简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ZarVista Review (2026 ): A Complete Look at Its High-Risk Profile and Customer Complaints

Abstract:Is ZarVista a safe and trustworthy broker? After carefully studying its regulatory status, customer feedback, and business transparency, our answer is clear: ZarVista operates as a high-risk broker with serious warning signs that potential investors must not ignore. The proof for this judgment is strong, starting with its very low WikiFX score of 2.07 out of 10, along with the clear warning: "Low score, please stay away!"

A Warning for Traders

Is ZarVista a safe and trustworthy broker? After carefully studying its regulatory status, customer feedback, and business transparency, our answer is clear: ZarVista operates as a high-risk broker with serious warning signs that potential investors must not ignore. The proof for this judgment is strong, starting with its very low WikiFX score of 2.07 out of 10, along with the clear warning: “Low score, please stay away!”

This ZarVista Review will break down the main problems that make this broker high-risk. We will look at its weak overseas regulation, which gives very little protection for traders' money. We will examine many serious customer complaints, especially about not being able to withdraw money and accusations of financial wrongdoing. Finally, we will consider the worrying results from on-site investigations that question whether the broker actually exists where they claim. Our goal is to provide a complete analysis based on real evidence, helping you make a fully informed and safe decision about your money.

Understanding Regulatory Status

A broker's regulatory status is the most important factor in determining how safe your money is. It controls what rules the company must follow, how much money it must keep on hand, and what legal options you have if there's a problem.As highlighted in this review of ZarVista, the brokers regulatory framework itself as a major warning sign.

The Offshore Licenses

ZarVista holds two licenses from offshore locations:

• Mauritius Financial Services Commission (FSC): License No. GB23202450, held by Zarvista Capital Markets (MU) Ltd.

• Comoros Mwali International Services Authority (MISA): License No. T2023293.

The term “Offshore Regulated” means that a broker is licensed in a country known for less strict financial oversight. Regulators like the FSC and MISA typically have lower money requirements, less strict reporting rules, and most importantly, often don't have investor protection programs. This is very different from top-level regulators in places like the UK (FCA) or Australia (ASIC), which enforce strict rules designed to protect client money, including keeping it separate from company accounts and providing a safety net if the broker fails.

What This Means for You

Trading with a broker regulated in Comoros and Mauritius means that if you have problems like withdrawal issues, trade manipulation, or even complete broker failure, your legal options are very limited. These locations do not provide a strong framework for solving disputes or paying traders back for financial losses.

This lack of transparency is further shown by the disconnect between the broker's registered address in Comoros and its real-world presence. To provide you accurate and reliable information in this ZarVista Review, a field survey was conducted by WikiFX investigators to find offices for “Zara FX” (ZarVista's previous name) at claimed addresses in Canada and Cyprus found nothing. This failure to prove a physical operational base raises serious questions about the company's legitimacy and accountability.

*Before putting money with any broker, especially one with offshore regulation, it is important to do your own research. We strongly advise traders to use independent verification tools like WikiFX to check the latest regulatory status and any active warnings.*

Looking at User Experiences

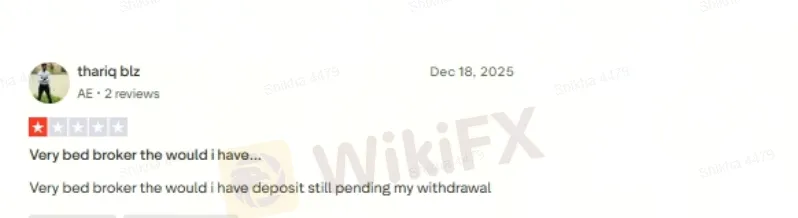

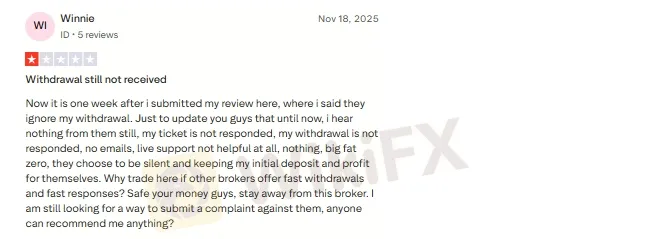

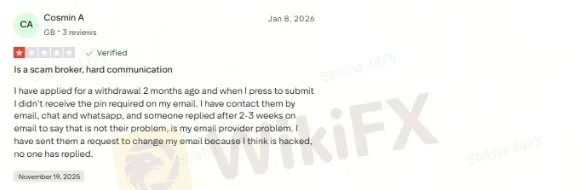

While regulatory status points to potential risk, real-world user experiences show the actual consequences. The high number and seriousness of complaints made against ZarVista are a main reason for its low trust score and serve as a clear warning to potential clients. We checked the ZarVista review online and discovered a consistent pattern of user-reported problems.it points out widespread problems within the broker's operations, particularly concerning fund withdrawals.

