简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

TopWealth Trading User Reviews: A Complete Look at Real Feedback and Warning Signs

Abstract:Choosing a forex broker in today's busy market is tough for traders. When you hear about TopWealth Trading, the first thing you want to know is whether it's safe and real. This brings us to the key questions we want to answer: Is TopWealth Trading Safe or Scam? And what do TopWealth Trading Complaints and reviews actually tell us about how they work?

Choosing a forex broker in today's busy market is tough for traders. When you hear about TopWealth Trading, the first thing you want to know is whether it's safe and real. This brings us to the key questions we want to answer: Is TopWealth Trading Safe or Scam? And what do TopWealth Trading Complaints and reviews actually tell us about how they work?

The answer is usually not just yes or no. A broker might look good on the outside while hiding serious problems. Instead of giving you a simple answer, this article will look closely at all the facts we can find. We will carefully study what users say about them, their legal status, what they claim to do, and the problems we notice. The broker gives mixed messages, so a detailed review based on facts is not just helpful - it's necessary for anyone thinking about using this platform. Our goal is to give you the information you need to make your own smart choice.

A Facts-Based First Look

To start our review, we need to first list the basic facts about TopWealth Trading. A quick look gives us an early picture of the broker, but as we will see, these details often create more questions than answers. This summary helps us start our deeper look into whether the broker can be trusted.

| Attribute | Details | Initial Interpretation |

| Overall Score | 6.83 / 10 | Medium; not a top score but also not in the dangerous lowest group. |

| Regulation | ASIC (Australia), VFSC (Vanuatu) | Mixed messages: A strong top-level regulator paired with a weak offshore one. |

| Operating Period | 2-5 years | A fairly new company that hasn't built a long history yet. |

| Platform | MT4 Full License, but only a “Mobile app” listed for trading | A big problem that needs immediate and complete investigation. |

| User Feedback | 5 Positive, 2 Neutral, 0 Negative (from available data) | Looks positive at first, but the sample size is very small. |

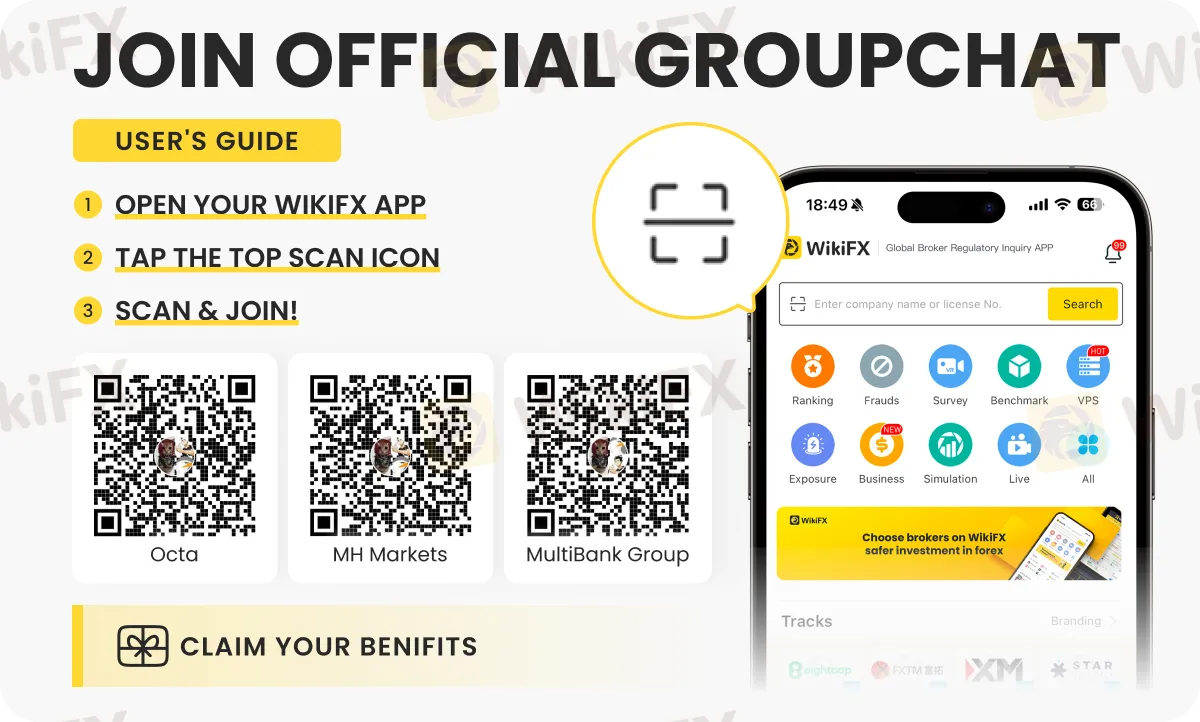

While these facts give us a picture, they don't tell the complete story. Checking a broker's license and current user feedback is an important step. We strongly suggest traders use independent checking platforms like WikiFX to double-check any broker's claims before putting in money.

