Abstract:When dealing with online trading, checking things carefully isn't just a good idea - it's necessary to protect your capital. This leads us to an important question that many potential traders are asking: Is ROCK-WEST safe or scam? The answer isn't simply yes or no. To make a smart decision, you need to look beyond marketing claims and examine real facts and actual user experiences.

This article provides a thorough, fact-based look into ROCK-WEST's business profile and reputation. Our goal is to help you, the trader, make a good decision. We will carefully examine the broker's regulatory status, its official rating, and most importantly, the user reviews and serious complaints sent to the financial broker checking platform, WikiFX. By looking at the positive feedback, the serious accusations and the company's official responses, we will build a complete and balanced view of the risks and benefits of trading with ROCK-WEST.

The Important Question

When dealing with online trading, checking things carefully isn't just a good idea - it's necessary to protect your capital. This leads us to an important question that many potential traders are asking: Is ROCK-WEST safe or scam? The answer isn't simply yes or no. To make a smart decision, you need to look beyond marketing claims and examine real facts and actual user experiences.

This article provides a thorough, fact-based look into ROCK-WEST's business profile and reputation. Our goal is to help you, the trader, make a good decision. We will carefully examine the broker's regulatory status, its official rating, and most importantly, the user reviews and serious complaints sent to the financial broker checking platform, WikiFX. By looking at the positive feedback, the serious accusations and the company's official responses, we will build a complete and balanced view of the risks and benefits of trading with ROCK-WEST.

An Unbiased Broker Profile

Before looking at personal user experiences, it's important to establish the basic facts. An objective look at a broker's main information provides the foundation needed to judge its overall reliability. Here, we present the key details of ROCK-WEST as recorded by the independent checking platform, WikiFX.

Key Details from WikiFX

A broker's score, regulatory status, and business history are the first things any careful investor should check. The following information has been taken directly from ROCK-WEST's WikiFX profile.

This table immediately shows a mixed picture. While the broker has been running for a good amount of time (5-10 years) and has a full MT5 license, its low score and the clear warning about user complaints are immediate warning signs.

The “Offshore Regulation” Risk

ROCK-WEST is regulated by the Seychelles FSA, which makes it an “offshore-regulated” broker. From an industry expert's view, this is an important risk factor. Offshore locations like Seychelles typically provide much lower regulatory oversight and investor protection compared to top financial authorities such as the UK's Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC).

For traders, this means that if there's a dispute, such as a refusal to process a withdrawal or other bad practices, your options for getting help are very limited. There is often no required compensation fund to protect your capital if the brokerage goes out of business. This regulatory environment naturally puts more risk on the client.

The First Warning Sign

The most noticeable feature on the broker's WikiFX profile is not its license but the warning message: “The WikiFX Score of this broker is reduced because of too many complaints!” This is not a personal opinion but an automatic flag created by the platform's system when many user-submitted issues, called “Exposures,” are filed against a broker. It serves as an immediate and strong sign that many users have reported negative experiences, requiring a deeper look into these complaints.

Before continuing, it's important for traders to do their own research. You can view the full, current regulatory details and any new alerts for ROCK-WEST by checking its profile on a verification platform such as WikiFX.

A Close Look at Complaints

The heart of any broker investigation lies in examining the patterns of user complaints. These “Exposure” reports on WikiFX provide unfiltered, first-hand accounts of the problems traders have supposedly faced. A careful analysis of these reports shows repeating themes that paint a worrying picture of the user experience at ROCK-WEST.

Common Complaint Patterns

By grouping the main issues reported by users from around the world, we can identify the most significant areas of alleged wrongdoing. The ROCK-WEST complaints are not small problems; they attack the core of a broker's basic responsibilities.

1. Withdrawal and Profit Issues: This is, by far, the most serious and frequently mentioned complaint. Multiple users claim they cannot access their funds. A user from South Africa reported that the broker refused to give both their profits and initial deposit, finally blocking the account from making more withdrawals. Similarly, a trader from Venezuela reported a loss of 170,100 pesos that the platform supposedly refused to pay. A user in Vietnam made a particularly serious claim that after successful trading, ROCK-WEST “automatically withdrew my profits” directly from their account, suggesting platform interference.

