简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Libertex Review 2026: Is this Forex Broker Legit or a Scam?

Abstract:Libertex holds a valid CySEC license and a moderate WikiFX score of 6.49, implying a baseline level of safety for European clients. However, numerous complaints regarding aggressive account managers and withdrawal blocks in the LatAm region suggest significant risks for international traders using the offshore entity.

Executive Summary: Libertex is a long-standing broker (established 2014) with a solid European license and a decent WikiFX Score of 6.49. However, a high volume of complaints alleging aggressive sales tactics and withdrawal denials casts a shadow over its reputation outside the EU.

Finding a trustworthy Forex broker can feel like navigating a minefield. You want a platform that offers legitimate opportunities, not one that traps your capital. In this Libertex review, we look beyond the glossy marketing to analyze the hard data and real user experiences. With an influence rank of “A”, Libertex is well-known, but popularity doesn't always equal safety. We will break down their regulation, platform security, and the serious red flags raised by traders recently.

Question 1: Libertex Regulation & Safety: Is my money safe?

Safety is the single most important factor in your trading journey. According to the WikiFX database, Libertex operates under a two-tiered system that you must understand to protect your funds.

The Good News: Strong European Oversight

Libertex is regulated by the Cyprus Securities and Exchange Commission (CySEC). This is a Tier-2 regulator that enforces strict standards for financial conduct within the European Union. Under CySEC regulation, brokers are typically required to maintain Segregated Accounts. This means your deposited funds are kept in a separate bank account from the broker's own operating funds. If the broker were to go bankrupt, your money theoretically cannot be used to pay their debts. This offers a significant safety net for traders registered under the Cyprus entity.

The Risk: Offshore & Regulatory Warnings

However, the data also shows that Libertex has headquarters in St. Vincent and the Grenadines. This is an offshore jurisdiction known for very loose financial oversight. Traders registered under this entity do not benefit from the same protections as EU clients. Additionally, the database flags a disclosure from BAPPEBTI (Indonesia), which placed the broker (or associated domains) on a blocklist for operating without a local license. This kind of regulatory warning usually indicates that a broker is aggressively marketing in regions where they are not authorized, which is a compliance red flag.

Verdict: If you are an EU citizen, you are likely under the safe umbrella of CySEC. If you are outside Europe (e.g., Latin America or Asia), you are likely contracting with the St. Vincent entity, where “Counterparty Risk”—the risk that the broker defaults or refuses to pay—is much higher.

Question 2: What are real traders complaining about?

While the WikiFX score is decent, the `casesText` database tells a worrying story. There are over 40 recent complaints, predominantly from Latin American countries like Colombia, Argentina, and Mexico. These complaints reveal a specific, recurring pattern of behavior that you need to be aware of.

The “Account Manager” Trap

A massive portion of the complaints (Case 1, 5, 6, 7, 8, 14) involves users being contacted by “advisors” (asesores) or “managers” who pressure them to deposit money.

- The Story: A trader from Colombia (Case 7) reported losing $3,400 in a single operation on “Natural Gas” after being guided by an advisor via telephone. The advisor pressured them to use a 60x multiplier, leading to an instant loss.

- Pro Tip: Real brokers execute trades; they do not give personalized investment advice. If a broker's employee calls you and tells you what to buy or sell, hang up. This is a massive conflict of interest—often, they profit when you lose.

