简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

TransXmarket Regulation Explained: Is TransXmarket Properly Regulated or Not?

Abstract:When checking out a forex broker, the first and most important question is about regulation. For TransXmarket Regulation , the answer is straightforward . Based on thorough public information and independent checking, TransXmarket currently operates without a valid financial regulatory license. This lack of oversight puts it in a high-risk category for any investor. The broker's extremely low score on global verification platforms serves as an immediate and serious warning sign. This article provides an investigative look into the evidence, breaking down the company's corporate structure, its license claims, and the real-world experiences of its users to provide a complete risk assessment.

When checking out a forex broker, the first and most important question is about regulation. For TransXmarket Regulation , the answer is straightforward . Based on thorough public information and independent checking, TransXmarket currently operates without a valid financial regulatory license. This lack of oversight puts it in a high-risk category for any investor. The broker's extremely low score on global verification platforms serves as an immediate and serious warning sign. This article provides an investigative look into the evidence, breaking down the company's corporate structure, its license claims, and the real-world experiences of its users to provide a complete risk assessment.

The Bottom Line on TransXmarket Regulation

The main finding of our investigation is clear: TransXmarket Regulation raises serious concerns, as TransXmarket is flagged as having no valid financial regulatory license. This conclusion is based on data from the global broker inquiry platform, WikiFX, which is an important first stop for any trader's research process.

The platform gives TransXmarket an alarmingly low score of 3.65 out of 10.0, a rating that signals significant potential risks to investors. This score is not random; it is a combined measure reflecting the broker's lack of licensing, questionable business practices, and user-reported issues. This article will break down the details behind this score, examining their corporate registration, analyzing their license claims, and reviewing first-hand user reports to give you a complete picture of the risks involved with broker.

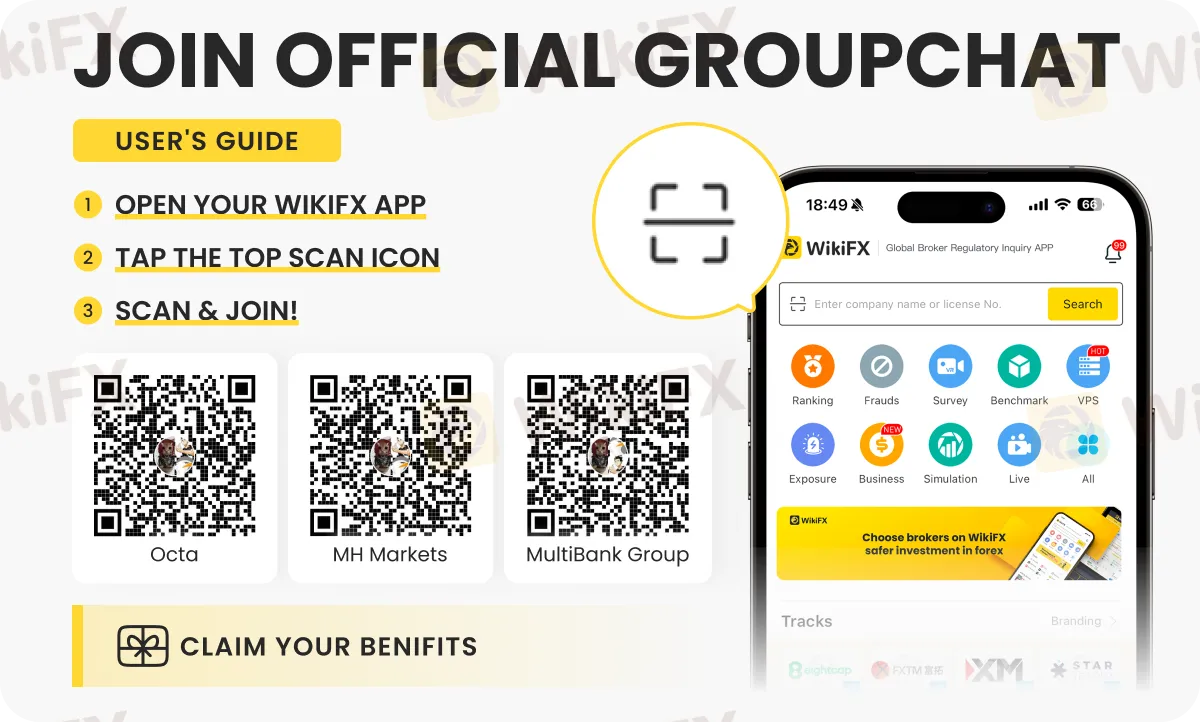

For a real-time view of their status and to see the full report, traders are strongly advised to check the TransXmarket profile on WikiFX before depositing any funds as this remains one of the most reliable ways to verify Regulation and overall broker credibility. Click here to www.wikifx.com/en/dealer/2195511036.html Checkout the TransXmarket Profile.

