简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Xtreme Markets on SC’s Alert List: The Broker That Trapped Local Traders

Abstract:At first glance, Xtreme Markets appears to be a legitimate online broker. However, a closer look at its WikiFX profile reveals a worrying pattern of regulatory gaps, trader complaints, and red flags that Malaysian investors cannot afford to ignore.

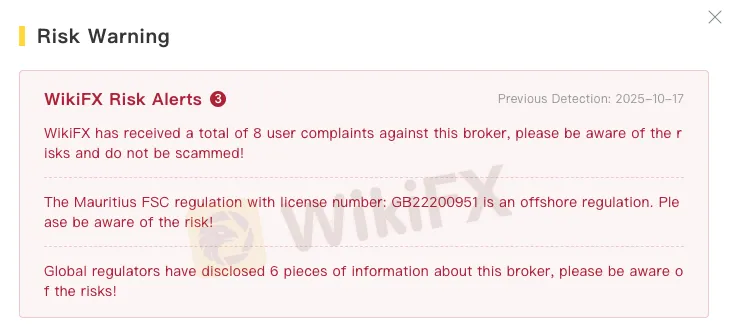

A Low WikiScore Reflects Serious Risk

A score of 5.11 on WikiFX is far below what would be considered safe for traders. The rating reflects weak transparency, questionable regulatory standing, and a large number of negative trader experiences. In short, the WikiScore tells us that Xtreme Markets does not meet the standards of a trustworthy broker.

View WikiFXs full review on this broker here: https://www.wikifx.com/en/dealer/7151422317.html

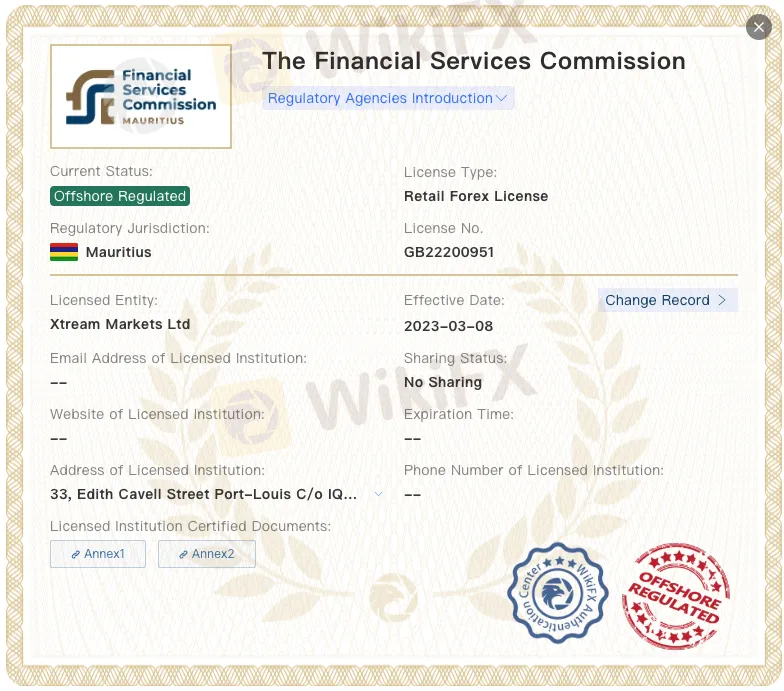

Questionable Regulation

Xtreme Markets only listed regulation is from the Financial Services Commission of Mauritius (FSC). While the FSC is a recognised regulator, it does not have the same strict oversight or investor protection measures as top-tier regulators like the FCA (UK) or ASIC (Australia).

