简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Checking if Is Alpari Legit: Dealing with Worries About Fake Brokers and Scams

Abstract:When you look up things like "Is Alpari legit" or "Alpari scam", you're asking an important question that every trader needs to answer before putting their money at risk. Picking a forex broker is one of the biggest money decisions you can make, and being scared of getting tricked by a fake company makes complete sense. This article works as a complete check about Is Alpari Legit or see if they're real, made to deal with your worries directly. To stay fair and give you useful information, our review will only use facts, user reports, and rule information gathered by the worldwide broker research platform, WikiFX.

When you look up things like “Is Alpari legit” or “Alpari scam”, you're asking an important question that every trader needs to answer before putting their money at risk. Picking a forex broker is one of the biggest money decisions you can make, and being scared of getting tricked by a fake company makes complete sense. This article works as a complete check about Is Alpari Legit or see if they're real, made to deal with your worries directly. To stay fair and give you useful information, our review will only use facts, user reports, and rule information gathered by the worldwide broker research platform, WikiFX.

Before putting money with any broker, doing a complete background check isn't just a good idea; it's a must-have safety step. We will use the detailed information from WikiFX as our main tool to look into Alpari, giving you a clear, fact-based way to help you make a smart and safe choice.

Understanding Alpari's WikiFX Score

The first and most important piece of information brokers regulation - Is Alpari Legit. On WikiFX , Alpari has a very low WikiFX score of 2.52 out of 10. This number right away sets off a clear and direct warning from the platform: “Warning: Low score, please stay away!”

This score isn't a random number. It's a carefully worked out rating that comes from looking at five key areas. The low score directly shows big problems, especially in areas that matter most for a trader's safety. According to WikiFX, the score gets much lower “because of too many complaints.”

Here's how the main things that make Alpari's rating so low break down:

• Rule Status: How good and where a broker's license comes from matters a lot. As we'll see, Alpari's rules are a big worry.

• License Score: This measures how valuable and strong the license is. Alpari's score here is low, showing weak rule control.

• User Complaints: This matters a lot. Way too many user complaints have directly hurt Alpari's overall score.

• Business Score: This looks at how stable the broker's operations are and their business ways.

• Risk Control: This checks how well the broker can handle and reduce money and operation risks.

The low score tells you clearly Is Alpari Legit trading partner or scammer . The next parts will look deeper into the two most important parts for any trader thinking about this broker: its rule standing and the real experiences written down by its users.

Looking at Alpari's Regulation

On the surface, Alpari looks like it follows rules. WikiFX information confirms it's controlled by the Alpari, the trading name of Parlance Trading Ltd, Bonovo Road – Fomboni, Island of Mohéli – Comoros Union, is incorporated under registered number HY00423015 and licensed by the Mwali International Services Authority, Island of Mohéli as an International Brokerage and Clearing Company under number T2023236.

The quality of rules isn't the same everywhere. A license from a top-level controller like the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) gives strong safety for traders. In comparison, the NBRB is seen as a much weaker, low-level controller. The level of investor protection it gives can't compare.

The table below shows the important differences in protection offered:

| Feature | Alpari's Controller | Top-Level Controllers (e.g., FCA, ASIC) |

| Investor Payment Fund | Not promised; protections are usually weak or don't exist. | Often required (e.g., FSCS in the UK protects up to £85,000). |

| Negative Balance Protection | Not a promised requirement. | Usually required, protecting traders from losing more than their deposit. |

| Keeping Client Money Separate | Rules may be less strict and enforcement weaker. | Strictly enforced, making sure client money stays separate from company money. |

| Overall Reputation | Seen as a low-level, offshore-style controller. | Known worldwide for strict oversight and strong investor protection. |

This weak rule environment directly connects to the “High potential risk” tag given to Alpari by WikiFX. Also, the “Disclosure” section on the WikiFX page shows another huge warning sign: Alpari has appeared on investor warning lists put out by money authorities. Specifically, it has been flagged by the Securities Commission Malaysia (MY SCM) and has been blocked by groups like Bappebti in Indonesia. Being on a rule warning list is one of the most serious signs of a high-risk operation.

