简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MondFX Review: No Valid Forex License, Regulatory Contradictions, and Growing Risk Signals

Abstract:Is MondFX really regulated? WikiFX findings expose licensing gaps, regulatory contradictions, and growing withdrawal concerns.

MondFX presents itself as a multi-asset online trading platform offering forex, metals, indices, cryptocurrencies, and commodities, with high leverage and low minimum deposit thresholds. While the platform promotes accessibility and competitive trading conditions, a closer examination of its regulatory status, operational disclosures, and user feedback reveals multiple risk indicators that investors should carefully evaluate.

According to publicly available data and verification results from WikiFX, MondFX currently does not hold a valid forex trading license, placing it in a higher-risk category compared with regulated brokers operating under recognized financial authorities.

Regulatory Status: No Valid Forex License Detected

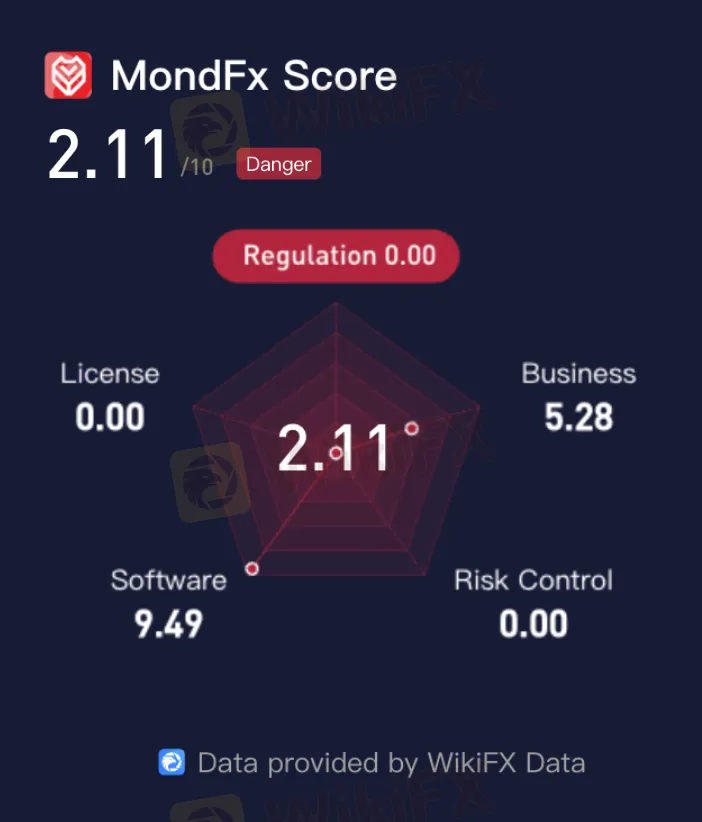

One of the most critical factors in assessing any broker is regulatory authorization. WikiFX data shows that MondFX does not possess an active forex regulatory license, and its overall safety score remains at a low level. A visible risk warning highlights the absence of verified regulation and urges caution when engaging with the platform.

Without a recognized license, a broker operates outside standardized investor protection frameworks, including client fund segregation, dispute resolution mechanisms, and regulatory oversight. This significantly increases operational and counterparty risk for retail traders.

