Phyntex Markets Forex Scam: $58K Blocked After $50K

Phyntex Markets forex scam: $50K withdrawal approved, $58K blocked on “toxic trading.” Unregulated Comoros broker scams Malaysian traders. Read exposure & protect funds!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When you come across a broker, such as NEWTON GLOBAL, your main concern is simple: Can you trust it for investments? The search for "Is NEWTON GLOBAL Legit" comes from needing a clear, fact-based answer to protect your capital. We understand this urgency. Read on as we answer this query.

When you come across a broker, such as NEWTON GLOBAL, your main concern is simple: Can you trust it for investments? The search for “Is NEWTON GLOBAL Legit” comes from needing a clear, fact-based answer to protect your capital. We understand this urgency. Before getting into the details, let's address the main issue directly.

From an investigative viewpoint, the initial evidence about NEWTON GLOBAL raises immediate and serious concerns. Our analysis, based on data from independent verification platforms, points to an operation with an extremely high-risk profile.

Here are the critical findings at a glance:

· Key Finding: No valid, verifiable financial regulation from a reputable authority.

· Trust Score: An alarmingly low score of 1.41 out of 10.

· Official Warning: The consensus from verification bodies is clear: “High potential risk, please stay away.”

These initial data points are not opinions; they come from a systematic review of the broker's operational and legal framework. As we will detail, these findings are supported by independent verification platforms, such as WikiFX, which track broker legitimacy through regulatory data and user experiences. This pattern of evidence forms the basis of our cautionary stance.

A low score and a warning are just the beginning. To truly understand the risk, we must break down the elements that contribute to this assessment. Examining the specific red flags associated with NEWTON GLOBAL provides a clear picture of why caution is not just advised, but essential. This deep dive helps you recognize similar warning signs in the future.

The single most important factor in a broker's legitimacy is its regulatory status. A regulated broker operates under the supervision of a government financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). These bodies enforce strict rules designed to protect traders, including keeping client funds separate and participating in compensation schemes.

NEWTON GLOBAL, operating under the company name NEWTON GLOBAL Commercial Business (NGCB) LTD, is registered in Mauritius. While Mauritius has a financial services commission, it is considered an offshore jurisdiction with significantly weaker regulatory oversight compared to tier-1 authorities.

More critically, independent verification reports find that NEWTON GLOBAL currently holds “No Regulation.” The broker's license status is flagged as “Suspicious Regulatory License.” This means there is no credible, top-tier regulatory body overseeing its operations and ensuring it follows fair financial practices. Trading with an unregulated broker removes the most fundamental layer of protection for your funds, leaving you with little to no recourse in case of disputes, withdrawal issues, or insolvency.

A trust score is not a random number. It is a data-driven metric calculated by combining multiple factors. These typically include:

· License Index: The quality and validity of the broker's licenses.

· Business Index: The broker's operational stability and business practices.

· Risk Management Index: The broker's ability to manage financial risks and protect client funds.

· Software Index: The quality and security of its trading platforms.

· Regulatory Index: The strength of the regulatory oversight.

A score as low as 1.41 out of 10 is a severe criticism of a broker's entire operation. It indicates systematic failures across nearly every assessment category. It suggests that from a risk management perspective, the broker fails to meet even the most basic industry standards for safety and reliability. Such a score is a definitive warning that the broker's operational framework is fundamentally flawed and poses a significant danger to traders' capital.

