简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

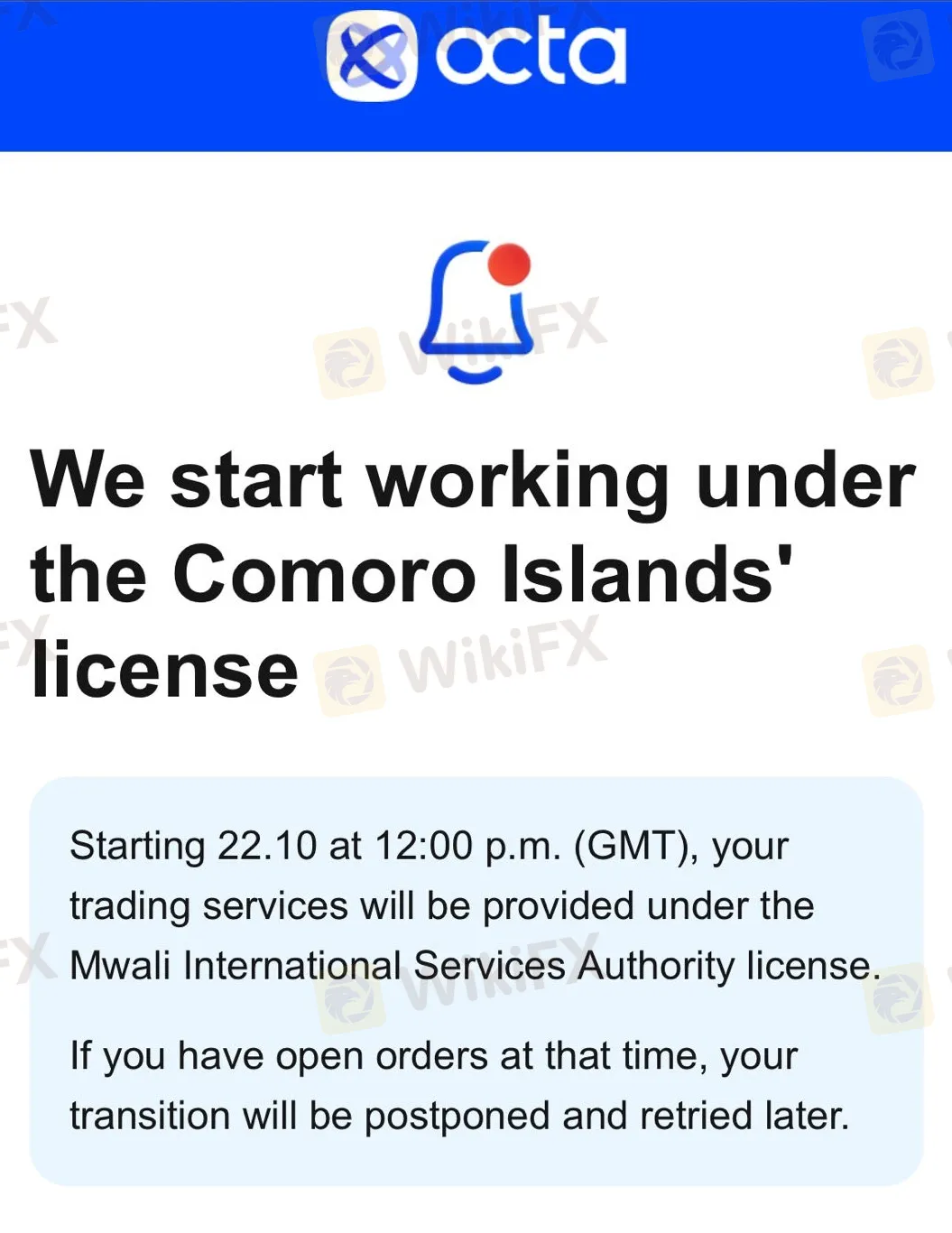

OctaFX Transitions to Comoro Islands Regulation Under Mwali International Services Authority

Abstract:Global forex broker OctaFX has announced that it will now operate under a new regulatory framework in the Comoro Islands, claiming to hold an International Brokerage and Clearing House licence issued by the Mwali International Services Authority (MISA).

