简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Naqdi Review 2026: Is this Forex Broker Legit or a Scam?

Abstract:Naqdi holds a valid South African FSCA license and offers the popular MT5 platform, resulting in a moderate WikiFX score of 6.20. However, recent serious trader complaints regarding withdrawal failures and rumors of insolvency create significant risks that potential clients must weigh against its regulatory status.

Executive Summary: Naqdi is a regulated South African broker offering the industry-standard MT5 platform and high leverage options. However, despite a valid license, recent user reports alleging withdrawal failures and bankruptcy rumors suggest high risk for potential clients.

Finding a trustworthy trading partner can be stressful. You want to grow your wealth, not worry about whether youll ever see it again. Before you find a Forexbroker to trust with your hard-earned capital, you need to look past the flashy website and check the facts. In this Naqdi review, we analyze their safety protocols, trading conditions, and real user feedback to help you decide. Currently, Naqdi holds a WikiFX Score of 6.20, a moderate score that reflects a mix of valid regulation and concerning operational feedback.

Question 1: Regulation & Safety: Is my money safe?

When you hand money over to a broker, the most critical question is: “Who is watching them?” For Naqdi, the overseeing body is the Financial Sector Conduct Authority (FSCA) in South Africa.

Naqdi Group (PTY) LTD is the licensed entity (License No. 51598). This confirms that their regulation status is active and legitimate. They have been established since 2021, giving them a few years of history in the market.

Why does this matter?

Regulators like the FSCA are like the referees in a sports game. They ensure the broker follows specific rules regarding conduct and financial reporting. Without regulation, a broker is essentially a “wild west” operation where you have no protection if they disappear.

However, it is important to understand that while the FSCA is a respected Tier-2 regulator, it does not always offer the same level of granular protection (such as strict compensation schemes) as Tier-1 regulators like the FCA in the UK. Furthermore, a license proves the company is legal, but it does not physically prevent a company from running out of money. It simply ensures they are supposed to manage risk responsibly.

Question 2: Are the trading fees and leverage fair?

Once you know a broker is regulated, you need to know if their costs will eat up your profits. Naqdi offers three main account types: Elite, Premier, and Standard.

The Leverage Trap

Naqdi offers maximum leverage of 1:500. For a beginner, this sounds exciting—it means with just $1, you can control $500 worth of currency. But in the world of Forex trading, leverage is a double-edged sword. While it can magnify your wins, it magnifies your losses just as fast. If the market moves 0.2% against you, you could lose your entire deposit instantly. A 1:500 ratio is considered very high and risky for inexperienced traders.

Spreads and Costs

The “spread” is the commission you pay to the broker on every trade.

- Elite Account: Spreads as low as 0.0 pips (likely with a commission per lot).

- Standard Account: Spreads start at 1.4 pips.

If you are a casual trader, 1.4 pips is acceptable but not the cheapest on the market. If you trade frequently, these costs add up, making it harder to stay profitable in the long run.

Question 3: What are real traders complaining about?

A license is good on paper, but how does the broker treat actual clients? We analyzed the WikiFX database and found 4 complaints in just the last 3 months. This is a high frequency for a smaller broker.

Case 1: The “Bankrupt” Allegation

A user from the UAE reported in late 2025 that they had not received a withdrawal for four months. The user claimed that employees were quitting due to bad management and bluntly stated, “This people are bankrupt.” When a broker delays withdrawals for months, it is often a sign of severe liquidity issues.