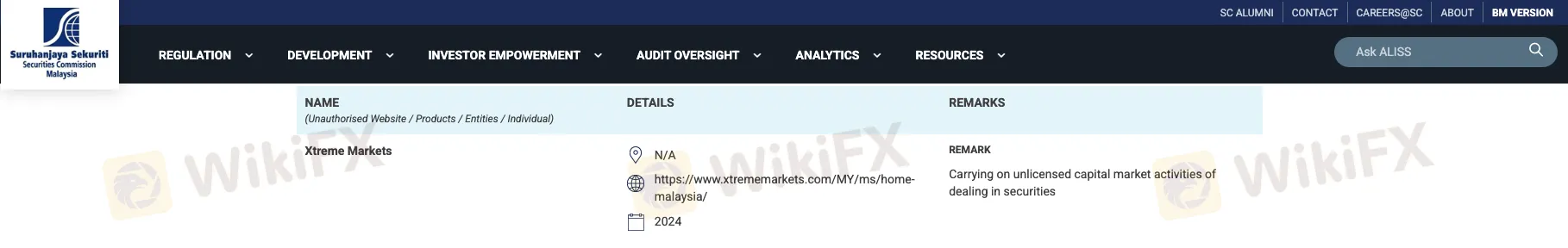

More importantly for Malaysian traders, the broker is not licensed or authorised by the Securities Commission Malaysia (SC) to carry out any trading or investment services.

This became undeniable when, in 2024, the Securities Commission Malaysia officially listed Xtreme Markets on its Investor Alert List for carrying on unlicensed capital market activities of dealing in securities. This means Xtreme Markets was found to be soliciting Malaysian investors illegally, without approval or oversight.

Complaints from Malaysian Traders

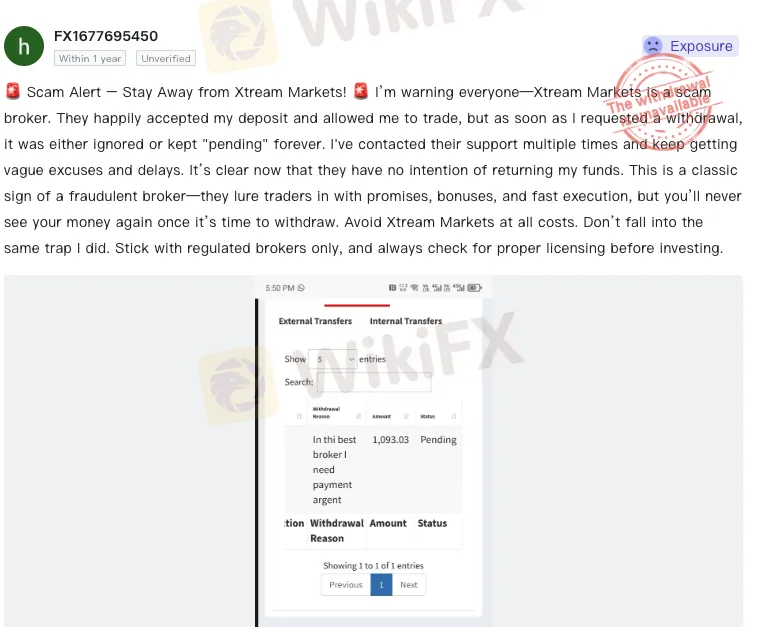

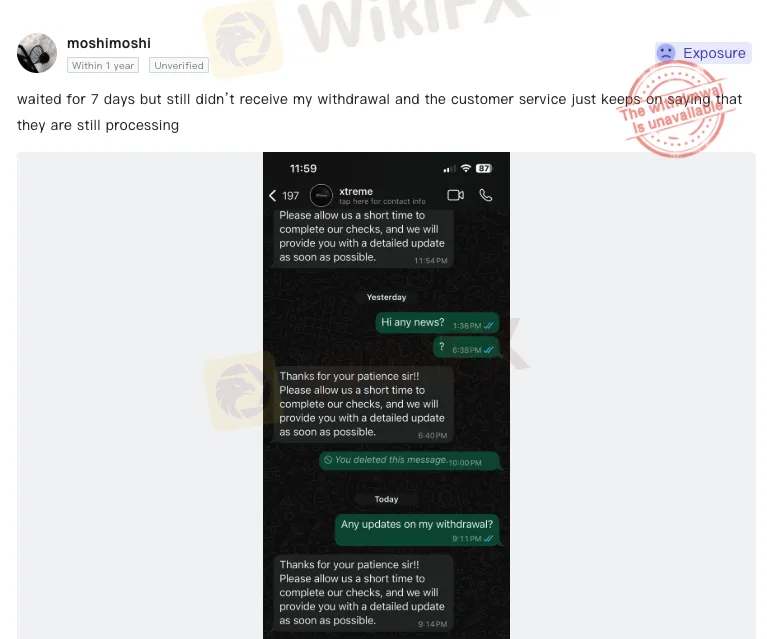

On WikiFXs Exposure page, several traders (a few from Malaysia) have come forward to share their negative experiences with Xtreme Markets. Their stories are alarming and consistent:

- Withdrawal problems: Many users report being unable to withdraw funds. Requests are either delayed for weeks or outright ignored, with excuses about “verification” or “system errors.”

