简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KODDPA Review: Safety, Regulation & Forex Trading Details

Abstract:KODDPA is an unregulated broker currently holding a low safety score of 1.45, indicating significant risk for investors. Recent market data and user reports highlight severe issues, including withdrawal denials and platform access failures attributed to alleged hacking incidents.

KODDPA has emerged in the financial landscape presenting itself as a Forex trading provider, but recent assessments raise serious questions about its legitimacy and safety. For investors considering this broker, a deep analysis of its regulatory status and user feedback is essential.

This KODDPA review analyzes the critical safety data, regulatory standing, and verified user complaints to provide a clear picture of the risks involved. Our goal is to offer objective, educational insights to help you protect your capital.

Key Takeaways

- Unregulated Status:KODDPA holds no valid financial license, resulting in a low WikiFX score of 1.45.

- High Withdrawal Risk: Multiple users report being unable to access their funds, with the broker often citing “hacking” or “tax” issues as excuses.

- Social Media Lures: Reports indicate that investments are often solicited via social media interactions, a common tactic in high-risk schemes.

- US Presence Unverified: Despite claiming a US base, there is no record of regulation by the NFA or CFTC.

KODDPA Broker Summary

When evaluating a trading partner, the first metric to check is the authoritative safety score. KODDPA currently struggles with a very weak standing in the industry.

According to WikiFX records, KODDPA was established in 2021 and claims to be based in the United States. However, its influence rank is rated as E, the lowest tier, suggesting it has very little authentic market presence or user base compared to established competitors. The broker's primary service region appears to include the US, yet it lacks the rigorous legal framework required to operate there legally.

With a total score of 1.45 out of 10, this broker falls into the “High Risk” category. This score reflects a lack of regulatory oversight and a high volume of unresolved user complaints. In the world of Forex KODDPA presents a profile that warrants extreme caution.

KODDPA Regulation: Is the License Real?

Regulation is the safety net that protects your funds. A legitimate KODDPA regulation check reveals a complete absence of valid oversight.

| Regulator | License Type | Status |

|---|---|---|

| US Regulators (NFA/CFTC) | None | Unauthorized |

| Global Regulators | None | Unregulated |

The Regulatory Void

KODDPA claims to be a US broker. In the United States, any broker offering Forex services to retail clients must be registered with the Commodity Futures Trading Commission (CFTC) and be a member of the National Futures Association (NFA). These bodies enforce strict capital requirements and ethical standards.

Our data confirms that KODDPA does not hold these licenses. Operating without them while claiming a US base is a significant red flag. It means there is no government agency monitoring their bank accounts, ensuring segregation of client funds, or auditing their trade execution. If the broker becomes insolvent or refuses a withdrawal, investors have no legal recourse through standard financial compensation schemes.

KODDPA User Reviews: Login & Withdrawal Complaints

Beyond technical data, the experiences of actual traders provide the most immediate evidence of a broker's conduct. A surge in negative reviews has been recorded, specifically targeting withdrawal processes and KODDPA login stability.

The “Social Media” Approach

Analysis of the `casesText` reveals a disturbing pattern. Users from India and other regions reported being approached by individuals on social media (specifically mentioning names like “Lin Xin”). These interactions often start as friendships or romances before pivoting to investment advice.

- Case Evidence: A user reported, “They have some girls on social media... make them invest in KODDPA and once we add money... we are not able to withdraw it.”

This tactic is often associated with high-risk platforms that rely on personal trust rather than market reputation to attract capital.

