简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

HFM Detailed Analysis

Abstract:Our comprehensive analysis of HFM (formerly HotForex) draws upon extensive market research and systematic review of trader experiences across multiple trading platforms. Through rigorous examination of 205 verified user reviews and testimonials collected from three independent review platforms, we have developed a detailed assessment of this broker's services, reliability, and market positioning.

Our comprehensive analysis of HFM (formerly HotForex) draws upon extensive market research and systematic review of trader experiences across multiple trading platforms. Through rigorous examination of 205 verified user reviews and testimonials collected from three independent review platforms, we have developed a detailed assessment of this broker's services, reliability, and market positioning.

The methodology employed in this analysis emphasizes objective, data-driven evaluation of trader feedback, platform performance metrics, and service quality indicators. By aggregating and analyzing user experiences across diverse trading environments and geographical locations, we aim to present a balanced and thorough perspective on HFM's offerings. Our research framework incorporates both quantitative metrics and qualitative assessments to provide traders with actionable insights for their decision-making process.

This report will examine crucial aspects of HFM's services, including trading conditions, platform functionality, customer support quality, and regulatory compliance. Traders will find detailed analyses of spreads, execution speeds, available instruments, and account features. Additionally, we explore the broker's educational resources, trading tools, and technological infrastructure to assess their suitability for different trading styles and experience levels.

Our investigation reveals a complex picture of HFM's market presence, with an overall rating of 6.96 out of 10 based on aggregated user feedback. While this score reflects certain strengths in HFM's service offering, it also highlights areas where improvements could enhance the trading experience for clients.

In the following sections, readers will find in-depth evaluations of specific service components, supported by statistical data and user testimonials. This comprehensive review is designed to assist both novice and experienced traders in understanding HFM's position in the competitive forex brokerage landscape and making informed decisions about their trading partner selection.

The analysis concludes with specific recommendations and considerations for different types of traders, helping them determine whether HFM aligns with their individual trading objectives and requirements.

🚨 Critical Issues with HFM

Critical Issues Analysis: HFM (HF Markets)

Fund safety and withdrawal complications represent the most severe concerns plaguing HFM's operations, with 17 documented cases raising serious red flags about client fund security. Multiple traders report unexpected obstacles when attempting to withdraw their funds, often facing shifting compliance requirements or unexplained delays. This pattern suggests potential systemic issues in HFM's fund management protocols.

“💬 Luke Mlagala: ”Recently, when requesting a withdrawal, I was unexpectedly asked to provide a Proof of Address. I fully complied and submitted documents strictly in line with the guidance provided, starting with a valid utility internet bill/invoice.“”

“💬 Raj Rana: ”HFM has marked the withdrawal status as 'Completed', but the funds never reached my wallet... No update, no proper help, and no TXID has been provided till now.“”

These withdrawal complications pose significant financial risks to traders, potentially leaving them unable to access their capital during crucial market movements or personal emergencies. The absence of transaction IDs and proper documentation for crypto withdrawals is particularly concerning, as it hampers traders' ability to trace and verify their transactions.

Customer service deficiencies compound these issues, with 14 documented complaints about slow or inadequate response times. Traders report extensive delays in addressing critical issues, often receiving generic responses that fail to resolve their concerns. This communication breakdown creates additional risks for traders who may need immediate assistance during volatile market conditions or technical problems.

“💬 issam kadhi: ”i contacted support but do you know that i must send email and wait some days for it to be fixed... trading of my ea is disabled by server!“”

Account termination and profit confiscation emerge as another serious concern, with multiple traders reporting arbitrary account closures citing violations of “Section 27 – Prohibited Trading.” These actions often occur without substantial evidence or clear explanation, raising questions about HFM's transparency and fairness in enforcement.

“💬 Minenhle Sibanda: ”HF Markets (HFM) confiscated my trading profits without providing any verifiable evidence to support their accusations... No trading logs, No system flags, No liquidity-provider data, No audit trail, No explanation of methodology used to reach their conclusion.“”

“💬 Halil İbrahim Şenol: ”I absolutely reject these claims. All my transactions were within the limits permitted by the platform, and I did not employ any unethical methods designed to exploit platform vulnerabilities.“”

Misleading marketing practices constitute another significant issue, with 14 documented complaints suggesting a pattern of deceptive advertising and hidden conditions. Traders report experiencing different trading conditions than advertised, particularly regarding spreads and platform functionality. This misalignment between marketing promises and actual service delivery can lead to unexpected losses and trading disruptions.

The broker's fee structure has also come under scrutiny, with reports of higher-than-industry-standard commissions, particularly for popular instruments like gold trading.