Conflicting Claims: Registration Versus Actual Regulatory Authority

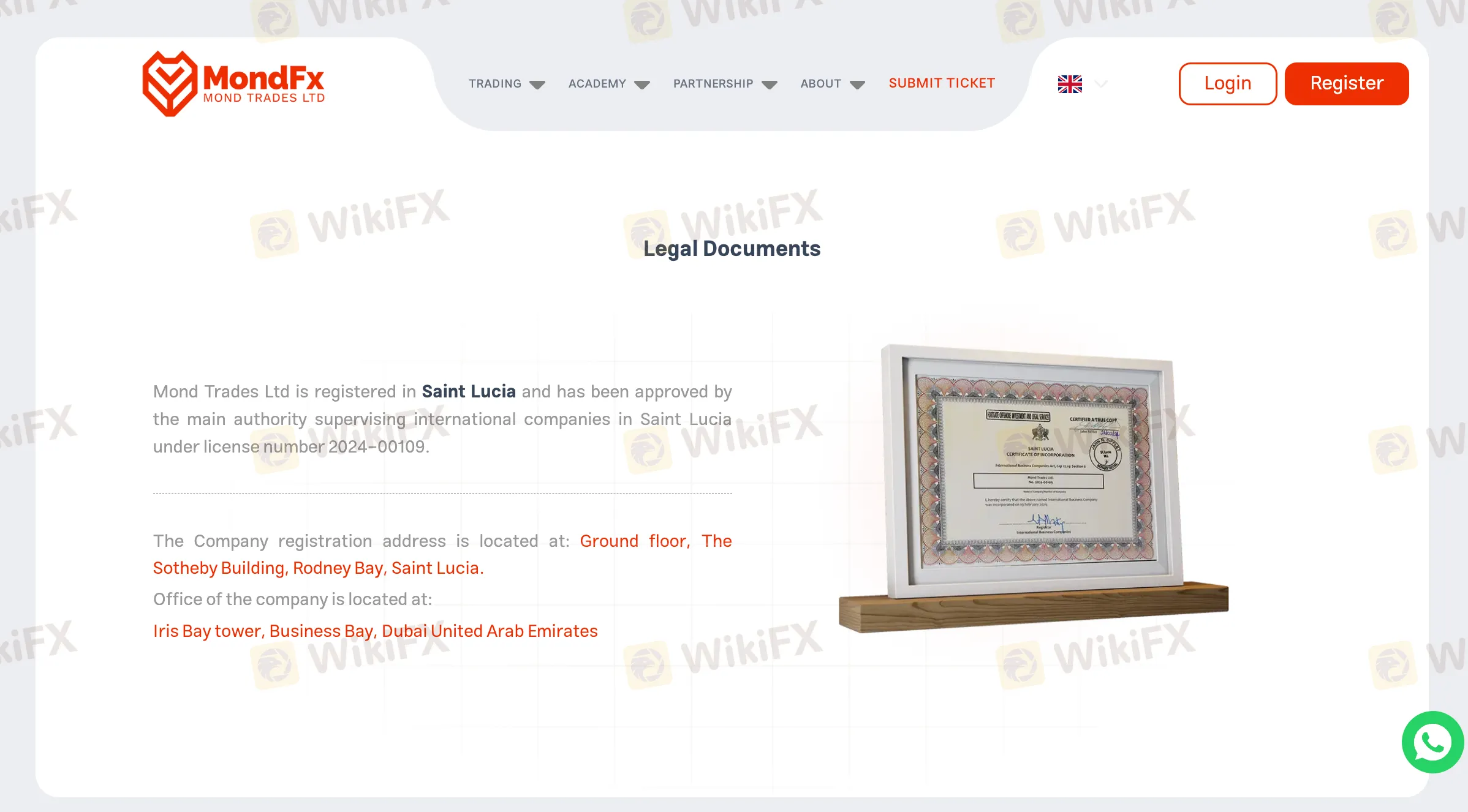

MondFXs website states that the company is registered in Saint Lucia and claims approval from local authorities. Supporting visuals on the site display corporate registration documents and references to regulatory approval.