Looking at 84+ User Complaints

Rule analysis gives a legal framework, but the real test of a broker's honesty lies in the experiences of its users. This is where the evidence against Alpari becomes most convincing for anyone researching Is Alpari Legit.. As of early 2026, WikiFX has received and written down a total of 84 user complaints against this broker. This is a large amount of negative feedback that points to system-wide problems.

By grouping these complaints, we can see clear patterns of problems that directly affect a trader's ability to operate and importantly, access their funds—central concerns in deciding Is Alpari Legit.

Huge Withdrawal Problems

The most common and serious type of complaints centers around not being able to withdraw money. This is the ultimate warning sign for any money service. Users report a consistent pattern of problems, including:

• Rejected Withdrawals: Many users say their withdrawal requests get rejected for weeks or even months without a clear reason. One user reported being unable to withdraw for a whole year.

• Unresponsive Customer Service: When users try to solve withdrawal problems, they often report that customer service doesn't respond, gives repetitive and unhelpful responses like “we are checking,” or can't be contacted at all.

• Money Never Arriving: Some traders complain that their account shows the withdrawal as “completed,” but the money never arrives in their bank account.

• Scam-like Methods: In one of the most alarming complaints from 2019, a user was told they needed to pay “20% of the fund for certification” to process a withdrawal. This practice of demanding extra payments to release money is a classic method used by fake operations.

Claims of Market Manipulation

Beyond withdrawal problems, there are serious claims of platform and chart manipulation. These accusations hit at the heart of a broker's honesty.

• One user from Iran filed a detailed complaint saying they lost about $10,000. They claim the loss was due to “drastic changes they made in the market” and that the broker “zeroed out my account by manipulating the chart” after their account balance grew.

• Another user from Taiwan claimed a disturbing connection between Alpari International and FXTM, claiming that after depositing with FXTM, their account became an Alpari account. They also said that when the account became profitable, the platform “will eat up the capital and profits.”

While each individual claim may be difficult to independently verify, their consistency and seriousness significantly damage confidence and heavily influence the conclusion on Is Alpari Legit.

Poor Service and Platform Problems

General complaints about poor customer service and platform instability are also common. Users mention “occasional spread” problems and the difficulty of getting any meaningful support, especially when money transactions are involved. The huge number of users reporting they “can't contact customer service” or that “no reply for a long time” is a clear sign of operational failure suggests operational weaknesses that further undermine trust in Is Alpari Legit.

To see the full, unfiltered list of these detailed complaints and read the latest user experiences, we strongly advise you to check the 'Exposure' and 'User Reviews' sections on Alpari's page on WikiFX https://www.wikifx.com/en/dealer/1161607157.html

What They Offer vs. The Risks

To give a balanced view, it‘s important to compare Alpari’s advertised features with the substantial risks identified. This comparison is essential when objectively assessing Is Alpari Legit.

| Pros (As Advertised) | Cons (The Reality from WikiFX) |

| Controlled by Comros | Extremely low WikiFX score (2.52/10) |

| Multiple account types (Standard, ECN, Pro ECN) | Huge number of user complaints (84+) |

| High maximum leverage (up to 1:3000) | Serious and frequent withdrawal problems |

| Low minimum deposit (from $20-$50) | Claims of chart manipulation and eating profits |

| MT4 and MT5 platforms available | Weak, low-level rules (NBRB) & offshore registration (Comoros) |

| Wide range of instruments | Appeared on multiple rule warning lists |

| Demo account available | “High potential risk” warning from WikiFX |

When looking at this information, a clear conclusion appears: the cons heavily outweigh the pros. Features like high leverage, a low minimum deposit, and the availability of popular platforms like MT4/MT5 are not unique to Alpari. They are standard offerings across the industry. However, these features become meaningless if the broker's basic trustworthiness is in question. The ability to deposit a small amount doesn't matter if you can never withdraw your profits—or your initial deposit. The appeal of high leverage is a dangerous trap if the platform is allegedly manipulating charts against you. The cons are not minor inconveniences; they are critical failures in safety, rules, and business ethics. For traders who prioritize capital protection, the answer to Is Alpari Legit is clear.