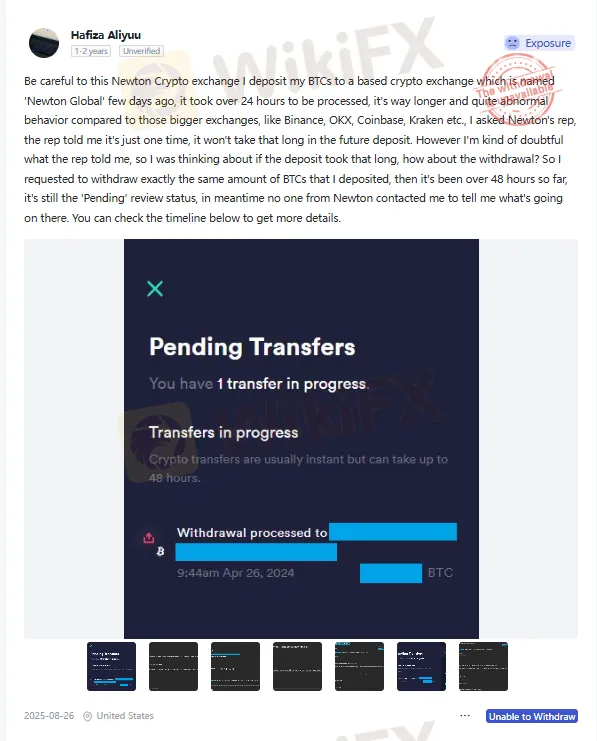

While data provides a structural overview, real-world user experiences reveal how a broker operates in practice. The “Exposure” section on verification platforms serves as a public record of user complaints, and the reports concerning NEWTON GLOBAL are deeply troubling.

One user, “عليو حيدر,” posted on August 28, 2025, with a straightforward complaint: “I can't withdraw for almost 2 days now.”

This type of issue, where traders are unable to access their own funds, is a classic red flag for a problematic broker.

An even more detailed account comes from user “Hafiza Aliyuu” on August 26, 2025. This user describes a multi-stage negative experience. First, a BTC deposit took over 24 hours to process, which is highly unusual for crypto transactions. Worried about this delay, the user attempted a withdrawal. After more than 48 hours, the withdrawal request was still stuck in “Pending” status, with no communication from the broker's support team. This user's testimony points directly to potential withdrawal obstruction, a hallmark often associated with a possible NEWTON GLOBAL scam.

In contrast, a single positive review from June 27, 2024, by user “fxhjjj” states, “Joining their program was the best decision I made this year!!!” We must analyze this critically.

The review is generic, lacks any specific details about trading, withdrawals, or platform performance, and stands in stark isolation against detailed, evidence-backed negative reports. In our experience, such vague, overly enthusiastic reviews can sometimes be a red flag themselves, used to reduce the impact of legitimate complaints.

Prospective traders can and should review these raw user reports on verification platforms such as WikiFX. These platforms are an essential resource for seeing past a broker's marketing and understanding its true performance and trustworthiness.

To provide a balanced analysis, it is important to examine what NEWTON GLOBAL claims to offer. Often, high-risk brokers attract clients with appealing trading conditions. However, these “pros” must be weighed against the overwhelming operational risks we've identified.

NEWTON GLOBAL structures its offering across several account tiers, a common practice in the industry. The low entry point is designed to attract new traders.

| Account Type | Minimum Deposit | Spreads (from) |

| Silver | $500 | 1.5 pips |

| Gold | $2,000 | 0.8 pips |

| Platinum | $10,000 | 0.5 pips |

The broker also offers high leverage up to 1:500. It is crucial to understand the dual nature of leverage. While high leverage can amplify profits, it drastically increases the risk of significant losses, often leading to a complete wipeout of a trading account. This risk is magnified exponentially when dealing with an unregulated entity where your capital is already at risk.

The broker provides access to the widely recognized MetaTrader 5 (MT5) platform and lists its own proprietary “NG Trader” as coming soon. The availability of MT5 lends an air of legitimacy, as it is a powerful and popular platform.

However, it is critical to note the absence of MetaTrader 4 (MT4). For millions of traders, MT4 remains the industry standard due to its simplicity and vast library of custom indicators and expert advisors. The lack of MT4 could be a significant drawback.

The range of tradable instruments includes Forex, Commodities, Stocks, and Indices is a standard offering for most online brokers.

