Abstract:You're asking a direct and important question: Is IEXS safe or a scam? As someone who might trade with them or already does, this is the most important research you can do. While IEXS says it is a global broker with over ten years of experience, a detailed look at its regulatory status and many user reviews shows serious warning signs that cannot be ignored. The evidence suggests a high-risk situation for traders' capital. This review will examine the available information, from official regulatory warnings to concerning first-hand user complaints, to give you a clear and fact-based view of the risks involved in trading with IEXS. Our goal is to give you the facts you need to make a smart decision.

Your Critical Question Answered

You're asking a direct and important question: Is IEXS safe or a scam? As someone who might trade with them or already does, this is the most important research you can do. While IEXS says it is a global broker with over ten years of experience, a detailed look at its regulatory status and many user reviews shows serious warning signs that cannot be ignored. The evidence suggests a high-risk situation for traders' capital. This review will examine the available information, from official regulatory warnings to concerning first-hand user complaints, to give you a clear and fact-based view of the risks involved in trading with IEXS. Our goal is to give you the facts you need to make a smart decision.

IEXS Safety Scorecard Overview

For those needing a quick assessment, this scorecard compares what the broker claims against documented evidence. It gives you a snapshot of the key factors that determine how safe and trustworthy IEXS is.

Analyzing IEXS Regulatory Status

A broker's regulatory status is the foundation of its trustworthiness. IEXS claims licenses from top regulators, but a closer look shows a concerning reality that's far from the secure image it presents. This difference between claims and reality is a major concern.

Claimed Licenses vs Reality

IEXS promotes itself as being regulated by the Australian Securities and Investments Commission (ASIC) and the UK's Financial Conduct Authority (FCA). However, the nature and status of these licenses are deeply problematic.

· ASIC (Australia): IEXS holds an Appointed Representative (AR) license, number 001301063. It's important to understand that an AR license is not a full, independent license. An AR operates under the main license of another company. This structure often means less direct regulatory oversight, less strict capital requirements, and reduced accountability compared to a fully licensed company.

· FCA (UK): The broker holds an Investment Advisory License, number 923324, but its status is listed as “Exceeded.” This is a major red flag. “Exceeded” means the company is operating beyond what its license allows. This is a serious rule violation and basically cancels the protections the license is supposed to provide to clients, as the regulator doesn't supervise these unauthorized activities.

ASIC Investor Alert Warning

The most serious piece of regulatory evidence is an official warning from a top regulator. On August 13, 2025, ASIC placed “IEXS Global (iexs.com)” on its investor alert list. Regulators issue such warnings when they have reason to believe a company may be involved in illegal operations, operating without a proper license, or posing a direct threat to investors. This is one of the most serious warnings a trader can receive about a broker and should be taken very seriously.

How to Verify Claims

We advise all traders to independently check a broker's regulatory claims. Don't just take a broker's word for it. To verify their current regulatory status and see these warnings for yourself, you can review their official registration details, which are often linked from its website. However, always double-check this information by searching for the company and license number directly on the official public register of the regulator (like the ASIC and FCA websites).

Deep Dive: User Complaints

While regulatory status gives a structural view of a broker's legitimacy, user experiences show how a broker actually operates. WikiFX has documented 13 “Exposure” complaints against IEXS. These aren't minor issues; they are detailed, often with specific amounts, accounts of significant financial losses and inability to access funds, showing a pattern of serious problems.

Nightmare of Withdrawals

A recurring and deeply concerning theme among user complaints is the inability to withdraw funds. Multiple users, mainly from Thailand, describe a consistent pattern of failed withdrawals.

· One user states, “No matter how many times I submit requests, the funds never arrive, and I'm only met with excuses or silence.”

· Another echoes this sentiment: “It feels like my capital is trapped, and I've completely lost control over my own assets.”

· An Indian user reported a five-day delay for a withdrawal of just 80,000 Rupees, showing that even when withdrawals are processed, they can be unacceptably slow. When a broker fails at this basic function, trust is completely broken.

Slippage and Execution Failures

The most detailed and numerous complaints focus on catastrophic trade execution. These reports directly contradict the broker's marketing of a stable and fair trading environment.

· Extreme Spread Widening: A trader reported that during a news release, spreads on EUR/USD, advertised as low, suddenly jumped from a normal 1.8 pips to a shocking 17.2 pips—a ninefold increase that resulted in a spread cost of $344 on a two-lot trade.

· Massive Slippage: One user experienced 200 pips of slippage on NFP night, which led to the complete loss of a ₹700,000 position. Another reported that a stop-loss order suffered 32 pips of slippage, causing a ₹21,000 loss.

· System Freezes: A user detailed how the system froze for a full seven minutes during an RBI interest rate announcement. When it recovered, their position had been closed with 45 pips of slippage, causing a ₹1,35,000 loss. Another trader reported a 40-second freeze while attempting to close a profitable position, which ultimately turned into a loss.

