Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Trive (formerly known or associated with Trive International Ltd) is a Virgin Islands-based brokerage established in 2013. With over a decade of history, the broker markets itself as a multi-asset trading provider offering global access to financial markets. The platform holds a corporate score of 7.91, suggesting a relatively established market presence.

Trive (formerly known or associated with Trive International Ltd) is a Virgin Islands-based brokerage established in 2013. With over a decade of history, the broker markets itself as a multi-asset trading provider offering global access to financial markets. The platform holds a corporate score of 7.91, suggesting a relatively established market presence.

However, despite holding licenses from several reputable regulatory bodies, Trive faces a challenging reputation due to a mix of regulatory statuses and a significant volume of recent user complaints regarding fund withdrawals. This review analyzes Trives safety, fees, and client feedback to help you determine if they are a legit trading partner.

When determining if a broker is safe, the first step is verifying their regulatory licenses. Trive operates under a complex structure with multiple entities, some of which are highly regulated while others are offshore or unverified.

| Regulator | Country | License Details | Status |

|---|---|---|---|

| ASIC | Australia | TRIVE FINANCIAL SERVICES AUSTRALIA PTY LTD | Regulated (Tier-1) |

| MFSA | Malta | TRIVE FINANCIAL SERVICES EUROPE LTD. | Regulated |

| FSCA | South Africa | TRIVE SOUTH AFRICA (PTY) LTD | Regulated |

| FSC | Virgin Islands | Trive International Ltd. | Offshore Regulation |

| FCA | United Kingdom | Trive Financial Services UK Limited | Unverified |

| BAPPEBTI | Indonesia | PT Trive Invest Futures | Unverified |

Trive demonstrates legitimacy through its Tier-1 authorization from ASIC (Australia) and regulation by the MFSA (Malta) and FSCA (South Africa). These licenses generally ensure specific standards regarding capital requirements and operational transparency.

However, traders should be cautious regarding the specific entity they contract with. The global entity is regulated by the Virgin Islands FSC, which is considered an offshore regulator with less stringent oversight than European or Australian authorities. Furthermore, the provided data indicates that licenses claimed for the UK (FCA) and Indonesia (BAPPEBTI) are currently listed as “Unverified,” which is a significant red flag for traders in those regions.

