简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

CBCX Detailed Analysis

Abstract:In the highly competitive and often opaque world of forex trading, selecting a reliable broker is paramount to both capital preservation and trading success. This comprehensive analysis report examines CBCX, a forex broker that has generated mixed responses from the trading community. Our evaluation is based on a rigorous, data-driven methodology designed to provide traders and investors with an objective assessment of this broker's performance and reliability.

In the highly competitive and often opaque world of forex trading, selecting a reliable broker is paramount to both capital preservation and trading success. This comprehensive analysis report examines CBCX, a forex broker that has generated mixed responses from the trading community. Our evaluation is based on a rigorous, data-driven methodology designed to provide traders and investors with an objective assessment of this broker's performance and reliability.

Our analytical framework draws upon 18 verified user reviews collected from multiple independent review platforms, designated throughout this report as Platform A, Platform B, and Platform C to maintain methodological consistency. This multi-source approach ensures a balanced perspective that minimizes platform-specific biases and captures diverse user experiences across different trading conditions, account types, and geographical locations. Each review has been systematically evaluated using quantitative metrics and qualitative analysis to identify recurring patterns, strengths, and weaknesses.

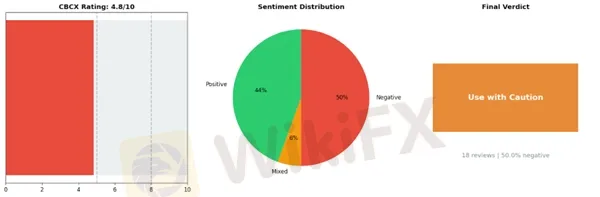

The data reveals a concerning picture: CBCX has received an overall rating of 4.83 out of 10, with a negative rate of 50.00%, indicating that half of the analyzed reviews reflect unfavorable experiences. Based on these findings, our system has assigned CBCX a “Use with Caution” conclusion, suggesting that potential clients should exercise heightened due diligence before committing capital to this platform.

This report is structured to provide readers with actionable insights across multiple dimensions of broker performance. You will find detailed analysis of user sentiment patterns, specific areas of concern raised by traders, comparative performance metrics, and practical recommendations for risk mitigation. We examine both positive and negative feedback to present a balanced view, allowing you to make informed decisions based on empirical evidence rather than marketing claims.

Whether you are considering opening an account with CBCX or evaluating your current broker relationship, this report equips you with the critical information necessary to assess whether this broker aligns with your trading objectives and risk tolerance. Our analysis prioritizes transparency and objectivity, presenting the data without commercial influence or promotional bias.

Key Issues Requiring Caution with CBCX

Recent user feedback reveals several concerning patterns at CBCX that warrant careful consideration before committing funds to this broker. While some clients report eventual resolution of their issues, the frequency and severity of complaints—particularly regarding fund access and withdrawal processing—suggest systemic problems that potential traders should understand before opening accounts.

Withdrawal Processing Concerns

The most prevalent issue centers on withdrawal delays and rejections, accounting for approximately 39% of reported problems. Multiple traders describe prolonged waiting periods extending weeks beyond initial requests, with some cases remaining unresolved for over a month. One Introducing Broker operating under IB code 888303 filed a formal complaint regarding CBCX's failure to release capital, profits, and rebates owed to clients across Vietnam, Thailand, and Indonesia. The broker disclosed their trading strategy to CBCX's Malaysia-based account manager prior to onboarding clients, yet still encountered fund release problems.

“💬 FX2092539889: ”Since April 29, my withdrawal request has not been processed. I'm using the official platform (not a phishing site)! I've emailed and confirmed with the official customer service! They asked for relevant information, which I've submitted weeks ago, yet my withdrawal is still not processed!“”

While CBCX attributes some delays to strict KYC verification and anti-arbitrage measures, the inconsistent application of these policies raises questions. Several traders report that withdrawals functioned normally initially, only to encounter sudden unexplained holds on subsequent requests.

Fund Safety and Data Security

Representing 28% of identified issues, fund safety concerns have escalated significantly. Most alarming are allegations of customer data breaches, with one reviewer claiming the platform leaked personal information including phone numbers, emails, and contact addresses. This same reviewer warned that the platform might be preparing an exit scam.

“: ”The cbcx platform has leaked all customer information, including personal data, phone numbers, emails, and contact addresses. Currently, many customers are unable to withdraw funds. It is estimated that the platform is about to run away.“”

Such allegations, whether ultimately proven or not, represent critical red flags that demand immediate verification from independent sources before depositing funds.

