Abstract:When selecting a forex broker, safety and regulatory status are the most critical factors. BePrimeGroup is a relatively new entrant in the financial markets, having been established in 2024. Headquartered in Saint Lucia, this broker offers digital account opening and operates on the MetaTrader 5 (MT5) platform. Despite offering high leverage and a variety of account types, the broker currently holds a very low WikiFX score of 1.77/10, primarily due to the absence of valid regulation and recent user complaints regarding withdrawals.

When selecting a forex broker, safety and regulatory status are the most critical factors. BePrimeGroup is a relatively new entrant in the financial markets, having been established in 2024. Headquartered in Saint Lucia, this broker offers digital account opening and operates on the MetaTrader 5 (MT5) platform. Despite offering high leverage and a variety of account types, the broker currently holds a very low WikiFX score of 1.77/10, primarily due to the absence of valid regulation and recent user complaints regarding withdrawals.

This review analyzes BePrimeGroups regulatory status, trading fees, platform features, and user exposure to help you determine if it is a legitimate trading partner or a potential risk.

Is BePrimeGroup Legit? Regulatory Status and Safety

The most reliable way to verify a broker's legitimacy is by checking its regulatory licenses. Unfortunately, the data indicates that BePrimeGroup poses significant safety risks.

Regulatory Analysis

BePrimeGroup is registered in Saint Lucia. In the forex industry, Saint Lucia is considered an offshore jurisdiction that does not provide the same level of client protection as Tier-1 regulators like the FCA (UK) or ASIC (Australia).

Key Regulatory Facts:

- Regulator: None. The broker is not regulated by any recognized financial institution.

- WikiFX Score: 1.77 (High Risk).

- License Type: N/A (No License Detected).

- Regional Influence: The broker has some presence in Colombia and Italy.

Because BePrimeGroup operates without oversight, there is no guarantee of segregated accounts or compensation schemes in the event of insolvency. The lack of regulation is a red flag for traders prioritizing the safety of their funds.

User Exposure: BePrimeGroup Scam Complaints and Withdrawal Issues

A critical part of assessing a broker is reviewing actual trader experiences. Based on recent data, BePrimeGroup has received legitimate complaints regarding account management and fund access.

