简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Deep Dive Review: Is BDSWISS Safe?

Abstract:At WikiFX, we analyze brokers based on their licenses, software, and user feedback. BDSWISS currently has a low score of

Date: 2025-08-25

Broker Name: BDSWISS (also known as BDS Markets)

WikiFX Score: 3.48 / 10 (High Risk)

Region: Global (Headquarters in Seychelles)

1. Quick Summary: The “Safety Score”

If you are thinking about investing with BDSWISS, you need to be very careful.

At WikiFX, we analyze brokers based on their licenses, software, and user feedback. BDSWISS currently has a low score of 3.48 out of 10. In the financial world, a score below 6.0 usually means the broker has legitimate risks.

This broker offers the popular MT4 and MT5 trading platforms, which is good. However, there is a large volume of complaints from traders who say they cannot get their money back.

Key Takeaways

- Weak Regulation: The broker is primarily regulated in an “offshore” location (Seychelles).

- Regulatory Warning: The German financial authority (BaFin) has issued a warning against this company.

- Withdrawal Issues: Many users report that their withdrawal requests are ignored for months.

- Hidden Fees: Some traders report being charged “inactivity fees” while waiting for their withdrawals to be processed.

2. Is the License Real? (The Fact Check)

A license is like a driver's license for a bank. It tells you who is watching the broker to keep your money safe. BDSWISS has a complicated regulatory situation.

Regulatory Data Table

| Regulator Name | Country | License Type | Status |

|---|---|---|---|

| FSA (Seychelles) | Seychelles | Offshore Regulatory | Regulated (Offshore) |

| CYSEC | Cyprus | European License | Unverified |

What This Means for You

1. Offshore Regulation (High Risk):

BDSWISS is regulated by the FSA in Seychelles (License SD047). While this is a legal license, it is considered “Offshore.” Offshore regulators often have less strict rules than regulators in the UK, USA, or Australia. They may not require the broker to keep insurance for your deposits.

2. The German Warning (BaFin):

Our records show a serious warning from BaFin (Germany's financial police). BaFin stated that BDS Markets (the company behind BDSWISS) is not authorized to do banking business in Germany. When a major government regulator warns the public, it is a very serious red flag.

3. Unverified Status:

The broker claims a connection to a Cyprus (CYSEC) license, but WikiFX data marks this as “Unverified.” You should assume you are not protected by European safety laws.