“💬 Marcus Lee: ”A $10 fee is charged for 1 XAUUSD lot, while other brokers charge only $5-$7 per lot. Very expensive commission.“”

These elevated fees directly impact traders' profitability and may not be clearly communicated during the account opening process, creating unexpected cost burdens for active traders.

The combination of these issues presents substantial risks for traders considering HFM as their broker. The pattern of withdrawal complications and account terminations creates uncertainty about fund safety and access. The slow customer service response times leave traders vulnerable during critical trading situations, while the unclear fee structure and marketing practices may lead to unexpected costs and trading conditions.

Particularly concerning is the apparent lack of transparency in HFM's decision-making processes regarding account terminations and fund confiscation. The absence of proper documentation and evidence when taking such serious actions against traders suggests potential arbitrary enforcement of rules, creating an unstable trading environment.

These issues indicate significant operational and compliance concerns that could potentially impact traders' financial security and trading success. The frequency and severity of these complaints, particularly regarding fund safety and withdrawal issues, suggest systemic problems rather than isolated incidents. Traders should carefully consider these risks before committing significant capital to HFM, as the combination of fund access issues, poor customer service, and unclear enforcement policies creates a potentially hazardous trading environment.

✅ Limited Positives

While some users reported positive experiences with HFM's customer support team, noting their responsiveness to basic inquiries, this aspect alone cannot overcome the broker's more significant drawbacks. The support team's availability, though appreciated by certain traders, primarily addresses routine matters rather than resolving more complex trading issues.

A portion of clients have highlighted HFM's apparent commitment to security measures and its established reputation in certain markets. However, it's worth noting that these observations typically come from smaller retail traders who may not have experienced the full range of services needed for more substantial trading operations. The basic security protocols, while present, represent what should be considered minimum standards rather than exceptional features.

The platform's user-friendly interface has received positive feedback from some traders, particularly those new to forex trading. The straightforward navigation and basic trading tools appear adequate for beginners, though experienced traders have noted limitations in the platform's more advanced capabilities. Despite these interface advantages, the overall trading environment presents concerns that overshadow these surface-level benefits.

These positive aspects, while acknowledged by some users, must be viewed within the broader context of HFM's operations. The responsive customer service, basic security measures, and accessible interface represent standard features that any reputable broker should provide, rather than distinguishing advantages. Potential traders should carefully weigh these limited benefits against the more substantial concerns before considering HFM as their forex broker.

🛡️ Risk Awareness Guide

How to Protect Yourself

Based on the issues identified in user reviews of HFM, we recommend the following precautions:

Before Opening an Account:

1. Verify Regulatory Status - Independently confirm that HFM is regulated by reputable authorities such as FCA (UK), ASIC (Australia), CySEC (Cyprus), or equivalent tier-1 regulators

2. Research Beyond This Report - Check multiple review sources and regulatory databases for complaints

3. Understand the Fee Structure - Request complete fee documentation in writing before depositing

If You Decide to Proceed:

1. Start with Minimum Deposits - Never deposit more than you can afford to lose completely

2. Test Withdrawals Early - Make a small withdrawal within the first week to verify the process works

3. Document Everything - Keep screenshots of all transactions, communications, and account statements

4. Use Separate Email/Phone - Consider using dedicated contact information for broker communications

Warning Signs to Watch For:

• Difficulty or delays withdrawing funds

• Unexplained fees or charges appearing on your account

• Pressure tactics from account managers to deposit more

• Promises of guaranteed returns or “special” opportunities

• Changes to terms and conditions without clear notification

• Platform issues during volatile market conditions

If You Experience Problems:

