Abstract:Pocket Option Scam Alert: Not regulated claims, suspicious license score, and platform-only trading risks summarized.

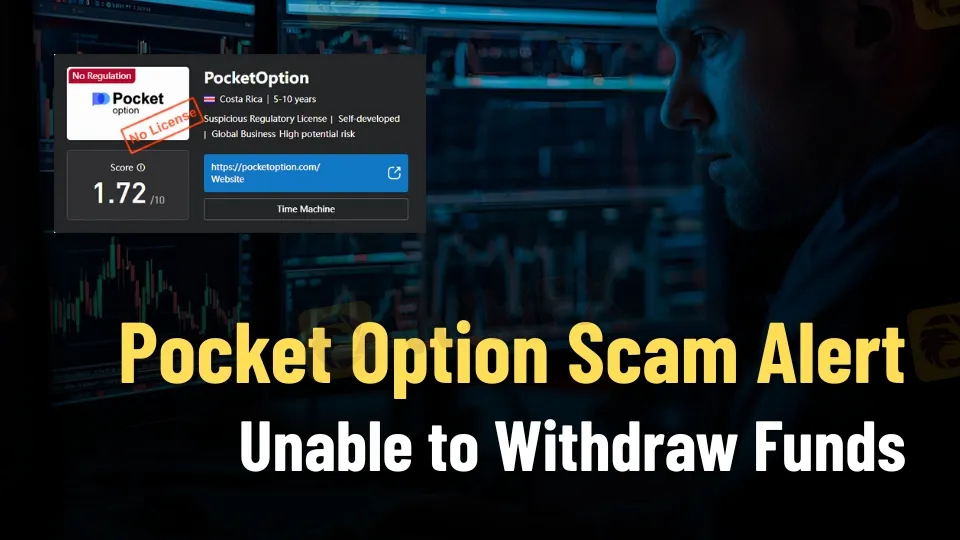

Pocket Option Scam: Blocked Accounts, Delayed Withdrawals

Pocket Option, operated by Infinite Trade LLC, has been the subject of mounting complaints across multiple regions. Traders from Spain, Russia, Malaysia, Nigeria, and Hong Kong have documented cases where withdrawal requests were either delayed for weeks or outright denied.

Several users describe a recurring pattern: once profits accumulate, the platform initiates prolonged verification procedures. These checks often extend beyond 14 days, creating psychological pressure on traders to continue trading rather than cashing out. In multiple instances, accounts were blocked under vague references to the “Public Offer Agreement,” leaving users without access to their funds.

The evidence presented in user testimonies highlights a systemic issue: trades are not routed to interbank markets but remain confined within the platform. This raises serious concerns about transparency and legitimacy.