Major Complaints Reported

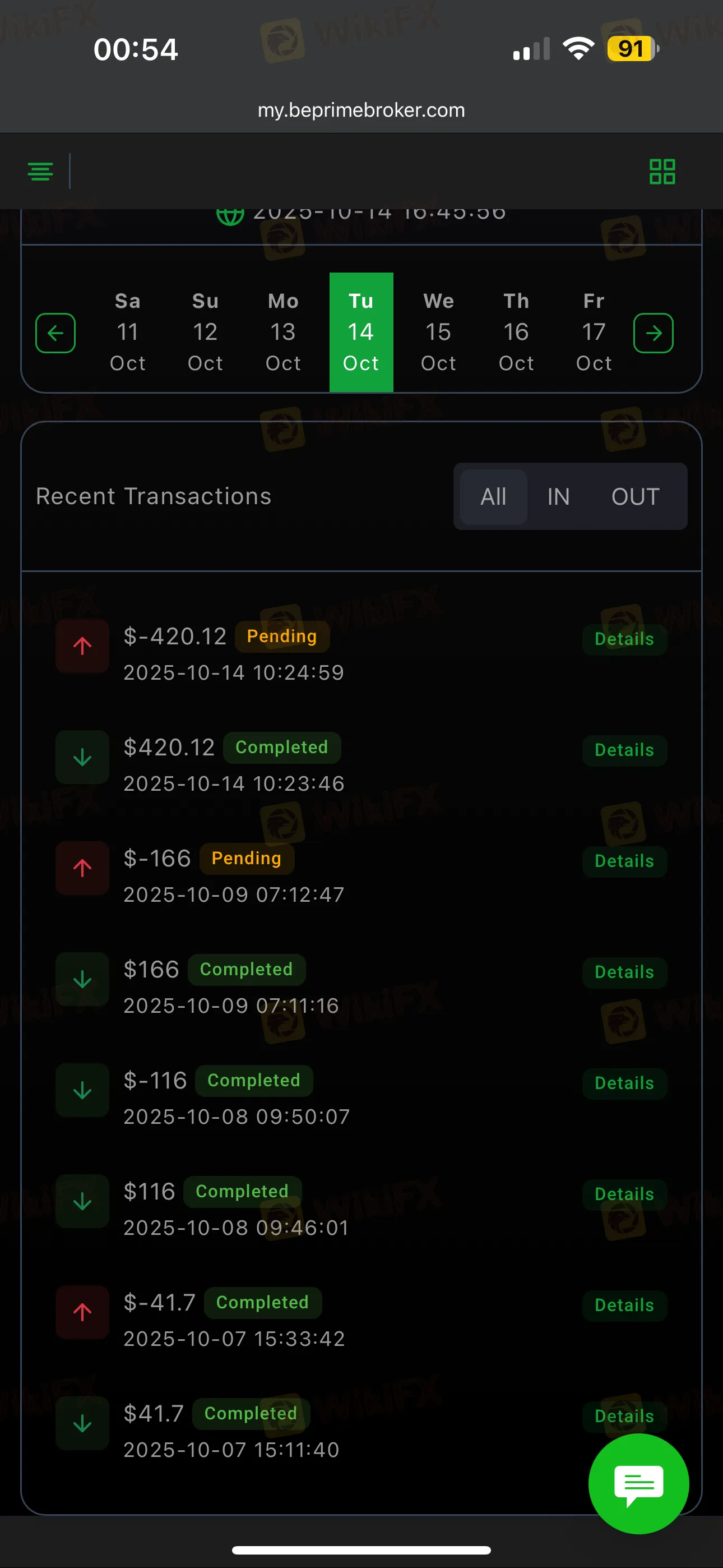

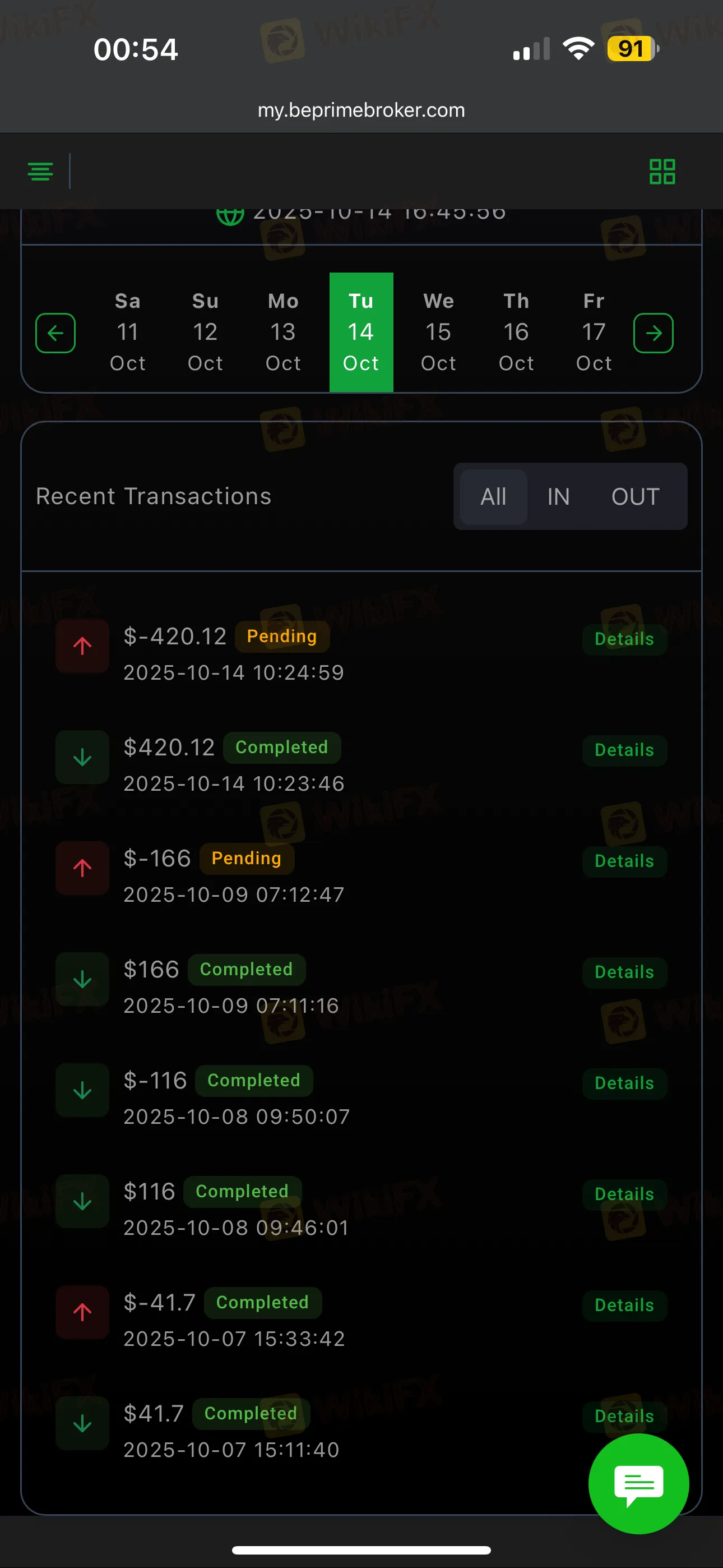

1. Withdrawal Delays (Malaysia)

A user from Malaysia reported initiating a withdrawal that had not been received by mid-October 2025. The trader explicitly labeled the platform a “scam broker” due to the inability to access their funds.