Frozen Accounts, No Support

Perhaps the most alarming complaint involves a user from India whose account, containing ₹6,00,000, was frozen without a clear reason. The only explanation provided by customer support was a vague “compliance review,” with no further details or timeline. This user also reported extreme slippage of 130 pips on a USD/JPY trade, which customer service dismissed as “normal.” This pattern of freezing funds and providing unclear support leaves traders powerless and facing significant financial risk.

Marketing vs User Reality

There is a stark contrast between user experiences and IEXS's promotional materials. The broker has been noted to run WhatsApp ads in Hindi promoting “zero slippage trading.” This directly contradicts the numerous, detailed accounts of massive slippage from users. While the company's marketing, which you can find on its official website, promotes professionalism and cutting-edge technology, these detailed, user-reported experiences present a very different and concerning picture.

Considering the Counterarguments

To provide a complete picture, it's important to acknowledge any information that goes against the negative findings. The data includes 8 positive and 7 neutral reviews, which we must consider.

Positive and Neutral Cases

· Positive: One user from Vietnam claims to have used IEXS for over half a year with “timely” withdrawals. Another user from India noted that a USDT withdrawal was processed in a fast 45 minutes. A third user had a good experience, but only on a demo account.

· Neutral/Defensive: An unverified user identifying as a “partner” of IEXS claims the negative reports are “malicious attacks.” Another user simply notes the experience between a demo account and a real account is “frustratingly different,” which is a neutral but telling observation.

A Critical Evaluation

When weighing the evidence, the counterarguments are not strong enough to offset the red flags. The negative complaints are far more numerous, highly specific, and include exact financial figures, dates, and technical details (like pip slippage and freeze durations), which makes them slightly suspicious. In contrast, the positive reviews are fewer and more general. Furthermore, a positive experience on a demo account doesn't matter, as it involves no real capital and doesn't test the broker's execution or withdrawal systems under real-world pressure. The claim of a “smear campaign” is a common, unproven defense used by brokers facing widespread criticism and carries little weight without evidence.

IEXS Trading Conditions Examined

An objective look at the trading conditions offered by IEXS reveals features that are typical of high-risk, offshore-style brokers, along with some internal inconsistencies.

· Account Types: IEXS offers Standard and DMA accounts.

· Minimum Deposit: There is a confusing contradiction in the available data. A section states the minimum deposit is $200, while the account details page lists a minimum of $10,000 (presumably for the DMA account). Such inconsistencies are unprofessional and can be a red flag.

· Maximum Leverage: The broker offers leverage up to 1:1000. This is an extremely high level of risk. Top regulators in places such as the UK, EU, and Australia have banned such high leverage for retail clients (typically capping it around 1:30) because it dramatically increases losses and is a sign of brokers targeting inexperienced traders.

· Spreads: Advertised spreads for a Standard account are listed, for example, at 1.8 pips on EURUSD. However, as noted in the user complaints section, these advertised rates appear to be unreliable, with reports of spreads widening by nearly 900% during volatile periods.

· Platforms: The broker provides access to the industry-standard MT4 and MT5 platforms, as well as its own IEXS Mobile App.

· Instruments: A range of products is available, including Forex, Metals, Energies, Indices, Stocks, and Cryptocurrencies.

For the most current list of available instruments and account specifications, traders are advised to check the broker's official website and compare it with the issues reported by other users.

Our Final Verdict on IEXS

After a thorough examination of the regulatory status, user complaints, and trading conditions, we can now deliver a final verdict that directly answers the initial question of safety.

The Weight of Evidence

The evidence against IEXS is substantial and consistent. The key findings are: a compromised regulatory status with an “Exceeded” FCA license and a weak “Appointed Representative” ASIC license; a formal investor alert from ASIC; an overwhelming number of detailed, credible user complaints alleging withdrawal failures, frozen accounts, and severe trading manipulation through slippage and system freezes; and the offering of high-risk products such as 1:1000 leverage, which is banned by reputable regulators.

Verdict: High-Risk Broker

Based on the extensive evidence provided by WikiFX, IEXS shows a clear pattern of behavior and regulatory red flags that place it firmly in the high-risk category. While we avoid the legal term “scam,” the volume of unresolved complaints regarding fund accessibility, coupled with practices like extreme slippage and system freezes that work against the client, makes it impossible for us to recommend this broker. The risk to a trader's capital appears to be substantial and unacceptable.

A Final Word of Advice

Your capital is your most important tool as a trader. Always prioritize brokers that hold full, direct licenses from top regulators (not AR or offshore licenses), demonstrate a long and consistent history of positive user reviews, and operate with transparency and reliability. The safety of your funds should always be your number one priority above all other features.

