简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

RockwellHalal User Reputation: Looking at Real User Feedback and Common Complaints to Check Trust

Abstract:The growth of online investment websites has created opportunities for many people, but it has also created a situation where telling real opportunities from possible risks is more important than ever. Websites like RockwellHalal are getting attention, and with that attention comes an important question from potential investors: Is RockwellHalal Safe or Scam? This article aims to give a direct, fact-based answer to that question.

Starting Our Investigation

The growth of online investment websites has created opportunities for many people, but it has also created a situation where telling real opportunities from possible risks is more important than ever. Websites like RockwellHalal are getting attention, and with that attention comes an important question from potential investors: Is RockwellHalal Safe or Scam? This article aims to give a direct, fact-based answer to that question.

Our goal is to do a fair investigation into RockwellHalal's user reputation and overall trustworthiness. To do this, we will look at the company's official claims, break down its investment model, and examine the common complaints and warning signs linked with websites that share its features. The goal is not to make a decision for you, but to give the clarity and information needed to understand the potential risks and make an informed choice for your financial safety.

What is RockwellHalal?

A Look at Their Claims

To understand RockwellHalal, we must first look at how it presents itself to the public. According to its official statements, RockwellHalal is a “global team of legal, technology, and cryptocurrency experts” that started operating digital asset exchanges in 2019, originally based in Switzerland. As of 2025, after more than five years in operation, their stated mission is to make cryptocurrency trading “secure, ethical, and accessible to users worldwide.”

The company positions itself as a global private markets investor with a focus on building long-term, trust-based relationships. Their main services focus on areas typically reserved for big institutional investors: Private Equity, Private Credit, and Infrastructure. They claim to offer access to these markets with lower fees, managed by a highly experienced team.

Their value proposition is summarized by several key claims:

• Who They Claim to Be: A global private markets investor with strong trading roots.

• Stated Mission: To generate superior, long-term returns and build trust with investors and partners.

• Key Offerings: Diversified assets, strong security, and “Best Support” available 24/7.

• Value Proposition: Providing access to private markets with a compelling fee structure and a professional team.

This self-description forms the baseline of promises that we will now carefully analyze.

Breaking Down the Promises

A Critical Analysis

A company's claims must stand up to careful examination. In the world of online finance, promises of high returns and perfect security demand a deep and skeptical analysis. This section breaks down RockwellHalal's investment model and operational claims to identify potential problems and warning signs.

Looking at the Investment Packages

One of the most direct ways to assess a website is by analyzing its promised returns. RockwellHalal offers several investment levels, which we have organized below for clarity.

| Package | Minimum Deposit | Maximum Deposit | Maximum Return |

| Starter | $100 | $1,499 | 3.5% |

| Pro | $1,500 | $4,999 | 20% |

| Elite | $5,000 | $10,000,000,000 | 25% |

A 3.5% return, as offered in the Starter package, is within the range of possibility for various investment types. However, the promised returns of 20% and 25% for the Pro and Elite packages raise immediate and significant concerns. These figures are not presented as potential, high-end outcomes but as the “Maximum Return” linked to specific deposit levels.

Guaranteed high returns are a classic sign of high-risk investment schemes and potential scams. Real financial markets, whether in stocks, private equity, or cryptocurrency, are naturally unpredictable. For context, the historical average annual return for the S&P 500, a benchmark for the U.S. stock market, is around 10%. While certain investments can yield higher returns, they come with substantial risk and are never guaranteed. Offering fixed returns of 20% or 25% is an extraordinary claim that is virtually impossible to maintain legitimately and should be viewed with extreme skepticism.

Examining Security and Contact

Beyond returns, a company's operational transparency and security claims are vital indicators of its legitimacy.

The “Commodo License” claim is a major red flag. This is likely a misspelling of “Comodo,” a well-known company that provides SSL certificates. An SSL (Secure Sockets Layer) certificate is a standard security technology for establishing an encrypted link between a web server and a browser. It ensures that all data passed between them remains private. However, it is crucial to understand that an SSL certificate is not a financial regulation license. It has nothing to do with a company's authority to handle investments, manage client funds, or operate as a brokerage. Presenting an SSL certificate as a form of security license is a common and highly misleading tactic used to create a false sense of legitimacy.

The provided contact information further undermines the company's professional image.

• Email: The use of a generic Gmail address (`rockwellhalal@gmail.com`) is highly unprofessional for an entity claiming to be a global financial firm. Legitimate companies almost universally use email addresses with their own custom domain (e.g., support@rockwellhalal.com).

• Address and Phone: There is a significant geographical disconnect. The website lists a UK phone number, a New York, USA address, and claims to have origins in Switzerland. This lack of a clear, verifiable, and singular physical headquarters is a serious red flag often seen with offshore or unregulated entities.