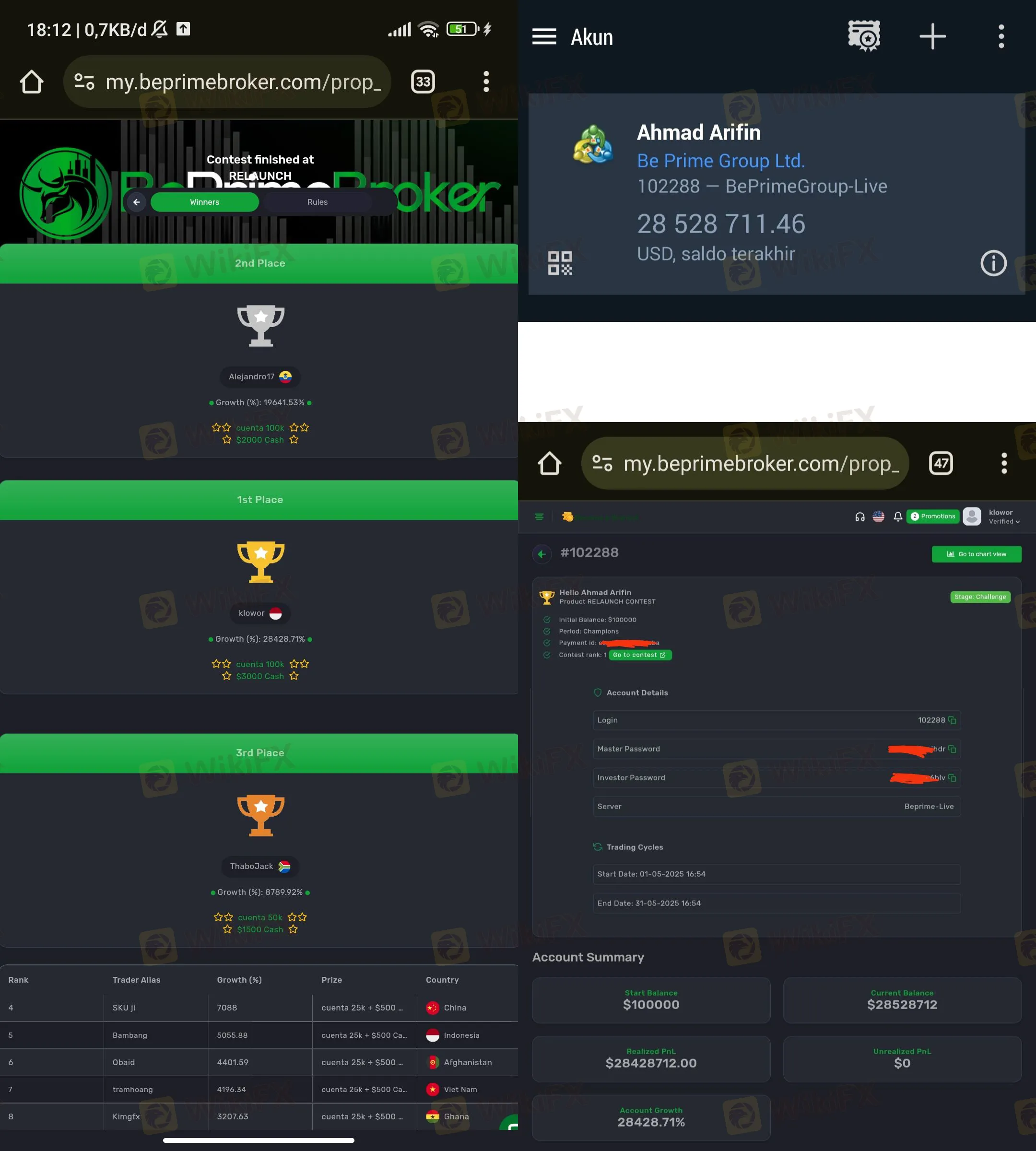

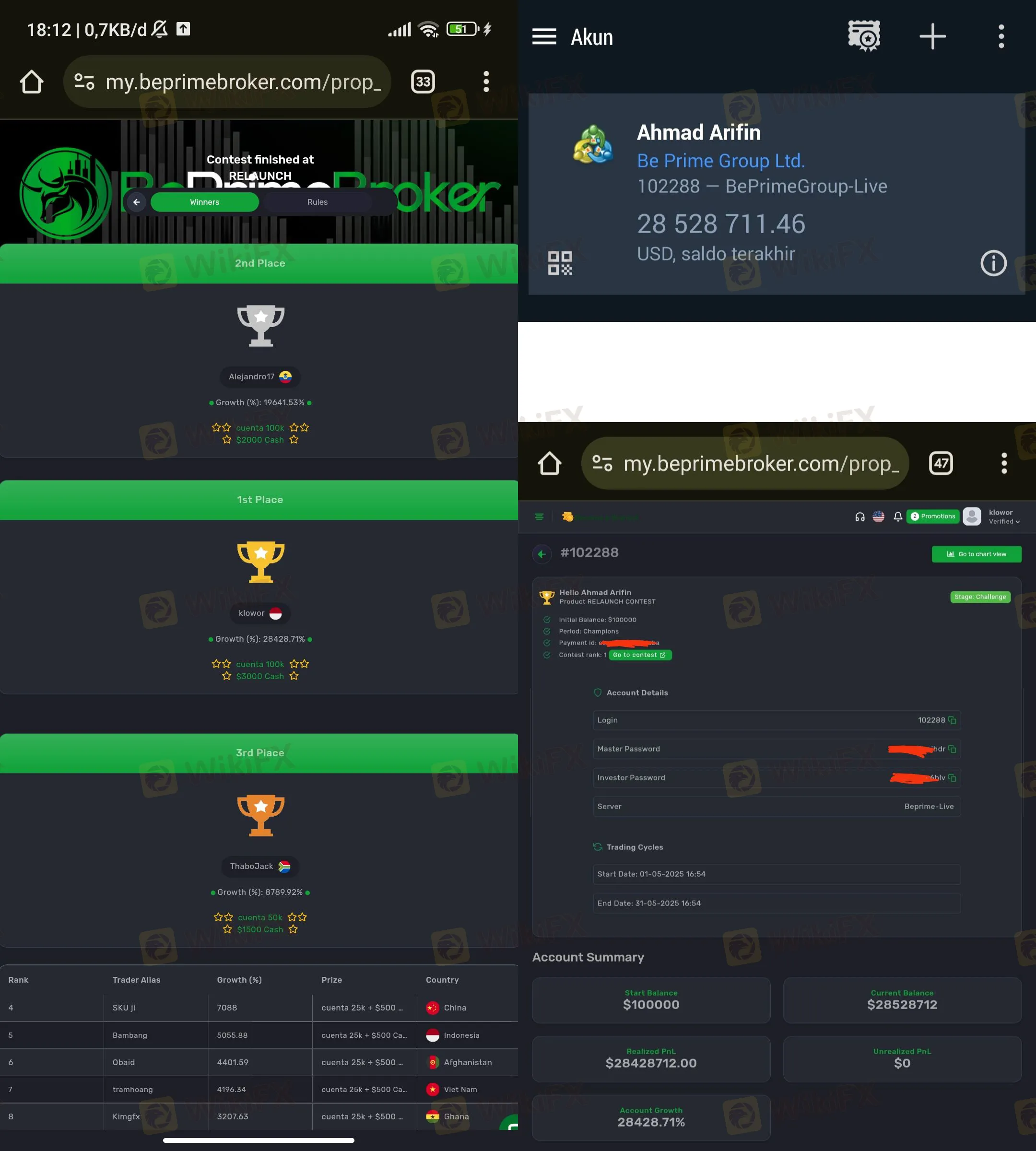

2. Unpaid Contest Prizes (Indonesia)

Another severe complaint involves a trader from Indonesia who claimed to have won a trading contest. According to the report, BePrimeGroup failed to pay the $3,000 USD prize money and did not provide the promised $100,000 USD funded account.