3. What Traders Say: Real Complaints

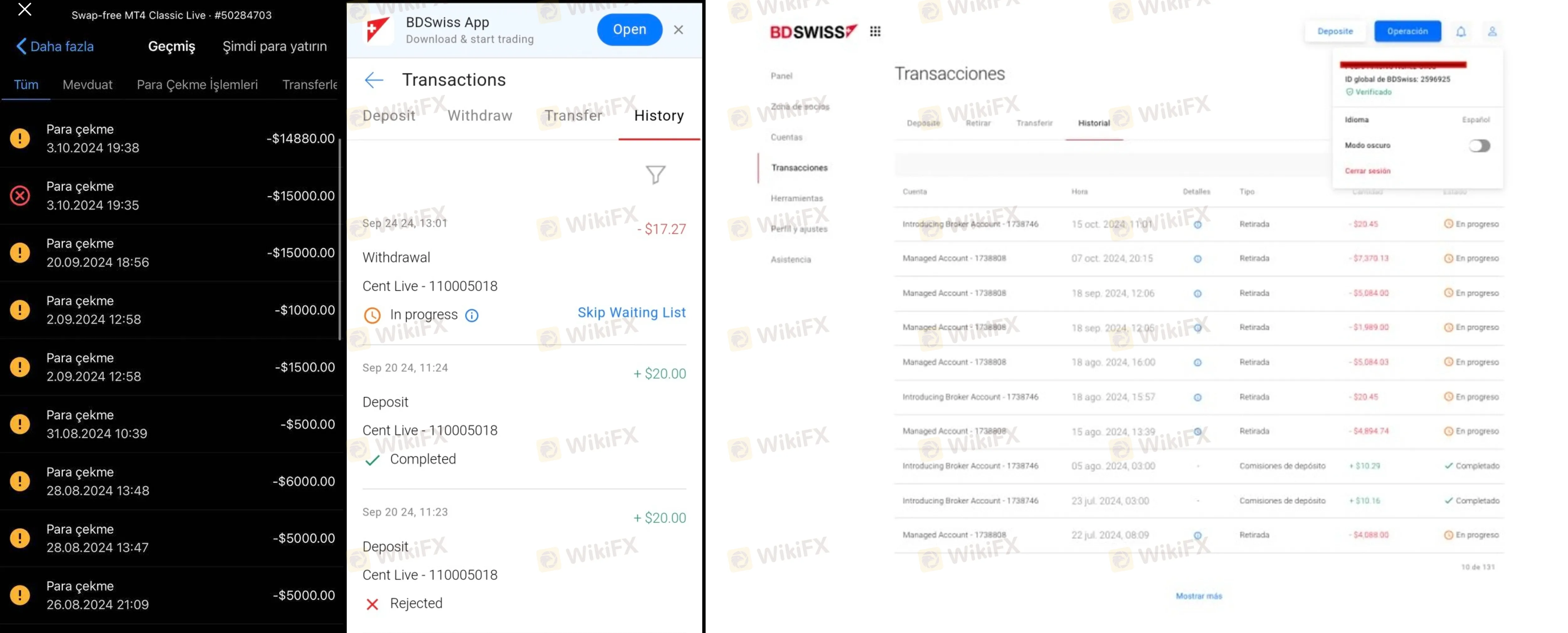

WikiFX has received over 30 complaints in recent months. When we analyze these complaints, we see clear patterns. It is not just one unhappy person; it is the same problem happening to many people in India, Brazil, Indonesia, and Europe.

Problem 1: Money is Accepted, But Not Returned

The biggest issue reported is that withdrawals are impossible. Traders can deposit money instantly, but when they ask to take it out, the system “freezes” or support stops replying.

- Case Evidence (India, August 2025): A user reported that their withdrawal has been pending for nearly a year. They cannot login, and customer service does not respond.