Global forex broker OctaFX has announced that it will now operate under a new regulatory framework in the Comoro Islands, claiming to hold an International Brokerage and Clearing House licence issued by the Mwali International Services Authority (MISA).

According to the companys official announcement, beginning 22 October at 12:00 p.m. GMT, all trading services offered by OctaFX will be provided under this new authorisation, identified as licence number T2023320. The broker stated that the transition would take place automatically, with minimal impact on client activity. However, accounts with open positions at the time of the change may experience a brief delay before the migration is completed.

OctaFX Claims Client Funds and Accounts Remain Unchanged

OctaFX assured clients that all existing funds and trading accounts will remain in place, adding that the move is intended to introduce what it describes as “added protection” for client assets under the new regulator. The broker maintained that trading conditions, account structures, and profit mechanisms would remain unchanged, with no interruption to client activity.

The company further indicated that the transition could result in improvements to service quality and operational efficiency in the coming months. However, no specific details were provided on how these changes would be implemented.

Legal Overview and Claimed Licence Details

In its public statement, OctaFX claimed to possess the International Brokerage and Clearing House licence T2023320, issued by the Mwali International Services Authority, which is the regulatory body overseeing international financial service providers in the Comoro Islands.

The broker described the regulatory change as part of its ongoing strategy to strengthen its legal and compliance foundation. Clients were informed that an updated version of the companys Customer Agreement is now available for review, outlining the new jurisdictional terms.

No Action Required from Clients

The firm stated that clients are not required to take any action to accept the change. All trading activities and account features will continue as normal under the new structure. For further clarification, OctaFX directed users to reach its Customer Support team at support@octabroker.com.

Throughout the announcement, OctaFX reiterated its commitment to platform stability, transparency, and client confidence, ensuring that trading operations will not be disrupted during or after the transition.