Reputable brokers are transparent about their regulatory status. They proudly display license numbers from top-tier financial authorities like the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). The complete absence of any such information on RockwellHalal's site is a critical warning sign.

Looking at Common Complaints

Patterns in User Feedback

While direct, verified user testimonials for RockwellHalal may be scattered, we can analyze the types of RockwellHalal Complaints that frequently arise with websites showing the red flags identified above. These patterns of user experience provide a powerful forecast of the potential problems investors might encounter.

Complaint 1: Withdrawal Issues

This is the most common and damaging complaint leveled against high-risk and fraudulent websites. The process often follows a predictable and painful pattern. Initially, depositing funds is quick and seamless. The user's online account dashboard may even show impressive profits, reinforcing their belief that they made a good investment.

The problems begin when the user attempts to make a withdrawal. Suddenly, the process becomes fraught with obstacles. Common tactics include endless delays with vague excuses, sudden demands for additional payments to cover “taxes,” “conversion fees,” or “withdrawal charges,” or, in the worst cases, the support team simply stops responding altogether. The account may be frozen, and the user's funds become inaccessible. This tactic is designed to extract as much money as possible from a client before they realize they have been deceived.

Complaint 2: Unresponsive Support

RockwellHalal's claim of “Best Support” available 24/7 often clashes with the reality reported by users of similar websites. Support agents may be incredibly attentive, friendly, and persuasive during the deposit phase, encouraging larger investments.

However, once a withdrawal is requested or difficult questions are asked, this “best support” frequently vanishes. Emails to the generic Gmail address go unanswered, and the single phone number may ring endlessly or be disconnected. A legitimate financial institution has a robust, multi-channel support infrastructure, not a single mobile number and a free email account. The lack of a professional support system is a strong indicator that there is no real team available to assist clients with problems.

Complaint 3: Misleading Information

This complaint ties all the other issues together. Users often report feeling deceived by misleading claims that made the website appear safe and regulated. The “Commodo License” is a prime example of this, where a basic website security feature is misrepresented as a financial credential.

Furthermore, the vague and often contradictory marketing language—mixing terms like “cryptocurrency trading” with “private equity” and “infrastructure”—can create confusion. This lack of clarity is often intentional, designed to impress potential investors with complex terminology without providing any real substance or a clear, verifiable investment strategy. When users later discover the truth about the website's lack of regulation and transparency, they rightfully feel that they were misled from the very beginning.