Looking at User Comments

The most honest view of a broker's performance comes straight from its clients. By breaking down real user reviews, we can move past marketing materials and understand the daily experience of trading with TopWealth Trading. The available feedback shows a complex picture with clear positives, some neutral observations, and a strange lack of negative comments.

The Good Feedback

A large part of the available user comments highlights specific working strengths. These repeating themes suggest that, in certain areas, the broker gives a satisfactory experience.

• Quick Withdrawals: This is the most often praised feature. Multiple users from different areas report that withdrawal requests are approved quickly, with some noting that money arrives on the same day. Comments like “fast withdrawals” and “withdrawals are approved immediately” show a pattern of efficient money processing.

• Quick-Response Customer Service: Traders have noted that the customer service team is quick to respond and actively solves problems. One user mentioned that the service is “very responsive” and able to solve problems quickly, which is an important factor for traders who need immediate help.

• Active “New Management”: A particularly interesting review from late 2025 mentions a problem-solving interaction with “new management.” The user states they were actively approached to solve a problem, which resulted in a satisfactory outcome. This could show a positive change in the company's working focus and commitment to client satisfaction.

• Smooth Transactions: General feedback points to a stable trading environment. A user described their experience with “smooth transactions” and “stable spreads,” contributing to the view of a trustworthy platform for daily trading activities.

The Middle Ground

Not all feedback is purely positive. Some users provide a more balanced view, pointing out areas where the broker's performance is just average or could be improved. These neutral reviews are valuable for setting realistic expectations.

• Changing Spreads: One trader, while generally happy with the service, noted that “spreads can be a bit higher than expected” at times. This suggests that while the platform may offer tight spreads, they are not always consistent, which can impact trading costs.

• Inconsistent Service Speed: Contrasting with the positive feedback on responsiveness, a neutral review mentions that customer service replies “can be slower during busy hours.” This highlights a potential inconsistency in support quality depending on market activity or time of day.

• “Average” Processing Speed: Another user describes withdrawal processing speed as “just average.” This stands in contrast to the more enthusiastic reviews praising same-day withdrawals and suggests that the experience may vary from one client to another.

The Missing Complaints

Perhaps as telling as the reviews themselves is what is missing: the complete absence of negative complaints in the available data. In an industry where disputes over withdrawals, pricing, and platform stability are common, having zero negative reviews is unusual. There are several possible explanations for this:

• It could genuinely reflect high user satisfaction and effective problem resolution. The “new management” comment supports the idea that the broker may be successfully turning potentially negative experiences into positive ones.

• It could be a result of the broker's relatively short time in operation (2-5 years) and a smaller user base, meaning a statistically significant number of complaints has not yet built up.

• It is important to remember that a small sample of seven reviews cannot represent the entire user base. The absence of negativity here does not guarantee its absence elsewhere.

Looking into Warning Signs

Despite the positive user feelings, a closer look at TopWealth Trading's operational and regulatory data reveals several significant contradictions and high-risk factors. These are not minor differences; they are fundamental problems that question the broker's transparency and overall safety. For any trader doing research, these warning signs demand serious consideration.

The Regulation Problem

TopWealth Trading claims regulation from two very different bodies: ASIC in Australia and the VFSC in Vanuatu. This dual-licensing structure is a major warning sign.

• ASIC (Australian Securities and Investments Commission): This is a world-class, top-level regulator known for its strict rules. It enforces strict client fund protection, capital adequacy requirements, and provides access to strong dispute resolution schemes. However, the license held by TopWealth Trading is a “Forex Execution License (STP),” which has specific limitations. More importantly, the broker's operational address and contact number are not in Australia.

• VFSC (Vanuatu Financial Services Commission): This is a well-known offshore regulator. Its requirements for brokers are minimal, capital adequacy rules are weak, and oversight is poor. A VFSC license offers traders very little real protection in the event of a dispute or company bankruptcy.

The critical risk here is confusion. While the ASIC license provides an appearance of legitimacy, the company's physical address and primary contact point are in Vanuatu. Traders must ask: which entity am I actually signing a contract with? If it's the Vanuatu entity, the protection provided by ASIC becomes irrelevant, and the trader is exposed to the high risks associated with offshore regulation.