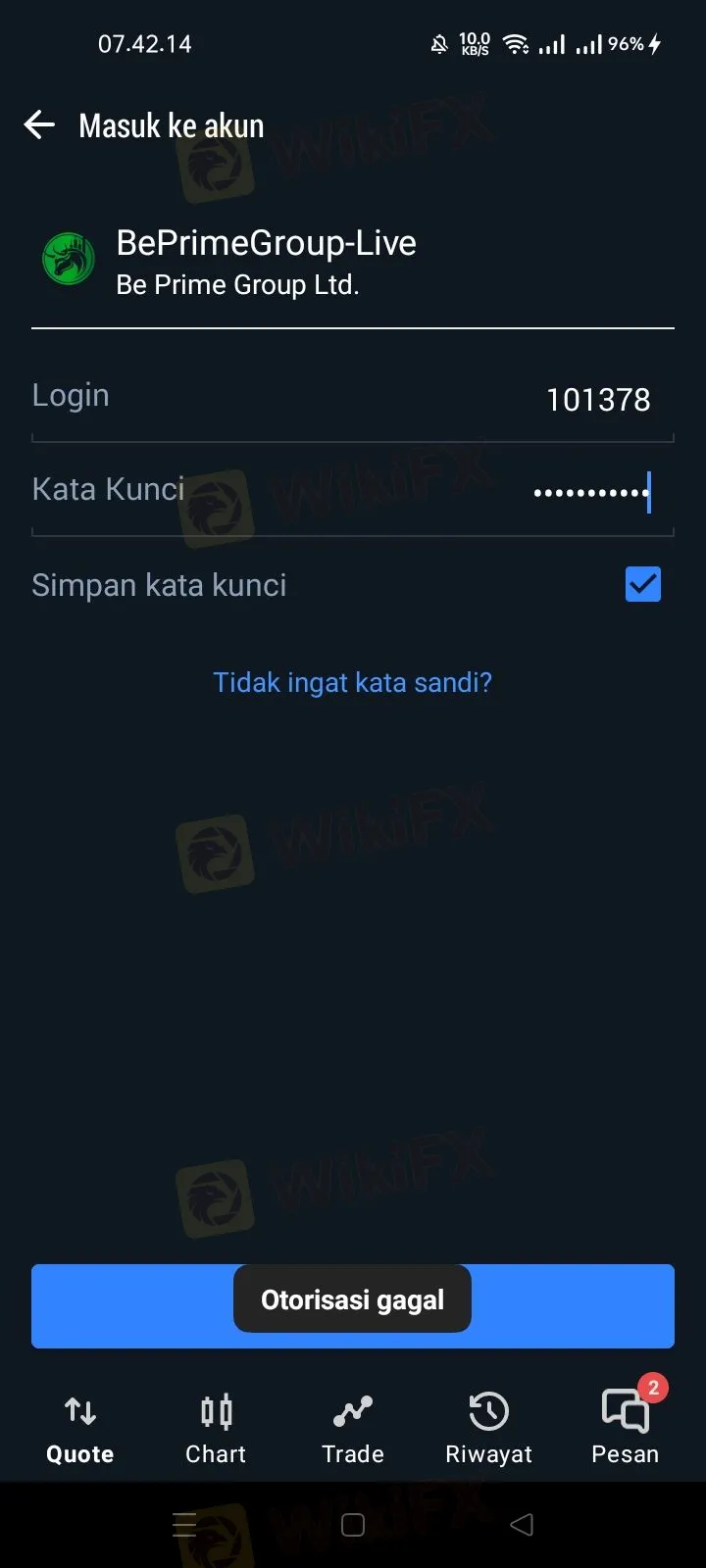

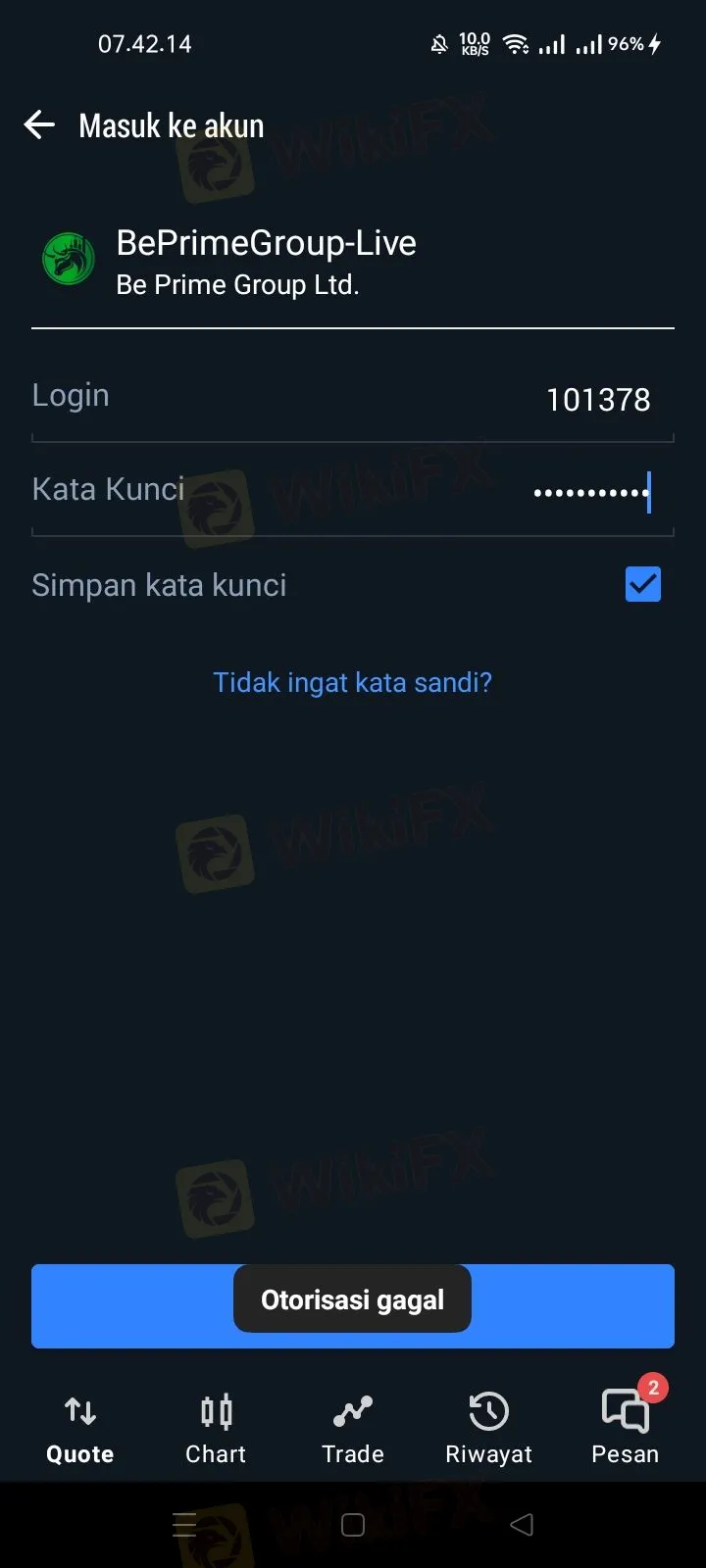

3. Unexplained Account Closures (Indonesia)

A third case highlights arbitrary account data handling. A user reported their account was suddenly closed without explanation. Attempts to contact Customer Service (CS) reportedly received no response.

These cases suggest a pattern of withdrawal obstruction and poor communication, which are common warning signs in the industry.

BePrimeGroup Trading Conditions: Platforms and Account Types

Despite the regulatory risks, BePrimeGroup offers competitive trading conditions on paper, including high leverage and the industry-standard MT5 platform.

Trading Platform

BePrimeGroup provides the MetaTrader 5 (MT5) platform under a Main Label license. MT5 is known for its advanced charting tools and automated trading capabilities (EAs). However, the software review notes a lack of biometric authentication (two-step login) for added security.

Account Structures

The broker offers six distinct account types, catering to micro-traders and high-volume traders alike.

- High Leverage: Leverage up to 1:1000 is available on Synthetic, Standard, and ECN Classic accounts. While this allows for maximizing small capital, it significantly increases the risk of liquidation.

- Low Entry: Traders can start with as little as $1 on the Cent account.

Customer Support