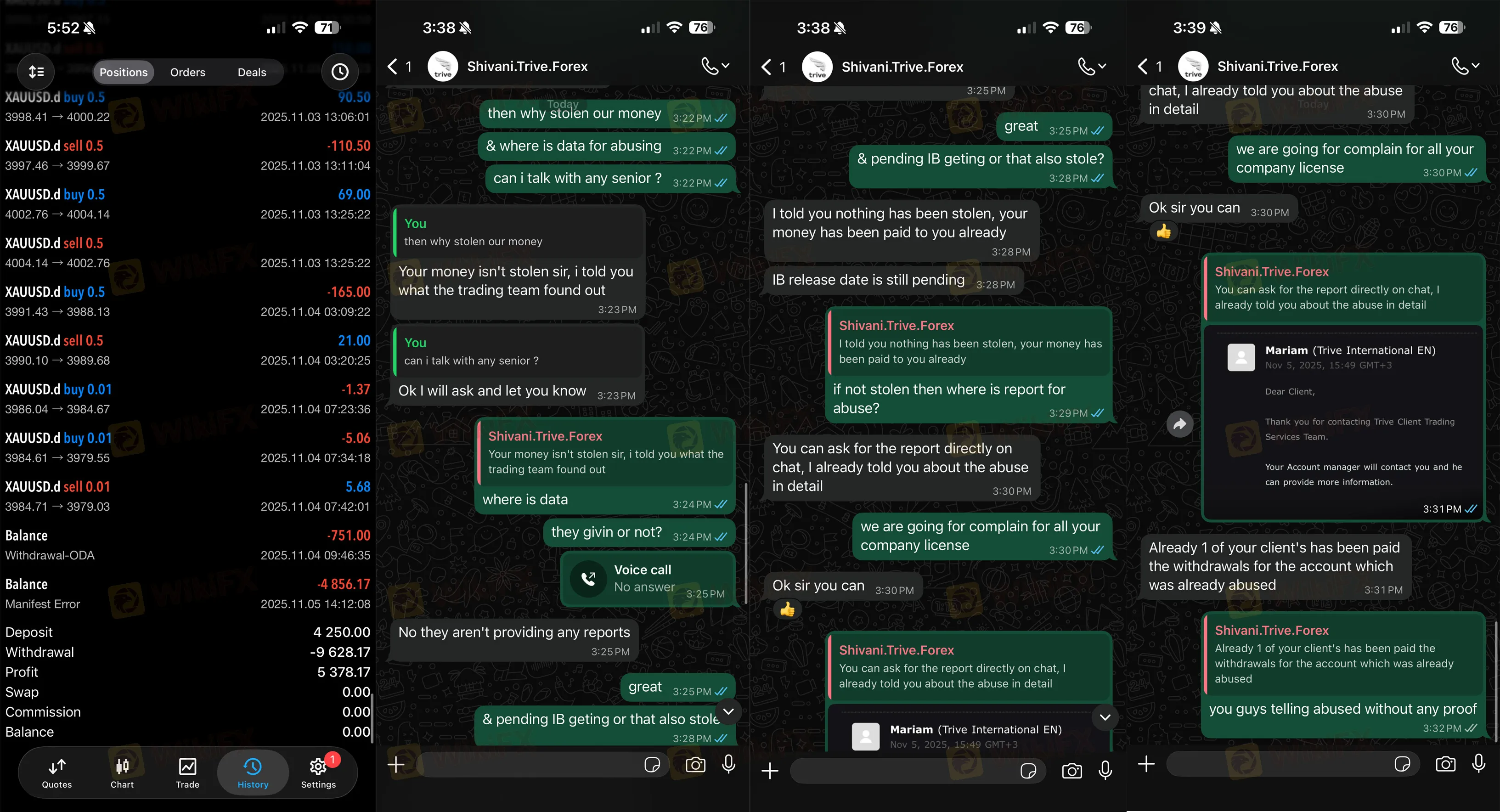

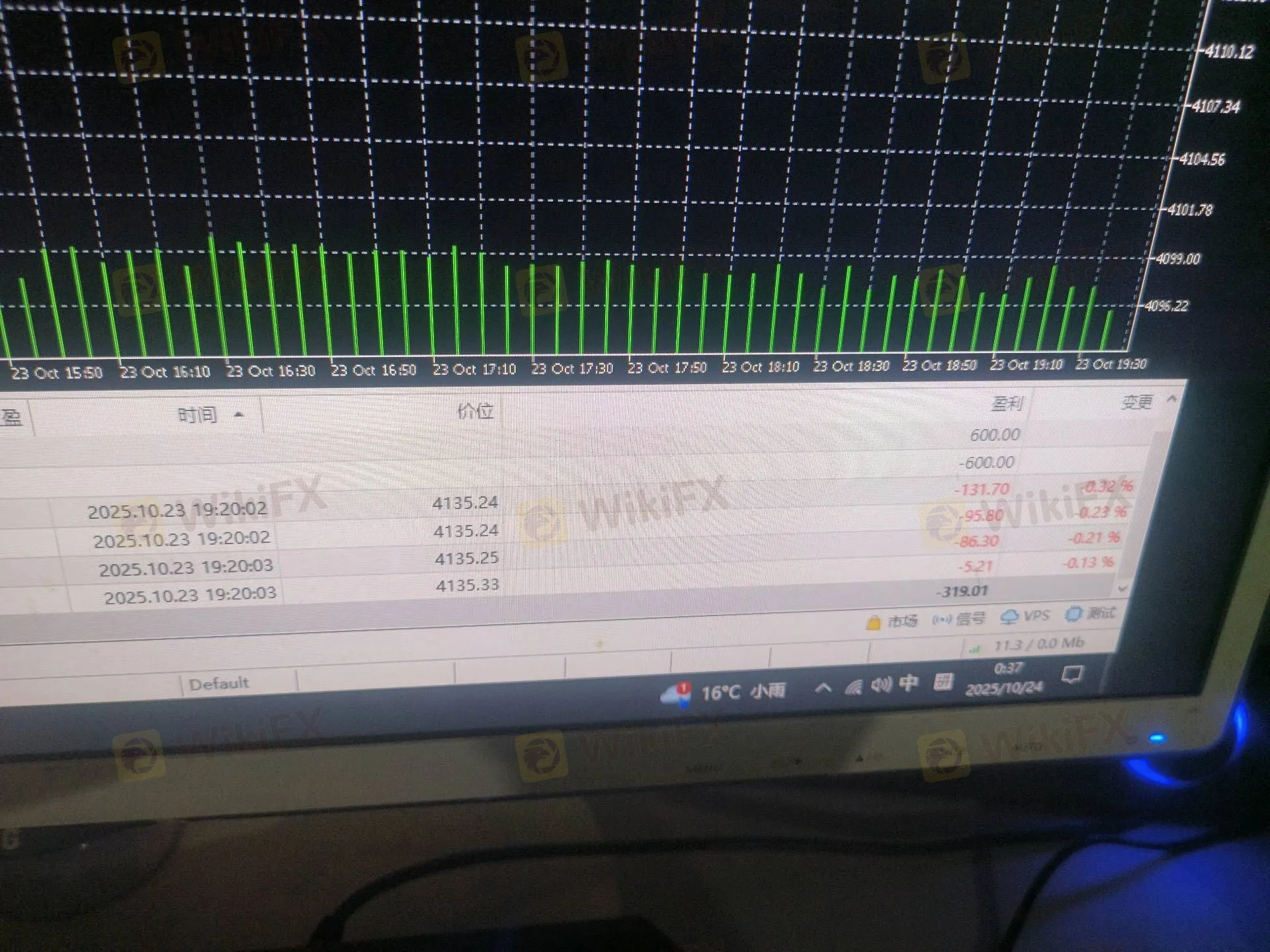

Despite a high system score, the user feedback paints a concerning picture. In the last three months alone, there have been multiple complaints registered against Trive. The primary allegations revolve around withdrawal refusals and the deduction of profits.

Data collected from traders in India, China, Hong Kong, and Syria highlights a pattern of disputes:

“Bonus” Traps: A report indicates that bonus funds offered by the platform may be used as a lever to close client positions unexpectedly.

Risk Warning: The recurrence of “profit deduction” complaints suggests aggressive risk management practices by the broker. Traders relying on specific strategies (scalping or news trading) should proceed with extreme caution.

For traders who choose to proceed, Trive offers flexible trading conditions. The broker uses a mix of proprietary technology and industry-standard third-party platforms.

Trive offers four distinct account types designed for different capital levels:

Trive offers extremely high leverage, reaching up to 1:500 for standard accounts and an aggressive 1:2000 for the “Pro Leveraged” account. While high leverage can amplify gains, it significantly increases the risk of rapid capital loss, especially for inexperienced traders.

Pros:

Cons:

Trive presents a conflicting profile. On paper, it appears to be a robust, multi-regulated broker with a good history since 2013 and access to top-tier trading platforms. The regulation by ASIC and MFSA adds a layer of credibility that many offshore brokers lack.

However, the recent surge in complaints regarding profit confiscation and withdrawal blocks cannot be ignored. The pattern of accusing profitable traders of “abuse” to void earnings is a severe warning sign. While the platform score is decent (7.91), the “Unverified” status of its UK license and the user exposure stories suggest that your capital may be at risk if you fall under their offshore jurisdiction.

Recommendation: If you trade with Trive, ensure you are contracted under their ASIC or MFSA entity. If you are dealing with their offshore branch, exercise extreme caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.