1x Trade Review Exposed: Withdrawal and Bonus Tricks

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:2025 is about to end, and if you still want to be a trader or investor and are looking for a broker to invest with. It is important to read real user complaints first. This will help you understand the kind of problems users are facing with MUFG broker. In this article, we will tell you about the major complaints users have reported about MUFG in 2025, so you know what to watch out for. Do not ignore this MUFG broker article and understand the problems.

2025 is about to end, and if you still want to be a trader or investor and are looking for a broker to invest with. It is important to read real user complaints first. This will help you understand the kind of problems users are facing with MUFG broker. In this article, we will tell you about the major complaints users have reported about MUFG in 2025, so you know what to watch out for. Do not ignore this MUFG broker article and understand the problems.

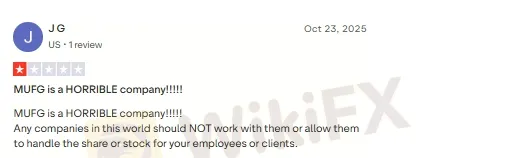

One reviewer said that MUFG is a horrible company and shared a very negative experience. He explained that the service was unreliable, slow, and frustrating. He also said companies should not trust MUFG to handle shares or stocks for their employees or clients, as it could lead to problems and unnecessary stress.

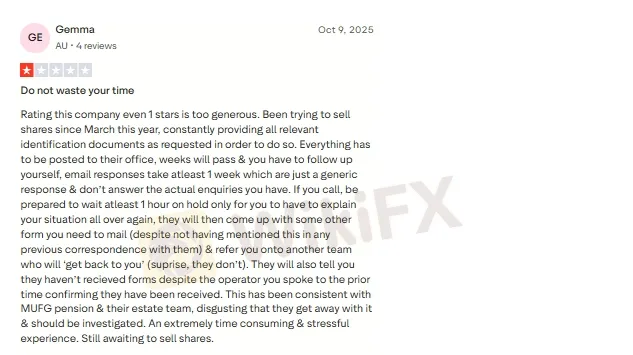

One customer said he waited 15 minutes on chat, shared his details, and never saw his place in the queue. He gave up.Another reviewer said MUFG takes a week to answer emails and still ignores the main questions. He added that phone calls mean waiting an hour on hold, then repeating everything with no solution. He described the support as stressful and slow.

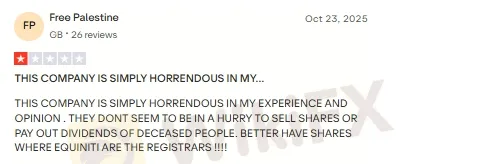

This company has been horrendous as per users experience. They do not seem to act quickly when selling shares or paying out dividends, even for deceased individuals. Because of this, he strongly felt it is better to have shares managed by others instead.

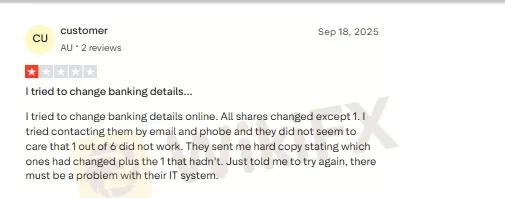

A customer tried to change his banking details online, but one share did not update. He contacted support by email and phone, but they did not seem to care. MUFG sent a hard copy showing all shares, including the one that failed to update. They just told him to try again because the IT system “might have a problem.”

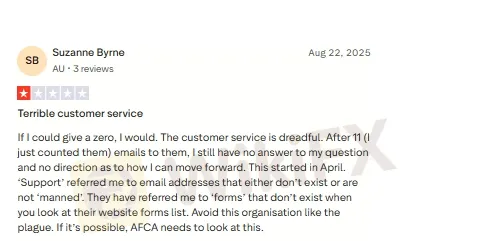

Another reviewer called MUFG’s customer service “terrible” and “dreadful.” He said he sent 11 emails and still got no clear answer. He claimed the support team was not helpful and even gave him email addresses and forms that did not exist.

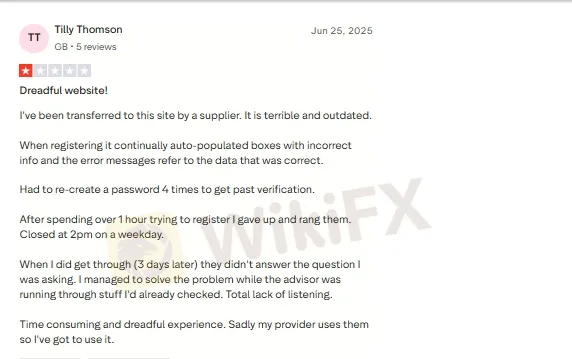

A customer said MUFGs website is outdated and hard to use. The registration form kept filling in the wrong details. He had to create his password four times to pass verification. After an hour of trying, he gave up.Three days passed with no reply from MUFG. He solved the issue himself while the advisor repeated steps he had already tried. He called the process slow and frustrating.

You can join the group by scanning the QR code below.

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

1x Trade scam: traders report that profits are being seized and withdrawals are being blocked. Review evidence and secure your funds now.

ACY Securities exposure: dozens of forex scam cases show withheld funds and account blocks; read reports, document losses, and stop deposits today.

FxPro, a United Kingdom-based forex broker, has been facing severe allegations concerning fund withdrawal issues, illegitimate account freezes, trade manipulation, and poor customer support. These allegations have been doing the rounds on several broker review platforms such as WikiFX. In this FXPro review article, we have examined these allegations for you to look at. Keep reading to learn how the broker allegedly worsened traders’ experiences.

Exclusive Markets review highlights weak offshore regulation and rising scams, including unpaid withdrawals. Multiple exposures demand caution—verify before trading.