What Traders Should Know

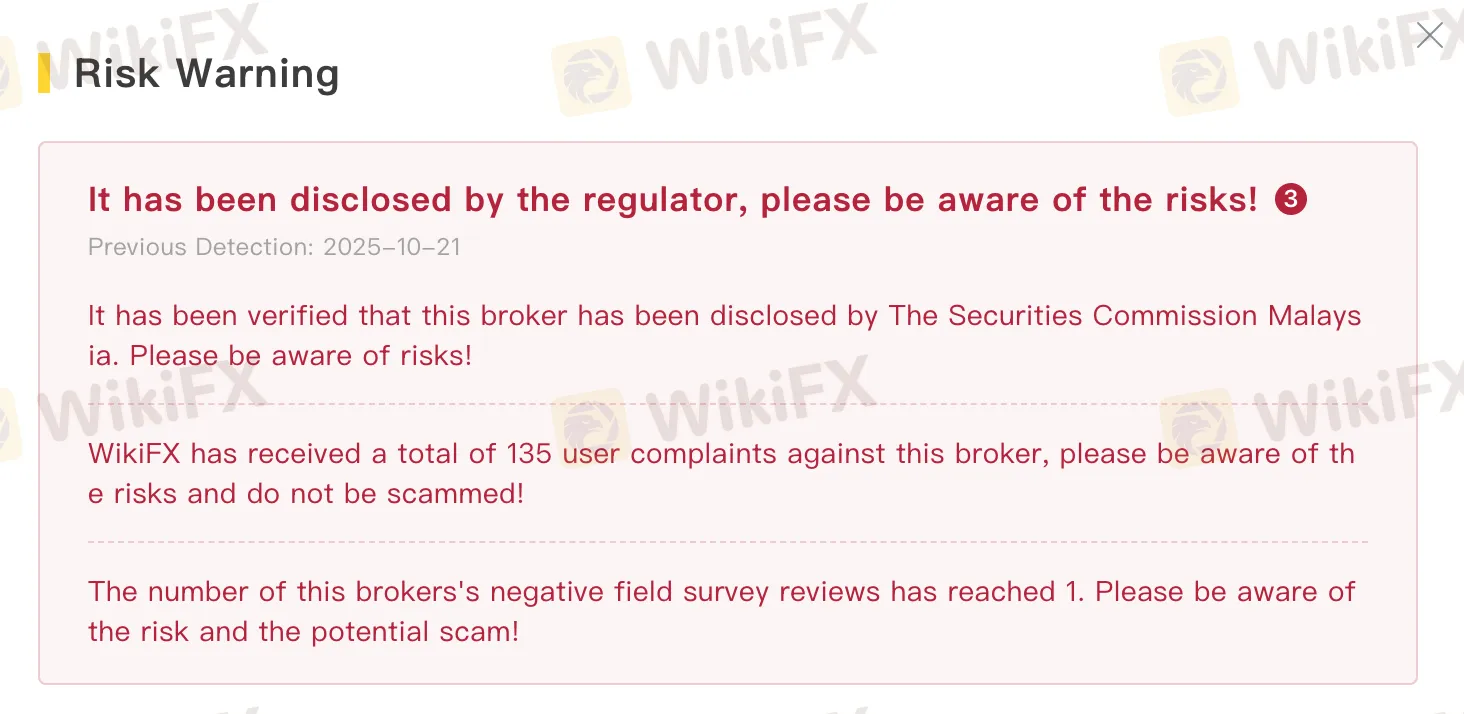

For traders, it remains essential to verify the authenticity of regulatory claims through independent and authoritative sources. WikiFX, a global broker regulatory information platform, allows users to check licences, regulatory status, and risk indicators for brokers operating across multiple jurisdictions.

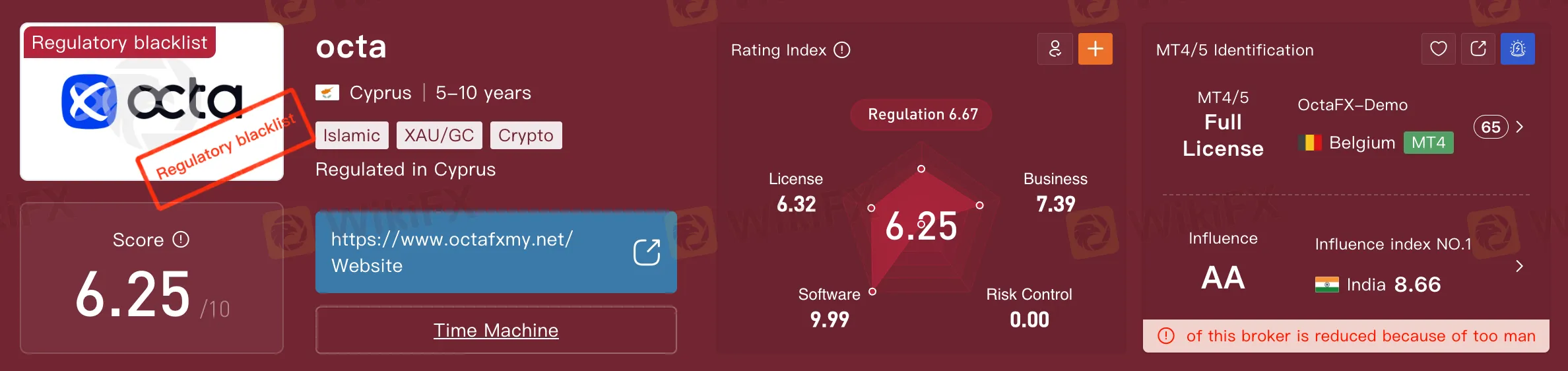

At first glance, OctaFX presents itself as a long-established, professional broker with a strong international presence. Its sleek website, diverse range of trading instruments, and claims of regulatory oversight often reassure traders. However, a closer OctaFX review conducted by WikiFX reveals a different story.