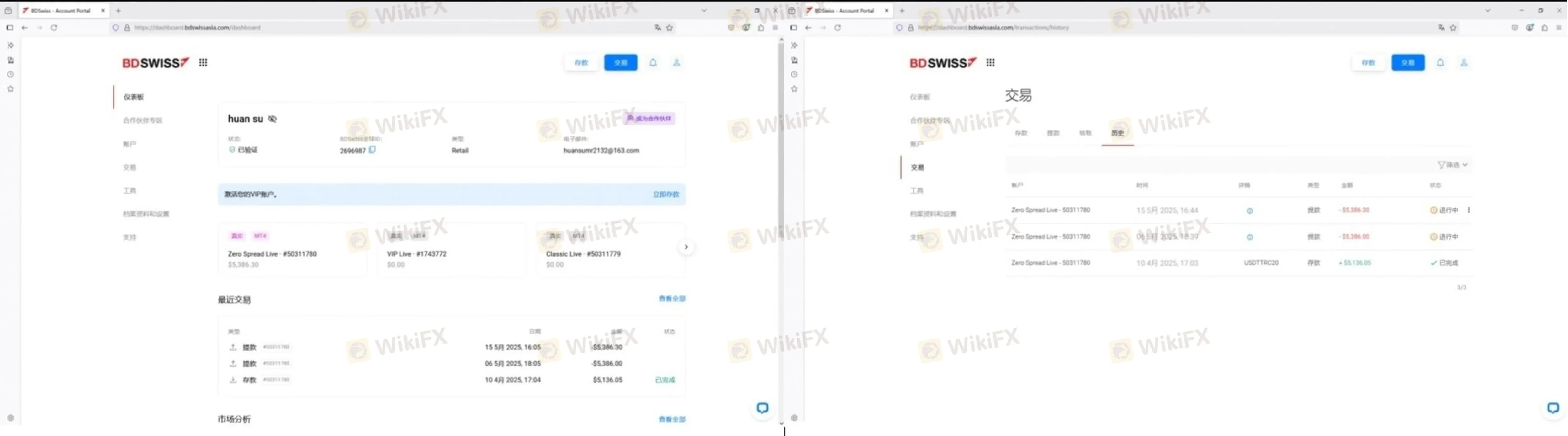

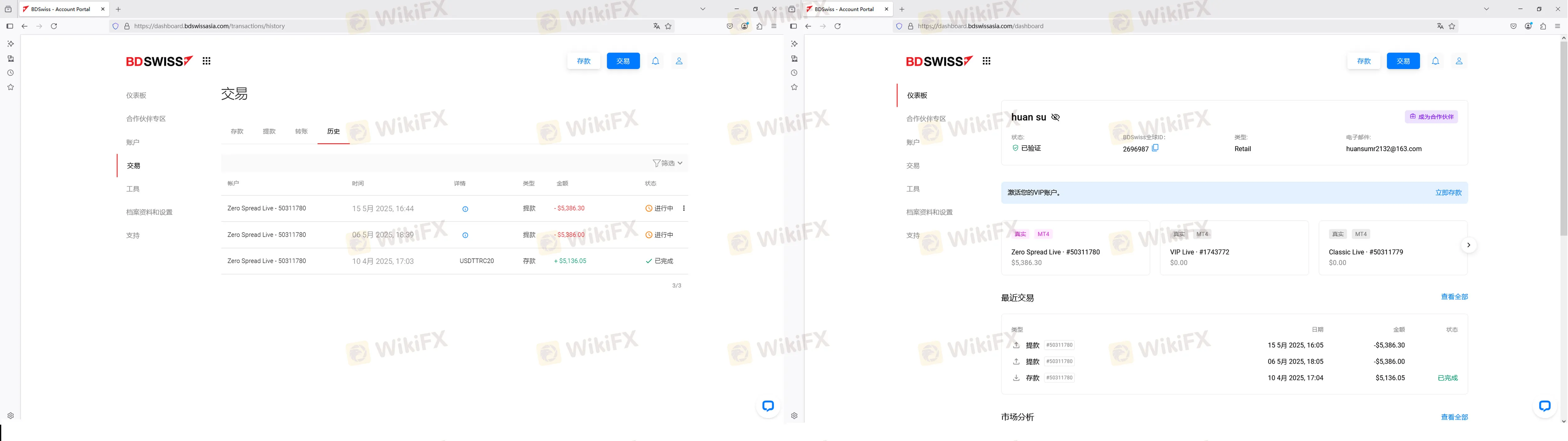

- Case Evidence (China, May 2025): A trader deposited over $5,000. When they tried to withdraw, the request was kept in “audit” indefinitely. The user warned that the platform allows deposits but blocks withdrawals.

