Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

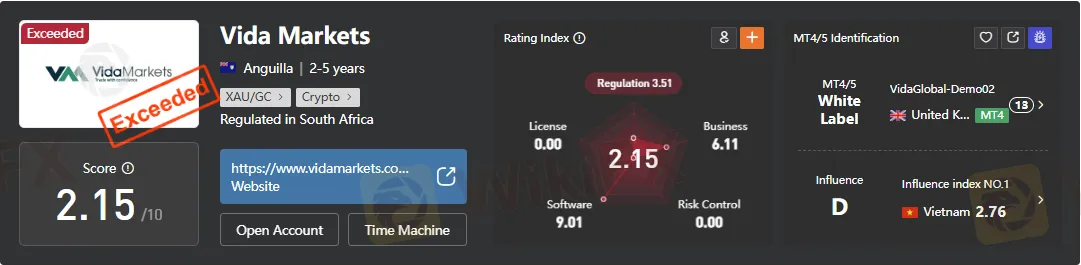

Abstract:Vida Markets regulation exceeded under FSCA. Broker review covers accounts, platforms, and risk considerations.

Vida Markets operates under the Financial Sector Conduct Authority (FSCA) in South Africa, with license number 42734 issued to Vida Global Markets (Pty) Ltd. The license was effective from July 12, 2011, yet its current status is marked as “Exceeded.”

In regulatory parlance, “Exceeded” signals that the broker has gone beyond its authorized scope or failed to maintain compliance standards. This raises questions about the brokers long-term credibility and investor protection. While Vida Markets presents itself as a regulated entity, the exceeded status diminishes the strength of its regulatory shield.

Transparency issues are evident: the brokers listed office address in Rosebank, Johannesburg, was flagged by WikiFX investigators as “No Office Found,” suggesting inconsistencies between registered details and physical presence.

According to the attached documentation, Vida Markets Limited is registered in Anguilla (2022) and operates globally with a declared presence in South Africa. The company website is https://www.vidamarkets.com/en/, and customer support is offered via support@vidamarkets.com.

The dual registration—Anguilla and South Africa—creates jurisdictional ambiguity. Competitor brokers such as Tickmill or Pepperstone typically emphasize clear, singular regulatory frameworks (FCA, ASIC, CySEC), whereas Vida Markets layered registrations complicate its compliance narrative.

Vida Markets provides access to a wide range of instruments:

This breadth of instruments positions Vida Markets competitively against mid-tier brokers. However, the exceeded FSCA regulation status undermines confidence in the safety of these offerings.

Vida Markets offers two primary account types:

| Feature | STP Account | RAW Account |

| Spreads | 1.2 pips | 0.1 pips |

| Commission | None | From $5/€5/£5 per lot |

| Leverage | Up to 1:1000 | Up to 1:1000 |

| Minimum Trade Size | 0.01 lots | 0.01 lots |

Additionally, a Swap-Free account is available for traders in Indonesia, Malaysia, and the MENA region.

The leverage ceiling of 1:1000 is significantly higher than industry norms. For comparison, FCA-regulated brokers cap leverage at 1:30 for retail clients. While high leverage appeals to aggressive traders, it magnifies risk exposure and potential losses.

Vida Markets supports:

Execution speeds average 164–177 ms, with multiple live and demo servers listed. While the infrastructure appears robust, the reliance on white-label MT4/MT5 servers suggests limited proprietary development compared to brokers like IC Markets or XM, which operate full-license servers with stronger risk control systems.

This dual structure mirrors industry practices, yet the lack of transparency around additional fees (withdrawal charges, inactivity fees) is a concern. Competitor brokers often publish detailed fee schedules, whereas Vida Markets documentation remains partially opaque.

Pros

Cons

The attached file highlights multiple user exposure cases:

These complaints, combined with the exceeded regulatory status, raise red flags about operational reliability. In contrast, brokers with strong regulatory oversight (e.g., FCA, ASIC) rarely face such systemic complaints.

Vida Markets offerings are attractive on paper but fall short in regulatory credibility compared to established competitors.

Vida Markets presents itself as a multi-asset broker with competitive spreads, high leverage, and modern trading platforms. However, the exceeded FSCA regulation status, ambiguous jurisdictional registration, and unresolved user complaints cast significant doubt on its legitimacy.

For traders seeking security, brokers with active FCA, ASIC, or CySEC licenses provide stronger safeguards. Vida Markets may appeal to risk-tolerant traders attracted by high leverage and social trading features, but caution is warranted.

Verdict: Vida Markets Broker offers breadth but lacks depth in regulatory assurance. The exceeded FSCA regulation is a critical weakness that overshadows its trading advantages.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.