View WikiFXs full review of OctaFX here: https://www.wikifx.com/en/dealer/8426481202.html

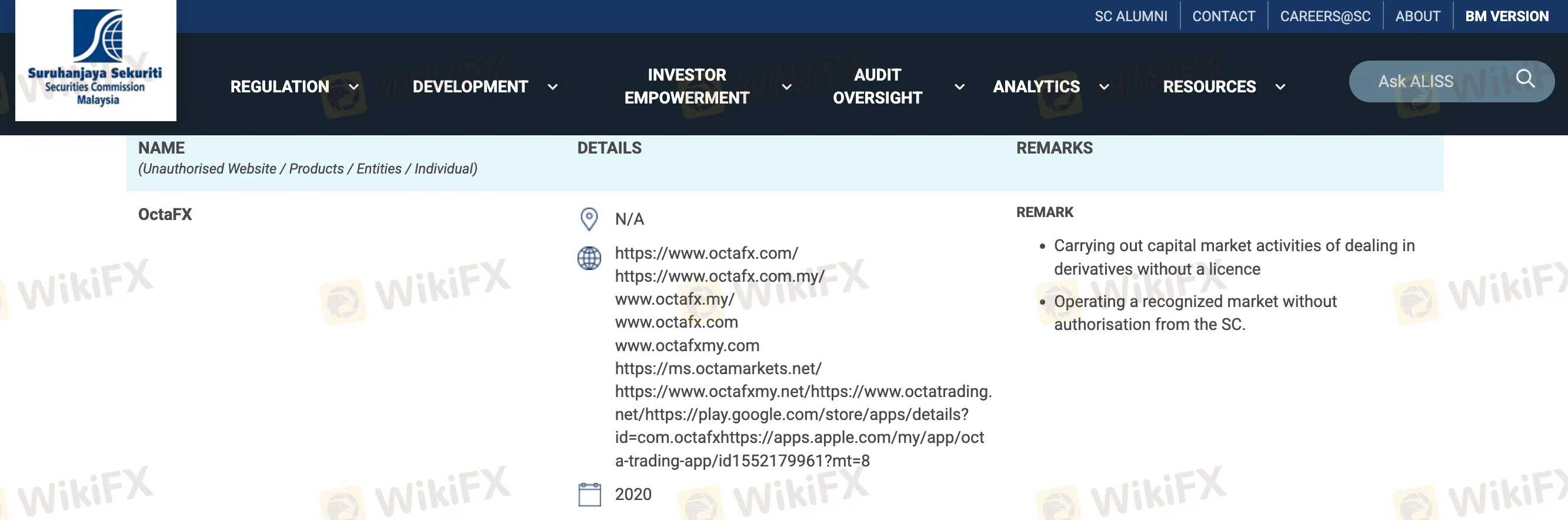

The Securities Commission of Malaysia (SC) has officially placed OctaFX on its Investor Alert List. The regulators notice states that OctaFX has been conducting derivative trading activities without a valid licence and operating a recognised market without authorisation. This means that, despite its global reputation, OctaFX is currently operating in Malaysia without proper approval from the SC.

As reported earlier, OctaFX does hold a licence with the Cyprus Securities and Exchange Commission (CySEC) under licence number 372/18, registered as a market maker. While this offers a degree of legitimacy in Europe, it does not cover operations in Malaysia. This is where many investors misunderstand the concept of regulation. Being licensed in one jurisdiction does not automatically mean a broker is authorised everywhere.

It is also important to know that the Mwali International Services Authority (MISA) serves as the regulatory body for the island of Mwali (Mohéli) in the Comoros. Its role is to oversee the issuance of international business and financial licences, particularly those aimed at offshore entities. However, despite its role in granting such licences, MISA operates within a loosely regulated framework, and its authorisations are not acknowledged by leading global financial regulators. The Central Bank of the Comoros has described MISA as a “fictitious structure”, asserting that any legitimate financial institution operating within the Comoros must first obtain approval directly from the central bank.

For Malaysian traders, this distinction is crucial. A broker's regulation is only effective in the regions where it is recognised. In the case of OctaFX Malaysia, clients lack the local protections that come with dealing through an SC-approved broker. This exposes traders to risks such as limited recourse in cases of disputes, delayed fund recovery, or potential malpractice.

In every circumstance, investors should not only verify whether a broker is regulated, but also ensure that it is authorised specifically within Malaysia's legal framework.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Why Opofinance’s Dual Licensing Looks Weak, Not Reassuring

Is Toyar Carson Limited Legit? A 2026 Investigation into Scam Allegations

Wall Street Giants Pivot: The "Reflation Trade" Returns

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Oil Markets Tighten: OPEC+ leans towards extending output pause into March

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Currency Calculator