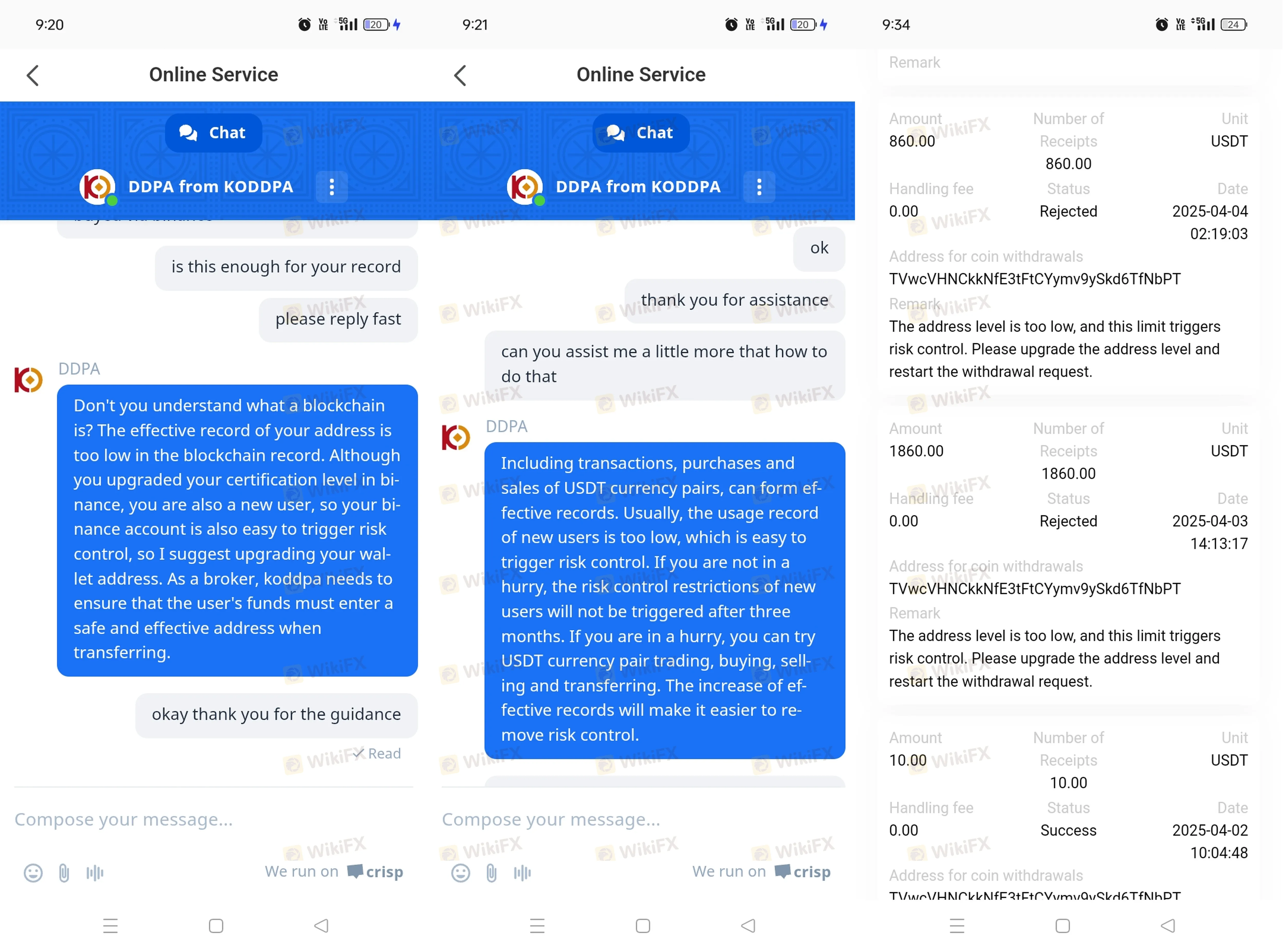

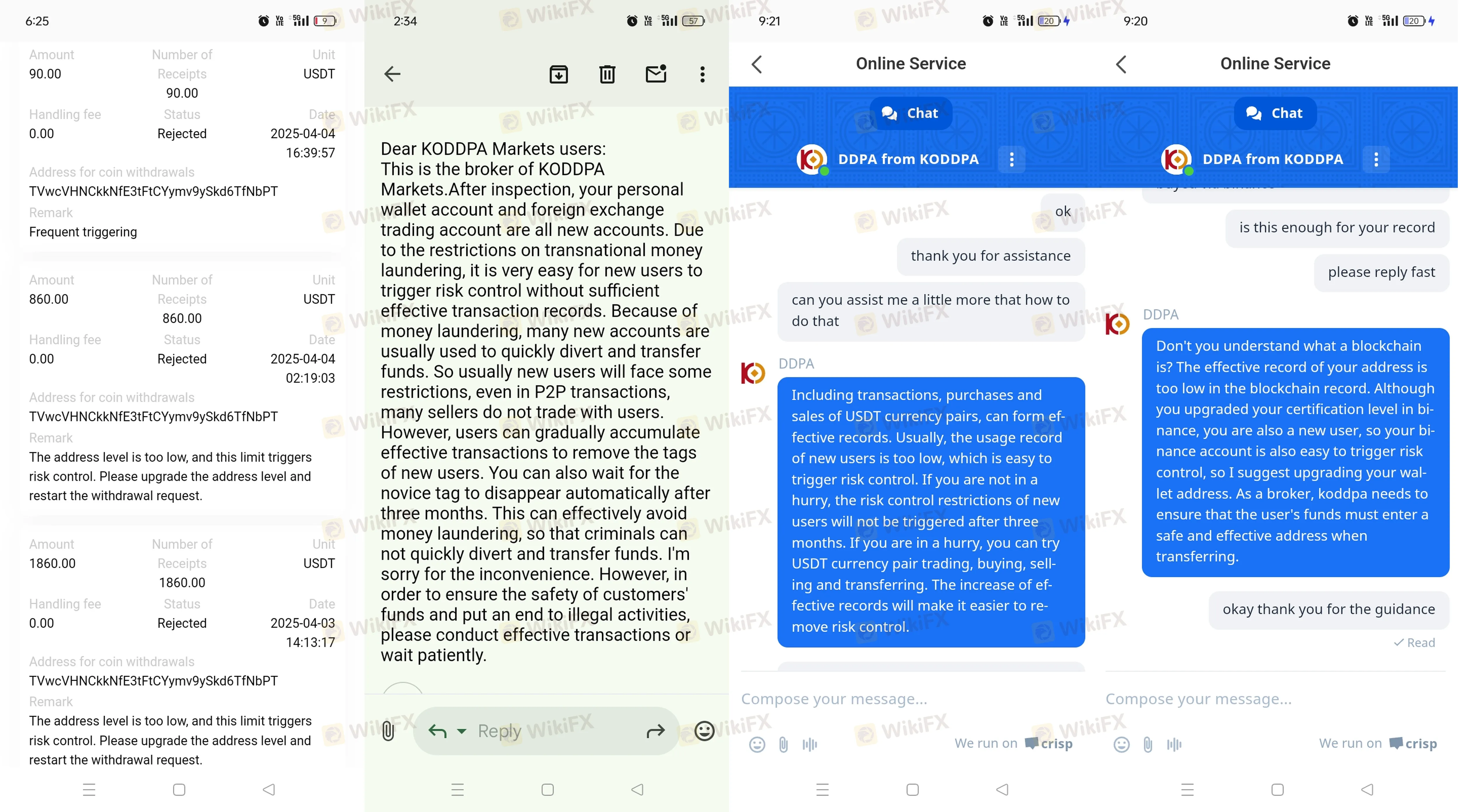

Withdrawal Failures and “Tax” Demands

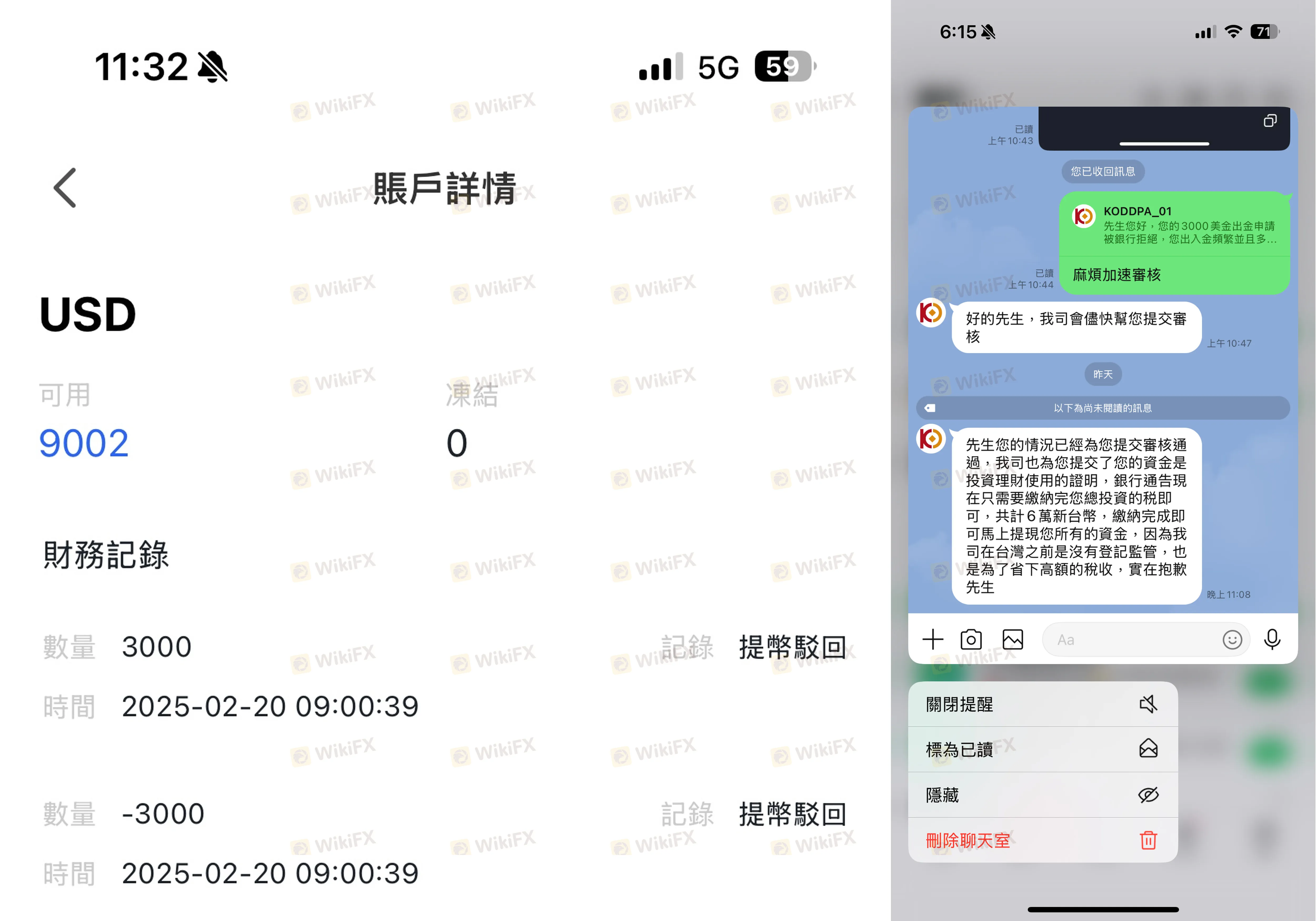

A legitimate Forex broker processes withdrawals simply: you request your money, and they send it. KODDPA users, however, report a different experience. Multiple complaints from Chile, Taiwan, and the US describe a scenario where withdrawals are blocked entirely.

- The Tax Excuse: Users reported being told they must “pay taxes” before they can withdraw. For example, a user from Taiwan noted, “Need to pay taxes to withdraw.” Legitimately regulated brokers deduct necessary taxes from the balance or leave tax reporting to the user; they never demand new deposits to release existing funds.

The “Hacking” Narrative & Platform Access

Perhaps the most alarming trend in the reviews is the claim that the platform was “hacked.”

