Abstract:In the world of online trading, a split second determines the difference between profit and loss. Recent investigations reveal that Pocket Option may be manipulating those seconds through opaque proprietary systems, leaving profitable traders blocked, banned, or simply ignored.

WikiFX Special Exposure · Urgency Level: Critical

Broker Status: Unregulated / High Risk

WikiFX Score: 1.72 / 10

Anonymity Disclaimer: All cases referenced here come from verified complaints held by WikiFX. Trader identities have been anonymized for protection.

The Hook: When the House Controls the Clock

The WikiFX Exposure Team has logged 23 severe complaints against Pocket Option in the last three months alone. Beyond routine withdrawal denials, the evidence points to something far more calculated: time manipulation. Traders report that the broker‘s internal clock drifts from real time, tilting binary outcomes in the broker’s favor.

Case Study: The “Time Warp” Anomaly

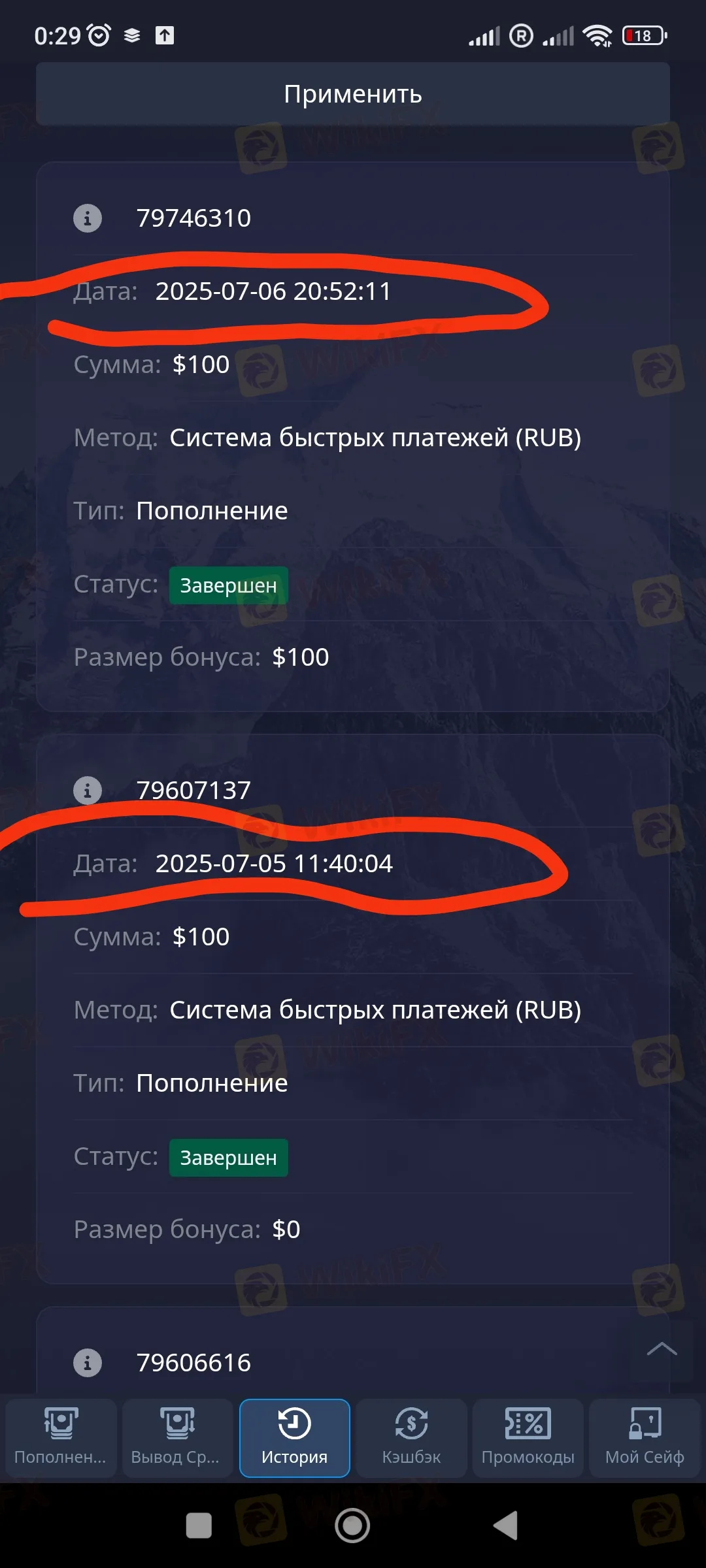

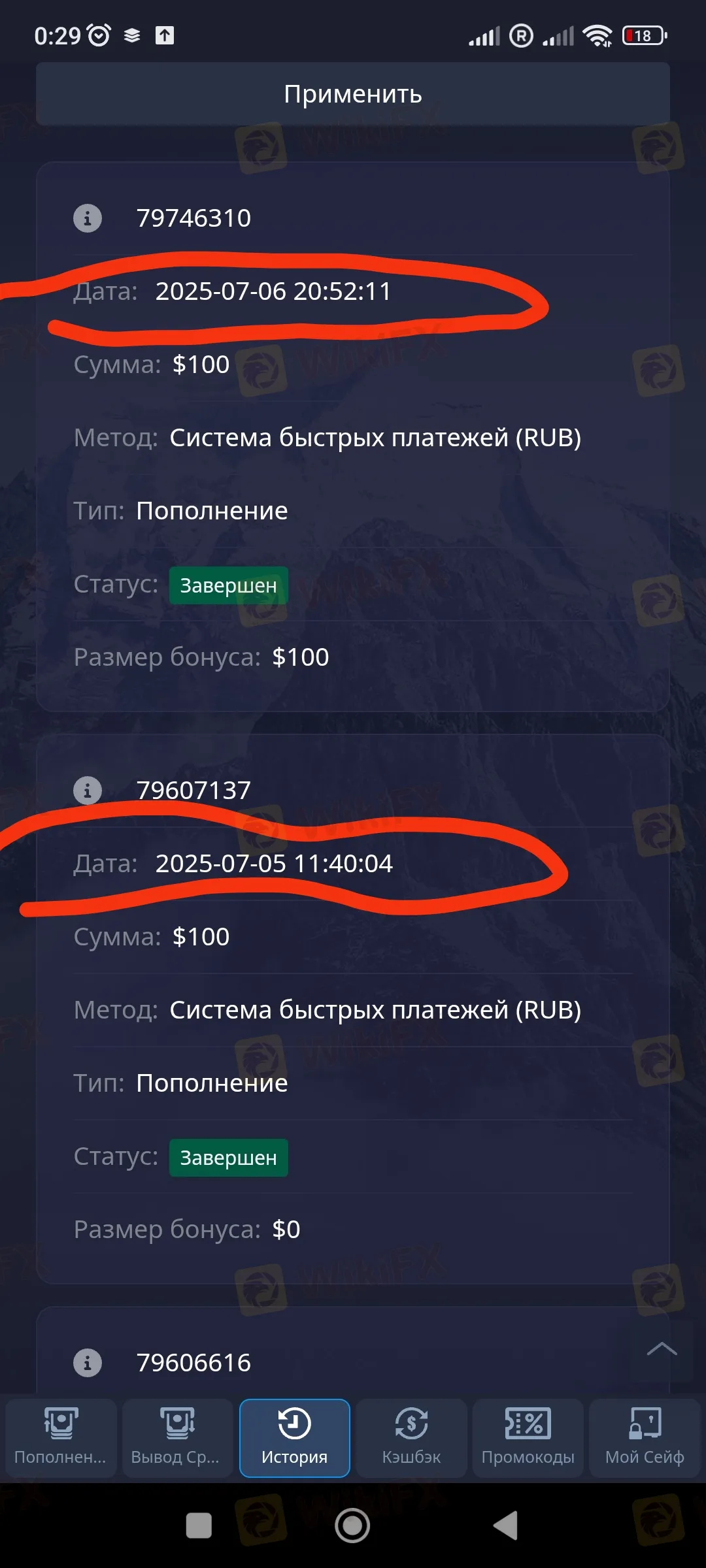

One trader submitted transaction logs showing that their bank timestamp (11:41:14) differed from Pocket Options execution time (11:40:04). When asked for raw logs, support blamed “timezone confusion (UTC+2)”—yet could not explain the minute-long gap. Because Pocket Option operates on self-developed proprietary software (not MT4/MT5), traders have no way to audit the time source.

The Regulatory Vacuum

Understanding the risk requires looking at the brokers legal standing.

Without a regulator auditing their proprietary code, there is no assurance that the price feeds or execution times reflect reality.

