Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Deriv is a major player in the online trading world, widely recognized in regions ranging from South Africa and Nigeria to Southeast Asia and South America. Established in 2019 with its headquarters in Malta, Deriv—a rebrand of the historic Binary.com—holds a high Influence Rank of AAA and a WikiFX Score of 7.04.

Deriv is a major player in the online trading world, widely recognized in regions ranging from South Africa and Nigeria to Southeast Asia and South America. Established in 2019 with its headquarters in Malta, Deriv—a rebrand of the historic Binary.com—holds a high Influence Rank of AAA and a WikiFX Score of 7.04.

While the broker boasts a massive global user base and advanced technology, potential clients must look beyond the marketing. With a mix of solid regulations and offshore licenses, plus a rising number of user complaints, is Deriv safe for your hard-earned capital?

Deriv operates under a complex regulatory structure. It utilizes multiple entities to serve clients across the globe. For traders, knowing which entity you are contracting with is crucial for fund safety.

Deriv currently holds the following regulatory statuses:

| Regulator | Country | Status | License Type |

|---|---|---|---|

| MFSA | Malta | Regulated | European (Tier-2) |

| LFSA | Malaysia | Regulated | Labuan (Mid-shore) |

| SCA | UAE | Regulated | Local Authority |

| VFSC | Vanuatu | Offshore Reg. | Offshore |

| BVI FSC | Virgin Islands | Offshore Reg. | Offshore |

| CIMA | Cayman Islands | Exceeded | Risk Warning |

Regulatory Context:

Deriv has legitimate licenses in credible jurisdictions like Malta (MFSA) and Malaysia (LFSA). However, a significant portion of its global retail clients are onboarded through its offshore entities (BVI or Vanuatu), which generally offer higher leverage but fewer investor protections compared to European standards.

Additionally, data shows that Deriv's license with the Cayman Islands (CIMA) is listed as “Exceeded,” meaning the broker may be operating outside the permitted scope of that specific license. Furthermore, regulators in Indonesia (BAPPEBTI) have issued warnings and blocked various domains associated with the broker for operating without local authorization.

Despite its popularity and high score, Deriv has faced a surge in serious user complaints in 2024 and 2025. The broker has received over 50 complaints in recent months.

Key Complaint Categories:

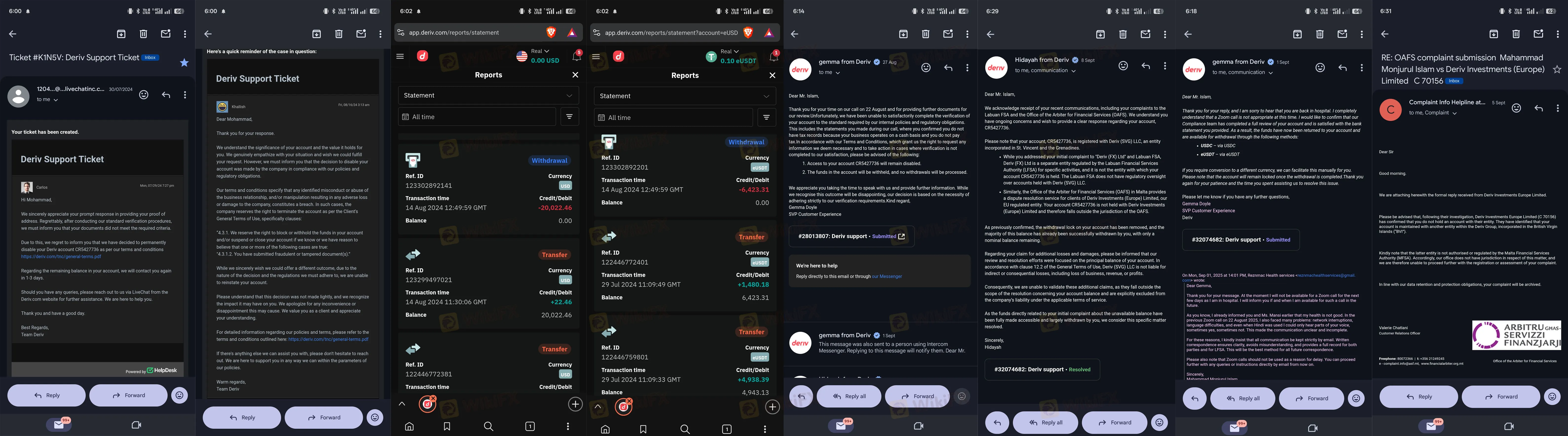

Frozen Accounts: Multiple reports suggest that Deriv freezes accounts during active trading sessions. Users describe being asked for excessive KYC documents (such as tax returns) to “verify” accounts that were previously approved, effectively locking their funds for weeks.