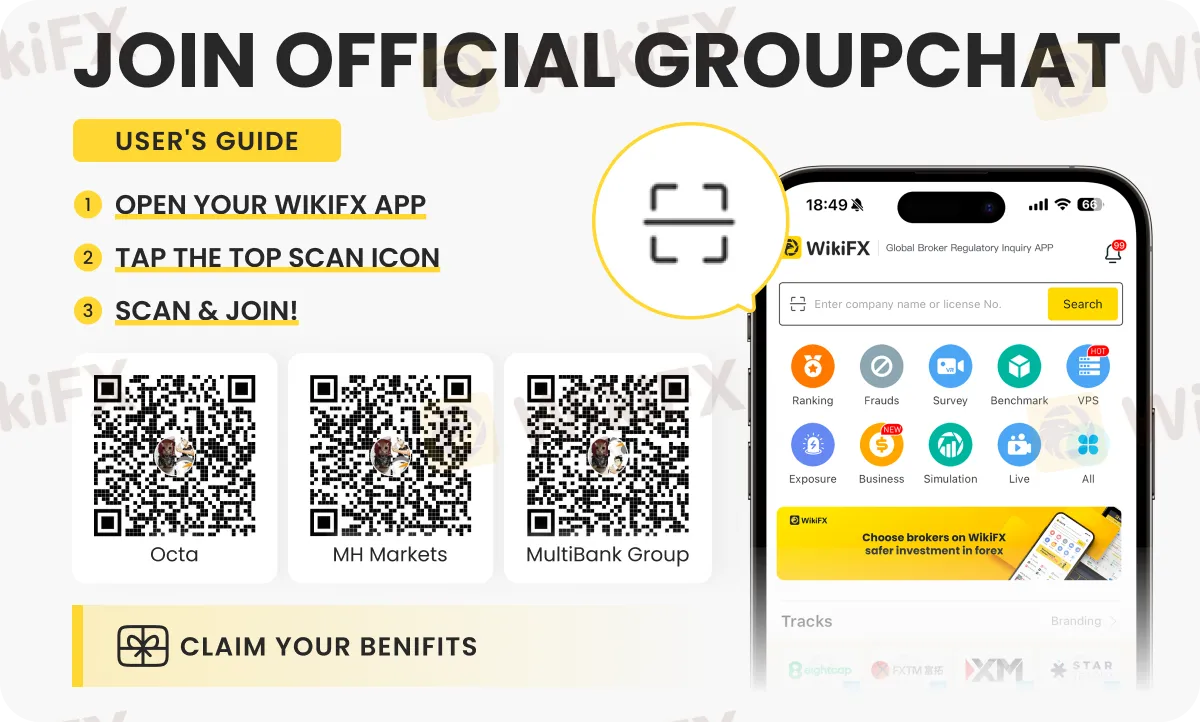

Validating the experiences of others is a critical step in due diligence. Independent review aggregators and regulatory databases are invaluable resources. For instance, the exposure and complaint sections on a verification website like WikiFX can provide crucial insight into whether a broker consistently honors withdrawals and operates transparently.

A Guide to Checking Brokers

Navigating the world of online investments requires a proactive and defensive mindset. To protect your capital, it is essential to have a practical framework for checking any broker or investment website, not just RockwellHalal. This guide provides an actionable checklist to help you identify trustworthy partners and avoid potential scams.

The Non-Negotiable Checklist

Before you deposit a single dollar, every website must pass this fundamental test. If a broker fails on any of these points, you should reconsider your investment.

1. Verify Regulation: This is the most important step. Check if the broker is licensed and regulated by a top-tier authority in a major jurisdiction (e.g., FCA, CySEC, ASIC). Do not take their word for it or trust a certificate they display on their site. Go directly to the regulator's official website and search for the company in their public register.

2. Examine Contact Details: Look for signs of a professional, established business. This includes a physical office address that can be verified on a map, a corporate email domain, and a landline phone number tied to their office location. Be extremely wary of mobile numbers, free email addresses (like Gmail or Outlook), and vague P.O. box addresses.

3. Question Unrealistic Returns: Be deeply skeptical of any website that guarantees high, consistent profits. Real investing involves risk, and returns are never guaranteed. Promises of 20%, 25%, or higher monthly or annual returns are almost always a sign of a high-risk scheme.

4. Read Independent Reviews: Do not rely on testimonials published on the broker's own website, as these can be easily fabricated. Search for reviews on multiple, independent third-party sites, forums, and social media. Pay close attention to patterns of complaints, especially those related to withdrawal problems.

5. Test the Website and Process: If a website passes the initial checks and you decide to proceed, start with the absolute minimum deposit amount you are willing to lose. Before investing more, test the entire process, including making a small withdrawal, to see how the company handles it.

The Ultimate Verification Tool

Fraudulent entities are becoming increasingly sophisticated in how they present themselves, making it difficult for individual investors to spot all the red flags. This is why using a dedicated, third-party verification service is not just a recommendation; it is an essential part of modern financial safety.

Before you engage with any broker, make it a mandatory rule to conduct a thorough background check. We urge all investors to use a comprehensive verification website like WikiFX. A simple search on their website can instantly reveal a broker's regulatory status, company history, license details, and real user reviews and complaints. This simple step provides a clear, aggregated signal of a broker's trustworthiness and can be the single most effective action you take to protect yourself from devastating financial loss.

Conclusion: The Final Verdict

On Trust and Reputation

After a detailed analysis of RockwellHalal's own claims, investment model, and operational details, a clear picture emerges. The website exhibits numerous, significant red flags that are strongly associated with high-risk and untrustworthy operations.

The combination of guaranteed, unrealistically high returns, the misrepresentation of a basic SSL certificate as a security license, the use of unprofessional contact details, and the complete lack of verifiable financial regulation paints a concerning portrait. These red flags directly align with the most common complaint patterns seen in the industry, namely withdrawal difficulties and non-existent customer support.

Based on this evidence, the answer to the question Is RockwellHalal Safe or Scam leans overwhelmingly towards extreme risk. While we refrain from a definitive legal judgment, the website's characteristics are inconsistent with those of a legitimate, regulated, and trustworthy financial firm. The most prudent course of action for any potential investor is to exercise extreme caution and avoid committing funds to a website with so many unresolved questions. Your financial security should always be the top priority. Always protect your capital by performing rigorous due diligence and leveraging independent verification tools before you invest.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Fed

Geopolitical Risk Returns: Iran Threatens 'Unforgettable Lesson' as Tensions Mount

TrioMarkets Launches TrioFunded as Brokers Continue to Expand Into Prop Trading

War Risk Premium Explosions: Gold Hits

FCA Warns on Complex ETP Sales Practices

One Message, RM600K Gone: WhatsApp Investment Scam Exposed

A Complete 2026 Review: Is RockwellHalal Legit or a Scam to Stay Away From?

A major development in Trump's Fed feud is set to happen next week in the Supreme Court

Forex 101: Welcome to the $7.5 Trillion Beast

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Currency Calculator