- Case Evidence: A user from Chile stated, “They indicated that the page was interfered by hackers... Lost all my money 1,760 USD.”

- Login Issues: Another user mentioned that they “closed the web page and disappeared.” This directly impacts the KODDPA login availability, leaving traders unable to access their accounts to verify balances or close positions.

When a broker claims a hack resulted in the total loss of client funds, it is often a sign of internal instability. Regulated brokers are required to keep client funds in segregated accounts, meaning a “hack” of the broker's website should not touch the client's deposited capital.

Conclusion

Based on a comprehensive review of the available evidence, KODDPA presents a level of risk that is unsuitable for safe trading. The combination of a 1.45 safety score, zero valid regulation, and a consistent pattern of withdrawal complaints suggests a high probability of capital loss.

The reports of “tax” fees and social media solicitation are standard warning signs in the investment world. We strongly advise investors to avoid this platform. Instead, seek brokers with verified licenses from top-tier regulators like the FCA, ASIC, or the NFA, where your rights and funds are protected by law.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

XeOne Complete Review: Is It Unregulated and Risky? A Detailed Look

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Toyar Carson Limited Review: A Detailed Look at a Risky Broker

USD Resilience: Strong Data Cushions Political Volatility as Trump Targets Fed

SNB Strategy: Intervention Preferred Over Negative Rates as Inflation Flatlines

Italy’s Financial Regulator Expands Crackdown on Unauthorised Investment Websites

Naira Rallies to Start February as Government targets Fiscal Consolidation

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Currency Calculator