The “Article 2.9” Trap

Pocket Option often employs a three-step cycle when a trader becomes profitable:

- Deposit: Onboarding and verification are smooth.

- Profit: The account grows—sometimes doubling.

- Blockade: At withdrawal, the account is flagged with references to “Article 2.9” or “Clause 2.2,” accusing the trader of speculative abuse.

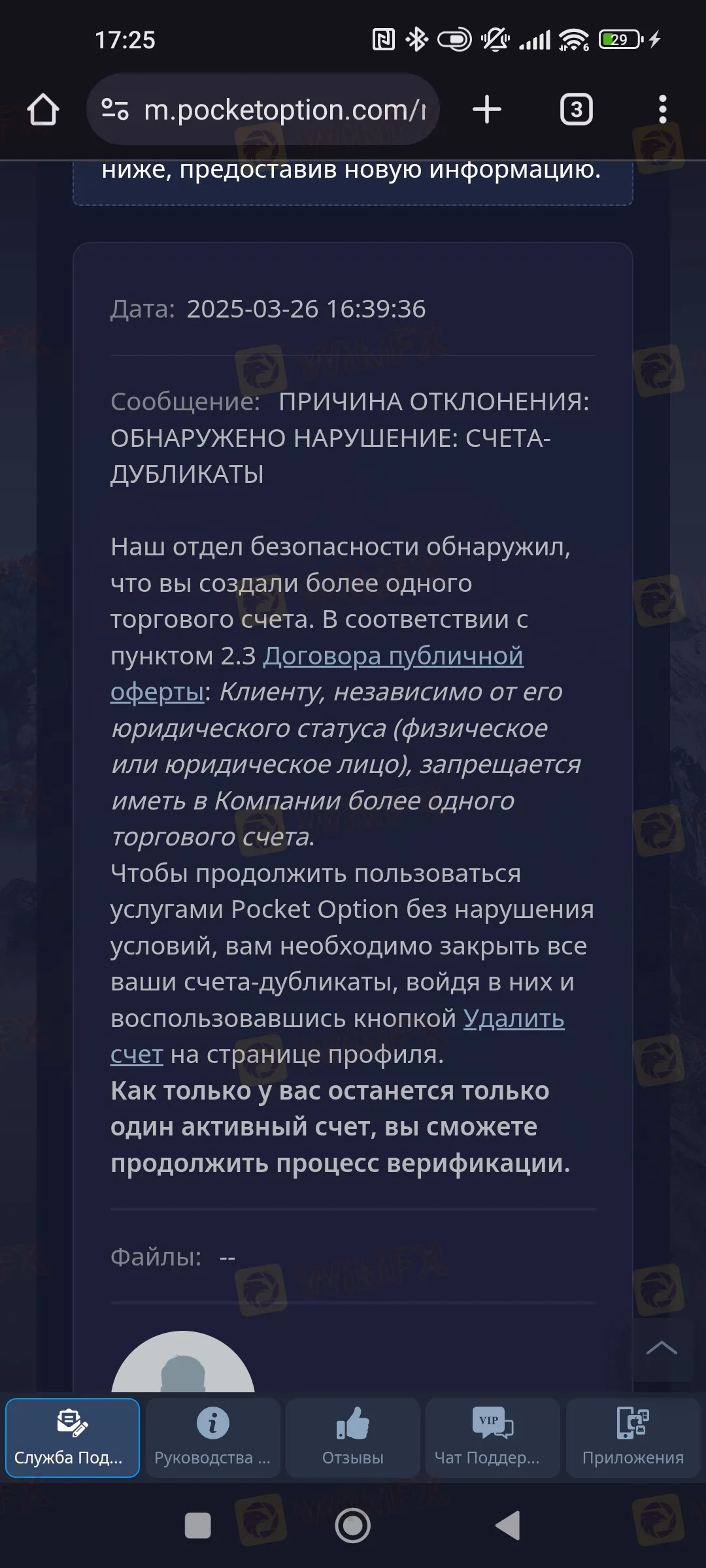

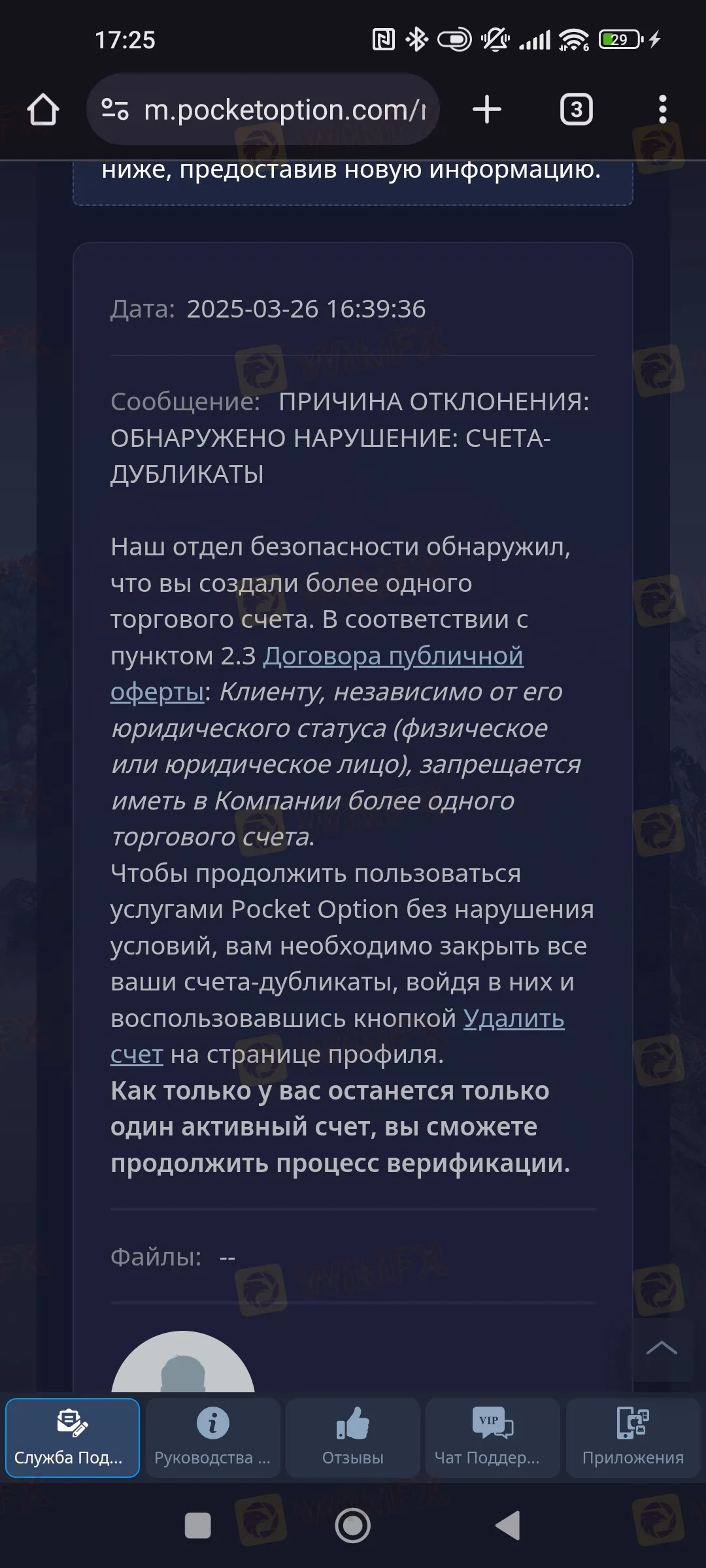

In an August 29, 2025 case, KYC documents were suddenly rejected only after profits were made. The traders account was frozen, and funds were seized.

Systemic Glitches and Silent Support

The complaints share common technical themes:

- Phantom Closures: Positions reportedly close without user input.

- Quote Mismatches: Prices differ from verified sources such as TradingView.

- Duplicate Account Excuse: Withdrawals frozen due to alleged duplicate accounts—even after the trader requested closure.

Despite advertising 24/7 support, traders describe unanswered tickets and generic replies when asking about missing funds.

WikiFX Verdict

Pocket Option combines opaque proprietary software, no regulation, and a pattern of accusing profitable traders to justify withholding funds. This is a textbook definition of a high-risk environment.

Recommendation: WikiFX urges traders to halt deposits immediately and migrate to brokers regulated by authorities such as the FCA, ASIC, or FSCA, where software audits and segregated funds are mandatory.

Risk Warning: Forex and CFD trading involve a high level of risk and may not be suitable for all investors. This report reflects current complaint data and regulatory flags stored in the WikiFX database. Always verify a brokers license status before depositing funds.