2. Deposit Delays at Critical Moments: A very specific and troubling complaint comes from a user in Malaysia. They claim that a deposit made to their account to cover a floating negative position and prevent a stop-out was deliberately delayed. According to the user, the funds only appeared in their account *after* the position was liquidated. The user states this is a tactic to “target users to lose money first.” This type of accusation suggests intentional manipulation of account funding to hurt the client.

3. Account Blocking: The inability to access an account is a trader's worst fear. The complaint from the South African user clearly mentions that their account was “blocking my account from making further withdrawals,” effectively freezing their funds and preventing access to any capital held with the broker.

Looking at Specific Accusations

To understand how serious these claims are, let's examine two cases more closely.

The Malaysian trader's experience with a delayed deposit is a classic warning sign. In a fast-moving market, timely handling of deposits and withdrawals is not a luxury; it's a basic function. The user's story describes depositing capital specifically to save a position from being stopped out, only to have the deposit process so slowly that the account was wiped out. The user's conclusion that this is a deliberate strategy—“deposit will be added after you lose all money”—highlights a deep loss of trust in the broker's operational honesty.

Equally alarming is the report from Vietnam. The user claims to have been “scammed by Rock West” after trading profitably. The accusation that the broker can “interfere with your money” and “automatically withdraw my profits” is one of the most serious charges that can be made against a brokerage. It suggests that the platform's backend may not be secure or, worse, that it is used to actively prevent successful traders from gaining.

These user-submitted complaints represent serious accusations. We strongly advise any potential trader to carefully read through all “Exposure” reports on the broker's WikiFX page to understand the full range of risks highlighted by other users.

Is There a Positive Side?

To maintain an objective and balanced analysis, it is important to examine the favorable reviews alongside the complaints. Not every user has had a negative experience with ROCK-WEST, and understanding what satisfied clients praise is necessary for a complete picture. However, the positive feedback also creates a stark and troubling contradiction.

What Supporters Highlight

Users who have left positive reviews for ROCK-WEST tend to focus on several key benefits that appeal particularly to new or small-scale traders.

· Accessibility for Beginners: A repeating theme is the low barrier to entry. One user from Colombia praised the ability to start trading with just $25, while another from Vietnam noted that the “low minimum deposit and reasonable commission rates make it easy to get started.” This suggests the broker is attractive to those who want to enter the market with minimal initial money.

· Ease of Transactions: In direct opposition to the serious complaints, some users have praised the broker's payment processing. A user from Malaysia highlighted that “withdrawing your profits are always fast and easy,” and a trader from Cyprus described the broker as “perfect, easy to deposit and withdraw money.”

· Support and Spreads: Positive mentions also include an “amazing support team” and “small spreads,” which are key factors for any trader looking for a cost-effective and supportive trading environment.

The Critical Contradiction

Here lies the central problem for anyone evaluating ROCK-WEST. How can one group of users praise “fast and easy” profit withdrawals while another, equally vocal group, claims that their funds and profits are unreachable and their accounts are blocked?

This is not a minor difference in opinion about customer service response times; it is a fundamental contradiction concerning the most critical function of a broker: returning a client's fund. Several possibilities could explain this difference:

· Inconsistent Service: The broker's service quality may be highly inconsistent, with some transactions processed smoothly while others encounter serious issues.

· Bonus Terms and Conditions: Some withdrawal issues, particularly those related to profits from “no deposit bonus” campaigns (as mentioned by the South African user), can be tied to complex and strict terms and conditions that users may not fully understand.

· Selective Treatment: A more negative view is that the broker may process small withdrawals smoothly to build confidence but create obstacles for larger withdrawals or consistently profitable traders.

Regardless of the reason, such a deep and fundamental contradiction in user experiences regarding fund withdrawals is a major concern. It suggests a high degree of unpredictability and risk for any potential client.

The Broker's Defense

How a company responds to public criticism is a powerful sign of its professionalism, accountability, and overall customer service approach. On the WikiFX platform, ROCK-WEST has officially replied to several of the user complaints. Analyzing the tone and content of these replies provides another layer of insight.

Breaking Down the Responses

The broker's replies vary significantly in their approach, ranging from seemingly helpful to generic and deflective.

· To the deposit delay complaint (Malaysia): The company acknowledged a “third-party issue” and apologized for the inconvenience, offering further support. This response appears specific and attempts to resolve the issue, shifting blame to an external processor while still showing some degree of accountability.

