Abstract:Sundramoorthy said investment scams continued to ensnare victims from all walks of life, including highly educated professionals accustomed to analytical and evidence-based thinking

Education and professional standing offer little protection against investment scams, which are becoming increasingly sophisticated and psychologically driven, a senior criminologist has warned.

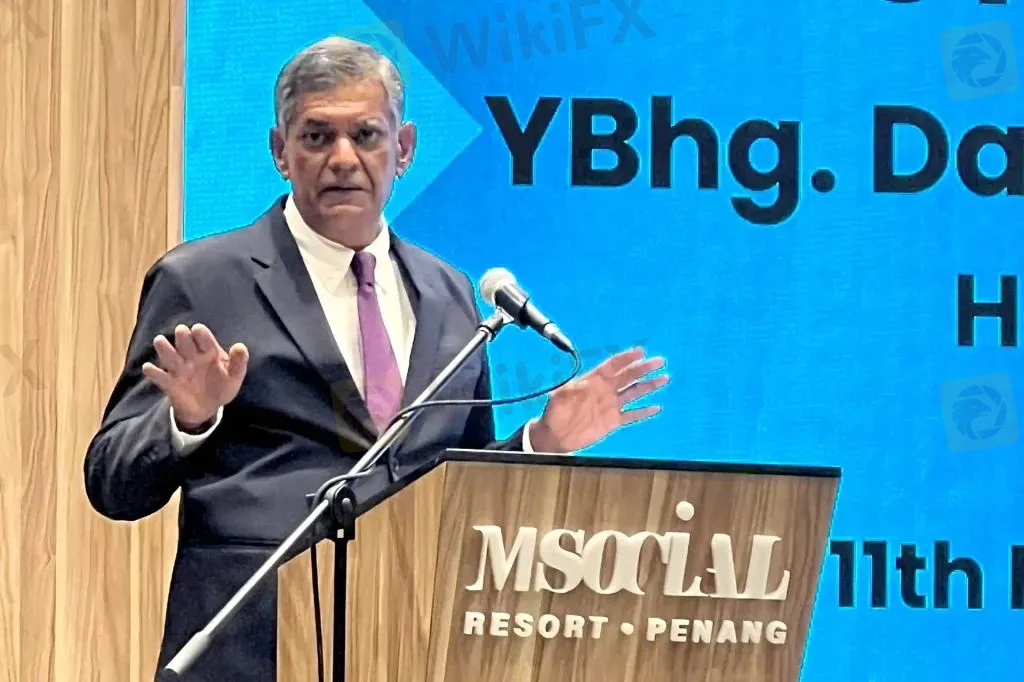

Datuk Dr P. Sundramoorthy said a recent case involving a medical specialist who allegedly lost more than RM500,000 to a non-existent cryptocurrency investment highlights how even highly educated individuals can fall victim, despite widespread public warnings and extensive media coverage.

From a criminological perspective, he said scam victimisation should not be dismissed as a matter of greed or ignorance. Instead, it is the result of a complex mix of psychological manipulation, social engineering and weaknesses within todays digital environment.

According to Sundramoorthy, investment scams continue to trap people from all backgrounds, including professionals who are trained to think critically and rely on evidence in their work. One of the main reasons these scams succeed, he said, is the careful exploitation of trust.

When an investment link or opportunity comes through social media from someone familiar, such as a colleague or acquaintance, suspicion is immediately reduced. Trust, familiarity and the appearance of legitimacy strongly influence decision-making, particularly when scams are embedded within personal or professional networks. In such situations, individuals may overlook warning signs and suspend critical judgement.

He added that emotional manipulation plays an equally important role. Many scams do not rely purely on promises of wealth but tap into deeper fears and hopes, including anxiety about financial security, optimism about future gains and the fear of missing out on opportunities.

Cryptocurrency scams, in particular, are often framed as innovative and time-sensitive, creating pressure to act quickly. Once emotions are triggered, rational thinking can give way to impulsive decisions, even among experienced professionals.

Cognitive biases further increase vulnerability. Sundramoorthy noted that overconfidence can lead educated individuals to believe they are capable of distinguishing legitimate investments from scams. Confirmation bias then reinforces this belief when scammers present fake profits or convincing indicators of success. Authority bias also comes into play when fraudsters pose as investment experts, lawyers or recovery agents, using official-sounding language and professional-looking documents.

The digital environment, he said, amplifies these risks. Social media platforms enable rapid sharing of information and create a false sense of credibility through repeated exposure and perceived social approval. When an investment appears popular or widely endorsed online, it is more likely to be trusted.

At the same time, the blurred line between social interaction and financial promotion allows scams to spread more easily without detection. This has also led to an increase in secondary victimisation, where individuals who have already been scammed are targeted again.

After realising they have been cheated, victims often become desperate to recover their losses. Scammers exploit this vulnerability by posing as recovery agents or legal representatives, causing further financial and emotional harm.

Sundramoorthy said investment scams continue to thrive because they exploit human psychology, technological systems and regulatory gaps at the same time. Victims, he stressed, are not irrational but are targeted by highly organised fraud networks operating in low-risk, high-reward environments.

He added that addressing the issue requires moving away from blaming victims and towards stronger regulation, greater accountability from digital platforms and public education that reflects the reality of how even well-educated individuals can be deceived in the digital age.

Recent figures underline the scale of the problem. Online scams surged sharply last year, with losses reaching RM2 billion in the first nine months alone, based on more than 47,000 reports. This represented a 94 per cent increase compared to the previous year.

Younger age groups have been particularly affected, with Generation Z and millennials emerging as the most vulnerable, reflecting their higher engagement with digital platforms and online financial activity.

Investment scams have now overtaken romance scams as the most common form of fraud, typically luring victims with promises of extraordinary returns through fake apps and platforms. Phone scams involving impersonation of authorities remain widespread, while online shopping and loan scams continue to contribute to significant financial losses.