简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

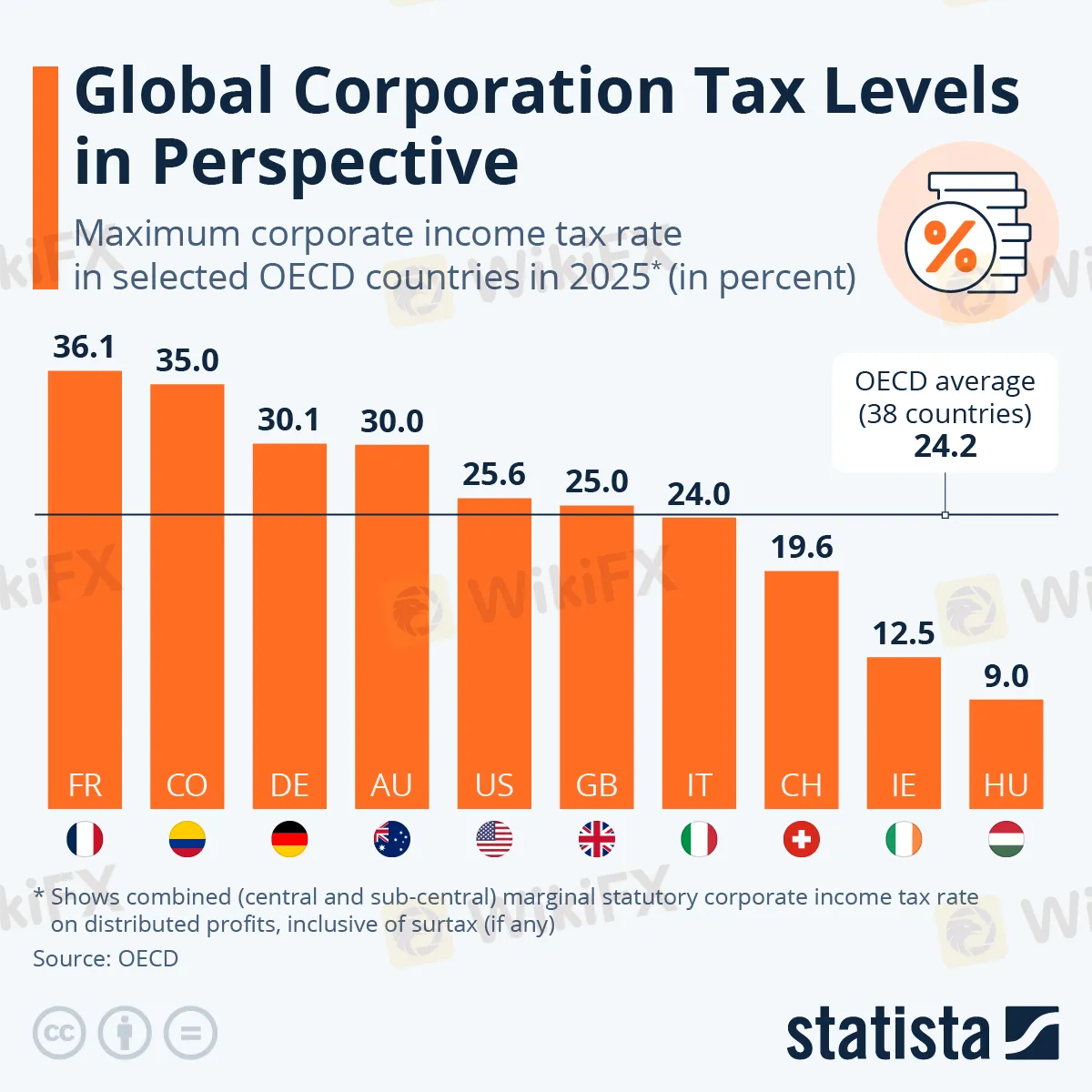

Global Corporate Tax Levels Continue To Slide, But France Remains Highest

Abstract:Since the turn of this century, OECD countries have experienced a marked trend of declining corporat

Since the turn of this century, OECD countries have experienced a marked trend of declining corporate tax rates.

The average corporate income tax rate applied by OECD members fell from about 33 percent in 2000 to between 24 and 25 percent in recent years (24.2 in 2025).

As Statista's Tristan Gaudiant details below, using the organization's data, France maintains the highest combined corporate tax rate in the OECD, at 36.1 percent in 2025, followed by Colombia(35 percent), while the lowest marginal corporate tax rate is found in Hungary, at 9 percent, followed by Ireland (12.5 percent).

In 2021, a major international agreement was reached under the guidance of the OECD to establish a minimum corporate tax rate of 15 percenton the profits of multinational companies, aimed at reducing tax inequalities and preventing profit shifting to low-tax territories.

Since then, many jurisdictions have taken steps towards the implementation of these rules into their domestic law, with the global minimum tax starting to apply from the beginning of 2024, although two countries (Hungary and Ireland) are yet to meet this requirement.

The challenge for OECD countries remains to strike a balance between economic attractiveness and tax fairness, while minimizing competitive distortions.

Advocates of low tax rates argue that theyattract foreign investment and boost competitiveness, whereas critics point out that such rates can reduce useful public revenue (public services, social policies funding) and exacerbate inequality, particularly when large corporations benefit from preferential regime and aggressive tax optimization.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Currency Calculator