Abstract:WikiFX has detected a disturbing surge in complaints regarding the broker Vittaverse (Opal Markets Ltd). In the last three months alone, nine severe complaints have been lodged, pointing to a specific, repeated pattern: the administrative deletion of profits under the vague label of "balance correction." While the broker holds an offshore license, reports suggest that traders' funds are vanishing from dashboards without market cause, leaving users with zero recourse.

WikiFX has detected a disturbing surge in complaints regarding the broker Vittaverse (Opal Markets Ltd). In the last three months alone, nine severe complaints have been lodged, pointing to a specific, repeated pattern: the administrative deletion of profits under the vague label of “balance correction.” While the broker holds an offshore license, reports suggest that traders' funds are vanishing from dashboards without market cause, leaving users with zero recourse.

Disclaimer: All cases cited in this report are based on real records submitted to the WikiFX support center. While trader identities have been anonymized for their protection, the financial figures and correspondence details are drawn directly from the evidence provided.

License vs. Reality: The Limits of Offshore Protection

Before examining the specific grievances, it is vital to understand who Vittaverse is on paper. Regulatory records held by WikiFX show that Vittaverse operates under Opal Markets Ltd and is regulated by the Seychelles Financial Services Authority (FSA), holding license number SD200.

While “Regulated” usually implies safety, African traders must understand the nuance. The Seychelles FSA is an offshore regulator. Unlike top-tier authorities (like the FCA in the UK or ASIC in Australia), offshore regulators often have looser requirements regarding segregated accounts and dispute resolution.

- The Reality: A license exists, but it has not prevented the operational anomalies described below.

- The Status: While technically legal, the “Offshore” status combined with a mediocrity score of 4.61/10 indicates a platform where higher vigilance is required.

The Phenomenon of “Profit Erasure”

The most alarming pattern emerging from our investigation is not that the market is moving against traders, but that the broker appears to be moving against the traders.

Multiple recent reports describe a scenario where a trader makes a profit, attempts to withdraw, and is immediately hit with a “Balance Correction.”