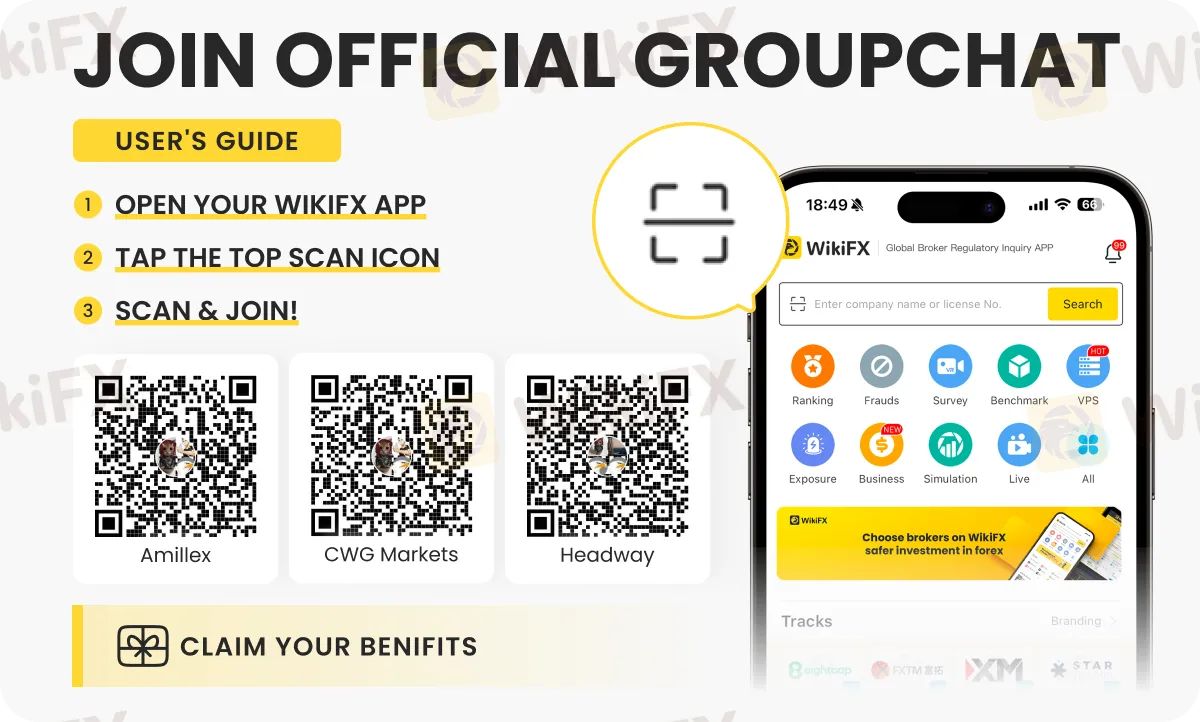

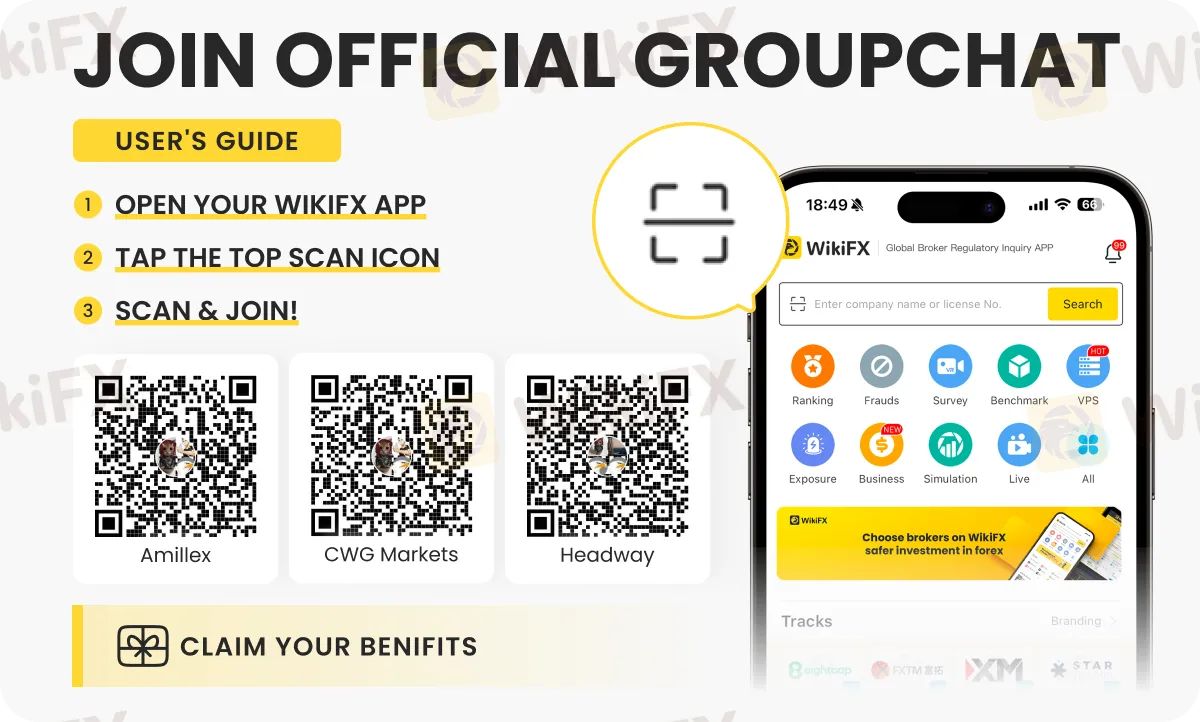

For more information about brokers and their offerings, join any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the simple instructions shown below.