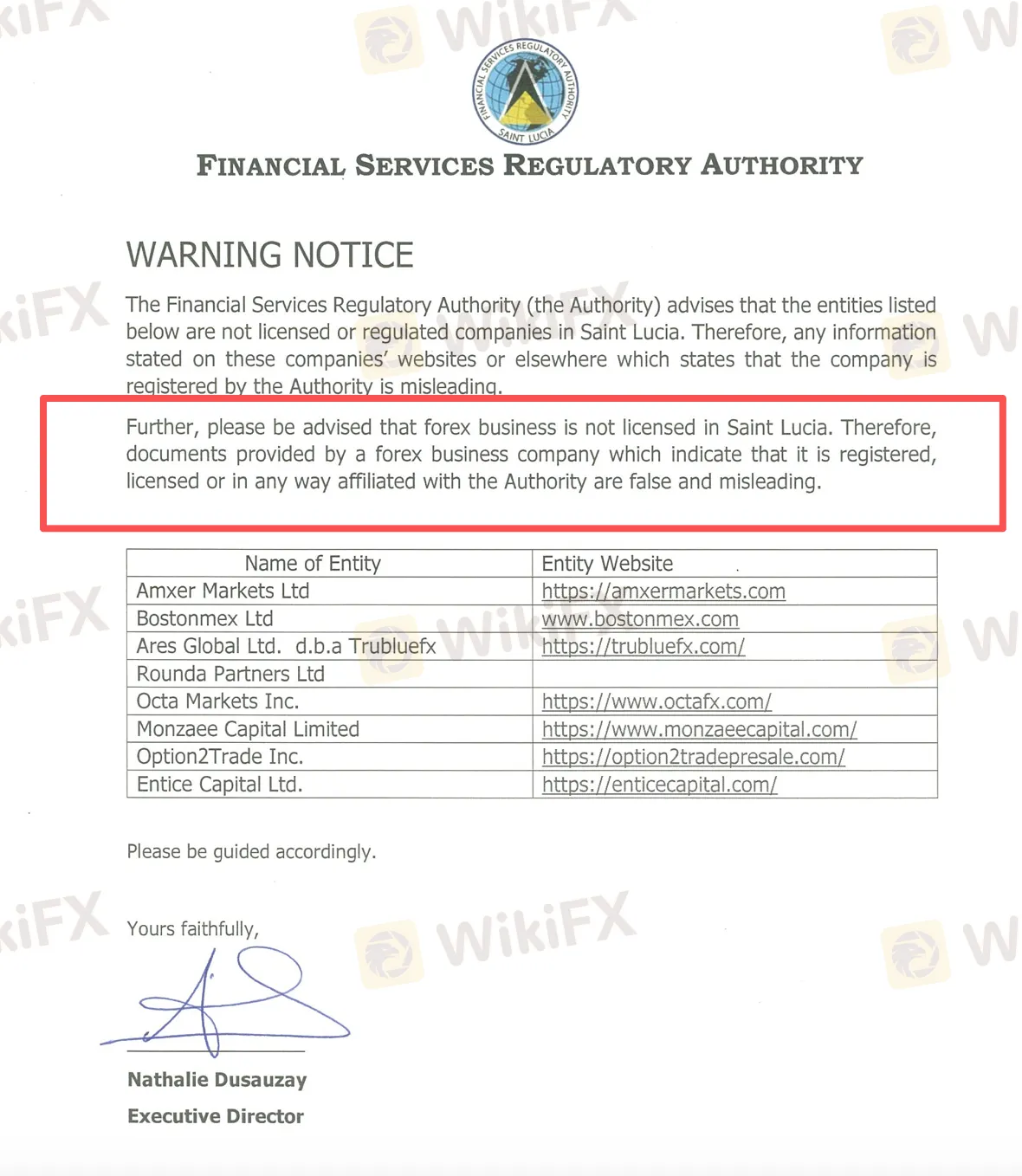

However, further examination of public notices from the Saint Lucia Financial Services Regulatory Authority (FSRA) clarifies an important regulatory reality: Saint Lucia does not issue specific licenses for retail forex or CFD trading activities. FSRA warnings explicitly state that any claims of authorization for forex brokerage activities in the jurisdiction are misleading.

This creates a clear contradiction between the platforms marketing claims and the regulatory framework itself. Corporate registration alone does not equate to authorization to provide leveraged forex trading services.