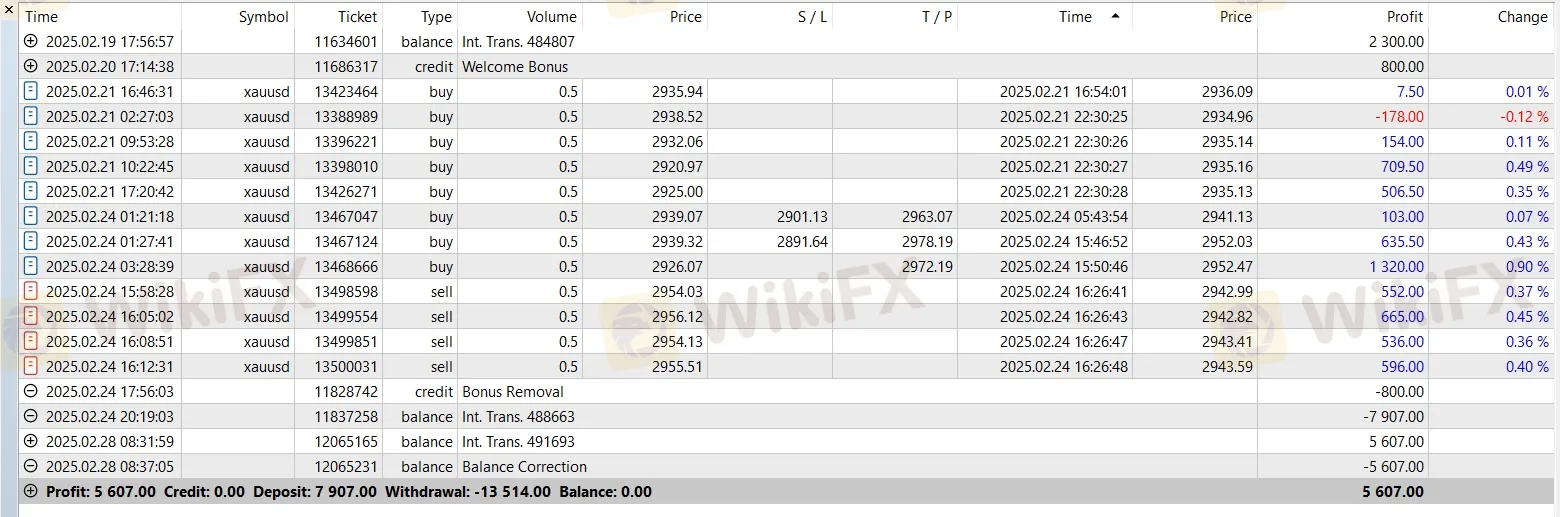

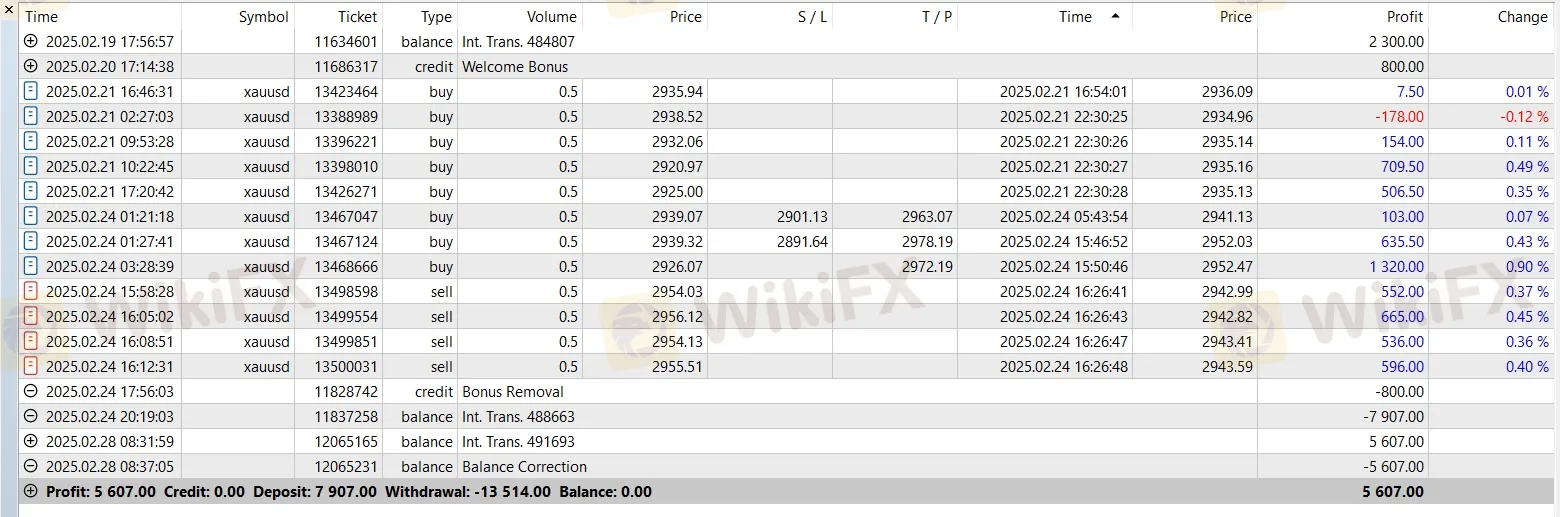

In one particularly distressing case, a trader deposited $2,300 and earned a significant profit of $5,609. When they requested a payout, the broker did not just delay the funds—they allegedly removed the entire $5,609 profit from the account. The trader reported that only the initial capital was returned, with the profits deducted without a clear explanation of which rule was violated.

This is not an isolated incident. Another trader reported that their wallet balance of $12,534 was simply removed. When they sought answers, the support line went silent. This points to a systemic issue where the broker may be invalidating winning trades retroactively to avoid paying out.

Evidence Log: Trader records showing disputed balance deductions

The Mystery of the “..” Rejection

Transparency is the bedrock of trust, yet Vittaverse's communication channels appear to be failing critically.

One case stands out for its absurdity. A trader attempting to withdraw $1,700 received a decline notification. The official reason given for the decline was simply two dots: “..”.

Following this cryptic rejection, the trader found that a “balance correction” had been applied, wiping out $3,500 from their wallet. The funds were not lost in a trade; they were administratively deleted. When the trader demanded to know what the two dots meant, or why the money was gone, email support reportedly stopped responding entirely.

Inside the Operation: Accusations Against Management

The investigation has deepened with reports from Introducing Brokers (IBs) and partners who claim they are also being targeted. Unlike standard client complaints, these reports name specific management figures, suggesting internal rot.

One detailed complaint alleges that high-ranking managers, specifically naming a “Mr. Usman” and “Mr. Sam Iqbal,” have been withholding commissions. The report claims these managers were previously associated with another firm, Naga Capital, before joining Vittaverse. The accuser provided records suggesting that over $14,000 in client withdrawals and over $1,400 in partner commissions have been blocked.