Theme 1: Serious Withdrawal Problems

A consistent and deeply concerning theme among user complaints is the inability to access and withdraw money. These are not minor delays but complete rejections and account lockouts.

• Rejected Profits: One user (FX5311292362) reported that profits made from manual trading were rejected for withdrawal. The broker allegedly failed to provide any proof for this action and was accused of manipulating processes against the terms of the MT5 platform.

• Declined Refunds: Another trader (Yuri2) noted that while spreads were low, withdrawal attempts were declined. The broker's response was to blame the user's bank, advising them to “speak with your card issuer,” effectively shifting responsibility away from their own platform.

• Complete Account Lockout: In a more extreme case, a user (crypback@hotmail) who complained about a withdrawal issue found themselves completely locked out of the website, unable to access their account or funds.

These reports paint a picture of a system where accessing your own money can become an impossible challenge, a critical failure for any financial service provider.

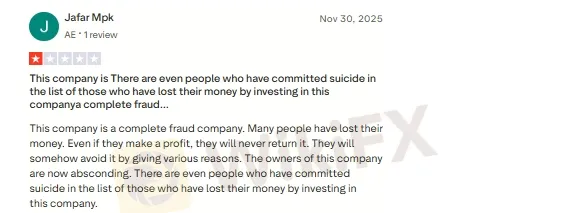

Theme 2: Claims of Stolen Money

One of the most alarming cases in this ZarVista forex broker review involves allegations of outright fund theft. A user claimed that after investing $50,000 in a PAMM account, the balance grew to $75,000 before the broker allegedly withdrew the entire amount internally and deleted the trading account. The trader reports filing a police complaint in India, submitting evidence to authorities.

• The broker then allegedly stole the entire amount through an internal withdrawal.

• Subsequently, the user's MT4 account and platform access were deleted to erase the evidence.

Importantly, this user states they have filed a police case in India, submitting all evidence to authorities in an attempt to recover their investment. Such a serious accusation, backed by the filing of a formal police report, represents the most severe red flag a broker can have.

Theme 3: Some Positive Feedback?

To maintain an objective view, it is important to acknowledge the positive and neutral feedback. Some users have praised ZarVista's platform. For instance, Giorgos Lazos complimented the customizable MT5 charts and a trading bonus, while user FX1524779398 praised the platform's speed and responsive customer service during an order execution issue.

However, even neutral feedback can be telling. One user (FX1524216419) praised the “chic platform” and “excellent customer service” but pointedly mentioned that a “faster withdrawal process would be the perfect accessory.” This comment, while framed positively, subtly confirms the widespread complaints about slow or problematic withdrawals, suggesting it is a known issue even among otherwise satisfied clients.

*These user-submitted reports highlight a significant difference between the broker's promises and the actual customer experience. We urge readers to review all available user feedback on platforms like WikiFX before making any commitment.*

A Look Behind the Marketing

A broker's trading conditions—its accounts, platforms, and fees—are often the focus of its marketing. While ZarVista presents an array of seemingly attractive features, these must be evaluated within the context of the overwhelming risks we have already identified. Superior trading tools are of little value if the broker operating them cannot be trusted with your money.