Attractive features can be misleading when the foundation of the broker is unstable. A side-by-side comparison puts the advertised benefits into their proper context.

| Claimed Pro | Critical Reality |

| MT5 Platform Available | While MT5 is a legitimate platform, the software itself does not guarantee the broker's integrity. A fraudulent broker can operate on a legitimate platform, and the platform cannot protect you from the broker's actions. |

| Multiple Contact Channels | The availability of a phone number, email, and live chat means little when users report that their fundamental issues, such as withdrawal requests, are not being resolved. Effective support is about problem resolution, not just availability. |

| High Leverage (1:500) | For an unregulated broker, high leverage is more of a risk than a benefit. It encourages over-trading and can lead to rapid, catastrophic losses, from which you have no regulatory recourse to recover. |

This comparison demonstrates that the perceived advantages are overshadowed by fundamental, non-negotiable risks related to regulation and fund safety.

After a thorough examination of the evidence, we can provide a definitive conclusion and, more importantly, a clear path forward to protect yourself as a trader.

While we cannot legally label any company a “scam,” NEWTON GLOBAL exhibits all the major warning signs of an untrustworthy and high-risk operation. The evidence points overwhelmingly to a broker that you should avoid.

Let's summarize the conclusive evidence:

· No verifiable, top-tier regulation to protect your funds.

· An extremely low trust score of 1.41/10, indicating systematic failures.

· Multiple, detailed user reports of withdrawal failures and processing delays.

· Registration in a high-risk offshore jurisdiction known for weak oversight.

Based on this evidence, we conclude that engaging with NEWTON GLOBAL presents a significant and unacceptable risk to your trading capital. The probability of encountering issues, particularly with withdrawing funds, appears to be very high.

To avoid brokers like NEWTON GLOBAL, you must adopt a simple, non-negotiable rule: Never deposit funds with a broker before thoroughly verifying it on an independent regulatory and review platform.

We explicitly recommend that every trader make it a habit to use a comprehensive tool, such as WikiFX, before opening an account. Such platforms are designed to be your first line of defense. They allow you to:

1. Instantly check a broker's regulatory status and license details against official databases.

2. See a transparent, data-driven trust score that summarizes its operational risks.

3. Read real, unfiltered user reviews and exposure reports to see how the broker treats its clients in real-time.

This is not just a recommendation; it is a critical step in your due diligence process. A five-minute check can save you from months of stress and the potential loss of your entire investment.

To move forward constructively, it helps to know what to look for in a truly legitimate trading partner. A trustworthy broker will proudly display these attributes, and they will be easily verifiable.

Use this checklist in your future searches:

· ✅ Tier-1 Regulation: The broker is regulated by a top-tier authority like the FCA (UK), ASIC (Australia), CySEC (Cyprus), or other reputable national bodies.

· ✅ Long-standing Reputation: The broker has a proven track record of reliable operations over many years, ideally a decade or more.

· ✅ Transparent Fees and Processes: All costs, spreads, commissions, and withdrawal procedures are clearly stated and easy to find. There are no hidden terms.

· ✅ Overwhelmingly Positive Reviews: Look for consistent, detailed praise from a large number of users, specifically regarding fast withdrawals, responsive support, and platform stability.

Your capital is your primary tool in trading. Protecting it by choosing a well-regulated and reputable broker is the most important trade you will ever make.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Phyntex Markets forex scam: $50K withdrawal approved, $58K blocked on “toxic trading.” Unregulated Comoros broker scams Malaysian traders. Read exposure & protect funds!

Exfor clients face blocked withdrawals and no support response. Scam cases exposed—protect your funds and avoid this unregulated forex broker.

When choosing a financial services company, the most important question is about its regulatory status. For traders looking at NEWTON GLOBAL, this question is extremely important. A basic investigation using third-party verification platforms shows a worrying picture: The broker is marked for having no valid regulation. This article provides a detailed, fact-based analysis of NEWTON GLOBAL's regulatory claims, company registration, and the major risks with how it operates. We will examine the data provided by global broker inquiry apps and public records to present a clear and objective report. For any trader, an important first step before investing in any broker is to do a basic check on such a platform. This simple action can be the most important part of your research process.

Valutrades is FCA & FSA regulated, offers MT4/5 and leverage up to 1:500. Read pros, cons & full awareness review to decide if it’s right for you.