Geographic Signals: Office Locations and Contact Information

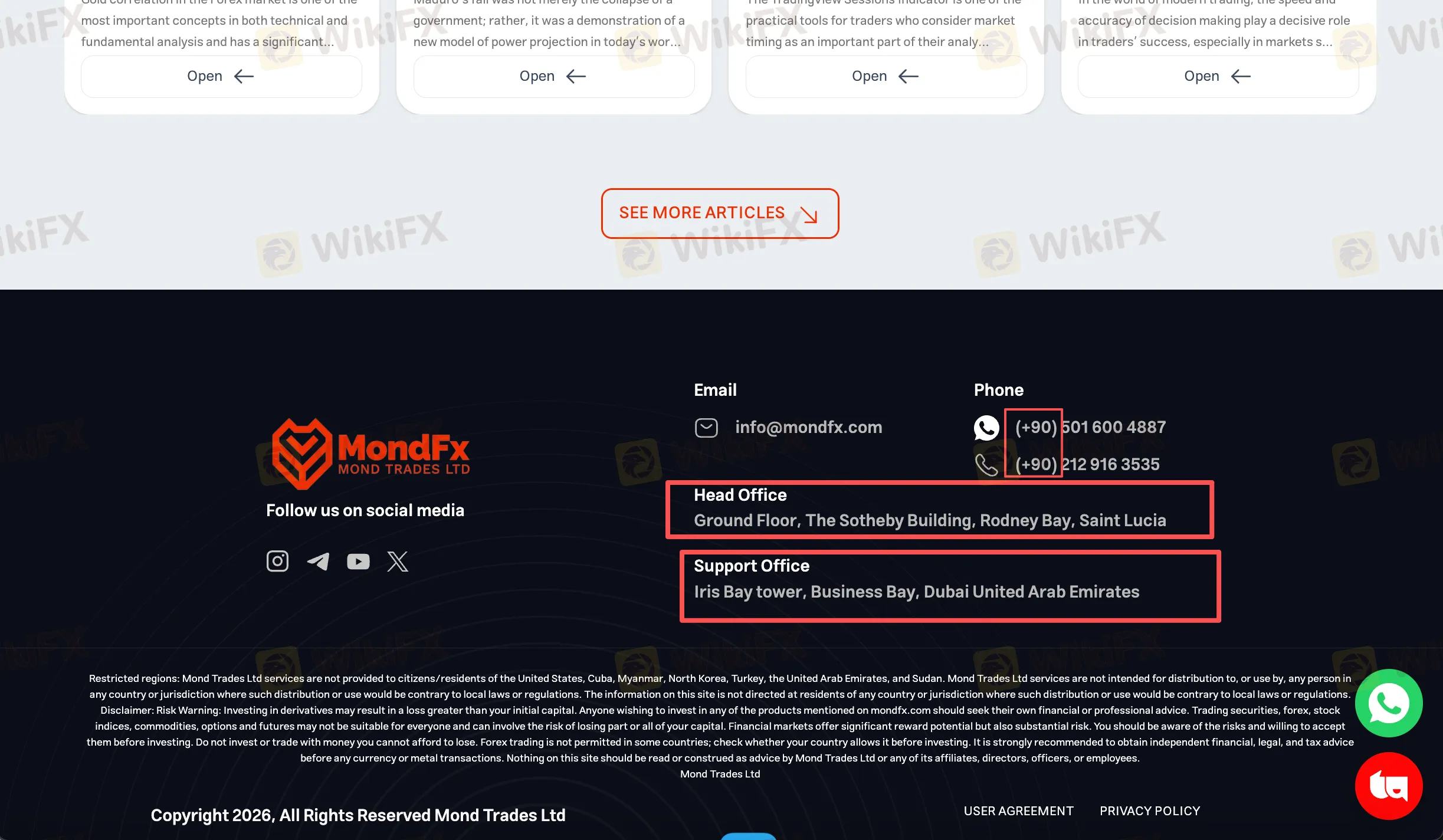

Additional operational signals raise questions about consistency and transparency. Public website disclosures indicate a registered address in Saint Lucia and a support office in Dubai. Meanwhile, listed phone numbers include a Turkish country code (+90), suggesting operational routing across multiple jurisdictions.

While cross-border operations are common in global brokerage businesses, fragmented geographic footprints combined with limited regulatory clarity increase due-diligence complexity for investors.

Trading Conditions and Platform Structure

MondFX provides access to multiple asset classes, including forex, metals, indices, cryptocurrencies, and commodities. The platform offers several account types with a relatively low minimum deposit starting from $30, along with leverage levels reaching up to 1:500.

From a trading infrastructure perspective, MondFX supports both cTrader and MetaTrader 5 (MT5), two commonly used platforms in the retail trading industry. These platforms typically provide functions such as real-time price feeds, charting tools, technical indicators, and standard order execution features.

In terms of funding, MondFX supports multiple cryptocurrency-based deposit and withdrawal options, including various blockchain networks and digital assets. While digital payments can offer operational efficiency, they also involve considerations related to transaction traceability, dispute handling, and operational transparency.