Understanding Corporate Registration

A common point of confusion for new traders is the difference between a registered business and a regulated financial services provider. A company can be legally registered in a country without being licensed to offer investment services. Understanding this difference is key to evaluating TransXmarket Regulation .

Official Company Information

Public records show TransXmarket's corporate details spread across two very different locations. This dual-location footprint requires careful analysis.

| Detail | Information from Public Records |

| Company Name | TransX Markets Limited |

| Registered Region | Saint Lucia |

| Registered Address | Ground Floor, The Sotheby, Rodney Village, ST. Lucia P.O Box : 838. |

| Operating Period | 2-5 years |

| Associated US Entity | Trans X Market Ltd (Colorado, United States) |

| US Entity Agent | SAMMIE T SHIELDS III |

TransXmarket Regulation - Saint Lucia Connection

To answer the TransXmarket Regulation question, we want you to know TransXmarket's primary registration is in Saint Lucia, a location widely recognized as an offshore financial center. While registration here is legal, it has significant implications for trader security.

Offshore locations like Saint Lucia, the Marshall Islands, or St. Vincent and the Grenadines are attractive to some brokers because their regulatory frameworks are often minimal or non-existent for international forex operations. The requirements for setting up a company are lenient, and there is little to no ongoing supervision of business practices. This offshore registration presents the clear picture of TransXmarket Regulation in front of you.

For a trader, this means:

• No Investor Protection: Unlike top-tier regulators like the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC), offshore locations typically do not offer investor compensation schemes. If the broker becomes insolvent or engages in fraud, your funds are not insured.

• No Dispute Resolution: There is no independent ombudsman or formal dispute resolution body to turn to if you have a problem, such as a withdrawal refusal. Your only option would be through the local legal system, which is often impractical and costly.

• Lower Operational Standards: Brokers in these regions are not held to the same standards for capital adequacy, segregation of client funds, or fair trade execution.

The US Connection

The mention of an entity named “Trans X Market Ltd” registered in Colorado, USA, can be misleading when evaluating TransXmarket Regulation. It is important to understand what this registration is—and what it is not. This is a standard business registration filed at the state level. It allows a company to exist legally within that state but gives no authority whatsoever to offer financial services.

To legally offer forex trading to US residents, a broker must be registered with the Commodity Futures Trading Commission (CFTC) and be a member of the National Futures Association (NFA). These are the top-tier federal regulators in the United States, known for having some of the strictest rules in the world. TransXmarket holds no such licenses. From a TransXmarket Regulation standpoint, the Colorado registration is, for all practical purposes, a misleading detail that adds an appearance of legitimacy without providing any actual regulatory protection.

Investigating the TransXmarket License Claims

With the corporate structure clarified, we turn to the most important question for any trader: does TransXmarket hold a license for forex trading? Any discussion of TransXmarket Regulation must be based on verified data from official regulatory bodies rather than marketing claims.

Verdict: No Valid License

Our investigation, supported by the findings on WikiFX, confirms a stark reality. The platform's official verdict is clear: “No forex trading license found. Please be aware of the risks.”

This is the single most important factor determining a broker's legitimacy. A financial license is not just a piece of paper; it is a legal commitment to operate under a set of rules designed to protect consumers. These rules govern how a broker handles client money, ensures fair pricing, and provides transparency. Operating without a license means the broker is accountable to no one but its owners, which severely undermines TransXmarket Regulation and leaves clients completely exposed.

The MT5 License Myth

Traders visiting TransXmarket's profile or website might see a reference to an “MT5 Full License” and mistakenly believe this is a form of regulation. This is a dangerous and common misconception that dishonest brokers often exploit.

Here is the important distinction:

• Myth: An MT5 Full License means the broker is legitimate, vetted, and safe to trade with.

• Fact: An MT5 license is a software license purchased from MetaQuotes Software Corp., the company that develops the MetaTrader 4 and MetaTrader 5 trading platforms.

This license simply means the broker has paid for the right to use the MT5 platform technology. It is a business-to-business transaction. MetaQuotes does not regulate brokers, verify compliance, or assess TransXmarket Regulation in any form. Any broker, regulated or not, can purchase this software if they have the funds.

