简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Bridge Markets Review 2026: Comprehensive Safety Assessment

Abstract:Bridge Markets, established in 2021, operates as an unregulated entity with a low WikiFX score of 2.10. While offering MT5 and high leverage, significant user complaints regarding withdrawal failures and account blocking suggest high risk.

Executive Summary

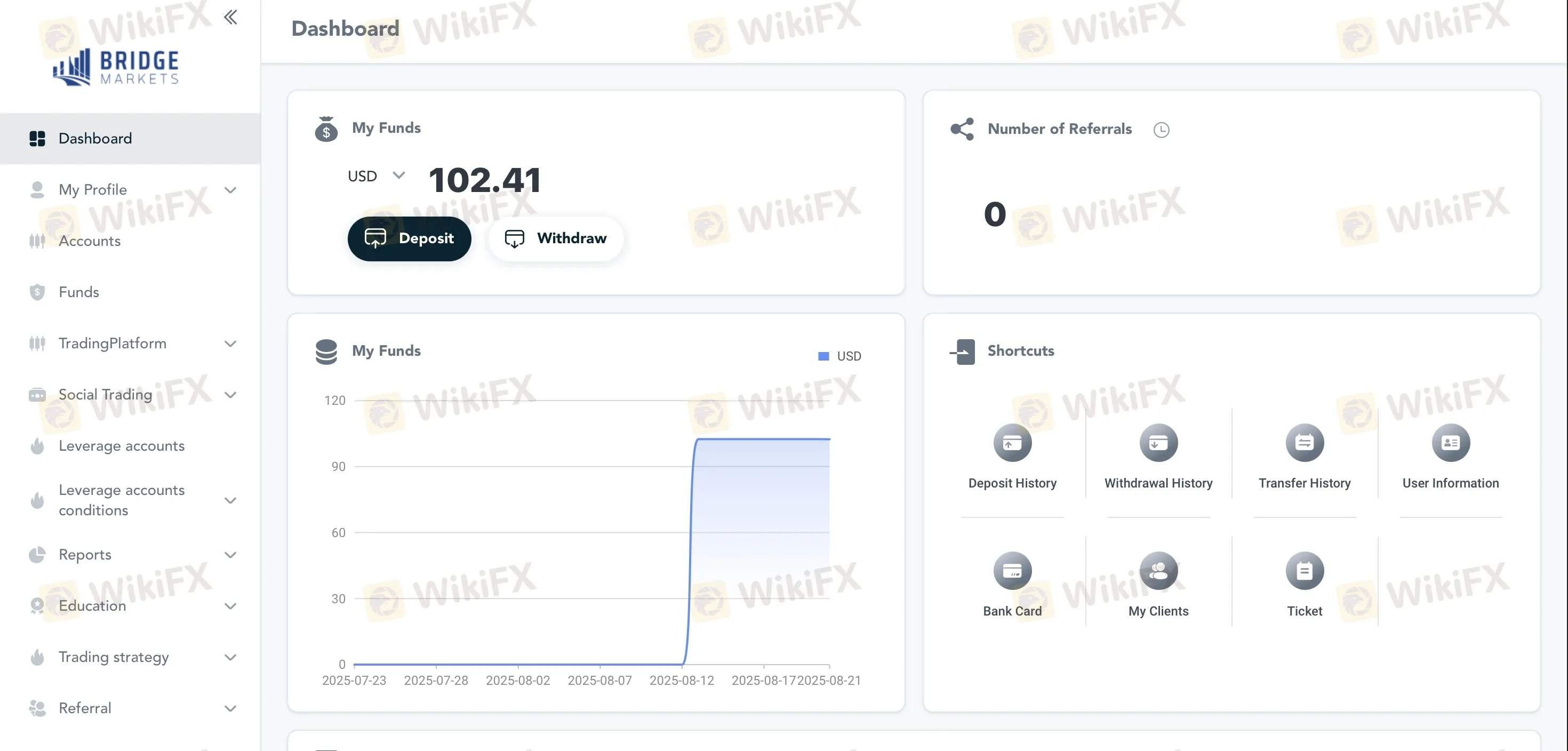

In this in-depth review, we analyze the key metrics and operational history of Bridge Markets to determine if it meets the safety standards required by modern traders. The broker was established in 2021 and maintains its headquarters in the Marshall Islands. Despite offering attractive trading conditions through the MetaTrader 5 platform, the entity suffers from a critically low WikiFX Score of 2.10 and holds a “C” influence rank.