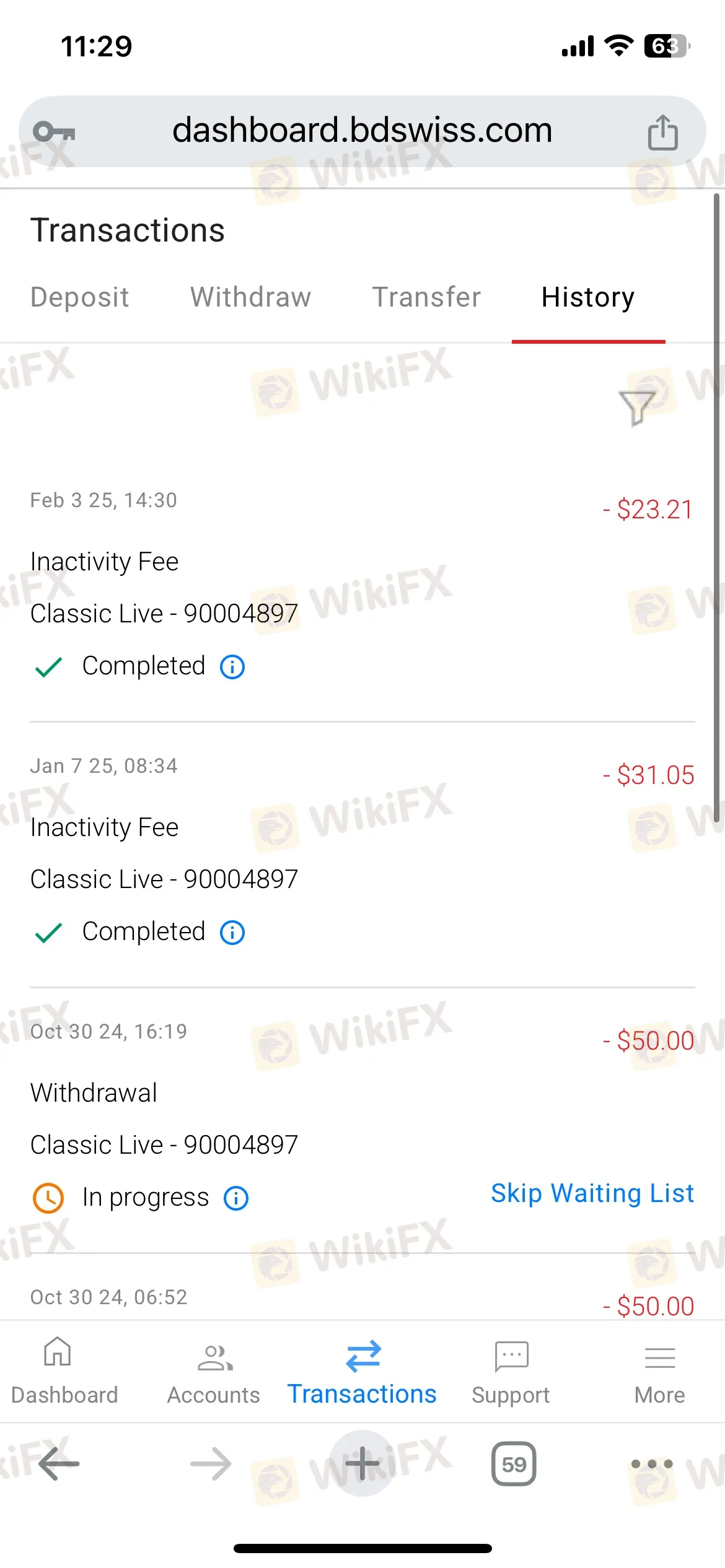

Problem 2: The “Inactivity Fee” Trap

This is a very unusual and unfair practice reported by users.

- How it works: You ask to withdraw your money. The broker delays the withdrawal for months.

- The Trap: Because you are waiting, you are not trading. The broker then deducts money from your account as an “Inactivity Fee” because you haven't traded—even though they are the ones holding your money.

- Evidence: A user from Morocco (Case 10, Feb 2025) reported that while his withdrawal was “processing” since October 2024, the broker deducted fees from his balance twice.

Problem 3: Poor Customer Support

Users from Thailand, Brazil, and India all report similar experiences with customer service.

- When asking about deposits, support is fast and helpful.

- When asking about withdrawals, support says “we are fixing the system” or stops replying entirely.

(Recent complaint showing frustration with delayed withdrawals)

4. Conclusion

Is BDSWISS safe for your investment?

WikiFX Verdict: NO.

Based on the facts available in our database, BDSWISS presents a high risk to your capital.

1. Low Score: A 3.48 score indicates poor reliability.

2. Regulatory Issues: A warning from Germany (BaFin) and weak offshore regulation.

3. Confirmed Delays: Dozens of users verify that withdrawals are delayed for months without valid reasons.

Recommendation: We strongly advise investors to avoid depositing money with BDSWISS. If you are already trading with them, we recommend attempting to withdraw your funds immediately. Look for brokers with a WikiFX score above 7.0 and valid Tier-1 licenses (like FCA, ASIC, or NFA) for better safety.

Disclaimer: This review is based on public data and user complaints available on the WikiFX platform as of the date of publication. Identities in case studies have been hidden for privacy. Trading Forex and CFDs involves high risk and you may lose your investment.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Fed

Geopolitical Risk Returns: Iran Threatens 'Unforgettable Lesson' as Tensions Mount

TrioMarkets Launches TrioFunded as Brokers Continue to Expand Into Prop Trading

War Risk Premium Explosions: Gold Hits

FCA Warns on Complex ETP Sales Practices

One Message, RM600K Gone: WhatsApp Investment Scam Exposed

A Complete 2026 Review: Is RockwellHalal Legit or a Scam to Stay Away From?

A major development in Trump's Fed feud is set to happen next week in the Supreme Court

Forex 101: Welcome to the $7.5 Trillion Beast

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Currency Calculator