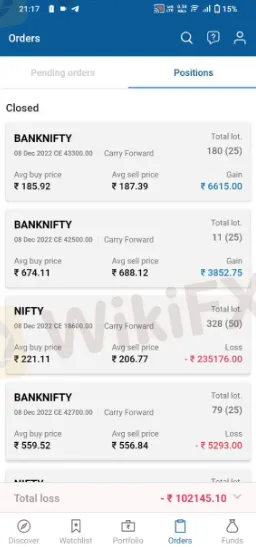

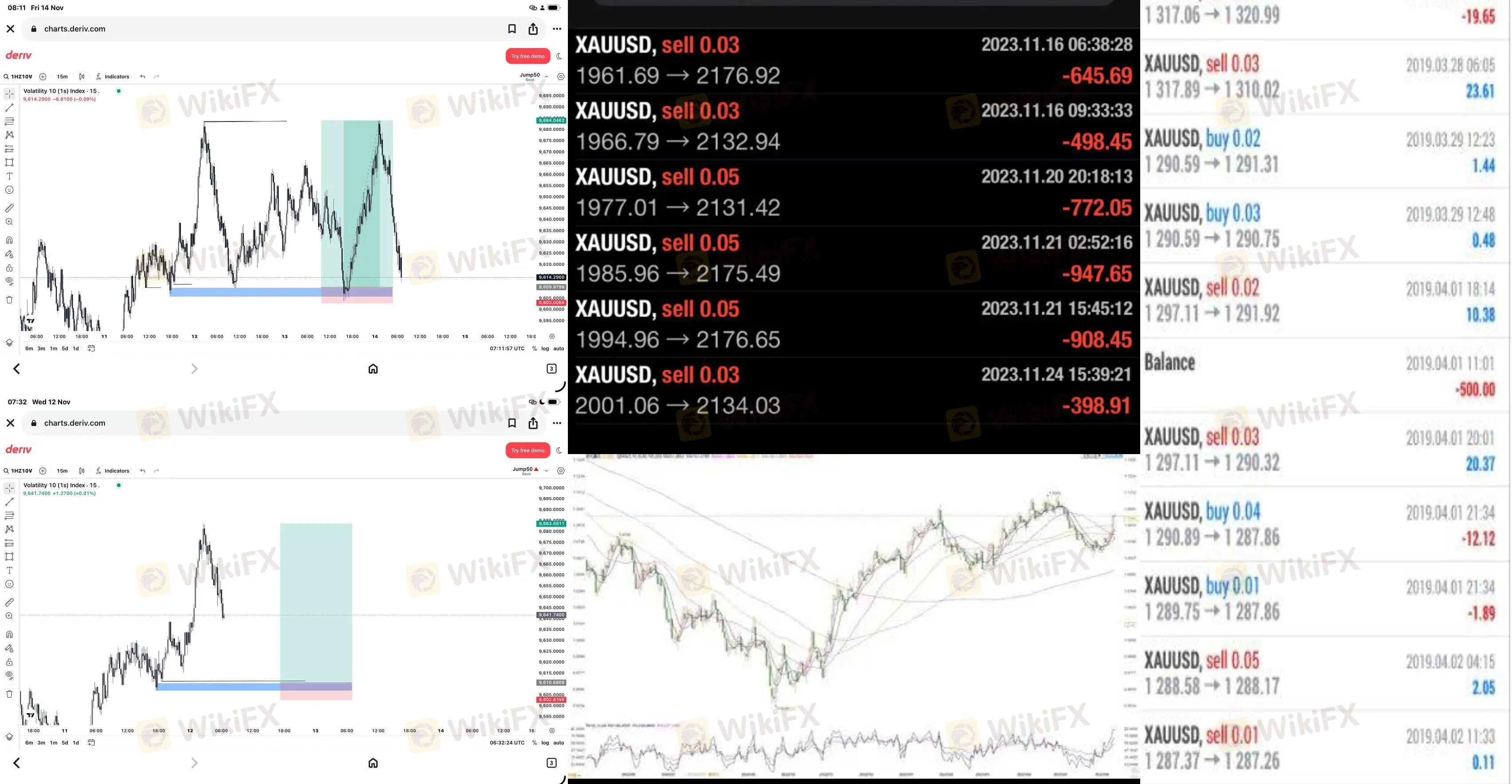

Execution Issues & Leverage Changes: A critical recurring complaint involves “sudden leverage reduction.” Users reported that their leverage was dropped from 1:200 to 1:50 without adequate warning during open trades, leading to immediate margin calls and liquidation.

Others have reported severe slippage (price jumping) that turns winning trades into losses.

Risk Note: While many traders use Deriv without issue, the volume of complaints regarding stuck withdrawals and sudden rule changes is concerning.

If we look solely at the trading infrastructure, Deriv offers a competitive environment, particularly for traders in emerging markets.

Platforms

Deriv primarily supports MetaTrader 5 (MT5). This is an industry-standard platform known for its advanced charting tools, automated trading capabilities (EAs), and multi-asset support.

Payment Flexibility

One of Deriv's strongest selling points is its massive array of payment methods, catering to local needs where traditional banking is difficult. Options include:

This flexibility makes it very easy to deposit, though as noted above, withdrawing can sometimes be more friction-heavy.

| Pros | Cons |

|---|---|

| ✅ Global Reach: Strong presence in Africa, Asia, and South America. | ❌ High Complaint Volume: Frequent reports of withdrawal blocks and account freezing. |

| ✅ Multiple Regulations: Regulated in Malta, Malaysia, and UAE. | ❌ Offshore Risk: Most global clients are under BVI/Vanuatu laws. |

| ✅ Payment Options: Huge variety of crypto and local mobile money methods. | ❌ CIMA Warning: Operating beyond the scope of its Cayman license. |

| ✅ MT5 Support: Industry-leading software. | ❌ Execution Issues: Reports of sudden leverage reductions causing liquidation. |

Is Deriv safe? The answer is nuanced. Deriv is a legitimate, established broker with valid licenses in respected jurisdictions like Malta and Malaysia. It is not a “fly-by-night” scam. Its support for diverse local payment methods makes it one of the most accessible brokers for traders in developing economies.

However, the recent spike in user complaints regarding withdrawals and sudden leverage changes introduces significant risk. Traders should be cautious, particularly when holding large balances. If you choose to trade with Deriv, ensure you understand which entity holds your account and verify your documents fully before depositing large sums.

To monitor Deriv's regulatory status or file a complaint if you experience issues, traders can visit the WikiFX app to view the broker's real-time safety score and latest user reviews.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.