The Platform Problem

One of the most obvious contradictions lies in the broker's trading platform information. The data shows that TopWealth Trading holds a “Full License MT4,” a costly and valuable asset for any broker. However, the same data clearly states that the MT4 and MT5 platforms are not supported for trading. Instead, clients are directed to use a proprietary “Mobile app.”

This problem raises serious questions:

• Misleading Information: Claiming to hold a full MT4 license while not offering the platform to clients is fundamentally misleading. It creates a false impression of technical capability and adherence to industry standards.

• Lack of Industry-Standard Tools: Forcing traders onto a proprietary mobile app is a major disadvantage. MetaTrader 4 is the global industry standard, trusted for its reliability, extensive charting tools, and support for automated trading (Expert Advisors). A proprietary app may lack these features and could be designed to operate in the broker's favor.

• Unexplained Business Logic: Why would a company pay for an expensive MT4 license and then not use it? This lack of a clear business reason is a significant concern and points to a serious lack of transparency in their operational model.

The Location Difference

Further adding to the confusion is the conflict between the broker's registered region and its physical address. The company is listed as being registered in Australia, which aligns with its ASIC license claim. However, the official company address and contact phone number (+678 prefix) are located in Port Vila, Vanuatu.

This difference creates critical legal and practical risks for a client. It makes it extremely unclear where the company is truly based and which country's legal jurisdiction would apply in a dispute. If a trader needs to take legal action, would they pursue it in Australia, where the company is registered, or in Vanuatu, where it operates? This confusion creates a significant hurdle for any client seeking help.

These differences in regulation, platform availability, and company location are significant warning signs that demand caution. Before proceeding with any broker showing such inconsistencies, it is essential to conduct your own thorough investigation on a trusted regulatory database like WikiFX.

Recognizing Stated Strengths

To ensure a balanced analysis, it is important to recognize the positive features and offerings that TopWealth Trading claims to provide. These “good signs,” when taken at face value, present the image of a versatile and accessible broker.

Various Account Offerings

The broker caters to a range of traders by offering several account types, all with an accessible minimum deposit of $100. This structure allows traders to choose an account that may better suit their experience level and trading style.

• Standard Account: Positioned for all levels of traders.

• Pro Account: Aimed at beginners and intermediate traders.

• ECN Account: Designed for expert traders seeking raw spreads.

Furthermore, the broker states it offers a wide array of tradable instruments. This includes Forex, Metals, Cryptocurrencies, Energies, Stocks, and Indices, providing traders with plenty of opportunities for portfolio diversification.

Accessibility and Support

TopWealth Trading provides multiple channels for client engagement and support. The availability of a demo account is a significant positive, allowing new users to test the platform and their strategies without risking real capital. The broker lists several contact methods, including a contact form, a telephone number for Vanuatu, and an official email address. A presence on social media platforms like Facebook, X, Instagram, and YouTube suggests an effort to engage with a wider audience.

Final Decision on Trust

After a thorough examination of the evidence, we return to the central question: can TopWealth Trading be trusted? The answer is caught in a deep conflict between positive user experiences and severe operational warning signs. On one hand, a small but consistent group of users from 2024 and 2025 praise the broker for fast withdrawals and responsive customer service—two of the most critical aspects of a broker's performance.

On the other hand, these positive stories are severely undermined by obvious, fundamental inconsistencies. The regulatory situation is, at best, unclear and, at worst, dangerously misleading. The claim of an Australian ASIC license is overshadowed by the operational reality of a Vanuatu address, phone number, and a secondary offshore VFSC license, which offers minimal client protection. The platform problem—holding an expensive MT4 license but only offering a proprietary mobile app—raises serious questions about transparency and technical integrity.

The risk tolerance for such a profile is a personal decision for every trader. However, the weight of the warning signs is substantial. The combination of offshore regulation, lack of operational transparency, and contradictory information creates a high-risk environment.

Ultimately, the decision to trade with any broker rests with you. Given the mixed evidence and significant operational questions surrounding TopWealth Trading, exercising extreme caution is paramount. We strongly urge all traders to independently verify every claim and check for real-time alerts or community feedback. For a comprehensive and up-to-date safety check on any broker, consulting a dedicated verification service like WikiFX should be your final step before committing any capital.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Understanding FX SmartBull Withdrawal & Deposit: Essential Information Before You Start Trading

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

Understanding UPFOREX Money Transfers: Important Facts You Need to Know

TradingMoon Review: Offshore Regulated Fraud Risk Exposed

UPFOREX Review 2026: Is UPFOREX Safe or Scam? A Look at User Reviews and Warning Signs

Jane Street Under Fire: From India’s Market Ban to a $40 Billion Crypto Conspiracy

FXORO Review: Investigating Withdrawal Denial and Fund Scam Allegations

Currency Calculator