Withdrawal Nightmares

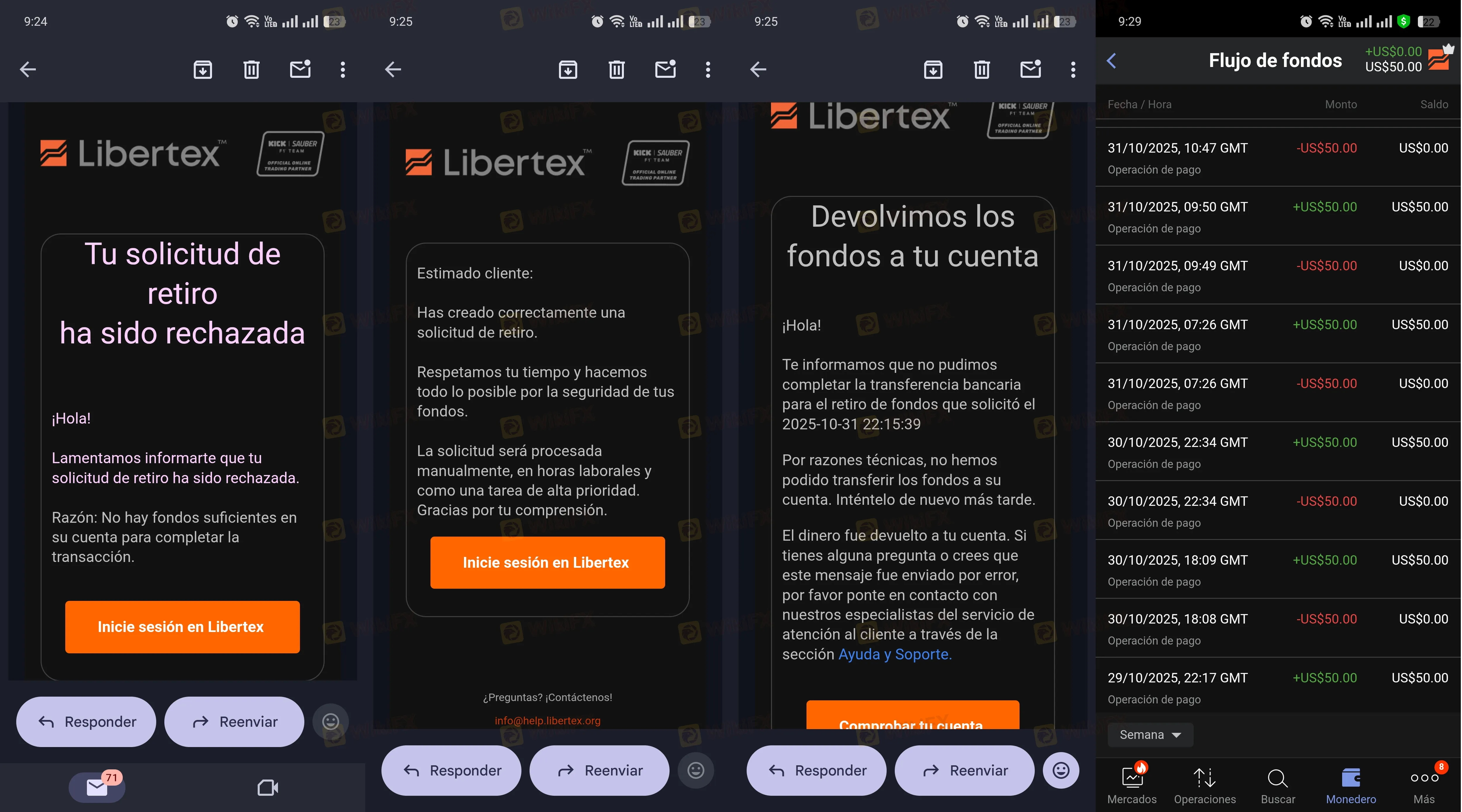

Multiple users (Case 2, 3, 4, 10, 12) report hitting a brick wall when trying to withdraw funds.

- The Tactic: Users mention that after requesting a withdrawal, they are hit with endless demands for verification documents or simply ignored. Case 12 highlights a user who had no issues until their profit hit $3,000, at which point the withdrawal process froze.

- Educational Context: Legitimate brokers must perform KYC (Know Your Customer) checks, but they usually do this before you deposit. When a broker demands excessive new documentation only after you try to withdraw profits, it is often a stalling tactic used by lower-tier brokerages.

Phantom Bonuses

Case 9 and Case 15 mention “100% deposit bonuses” that lock your funds. Brokers often use bonuses to prevent withdrawals until you trade an impossible volume of lots. Never accept a bonus without reading the fine print.

Question 3: What software will I use?

The database confirms that Libertex offers MT4 and MT5 (MetaTrader 4 and 5) platforms.

Why this is good:

MT4 and MT5 are the industry standards. They are highly customizable and support automated trading strategies. The data notes that their implementation of MT5 allows for clear fee reporting, which is a positive feature for transparency.

Security Warning: The Login Process

Several complaints (Case 18 and 19) from Malaysia report `Error 404` messages or the inability to access the website after registering. This raises a critical security point regarding your Libertex login.

1. Phishing Risk: Because brokers like Libertex have many domains (libertex.org, libertex.com), scammers often create fake “login” pages to steal your credentials.

2. Platform Access: If you cannot login to the web platform, you cannot close losing trades. Always ensure you have the mobile MT4/MT5 app installed on your phone as a backup. This allows you to manage your positions even if the broker's website is down or blocked in your region.

Final Verdict: Should I open an account?

Libertex presents a “Jekyll and Hyde” scenario. On paper, they are a legitimate, CySEC-regulated broker suitable for European traders. However, the sheer volume of complaints regarding their offshore operations—specifically the aggressive “advisor” calls and withdrawal obstacles—makes them a risky choice for international traders.

Recommendation:

If you are in the EU, Libertex is a viable option. If you are outside the EU, the evidence suggests you may face difficulties withdrawing profits or dealing with aggressive sales pressure.

Status changes daily. Before depositing, check the WikiFX App for the latest real-time certificate and regulatory updates.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Solitaire PRIME Regulatory Status: Understanding Their Licenses and Company Information

Trade deal: India and EU to announce FTA amid Trump tariff tensions

Asia FX & Rates: JGB Yields Spike vs. China Capital Inflows

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

Bitget Review: A Regulatory Ghost Running a Phishing Playground

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Currency Calculator