Abstract:When you look up things like "Is Vida Markets Legit" or "Vida Markets Scam", you're asking an important question that affects your capital's safety. You need a clear, fact-based answer to figure out if this company can be trusted with your capital or if it might be risky.

This article gives you a complete check on whether Vida Markets is legitimate. We won't just repeat its advertising claims or random opinions. Instead, we'll do a deep investigation using facts we can prove, including whether it is properly regulated, its business history, real complaints from users, and reports from people who checked its offices. Our goal is to give you the facts clearly so you can make a smart and safe choice.

When you look up things like “Is Vida Markets Legit” or “Vida Markets Scam”, you're asking an important question that affects your capital's safety. You need a clear, fact-based answer to figure out if this company can be trusted with your capital or if it might be risky.

This article gives you a complete check on whether Vida Markets is legitimate. We won't just repeat its advertising claims or random opinions. Instead, we'll do a deep investigation using facts we can prove, including whether it is properly regulated, its business history, real complaints from users, and reports from people who checked its offices. Our goal is to give you the facts clearly so you can make a smart and safe choice.

The Quick Answer

For traders who need a fast answer, our most important findings show some worrying problems. We've put together the key facts from our detailed research in an easy-to-read format. This summary shows the biggest risk factors with Vida Markets.

Main Facts

Based on public records and investigation reports, we found several alarming problems. The broker's overall profile shows a high level of potential risk for any trader thinking about using their services.

Our First Conclusion

These facts together show major warning signs. The combination of an extremely low trust score, problematic regulatory history, and many serious user complaints raises questions about whether this broker can be trusted as a legitimate trading partner.

Before considering any broker, especially one with such clear warnings, you need to do your own thorough checking. You can review the complete, up-to-date report and user complaints for Vida Markets on a specialized verification platform.

Click here to view the full Vida Markets investigation on WikiFX.

Understanding the Regulatory Warning Signs

A broker's regulatory status is the foundation of whether it can be trusted. It determines how much protection a trader has and whether the company follows any recognized standards. For Vida Markets, our analysis shows not just one problem, but a pattern of regulatory failures across multiple countries.

A Pattern of Problems

A deep look into the broker's licensing history shows a trail of revoked licenses, exceeded permissions, and operations in places with little oversight. This pattern is a major sign of high risk.

1. Anguilla Registration: Vida Markets is registered in Anguilla, an offshore location. Regulators in such places are often known for minimal oversight and easy requirements. This gives little to no meaningful protection for traders' money if there's a dispute or if the broker goes out of business. Traders are mostly on their own.

2. South Africa (FSCA) License - Status: “Exceeded”: The related company, VIDA GLOBAL MARKETS (PTY) LTD, does have a license no. 42734 from South Africa's FSCA. However, its status is marked as “Exceeded.” This means the broker is doing business activities beyond what its license allows. Operating outside the authorized framework is a serious rule violation and suggests that it does not respect regulatory boundaries.

3. Vanuatu (VFSC) License - Status: “Revoked”: This is one of the most serious red flags. Public records show an official “Notice of Revocation” was issued by the Vanuatu Financial Services Commission (VFSC) for Vida Markets on August 30, 2023. A license revocation is a punishment taken by a regulator because of significant misconduct or failure to meet standards. It effectively removes the broker's legal authority to operate under that license.

4. Cyprus (CySEC) Entity - Status: “Deregistered”: Further investigation shows a related company, VIDA GLOBAL MARKETS LTD, in Cyprus. This company is listed as “Deregistered.” This shows a previous attempt to establish a presence in a reputable location that was either abandoned or failed, adding another layer to the broker's unstable operational history.

Real Trader Experiences

While regulatory data gives an official overview, real user experiences show the actual consequences of a broker's practices. The large number and consistency of complaints against Vida Markets are alarming. We've organized these user-submitted reports into different themes of alleged misconduct, which show a troubling operational pattern.

Theme 1: Taking Away Profits

A common and recurring complaint involves the arbitrary removal of earned profits from client accounts. Traders report that after successful trading, their profits are taken away through unexplained “adjustments,” leaving them with only their initial deposit or less.

> Case Study: A trader from India reported depositing $2,500 and successfully growing their account to $5,536, representing a profit of over $3,200. Then, the broker allegedly made a “Cash adjustment pnl” of -$3,226.69, wiping out nearly the entire profit. The user was left with just over $2,300 and described the action as theft.

