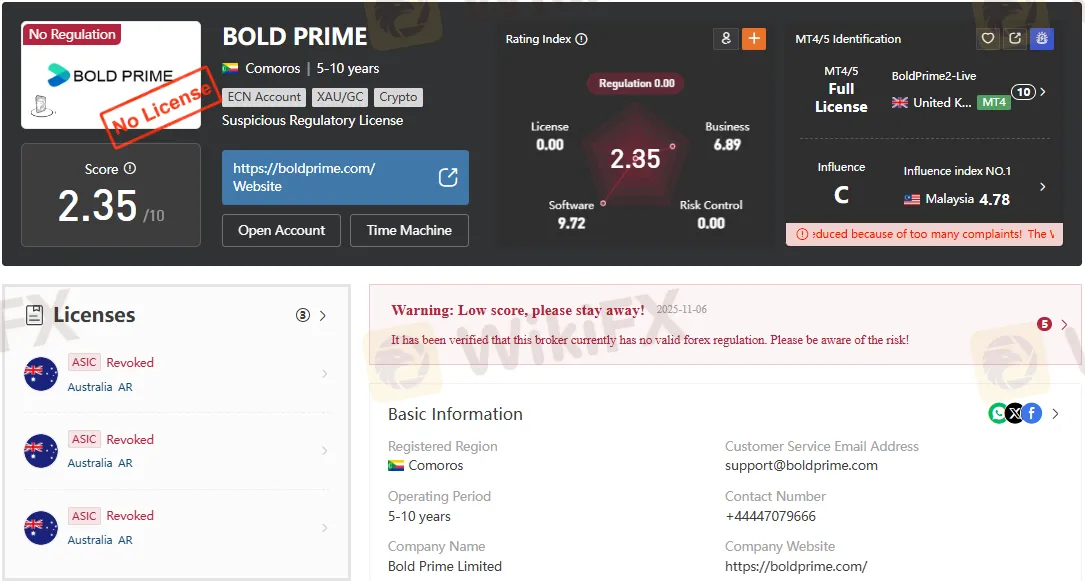

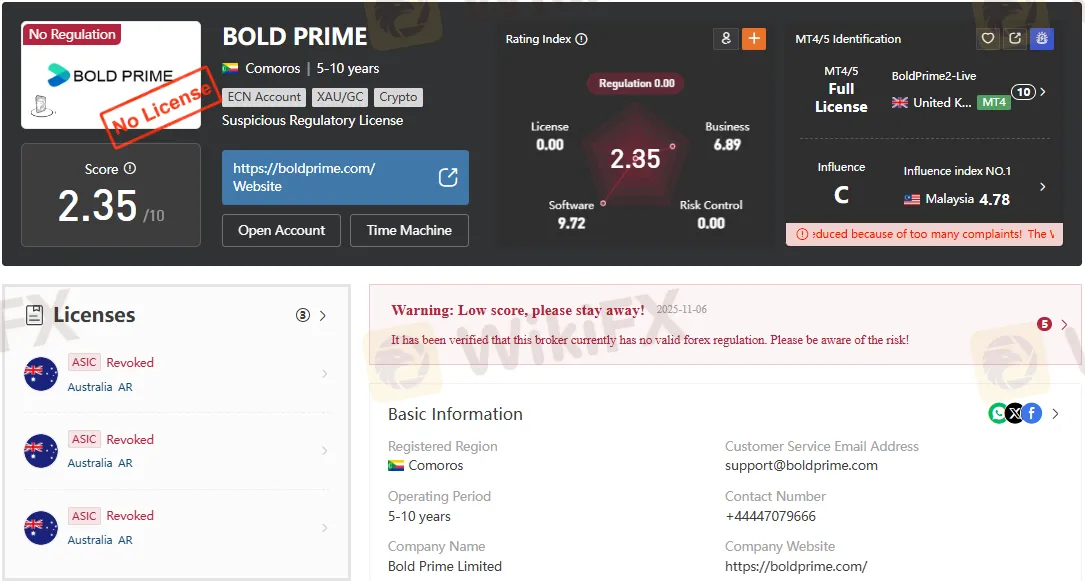

Abstract:Bold Prime Regulation Review: ASIC license revoked. Learn the risks of trading with unregulated brokers and why oversight matters.