Customer Support Deficiencies

Approximately 17% of complaints involve inadequate customer support responses. Traders describe situations where both platform representatives and agents provide no substantive answers, simply instructing clients to wait indefinitely. This communication breakdown compounds the stress of frozen funds and creates an environment where traders feel powerless to resolve legitimate concerns.

“💬 Get rich quicK: ”Initially, there were no issues with withdrawals. Suddenly, last Friday, my withdrawal was stuck and they gave no explanation. Neither platform customer service nor the agent provided any response, the agent just told me to wait.“”

Promotional Practices and Rule Clarity

Additional concerns involve promotional offers that allegedly fail to deliver promised benefits. One trader specifically mentioned a 20% Malaysian ID promotional discount, only to face withdrawal restrictions despite not executing any trades. The anti-arbitrage mechanisms, while potentially legitimate risk management tools, appear overly aggressive and poorly communicated, catching even novice traders in their net.

Risk Assessment

For active traders, the withdrawal delays pose significant operational risks, potentially trapping capital needed for time-sensitive opportunities. Introducing Brokers face reputational damage and client relationship problems when unable to secure owed rebates. Even conservative investors making simple deposits face unexplained holds that contradict basic expectations of fund accessibility.

Given the pattern of complaints, concentration in Southeast Asian markets, and particularly the data breach allegations, extreme caution is warranted when considering CBCX until these issues receive transparent, verifiable resolution.

Positive Aspects of CBCX: Strengths That Require Informed Consideration

CBCX has garnered positive feedback from active traders, particularly regarding three core operational areas: deposit and withdrawal processes, platform usability, and execution speed. While these strengths merit recognition, prospective users should approach these advantages with appropriate due diligence and realistic expectations.

Deposit and Withdrawal Efficiency

The most frequently cited positive aspect involves CBCX's fund processing capabilities. Multiple users report successful withdrawals with minimal delays, suggesting the broker maintains functional payment infrastructure. One trader noted their experience with the platform's support system:

“💬 FX4132923956: ”There was a delay in withdrawal once because I uploaded incorrect information, but the customer service immediately reminded me to make up for it, and the funds were credited the next day.“”

This feedback indicates that while the system generally functions as intended, user errors can cause delays—a reminder that proper documentation remains essential. Another user reported instant withdrawal processing, though it's worth noting they mentioned platform version differences that could affect user experience. The variance in reported withdrawal times—from instant to next-day processing—suggests performance may depend on factors including payment method, verification status, and account standing.

Platform Interface and Accessibility

Users describe CBCX's interface as clear and convenient, with recent CRM updates apparently improving the user experience. The platform appears designed for straightforward navigation, which benefits both novice and experienced traders:

“💬 FX3746530712: ”I have been trading on CBCX for a while and it is pretty good. I personally feel it is very convenient and the withdrawal of funds is also very fast.“”

However, prospective users should independently verify current platform features, as interface quality can vary across different access points and account types. What works seamlessly for one trader may present challenges for another depending on technical setup and trading requirements.

Execution Speed and Trading Conditions

Several traders commend CBCX's execution speed and competitive spreads, critical factors for active trading strategies. One experienced user provided this assessment:

“After using it for half a year, the trading speed is very fast and the spread is also good. The only drawback is that RMB deposits are not accepted.”

This comment highlights both a strength and a limitation—fast execution paired with restricted deposit options for certain currencies. Traders should verify whether available funding methods align with their needs before committing capital.

While these positive experiences reflect genuine user satisfaction, the limited sample size and timeframe of reviews warrant cautious interpretation. Prospective clients should conduct independent research, verify regulatory status, test the platform with minimal capital initially, and ensure CBCX's operational framework aligns with their specific trading requirements and risk tolerance.