Our review methodology focuses heavily on regulatory compliance and user experiences. As a broker entity operating since 2021, Bridge Markets promotes five distinct account types ranging from “CENTO PRO” to “ECN,” yet severe red flags regarding fund safety have emerged. The verdict of this assessment highlights a significant disparity between the platform's marketing claims and the documented reality of client withdrawals.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation operates under—or in this case, the lack thereof. Bridge Markets is not regulated by any major financial authority such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). Instead, it is registered in the Marshall Islands, a jurisdiction often referred to as a “regulatory sandbox” due to its minimal oversight and lack of strict auditing requirements for financial service providers.

Regarding regulation standards, valid oversight is essential because it guarantees the segregation of client funds and provides a recourse mechanism in the event of insolvency. The absence of strict regulation means that Bridge Markets is under no legal obligation to separate client money from its operating capital. For traders, this implies that capital deposited with this broker is exposed to maximum risk, with no compensation scheme available should the company cease operations or refuse withdrawals.

2. Forex Trading Conditions

For traders focusing on Forex instruments, Bridge Markets offers an aggressive environment characterized by high leverage and variable spreads. The broker provides a maximum leverage of 1:500, which significantly amplifies both potential profits and risk exposure. While experienced traders often seek high leverage, it can be a double-edged sword for beginners, leading to rapid account liquidation.

Does Forex pricing compete with top-tier providers? The account structure implies competitive costs, with the “ECN” and “PROFESSIONAL TRADER” accounts boasting spreads “from 0.0.” However, standard accounts start from 0.8 to 1.2 pips. While these on-paper conditions appear favorable for Forex strategies like scalping (which the broker claims to allow), the actual execution quality is disputed by user feedback alleging delays and slippage.

3. User Feedback & Complaints

A disturbing pattern has emerged in the user feedback logs, heavily impacting the broker's reputation. Multiple users have reported severe operational issues, ranging from denied withdrawals to sudden account terminations.