- Poor communication: Customer service often goes silent when problems arise. Some traders mentioned being blocked or ignored entirely by company representatives.

- Loss of funds: In multiple cases, Malaysian investors lost their entire deposits after being pressured to add more funds to “unlock” their withdrawals, that is a tactic often associated with scam operations.

These cases show that Xtreme Markets has left a trail of frustration and financial loss among Malaysians, confirming the SCs warning.

Offshore Licence: Could Sometimes be a False Sense of Security

The Mauritius FSC licence may look legitimate, but traders should understand that it offers minimal protection. Offshore regulators like the FSC typically require low capital, conduct little enforcement, and provide no investor compensation in case of fraud or bankruptcy.

This makes Xtreme Markets especially dangerous. It can legally operate offshore but use that licence as a marketing tool to appear regulated, while still engaging in high-risk or illegal activities abroad, including Malaysia.

Read this article to learn the difference between offshore and onshore regulated brokers:

Lessons for Malaysian Traders

Xtreme Markets case is a crucial reminder that regulation matters, and not all regulation is equal. A broker licensed offshore may seem legitimate, but that does not make it safe for Malaysian traders.

Here are key takeaways:

- Always verify with the SC before investing. If a broker is not licensed locally, it is not legally allowed to operate in Malaysia.

- Be cautious with offshore entities. Licences from places like Mauritius or St Vincent and the Grenadines offer little investor protection.

- Heed the WikiFX rating and complaints. A low score and multiple user warnings are strong signs to stay away.

- Never trust “guaranteed profits.” Many victims of Xtreme Markets were lured in by false promises of high returns.

Rising Threat of Investment Scams

Investment fraud is on the rise globally, affecting traders of all experience levels. WikiFX serves as an independent, international third-party platform dedicated to evaluating and verifying the safety and reliability of FX brokers. Our comprehensive database covers more than 70,000 brokers, enabling investors to research broker profiles, regulatory agencies, financial licences, and safety indicators with confidence.

At WikiFX, our mission is to empower investors with the knowledge and tools required to make safe, informed decisions. When selecting an overseas broker, we strongly advise exercising due diligence and, wherever possible, choosing one regulated by a reputable authority such as Australia‘s ASIC, the United Kingdom’s FCA, or other recognised regulators.

If you encounter suspicious activity or fall victim to an investment scam, WikiFX is here to help. Our team analyses each case thoroughly, offering personalised guidance and practical solutions to help minimise potential losses.

WikiFX Exposure Service – Share and Protect

Transparency is central to investor protection. The WikiFX Exposure Service allows traders to report suspected scams and share critical risk information with the wider community. Every report is carefully investigated, and, where appropriate, WikiFX updates broker ratings and reliability scores to reflect the latest findings.

By contributing to this collective knowledge, you are not only protecting yourself but also helping to safeguard other investors. Importantly, WikiFX ensures that all personal data is kept strictly confidential, employing advanced security measures to prevent leaks and unauthorised access.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

The "Demo Trap": Why You Win Millions for Fun but Lose Your Rent in Real Life

Want to Trade with $100,000? The Truth About Prop Firms

Stop Bleeding Cash: Why Most Forex Rookies Get Crushed

The Silent Killer: Why Your Biggest Wins Often Precede Your Worst Crash

FAKE TRADES ALERT: How Long Candles Are Used to Mislead Retail Traders

Razor Markets Regulation Explained: Real User Reviews Exposed!!

Equiti Regulation: Compliance and Licensing Info

November's inflation report is the first to be released after the shutdown. Here's what to expect

Stop Chasing Green Candles: 3 Fatal Mistakes You’re Making in Trend Trading

Tradgrip Review 2025: Regulation Details, User Experiences & Complaints

Currency Calculator