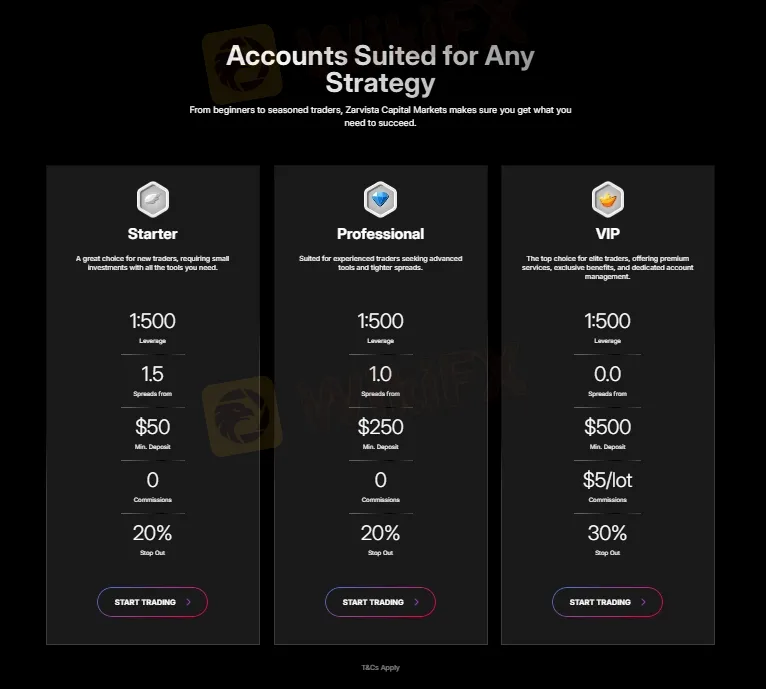

| Account Name | Minimum Deposit | Spreads | Commission | Key Feature |

| Starter | $50 | 1.5pips | None | Zero commission |

| Professional | $250 | 1.0 pips | None | Zero commission |

| VIP | $500 | 0.0 pips | $6 per lot | $5 |

All accounts offer high leverage up to 1:500 and are designated as swap-free, which may appeal to certain trading styles.

Trading Platform and Instruments

ZarVista provides its clients with the MetaTrader 5 (MT5) platform. MT5 is a globally respected, fully licensed platform known for its powerful analytical tools, multi-asset capabilities, and support for algorithmic trading via Expert Advisors (EAs). It is, by all measures, a top-tier trading terminal.

However, while a powerful platform like MT5 is a plus, its benefits are severely undermined if the broker operating it cannot be trusted with fund withdrawals. The sophistication of the software is irrelevant if the funds within the account are at risk.

The broker offers a standard range of market instruments, including:

• Currencies (Forex)

• Metals

• Indices

• Commodities

• Cryptocurrencies

Spreads, Commissions, and Fees

The fee structure varies by account type, with options for zero-commission trading with wider spreads (Starter, Business) or raw spreads with a commission per lot (Professional, VIP). The broker aggressively markets its payment system with claims of instant deposits and lightning-fast withdrawals 24/7. This marketing claim stands in direct and stark contradiction to the numerous, detailed user complaints about withdrawal rejections, delays, and lockouts. This disconnect between marketing promises and user reality is a significant red flag.

ZarVista Pros and Cons

When we weigh the potential advantages of trading with ZarVista against the documented disadvantages, the balance is not just uneven—it is overwhelmingly tilted toward risk. A simple pros-and-cons analysis makes this difference clear.

The Potential Positives (The “Pros”)

• Wide Range of Instruments: Offers access to forex, commodities, indices, metals, and cryptocurrencies.

• High Leverage: Provides leverage up to 1:500, which can multiply gains (but also losses).

• Advanced Platform: Uses the well-regarded and full-featured MetaTrader 5 (MT5) platform.

• Multiple Account Tiers: Structures accounts to cater to beginners and professionals, with some offering zero-commission or raw-spread options.

• Bonus Offerings: The broker mentions a 30% deposit bonus to attract new clients.

The Overwhelming Negatives (The “Cons”)

• Extremely High Risk & Low Trust Score: An exceptionally low WikiFX score of 2.07/10 is paired with an explicit directive to “stay away.”

• Weak Offshore Regulation: Licensed in Comoros and Mauritius, two locations that offer minimal trader protection, no compensation funds, and limited legal options.

• Severe and Numerous Withdrawal Complaints: A clear pattern of documented user reports details rejected withdrawals, unexplained delays, and even being locked out of accounts after complaining.

• Serious Claims of Fraud: Multiple, credible user claims of stolen investment funds, including one case involving $50,000 where the user filed a police report after their funds and account were deleted.

• Lack of Physical Presence: On-site investigations to verify office locations in Canada and Cyprus for its previous brand name, Zara FX, found no presence, raising questions about the company's operational transparency.

• Contradictory Marketing: The broker's claim of “lightning-fast withdrawals” is directly contradicted by a large body of evidence from user complaints.

Final Verdict: A Risk Not Worth Taking

In this ZarVista Review, While ZarVista presents a modern appearance with an advanced MT5 platform, high leverage, and a variety of account types, these features are overshadowed by fundamental and severe issues. The evidence points to an operational environment where trader security is not a priority.

The three core pillars of risk—weak offshore regulation, a disturbing pattern of user complaints about withdrawals and fund safety, and a lack of verifiable operational transparency—combine to create an unacceptably high-risk proposition. The claims of stolen funds and account deletions are particularly alarming and cannot be overlooked. Based on our comprehensive review of the available data, the risks associated with ZarVista far outweigh any potential benefits.

The world of online trading is filled with options. Your top priority must always be the security of your money. We strongly encourage every trader to independently verify any broker's license, history, and user reviews on a trusted platform like WikiFX before opening an account or depositing funds.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Fun Corporation Ltd Review: A Deep Dive into Safety and Regulation

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Currency Calculator