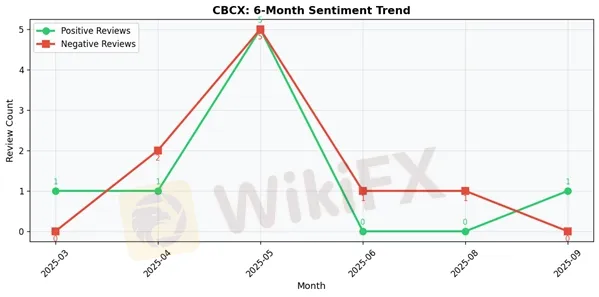

📊 CBCX: 6-Month Review Trend Data

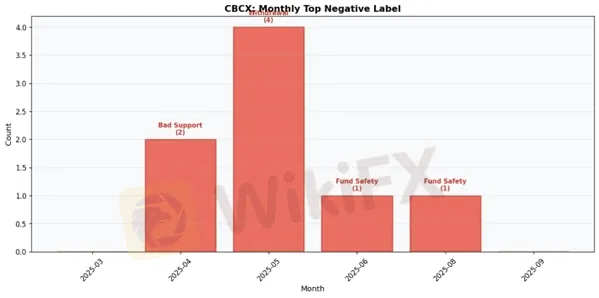

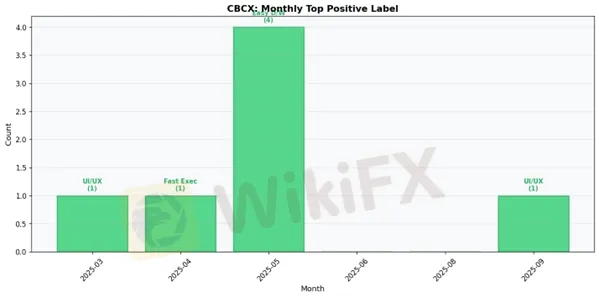

2025-03:

• Total Reviews: 1

• Positive: 1 | Negative: 0

• Top Positive Label: User Friendly Interface

• Top Negative Label: N/A

2025-04:

• Total Reviews: 3

• Positive: 1 | Negative: 2

• Top Positive Label: Fast Execution Low Latency

• Top Negative Label: Slow Support No Solutions

2025-05:

• Total Reviews: 11

• Positive: 5 | Negative: 5

• Top Positive Label: Easy Deposit Withdrawal

• Top Negative Label: Withdrawal Delays Rejection

2025-06:

• Total Reviews: 1

• Positive: 0 | Negative: 1

• Top Positive Label: N/A

• Top Negative Label: Fund Safety Issues

2025-08:

• Total Reviews: 1

• Positive: 0 | Negative: 1

• Top Positive Label: N/A

• Top Negative Label: Fund Safety Issues

2025-09:

• Total Reviews: 1

• Positive: 1 | Negative: 0

• Top Positive Label: User Friendly Interface

• Top Negative Label: N/A

CBCX Final Conclusion

CBCX presents a concerning profile that warrants significant caution from traders of all experience levels. With a final rating of 4.83 out of 10 and a troubling 50% negative review rate across 18 total reviews, this broker exhibits fundamental reliability issues that overshadow its operational strengths.

The data reveals a stark contradiction in CBCX's service delivery. While the platform demonstrates genuine competencies in user experience—offering easy deposit and withdrawal processes, an intuitive interface, and fast execution with low latency—these positives are severely undermined by critical deficiencies in core trust areas. The most alarming concerns center on withdrawal delays and rejections, fund safety issues, and inadequate customer support that fails to provide timely solutions. This pattern suggests that while CBCX may function smoothly during the account funding and trading phases, serious problems emerge when clients attempt to access their capital, which represents an unacceptable risk for any trader.

For beginner traders, CBCX cannot be recommended despite its user-friendly interface. New traders are particularly vulnerable to withdrawal complications and require brokers with proven track records of fund security and responsive support. The learning curve in forex trading is steep enough without adding concerns about capital accessibility.

Experienced traders should approach CBCX with extreme skepticism. While the fast execution and low latency might appear attractive for active trading strategies, the withdrawal issues and fund safety concerns create an unacceptable risk-reward equation. No trading advantage justifies compromising capital security.

High-volume traders should definitively avoid CBCX. The combination of withdrawal problems and fund safety issues becomes exponentially more dangerous when dealing with substantial capital. High-volume traders require institutional-grade reliability that CBCX's performance metrics simply do not support.

For specific trading styles, the concerns remain universal. Scalpers might initially appreciate the low latency execution, but withdrawal complications negate any technical advantages. Swing traders and position traders face even greater exposure given longer capital commitment periods with a broker demonstrating questionable fund management practices.

The limited review sample of 18 assessments does introduce some statistical uncertainty, yet the 50% negative rate is too substantial to dismiss. This isn't a case of isolated complaints but rather a consistent pattern affecting half of all reviewers. The “Use with Caution” system conclusion appropriately reflects the risk profile, though many analysts would argue this assessment may still be too generous given the severity of reported issues. CBCX may allow you to enter trades efficiently, but a broker's true character is revealed when you attempt to leave—and that's precisely where this platform's most serious failures emerge.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

9Cents Review 2026: Is this Broker Safe?

Titan Capital Markets Review 2026: Comprehensive Safety Assessment

Plus500 Scam Alert: Withdrawal Issues Exposed

PXBT Review: A Seychelles-Based Trap for Your Capital

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

Here are the five key takeaways from the January jobs report

Is Alpari safe or scam? What You Need to Know

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

Currency Calculator