Pocket Option Review: Suspicious License, Low Trust

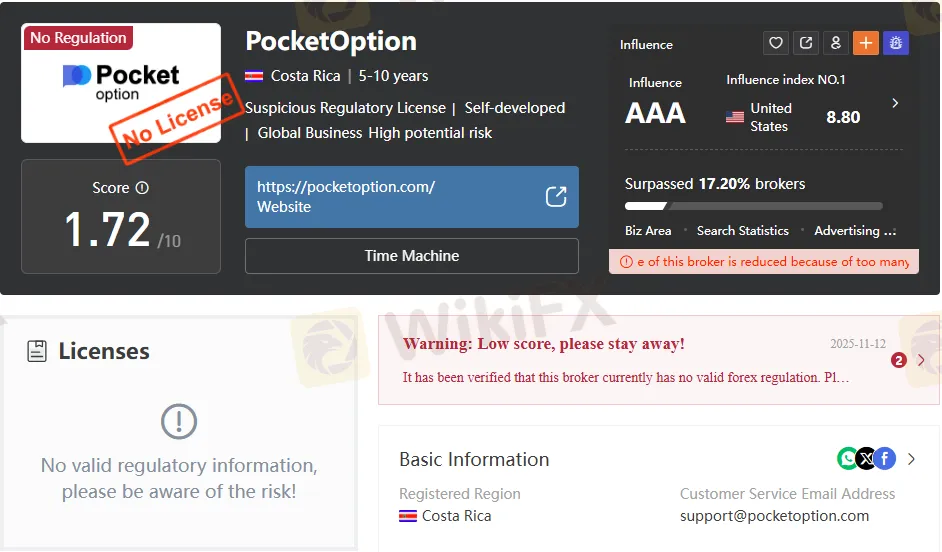

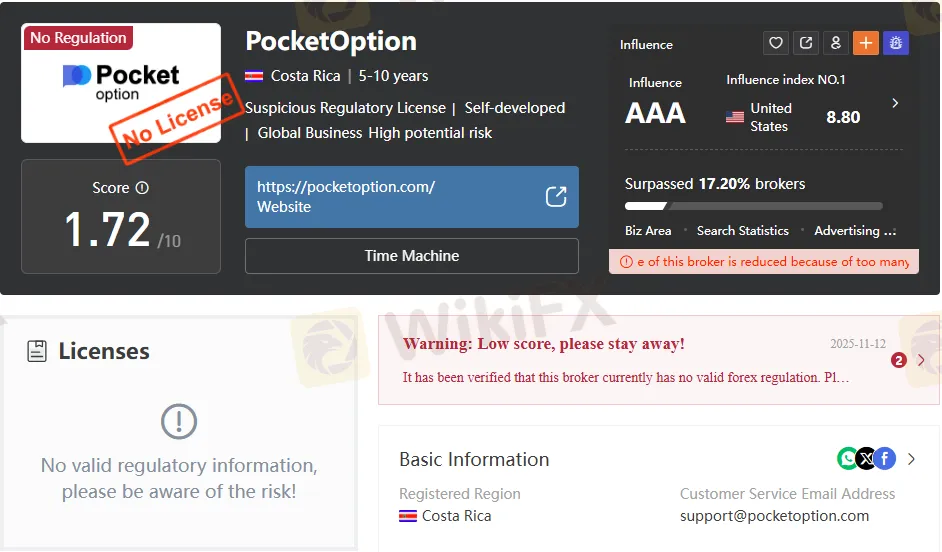

Pocket Option claims to operate under Infinite Trade LLC with a stated history of 5–10 years. However, independent assessments reveal a suspicious regulatory license and a trust score of just 1.72.

This score is far below industry standards for regulated brokers. A legitimate broker typically holds licenses from recognized authorities such as CySEC, FCA, or ASIC. Pocket Options lack of credible oversight means traders face heightened risks, including arbitrary account bans and manipulated trading conditions.

The absence of regulation is not a minor detail—it directly impacts the safety of client funds. Without external audits or compliance checks, users are left vulnerable to internal manipulations, as documented in multiple case studies.

Pocket Option Exposed: Time and Balance Manipulation

One of the most alarming findings comes from Russian traders who provided detailed evidence of time and balance manipulations. Bank receipts showed timestamps later than those recorded on the Pocket Option platform, with discrepancies ranging from one to four minutes.

After complaints, the platform retroactively altered balances and timestamps. Support staff attributed the issue to “UTC+2 time zone differences,” but this explanation failed to account for the fact that platform times appeared earlier than bank confirmations.

Requests for raw logs and complete trade reports were met with evasive responses. This lack of transparency undermines the credibility of Pocket Options trading environment and suggests deliberate manipulation.