Theme 2: Platform Manipulation

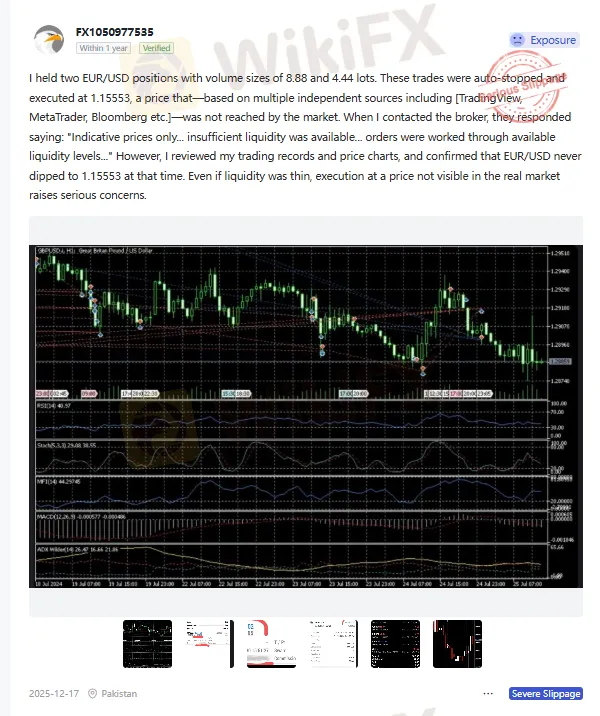

Multiple users have filed complaints claiming that the trading platform is being manipulated against them. These reports include non-market price execution, unfair stop-outs, and failure to honor advertised margin and leverage rules. Such actions suggest that the trading environment may not be fair or transparent.

> Case Study: One trader reported that their positions on EUR/USD were stopped out at a price of 1.15553. After checking multiple independent price feeds, they confirmed the market never reached that level. When they confronted the broker, the explanation given was “insufficient liquidity,” a common excuse used to justify abnormal price execution that benefits the broker.

> Another Case: A user carefully calculated their automatic stop-out level, which should have been triggered at a 20% margin level. However, their position was forcibly closed when their margin level was still at 75%. This shows that the advertised 500:1 leverage and margin rules were not being honored, leading to premature and unfair losses.

Where to Find These Reports

These detailed, user-submitted accounts are critical evidence for any trader doing research. They provide unfiltered insight into the potential risks. To make sure you have the latest information, including these firsthand stories, we recommend checking a public database.

You can read all 10+ user exposure reports on the Vida Markets page on WikiFX.

A Critical Look at What It Offers

At first glance, Vida Markets' offerings might seem competitive. It advertises popular platforms, high leverage, and different account types. However, when viewed through the lens of the previously established red flags, these features can be seen as misleading or even as tools that increase risk.

Trading Platforms: MT4/MT5

· What It Offers: Vida Markets provides access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

· The Critical Context: The investigation report identifies these as “White Label” platforms. This means Vida Markets doesn't own a full, direct license for the software but is essentially renting it from a primary license holder. White-label setups can create risks, including the potential for manipulative third-party plugins, less server control, and a dependency that can be cut off, potentially disrupting trading operations.

Leverage: The 1:1000 Double-Edged Sword

· What It Offers: An extremely high maximum leverage of up to 1:1000.

· The Critical Context: While high leverage can increase profits, it increases losses just as quickly and is a high-risk tool. Coming from a broker with a history of a revoked license and many user complaints about non-market price execution and unfair stop-outs, this feature becomes particularly dangerous. It can be seen as a way to speed up trader losses and trigger margin calls more rapidly, rather than a genuine benefit for the trader.

Account Types and Fees

· What It Offers: The broker advertises STP and RAW accounts, with spreads on the RAW account starting from a seemingly competitive 0.1 pips plus commission.

· The Critical Context: The advertised low spreads become meaningless if the broker engages in the practices alleged by its users. If prices are manipulated to widen spreads at critical moments or to trigger stop-losses at non-market rates, the official fee structure becomes irrelevant. The trust required to believe in a stated fee model is broken by the pattern of user complaints and regulatory failures.

Final Verdict and Advice

After a thorough investigation, we must return to the original question: Is Vida Markets a legitimate trading partner or a high-risk operation to be avoided? The evidence points toward a clear conclusion.

Summary of the Evidence

Our analysis, based on publicly available data and documented reports, has uncovered a consistent pattern of serious red flags that no careful trader can ignore:

· No credible, active regulation in a reputable location.

· A documented history of a revoked license from the VFSC and an “Exceeded” status from the FSCA.

· A significant volume of serious user complaints alleging profit confiscation, platform manipulation, and withdrawal blockages.

· A lack of transparency, demonstrated by the failure to find a physical office at its registered address.

The Answer to Your Question

Given the overwhelming weight of negative evidence, Vida Markets does not show the characteristics of a trustworthy or legitimate trading partner. The combination of systematic regulatory failures and a consistent pattern of serious user complaints places it firmly in the high-risk category. The allegations made by users align closely with behaviors commonly associated with scam operations. We strongly advise extreme caution and recommend that traders avoid entrusting their funds to this broker.

The Golden Rule of Trading

Your financial security is most important. The problems highlighted with Vida Markets emphasize a critical rule for every trader: never deposit funds with any broker without first doing your own independent research.

Don't rely on a broker's marketing promises or flashy websites. Use objective, third-party verification tools to check its true regulatory status, full company history, and, most importantly, unfiltered reviews and complaints from other users. This simple step can protect you from significant financial loss.

Protect your capital. Start every broker investigation on WikiFX to get the facts before you trade.