |

| Acciones | ✔ |

| Forex | ❌ |

| Productos Básicos | ❌ |

| Índices | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

| Fondos Mutuos | ❌ |

Plataforma de Trading

| Plataforma de Trading | Soportado | Dispositivos Disponibles |

| Aplicación | ✔ | Google Play, App Store |