User Feedback Signals: Withdrawal and Account Concerns

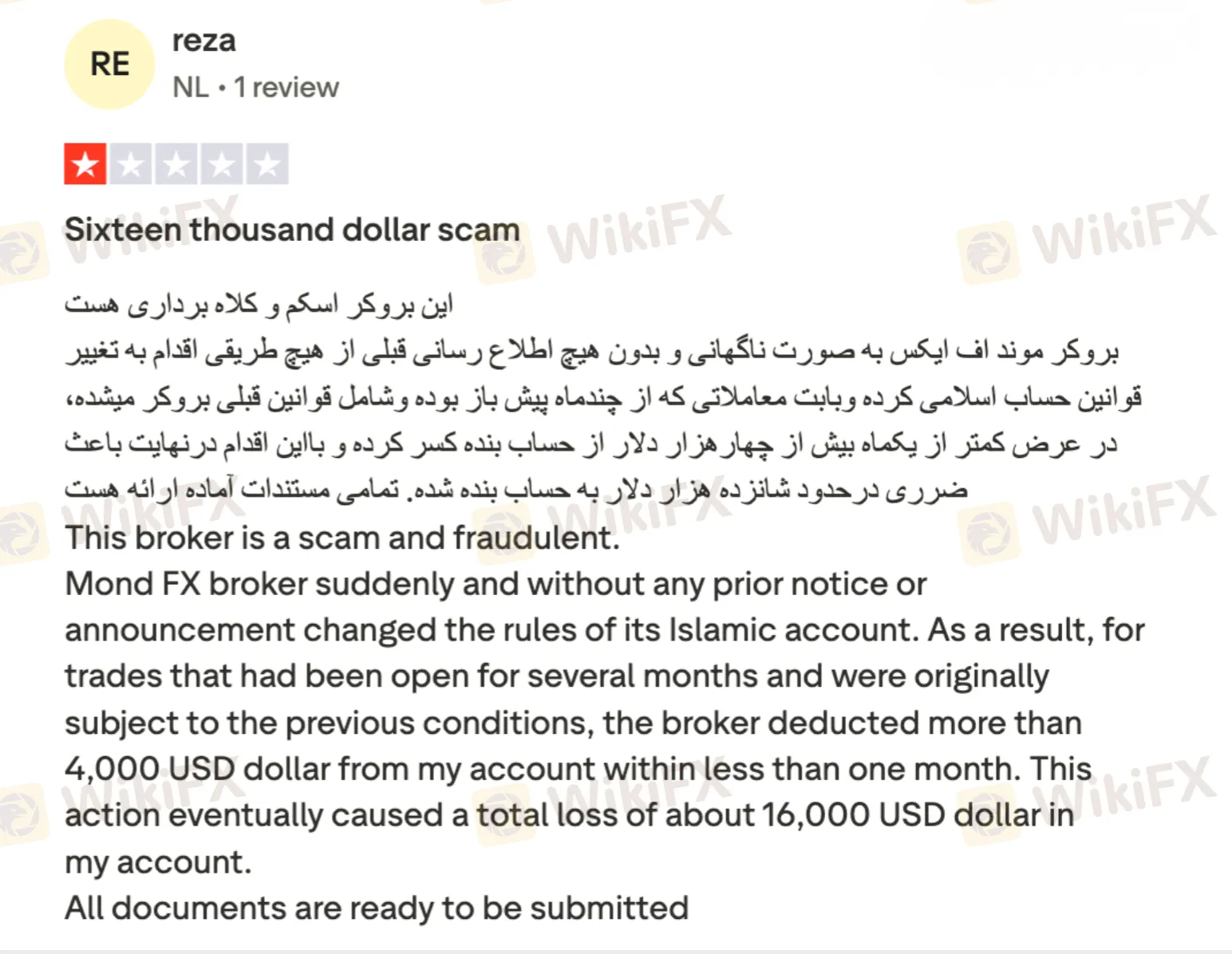

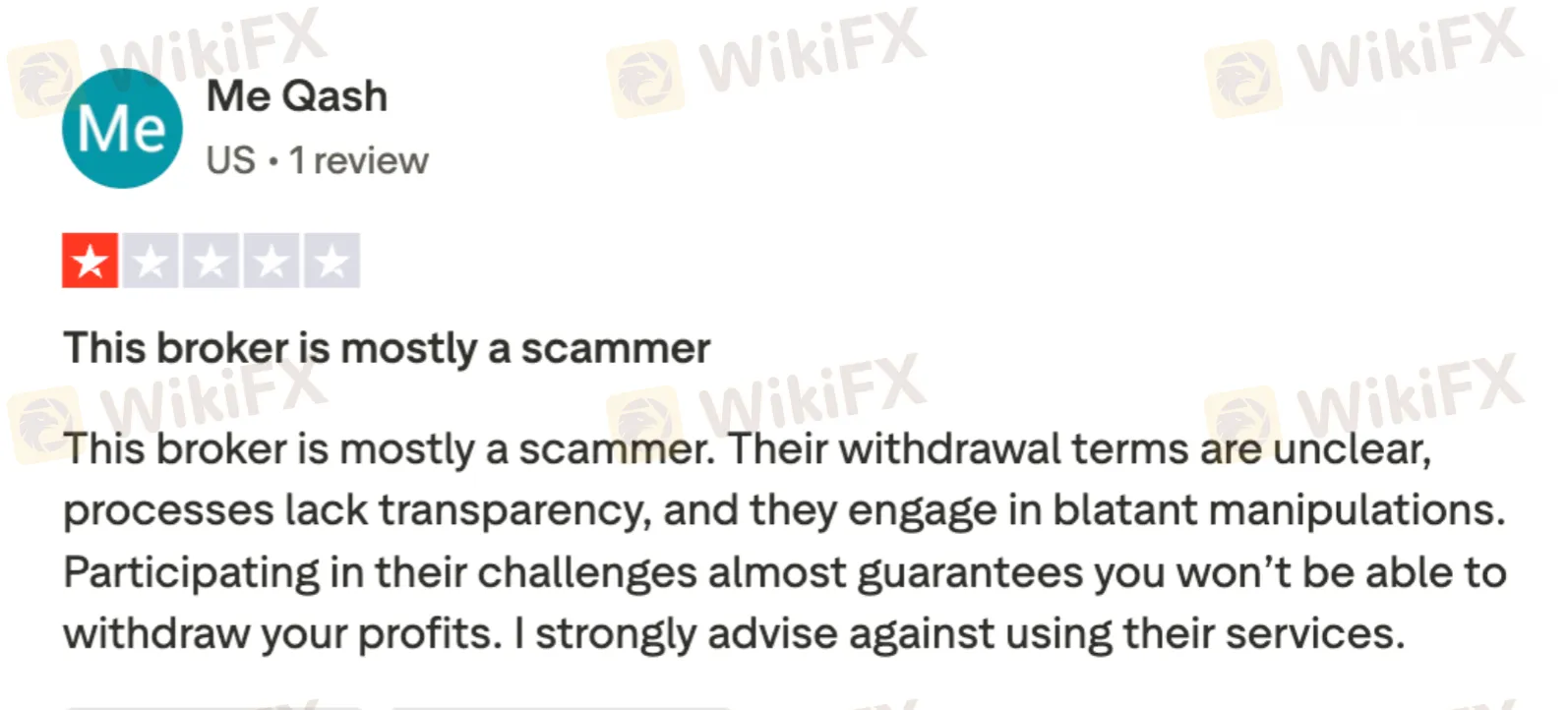

Independent user submissions collected online describe recurring issues involving:

- Account rules changed without notice, resulting in unexpected balance deductions and altered trading conditions.

- Withdrawal requests repeatedly rejected or delayed, with unclear terms and limited transparency.

- Account access restricted after deposits, followed by slow or inconsistent communication.

Several users reported significant financial losses following operational changes or failed withdrawal attempts. While individual cases vary, the consistency of these reports reinforces concerns surrounding fund access transparency and internal controls.

Risk Summary: Key Factors Investors Should Consider

Based on currently available information, MondFX presents multiple overlapping risk signals:

- No verified forex regulatory license

- Regulatory contradictions between marketing claims and FSRA disclosures

- Low safety score and risk warnings on WikiFX

- High leverage exposure without strong regulatory safeguards

- Mixed geographic operational signals

- Recurring user complaints related to withdrawals and account handling

Each factor alone may not be decisive, but together they form a consistent risk profile that warrants heightened caution.

About WikiFX

WikiFX is a global broker information platform specializing in regulatory verification, risk alerts, and objective broker data analysis. By aggregating licensing records, operational indicators, and user exposure reports, WikiFX helps traders assess potential risks before engaging with online trading platforms.

Verifying regulatory status and understanding the depth of oversight remain essential steps for managing trading risk in todays online trading environment.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

$128M Crypto Scam: Chinese Suspect Nabbed in Thailand

Is AssetsFX Safe or Scam: Looking at Real User Feedback and Complaints

FIBOGroup Critical Withdrawal Scam Exposed

Institutional Players Pivot to Physical Gold: CMC Markets Eyes Singapore Expansion Amid Macro Uncertainty

Prop Trading Industry Pivots to Futures to Secure US Market Access

GODO Legitimacy Check: Addressing Fears - Is This a Fake Broker or a Legitimate Trading Partner?

Fintech Partnership Targets "False Positive" Crisis in Market Surveillance

The Trading Pit Launches Regulated Brokerage Unit 'TTP Markets' in Strategic Pivot

CME Group Moves to 24/7 Trading for Digital Asset Derivatives

Trump Defies Supreme Court with 15% Global Tariff; Record Retail Flows Buffer Market Impact

Currency Calculator