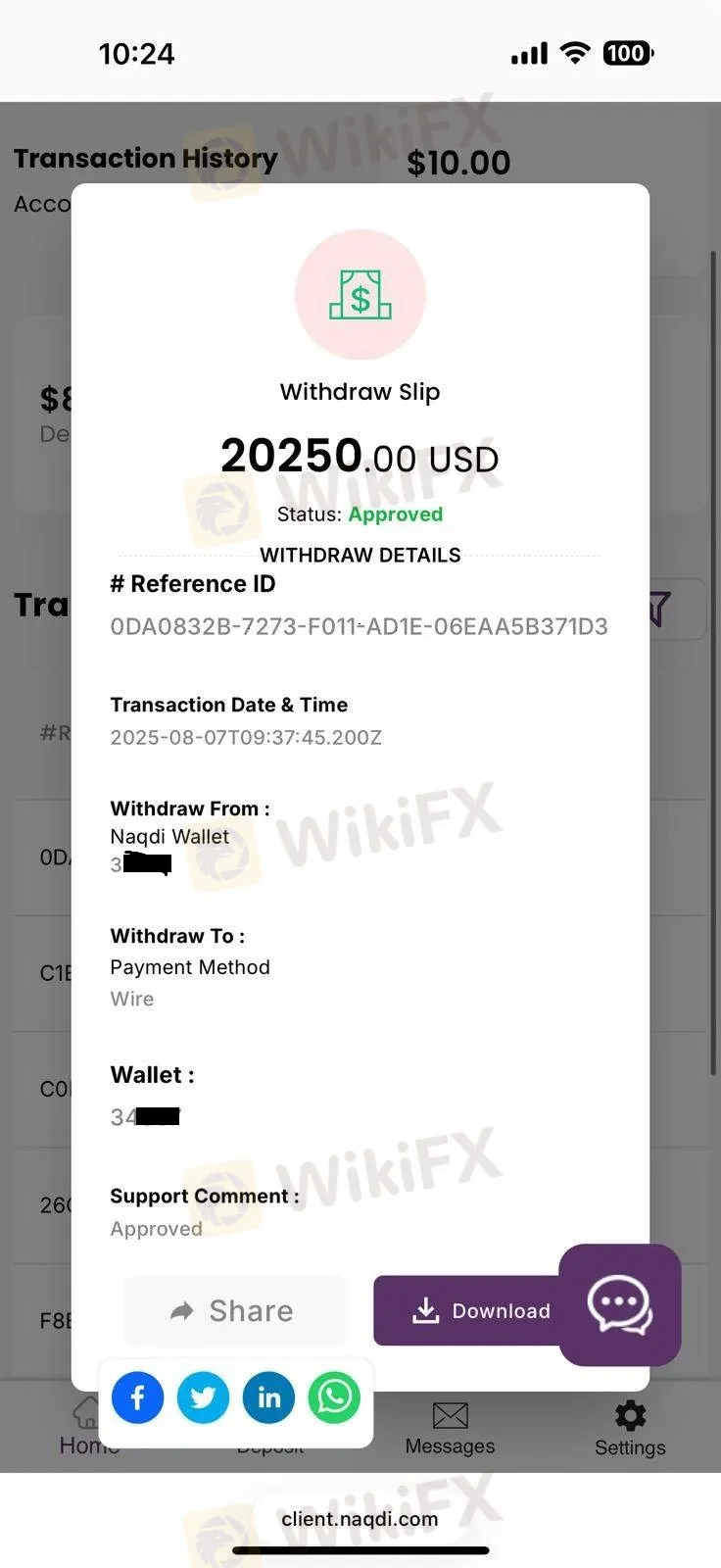

Case 2: The “Ghost” Transfer

A Russian trader shared a detailed story about hidden fees and failed withdrawals. After being told there were no commissions on crypto pairs, they were charged anyway. Worse, when they tried to withdraw, the broker marked the funds as “sent” in the portal, but the money never arrived in the user's wallet. The broker refused to provide a transaction hash (proof of payment).

Pro Tip: If a finance team claims they sent your crypto withdrawal but refuses to give you a TXID (Transaction Hash), they likely haven't sent it. Public blockchains never lie; if the hash doesn't exist, the transaction didn't happen.

Question 4: What software will I use?

Naqdi provides the MetaTrader 5 (MT5) platform. This is the successor to the famous MT4 and is widely regarded as one of the best trading platforms in the world. It offers advanced charting, automated trading capabilities, and more timeframes than its predecessor.

However, software security depends on more than just the platform name. Our review of the system data notes that Naqdi's setup lacks two-step login and supports no biometric authentication.

Why is this a risk?

In an era of high-tech scams, relying on a simple password is risky. You must be hyper-vigil about your login security. Always ensure you are on the official site before entering your login credentials to avoid phishing scams, as the lack of 2FA (Two-Factor Authentication) means that if a hacker guesses your password, they have full access to your funds immediately.

Final Verdict: Should I open an account?

Naqdi presents a conflicting picture. On one hand, they operate under valid FSCA regulation and use top-tier MT5 software. On the other hand, recent recurring complaints about withdrawal failures and poor support response times are major red flags that cannot be ignored.

If you are testing the waters, reliability in getting your money out is just as important as getting it in. The reports of funds being marked as “sent” without receipt are particularly worrying.

Status changes daily. Before depositing, check the WikiFX App for the latest real-time certificate and to see if the withdrawal complaints have been resolved.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

Currency Calculator