A Suspicious License Flag

Further adding to the concerns is the “Suspicious Regulatory License” tag associated with TransXmarket on verification platforms. This flag is applied when a broker's license claims are doubtful and reinforces the absence of genuine TransXmarket Regulation. It can indicate several possibilities:

• The broker may be using the details of a legitimately regulated firm (a “clone”).

• The license may have expired and has not been renewed.

• The license may be issued by a private, self-proclaimed “regulator” with no legal authority or government backing.

In any of these scenarios, the outcome for the trader is the same: there is no genuine regulatory protection. The distinction between a software license and a regulatory license is vital. You can examine these details yourself on the comprehensive TransXmarket review on WikiFX.

A Look at User Reviews

The abstract risks of dealing with an unregulated broker become real when we examine the experiences of actual users. While online reviews can be mixed, a clear pattern of serious complaints is a major warning sign.

The Official Warning

Verification platforms often issue explicit warnings based on a broker's risk profile. In this case, the message is direct: “Low score, please stay away!” This warning is a direct consequence of the lack of regulation combined with an accumulation of negative user reports.

Serious Withdrawal Allegations

The most frequent and severe complaints against unregulated brokers involve withdrawal problems. For TransXmarket, user reports filed in 2024 and 2025 paint a troubling picture.

• Case 1: Withdrawal Rejection. A verified user from the United States shared their experience: “I've been trading with TransXmarket for long... when I tried to withdraw my earnings, I was met with rejection without any clear explanation or justification.” This is a classic tactic used by problematic brokers to hold onto client funds.

• Case 2: Fraud Allegations. Another user, from the United Arab Emirates, made even more serious claims: “The broker is fraud. They booked fraud trades to show loss when placed a request for withdrawal... There is money available but they are not approving the withdrawal.” This allegation of active manipulation of a client's account to prevent withdrawal is one of the most severe accusations that can be made against a broker.

These reports directly illustrate the dangers. Without a regulator to enforce rules on processing withdrawals, a client is left at the complete mercy of the broker.

Acknowledging Positive Feedback

To provide a balanced view, it is important to note that not all user feedback is negative. Several reviews from late 2024 praise TransXmarket for “buttery smooth” withdrawals and helpful support staff. One user from the UAE called it a “very good broker” due to fast transactions.

However, these positive reports must be viewed with extreme caution. With unregulated entities, positive experiences can be inconsistent and often occur during the early stages of a client's relationship with the broker to build trust. The true test comes when a client attempts to withdraw a significant sum. The severe allegations of withdrawal failures and fraud carry far more weight, as they highlight the potential for total financial loss—a risk that positive reviews cannot eliminate. The absence of a regulator means there is no guarantee that a positive experience today will not turn into a catastrophic one tomorrow.

Final Verdict on TransXmarket Regulation

After a thorough review of TransXmarket's corporate structure, licensing status, and user feedback, our conclusion is clear and firm. The evidence points to an extremely high-risk operation that traders should approach with the utmost caution.

Summary of Findings

| Assessment Area | Finding | Risk Level |

| Financial Regulation | None Found | Very High |

| Corporate Location | Saint Lucia (Offshore) | High |

| License Claims | MT5 Software License (Misleading) | High |

| User Reports | Severe allegations of withdrawal issues & fraud | Very High |

| Overall Score (WikiFX) | Extremely Low (1.83/10) | Very High |

Our Clear Recommendation

Based on the complete lack of credible financial regulation, the offshore registration, the misleading claims regarding an MT5 license, and the serious user-reported issues involving withdrawal denials and alleged fraud, we cannot recommend engaging with TransXmarket. The risks to your capital are substantial and unjustifiable.

Trading with an unregulated broker is a gamble where the odds are heavily stacked against you. Your funds are not protected by segregation or compensation schemes, and you have no effective legal or regulatory recourse in the event of a dispute.

The Golden Rule for Traders

The most powerful tool a trader has is proper research. The issues highlighted in this report could have been identified by any trader before they deposited a single dollar. Protecting yourself from scams and problematic brokers requires a simple, disciplined process.

1. Always prioritize regulation. Only consider brokers regulated by a reputable authority in a top-tier location.

2. Never confuse a software license (like MT5) or a simple business registration with a financial license.

3. Verify every claim. Use independent, third-party verification tools to check a broker's license and history.

Make it a habit. Before you even create an account, check the broker's complete, up-to-date regulatory status and user reviews on a trusted platform like WikiFX. Checkout TransXmarket Regulation https://www.wikifx.com/en/dealer/2195511036.html Now .It is the single most important step you can take to safeguard your capital and ensure you are dealing with a legitimate financial entity.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Currency Calculator