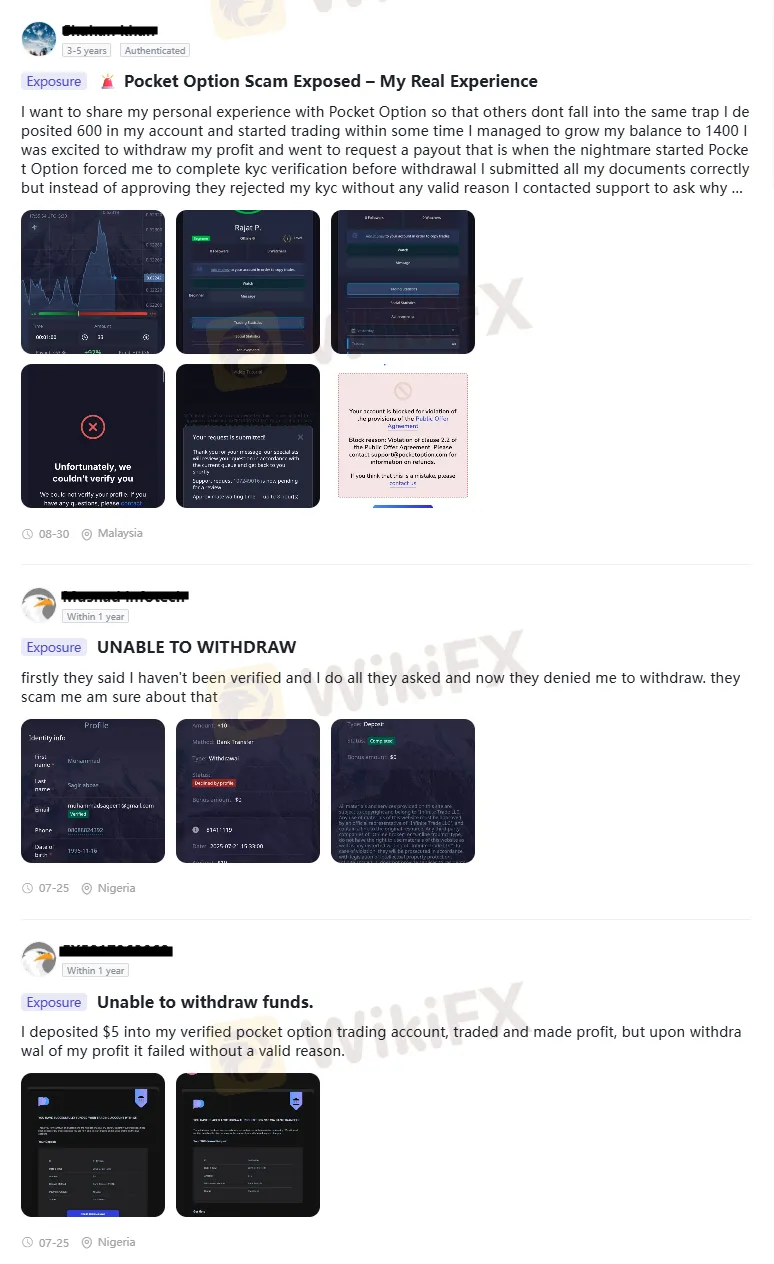

Pocket Option Scam: Real Cases from Global Traders

Across multiple countries, traders have shared consistent experiences:

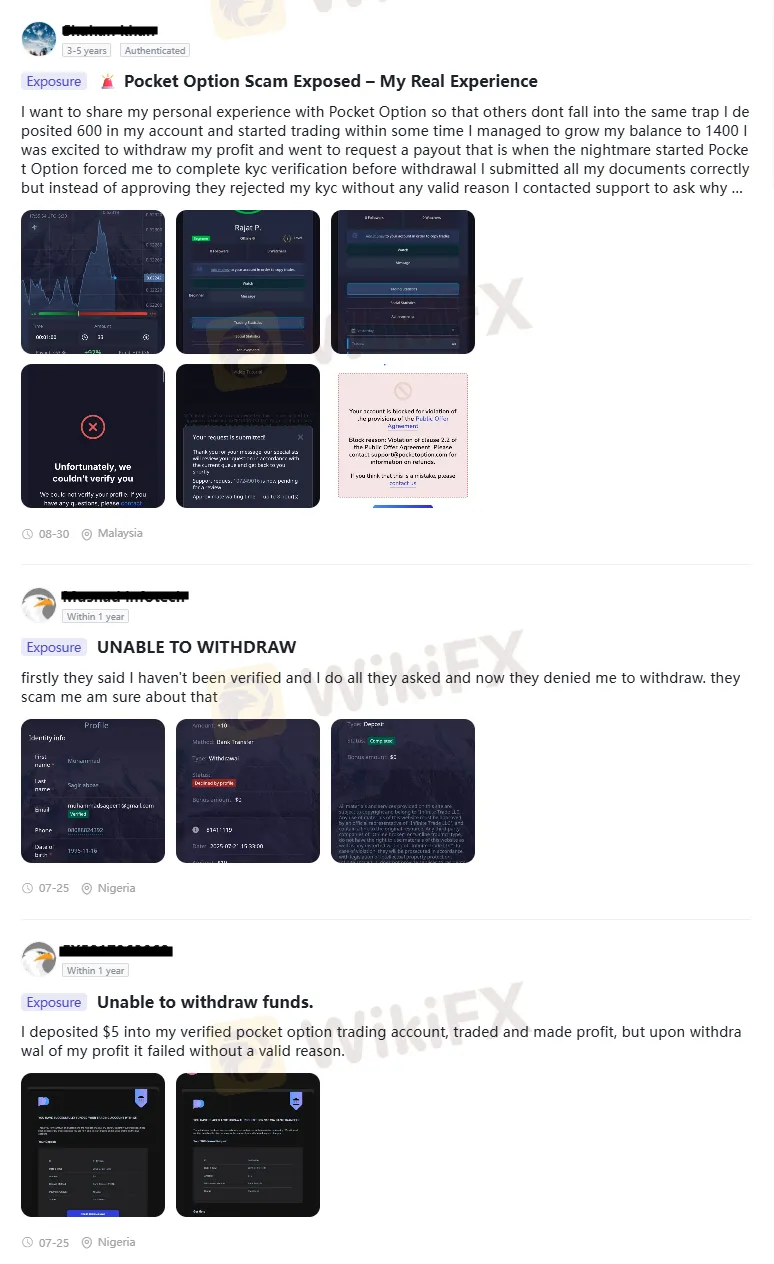

- Malaysia (August 2025): A trader grew a $600 deposit to $1,400 but was blocked after submitting KYC documents. The account was terminated under clause 2.2 of the Public Offer Agreement.

- Nigeria (July 2025): Several users reported deposits as small as $5 being trapped. Even verified accounts faced withdrawal failures without explanation.

- Hong Kong (September 2025): A trader with nearly $3,000 pending withdrawal was banned under clause 2.9, accused of “fraudulent activities” despite adhering to standard trading cycles.

These cases illustrate a consistent pattern: profitable accounts face sudden restrictions, while withdrawal requests remain unprocessed. The recurring references to vague contractual clauses suggest a strategy designed to prevent payouts rather than enforce legitimate compliance.

Pocket Option Risks: Why Traders Should Avoid

The cumulative evidence paints a clear picture: Pocket Option operates with no credible regulation, a low trust score, and a history of documented manipulations. Traders face:

- Arbitrary account bans under loosely defined clauses.

- Withdrawal delays extending beyond industry norms.

- Platform-only trading, with no connection to interbank markets.

- Persistent discrepancies in trade percentages and quotes compared to verified sources like TradingView.

For retail traders seeking transparency and security, these risks are unacceptable. The lack of regulatory oversight means there is no external body to hold Pocket Option accountable.

Conclusion

Pocket Option presents itself as a global trading platform, but mounting evidence from multiple regions suggests otherwise. With repeated reports of blocked accounts, withdrawal failures, and suspicious license claims, the platform raises red flags that cannot be ignored.

Traders considering Pocket Option should weigh these risks carefully. The documented experiences show that profitability does not guarantee access to funds, and regulatory gaps leave users exposed.