· To the profit scam allegation (Vietnam): The reply thanks the user for their “collaboration in resolving this issue.” This suggests that some form of communication occurred behind the scenes. However, it offers zero public transparency on what the issue was or how it was “resolved,” leaving outside observers in the dark about a very serious allegation.

· To the general loss complaint (Venezuela): Here, the response is generic. The broker speaks about market volatility and the need for education, effectively avoiding the user's specific claim of non-payment and instead lecturing them on the risks of trading.

· To the withdrawal block complaint (South Africa): The reply states that their withdrawal processes are among the fastest in the industry and that blocking an account is only done “in accordance with our terms and policies.” This implies the user violated a rule, but without providing any specifics, it serves as a non-transparent justification that places all blame on the user.

What These Replies Show

The official responses from ROCK-WEST are mixed. While some attempt a professional and helpful tone, others, particularly those addressing the most serious allegations of fund and profit withdrawal issues, are vague and deflective. The lack of transparency in explaining how critical issues are resolved is a significant point of concern. For an outside observer, a reply that simply says an issue is “resolved” without explanation does little to build trust or reduce fears that the same problem could happen to them.

Weighing the Evidence

After a thorough analysis of the objective data, user complaints, positive reviews, and the broker's own responses, we can now combine the findings to address the primary question of ROCK-WEST's trustworthiness. The decision to invest with any broker is personal, but it must be informed by a clear assessment of the available evidence.

Final Verdict: High Risk

The evidence points strongly to a high-risk profile for ROCK-WEST. This conclusion is based on several key, verifiable findings:

1. Weak Regulation: The broker operates under an offshore license from Seychelles, which offers minimal investor protection and recourse in case of disputes.

2. Complaint-Driven Low Score: Its WikiFX score of 4.31/10 is clearly reduced due to a high volume of user complaints, a clear measurable sign of widespread issues.

3. Severity of Complaints: The allegations are not minor. They center on the most critical aspect of a broker's trustworthiness: the ability to withdraw funds and profits. Reports of blocked accounts, withheld profits, and manipulative deposit delays are serious warning signs.

4. Clear Contradictions: While some users report positive experiences, the stark contradiction with the serious negative reports, especially concerning withdrawals, creates uncertainty and suggests, at best, a deeply inconsistent and unpredictable service.

While we cannot definitively label ROCK-WEST a “scam” without a formal legal ruling, the volume, nature, and severity of the user-reported evidence are impossible to ignore. The risk profile is significantly elevated, and the patterns of complaints should serve as a major warning for any cautious trader.

Your Most Important Step

Ultimately, the responsibility for protecting your capital rests with you. The information presented here, based on real user experiences, strongly suggests that extreme caution is needed.

Before you deposit funds with ROCK-WEST or *any* broker, your first and most important step should be to use an independent verification tool. Visit WikiFX to review the broker's complete profile, read every single user exposure report, and check for any new warnings or regulatory updates. This simple, five-minute check provides a layer of protection that marketing materials and sponsored reviews cannot. It allows you to learn from the documented experiences of others and can help you make a much safer trading choice.