Another report explicitly names a “Marc Memoni” as being behind decision-making processes that lead to funds being frozen. When partners and IBs—who usually have a direct line to the broker—are accusing the firm of withholding earnings, it serves as a massive red flag for retail traders.

Silence is the Only Response

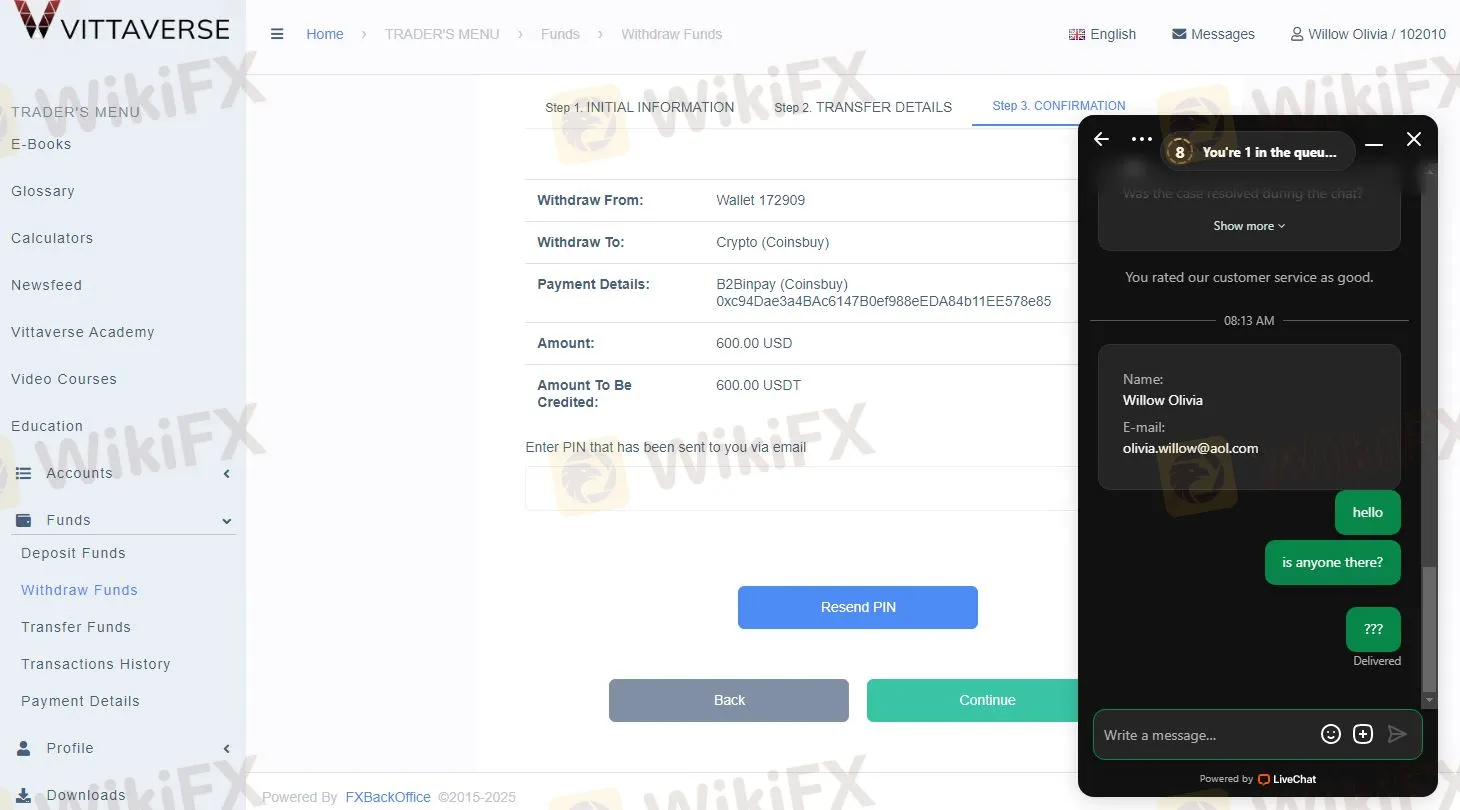

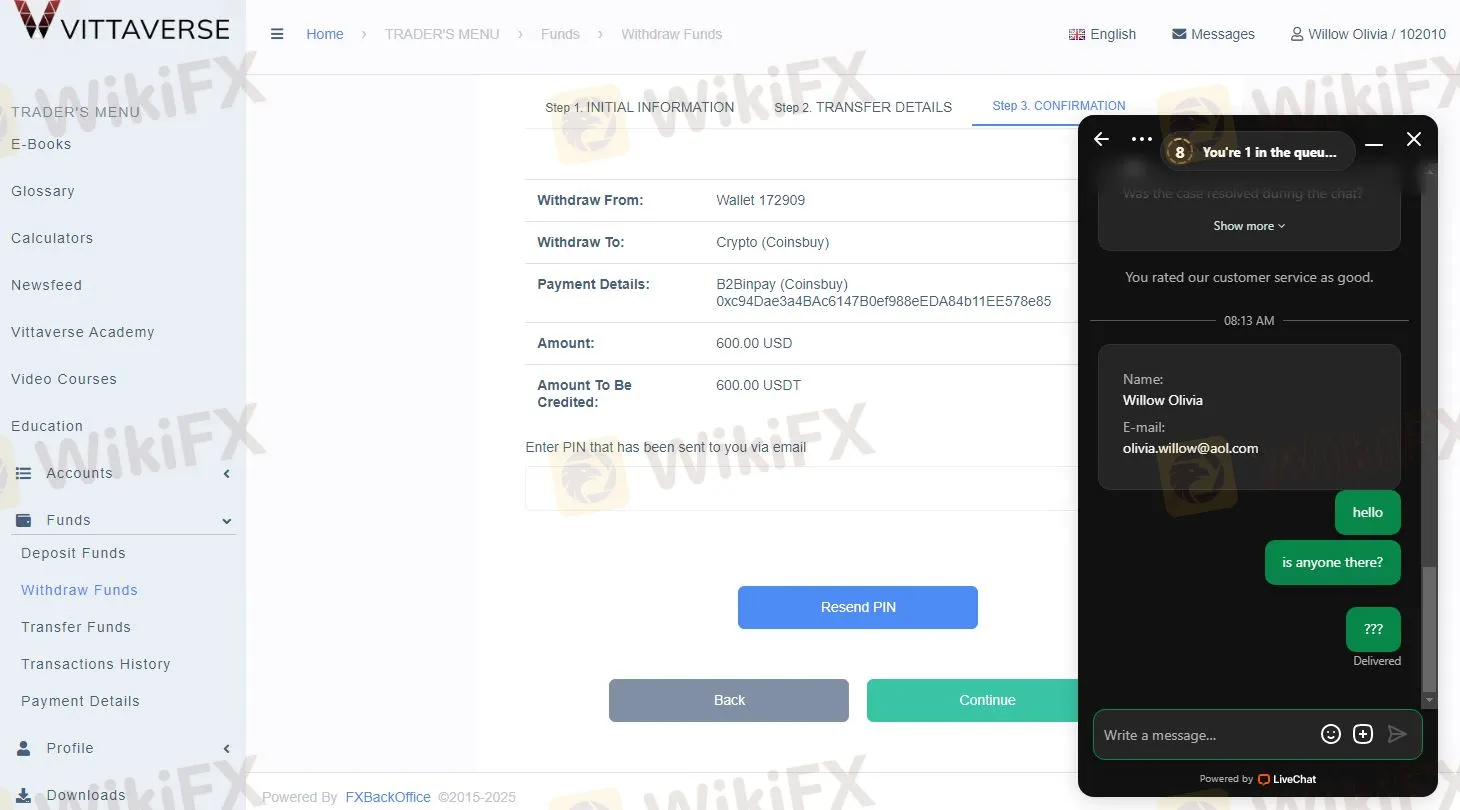

Across all reviewed cases, a common theme is the degradation of customer support. Whether it is a trader asking why their $600 deposit is stuck or a VIP client inquiring about missing thousands, the response pattern is consistent:

- Generic, repeated messages.

- Cryptic rejection codes (like the “..”).

- Total radio silence.

WikiFX Verdict

The evidence points to a high-risk environment. While Vittaverse holds a Seychelles license, the reported behaviors—specifically the retroactive deletion of profits and the withholding of partner commissions—are inconsistent with fair trading practices.

Recommendation for Traders:

- Caution Advised: We strongly urge traders to exercise extreme caution with Vittaverse at this time.

- Documentation: If you are currently trading with them, document every trade execution and daily balance screenshot immediately.

- Withdrawal Test: Attempt to withdraw profits frequently. If you face a “balance correction,” contact WikiFX immediately to lodge a formal complaint to the regulator.

WikiFX Risk Warning

Forex and CFD trading involve significant risk and may not be suitable for all investors. Accounts can be lost due to market volatility or broker insolvency. The information in this article is based on currently available regulatory data and user-submitted evidence.