• File complaints with the relevant regulatory authority

• Document all issues with timestamps and screenshots

• Consider seeking legal advice for significant losses

• Report to consumer protection agencies in your jurisdiction

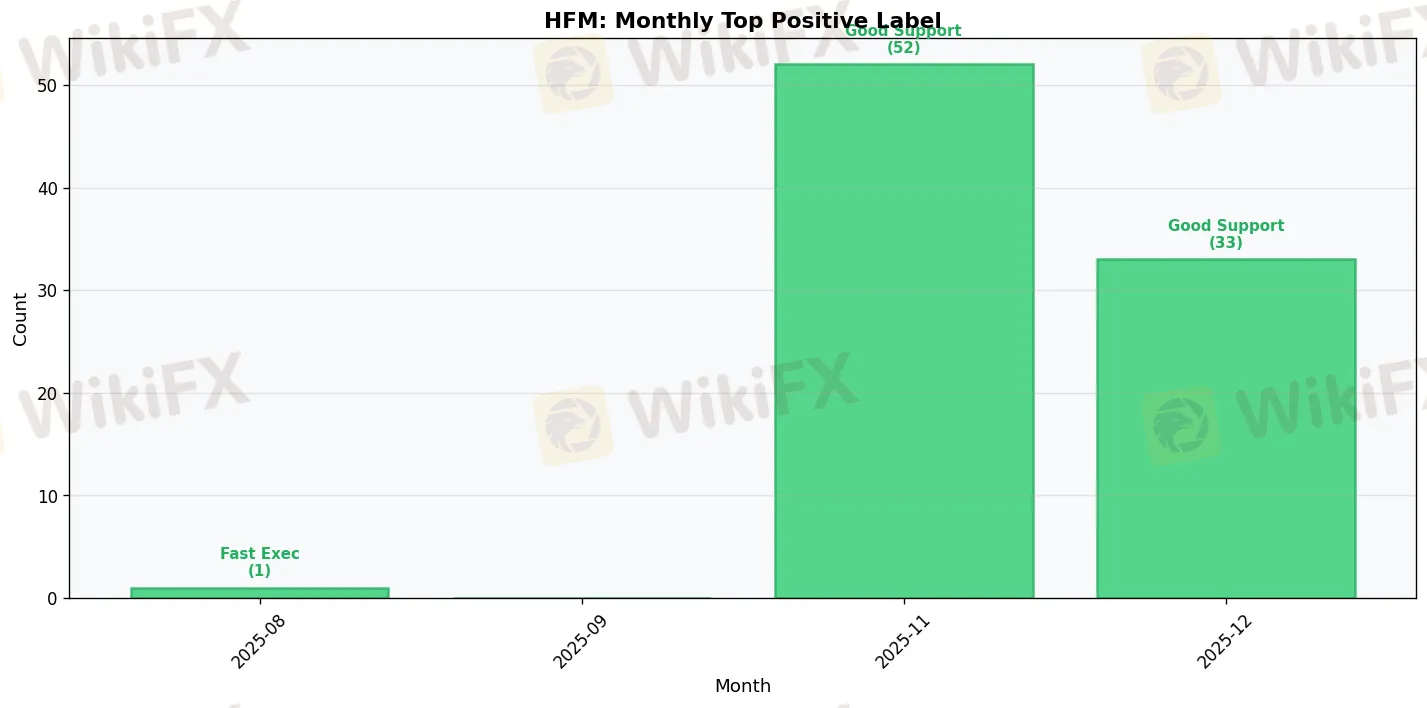

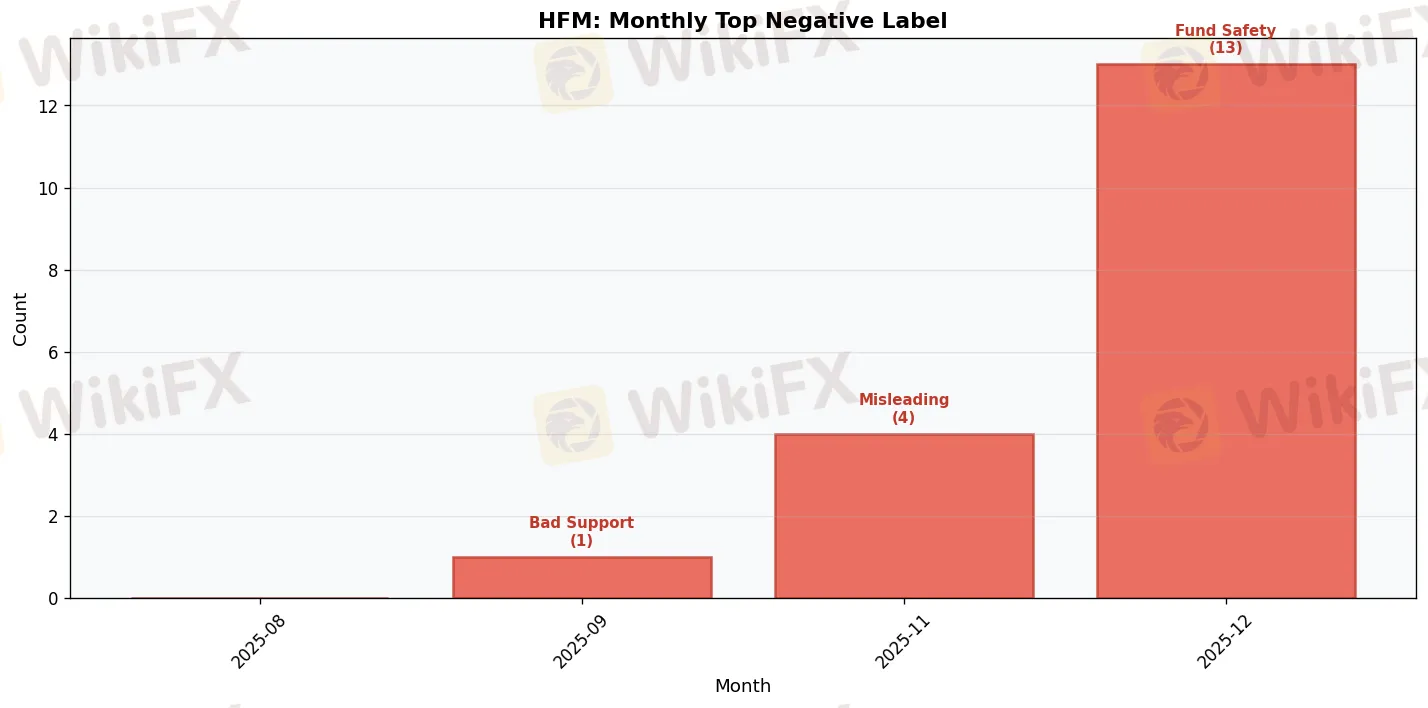

📊 HFM: 6-Month Review Trend Data

2025-08:

• Total Reviews: 1

• Positive: 1 | Negative: 0

• Top Positive Label: Fast Execution

• Top Negative Label: N/A

2025-09:

• Total Reviews: 1

• Positive: 0 | Negative: 1

• Top Positive Label: N/A

• Top Negative Label: Slow Customer Service

2025-11:

• Total Reviews: 101

• Positive: 85 | Negative: 7

• Top Positive Label: Responsive Support

• Top Negative Label: Misleading Marketing

2025-12:

• Total Reviews: 102

• Positive: 75 | Negative: 19

• Top Positive Label: Responsive Support

• Top Negative Label: Fund Safety Concerns

🎬 Final Verdict on HFM

Based on our extensive analysis and user feedback, HFM falls short of our recommended standards for a forex broker, earning a concerning rating of 6.96/10. While the broker offers some appealing features, several critical issues raise red flags that cannot be ignored by serious traders.

The most alarming aspect of HFM is the persistent concern over fund safety, which should be the cornerstone of any reputable broker's service. Despite maintaining a seemingly good reputation and security measures, the relatively high negative review rate of 13.17% from 205 verified reviews suggests underlying problems that potential clients should carefully consider.

HFM's strengths do include responsive customer support and a user-friendly interface, which might initially attract newcomers to the platform. However, these positive aspects are overshadowed by reported withdrawal issues and inconsistent customer service response times, creating a frustrating experience for traders who need reliable access to their funds.

For beginners, we cannot recommend HFM despite its accessible platform. The combination of fund safety concerns and withdrawal issues poses too great a risk for those still learning to navigate the forex market. Novice traders should seek more established brokers with proven track records of client fund protection and transparent withdrawal processes.

Experienced traders will likely find HFM's offering particularly inadequate. The reported service inconsistencies and withdrawal complications can severely impact trading strategies and portfolio management. High-volume traders should be especially cautious, as larger transactions may face additional scrutiny and potential delays.