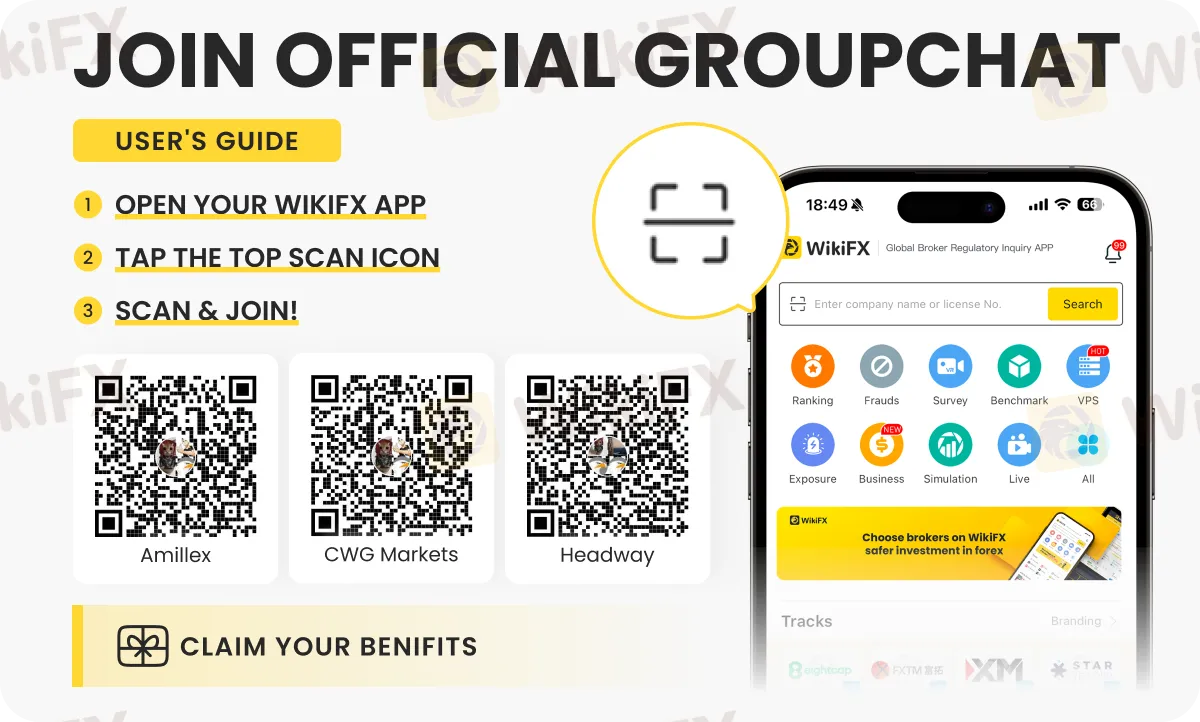

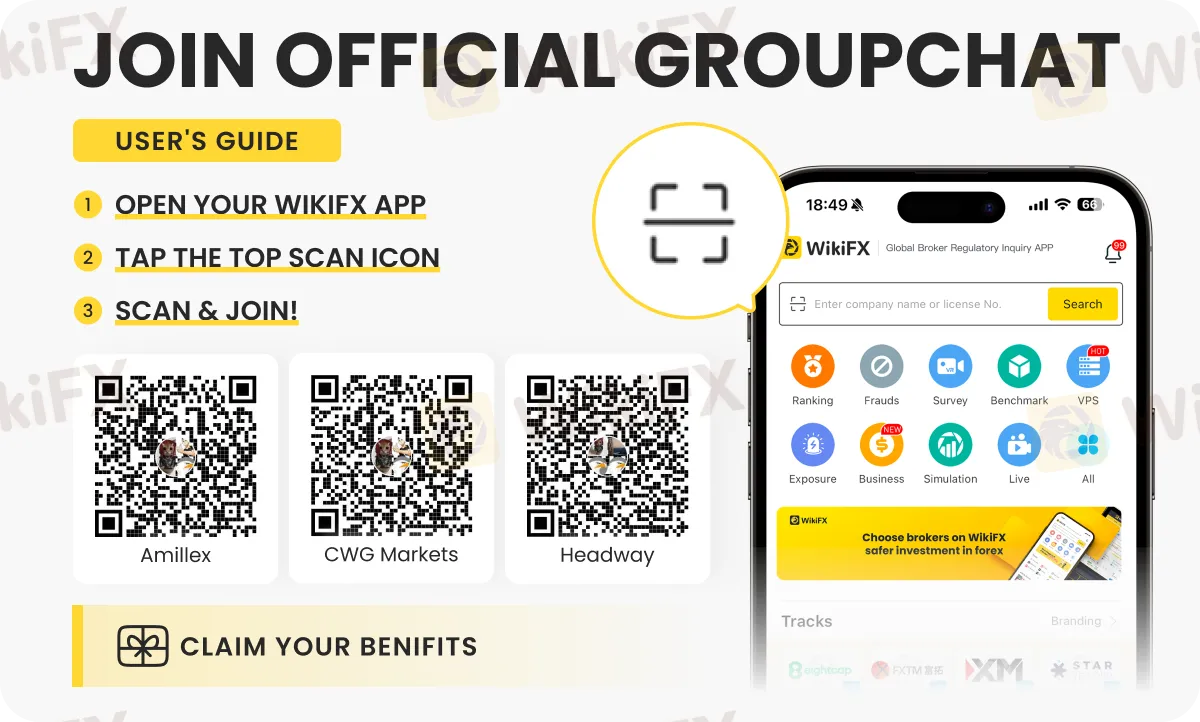

Check the latest forex updates and insights on these expert-led special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - by following the instructions shown below.