Introduction

Bold Prime, once tied to Australia‘s Securities and Investments Commission (ASIC), has seen its regulatory standing collapse. Regulation is the invisible shield protecting traders in the volatile world of forex and CFDs. Without it, investors are exposed to unnecessary risks. This review explores the broker’s licensing journey, its current status, and what traders should know before engaging with it.

Bold Primes Background

Bold Prime Pty Ltd entered the market with ambitions of becoming a global broker. To establish credibility, it operated as an Appointed Representative (AR) under STAR FUNDS MANAGEMENT PTY LTD.

This structure allowed Bold Prime to market itself as regulated in Australia, but the distinction matters. An Appointed Representative does not hold a direct license—it operates under another firms authorization. For traders, this means oversight is indirect and weaker compared to brokers with full ASIC licenses.

For years, Bold Prime leaned on this framework:

- License No. 488828 (Bold Prime Pty Ltd)

- License No. 001305306 (Appointed Representative under STAR FUNDS MANAGEMENT PTY LTD)

- Effective Date: March 14, 2017

- Revocation Date: August 17, 2023

These details reveal a broker whose regulatory foundation was borrowed rather than earned.

ASIC Oversight Explained

The Australian Securities and Investments Commission (ASIC) is one of the most respected regulators globally. Brokers under ASIC oversight must meet strict standards, including:

- Segregation of client funds

- Capital adequacy requirements

- Regular audits and compliance reporting

- Dispute resolution mechanisms

These safeguards are designed to protect traders from fraud, insolvency, and malpractice.

Bold Prime‘s reliance on an Appointed Representative license meant it was never directly accountable to ASIC. Instead, STAR FUNDS MANAGEMENT carried the responsibility. This indirect relationship left Bold Prime’s compliance weaker than brokers holding full ASIC licenses.

Current Status: Revoked License

On August 17, 2023, Bold Primes appointed representative license was officially revoked.

Key Details:

- Regulatory Jurisdiction: Australia

- Licensor: STAR FUNDS MANAGEMENT PTY LTD

- Status: Revoked

- Address of Licensed Institution: 6C Barellan Ave, Carlingford NSW 2118

Revocation means Bold Prime no longer has the legal right to claim ASIC oversight. For traders, this translates into a loss of protection—no audits, no dispute resolution, no safety net.

Implications for Traders

The consequences of losing ASIC oversight are far‑reaching:

- Investor Protection Vanishes – Without ASIC, traders lose access to compensation schemes and complaint channels.

- Transparency Becomes Questionable – Revocation often signals compliance failures or a deliberate retreat from regulatory scrutiny.

- Reputation Suffers – In competitive markets, credibility is currency. A revoked license is a red flag that traders cannot ignore.

Independent review platforms echo this sentiment, warning traders against using brokers that are not regulated by top‑tier authorities.

Comparative Analysis: Bold Prime vs. Regulated Brokers

This comparison highlights the gulf between Bold Primes current standing and brokers maintaining active ASIC licenses.

Why Regulation Matters

Regulation is more than a legal requirement—it is the backbone of trust in financial markets. Traders rely on regulators to enforce standards that prevent fraud, mismanagement, and abuse.

When a license is revoked, confidence evaporates. Traders are left to rely on the broker‘s word rather than the regulator’s oversight. Thats a gamble few investors can afford.

Conclusion

Bold Primes license revocation in August 2023 highlights the risks traders face with unregulated brokers. Losing ASIC oversight means no investor protection or dispute resolution.

Traders must always check a brokers current regulatory status before investing. Active licenses from top regulators like ASIC, FCA, or CySEC ensure transparency and security.

Bold Primes revoked license is a clear warning. For safety and trust, choose brokers with valid, reputable regulatory credentials.