Support is available via Email, WhatsApp, Facebook, X, and other social channels. While they support English and other languages, the review data indicates that response times can be slow, consistent with the user complaints about lack of response.

Pros and Cons of BePrimeGroup

Pros:

- Uses MT5 Trading Platform (Main Label).

- Diverse range of account types (6 options).

- Very low minimum deposit ($1 for Cent accounts).

- High leverage available (up to 1:1000).

Cons:

- No Regulation: The broker is unregulated.

- Low Safety Score: WikiFX rates it 1.77/10.

- Withdrawal Issues: Serious user complaints about unpaid funds.

- Account Closures: Reports of accounts being closed without warning.

- Limited Security: No biometric login on the app.

Final Review Verdict: Can You Trust BePrimeGroup?

No, BePrimeGroup is not considered a safe broker to trade with at this time.

While the inclusion of the MT5 platform and low entry costs might seem attractive, the lack of regulation combined with serious allegations of unpaid withdrawals and contest prizes renders this broker extremely high-risk. A WikiFX score of 1.77 serves as a strong warning to potential investors. Trading with an unregulated entity means you have no legal recourse if the broker refuses to release your funds.

Recommendation: We strongly advise traders to choose brokers regulated by Tier-1 authorities such as the FCA, ASIC, or NFA.

For a safer trading experience, consider using the WikiFX App. It allows you to verify broker licenses, read real-time exposure stories, and access legal aid services to protect your investments from potential scams.