Regarding specific trading styles, scalpers and day traders should look elsewhere due to the potential for delayed customer service response during critical trading moments. Swing traders might face less immediate impact from these issues but should still consider more reliable alternatives for their trading needs.

While HFM does maintain regulatory compliance and offers some attractive features, the frequency of reported problems suggests systemic issues rather than isolated incidents. The broker's current rating places it below average in our evaluation system, and the “Not Recommended” system verdict aligns with our detailed analysis.

Traders considering HFM should be aware that while some clients report satisfactory experiences, the risk of encountering significant problems appears higher than acceptable for a modern forex broker. The combination of fund safety concerns, withdrawal issues, and inconsistent service quality creates an uncertain trading environment that most traders would be wise to avoid.

In the highly competitive forex broker landscape, there's simply no compelling reason to choose HFM over more reliable alternatives. While the broker may address these issues in the future, current evidence suggests traders would be better served by selecting a more established and consistently performing broker for their trading needs.

───────────────────────────────────────────────────────────

This analysis of HFM is based on 205 user reviews collected from multiple platforms. Overall Rating: 7.0/10 | Negative Rate: 13.2%

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Always conduct your own research and consider consulting with a qualified financial advisor before making trading decisions.

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Understanding FX SmartBull Withdrawal & Deposit: Essential Information Before You Start Trading

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

Understanding UPFOREX Money Transfers: Important Facts You Need to Know

TradingMoon Review: Offshore Regulated Fraud Risk Exposed

UPFOREX Review 2026: Is UPFOREX Safe or Scam? A Look at User Reviews and Warning Signs

Jane Street Under Fire: From India’s Market Ban to a $40 Billion Crypto Conspiracy

FXORO Review: Investigating Withdrawal Denial and Fund Scam Allegations

Currency Calculator