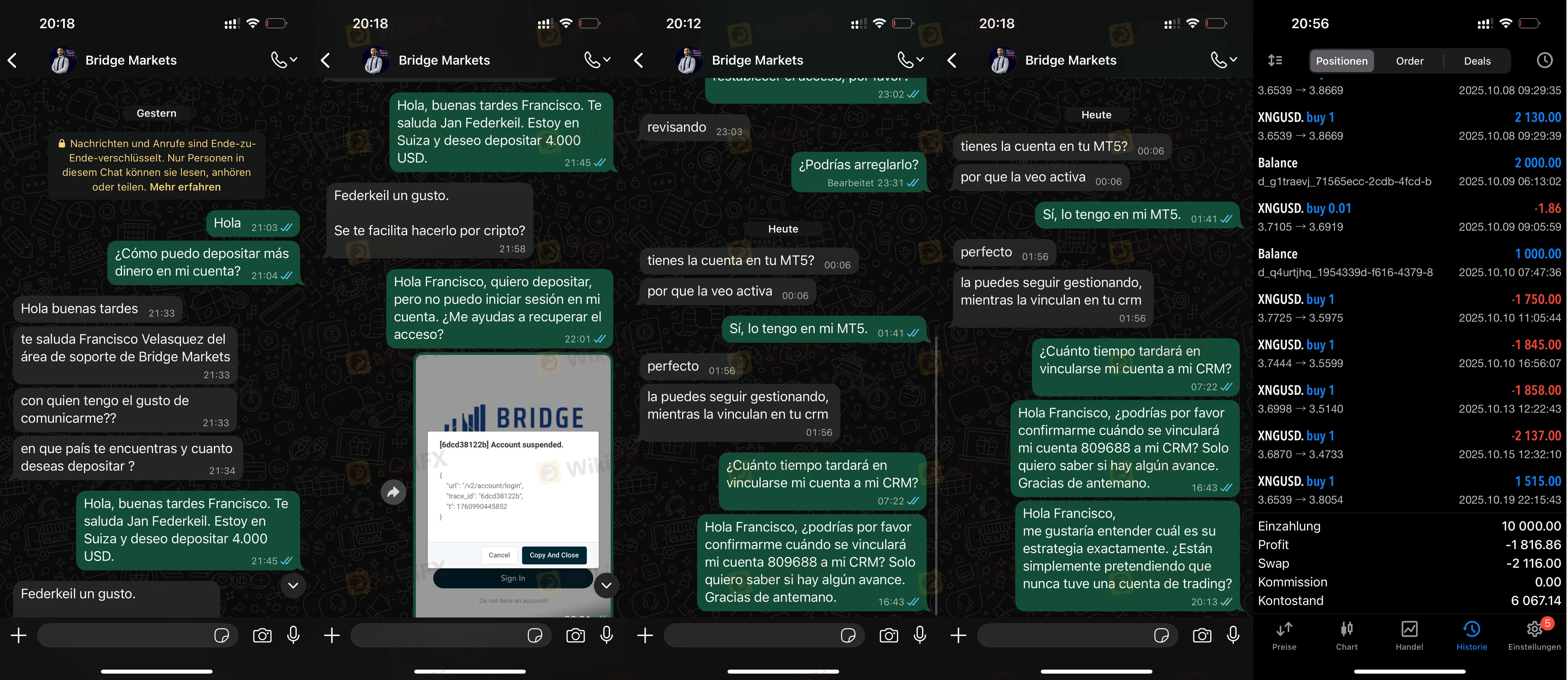

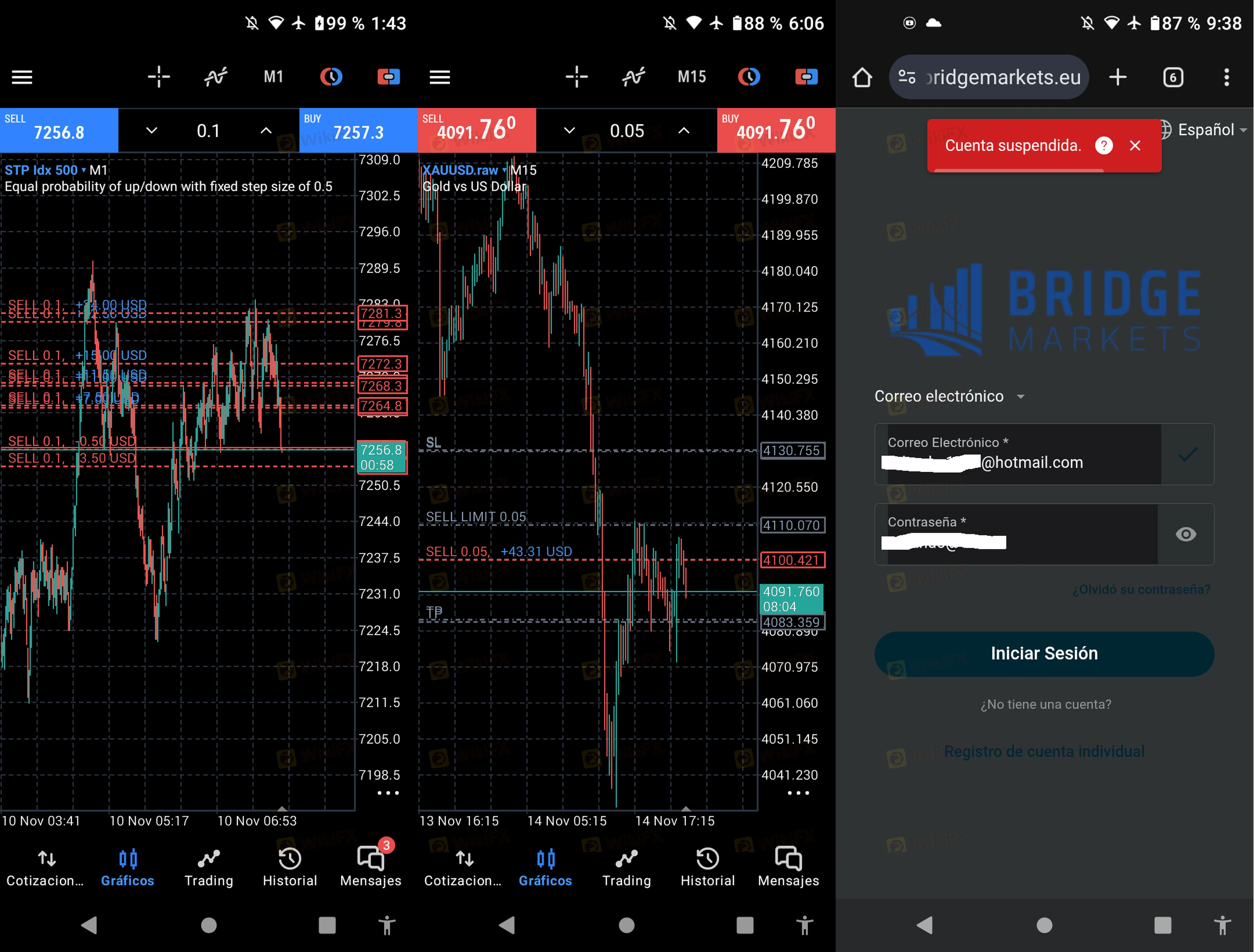

One critical issue connects directly to account access. Users have reported difficulties with their login stability, with one specific case (Case 2, dated 2025-10-21) detailing how a trader's account was blocked and their MT5 disconnected while holding over $6,000. When the user contacted support pretending to want to deposit more money, they received an immediate response, but silence resumed once they asked about restoring their login access to the blocked funds.

Other complaints consistently highlight withdrawal failures:

- Case 1: A user alleged their account was flagged for “high-frequency trading” violations after growing a balance from $497 to $3497, resulting in non-payment.

- Case 4: A trader reported execution delays of over 1 second and an inability to withdraw even a small initial deposit of $100.

- Case 5: A report of profits being wiped and the withdrawal history altered to show a lower amount than requested.

4. Software & Access

Bridge Markets utilizes the MetaTrader 5 (MT5) platform, which is generally regarded as the industry standard for advanced trading. MT5 offers superior charting tools, algorithmic trading capabilities, and a wider range of asset classes compared to its predecessor.

To access the platform, traders must complete the login security steps provided by the broker. While MT5 itself is a secure piece of software, the security of the login process is only as good as the broker's backend administration. As noted in the complaints section, the platform's technical reliability is overshadowed by administrative interventions where users lose access to the server entirely. A secure login page is irrelevant if the administration disables the account on the backend to prevent withdrawals.

Final Verdict

Bridge Markets presents a high-risk profile for any potential investor. While the inclusion of MT5 and high leverage might appeal to aggressive traders, the lack of valid regulation and the volume of severe complaints regarding withdrawal refusals constitute a “Stay Away” warning. The entity operates without the oversight necessary to guarantee fair play.

For real-time updates on regulation status or to verify the official login page URL to avoid phishing clones, consult the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Geopolitical Risk: Iran Accuses West of Inciting Domestic Unrest

Oil Markets Tighten: OPEC+ leans towards extending output pause into March

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Wall Street Giants Pivot: The "Reflation Trade" Returns

Geopolitical Risk: US Carrier Deploys as Iran Eyes Hormuz

Currency Calculator