The Final Word on Alpari

Based on the extensive evidence compiled by WikiFX, the picture is deeply worrying. The combination of an extremely low safety score, rules from a weak, low-level place, registration in an offshore zone, placement on official rule warning lists, and a massive number of serious user complaints—particularly regarding the inability to withdraw money—presents an unacceptable level of risk for any trader.

While Alpari holds a license, the overwhelming evidence points to a pattern of behavior that puts traders' money at significant risk. The huge number of complaints claiming withdrawal blocking and market manipulation cannot be ignored. These are not the signs of a legitimate, trustworthy broker.

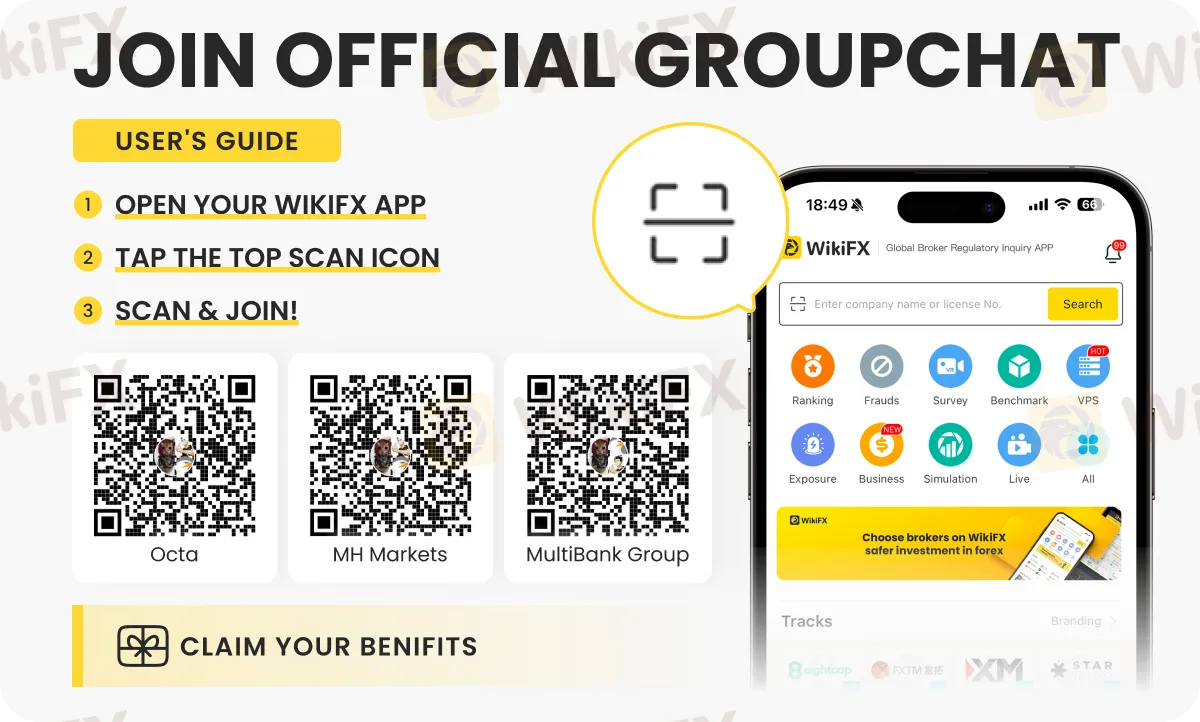

This simple habit is your strongest defense against potential financial loss and the smartest way to protect yourself when questioning Is Alpari Legit. Go to the WikiFX website or download their app. Search for 'Alpari' To see the live information, user complaints, and rule status for yourself. Click on the Link www.wikifx.com/en/dealer/1161607157.htmlto know Alparis status .

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Gold Rally Validated as Miners Forecast Doubled Earnings

Renewable Grid Integration: Economics and Technology

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Currency Calculator